Professional Documents

Culture Documents

Marine Bank Repayment for Altered Certified Check

Uploaded by

Chimney sweepOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marine Bank Repayment for Altered Certified Check

Uploaded by

Chimney sweepCopyright:

Available Formats

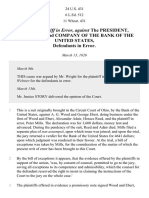

Marine National Bank v.

National City Bank

Facts:

-

The Lunt Brothers (drawer) who were merchants in New York gave a stranger

a $25 check in exchange for the same amount in cash, drawn upon Marine

National Bank (drawee), and payable to the order of Henry Smith (payee)

The next day, a person called upon Derippe & Co (NY gold brokers) stating

that he wished to buy some gold for the Lunt Brothers, and asked $3,334 gold

in currency

A memo, giving the amount as $4,079.96 was delivered to him

he person then altered the $25 check by erasing the date, payee, and

amount

In place of the original, he inserted Dec. 2, 1969, payee as Derippe & Co, and

the amount as $4,079.96

He then sent the check to Marine National Bank for certification, which the

latter duly certified upon presentation

Derippe & Co, without notice of and being ignorant of the alteration and

relying upon the certification, gave to the person the sum of $3,334 American

gold, receiving in payment the certified check

Derippe indorsed the check and deposited it in National City Bank (collecting

Bank)

Marine Bank paid the check to National City Bank, but requested repayment

of the amount immediately when it discovered the alterations

Nationall City Bank refused to repay the same

Before the discovery of the alteration, both banks believed the check to be

genuine

Judgment was rendered for Marine Bank on the ground that it did not

guarantee the genuineness of the filling out of the check by certifying, and so

it was not estopped from showing the alteration, and was entitled to the

repayment.

Issue(s):

w/n Marine National Bank is entitled to the repayment

SC Ratio:

That an acceptor of a bill of exchange by acceptance only admits the genuineness

of the signature of the drawer, and does not admit the genuineness of the

indorsements...or any other part of the bill, is elementary and sustained by an

unbroken current of authority. The reason is that when the bill is presented for

acceptance the acceptor looks to the handwriting of the drawer with which he is

presumed to be acquainted...But the acceptor cannot be presumed to have any

such knowledge of the other facts upon which the rights of the holder may depend.

The doctrine is applied to cases of bills altered in the body, by the raising of the

amount for which they were drawn, and also to those in which the name of the

payee has been feloniously changed.

The drawee is presumed to be acquainted with the drawers signature, but to

require the drawee to know the handwriting of the residue of the bill is

unreasonable. It would, in most cases, be requiring an impossibility. Such a rule

would be not only arbitrary and rigorous, but unjust.

Disposition Judgment affirmed.

You might also like

- Nego Cases - 091615: Is Marine National Bank Entitled To A Refund? YES. When It Made The Certification? Only TheDocument8 pagesNego Cases - 091615: Is Marine National Bank Entitled To A Refund? YES. When It Made The Certification? Only TheKarla BeeNo ratings yet

- White v. National Bank, 102 U.S. 658 (1881)Document6 pagesWhite v. National Bank, 102 U.S. 658 (1881)Scribd Government DocsNo ratings yet

- Forgery Case DigestsDocument14 pagesForgery Case DigestsMark Jason Crece AnteNo ratings yet

- Notice of DishonorDocument12 pagesNotice of DishonorCocoy LicarosNo ratings yet

- Newport Bank v. Herkimer Bank, 225 U.S. 178 (1912)Document6 pagesNewport Bank v. Herkimer Bank, 225 U.S. 178 (1912)Scribd Government DocsNo ratings yet

- Bank v. Kennedy, 84 U.S. 19 (1873)Document8 pagesBank v. Kennedy, 84 U.S. 19 (1873)Scribd Government DocsNo ratings yet

- Negotiable Instruments Law DigestDocument83 pagesNegotiable Instruments Law DigestCha100% (2)

- Savings Bank Forgery CaseDocument2 pagesSavings Bank Forgery CaseKim Balauag100% (1)

- NEGO Bank Liability Forgery CasesDocument11 pagesNEGO Bank Liability Forgery CasesAlvinRelox100% (1)

- NEGOTIABLE INSTRUMENTS LAW DIGESTSDocument22 pagesNEGOTIABLE INSTRUMENTS LAW DIGESTSDianne Bernadeth Cos-agonNo ratings yet

- Merchants' Bank v. State Bank, 77 U.S. 604 (1871)Document59 pagesMerchants' Bank v. State Bank, 77 U.S. 604 (1871)Scribd Government DocsNo ratings yet

- NEGO Gr. 11 - Assoc Bank and Conrado Cruz v. CADocument6 pagesNEGO Gr. 11 - Assoc Bank and Conrado Cruz v. CABiBi JumpolNo ratings yet

- Case DigestDocument4 pagesCase DigestRose Anne CuarterosNo ratings yet

- Case StudyDocument9 pagesCase StudyMegha ShahNo ratings yet

- NEGO Week 5 (July 5 and 6)Document3 pagesNEGO Week 5 (July 5 and 6)larcia025No ratings yet

- Negotiable Instruments Digested Cases 2Document9 pagesNegotiable Instruments Digested Cases 2ChristineNo ratings yet

- Philippine Education Co. Inc. V. Soriano (G.R. No. L-22405. June 30, 1971)Document7 pagesPhilippine Education Co. Inc. V. Soriano (G.R. No. L-22405. June 30, 1971)Ipe DimatulacNo ratings yet

- Commercial Bank of Pa. v. Armstrong, 148 U.S. 50 (1893)Document6 pagesCommercial Bank of Pa. v. Armstrong, 148 U.S. 50 (1893)Scribd Government DocsNo ratings yet

- Jimmy M. Reed v. Central National Bank of Alva, A Corporation, 421 F.2d 113, 10th Cir. (1970)Document8 pagesJimmy M. Reed v. Central National Bank of Alva, A Corporation, 421 F.2d 113, 10th Cir. (1970)Scribd Government DocsNo ratings yet

- Carolyn M. Garcia vs. Rica Marie S. Thio GR. No. 154878Document5 pagesCarolyn M. Garcia vs. Rica Marie S. Thio GR. No. 154878Rhei BarbaNo ratings yet

- Nil 2Document10 pagesNil 2KC ToraynoNo ratings yet

- National Bank of Commerce of Boston v. Merchants' Nat. Bank of Memphis, 91 U.S. 92 (1875)Document11 pagesNational Bank of Commerce of Boston v. Merchants' Nat. Bank of Memphis, 91 U.S. 92 (1875)Scribd Government DocsNo ratings yet

- Dispute Over Promissory Note and Dishonored ChecksDocument192 pagesDispute Over Promissory Note and Dishonored CheckskuheDSNo ratings yet

- Negotiable Instrument (Discharge of Instrument)Document15 pagesNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- NIL Syl Digested CasesDocument20 pagesNIL Syl Digested CasesJerik SolasNo ratings yet

- Negotiable Instruments Case Digests For November 8Document3 pagesNegotiable Instruments Case Digests For November 8Megan MateoNo ratings yet

- Digest NegoDocument16 pagesDigest Negoiceiceice023No ratings yet

- National Security Bank v. Butler, 129 U.S. 223 (1889)Document7 pagesNational Security Bank v. Butler, 129 U.S. 223 (1889)Scribd Government DocsNo ratings yet

- United States v. City Bank of Columbus, 60 U.S. 385 (1857)Document4 pagesUnited States v. City Bank of Columbus, 60 U.S. 385 (1857)Scribd Government DocsNo ratings yet

- Bank liable for cashier's checkDocument8 pagesBank liable for cashier's checkSka Agcaoli0% (1)

- NilDocument15 pagesNilLexa L. DotyalNo ratings yet

- Olbres NH SCT 1997Document6 pagesOlbres NH SCT 1997Chris BuckNo ratings yet

- Chiang Ya Min V CaDocument2 pagesChiang Ya Min V CaYaj Apolap100% (1)

- Negotin 1ST Week Case Assignments - DigestDocument8 pagesNegotin 1ST Week Case Assignments - DigestArann PilandeNo ratings yet

- People vs. Tanjutco, G.R. No. L-23924, April 29, 1968Document12 pagesPeople vs. Tanjutco, G.R. No. L-23924, April 29, 1968Lorenz BaguioNo ratings yet

- New York County Nat. Bank v. Massey, 192 U.S. 138 (1904)Document7 pagesNew York County Nat. Bank v. Massey, 192 U.S. 138 (1904)Scribd Government DocsNo ratings yet

- Bank Liable for Encashment of Crossed ChecksDocument5 pagesBank Liable for Encashment of Crossed ChecksArvy VelasquezNo ratings yet

- REPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKDocument5 pagesREPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKZaira Gem GonzalesNo ratings yet

- Ramon D. Villanueva Jr. Jd-2BDocument6 pagesRamon D. Villanueva Jr. Jd-2BJean Jamailah TomugdanNo ratings yet

- Bank Liable for Forgery Despite Contributory NegligenceDocument13 pagesBank Liable for Forgery Despite Contributory NegligenceKirby ReniaNo ratings yet

- Supreme Court rules crossed checks must only be deposited by intended payeeDocument6 pagesSupreme Court rules crossed checks must only be deposited by intended payeeGendale Am-isNo ratings yet

- Cabrera vs. PeopleDocument18 pagesCabrera vs. PeopleShien TumalaNo ratings yet

- Negotiable Instruments Law: San Carlos Mining Vs BPIDocument5 pagesNegotiable Instruments Law: San Carlos Mining Vs BPIkathNo ratings yet

- Krauffman vs. PNB 42 PHIL 162 GR No. 16454, Sept. 29, 1921 FactsDocument91 pagesKrauffman vs. PNB 42 PHIL 162 GR No. 16454, Sept. 29, 1921 FactsAemjae Sainty AlbanoNo ratings yet

- Restrictive Endorsement CaseDocument3 pagesRestrictive Endorsement CaseTricia MontoyaNo ratings yet

- New Pacific Timber & Supply Co., Inc vs. Seneris GR No. L-41764 December19, 1980. Concepcion JR., JDocument3 pagesNew Pacific Timber & Supply Co., Inc vs. Seneris GR No. L-41764 December19, 1980. Concepcion JR., JJadenNo ratings yet

- Mills v. Bank of United States, 24 U.S. 431 (1826)Document6 pagesMills v. Bank of United States, 24 U.S. 431 (1826)Scribd Government DocsNo ratings yet

- Chan Wan Vs Tan KimDocument12 pagesChan Wan Vs Tan KimCarlo ColumnaNo ratings yet

- Salazar Vs JY Bros Marketing CorpDocument2 pagesSalazar Vs JY Bros Marketing CorpCelyne Esden100% (2)

- Case Digest New 9142022Document6 pagesCase Digest New 9142022Eun Ae YinNo ratings yet

- Cases 25,26,&27Document12 pagesCases 25,26,&27Ainah BaratamanNo ratings yet

- Bank Liable for Paying Forged Checks Despite NegligenceDocument11 pagesBank Liable for Paying Forged Checks Despite Negligenceclaire beltranNo ratings yet

- 17 Rizal Commercial Banking Corporation V Hi-Tri Development CorpDocument2 pages17 Rizal Commercial Banking Corporation V Hi-Tri Development CorpJazem AnsamaNo ratings yet

- Negotiable Instruments Case Digest 6 PDF FreeDocument50 pagesNegotiable Instruments Case Digest 6 PDF FreeJr MateoNo ratings yet

- Jai-Alai Corp v. BPIDocument10 pagesJai-Alai Corp v. BPIGia DimayugaNo ratings yet

- Negotiable Compiled Cases (Week 1,2 and 3)Document12 pagesNegotiable Compiled Cases (Week 1,2 and 3)MoireeGNo ratings yet

- Checks Rulings on Holder in Due Course StatusDocument12 pagesChecks Rulings on Holder in Due Course StatuscelineNo ratings yet

- Case Digest 2Document5 pagesCase Digest 2TsuuundereeNo ratings yet

- Forgery Case Digest: BPI v. CA, China Banking Corp and Phil. Clearing House CorpDocument11 pagesForgery Case Digest: BPI v. CA, China Banking Corp and Phil. Clearing House CorpVitas VitalyNo ratings yet

- MABANGDocument67 pagesMABANGWazzupNo ratings yet

- 14 - People v. Godoy (G.R. Nos. 115908-09, December 06, 1995)Document34 pages14 - People v. Godoy (G.R. Nos. 115908-09, December 06, 1995)Chimney sweepNo ratings yet

- Umali vs. EstanislaoDocument11 pagesUmali vs. EstanislaoJuan Dela CruzNo ratings yet

- Shortlist Adsoc JDocument2 pagesShortlist Adsoc JChimney sweepNo ratings yet

- AONo 2018-080Document3 pagesAONo 2018-080Chimney sweepNo ratings yet

- Garcilliano Vs HRET GR 170338Document13 pagesGarcilliano Vs HRET GR 170338Joffrey UrianNo ratings yet

- 9 - Farinas v. Executive Secretary, 463 Phil. 179 (2003)Document21 pages9 - Farinas v. Executive Secretary, 463 Phil. 179 (2003)Chimney sweepNo ratings yet

- Citizen's Charter Updated - 2019Document17 pagesCitizen's Charter Updated - 2019Chimney sweepNo ratings yet

- 1 - People v. Purisima (G.R. L-42050-66, November 20, 1978)Document19 pages1 - People v. Purisima (G.R. L-42050-66, November 20, 1978)Chimney sweepNo ratings yet

- Tanada v. Tuvera, 230 Phil. 528Document4 pagesTanada v. Tuvera, 230 Phil. 528Chimney sweepNo ratings yet

- Feliciano, The Law Library (2009)Document23 pagesFeliciano, The Law Library (2009)Chimney sweepNo ratings yet

- Guidelines For Litigation in QC Trial CourtsDocument9 pagesGuidelines For Litigation in QC Trial CourtsRod MagatNo ratings yet

- IBP's Mandatory Pro Bono Legal Services for Filipino CitizensDocument16 pagesIBP's Mandatory Pro Bono Legal Services for Filipino CitizensAlfred Bryan AspirasNo ratings yet

- SET Case No. 001 16 Resolution No. 16 143 Dated 06 May 2019Document6 pagesSET Case No. 001 16 Resolution No. 16 143 Dated 06 May 2019Chimney sweepNo ratings yet

- Omb Mc-No.-2018-002Document3 pagesOmb Mc-No.-2018-002Chimney sweepNo ratings yet

- Upd Faculty Manual 2003Document351 pagesUpd Faculty Manual 2003Stiminiw EdanoNo ratings yet

- Privacy Policy Office Advisory Opinion No. 2018-053Document4 pagesPrivacy Policy Office Advisory Opinion No. 2018-053Chimney sweepNo ratings yet

- Best Efforts Practical LawyerDocument10 pagesBest Efforts Practical LawyerPriyanka DevershettyNo ratings yet

- IRR Implementing 8042 As Amended by RA 10022Document49 pagesIRR Implementing 8042 As Amended by RA 10022Ivanheck GatdulaNo ratings yet

- Arbitration and ADRDocument59 pagesArbitration and ADRChimney sweepNo ratings yet

- Requirements for Repeaters and RefreshersDocument6 pagesRequirements for Repeaters and RefreshersTugonon M Leo RoswaldNo ratings yet

- BIR receipt circular prescribes use of printed receiptDocument2 pagesBIR receipt circular prescribes use of printed receiptAmberlyNo ratings yet

- Johnston v. JohnstonDocument11 pagesJohnston v. Johnstonlenard5100% (1)

- Linberg V MakatiDocument2 pagesLinberg V MakatiChimney sweepNo ratings yet

- Johnston v. JohnstonDocument11 pagesJohnston v. Johnstonlenard5100% (1)

- 20 BLGF Opinion February 2, 2009Document1 page20 BLGF Opinion February 2, 2009Chimney sweepNo ratings yet

- The Negotiable Cow PDFDocument4 pagesThe Negotiable Cow PDFChimney sweepNo ratings yet

- 15 Customs Brokers PDFDocument4 pages15 Customs Brokers PDFpinkblush717No ratings yet

- 20 BLGF Opinion February 2, 2009Document1 page20 BLGF Opinion February 2, 2009Chimney sweepNo ratings yet

- 15 Customs Brokers PDFDocument4 pages15 Customs Brokers PDFpinkblush717No ratings yet

- Lasala Vs NfaDocument3 pagesLasala Vs NfaGretch PanoNo ratings yet

- BP 22 VawcDocument13 pagesBP 22 VawcMa Krishina Joy Amigo - EscobarNo ratings yet

- Act 150 PassportDocument18 pagesAct 150 PassportBayu AbirowoNo ratings yet

- Davao Light and Power Co p6Document2 pagesDavao Light and Power Co p6Tet DomingoNo ratings yet

- Morales v. Harbour Center (2012)Document2 pagesMorales v. Harbour Center (2012)franzadonNo ratings yet

- Lucman vs. SBDocument5 pagesLucman vs. SBWen DyNo ratings yet

- Olongapo Vs Subic WaterDocument10 pagesOlongapo Vs Subic WaterMa Alyssa Rea NuñezNo ratings yet

- Technology For Teaching and Learning 2: 1. Intellectual Property RightsDocument9 pagesTechnology For Teaching and Learning 2: 1. Intellectual Property RightsJung Rae JaeNo ratings yet

- Bill of RightsDocument10 pagesBill of RightsJia Chu ChuaNo ratings yet

- Wyatt v. Moncrief Et Al (INMATE 2) - Document No. 3Document4 pagesWyatt v. Moncrief Et Al (INMATE 2) - Document No. 3Justia.comNo ratings yet

- Cabanas vs. Pilapil (G.R. No. L-25843 July 25, 1974) Case DigestDocument1 pageCabanas vs. Pilapil (G.R. No. L-25843 July 25, 1974) Case Digestmonjekatreena100% (1)

- Understanding the key elements of consideration in contract lawDocument11 pagesUnderstanding the key elements of consideration in contract lawJaseme OtoyoNo ratings yet

- Trial Court Has Discretion to Dismiss Case Despite DefaultDocument2 pagesTrial Court Has Discretion to Dismiss Case Despite DefaultderekNo ratings yet

- Should Britain Abolish The MonarchyDocument1 pageShould Britain Abolish The Monarchygame overNo ratings yet

- Four Theories of The PressDocument1 pageFour Theories of The PressrenzoagrielaNo ratings yet

- Claims For Disability and Death Benefits of OfwsDocument2 pagesClaims For Disability and Death Benefits of OfwsAnonymous X5ud3UNo ratings yet

- NEGOTIABLE INSTRUMENT ACT, 1881 - ExamDocument3 pagesNEGOTIABLE INSTRUMENT ACT, 1881 - Examrahulpatel1202No ratings yet

- Comparitive Uk & UsaDocument13 pagesComparitive Uk & UsaEliim RehmanNo ratings yet

- People V AbellaDocument2 pagesPeople V AbellaChupsNo ratings yet

- Law and Morality ProjectDocument18 pagesLaw and Morality ProjectMukul Singh RathoreNo ratings yet

- #11 - Vicente ChingDocument2 pages#11 - Vicente ChingRealKD30No ratings yet

- 125 CRPCDocument53 pages125 CRPCSudeep SharmaNo ratings yet

- Research Handbook On InternationalDocument850 pagesResearch Handbook On InternationalNevi Kurniati100% (1)

- ATA ContractDocument34 pagesATA ContractalijsyedNo ratings yet

- Opposition To Motion For ArbitrationDocument28 pagesOpposition To Motion For ArbitrationLaw&CrimeNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Perjanjian Internasional Agreement Indonesia Dan AustraliaDocument13 pagesPerjanjian Internasional Agreement Indonesia Dan AustraliaAdityas NugrahaNo ratings yet

- PR2 PPT-G4Document7 pagesPR2 PPT-G4Criselle Magalong GarciaNo ratings yet

- People v. Gensola 29 SCRA 483Document4 pagesPeople v. Gensola 29 SCRA 483Khristine Ericke De MesaNo ratings yet

- Interest LetterDocument2 pagesInterest LetterNyakuni NobertNo ratings yet