Professional Documents

Culture Documents

National Travel Fund Application1

Uploaded by

RosemaryCastroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

National Travel Fund Application1

Uploaded by

RosemaryCastroCopyright:

Available Formats

NATIONAL TRAVEL

FUND APPLICATION

Name:

Club/Organization Name:

President/Chair:

Phone Number:

SacLink Email:

Treasurer/Like Officer:

Phone Number:

SacLink Email:

Event Date(s)/Location:

Car

Mode of

Transportation: Bus

How many members of

your club will be attending?

Airplane

Other

Train

Requested Funding (For example -Airfare - $200, bus from airport):

TOTAL: $ _______________

THINGS TO REMEMBER

Only Club President/Treasurer may submit the application.

Your Club/Organization must have a valid CAF on file.

Submit a copy of the official national conference agenda with application.

Students traveling via airplane or bus (capacity over 15 passengers) must submit a copy of the University Travel

Waiver prior to travel.

400.42 National Travel Fund

A. General Purpose

1. The National Travel Fund shall exist in order to support clubs and organizations managing travel

expenses to attend national conferences.

2. Clubs and organizations must be attending a national conference in order to apply for National Travel

Funds.

3. All applicants must be recognized organizations as defined by those groups having filed the

necessary campus organization registration forms with the Sacrament State Student Organizations and

Leadership Office and deemed in good standing.

4. Each applicant may receive a maximum of $1,000 per organization. A club or organization may not

be funded more than two (2) consecutive years.

5. Only direct travel expenditures will be funded. This includes, but is not limited to: airline tickets,

vehicle rental, and gas.

6. This eligibility is separate from the organizations DOC eligibility.

7. The National Travel Fund reimbursement deadlines adhere to the DOC reimbursement deadlines for

the semester in which the club or organization was funded in.

Valid CAF:

Good Standing:

CSR Verification:

Date:

Approved Amount $

VP Finance

DFA

CHECK REQUEST SUPPORTING DOCUMENTATION REQUIREMENTS

**IT IS THE ORGANIZATIONS RESPONSIBILITY TO READ THE INSTRUCTIONS BELOW & ENSURE ALL

CHECK REQUESTS ARE COMPLETE. INCOMPLETE CHECK REQUESTS WILL NOT BE ACCEPTED**

Contact ASI Accounting Services at (916) 278-2231 if you have any questions or stop by our

Office on the 3rd floor of the University Union.

1.

AUTHORIZED SIGNERS: A current Club Agreement Form (CAF) with authorized signatures must be on file in the ASI

Business Office. The check request must be signed by one of the authorized signatures on the CAF. Prior to submitting

your request, verify the CAF on file is current. The authorizing signature on the check request cannot be the same as the

individual to be paid.

2.

RECEIPTS/INVOICES: Original itemized receipts/invoices must be attached to the check request. NO COPIES

ACCEPTED. Copies of invoices are accepted only if the invoice(s) is faxed/emailed directly from the vendor. If items are

being shipped or delivered, please mark received on invoice prior to submittal of check request, if not, the request will be

considered an advance and receipt of goods (packing slip) will have to be submitted after order is received. NEATLY tape

all loose receipts on a blank piece of 8 x 11 paper. If purchases were made by check or credit card, a bank statement and/or

copy of the credit/debit card showing ONLY the LAST 4 numbers and the purchasers name need to be submitted. Alcohol is

not a reimbursable expense.

3.

MEETINGS: Per Policy for Business Related Hospitality (Food and Drink) Expenses, all reimbursements that are related to

food and drinks at business meetings (i.e. reimbursement for pizza purchased for club meeting) must include a list of

members that attended the meeting. Policy can be found at www.csus.edu/acpy/Bus_Hosp_Exp_Policy.pdf. Tips are only

reimbursed up to a maximum of 15% of the total reimbursable bill AND are paid on credit or debit card. CASH TIPS ARE

NOT REIMBURSED.

4.

CONFERENCES: Clubs must show proof of attendance. Example: Name badge, conference materials.

5.

ADDITIONAL SALES TAX: Any items that were not charged applicable sales tax will be subject to 8.50% sales/use tax.

Any receipt/invoice that do no have a sales tax line item will be subject to 8.50% sales/use tax that will be charged to

club/organization and ASI will pay tax to the State Board of Equalization. This also applies to vendors that do business

within the State of CA if tax has not already been applied.

6.

ADVANCES: All requests for advance reimbursement will need prior approval from the Director of Finance and

Administration or the Accounting Manager and should be on a separate check request. A memo or Advance Check Request

Agreement stating the purpose for the advance and signed by an authorized signer should be attached to advance requests.

Advances have to be a minimum $100 and in most cases check will be made directly to vendor. The request should have

quotes or estimates of charges directly from the vendor. Important: Original receipts will need to be given to our office

within two weeks following the event, if not; your organizations privilege for advancement of funds will be revoked.

7.

W9 _MOA FOR CONTRACTED SERVICES (Contracted Services are self-employed or unincorporated entities

receiving payment for services provided): Check Request forms along with a completed Memorandum of Agreement and

IRS W-9 Form. At the end of the calendar year, the vendor will be sent a tax form 1099. If person(s) or organization being

paid for services is a non-resident of California, the entity is subject to California Income Tax withholding of 7% unless they

provide documentation showing they are exempt from withholding. DO NOT pay directly for contracted or outside

services, instead ASI will pay these types of vendors in order to capture the associated tax. DO fill out the MOA and

W9 forms which are available online and in the ASI Business Office.

8.

BUS, TRAIN, AIRFARE: Receipts and proof of travel must accompany all check requests for bus, train, or airline fares,

including boarding passes, itineraries, airline tickets, etc. For student travelers via airplane or bus (capacity over 15

passengers), a copy of the University Travel Waiver must be submitted if paying for travel in advance. Student travelers

from Clubs and Organizations, external and IRA grants must use the University Travel Waiver located at:

http://www.rms.csus.edu/riskmanagement/forms/FieldTripStudentWaiver.pdf.

9.

GAS AND MILEAGE REIMBURSEMENT AND CAR RENTAL REIMBURSEMENT:

Mileage expenses for a privately owned automobile will be reimbursed using CSUS business mileage rate. Gas expenses for

a privately owned vehicle will be assessed on a case by case basis. If you have any questions, please contact the ASI

Business Office prior to Travel. YOU CANNOT BE REIMBURSED FOR BOTH GAS AND MILEAGE. For

reimbursement, submit a map showing total mileage traveled and indicate the names of the individuals traveling and

documentation showing proof of purpose of travel (example: proof of conference attendance). Multiply the total mileage

traveled by the CSUS business rate. The rate for 2013 is .56 per mile. For example: 20 miles traveled x .56 = $11.20

reimbursement. For car rentals provide gas receipts and proof of car rental statement. Mileage is computed from either

headquarters (CSUS) or the traveler's residence to the destination, whichever is less.

You might also like

- Scrabble Words Lips PageDocument1 pageScrabble Words Lips PageRosemaryCastroNo ratings yet

- Dr. Seuss UnitDocument13 pagesDr. Seuss Unitgoobers51No ratings yet

- Bathroom SuperheroDocument6 pagesBathroom SuperheroRosemaryCastroNo ratings yet

- FREESchool Supply LabelsDocument1 pageFREESchool Supply LabelsRosemaryCastroNo ratings yet

- OB ReviewDocument257 pagesOB ReviewRosemaryCastro100% (1)

- Neonatal Resuscitation Program DiagramDocument1 pageNeonatal Resuscitation Program DiagramRosemaryCastroNo ratings yet

- Hormonal Physiology of Childbearing PDFDocument248 pagesHormonal Physiology of Childbearing PDFRosemaryCastro100% (1)

- Obstetrics ReviewDocument257 pagesObstetrics ReviewRosemaryCastroNo ratings yet

- Taylor 2008 The STABLER Program Postresuscitation Pretransport Stabilization Care of Sick Infants PDFDocument7 pagesTaylor 2008 The STABLER Program Postresuscitation Pretransport Stabilization Care of Sick Infants PDFRosemaryCastroNo ratings yet

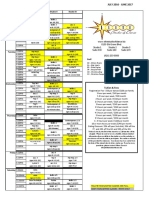

- EliteSchedule16 17mar172017 PDFDocument1 pageEliteSchedule16 17mar172017 PDFRosemaryCastroNo ratings yet

- SrableDocument39 pagesSrableYatza Sanches SanchesNo ratings yet

- Hormonal Physiology of Childbearing PDFDocument248 pagesHormonal Physiology of Childbearing PDFRosemaryCastro100% (1)

- Resuscitation and Support of Transition of Babies at Birth PDFDocument11 pagesResuscitation and Support of Transition of Babies at Birth PDFRosemaryCastroNo ratings yet

- BrainSheet 3patientDocument2 pagesBrainSheet 3patientRosemaryCastroNo ratings yet

- IV Solutions CheatsheetDocument1 pageIV Solutions CheatsheetRosemaryCastroNo ratings yet

- Loan Forgiveness For Nurses Application NeedsDocument5 pagesLoan Forgiveness For Nurses Application NeedsRosemaryCastroNo ratings yet

- National Travel Fund Application1Document2 pagesNational Travel Fund Application1RosemaryCastroNo ratings yet

- SrableDocument39 pagesSrableYatza Sanches SanchesNo ratings yet

- SIM Lab Sign UpsDocument3 pagesSIM Lab Sign UpsRosemaryCastroNo ratings yet

- NRP GeneralDocument1 pageNRP GeneralRosemaryCastroNo ratings yet

- ABG ROME FlowchartDocument1 pageABG ROME FlowchartRosemaryCastroNo ratings yet

- Where Have I Been While in NURSING SCHOOL?: Résumé Worksheet Belonging To - Save MeDocument2 pagesWhere Have I Been While in NURSING SCHOOL?: Résumé Worksheet Belonging To - Save MeRosemaryCastroNo ratings yet

- PHN SAMPLE AppDocument3 pagesPHN SAMPLE AppRosemaryCastroNo ratings yet

- Monthly Shot-March 2016Document7 pagesMonthly Shot-March 2016RosemaryCastroNo ratings yet

- Monthly Shot January 2016Document7 pagesMonthly Shot January 2016RosemaryCastroNo ratings yet

- National Wear Red Day newsletterDocument4 pagesNational Wear Red Day newsletterRosemaryCastroNo ratings yet

- Nclex Part 2 ExamplesDocument5 pagesNclex Part 2 ExamplesRosemaryCastroNo ratings yet

- Exam Cram Cheet SheetDocument2 pagesExam Cram Cheet SheetSheila Stenson-Roberts100% (1)

- NCLEX Nursing Exam Cram SheetDocument9 pagesNCLEX Nursing Exam Cram SheetJodie OrangeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Income Tax Classification Guide for Individuals & BusinessesDocument15 pagesIncome Tax Classification Guide for Individuals & BusinessesclaraNo ratings yet

- Self Employment and Small Scale Industry in NepalDocument16 pagesSelf Employment and Small Scale Industry in NepalsamyogforuNo ratings yet

- Fr & Fsa Sem-6 Gkj (Final File)_02!03!24 (Final)Document72 pagesFr & Fsa Sem-6 Gkj (Final File)_02!03!24 (Final)bharatipaul42No ratings yet

- Budget 2018-19: L'analyse de KPMGDocument23 pagesBudget 2018-19: L'analyse de KPMGDefimediaNo ratings yet

- HDFC Life Click 2 Protect 3D Plus - BrochureDocument28 pagesHDFC Life Click 2 Protect 3D Plus - BrochureankitNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document1 pageFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Chapter 4 Activity Assignment 2Document9 pagesChapter 4 Activity Assignment 2Amir ShahzadNo ratings yet

- Gasbill 2864608891 202307 20230721180052Document1 pageGasbill 2864608891 202307 20230721180052Shahhussain HussainNo ratings yet

- Emerging Trends in Retail BankingDocument6 pagesEmerging Trends in Retail Bankinganandsree12345100% (3)

- PE Ratio Factors Book vs Market ValueDocument28 pagesPE Ratio Factors Book vs Market Valuebeyonce0% (1)

- Income Taxes For CorporationsDocument35 pagesIncome Taxes For CorporationsKurt SoriaoNo ratings yet

- Soudamini Resume 1Document2 pagesSoudamini Resume 1Soudamini MohapatraNo ratings yet

- PWC Global Automotive Tax Guide 2015Document571 pagesPWC Global Automotive Tax Guide 2015ChristianNicolasBetantos100% (1)

- 2019 Spring Ans (Q35 Ans Is C)Document24 pages2019 Spring Ans (Q35 Ans Is C)Zoe LamNo ratings yet

- PD 2026Document2 pagesPD 2026Lv AvvaNo ratings yet

- Epiphany by The Madras High Court in TRAN-1 Debate: CompendiumDocument6 pagesEpiphany by The Madras High Court in TRAN-1 Debate: CompendiumM.KARTHIKEYANNo ratings yet

- Central & State RelationsDocument8 pagesCentral & State RelationsVISWA TEJA NemaliNo ratings yet

- REmedies Procedure Lecture 1Document5 pagesREmedies Procedure Lecture 1Susannie AcainNo ratings yet

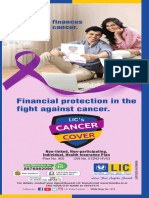

- Cancer PlanDocument10 pagesCancer PlanGURPREET SINGHNo ratings yet

- Federal Insurance Contributions ActDocument3 pagesFederal Insurance Contributions ActMaryNo ratings yet

- Dr. Reddy's - 900011757Document1 pageDr. Reddy's - 900011757srinivaskurellaNo ratings yet

- En Banc (G.R. No. 198529, February 09, 2021) Manila Electric Company, Petitioner, vs. City of Muntinlupa and Nelia A. Barlis, Respondents. Decision Hernando, J.Document10 pagesEn Banc (G.R. No. 198529, February 09, 2021) Manila Electric Company, Petitioner, vs. City of Muntinlupa and Nelia A. Barlis, Respondents. Decision Hernando, J.Ryan Jhay YangNo ratings yet

- 17 Compania General de Tabacos Vs City of ManilaDocument6 pages17 Compania General de Tabacos Vs City of ManilaYaz CarlomanNo ratings yet

- Contemporary World.Document3 pagesContemporary World.Liezel CabilatazanNo ratings yet

- Application Form - Capital Walk Updated 06-10-2022Document69 pagesApplication Form - Capital Walk Updated 06-10-2022Satyender DalalNo ratings yet

- Dissecting The India Hospitality IndustryDocument14 pagesDissecting The India Hospitality IndustrySwapnesh R JainNo ratings yet

- Quicknotes in Income TaxDocument13 pagesQuicknotes in Income TaxTrelle DiazNo ratings yet

- Econ 100.2 THC - Problem Set 4Document3 pagesEcon 100.2 THC - Problem Set 4TiffanyUyNo ratings yet

- Legal Ethics Book - AgpaloDocument349 pagesLegal Ethics Book - AgpaloDagul JauganNo ratings yet

- Business A2 NotesDocument120 pagesBusiness A2 NotesMohamedNo ratings yet