Professional Documents

Culture Documents

Midterm Answer Key

Uploaded by

Rebecca ParisiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm Answer Key

Uploaded by

Rebecca ParisiCopyright:

Available Formats

Mid-Term

ACC1011 Answer Key Name:__________________________________________

1. Sam

Smith

is

the

sole

stockholder

and

operator

of

Smiths

Catering

Company.

At

the

end

of

the

accounting

period,

December

31,

2000,

Sams

Catering

has

assets

of

$135,000

and

liabilities

of

$72,000.

Required:

Using

the

accounting

equation

and

considering

each

case

independently,

determine

the

following

amounts:

a. Stockholders equity on 12/31/2000.

b. The amount and direction (increase or decrease) of the periods

change in stockholders equity if, during 2001, assets decreased by

$22,000 and liabilities decreased by $7,000.

c. Net income (or net loss) during 2001, assuming that as of December

31, 2001, assets were $148,000, liabilities were $75,000, capital stock

of $25,000 was issued and dividends of $12,000 were paid.

Solution

#

1:

Net

income

(or

net

loss)

during

2001,

assuming

that

as

of

December

31,

2001,

assets

were

$148,000,

liabilities

were

$75,000,

capital

stock

of

$25,000

was

issued,

and

dividends

of

$12,000

were

paid

a)

Assets

=

Liabilities

+

Owners

Equity

$135,000

=

$72,000

+

?

135,000

=

72,000

+

63,000

b)

Change

in

2001

-22,000

=

-7,000

+

?

-22,000

=

-7,000

+

-15,000

c)

Step

1:

solve

for

12/31/2001

equity

12/31/2001

$148,000

=

$75,000

+

?

148,000

=

75,000

+

73,000

12/31/2000

135,000

=

72,000

+

63,000

Change

in

2001

$13,000

=

$3,000

+

$10,000

Step

2:

solve

for

net

income

Capital

stock

-

Dividends

+

Net

Income

=

Change

in

Equity

$25,000

-

-12,000

+

?

$10,000

Net

Loss

=

$3,000

=

10,000

-

25,000

+12,000

Mid-Term ACC1011 Answer Key Name:__________________________________________

2. For each of the following transactions, indicate which elements of the

accounting equation are affected (minimum of 2 per transaction) and whether the

element has increased or decreased as a result.

a) Paid rent for August $3,000

b) Received cash from cash customers $7,500

c) Received cash for capital stock $15,000

d) Paid creditors on account $800

e) Received cash from customers on account $1,200

Solution #2:

a) Asset decrease Owners equity decrease

b) Asset increase Owners equity increase

c) Asset increase Owners equity increase

d) Asset decrease Liabilities decrease

e) Asset increase Asset decrease

3. For each of the following transactions, indicate which elements of the accounting

equation are affected (minimum of 2 per transaction) and whether the affected

elements have increased or decreased as a result.

a. Purchased supplies for cash, $1,200

b. Paid cash dividends, $1,000

c. Billed customers for services rendered on account, $2,800

d. Paid utilities for September, $85

e. Purchased equipment on account, $3,200

f. Received cash for services rendered, $900

g. Determined that the cost of supplies on hand was $30; therefore, $90

of supplies had been used

h. Paid $1,000 equipment purchased in (e) above

Solution # 3:

a) Asset increase Asset decrease

b) Asset decrease Owners equity - decrease

c) Asset increase Owners equity - increase

d) Asset decrease Owners equity - decrease

e) Asset increase Liabilities increase

f) Asset increase Owners equity - increase

g) Asset decrease Owners equity - decrease

h) Asset decrease Liabilities decrease

Mid-Term ACC1011 Answer Key Name:__________________________________________

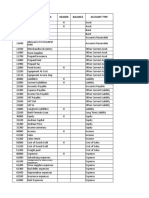

4. Indicate the financial statement on which each of the following accounts

would appear.

a) Prepaid rent

b) Cash

c) Capital stock

d) Rent expense

e) Dividends

f) Fees earned

g) Accounts payable

h) Retained earnings

Solution #4:

a) Prepaid rent balance sheet - asset

b) Cash balance sheet - asset

c) Capital stock balance sheet owners equity

d) Rent expense income statement - expense

e) Dividends retained earnings

f) Fees earned income statement - revenue

g) Accounts payable balance sheet - liabilities

h) Retained earnings statement of retained earnings

Mid-Term ACC1011 Answer Key Name:__________________________________________

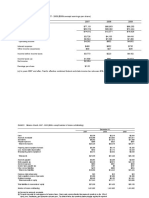

5.

The

following

table

shows

financial

data

for

Sweet

Cupcakes,

Inc.

as

of

June

30,

2014.

Prepare

a

balance

sheet

using

this

data.

Accounts

receivable

$419,200

Accounts

payable

349,200

Inventory

58,400

Capital

stock

662,100

Other

assets

69,400

Notes

payable

268,900

Cash

732,600

Equipment

118,500

Retained

earnings

117,900

Solution

#5:

Assets

Cash

AR

Inventory

Equipment

Other

Assets

TOTAL

ASSETS

Sweet Cupcakes, Inc.

Balance Sheet

As of June 30, 2014

Liabilities

$732,600

AP

419,200

Notes Payable

58,400

TOTAL LIABILITIES

118,500

69,400

Stockholders

Equity

$1,398,100

Capital Stock

Retained Earnings

TOTAL

STOCKHOLDERS

EQUITY

TOTAL L & SE

$349,200

268,900

$618,100

$662,100

117,900

$780,000

$1,398,100

Mid-Term ACC1011 Answer Key Name:__________________________________________

6.

Determine

the

net

income

(or

net

loss)

for

the

year,

assuming

that

additional

capital

stock

of

$35,000

was

issued,

and

that

no

dividends

were

paid.

Total

Assets

Total

Liabilities

Beginning

of

the

year

$625,000

$428,000

End

of

the

year

$782,000

250,000

Solution

#6:

Assets

-

Liabilities

=

OE

Beginning

of

the

625,000

428,000

197,000

year

End

of

the

year

782,000

250,000

532,000

Increase

OE

335,000

Increase

in

OE

335,000

Stock

issued

35,000

Dividends

0

Net

Income

300,000

7. Fill

in

the

blank:

a. The

Income

Statement

summarizes

all

revenue

and

expenses

for

a

period.

If

the

revenues

exceeds

expenses,

the

result

is

a

net

income.

If

the

expenses

exceed

the

revenues,

the

result

is

a

net

loss.

8. Accountants

communicate

with

users

through

four

financial

statements.

What

are

they?

List

them

in

the

order

that

they

should

be

prepared.

a. Income

Statement

b. OE

Statement

c. Balance

Sheet

d. Statement

of

Cash

Flows

9. Fill

in

the

blank:

a. The

Balance

Sheet

is

a

position

statement

that

shows

the

position

of

the

business

at

a

point

of

time.

It

MUST

balance,

where

the

A

=

L

+

OE

10. Fill

in

the

blank:

a. The

Statement

of

Cash

Flows

reports

three

different

activities,

these

are

Operating,

Investing

and

Financing.

Mid-Term ACC1011 Answer Key Name:__________________________________________

11. Resources

owned

by

a

business

and

used

in

carrying

out

its

operating

activities

are:

a.

liabilities

b. stockholders'

equity

c. revenues.

d. assets.

12. GAAP is an abbreviation for:

a. Generally authorized accounting procedures.

b. Generally applied accounting procedures.

c. Generally accepted auditing practices.

d. Generally accepted accounting principles

13. The amounts of the assets and liabilities of Wilderness Travel Service at April

30, 2014, the end of the current year, and its revenue and expenses for the

year are listed below. The capital of Harper Borg, owner, was $180,000 at

May 1, 2013, the beginning of the current year, and the owner withdrew

$40,000 during the current year.

Accounts payable

$ 25,000

Accounts receivable

210,000

Cash

146,000

Fees earned

875,000

Miscellaneous expense

1 5,000

Rent expense

75,000

Supplies

$ 9,000

Supplies expense

12,000

Taxes expense

10,000

Utilities expense

38,000

Wages expense

525,000

Instructions

1.

Prepare

an

income

statement

for

the

current

year

ended

April

30,

2014.

2.

Prepare

a

statement

of

owner's

equity

for

the

current

year

ended

April

30,

2014.

3.

Prepare

a

balance

sheet

as

of

April

30,

2014.

4.

What

item

appears

on

both

the

income

statement

and

statement

of

owner's

equity?

Mid-Term ACC1011 Answer Key Name:__________________________________________

Mid-Term ACC1011 Answer Key Name:__________________________________________

14.

The

following

errors

took

place

in

journalizing

and

posting

transactions:

a.

Rent

of

$13,550

paid

for

the

current

month

was

recorded

as

a

debit

to

Rent

Expense

and

a

credit

to

Prepaid

Rent.

b.

A

withdrawal

of

$14,000

by

Ron

Sutin,

owner

of

the

business,

was

recorded

as

a

debit

to

Wages

Expense

and

a

credit

to

Cash.

Journalize

the

entries

to

correct

the

errors.

a.

Prepaid

Rent

13,550

Cash

13,550

b.

Dividends

14,000

Wages

Expense

14,000

15. Indicate

which

of

the

following

errors,

each

considered

individually,

would

cause

the

trial

balance

totals

to

be

unequal:

a. A

fee

of

$21,000

earned

and

due

from

a

client

was

not

debited

to

Accounts

Receivable

or

credited

to

a

revenue

account,

because

the

cash

had

not

been

received.

b. A

receipt

of

$11,300

from

an

account

receivable

was

journalized

and

posted

as

a

debit

of

$11,300

to

Cash

and

a

credit

of

$11,300

to

Fees

Earned.

c. A

payment

of

$4,950

to

a

creditor

was

posted

as

a

debit

of

$4,950

to

Accounts

Payable

and

a

debit

of

$4,950

to

Cash.

d. A

payment

of

$5,000

for

equipment

purchased

was

posted

as

a

debit

of

$500

to

Equipment

and

a

credit

of

$500

to

Cash.

e. Payment

of

a

cash

withdrawal

of

$19,000

was

journalized

and

posted

as

a

debit

of

$1,900

to

Salary

Expense

and

a

credit

of

$19,000

to

Cash.

Indicate

which

of

the

preceding

errors

would

require

a

correcting

entry.

Inequality

of

trial

balance

totals

would

be

caused

by

errors

described

in

(c)

and

(e).

For

(c),

the

debit

total

would

exceed

the

credit

total

by

$9,900

($4,950

+

$4,950).

For

(e),

the

credit

total

would

exceed

the

debit

total

by

$17,100

($19,000

$1,900).

Errors

(b),

(d),

and

(e)

would

require

correcting

entries.

Although

it

is

not

a

correcting

entry,

the

entry

that

was

not

made

in

(a)

should

also

be

entered

in

the

journal.

Mid-Term ACC1011 Answer Key Name:__________________________________________

16. (5 pts) Why is the debt to equity ratio important? What does it mean if a

business has a ratio of 3.5 and -3.5?

Debt to equity measures how much debt a company has compared to its

equity. That means it looks at how much the company owes and divides it by

the firm's equity. (Equity is just the opposite of debt -- it is ownership,

including shares of stock in a corporation.)

To state it another way, the ratio compares long-term funds provided by

creditors with funds provided by owners -- what a company owes versus the

amount of money it has invested in it. It indicates what portion or percentage

of equity and what portion or percentage of debt the company is using to

finance its business.

The formula for the debt to equity ratio is total liabilities divided by total

equity. The debt to equity ratio is a financial leverage ratio. Financial

leverage ratios are used to measure a company's ability to handle its long

term and short term obligations. Considering that a company's assets or

value is comprised of liabilities plus equity, the debt to equity ratio contrasts

these two variables to show a company's leverage position. As a company

increases their leverage or debt, they are considered a higher risk. This

higher risk and debt to equity ratio is discussed in the following section.

A high debt/equity ratio (3.5) means that the company has been "aggressive"

in financing its growth with debt and that it is carrying a sizable amount of

interest expense.

A ratio greater than 1 means assets are mainly financed with debt; a ratio

less than one (-3.5) means equity provides the majority of the financing.

Ideally, you want to invest in a company where the total debt to equity figure

is low -- below .50. However, there are many well-run companies that have a

ratio of 1 or even higher. But if the debt-equity ratio surpasses 2, be

extremely cautious. Make certain the company can handle its interest

payments, and that it has a strong cash flow.

Mid-Term ACC1011 Answer Key Name:__________________________________________

17.

(5

pts)

When

completing

a

horizontal

analysis

how

do

you

determine

the

amount

and

the

percentage?

Horizontal

analysis

uses

two

financial

statements

(for

example,

two

year-end

statements)

to

determine

percentage

changes

based

on

dollar

changes.

a.

First

the

dollar

change

(increase

or

decrease)

from

the

earlier

(base)

period

to

the

later

period

is

calculated

going

horizontally

across

the

chart.

b.

Then

the

percentage

change

is

calculated

by

dividing

the

dollar

change

by

the

earlier

(base)

period

amount.

18. (5

pts)

Which

of

the

following

applications

of

the

rules

of

debit

and

credit

is

true?

a. Increase

rent

expense

with

debits

and

the

normal

balance

is

a

debit.

b. Decrease

accounts

receivable

with

credits

and

the

normal

balance

is

a

credit.

c. Increase

accounts

payable

with

credits

and

the

normal

balance

is

a

debit.

d. Decrease

cash

with

debits

and

the

normal

balance

is

a

credit.

19.

(5

pts)

The

process

of

initially

recording

a

business

transaction

is

called:

a. Charting

b. Posting

c. Journalizing

d. Transposing

20.

(5

pts)

Accounts

with

normal

debit

balances

include:

a. Assets

and

liabilities

b. Liabilities

and

expenses

c. Expenses

and

assets

d. Stockholders

equity

and

revenues

21.

(5

pts)

Borrowing

cash

from

the

bank

causes

assets

to

decrease

and

liabilities

to

increase.

a. True

b. False

Borrowing cash from the bank causes assets to increase and

liabilities to increase. There is not a way to argue that this question

would be true.

You might also like

- Cost Management Questionnaire PCPDocument2 pagesCost Management Questionnaire PCPJoaquín Quiñones SoteloNo ratings yet

- IA3 Mod 4 REDocument12 pagesIA3 Mod 4 REjulia4razoNo ratings yet

- Mas Prequali FSUU AccountingDocument8 pagesMas Prequali FSUU AccountingRobert CastilloNo ratings yet

- On October 1 2018 Jay Crowley Established Affordable Realty WhichDocument1 pageOn October 1 2018 Jay Crowley Established Affordable Realty WhichAmit Pandey0% (1)

- Cash To Inventory Reviewer 1Document15 pagesCash To Inventory Reviewer 1Patricia Camille AustriaNo ratings yet

- Lesson 1 Cluster 2 FSUU AccountingDocument6 pagesLesson 1 Cluster 2 FSUU AccountingRobert CastilloNo ratings yet

- Accounting 321 Solutions - Practice Quiz 4Document3 pagesAccounting 321 Solutions - Practice Quiz 4cristiano ronaldooNo ratings yet

- ACC101 - Accounting for ReceivablesDocument15 pagesACC101 - Accounting for Receivablesinfinite_dreamsNo ratings yet

- Topic 8 Receivable Financing Rev Students 653Document39 pagesTopic 8 Receivable Financing Rev Students 653Nemalai VitalNo ratings yet

- Chap 8Document13 pagesChap 8MichelleLeeNo ratings yet

- FarDocument1 pageFarRyoma EchizenNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Conceptual Framework - Objective of Financial ReportingDocument8 pagesConceptual Framework - Objective of Financial ReportingSandra CenizaNo ratings yet

- The Following Trial Balance of Oakley Co Does Not Balance PDFDocument1 pageThe Following Trial Balance of Oakley Co Does Not Balance PDFAnbu jaromiaNo ratings yet

- Quiz Budgeting and Standard CostingDocument2 pagesQuiz Budgeting and Standard CostingAli SwizzleNo ratings yet

- BUS 201 Review For Exam 2Document7 pagesBUS 201 Review For Exam 2Brandilynn WoodsNo ratings yet

- FAR - Estimating Inventory - StudentDocument3 pagesFAR - Estimating Inventory - StudentPamelaNo ratings yet

- Project C Manual For Counters ReviewedDocument30 pagesProject C Manual For Counters ReviewedDarlynSilvanoNo ratings yet

- Homework CVP & BEDocument11 pagesHomework CVP & BEYamato De Jesus NakazawaNo ratings yet

- Abs CBN Ratio AnalysisDocument2 pagesAbs CBN Ratio AnalysisMarjorie Fronda TumbaliNo ratings yet

- AccountingDocument4 pagesAccountingTk KimNo ratings yet

- Cost Accounting Concept and DefinitionDocument10 pagesCost Accounting Concept and DefinitionRifa AzeemNo ratings yet

- Tutorial Solution Week 06Document4 pagesTutorial Solution Week 06itmansaigonNo ratings yet

- Bs T Partners Has Developed A New Hubcap With The ModelDocument1 pageBs T Partners Has Developed A New Hubcap With The ModelAmit PandeyNo ratings yet

- Problem 1: Organizing Categorical Variables: SolutionDocument34 pagesProblem 1: Organizing Categorical Variables: SolutionArgieshi GCNo ratings yet

- 55026RR 14-2010 Accreditation PDFDocument5 pages55026RR 14-2010 Accreditation PDFlmin34No ratings yet

- GEN009 - q2Document14 pagesGEN009 - q2CRYPTO KNIGHTNo ratings yet

- Item (A) Type of Adjustment (B) Accounts Before AdjustmentDocument11 pagesItem (A) Type of Adjustment (B) Accounts Before Adjustmentsuci monalia putriNo ratings yet

- Pq-Cash and Cash EquivalentsDocument3 pagesPq-Cash and Cash EquivalentsJanella PatriziaNo ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- Heats Corporation Current and Noncurrent LiabilitiesDocument1 pageHeats Corporation Current and Noncurrent LiabilitiesjhobsNo ratings yet

- Bank ReconciliationDocument9 pagesBank Reconciliationlit afNo ratings yet

- Audit 2 - Topic4Document18 pagesAudit 2 - Topic4YUSUF0% (1)

- Financial Accounting Problems: Problem I (Current Assets)Document21 pagesFinancial Accounting Problems: Problem I (Current Assets)Fery AnnNo ratings yet

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blaireNo ratings yet

- Accounting Intermediate Part 3 Statement of Financial PositionDocument3 pagesAccounting Intermediate Part 3 Statement of Financial PositionCj GarciaNo ratings yet

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Exercises Ch05Document3 pagesExercises Ch05Ahmed El KhateebNo ratings yet

- Assignment 1 - Chapter 2Document6 pagesAssignment 1 - Chapter 2Ho Thi Phuong ThaoNo ratings yet

- Chapter 8 Consolidation IDocument18 pagesChapter 8 Consolidation IAkkama100% (1)

- Understanding Inventory Valuation and ReportingDocument57 pagesUnderstanding Inventory Valuation and ReportingA. MagnoNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Reviewer ErrorDocument13 pagesReviewer ErrorPatriciaSamaritaNo ratings yet

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsDocument13 pagesIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikNo ratings yet

- Multiple choice and accounting practice questionsDocument3 pagesMultiple choice and accounting practice questionsSewale AbateNo ratings yet

- Practice Set - Audit of Sales and ReceivablesDocument2 pagesPractice Set - Audit of Sales and ReceivablesnikkaNo ratings yet

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- Chapter 4 ITISDocument40 pagesChapter 4 ITISmannybanwaitNo ratings yet

- D. None of These.: 1 - Page DR/ Magdy Kamel Tel/ 01273949660Document10 pagesD. None of These.: 1 - Page DR/ Magdy Kamel Tel/ 01273949660magdy kamelNo ratings yet

- 5.equity-EpsDocument54 pages5.equity-EpsArjun DonNo ratings yet

- Intermediate Accounting - Final Output ReceivablesDocument56 pagesIntermediate Accounting - Final Output ReceivablesAnitas LimmaumNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- Introduction To Financial Accounting: Key Terms and Concepts To KnowDocument16 pagesIntroduction To Financial Accounting: Key Terms and Concepts To KnowAmit SharmaNo ratings yet

- ACC101 Chapter1newDocument16 pagesACC101 Chapter1newtazebachew birkuNo ratings yet

- Acct 2251 Enlarged Review Qs Final ExamW07Document9 pagesAcct 2251 Enlarged Review Qs Final ExamW07hatanolove100% (1)

- ACC121 FinalExamDocument13 pagesACC121 FinalExamTia1977No ratings yet

- Do Not Turn Over This Question Paper Until You Are Told To Do SoDocument17 pagesDo Not Turn Over This Question Paper Until You Are Told To Do SoMin HeoNo ratings yet

- Chapter 1 Exam PracticeDocument16 pagesChapter 1 Exam PracticeAlison JcNo ratings yet

- Tort Essay SampleDocument4 pagesTort Essay SampleRebecca ParisiNo ratings yet

- Business Law Bailments and SalesDocument34 pagesBusiness Law Bailments and SalesRebecca ParisiNo ratings yet

- BL Quiz 1 Answer KeyDocument2 pagesBL Quiz 1 Answer KeyRebecca ParisiNo ratings yet

- Calculate gross profit, cost of goods sold, ending inventoryDocument2 pagesCalculate gross profit, cost of goods sold, ending inventoryRebecca ParisiNo ratings yet

- Understanding Depreciation Methods and ConceptsDocument30 pagesUnderstanding Depreciation Methods and ConceptsVimalKumar100% (1)

- IGNOU MBA MS04 Solved AssignmentsDocument10 pagesIGNOU MBA MS04 Solved AssignmentstobinsNo ratings yet

- Accounting For Investments: TheoriesDocument20 pagesAccounting For Investments: TheoriesJohn AlbateraNo ratings yet

- Management Accounting (Bba32) Unit - IDocument42 pagesManagement Accounting (Bba32) Unit - IT S Kumar KumarNo ratings yet

- Conceptual Framework Underlying Financial Accounting: Intermediate Accounting 12th Edition Kieso, Weygandt, and WarfieldDocument39 pagesConceptual Framework Underlying Financial Accounting: Intermediate Accounting 12th Edition Kieso, Weygandt, and WarfieldFuzy ZiaNo ratings yet

- Accounting Class Notes PDFDocument146 pagesAccounting Class Notes PDFshahzebkhans50% (2)

- A Study On Commodity Market With Reference To Gold and Silver BullionDocument84 pagesA Study On Commodity Market With Reference To Gold and Silver Bullion07 Bhavesh JagtapNo ratings yet

- Analyze Credit Using Liquidity, Capital StructureDocument58 pagesAnalyze Credit Using Liquidity, Capital Structurehy_saingheng_760260967% (9)

- Chapter 16 Non Profit OrganizationsDocument28 pagesChapter 16 Non Profit Organizationslou-924No ratings yet

- Financial Statements Vodafone Idea LimitedDocument6 pagesFinancial Statements Vodafone Idea LimitedRamit SinghNo ratings yet

- Srei Consolidates 100% Shareholding in Srei Equipment Finance Limited ("SEFL") (Company Update)Document3 pagesSrei Consolidates 100% Shareholding in Srei Equipment Finance Limited ("SEFL") (Company Update)Shyam SunderNo ratings yet

- Ktu-Fsa-Course Project PresentationDocument19 pagesKtu-Fsa-Course Project PresentationAlbert VargheseNo ratings yet

- RatioDocument20 pagesRatioAkashdeep MarwahaNo ratings yet

- Adelphia - V1Document6 pagesAdelphia - V1PratikkalantriNo ratings yet

- Analysis and Interpretation of Financial StatementDocument7 pagesAnalysis and Interpretation of Financial StatementshubhcplNo ratings yet

- Atlas & Union Jute Press Co. LTD.: Chartered AccountantsDocument30 pagesAtlas & Union Jute Press Co. LTD.: Chartered Accountantsravibhartia1978No ratings yet

- 1-9 A Fundamental Analysis of Indian Automobile Industry With Special Reference To Tata, Maruti & Mahindra & Mahindra PDFDocument9 pages1-9 A Fundamental Analysis of Indian Automobile Industry With Special Reference To Tata, Maruti & Mahindra & Mahindra PDFMariyam KaziNo ratings yet

- Natural Accounts COA OracleDocument9 pagesNatural Accounts COA OracleHussein Abdou HassanNo ratings yet

- Dissertation TopicsDocument24 pagesDissertation Topicsdineshlutya50% (2)

- Shareholders Equity Part 1Document57 pagesShareholders Equity Part 1AlliahDataNo ratings yet

- Chapter 11Document29 pagesChapter 11Fathan Mubina92% (12)

- Ey Good Company Fta India PDFDocument164 pagesEy Good Company Fta India PDFyasinNo ratings yet

- Chapter 3 FM 313 1Document37 pagesChapter 3 FM 313 1Janica VilladelgadoNo ratings yet

- CMNPDocument2 pagesCMNPIsni AmeliaNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- FileDocument16 pagesFileGhiann TolibatNo ratings yet

- A Strategic Management Term Paper On UNILEVER PhilippinesDocument34 pagesA Strategic Management Term Paper On UNILEVER PhilippinesAndrenelReyesNo ratings yet

- Test bank for Financial Accounting, 4th EditionDocument46 pagesTest bank for Financial Accounting, 4th EditionBảo Anh PhạmNo ratings yet

- Partnership Operation Quiz 1 Combined OnlineDocument7 pagesPartnership Operation Quiz 1 Combined OnlineZyka SinoyNo ratings yet

- Account Name Header Balance Account Type Account NumberDocument5 pagesAccount Name Header Balance Account Type Account NumberJohanNo ratings yet