Professional Documents

Culture Documents

Financial Market: Money Market Capital Market

Uploaded by

Preethi GopalanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Market: Money Market Capital Market

Uploaded by

Preethi GopalanCopyright:

Available Formats

Financial Market

You gave me money I gave you a piece of paper (security)

The place where we did this business is called financial market.

If I had promised to pay back money in less than 1 year (=short

term loan) , this will be called Money Market

If I had promised to pay back money after long time like 10-20

years (=long term loan) , this will be called a CAPITAL MARKET.

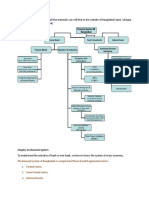

Players in Capital Market (diagram)

Subparts of capital market.

As said above, when I take long term loan = its capital market.

When initially I took money from you and give you piece of paper

= this is PRIMARY market. *

But after sometime, you need the money while Im going to pay

back after 10 years.

So you borrow 100 Rs from another guy and give that piece of

paper (=security) to that guy. And tell him to recover the money from

Mrunal = you traded my security. This is SECONDARY MARKET

(Sharemarket / BSE/NSE etc)

(*this primary market will be discussed in another article) our current article

deals only with capital market.)

Its the job of SEBI to control both Primary & Secondary Capital market in

India. (detailed article about SEBI,BSE,&NSE is coming soon.)

As you saw on above diagram that Govt. is also a player in capital market.

So,

Why does Government issue securities?

Suppose Im the Govt.

My expenses are more than my income

= Im in deficit (gap)

Ive following options to cover that deficit

1. Increase tax rates (income tax, VAT, import duties)

But this will make people unhappy and theyll not vote for me in next

election

2. Print more money

But this will create inflation= again unhappy people= less votes.

3. Borrow from international institution (world bank / IMF)

But if I borrow too much, Ill have to play by their tunes regarding Kashmir,

Copenhagen, WTO-Doha.

4. Borrow from people within India

This sounds safer!

So Ill issue securities. (When you issue for the first time = youre

in primary market.)

keep in mind that Govt. does this for short term deficits. (its like I

need money in October 2010 but youre going to pay income tax in

March 2011 so Ill use this trick to cover my money needs.)

Govt. generally plays only in the primary market.

When you give me your money and receive that piece of paper

(security) = you can be certain that Im going to pay back and wont

run away like Ashok Jadeja. After all Im the Government. And I pay

good profits.

thats why Govt. securities are called Gilt-Edged securities

How does this thing work?

As I decided to issue security in primary market, but that doesnt

mean Ill send my peon/clerk/Secretary to the primary market with bag

full of papers (security) and sell it like vegetables.

I give my piece of papers (security / treasury bills) to RBI- theyll

give me the money and then RBIs men will sell it in the primary

market. = RBI is Govt.s debt manager.*

*Security Paper= Im going to pay money after some time. = Im in

your debt. And RBI managers my security papers so theyre my debt

manager.

Separate debt Management office.

Ok so now you know that RBI is Govt.s debt manager. But

consider this

RBIs main job = maintain liquidity (=money supply) in market

via monetary policy (=CRR,Repo etc crap)

But, When RBI sells Govt. securities in primary market, and give

the money to Govt. = money supply flow is interrupted = liquidity is

drying = harder to get loans

= conflict of interest.

Thats why many people are calling for separate Public debt

Management office and relieve RBI from this duty.

Ok now ,final part in this article-As we saw, there are 2 types of capital

market : Primary and secondary. but

Why do we need Secondary market?

Gives Exit Route

Im going to return money to you after 10 years. So your hands are

tied you cant recover it from me until next 10 years, so what if you

needed money in emergency? Youve secondary market so youll sell

my security to someone else and recover the money. Otherwise,

In the absence of a secondary market, many of the investors

would probably not agree to supply capital (money) in the primary

market because they would not have an exit route for their investment.

Gives Price information

By active trading by millions of investor, you get price information regarding

the securities.

This price information is used to judge

1. the corporate performance (share prices)

2. performance of the Government

3. economy (through interest rates on Government debt).

4. facilitating value-enhancing control activities (mergers &

acquisitions) and

5. enabling implementation of incentive-based management

contracts (employee stock options).

Issues & Securities,

1. If I write on a piece of paper saying anyone who gives me 100 Rs.,

Ill give him 120 rupees after 6 months = this is public issue

2. If you give me 100 Rs. And take that paper- then that paper

becomes the security

Keep in mind that The 100 Rs you give to me or the 120 Rs. Ill give to you

after 6 months- that is NOT Security. That Piece of paper is the security.

Technical definition

Security means a formal declaration that documents a fact of

relevance to finance and investment gives the holder a right to receive

interest or dividends.

Security means A guarantee that an obligation will be met

Shares, debentures.

Theyre also securities of one type. You must be knowing about them already

so just in brief-1. If for your 100 rs, I give you a limited ownership in my company

and promise to give you the share from my profit = this is share

2. But if I say that, Ill give you 15 Rs. Every year no matter I get any

profit / not = this is debenture.

Derivatives / Stock Market Derivatives

you gave me 100 Rs and I gave you a paper saying Ill payback

120 Rs. (=Mrunals security paper)

there is another guy named Mitul who, same way borrowed 100

Rs. And gave you another paper saying hell pay you 120 Rs after 6

months. (Mituls security paper.)

Now you need money before 6 months, so you write on a new

paper, anyone who gives me 220 Rs, Ill give him 240 Rs. Worth

Security papers of Mrunal and Mitul.

that new paper you crated is again a security but it doesnt have

direct-money attached with it instead, it derives its value from the

security papers for Mrunal and Mitul. So your new paper is called

Derivatives

lets now deviate from our articles topic for a while to learn a few

things related to recession from above talk.

Mortgage, Asset bubble & derivatives

You give me 100 Rs. And I give you paper saying if I dont pay

back, you can take away my house

this is mortgage. But again this is also one kind of security paper

Now youre a big bank, so youve plenty of such mortgage papers

because you give loans to lot of people. (even to those who cant

afford to pay back the loan)

Then you repack those mortgage papers (security ) and make a

new security paper anyone who gives me 500 Rs. Ill give him

mortgage papers of 5 houses = this is derivative product.

Suppose 3 guy bought such derivative papers and after few

months, he repacks them- makes another derivative product and sell it

to 4 guy.

Such papers are one sort of asset (because you can get money

from someone using it.)

but as you can see, you did not create any new asset youre just

keep reselling same stuff over and over to different people. So youre

blowing a bubble

After few months, I refuse to pay money, and tell the 4 guy to

take away my home. But the prices in reality sector are low so even if

you sell my home you cant recover your 100 Rs. = this is toxic

asset / NPA = non-performing asset and your asset bubble is burst

rd

th

th

You might also like

- Economy Mrunal NotesDocument611 pagesEconomy Mrunal NotesJishnu Asok85% (20)

- Mrunal NotesDocument511 pagesMrunal NotesRakshit JoshiNo ratings yet

- Bonds N SharesDocument12 pagesBonds N SharesDesperadoSatosNo ratings yet

- Investment or SpeculationDocument6 pagesInvestment or SpeculationNiharika Satyadev JaiswalNo ratings yet

- The Best Funds To Invest In: How You Can Invest in A Mutual FundDocument4 pagesThe Best Funds To Invest In: How You Can Invest in A Mutual FundAnonymous YWS7ndsiNo ratings yet

- How Is The Price of A Stock Determined?Document24 pagesHow Is The Price of A Stock Determined?sandeepkakNo ratings yet

- Reliance Capital LimitedDocument13 pagesReliance Capital LimitedavaniagravatNo ratings yet

- Badla MechanismDocument27 pagesBadla Mechanismdivyapillai0201_No ratings yet

- Financial LiteracyDocument67 pagesFinancial LiteracyDhiya MalarvannanNo ratings yet

- First Thing We Have To Cover, All The Materials You Will Find in The Website of Bangladesh Bank. (Cheque The Website of Bangladesh Bank)Document12 pagesFirst Thing We Have To Cover, All The Materials You Will Find in The Website of Bangladesh Bank. (Cheque The Website of Bangladesh Bank)afnan huqNo ratings yet

- Quick Lesson: We Have Been Talking About Derivatives Recently, So What Is Derivatives ?Document13 pagesQuick Lesson: We Have Been Talking About Derivatives Recently, So What Is Derivatives ?Rushabh ShahNo ratings yet

- Accrued Interest $1,000 X 0.05/2 X 30/180 $4.16Document3 pagesAccrued Interest $1,000 X 0.05/2 X 30/180 $4.16Chynna BendijoNo ratings yet

- Stock InvestingDocument9 pagesStock InvestingAnant TiwariNo ratings yet

- Value InvestingDocument57 pagesValue InvestingKannan100% (1)

- Capital Market & Money MarketDocument8 pagesCapital Market & Money Marketshital maneNo ratings yet

- What Is Recession ? Whats Happening in The Economy ?Document13 pagesWhat Is Recession ? Whats Happening in The Economy ?abhi2282100% (2)

- Money 3.2 Demand For Money and Supply of MoneyDocument19 pagesMoney 3.2 Demand For Money and Supply of MoneyHrushikesh ShejaoNo ratings yet

- FAQs About The Financial CrisisDocument15 pagesFAQs About The Financial CrisisMuhammad Arief Billah100% (12)

- I - Functions of MoneyDocument38 pagesI - Functions of MoneyVISHVESH JUNEJANo ratings yet

- Retailing FsDocument11 pagesRetailing Fsnianidi0125No ratings yet

- Debt & DeficitDocument6 pagesDebt & DeficitPreethi GopalanNo ratings yet

- Secret 4 Early RetirementDocument46 pagesSecret 4 Early RetirementatihariNo ratings yet

- Lec 51Document15 pagesLec 51swastikNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- The Advanced Stock Market Investing Guide: Follow This Step by Step Beginners Trading Guide for Learning How to Trade Penny Stocks, Bonds, Options, Forex, and Shares; to Become a Stock Trader Today!From EverandThe Advanced Stock Market Investing Guide: Follow This Step by Step Beginners Trading Guide for Learning How to Trade Penny Stocks, Bonds, Options, Forex, and Shares; to Become a Stock Trader Today!Rating: 5 out of 5 stars5/5 (7)

- Is LM Money Market BasicDocument13 pagesIs LM Money Market BasicqazplmNo ratings yet

- What Are The SensexDocument13 pagesWhat Are The SensexprasanjeetbNo ratings yet

- Important: This Account We're Going To Open Is Merely A Tool To Be Able To Receive The MoneyDocument5 pagesImportant: This Account We're Going To Open Is Merely A Tool To Be Able To Receive The MoneyRehTehNo ratings yet

- A Beginner's Guide To The Black-Scholes Option Pricing Formula (Part 1)Document21 pagesA Beginner's Guide To The Black-Scholes Option Pricing Formula (Part 1)Ritik SinghaniaNo ratings yet

- A Primer On Treasury BondsDocument8 pagesA Primer On Treasury BondsThavam RatnaNo ratings yet

- Indian Stock Market-An IntroductionDocument12 pagesIndian Stock Market-An IntroductionriddhidoshiNo ratings yet

- The Best Funds To Invest In: How You Can Invest in A Mutual FundDocument23 pagesThe Best Funds To Invest In: How You Can Invest in A Mutual FundsakifakiNo ratings yet

- CHAP.-1 BASIC ACCOUNTING TERMINOLOGY FinalDocument17 pagesCHAP.-1 BASIC ACCOUNTING TERMINOLOGY FinalPurva ChaudhariNo ratings yet

- Financial MarketDocument16 pagesFinancial MarketchitkarashellyNo ratings yet

- A Contrarian ChecklistDocument7 pagesA Contrarian ChecklistvinamraNo ratings yet

- How To Build A 10 Million Dollar Real Estate NesteggDocument13 pagesHow To Build A 10 Million Dollar Real Estate NesteggJayson Jonson AraojoNo ratings yet

- Passing PackageDocument3 pagesPassing Packagesalaskarprem42No ratings yet

- Stock Quitters SecretDocument12 pagesStock Quitters SecretfabiokimuraNo ratings yet

- Lec 1Document16 pagesLec 1Bhavya NarangNo ratings yet

- Financial Market and InstitutionsDocument24 pagesFinancial Market and InstitutionsNehaChaudharyNo ratings yet

- What Are International Capital Markets? So Before We Proceed To Our Main Topic, LetDocument3 pagesWhat Are International Capital Markets? So Before We Proceed To Our Main Topic, LetChesca GonzalesNo ratings yet

- Now, Let S Talk About Why I Am Writing Here at All and Asking 10 Billion ISKDocument3 pagesNow, Let S Talk About Why I Am Writing Here at All and Asking 10 Billion ISKMantas RaulinaviciusNo ratings yet

- Unit 2-Money in Motion/Banking Equations: Analyse The Following Cases and Answer The QuestionsDocument6 pagesUnit 2-Money in Motion/Banking Equations: Analyse The Following Cases and Answer The Questionssatyam singhNo ratings yet

- What's A Stock/Share?Document8 pagesWhat's A Stock/Share?mailrahulrajNo ratings yet

- (English) What Is Muhurat Trading - Stock To Checkout For Long Term - Anish Singh Thakur - Booming Bulls (DownSub - Com)Document12 pages(English) What Is Muhurat Trading - Stock To Checkout For Long Term - Anish Singh Thakur - Booming Bulls (DownSub - Com)Deepria GuptaNo ratings yet

- Step by Step LearningDocument91 pagesStep by Step Learningshyam_82No ratings yet

- How To Double Your Money: Small Contributions HelpDocument5 pagesHow To Double Your Money: Small Contributions HelpHimanshu TandonNo ratings yet

- Lec 2Document15 pagesLec 2Dennis Noel de LaraNo ratings yet

- Iso-885dfdfd9-1 - Time Value of Money 2Document33 pagesIso-885dfdfd9-1 - Time Value of Money 2kdfohasfowdeshNo ratings yet

- Mrunal Handout 4 CSP20Document50 pagesMrunal Handout 4 CSP20Margesh PatelNo ratings yet

- Chapter 11Document13 pagesChapter 11Anonymous BBs1xxk96VNo ratings yet

- Case Studies - Management AccountingDocument48 pagesCase Studies - Management AccountingAshvi AgrawalNo ratings yet

- Who Took My Money - Robert KiyosakiDocument3 pagesWho Took My Money - Robert KiyosakiPieter du Plessis100% (1)

- Bond Markets: What Are Bonds?Document10 pagesBond Markets: What Are Bonds?Hades RiegoNo ratings yet

- OFS9.Special OFS Messages (FOREX and LD) - R13 PDFDocument18 pagesOFS9.Special OFS Messages (FOREX and LD) - R13 PDFPreethi GopalanNo ratings yet

- Ofsml PDFDocument6 pagesOfsml PDFPreethi Gopalan0% (1)

- T24 OfsDocument73 pagesT24 OfsPreethi Gopalan83% (12)

- OfsDocument31 pagesOfsAlfredo100% (2)

- OFS5.OFS Telnet Mode-R13Document14 pagesOFS5.OFS Telnet Mode-R13Preethi GopalanNo ratings yet

- OFS1.Introduction and Common OFS Messages-R13Document23 pagesOFS1.Introduction and Common OFS Messages-R13Preethi GopalanNo ratings yet

- OFS2.OFS Modes (BASICS) - R13Document16 pagesOFS2.OFS Modes (BASICS) - R13Preethi GopalanNo ratings yet

- Day 1 BASEL-standardized Program For All The Banks : Aa CoreDocument16 pagesDay 1 BASEL-standardized Program For All The Banks : Aa CoreAlexandra Sache100% (3)

- Temenos Banking Reference Process - ReadMe PDFDocument13 pagesTemenos Banking Reference Process - ReadMe PDFAJ AmineNo ratings yet

- Evolution of T24Document29 pagesEvolution of T24Preethi Gopalan100% (1)

- Classic NavigationDocument39 pagesClassic NavigationPreethi GopalanNo ratings yet

- Jed EditorDocument6 pagesJed EditorPreethi GopalanNo ratings yet

- Directory Structure of T24Document32 pagesDirectory Structure of T24Preethi GopalanNo ratings yet

- IRIS R18 User Guide PDFDocument120 pagesIRIS R18 User Guide PDFKirson80% (15)

- Browser NavigationDocument26 pagesBrowser NavigationPreethi GopalanNo ratings yet

- TAFJ R18 Release NotesDocument10 pagesTAFJ R18 Release NotesGopal ArunachalamNo ratings yet

- Ace The Ielts Trial Listening Edition3Document53 pagesAce The Ielts Trial Listening Edition3DOMINICNo ratings yet

- Temenos Banking Reference Process - ReadMe PDFDocument13 pagesTemenos Banking Reference Process - ReadMe PDFAJ AmineNo ratings yet

- Arrangement Architecture - BasicDocument26 pagesArrangement Architecture - Basicsharath.np100% (6)

- DEL6 - Delivery Carriers eMAIL, SMS, Secure Message-R14Document36 pagesDEL6 - Delivery Carriers eMAIL, SMS, Secure Message-R14Preethi GopalanNo ratings yet

- TAFJ ChangeSet InstallationDocument13 pagesTAFJ ChangeSet InstallationPaulTinocoNo ratings yet

- Tafj CommandsDocument4 pagesTafj CommandsPreethi Gopalan100% (2)

- TAFJ ChangeSet InstallationDocument13 pagesTAFJ ChangeSet InstallationPaulTinocoNo ratings yet

- DEL4 - T24 Outward Delivery - PART II-R13.01 PDFDocument61 pagesDEL4 - T24 Outward Delivery - PART II-R13.01 PDFPreethi Gopalan100% (3)

- DEL3 - T24 Outward Delivery - Part I-R13.01Document65 pagesDEL3 - T24 Outward Delivery - Part I-R13.01Preethi Gopalan50% (2)

- DEL6 - Delivery Carriers eMAIL, SMS, Secure Message-R13.01Document36 pagesDEL6 - Delivery Carriers eMAIL, SMS, Secure Message-R13.01Preethi GopalanNo ratings yet

- DEL7 - Delivery (INWARD) - R14 PDFDocument41 pagesDEL7 - Delivery (INWARD) - R14 PDFPreethi GopalanNo ratings yet

- DEL5 - Soft Delivery-R14Document22 pagesDEL5 - Soft Delivery-R14Preethi Gopalan100% (2)

- DEL5 - Soft Delivery-R13.01Document22 pagesDEL5 - Soft Delivery-R13.01Preethi GopalanNo ratings yet

- DEL1-Delivery Outward - Induction Only-R14Document73 pagesDEL1-Delivery Outward - Induction Only-R14Preethi GopalanNo ratings yet

- Hero CyclesDocument87 pagesHero Cyclesanon_61822950% (4)

- Financial Management AssignmentDocument4 pagesFinancial Management AssignmentHarichandan PNo ratings yet

- Introduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualDocument42 pagesIntroduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualberthaNo ratings yet

- CDBLDocument5 pagesCDBLsmg_dreamNo ratings yet

- TIDSOSMDocument9 pagesTIDSOSMMáté Dániel CsöndesNo ratings yet

- 1.duration Question 2Document9 pages1.duration Question 2ShobhitNo ratings yet

- Manual To ShreveDocument64 pagesManual To ShreveIvan Tay100% (1)

- Mudharabah Assignment - Muhammad Fadlil Kirom - AIB-17-IPDocument4 pagesMudharabah Assignment - Muhammad Fadlil Kirom - AIB-17-IPAdil KiromNo ratings yet

- E-Commerce:: E-Business Is The Use of The Internet and Other Networks andDocument13 pagesE-Commerce:: E-Business Is The Use of The Internet and Other Networks andImroz MahmudNo ratings yet

- Study Notes The Building Blocks of Risk ManagementDocument19 pagesStudy Notes The Building Blocks of Risk Managementalok kundaliaNo ratings yet

- Debt A-BDocument966 pagesDebt A-Bmerrylmorley100% (1)

- TUTMACDocument63 pagesTUTMACThùy Dương NguyễnNo ratings yet

- Dance of The Lions and DragonsDocument84 pagesDance of The Lions and Dragonsvelhobiano100% (1)

- Midterm Exam: B. Deciding Whether or Not To Purchase A New Machine For The Production LineDocument4 pagesMidterm Exam: B. Deciding Whether or Not To Purchase A New Machine For The Production LineNguyễn DatNo ratings yet

- HKEX Listing RulesDocument1,038 pagesHKEX Listing Rulesjennifertong82No ratings yet

- Bridgecreek Investment Management Firm Tops $1 Billion in Assets Under ManagementDocument3 pagesBridgecreek Investment Management Firm Tops $1 Billion in Assets Under ManagementPR.comNo ratings yet

- Bloom Consulting Country Brand Ranking Trade 2013Document36 pagesBloom Consulting Country Brand Ranking Trade 2013The Santiago TimesNo ratings yet

- SM02 She-1Document3 pagesSM02 She-1Arieza MontañoNo ratings yet

- Project Report On FdiDocument15 pagesProject Report On FdiAkshata ZopayNo ratings yet

- Engineering Economics Mid TermDocument2 pagesEngineering Economics Mid TermMuhammad AneesNo ratings yet

- CFA Essay Writing HelpDocument4 pagesCFA Essay Writing HelpNeeraj SinghNo ratings yet

- CIFC Exam Prep Live Webinar Practice Questions 2018 v.2 69276 1 25 2018 1254Document17 pagesCIFC Exam Prep Live Webinar Practice Questions 2018 v.2 69276 1 25 2018 1254Anup KhanalNo ratings yet

- Revision Pack and AnsjjwersDocument34 pagesRevision Pack and AnsjjwersShree Punetha PeremaloNo ratings yet

- Amla 2003Document4 pagesAmla 2003jafernandNo ratings yet

- Equity Theory On Job MotivationDocument11 pagesEquity Theory On Job MotivationNitin SharmaNo ratings yet

- Lecture2 - Social Infrastructure PlanningDocument26 pagesLecture2 - Social Infrastructure PlanningArunava SarkarNo ratings yet

- Product Highlights: Sun Grepa Power Builder 10Document9 pagesProduct Highlights: Sun Grepa Power Builder 10Cyril Joy NagrampaNo ratings yet

- R47 Security Market IndicesDocument21 pagesR47 Security Market Indiceskazimeister1No ratings yet

- Annual Report Analysis On ACCDocument42 pagesAnnual Report Analysis On ACCShiVâ SãiNo ratings yet