Professional Documents

Culture Documents

Q601

Uploaded by

satish sCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q601

Uploaded by

satish sCopyright:

Available Formats

Stocks & Commodities V.

15:13 (601-602): Quick Scans: Trading Without Fear

QUICK-SCANS

TRADING WITHOUT FEAR

Eliminating Emotional Decisions with

Arms Trading Strategies

John Wiley & Sons

605 Third Avenue

New York, NY 10158

To order: 908 469-4400

Phone: 800 225-5945

Internet: http://www.wiley.com

Author: Richard W. Arms Jr.

228 pages, $49.95, 1996

ISBN 0-471-13748-0

Technician Richard Arms is of the mind

that although the price of a security may

tell us whats happening with that security, its the trading volume that tells us

how its happening. Arms has devoted

much of his career to finding ways of

including volume in the visual depiction

of a securitys movement on the charts of

the technical analyst.

Armss first major contribution to technical analysis was the nowwidely used

Arms index, sometimes referred to as the

short-term trading index (TRIN). Whichever name it goes by, today it can usually

be found on the tickers that run across the

bottom of financial television broadcasts

or around the walls of the Wall Street

caverns.

Arms also developed a charting system known as Equivolume. In it, relative

volume is shown on the price chart, giving the trader a better perspective on

subsequent price movement. In looking

for a way to express his Equivolume

concept numerically as well as visually,

increasing its usability in formulas, Arms

developed an oscillator called ease of

movement. All three of those concepts led

to various works by Arms on those respective subjects.

In Trading Without Fear, Arms begins

with an introductory chapter on technical

analysis, then uses the next three chapters

to summarize the concepts in each of his

previous books as a foundation for lessons on trading with less apprehension.

Since the main theme of his work is

founded on the use of volume over the

more widely used price-based approach

to trading, its not surprising that in Trading Without Fear he introduces more new

ways to make volume a part of several

fundamental indicators.

The moving average is the most basic

of all charting tools, and in chapter 5,

Arms explains how and why to use the

volume-adjusted moving average. Another charting tool is the trendline, and

chapter 6 teaches us to look at volume

before deciding when a trend change is

likely. However, you could not use Gann

trendlines because a precise definition of

the ratio of price to volume is not provided.

In the next two chapters, examined is

changing market tides in regard to volume

as well as price. The reader is taught how

to use Equivolume, ease of movement

and volume-adjusted moving averages to

analyze the waves of price increases and

declines.

In chapter 9, Arms provides an overview of market history up to current times

to tie together his themes. This history of

market tops and bottoms, as seen through

the indicators and charting style developed by Arms, gives the reader insight

into long-term market movement.

THE LONG TERM

Investors have found that the Arms index

is as useful in decision-making for the

long term as it has been for short-term

traders. In one of the many revealing

examples in the book, chapter 10 presents

a graph superimposing the 100-, 200- and

300-day moving averages of the Arms

index. While the amplitudes of the plots

differ somewhat, the spacing of the swings

is similar. Moving averages with longer

lookback periods seem only to eliminate

the quicker price changes caused by

changes in market sentiment.

The next five chapters cover the specifics of buying, selling and shorting the

market. Here, were shown how to put our

newfound knowledge to work in deciding

what securities to own and when to own

them. Arms believes if a trader knows

why he is buying or selling, then the when

will be an automatic reaction. He suggests

you make trading decisions as if you

didnt own the security in question.

Though most of Armss work has to do

with stocks, chapter 16 shows that his

methods are also useful in other markets.

The price movements of futures, indices

and foreign markets, when you can obtain

enough data to perform the calculations,

can all be analyzed using the methods

Copyright (c) Technical Analysis Inc

Trading Without Fear presents a nice summary of

Richard Armss contributions to technical analysis, as

well as illustrating new ways to look at volume in

trading.

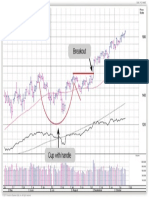

outlined here. As in the rest of the book,

the graphs used here visually make the

case for the ideas being presented.

In the concluding chapter, we are reminded that charts incorporating volume

give a much better picture of the trading

behind a security. Often, its the emotions

of traders, played out over and over again,

that cause the prices to change in familiar

patterns, and volume helps us discern

these patterns.

Trading Without Fear is an interesting,

well-illustrated and thoughtful look at the

work of Richard Arms. Each point is

carefully explained and easy to follow.

While he makes it clear that he hasnt set

out to present a mechanical trading system in this book, Arms teaches the reader

how to acquire the discipline to increase

profits and decrease the stress and fear

that trading can induce.

Bruce Faber, Staff Writer

READING

Arms, Richard W., Jr. [1990]. Ease of

movement, Technical Analysis of

STOCKS & COMMODITIES, Vol.8:

May.

____[1990]. Volume-adjusted moving

averages, Technical Analysis of

Stocks & Commodities, Volume 8:

March.

____ [1989]. What volume is it? Technical Analysis of STOCKS & COMMODITIES, Volume 7: December.

Hartle, Thom [1991]. Arms on Arms:

Richard W. Arms, interview, Technical Analysis of STOCKS & COMMODITIES, Volume 9: July.

S&C

You might also like

- News Release: Nomura Individual Investor SurveyDocument17 pagesNews Release: Nomura Individual Investor Surveysatish sNo ratings yet

- Simple Supper Trading SystemDocument3 pagesSimple Supper Trading Systemsatish sNo ratings yet

- 1208452Document4 pages1208452satish sNo ratings yet

- The Stock Market Update: September 11, 2012 © David H. WeisDocument1 pageThe Stock Market Update: September 11, 2012 © David H. Weissatish sNo ratings yet

- Es130617 1Document4 pagesEs130617 1satish sNo ratings yet

- Unusual Options Activity Halftime Report - : There Is A Risk of Loss in All TradingDocument3 pagesUnusual Options Activity Halftime Report - : There Is A Risk of Loss in All Tradingsatish sNo ratings yet

- Get More Out of Trading with PPO Indicator ManualDocument4 pagesGet More Out of Trading with PPO Indicator Manualsatish sNo ratings yet

- Crystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural InformationDocument3 pagesCrystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural Informationsatish sNo ratings yet

- ETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst FundsDocument5 pagesETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst Fundssatish sNo ratings yet

- Top 20 Day Trading Rules For SuccessDocument4 pagesTop 20 Day Trading Rules For Successbugbugbugbug100% (3)

- Raschke0204 PDFDocument10 pagesRaschke0204 PDFAnonymous xU5JHJe5No ratings yet

- BattenBook Chapter7Enhanced PDFDocument55 pagesBattenBook Chapter7Enhanced PDFsatish sNo ratings yet

- Power PatternsDocument41 pagesPower Patternsedmond1100% (1)

- Sharpening Skills WyckoffDocument16 pagesSharpening Skills Wyckoffsatish s100% (1)

- The Art of Timing The TradeDocument1 pageThe Art of Timing The Tradesatish s0% (3)

- Position SizingDocument29 pagesPosition SizingIan Moncrieffe94% (18)

- Wabash National Corp WNC: Last Close Fair Value Market CapDocument4 pagesWabash National Corp WNC: Last Close Fair Value Market Capsatish sNo ratings yet

- Greatness SurveyDocument14 pagesGreatness SurveyNew York PostNo ratings yet

- An Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange MarketDocument7 pagesAn Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange Marketsatish sNo ratings yet

- Forecasting Stock Returns: What Signals Matter, and What Do They Say Now?Document20 pagesForecasting Stock Returns: What Signals Matter, and What Do They Say Now?dabiel straumannNo ratings yet

- CH 4Document38 pagesCH 4satish sNo ratings yet

- Smartbuild - Smart Design For Smart SystemsDocument1 pageSmartbuild - Smart Design For Smart Systemssatish sNo ratings yet

- How To Buy Common Patterns1 2Document1 pageHow To Buy Common Patterns1 2satish sNo ratings yet

- Uniti Group Inc UNIT: Last Close Fair Value Market CapDocument4 pagesUniti Group Inc UNIT: Last Close Fair Value Market Capsatish sNo ratings yet

- Trading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLDocument8 pagesTrading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLsatish sNo ratings yet

- Money Management Controlling Risk and Capturing Profits by Dave LandryDocument20 pagesMoney Management Controlling Risk and Capturing Profits by Dave LandryRxCapeNo ratings yet

- Kuhn FEMADocument1 pageKuhn FEMAsatish sNo ratings yet

- Receiving, Inspection, Acceptance Testing and Acceptance or Rejection ProcessesDocument18 pagesReceiving, Inspection, Acceptance Testing and Acceptance or Rejection ProcessesjeswinNo ratings yet

- Pega 7 1 Sla1Document3 pagesPega 7 1 Sla1satish sNo ratings yet

- Greenhill & Co Inc GHL: DividendsDocument5 pagesGreenhill & Co Inc GHL: Dividendssatish sNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Calculation of Exchange Ratio From The Perspective of The Acquired and The Acquiring FirmDocument16 pagesCalculation of Exchange Ratio From The Perspective of The Acquired and The Acquiring FirmabhishekNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Vinodh KumarNo ratings yet

- PMSBazaar PMSPerformance December 2020Document15 pagesPMSBazaar PMSPerformance December 2020MoneycomeNo ratings yet

- Asset Liability Management CommitteeDocument2 pagesAsset Liability Management CommitteeRoger RogerNo ratings yet

- Chapter 15 - Taxation and Corporate IncomeDocument26 pagesChapter 15 - Taxation and Corporate Incomewatts1No ratings yet

- AIGDocument13 pagesAIGNazish SohailNo ratings yet

- Certified Treasury ProffessionalDocument366 pagesCertified Treasury ProffessionalsumanNo ratings yet

- A Catering Theory of DividendsDocument63 pagesA Catering Theory of DividendsAnita Permata SariNo ratings yet

- Fintech Trends & Disruption in Financial Services CB InsightDocument29 pagesFintech Trends & Disruption in Financial Services CB InsightOxford Biochronometrics100% (1)

- J. InternasionalDocument93 pagesJ. Internasionalriski ramadhanNo ratings yet

- Ipo ...... Details of Adani Power Ltd.Document11 pagesIpo ...... Details of Adani Power Ltd.Abbas AnsariNo ratings yet

- Project Report - JGB JCB Works and ServiDocument10 pagesProject Report - JGB JCB Works and Servinatraj kumarNo ratings yet

- Answers To The 2016 Bar Exams in Mercantile Law (Unlocked) PDFDocument5 pagesAnswers To The 2016 Bar Exams in Mercantile Law (Unlocked) PDFDaley CatugdaNo ratings yet

- Kpmg-Ifrs 9Document4 pagesKpmg-Ifrs 9StevenTsaiNo ratings yet

- Difference Between Member and Shareholder of A Company For A CompanyDocument2 pagesDifference Between Member and Shareholder of A Company For A CompanyMragank ShuklaNo ratings yet

- Rsm433 Case 6Document2 pagesRsm433 Case 6LeahHuangNo ratings yet

- 13 Corporate FinancingDocument25 pages13 Corporate FinancingKanika AggarwalNo ratings yet

- Financial Management Synopsis at ICICI BankDocument10 pagesFinancial Management Synopsis at ICICI BankKhaisarKhaisarNo ratings yet

- Phil. Consolidated Coconut Industries V CIR (70 SCRA 22) PDFDocument15 pagesPhil. Consolidated Coconut Industries V CIR (70 SCRA 22) PDFKaye Miranda LaurenteNo ratings yet

- Investment Behavior: A Study On Working Women in ChittagongDocument2 pagesInvestment Behavior: A Study On Working Women in ChittagongAjish ShajiNo ratings yet

- Avt Secondaries Analysis 2010Document193 pagesAvt Secondaries Analysis 2010PJ Amin100% (1)

- 4 5832174685814523657 PDFDocument35 pages4 5832174685814523657 PDFYeisson Stiven84% (19)

- The Big Market DelusionalDocument19 pagesThe Big Market DelusionalSg SubramaniamNo ratings yet

- Options Theory Guide for Professional TradingDocument134 pagesOptions Theory Guide for Professional TradingVibhats VibhorNo ratings yet

- Italy's First Fintech Accelerator for Banks and InsuranceDocument41 pagesItaly's First Fintech Accelerator for Banks and InsurancenavdeepNo ratings yet

- Winfieldpresentationfinal 130212133845 Phpapp02Document26 pagesWinfieldpresentationfinal 130212133845 Phpapp02Sukanta JanaNo ratings yet

- Nse's Certification in Financial Markets - Options Trading StrategiesDocument60 pagesNse's Certification in Financial Markets - Options Trading Strategiessachindravid100% (1)

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Introduction To CooperativesDocument35 pagesIntroduction To Cooperativesxformal100% (1)

- It Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesDocument24 pagesIt Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesAnonymous KN4pnOHmNo ratings yet