Professional Documents

Culture Documents

Inventory Optimization & Management: Practice Area Overview

Uploaded by

Akhil DayaluOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Optimization & Management: Practice Area Overview

Uploaded by

Akhil DayaluCopyright:

Available Formats

Practice Area Overview

Inventory Optimization & Management

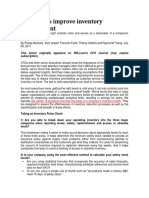

Case Study

At one consumer goods manufacturer

we worked with, safety stock targets

were a mlange of system defaults,

values inherited from long ago,

and values set by the software

installation team with little regard for

the business problem. The planners

whip-sawed targets up and down

on a weekly basis in reaction to one

crisis after another. The result was

the classic problem of aggregate

inventory exceeding financial targets

and flagging customer service.

Our team looked at the key drivers

for setting a data-driven safety stock,

namely lead-time for replenishment

orders and demand variability. The

analysis showed that by simply

changing the safety stock levels on

parts, we could both reduce overall

inventory and greatly improve

customer service levels.

Figure 1 shows scatter plots of the

before and after safety stock settings

for several hundred parts in the

portfolio. Inventory science says that

inventory should go up as re-supply

lead-time increases. Likewise, as

demand volatility increases, so too

should safety stock. These trends are

obvious in our after results. Before

the application of rigorous analytics,

the safety stock values were all over

the map.

Introduction

We all buy insurance. We insure our health, our

home, our car. And properly managed, everyone

wins. As individuals we enjoy peace of mind,

sleeping easy at night knowing were protected in

the face of disaster. And the insurers earn a living in

exchange for absorbing our risk.

Rates, of course, vary depending on the level of

that risk. Smokers pay more. Homeowners on a

flood plain pay more. And young drivers pay more.

The actuaries use mountains of historical data to

determine who should pay what.

Inventory is one of our supply chains insurance

policies. We pay extra for safety stock to keep

the supply chain running in the face of disruptive

events. Adopting good supply chain behaviors

minimizes our risk and reduces our annual inventory

insurance premiums. The firms best skilled at this

supply chain equivalent to actuarial science achieve

the highest level of customer service for each

inventory dollar they invest.

We consider eight key elements when working to

improve supply chain inventory management.

1. Network Inventory

In a multi-echelon system one in which we take a

network-wide view of the many nodes in the supply

chain the optimal levels of inventory depend

on whats going on elsewhere in the network. A

common pitfall of inventory management is failure

to think globally, act locally. Decisions made at a

local level (e.g., minimizing factory inventory) often

come at the expense of the globally optimal solution

(service out of a downstream distribution center).

For example, we see many firms fail to properly

locate the push-pull boundary. Thats the point

in the supply chain at which you transition from

pushing (operating to a forecast) to pulling, or

responding directly to customer demand.

Locating the push-pull boundary correctly may

enable the pooling of demand uncertainty across

multiple markets, reducing overall inventory needs.

Its the same logic that explains why group insurance

rates are generally lower. (For more information,

see our overview on supply chain network design.)

2. Part-Level Inventory

When designing a supply chain network we model

inventory in bold strokes to support strategic

decisions. But supply chains succeed (or fail) on the

back of day-to-day operations. We need detailed

inventory decisions for each part at each location.

We use different techniques for scientifically

managing the inventory of parts that go into

manufactured products, where demand for the

lower-level components depends on the plan for

the top-level items. In the post-sales service world,

parts play a different role and they are planned in a

somewhat different manner. Nonetheless, the same

fundamental science of inventory management

applies.

3. Inventory-Driven Costs

We find it important to highlight the expense of

inventory (income statement) as well as the balance

sheet impact.

Most firms account for the trade-off between free

cash and cash tied up as an inventory asset. But

Why End-to-End Analytics?

Successful inventory management

requires discipline and attention

to detail built on a foundation of

rigorous analytical processes. The

End-to-End team has extensive

experience helping businesses

tune their inventory management

practices in industries ranging from

cosmetics to baked goods to medical

instruments to high tech. Equally

important, as practitioners in industry

we have held responsibility for

managing inventory. We know how

to meet both financial and customer

service targets.

This experience allows us to put

together the right project team,

understand the key dynamics of

the problem, interpret the source

data, and use the right mix of

tools and models (ranging from

simulation to network optimization to

spreadsheets) to help make the right

part-by-part recommendations.

firms tend to underestimate the full cost of holding

inventory by as much as 100%. They fail to account

for costs of warehousing, shrinkage, returns, and the

potential for obsolescence.

4. Lot Sizing

The concept of an economic order quantity (EOQ)

dates back a century, but it should still be part of

every inventory management toolkit.

We routinely encounter businesses that

inappropriately size replenishment orders, either

overinvesting in inventory or enduring excessive

transaction costs to manage their parts. We taught

one firm how to save 40% ($2M/year) just by right

sizing their replenishment orders.

5. Service Levels

The flip side of an inventory problem is a customer

service problem lost sales, penalties, backorders to

manage, and a bruised reputation. Proper inventory

management finds the right level of investment to

stave off the costs of poor service.

Understanding the ramifications of running out

of material enables a rational decision about how

much inventory to hold. Have you sold a lucrative

fast-response service contract? The cost of poor

service will be high. Alternatively, if the end

customer is buffered by downstream finished goods,

the relative cost of a stockout is lower.

6. Safety Stock

Analytical techniques allow you to set an inventory

level based on real data from your business, not just

gut feel. First we assess the risk the chance that

you will run out of inventory before a replenishment

order arrives. Our inability to confidently forecast

variable demand typically drives this calculation.

We also look at the lead-time and reliability of the

replenishment process, since late suppliers cause

stock-outs as well.

Finally, we weigh these risks against the cost of

stocking out, often translating this into a target

service level (e.g., 92% off-the-shelf availability).

955 Alma St., Suite B

Palo Alto, CA 94301

(650) 331-9659

www.e2eAnalytics.com

info@e2eAnalytics.com

Copyright 2013 End-to-End Analytics, LLC.

All Rights Reserved.

7. Transaction Systems

Transaction systems play an important role in

managing inventory. As the name implies, they

manage all the transactions material moving in,

material moving out, and the balance on hand. This

information is a critical starting point for inventory

management. However, the ability of various

transaction systems to provide decision support

capability how much inventory should I hold?

varies widely.

In our experience across many corporate

landscapes, the norm is a system falling short of the

mark. This is generally not the fault of the software,

as most commercial systems have adequate builtin technical capabilities. Rather, we often find

the problem to be systems poorly tailored for the

specific business need.

8. Processes & Metrics

Success in practice depends on more than just

better science. It takes discipline to maintain

material master data, supplier data, and planning

parameters over the product life cycle. One

company entered some part values incorrectly

inflated by a factor of 1000 and as a result held

inappropriately low levels of inventory for cheap C

parts. This resulted in inexcusably missed orders.

And, as we so often find, individual and

organizational performance metrics need to be

aligned. A blanket cry to Cut inventory! often

leads to suboptimal results, with service being

sacrificed for inventory. See Figure 2 for the results

of one organizations tenacious effort to improve

overall performance.

Getting Started

To learn more please visit our website at

www.e2eAnalytics.com, or contact us by email

at info@e2eAnalytics.com.

You might also like

- Chapter OneDocument5 pagesChapter OneFello KimNo ratings yet

- MBE Consultancy Proposal PSDA1Document24 pagesMBE Consultancy Proposal PSDA1aastha khannaNo ratings yet

- Enterprise Asset Management OverviewDocument48 pagesEnterprise Asset Management OverviewSushayan Hunsasuk100% (1)

- Research Paper Inventory Management SystemDocument4 pagesResearch Paper Inventory Management Systemjppawmrhf100% (1)

- Better Inventory Management: Big Challenges, Big Data, Emerging SolutionsDocument10 pagesBetter Inventory Management: Big Challenges, Big Data, Emerging SolutionsFattabiouniNo ratings yet

- Inventory Management Feb. 7Document7 pagesInventory Management Feb. 7JennelNo ratings yet

- Ten ways to optimize inventory managementDocument10 pagesTen ways to optimize inventory managementamolkingNo ratings yet

- M07 Maintain EquipDocument13 pagesM07 Maintain EquipTerefe GezahegnNo ratings yet

- Seven Challenges of Inventory ManagementDocument6 pagesSeven Challenges of Inventory ManagementSuresh Chivukula100% (1)

- MANAGING INVENTORY HandoutsDocument17 pagesMANAGING INVENTORY HandoutsJohn Albatera100% (1)

- Sage ERP Better Inventory Management WPDocument10 pagesSage ERP Better Inventory Management WPMohit AssudaniNo ratings yet

- Ten ways to improve inventory management - Bain & CompanyDocument2 pagesTen ways to improve inventory management - Bain & Companyjohn488No ratings yet

- Inventory Management: Inventory Management Must Be Designed To Meet The Dictates of MarketDocument17 pagesInventory Management: Inventory Management Must Be Designed To Meet The Dictates of MarketHumaira FathimaNo ratings yet

- SC4 W1 Role Function & Types of InventoryDocument6 pagesSC4 W1 Role Function & Types of InventoryLiz BelasaNo ratings yet

- Inventory Research PaperDocument8 pagesInventory Research Paperafnhiheaebysya100% (1)

- Wisner CH 7 Inventory ManagementDocument14 pagesWisner CH 7 Inventory ManagementBeatriz LatorreNo ratings yet

- 8 Ways To Reduce Warehouse CostsDocument22 pages8 Ways To Reduce Warehouse CostsDennis DuNo ratings yet

- Risk pooling reduces demand variability across locations and productsDocument3 pagesRisk pooling reduces demand variability across locations and productsÄyušheë TŸagïNo ratings yet

- What is inventoryDocument10 pagesWhat is inventoryrokhankhogyani313No ratings yet

- Thesis Paper On Inventory ManagementDocument4 pagesThesis Paper On Inventory ManagementKim Daniels100% (2)

- 10 Ways For Inv MGMTDocument3 pages10 Ways For Inv MGMTVictor Hugo MGomezNo ratings yet

- Benchmarketing WercDocument9 pagesBenchmarketing WercangeloNo ratings yet

- What Is Inventory ManagementDocument2 pagesWhat Is Inventory ManagementJeremy SaltingNo ratings yet

- WP Your Complete Guide To Inventory ForecastingDocument16 pagesWP Your Complete Guide To Inventory ForecastingAlec NanetteNo ratings yet

- Inventory Planning and Control TechniquesDocument3 pagesInventory Planning and Control TechniquesJohn Paul Palomino AndradeNo ratings yet

- Objectives of Inventory Management HomeworkDocument4 pagesObjectives of Inventory Management Homeworkafetmagzj100% (1)

- Inventory Management Thesis TopicsDocument5 pagesInventory Management Thesis Topicsameliarichardsonsouthbend100% (2)

- Inventory Management Sample ThesisDocument5 pagesInventory Management Sample Thesisafktlrreerdihj100% (2)

- Contemporary Logistics 11th Edition Murphy Test BankDocument19 pagesContemporary Logistics 11th Edition Murphy Test Bankdieulienheipgo100% (29)

- Improve inventory accuracy with automated toolsDocument7 pagesImprove inventory accuracy with automated toolsAndrea UyNo ratings yet

- Implement Effective Inventory ControlDocument4 pagesImplement Effective Inventory ControlHarold FilomenoNo ratings yet

- Inventory Control - Best Practices and Everything You Need - NetSuiteDocument41 pagesInventory Control - Best Practices and Everything You Need - NetSuiteinformsueNo ratings yet

- Retail InvontryDocument47 pagesRetail InvontryManoj Kumar.SNo ratings yet

- Thesis Inventory ControlDocument5 pagesThesis Inventory Controlvxjtklxff100% (2)

- Research Paper On Inventory ManagementDocument4 pagesResearch Paper On Inventory Managementlsfxofrif100% (1)

- DMC 216Document4 pagesDMC 216sailesh chaudhary0% (1)

- Operational Management AK-7-B SENTDocument10 pagesOperational Management AK-7-B SENTPratham KochharNo ratings yet

- Inventory Management System Sample ThesisDocument7 pagesInventory Management System Sample Thesisnicolegetherscharleston100% (1)

- Ritik Synopsis PDFDocument10 pagesRitik Synopsis PDFVaibhav TanejaNo ratings yet

- Make Safety Your Top PriorityDocument6 pagesMake Safety Your Top PriorityDennis DuNo ratings yet

- Stores RecordingDocument11 pagesStores RecordingLenny IthauNo ratings yet

- Dissertation On Inventory ManagementDocument5 pagesDissertation On Inventory ManagementHelpWithYourPaperSingapore100% (1)

- LR, Report, SynDocument49 pagesLR, Report, Synvijay_gautam33No ratings yet

- Inventory costs, safety stock, ABC approachDocument1 pageInventory costs, safety stock, ABC approachCobain LayagueNo ratings yet

- Ordering CostDocument20 pagesOrdering Costpammy313No ratings yet

- Ans 1Document7 pagesAns 1Jaya SharmaNo ratings yet

- 5.4 Inventory MagtDocument48 pages5.4 Inventory Magtbha_goNo ratings yet

- Inventory Control and Management A Crucial Component of Business SuccessDocument2 pagesInventory Control and Management A Crucial Component of Business SuccessSuhailShaikhNo ratings yet

- Solved 2022 15 MarksDocument22 pagesSolved 2022 15 Marksmeggie123No ratings yet

- OP - Inventory ManagementDocument4 pagesOP - Inventory ManagementPavi Antoni VillaceranNo ratings yet

- Conceptual Framework: Review of Related Literatures and Studies Ordering SystemDocument22 pagesConceptual Framework: Review of Related Literatures and Studies Ordering SystemCLARICE BONIFACIONo ratings yet

- Achieving Operation Excellence and Customer Intimacy Enterprise ApplicationsDocument23 pagesAchieving Operation Excellence and Customer Intimacy Enterprise ApplicationsSinzihara Mazina Guy OctaveNo ratings yet

- IOMP FinalsDocument18 pagesIOMP Finalslorraine kate umaliNo ratings yet

- Optimize Inventory Management with Models and AnalysisDocument3 pagesOptimize Inventory Management with Models and AnalysisRaihan RakibNo ratings yet

- KANHADocument40 pagesKANHAdebasis tripathyNo ratings yet

- 462 AartiDocument13 pages462 AartiPromish MuktanNo ratings yet

- Inventory ManagementDocument23 pagesInventory ManagementChanchal GuptaNo ratings yet

- Supply Chain and Procurement Quick Reference: How to navigate and be successful in structured organizationsFrom EverandSupply Chain and Procurement Quick Reference: How to navigate and be successful in structured organizationsNo ratings yet

- How to Optimise Your Supply Chain to Make Your Firm Competitive!From EverandHow to Optimise Your Supply Chain to Make Your Firm Competitive!Rating: 1 out of 5 stars1/5 (1)

- Tamil Nadu 12th Standard HistoryDocument194 pagesTamil Nadu 12th Standard HistoryIndia History Resources88% (8)

- Indian Engineering Services - SyllabusDocument2 pagesIndian Engineering Services - SyllabussantosprsdNo ratings yet

- Adv EngDocument1 pageAdv EngAkhil DayaluNo ratings yet

- Chapter 2Document9 pagesChapter 2Akhil DayaluNo ratings yet

- Tech Brief 2013 - Reading Centrifugal Pump Curves PDFDocument5 pagesTech Brief 2013 - Reading Centrifugal Pump Curves PDFFawaaz KhurwolahNo ratings yet

- Just in Time Manufacturing V/S Synchronous Manufacturing: Submitted By:-"Group-10"Document1 pageJust in Time Manufacturing V/S Synchronous Manufacturing: Submitted By:-"Group-10"Akhil DayaluNo ratings yet

- Appendix - B Kolkata Port TrustDocument6 pagesAppendix - B Kolkata Port TrustAkhil DayaluNo ratings yet

- Hypergeometric Probability Distribution and Blackjack ExamplesDocument21 pagesHypergeometric Probability Distribution and Blackjack ExamplesAkhil DayaluNo ratings yet

- Tata Docomo - Instant PayDocument2 pagesTata Docomo - Instant PayAkhil DayaluNo ratings yet

- Optical General MicrostructureDocument19 pagesOptical General MicrostructureAkhil DayaluNo ratings yet

- Table of Contents ReadyDocument7 pagesTable of Contents ReadyAkhil DayaluNo ratings yet

- C. Basic PlanDocument48 pagesC. Basic Planwww_prajapati007No ratings yet

- IIT DelhiDocument1 pageIIT DelhiAkhil DayaluNo ratings yet

- Identitas AljabarDocument3 pagesIdentitas AljabarAgung TriatmojoNo ratings yet

- Supply Chain CertiDocument1 pageSupply Chain CertiAkhil DayaluNo ratings yet

- Unit 1 Solar EnergyDocument176 pagesUnit 1 Solar EnergyAkhil Dayalu100% (1)

- Pultrusion of Composites - An OverviewDocument15 pagesPultrusion of Composites - An OverviewAkhil DayaluNo ratings yet

- International News - 2013Document27 pagesInternational News - 2013Rajarshi1415No ratings yet

- I Will Try To Be As Simple As I CanDocument1 pageI Will Try To Be As Simple As I CanAkhil DayaluNo ratings yet

- IIT DelhiDocument1 pageIIT DelhiAkhil DayaluNo ratings yet

- Drawing 1Document1 pageDrawing 1Akhil DayaluNo ratings yet

- Simulation analysis of manufacturing, grocery store, bank, traffic and bakery systemsDocument2 pagesSimulation analysis of manufacturing, grocery store, bank, traffic and bakery systemsAkhil DayaluNo ratings yet

- SNAP GK Question Bank 2013Document9 pagesSNAP GK Question Bank 2013Akhil DayaluNo ratings yet

- Experimental Studies On Heat Transfer and Friction FactorDocument8 pagesExperimental Studies On Heat Transfer and Friction FactorAkhil DayaluNo ratings yet

- RPV 1 2Document9 pagesRPV 1 2Akhil DayaluNo ratings yet

- Unit 1 Solar EnergyDocument118 pagesUnit 1 Solar EnergyAkhil DayaluNo ratings yet

- Simple EquationsDocument10 pagesSimple EquationsAkhil DayaluNo ratings yet

- Who Is An Entrepreneur? Ship-Process, Prise - OrganDocument21 pagesWho Is An Entrepreneur? Ship-Process, Prise - OrganlenoyjacobNo ratings yet

- Barrons - Wordplay 550 - 00 - BookletDocument32 pagesBarrons - Wordplay 550 - 00 - Bookletdronedevil20No ratings yet

- Review of Literature: Misra, K.K (1974) - Labour Welfare in Indian Industries, Meerut, Meenakshi PrakashanDocument36 pagesReview of Literature: Misra, K.K (1974) - Labour Welfare in Indian Industries, Meerut, Meenakshi PrakashanalwinNo ratings yet

- Thank You For Insuring With Liberty Mutual: Contact UsDocument8 pagesThank You For Insuring With Liberty Mutual: Contact UsShannon StricklandNo ratings yet

- Reliance General Insurance Co. LTDDocument17 pagesReliance General Insurance Co. LTDAbhishek MalikNo ratings yet

- Agency Correspondence: Allianz Life Insurance Malaysia BerhadDocument2 pagesAgency Correspondence: Allianz Life Insurance Malaysia BerhadKt TanNo ratings yet

- Hto 4B 22 7065327 02 000 - ScheduleDocument7 pagesHto 4B 22 7065327 02 000 - ScheduleNithin GuptaNo ratings yet

- Public Accounts 2010-2011 Saskatchewan Government Details of Revenue & ExpensesDocument277 pagesPublic Accounts 2010-2011 Saskatchewan Government Details of Revenue & ExpensesAnishinabe100% (1)

- Summer Internship Report at Future Generali Insurance LTDDocument44 pagesSummer Internship Report at Future Generali Insurance LTDpratiksha2467% (3)

- Project Cash Flow AnalysisDocument71 pagesProject Cash Flow AnalysisNovita HalimNo ratings yet

- Salary Material Py 2017-18Document16 pagesSalary Material Py 2017-18MS editzzNo ratings yet

- Banking LawDocument5 pagesBanking Lawrishabh1511900% (3)

- LONE EAGLE RESORTS, INC. v. ACE AMERICAN INSURANCE COMPANY Charter PolicyDocument65 pagesLONE EAGLE RESORTS, INC. v. ACE AMERICAN INSURANCE COMPANY Charter PolicyACELitigationWatchNo ratings yet

- State of Madhya Pradesh V KaluramDocument2 pagesState of Madhya Pradesh V KaluramSparsh Agrawal100% (1)

- Team Health Stock ReportDocument59 pagesTeam Health Stock ReportDennis LiNo ratings yet

- Case 1: Impairment On Local Level: Tax Rate 25% Change in Value T 1 vs. T 2Document1 pageCase 1: Impairment On Local Level: Tax Rate 25% Change in Value T 1 vs. T 2singhsanjNo ratings yet

- Estate Planning for Mr. Barry RichDocument1 pageEstate Planning for Mr. Barry RichKaityNo ratings yet

- Philippine American General Insurance Vs CADocument3 pagesPhilippine American General Insurance Vs CACloudy Mari100% (1)

- FlexiDocument4 pagesFlexiManish Mani100% (1)

- Eastern Shipping Lines v. CA, 234 SCRA 781 (1994)Document9 pagesEastern Shipping Lines v. CA, 234 SCRA 781 (1994)Clive HendelsonNo ratings yet

- My: Optima SecureDocument4 pagesMy: Optima Secureaparna singhNo ratings yet

- Problem Session-2 15.03.2012Document44 pagesProblem Session-2 15.03.2012Chi Toan Dang TranNo ratings yet

- TI Emulgade SE-PFDocument1 pageTI Emulgade SE-PFeggy mushadi100% (1)

- Debit Card Application Form For Burgundy Savings Account PDFDocument2 pagesDebit Card Application Form For Burgundy Savings Account PDFSiva Naga Prasad TadipartiNo ratings yet

- FIN 102 Banking and Financial Institutions OverviewDocument10 pagesFIN 102 Banking and Financial Institutions Overviewron aviNo ratings yet

- University of Nairobi Research on Insurance (Motor Vehicle Third Party Risks) Amendment Bill 2010Document60 pagesUniversity of Nairobi Research on Insurance (Motor Vehicle Third Party Risks) Amendment Bill 2010Kclf- Kenya Christian LawyersNo ratings yet

- Obligations and Contracts Table of ContentsDocument101 pagesObligations and Contracts Table of ContentsImmah SantosNo ratings yet

- Zimwnt-Ufc01 - WNTP236 - 4097 - 001 (00000002) PDFDocument71 pagesZimwnt-Ufc01 - WNTP236 - 4097 - 001 (00000002) PDFNatasa RalicNo ratings yet

- Market Myths ExposedDocument33 pagesMarket Myths Exposedkthakker0100% (1)

- Purchase Order From CXCDocument10 pagesPurchase Order From CXCUsman MahmoodNo ratings yet

- Socorro Water District Surigao Del Norte Executive Summary 2021Document4 pagesSocorro Water District Surigao Del Norte Executive Summary 2021Miss_AccountantNo ratings yet

- About Bharti AxaDocument6 pagesAbout Bharti AxaNoman AkhtarNo ratings yet