Professional Documents

Culture Documents

Capital Market of Bangladesh: An Assignment On

Uploaded by

Saidur Rahman TareqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Market of Bangladesh: An Assignment On

Uploaded by

Saidur Rahman TareqCopyright:

Available Formats

InvestmentManagement:CapitalMarketofBangladesh|1

AnAssignmenton

CAPITALMARKETOFBANGLADESH

WWW.ASSIGNMENTPOINT.COM

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|2

LETTEROFTRANSMITTAL

Date:

Mr./Ms.

FacultyofBusinessAdministration

SchoolofBusiness

Subject:SubmissionoftheAssignmentonCapitalMarketofBangladesh.

DearSir/Madam,

ItisagreatpleasureforusthatwehavetheopportunitytosubmittheassignmentonCapital

MarketofBangladesh.

Wehavetriedourlevelbesttoputmeticulouseffortforpreparethisassignment.Any

shortcomingsorfaultmayariseasourunintentionalmistakes.Wewillwholeheartedly

welcomeanyclarificationandsuggestionaboutanyviewandconceptiondisseminatedthrough

thisassignment.

Thankyou.

YoursSincerely,

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|3

AKNOWLEDGEMENT

One of the most pleasant parts of writing this report is the

opportunity to thanks those who have contributed to it.

Unfortunately, in any establishment, the list of expression of

thanks no matter how allembracing is always imperfect and

insufficient, this acknowledgement is alike other is not an

immunity.

At first we want to thanks our Almighty Allah who gave me

energy and patient and also knowledge for making that kind of

report. Secondly we want to thanks our course instructor

withoutwhomwemustbeunabletomakeit.Weareveryhappy

toparticipateinthisAssignment.

Finally we want to thanks our friends and course mates who

helped us for gaining information and complete the assignment

successfully.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|4

TABLEOFCONTENTS

CAPITALMARKETOFBANGLADESH

1.

INTRODUCTION

01

2.

THEPRIMARYMARKET

02

3.

THESECONDARYMARKET

03

4.

BANGLADESHSTOCKEXCHANGES

04

5.

THEROLEOFCAPITALMARKETSINANECONOMY

06

6.

BANGLADESHCAPITALMARKETOUTLOOK

07

7.

BANGLADESH:THEPROSPECTS,POSSIBILITIES&CHALLENGES

09

8.

THEPOTENTIALOFTHEBANGLADESHCAPITALMARKET

12

9.

REASONSBEHINDTHEUNDERDEVELOPMENT

13

10.

OPPORTUNITIESOFBANGLADESHCAPITALMARKET

16

11.

RECOMMENDATIONS&CONCLUSION

18

REFERENCES

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|5

CAPITALMARKETOFBANGLADESH

1.

INTRODUCTION

Acapitalmarketisamarketforsecurities(debtorequity),wherebusinessenterprises(companies)and

governmentscanraiselongtermfunds.Itisdefinedasamarketinwhichmoneyisprovidedforperiods

longerthanayear,astheraisingofshorttermfundstakesplaceonothermarkets(e.g.,themoney

market).Thecapitalmarketincludesthestockmarket(equitysecurities)andthebondmarket(debt).

Financialregulators,suchastheBangladeshFinancialServicesAuthorityortheBangladeshSecurities

andExchangeCommission(SEC),overseethecapitalmarketsintheirdesignatedjurisdictionstoensure

thatinvestorsareprotectedagainstfraud,amongotherduties.

Capitalmarketsmaybeclassifiedasprimarymarketsandsecondarymarkets.Inprimarymarkets,new

stockorbondissuesaresoldtoinvestorsviaamechanismknownasunderwriting.Inthesecondary

markets,existingsecuritiesaresoldandboughtamonginvestorsortraders,usuallyonasecurities

exchange,overthecounter,orelsewhere.

TheCapitalmarket,animportantingredientofthefinancialsystem,playsasignificantroleinthe

economyofthecountry.

Thecapitalmarketisthemarketforsecurities,wherecompaniesandgovernmentscanraiselongterm

funds.Thecapitalmarketincludesthestockmarketandthebondmarket.Capitalmarketspromote

andkeepcapitalismalive.Themarketsareacriticalpiecetomaycountryseconomiesandthebigger

themarketsthemorepotentialforeconomicgrowth.Itallowsforconsumersandbusinessestohavea

shareinthenationswealth.Theavailabilityofseveralwaystoraisemoneyneededisattractivebecause

theycancontinuetostrikeintonewsourcesofmoneyovertime.Thegoalofthemarketsistoincrease

investorconfidencebymoreactiveparticipation.Themarketsrequireafreeflowofinformationtorun

smoothlyandefficientlyandtheinternetcanbeusedforuptotheminutetradeinformation.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|6

2.

THEPRIMARYMARKET

Theprimarymarketisthatpartofthecapitalmarketsthatdealswiththeissueofnewsecurities.

Companies,governmentsorpublicsectorinstitutionscanobtainfundingthroughthesaleofanewstock

orbondissue.Thisistypicallydonethroughasyndicateofsecuritiesdealers.Theprocessofsellingnew

issuestoinvestorsiscalledunderwriting.Inthecaseofanewstockissue,thissaleisaninitialpublic

offering(IPO).Dealersearnacommissionthatisbuiltintothepriceofthesecurityoffering,thoughit

canbefoundintheprospectus.Primarymarketscreateslongterminstrumentsthroughwhich

corporateentitiesborrowfromcapitalmarket.

Featuresofprimarymarketsarethisisthemarketfornewlongtermequitycapital.Theprimarymarket

isthemarketwherethesecuritiesaresoldforthefirsttime.Thereforeitisalsocalledthenewissue

market(NIM).

Inaprimaryissue,thesecuritiesareissuedbythecompanydirectlytoinvestors.Thecompanyreceives

themoneyandissuesnewsecuritycertificatestotheinvestors.

Primaryissuesareusedbycompaniesforthepurposeofsettingupnewbusinessorforexpandingor

modernizingtheexistingbusiness.Theprimarymarketperformsthecrucialfunctionoffacilitating

capitalformationintheeconomy.

Thenewissuemarketdoesnotincludecertainothersourcesofnewlongtermexternalfinance,suchas

loansfromfinancialinstitutions.Borrowersinthenewissuemarketmayberaisingcapitalforconverting

privatecapitalintopubliccapital;thisisknownas"goingpublic."

Thefinancialassetssoldcanonlyberedeemedbytheoriginalholder.

Methodsofissuingsecuritiesintheprimarymarketare:

Initialpublicoffering;

Rightsissue(forexistingcompanies);

Preferentialissue.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|7

3.

THESECONDARYMARKET

Thesecondarymarket,alsoknownastheaftermarket,isthefinancialmarketwherepreviouslyissued

securitiesandfinancialinstrumentssuchasstock,bonds,options,andfuturesareboughtandsold.[1].

Theterm"secondarymarket"isalsousedtorefertothemarketforanyusedgoodsorassets,oran

alternativeuseforanexistingproductorassetwherethecustomerbaseisthesecondmarket(for

example,cornhasbeentraditionallyusedprimarilyforfoodproductionandfeedstock,buta"second"

or"third"markethasdevelopedforuseinethanolproduction).Anothercommonlyreferredtousageof

secondarymarkettermistorefertoloanswhicharesoldbyamortgagebanktoinvestorssuchas

FannieMaeandFreddieMac.

Withprimaryissuancesofsecuritiesorfinancialinstruments,ortheprimarymarket,investorspurchase

thesesecuritiesdirectlyfromissuerssuchascorporationsissuingsharesinanIPOorprivateplacement,

ordirectlyfromthefederalgovernmentinthecaseoftreasuries.Aftertheinitialissuance,investorscan

purchasefromotherinvestorsinthesecondarymarket.

Thesecondarymarketforavarietyofassetscanvaryfromloanstostocks,fromfragmentedto

centralized,andfromilliquidtoveryliquid.Themajorstockexchangesarethemostvisibleexampleof

liquidsecondarymarketsinthiscase,forstocksofpubliclytradedcompanies.Exchangessuchasthe

DhakaStockExchangeandChittagongStockExchangeprovideacentralized,liquidsecondarymarketfor

theinvestorswhoownstocksthattradeonthoseexchanges.Mostbondsandstructuredproductstrade

overthecounter,orbyphoningthebonddeskofonesbrokerdealer.Loanssometimestradeonline

usingaLoanExchange.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|8

4.

BANGLADESHSTOCKEXCHANGES

TheSecuritiesandExchangeCommissionexercisespowersundertheSecuritiesandExchange

CommissionAct1993.Itregulatesinstitutionsengagedincapitalmarketactivities.BangladeshBank

exercisespowersundertheFinancialInstitutionsAct1993andregulatesinstitutionsengagedin

financingactivitiesincludingleasingcompaniesandventurecapitalcompanies.TheSEChasissued

licencesto27institutionstoactinthecapitalmarket.Ofthese,19institutionsareMerchantBanker&

PortfolioManagerwhile7areIssueManagersand1(one)actsasIssueManagerandUnderwriter.There

aretwostockexchanges(theDhakaStockExchange(DSE)andtheChittagongStockExchange(CSE))

whichdealinthesecondarycapitalmarket.

Astockexchangeisanentitythatprovides"trading"facilitiesforstockbrokersandtraders,totrade

stocks,bonds,andothersecurities.Stockexchangesalsoprovidefacilitiesforissueandredemptionof

securitiesandotherfinancialinstruments,andcapitaleventsincludingthepaymentofincomeand

dividends.Securitiestradedonastockexchangeincludesharesissuedbycompanies,unittrusts,

derivatives,pooledinvestmentproductsandbonds.

Tobeabletotradeasecurityonacertainstockexchange,itmustbelistedthere.Usually,thereisa

centrallocationatleastforrecordkeeping,buttradeisincreasinglylesslinkedtosuchaphysicalplace,

asmodernmarketsareelectronicnetworks,whichgivesthemadvantagesofincreasedspeedand

reducedcostoftransactions.Tradeonanexchangeisbymembersonly.

Theinitialofferingofstocksandbondstoinvestorsisbydefinitiondoneintheprimarymarketand

subsequenttradingisdoneinthesecondarymarket.Astockexchangeisoftenthemostimportant

componentofastockmarket.Supplyanddemandinstockmarketsisdrivenbyvariousfactorsthat,as

inallfreemarkets,affectthepriceofstocks(seestockvaluation).

Thereisusuallynocompulsiontoissuestockviathestockexchangeitself,normuststockbe

subsequentlytradedontheexchange.Suchtradingissaidtobeoffexchangeoroverthecounter.This

istheusualwaythatderivativesandbondsaretraded.Increasingly,stockexchangesarepartofaglobal

marketforsecurities.

BangladeshcapitalmarketisoneofthesmallestinAsiabutthethirdlargestinthesouthAsiaregion.

IthastwofullfledgedautomatedstockexchangesnamelyDhakaStockExchange(DSE)andChittagong

StockExchange(CSE)andanoverthecounterexchangeoperatedbyCSE.Italsoconsistsofadedicated

regulator,theSecuritiesandExchangecommission(SEC),since,itimplementsrulesandregulations,

monitorstheirimplicationstooperateanddevelopthecapitalmarket.ItconsistsofCentralDepository

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|9

BangladeshLimited(CDBL),theonlyCentralDepositoryinBangladeshthatprovidesfacilitiesforthe

settlementoftransactionsofdematerializedsecuritiesinCSEandDSE.

DHAKASTOCKEXCHANGE

DhakaStockExchange(GenerallyknownasDSE)isthemainstockexchangeofBangladesh.Itislocated

inMotijheelattheheartoftheDhakacity.Itwasincorporatedin1954.Dhakastockexchangeisthefirst

stockexchangeofthecountry.Asof18August2010,theDhakaStockExchangehadover750listed

companieswithacombinedmarketcapitalizationof$50.28billion.

History

ItfirstincorporatedasEastPakistanStockExchangeAssociationLtdin28April1954andstartedformal

tradingin1956.ItwasrenamedasEastPakistanStockExchangeLtdin23June1962.Againrenamedas

DaccaStockExchangeLtdin13May1964.Aftertheliberationwarin1971thetradingwasdiscontinued

forfiveyears.In1976tradingrestartedinBangladesh.In16September1986wasstarted.Theformula

forcalculatingDSEallsharepriceindexwaschangedaccordingtoIFCin1November1993.The

automatedtradingwasinitiatedin10August1998.In1January2001wasstarted.CentralDepository

Systemwasinitiatedin24January2004.AsofNovember16,2009,thebenchmarkindexoftheDhaka

StockExchange(DSE)crossed4000pointsforthefirsttime,settinganothernewhighat4148points.

Formation

DhakaStockExchange(DSE)isapubliclimitedcompany.ItisformedandmanagedunderCompanyAct

1994,SecurityandExchangeCommissionAct1993,SecurityandExchangeCommissionRegulation1994,

andSecurityExchange(InsideTrading)regulation1994.TheissuedcapitalofthiscompanyisTk.500,000

whichisdividedupto250shareseachpricingTk.2000.Noindividualorfirmcanbuymorethanone

share.Accordingtostockmarketruleonlymemberscanparticipateinthefloorandcanbuysharesfor

himselforhisclients.Atpresentithas230members.MarketcapitalizationoftheDhakaStockExchange

reachednearly$9billioninSeptember2007and$27.4billioninDec9,2009.

CHITTAGONGSTOCKEXCHANGE

ChittagongStockExchangeisastockexchangelocatedintheportcityofChittagonginsoutheastern

Bangladesh.Itwasestablishedin1995asthesecondstockexchangeofthecountry.Theexchangeis

locatedintheAgrabadcommercialareaofthecity.

Timeline

1April1995CSEincorporatedasacompany.

10OctabarFloortradingstartedincrioutsystem.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|10

4November1995formallyopenedbythenformerPrimeMinisterBegumKhaledaZia.

30May2004InternetbasedTradingsystemopened.

5.

THEROLEOFCAPITALMARKETSINANECONOMY

Providesanimportantalternativesourceoflongtermfinanceforlongtermproductive

investments.Thishelpsindiffusingstressesonthebankingsystembymatchinglongterm

investmentswithlongtermcapital.

Providesequitycapitalandinfrastructuredevelopmentcapitalthathasstrongsocioeconomic

benefitsroads,waterandsewersystems,housing,energy,telecommunications,public

transport,etc.idealforfinancingthroughcapitalmarketsvialongdatedbondsandasset

backedsecurities.

Providesavenuesforinvestmentopportunitiesthatencourageathriftculturecriticalin

increasingdomesticsavingsandinvestmentratiosthatareessentialforrapidindustrialization.

TheSavingsandinvestmentratiosaretoolow,below10%ofGDP.

Encouragesbroaderownershipofproductiveassetsbysmallsaverstoenablethembenefitfrom

Bangladeshseconomicgrowthandwealthdistribution.Equitabledistributionofwealthisakey

indicatorofpovertyreduction.

Promotespublicprivatesectorpartnershipstoencourageparticipationofprivatesectorin

productiveinvestments.Pursuitofeconomicefficiencyshiftingdrivingforceofeconomic

developmentfrompublictoprivatesectortoenhanceeconomicproductivityhasbecome

inevitableasresourcescontinuetodiminish.

AssiststheGovernmenttocloseresourcegap,andcomplementitseffortinfinancingessential

socioeconomicdevelopment,throughraisinglongtermprojectbasedcapital.

Improvestheefficiencyofcapitalallocationthroughcompetitivepricingmechanismforbetter

utilizationofscarceresourcesforincreasedeconomicgrowth.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|11

ProvidesagatewaytoBangladeshforglobalandforeignportfolioinvestors,whichiscriticalin

supplementingthelowdomesticsavingratio.

6.

BANGLADESHCAPITALMARKETOUTLOOK

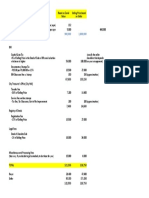

Capitalmarketscontinuestrongperformance

SubprimecrisishasleftlittleimpactonBangladeshmarkets

MarketcapitalizationisaboveUS$20bnin2009fromUS$10bnin2007

AveragedailyturnoverisapproximatelyUS$75mmin2009fromUS$24mmin2007

OpportunitiesandChallenges

Keyopportunitiesforfuturegrowth

Institutionalizationofmarketbringsgreaterliquidityandlowervolatility

Attractinglargecorporateforlistingprovidesinvestorswithviableinvestmentoptions

Challengesahead

Retaildominatedmarketresultinginhighervolatilityfromspeculation

Large,wellreputedcompaniesprefertosourcefundsfromtraditionalbankfinanceagainst

capitalmarkets

Remittanceinflowhasbeenresilienttoglobalturmoil

BangladeshisabroadsenthomeUS$887.9mminSeptember09

Inflationcontinuestodecline

Fellto6.04%inJuly09,from6.66%inJune09and8.90%inDecember08

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|12

GDPgrowthforecasthasbeenreviseddownwardsto5.88%,comparedto6.19%inthe

previousfiscalyear

ExportshavebeenrelativelyshelteredduetolowcostnatureofBangladeshiproducts

RecoveryintheUSandEurope,themajorbuyers,expectedtoboostexportearnings

KeyCommentary

Localmarkethasbeenrelativelyshelteredfromtherecentglobalmeltdownin2008

Marketwasvolatileinearly2009buthasstabilizedwithhighturnoverandmarketcapitalization

FIIinteresttoexplorenewfront

Impressivegrowthinliquidityinrecentyears

AverageDailyTurnoverincreasedfromUS$24mmin2007toUS$75mmin2009

HighestrecordedliquidityofUS$166mmonJuly2,2009

MarketCapitalizationofDSEin2009hasbeenaroundUS$20bn,upfromaboutUS$10bnin

2007

15newissuesin2008with3directlistings

7newissuescompletedin2009

RecentlycompletedlargestIPOinBangladeshhistory.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|13

7.

BANGLADESHCAPITALMARKET:THEPROSPECTS,POSSIBILITIESAND

CHALLENGES

THErecentgrowthofcapitalmarketofBangladeshwasbehindtime.Wehavewitnessedthemoney

marketgrowstableinthiscountryoverthelastdecade;oureconomywasstarvingforamaturedand

stablecapitalmarket.Thestabilitycamethroughavarietyofsourcesnamely,educatedretailinvestors,

institutionalinvestorsandlastbutnotleastthecapitalmarketregulators.

Asitisamarketthatinvolvesboththesponsorsandinvestors,theneedforahealthyandstablemarket

becamenecessary.ThroughvariousformsofreformsandautomationthecapitalmarketofBangladesh

wontheconfidenceofinvestorsfromallwalksoflife.Itisafactthatcapitalmarketoutperformed

moneymarketbyfarinthelastcoupleofyearsbutthatwasonlypossibleduetotheuniformandstate

ofthearetechnologythathasbeenusedastheplatformofourcapitalmarket.Inadditiontothat,the

governmentfacilitatedourcapitalmarketbystructuringitsmonetaryandfiscalpoliciesinaprocapital

marketmanner.

Thecentralbank(CB)playedathoughtfulpartindevelopingourcapitalmarket.Itbroughttransparency

tothebankingsector,whichactuallywelcomedtheretailinvestorstojointhecapitalmarketwithhigh

confidence.Theperformanceandhealthyreturnofthebankingsectorworkedasacrucialcomponent

tobringininstitutionsandforeigninvestors.Powerandpharmaceuticalsectoralsooutperformedthe

expectationsofgeneralinvestors;resultingfreshfundinjectionintoourcapitalmarket.

Ouremergingeconomymostlyinvitedthefundsfromallovertheglobe.Marketcapitalhasshown

amazinggrowth.Althoughcurrentmarketpriceearningratioishigherthanthatoftheneighbouring

countrybutitismybeliefthatconsideringthedemandforlackofavenuetoinvest,thecapitalmarketof

ourcountryhasabrightandattractivefutureanduntappedsector.

Addressingtheissueregardingourcapitalmarket,'liquidity'andlackof"instrument"wouldtopthelist

ofchallengesthatwehaverightnow.Themajorreasonfortheexistenceofthestockmarketisto

provideliquidityofsharesanddiversifiedinstrumentswhichhelpsincreasemarketcapitalisation.Italso

helpsinvestorstogainmoreconfidenceandpositivelyimpactGrossDomesticProduct(GDP)ofour

country.NeighbouringcountriessuchasIndiaandPakistanhavemarketcapitalisationofmorethan75%

oftheirGDP.Comparatively,theBangladeshcapitalmarketaccountsforafarlessershareofitsGDP

indicatingamplescopeforfutureintensificationinthissector.Hence,weshouldaddresstheaboveto

issueswithutmostseriousnessandwithafuturevision.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|14

Asweknow,oureconomyisanemergingone;thereisamplescopeofgrowthofourcapitalmarket.Our

marketcap,accountsforalowershareofourGDPinacomparativeregionalperspective.Withthehelp

ofupcomingissues(IPO)weareveryoptimisticthatthemarketcapitalisationisreachahigherlevel

withinashortspanoftime.AutomationandintroductionofCentralDepositoryhelpedourcapital

markettogrowconsiderably.Theregulatorybody,namelySecuritiesandExchangeCommission,is

continuouslyfacilitatingourcapitalmarketwithitsinternationalstandardsurveillanceandmonitoring.

ThecontinuousendeavouroftheSEChasresultedinourcapitalmarkettobefreefromfraudulentand

manipulativeactivities.ThuspresenceoftheSEChasimpactedsignificantlyinthedevelopmentofthe

market.However,consideringourmarketsize,theSECshouldemploymoreprofessionalsfromprivate

sector.Wouldbringmoredynamismtothemarket.

Themajordrawbacksofourcapitalmarketarelackofinstrumentsandliquidity.Wecanaddressthese

twoissuesbyattractingmorecompaniestothemarket.Inordertomakethemarketmoreattractive,

thecorporatetaxbracketcanbeloweredinordertoencouragesponsorstolisttheircompaniesinthe

exchanges.WecanalsointroduceFutureandOptionMarketandhelpouralreadyexistingbondmarket

tobemorevibrantleavingtheinvestorswithmoreinstruments.Althoughwehavesomemutualfunds

(MF)currentlytradinginthesecondarymarket,yetwebelievethereishigherdemandforsuch

products,sinceMFprovidestheclientstheopportunitytoreduceinvestmentrisk.Withthehelpofthe

bourse,weshouldwelcomehedgefundsfromdifferentpartsofworldtoinvestinourcapitalmarket.

Cashmanagementcanalsoplayasignificantroleinovercomingthedrawbacksofourcapitalmarket.

Withthehelpofefficientandonlinecashmanagementourcumbersomesettlementprocedurecouldbe

streamlined.Thereareothernumerouswayswecanreducethedrawbacksofourcapitalmarket.Last

butnotleast,internationalauditingstandardhastobeadopted,resultinginmoretransparencyinthe

financialactivitiesandreporting.Thiswoulddrawtheattentionofgeneralinvestorsandgainthen

confidencetoinvestineverysector.Moreimportantly,inthecontextofonlinecentraldepository

system,guaranteedclearingagentforsettlementisobviousformarketdevelopment.

Absenceofcapitalgaintaxisthemostattractivereasonforforeigninvestors(FI)toinvestinBangladesh

capitalmarket,whichisnotverycommoninemergingeconomiessuchasBangladesh.Inadditionto

highreturnandsignificantdividendyield,FIsshouldbeattractedtoourcapitalmarketbecauseofthe

easyandhasslefreerepatriationoffunds.

Fromthepresentpointoftimethefutureseemsbright,notonlybecauseofourvibrantcapitalmarket

butalsoofourroomfornewproducts.Withtheintroductionofdirectlistingandpossiblebookbuilding

method,ourprimarymarketisimprovinginlinewiththesecondarymarket.Themarketcapwillgrow

significantlywithinnextfewyearsandturnovershallreachaninternationallevel.Moreover,

institutionalclients,namelybanksareenteringthemarketwiththeirhugeliquidfundcausingthe

capitalmarkettogrowveryrapidly.Domesticandinternationalbankshavestartednotonlytoinvestin

thecapitalmarketbutalsotooperatebrokerageandmerchantbankingwing.Crossbordertradingand

indextradingareideaswemightadoptinfuture,whichwillresultinliquidityandnewavenuesfor

investmentandminimiseourcashmarketrisk.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|15

TheBangladeshiandforeigninvestorsareexperiencingthescarcityofdiversifiedproductsin

Bangladesh.Theplatformofthismarketissupplyanddemand.Duetotheabsenceofdiversified

products,theliquidityofmarketisdeclining.

Introducingoptionandfuturemarkettoourcapitalmarketcanbeasolutiontotheaboveissue.

TurnoverandmarketcapitalofIndiagrewsubstantiallyafterintroducingtheoptionandfuturemarket.

However,theinvestorshavetobeeducatedproperlytoreducespeculation.Derivativesandoption

marketisunavailableonlyduetoourlackofprofessionalsandtechnicalweaknessandalsothereareno

specificregulationsrelatingtotheseproducts.However,inaveryshortspanoftimecapitalmarket

intermediariesarebringingininfrastructurechangessuchasbookbuilding,derivativeandoption

markettoourmarket.Introductionoftheseproductswillfurtherbroadeninvestmenthorizonandbring

enhanceddepthandliquiditytoourmarketandattractglobalcustomers.

Althoughwehaveabondmarketbutcomparedtoothercountriesitisveryweak.Wehavetoattract

privateandpublicsectorcompaniestoissuemorebondsandthusincreaseliquidityinourbondmarket.

Theneedforcooperationamongthestockexchangesinthisregionhastobeemphasisedherinorder

reaptremendousbenefits.Atpresent,thelevelofsuchcooperationsremainsataverylowlevel.The

experiencewehavehadinourrespectivemarketscanbevaluabletoeachotherandoughttobe

exchanged,eventhoughthesizesandspecificationsofourmarketsmayvary.Regionwise,wearebound

bycommonalitiesinculture,environment,tradition.ThesameSociopoliticalfactorsaffectusrather

similarly.Hence,theknowledgegatheredinourrespectivecountriescanbevaluabletous,whobelong

tothesameregion.Throughafriendlydisseminationofknowledgeandexperience,wecanrevitalise

andenergiseoureconomies.Sharedknowledgecanfuelthegrowthofastrongerandmorevibrant

capitalmarket.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|16

8.

THEPOTENTIALOFTHEBANGLADESHCAPITALMARKET

Thecapitalmarketistheengineofgrowthforaneconomy,andperformsacriticalroleinactingasan

intermediarybetweensaversandcompaniesseekingadditionalfinancingforbusinessexpansion.

Vibrantcapitalislikelytosupportarobusteconomy.Whilelendingbycommercialbanksprovides

valuableinitialsupportforcorporategrowth,adevelopedstockmarketisanimportantprerequisitefor

movingintoamorematuregrowthphasewithmoresophisticatedconglomerates.Today,witha$67

billioneconomyandpercapitaincomeofroughly$500,Bangladeshshouldreallyfocusonimproving

governanceanddevelopingadvancedmarketproducts,suchasderivatives,swapsetc.

Despiteachallengingpoliticalenvironmentandwidespreadpoverty,Bangladeshhasachieved

significantmilestonesonthesocialdevelopmentside.Withgrowthreaching7percentin2006,the

economyhasacceleratedtoanimpressivelevel.Itisnoteworthythattheleadingglobalinvestment

banks,Citi,GoldmanSachs,JPMorganandMerrillLynchhaveallidentifiedBangladeshasakey

investmentopportunity.TheDhakaStockExchangeIndexisata10yearhigh,however,thecapital

marketinBangladeshisstillunderdeveloped,anditsdevelopmentisimperativeforfullrealisationof

thecountry'sdevelopmentpotential.

CraigBrewer

ItisencouragingtoseethatthecapitalmarketofBangladeshisgrowing,albeitataslowerpacethan

manywouldlike,withmarketdevelopmentstillatanascentstage.Themarkethasseenalotof

developmentssincetheinceptionoftheSecuritiesandExchangeCommission(SEC)in1993.Afterthe

bubbleburstof1996,thecapitalmarkethasattractedalotmoreattention,importanceandawareness,

thathasledtotheinfrastructurewehaveinthemarkettoday.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|17

9.

REASONSBEHINDTHEUNDERDEVELOPMENT

Accesstohighqualityandcrediblecorporateinformationremainsamajorprobleminthemarket.While

ahandfulofinstitutionalinvestorsmayenjoycertainbenefitssincetheyhaveaninvestmentunit

mannedwithqualifiedofficers,nothingexistsforretailinvestors.And,intheabsenceofindependent

researchhouses,retailinvestorsprimarilyfocusonadvicegivenbytheirbrokers,whichoftenconsistsof

marketrumours.Thisisnotacceptable,anditoftenleadstoenormouslossesforsmallinvestorswho

arevitalforalowincomeandemergingmarketlikeBangladesh.Filteringofinformationamong

differenttypesofinvestorsmayleavescopeformanipulation;thisassumptionhadbeenprovedrightin

the1996marketmeltdownatthecostofmanyindividualsandhouseholds.

Themarketdoesnothaveanadequatenumberoffundamentallysoundscrips.Theauthoritiesshould

notforcemajorcorporationstocomeintothemarket,withoutcreatinganenablingenvironment.The

focusshouldbeontheprivatisationofstateownedenterprisesthroughpublicofferingsinthebourses.

Themarkethastoreachsuchastageofdevelopmentthatcompanieswilltakeitasaseriousalternative

tobankfinancing.

Thegovernmenthasreducedtheinterestratesonsavingsinstruments,howeverthisparticularmarket

isstilllimitedtothecommercialbanks,andindividualinvestorsdonothaveaccesstotheseinstruments.

Thesesavingsinstrumentsareconsideredriskfree,andsincetheyarenotpresentinthecapitalmarket,

theoverallriskofinvestmentforaninvestorremainsveryhigh.Aportfolioinvestordoesnothavethe

optionofreducinghisaverageportfolioriskbyaddingtheseriskfreeopportunities.

AnestimatesuggeststhattheratioofinstitutionaltoretailinvestorsisstilllowinBangladesh,even

relativetootheremergingmarkets.Institutionalinvestorsbringlongtermcommitmentandagreater

focusonfundamentalsand,hence,stabilityinthemarket.Thepresenceofinstitutionalinvestorsisalso

expectedtoensurebettervaluationlevelsduetotheirspecialisedanalyticalskills.Whilewedohave

publicsectoraswellasprivatesectorinstitutionalinvestorsintheeconomy,proprietaryinvestment

fromtheseinstitutionsisnotsignificantotherthantheInvestmentCorporationofBangladeshthat

wascreatedin1976andcurrentlymanagesseveralmutualfunds.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|18

Corporategovernanceofinternationalstandardisstilllacking.Multinationalcorporationsand

institutionsoperatinginBangladeshoftenadheretoaveryhighinternationalstandardcompliance

regime.Parentcompaniesofmostofthesecorporationsandinstitutionshavetheirscripslistedin

developedmarkets.Unlessthelocalmarketadheresto,andeffectivelyenforces,astandardcorporate

governancesystem,therewillnotbealevelplayinggroundforinternationalbusinesshousesvisavis

localoperators.

Animportantaspectforcapitalmarketisreflectionoffairvalueofscrips.Thisisnotadequatelypresent

inthecurrentscenario,andduetothisreasonthemarketisnotreceivingtheattentionofanimportant

segmentofinvestors,bothforeignandlocal.Investorsareperhapsdependingmoreonspeculative

analysis,resultinginvolatilityinthemarket,asopposedtofundamentalanalysis,whichcouldattract

morestablelongterminvestorswhoaresureabouttheirinvestmenttenureandexpectations.

Thebullrunthattookplacein1996hasleftanumberofpositivesforthemarket.Alotofinvestment

friendlyregulatoryreformshavebeenimplementedbytheSEC.Wenowhavestrongersurveillanceand

improvedrulesrelatingtopublicissue,rightsissue,acquisition,mergersandsoon.Allthese

fundamentaldevelopments,whichwerewelloverdue,followedthe1996bullrun.Itwasalearning

experienceforBangladesh,andthedesiredlevelofchangeswasinitiatedbythemarketwatchdog

subsequently.

Inthesecondarymarket,surveillanceismoreactiveandparticularthanbefore.Thesedevelopments,

thatarewidelyappreciated,areactuallythefundamentalrequirementsthatareinplacetodayresulting

fromthecontinuouseffortsofthegovernmentandmultilateralagencies.

Tradinghasnowbecomeautomated,ledbytheChittagongStockExchangethroughthecentral

depository.Inthepresentautomatedtradingenvironment,bids/offers,depth,andrequiredbroker

particularsareallrecordedandcanberetrievedforfuturereference.TheCentralDepository

BangladeshLimited(CDBL)wascreatedinAugust2000tooperateandmaintaintheCentralDepository

System(CDS)ofElectronicBookEntry,recordingandmaintainingsecuritiesaccountsandregistering

transfersofsecurities;changingtheownershipwithoutanyphysicalmovementorendorsementof

certificatesandexecutionoftransferinstruments,aswellasvariousotherinvestorservicesincluding

providingaplatformforthesecondarymarkettradingofTreasuryBillsandGovernmentBondsissuedby

theBangladeshBank.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|19

Thestockmarketsurveillancemechanicsinplaceatpresenthasnoresemblancetothatof1996.There

arestrictrulesandguidelines,tradingcircuitbreakersandinternationalstandardsurveillancetoprotect

investorrightsandensurefairplay.Thedisclosurerequirementsanditstimingforbothlistedscripsand

IPOsasdevisedbytheSECarenowmorereflectiveofinternationalpractices.TheSECisalsoadopting

newvaluationmethodsthatresultinfairpricingofnewissues.Whilethereisstillalackofcredible

researchorganisations,afewfirmslikeAssetandInvestmentManagementServicesofBangladeshLtd.

(Aims)havecomeup,andtheyareinvestinginresearchandbuildingupstockmarketrelated

credentials.

THERECENTSURGEINTHESTOCKMARKET

TheDhakaStockExchangeIndexwasata10yearhighinthe2007yearend(up66percent),which

madeitAsia'stopperformerafterChina.Thesteadyinvestmentatmosphereprevailingthroughout

2007isconsideredtobeoneofthemainreasonsbehindthissurge.Goodreturnprospects,stable

marketgrowth,anduninterruptedtradingasaresultofpoliticalstabilityattractedforeigninvestorsto

localsecurities.In2007,foreigninvestorsboughtsharesworth$205.7million,whiletheamountof

sellingwas$78.6million,accordingtoaDSEstatistic.AccordingtotheDSE,in2007,netforeignor

portfolioinvestmentontheDhakaStockExchangesurged8.3xto$129million.Thebankingsector,

followedbythepower,pharmaceuticalandcementsectors,receivedthemostforeigninvestment.

Thecaretakergovernmenthasalsoattractedinvestorsbypledgingtosellstateenterprises.Thestate

ownedcompaniesJamunaOilCompanyLtd.andMeghnaPetroleumLtd.debutedinthebourses

earlythismonth.Someanalyststhinkthatthemarkethadbeenundervaluedbeforethesurge,andthe

uphilltrend,therefore,playedtheroleofanupwardcorrectionofthemarket.

TheP/Erationowstandsat20xascomparedto14.1xforemergingmarkets.Itseemssustainableifthe

plannedbigIPOsofafewSOEsandthetoptelecomcompaniestakeplace.Moresuchlargeissuesare

required,whichcanemergeoutoftheenergy,infrastructureandpublicsectors.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|20

10.

OPPORTUNITIESOFBANGLADESHCAPITALMARKET

ThecapitalmarketsinAsiaaregettingmoreandmorefocuswiththegrowingcorporatisationofthe

Asianeconomies.EasternAsiahasprogressedalotwithrespecttoattractingwesterncompaniestoget

listedinAsianboursesaswellassupportinginnovativeinstruments,andSoutheastAsiaisalsocoming

upwithIndialeadingtheway.Comparingthelocalmarketscenariowiththatoftherestoftheregion,

Bangladeshisinprettygoodshapeaswehavemostoftheinfrastructureinplace.Ourmarket

capitalisationisrelativelysmalleranditcurrentlystandsat$9.3billion,whichisjustover13percentof

GDP.Higherliquidityisskewedtowardsahandfulofscrips,whileastagnantsituationexistsforfewless

profitableissuers.

Atpresent,thegovernmentisheavilyfocusingondevelopingadebtcapitalmarket.Suchmeasuresare

certainlywelcomeasBangladeshlacksapropersecondarymarketforbonds.Themarketisyetto

supportshorttermcapitalrequirementsofcorporations.CommercialPaper(CP)hasnotyetbeentried

primarilyduetointerestratevolatilityandilliquidriskfreeinstrumentsthatcanbeusedasbenchmark

neitherforshorttermandhardlyforlongtermfinancing.Itcan,therefore,besaidthatwehavea

somewhatflatyieldcurveinBangladeshatthemoment.

DebuttradingofstateownedoilcompanieslikeJamunaOilCompanyLtdandMeghnaPetroleum

LimitedonthelocalboursesinJanuary2008hasspurredalotofencouragementamonginvestors.This

initiativetakenbythegovernmenttolistSOEswillincreasemarketcapitalisationandimprovedliquidity.

SECisalsocontemplatingtheintroductionofthebookbuildingmethodinthevaluationofIPOsinorder

toensureafairpricewithinthisyear.Thiswillencouragecompanieswithsoundfinancialhealthto

comeintothemarket.

Regulatorypressuresaremountingontelecomcompaniestogetlisted.Itisestimatedthatthelistingof

thetoptelecomcompanieswillattractmoreforeigninvestment,increasethemarketcapitalisationby

fewfolds,andbringabouthigherstandardsofcorporategovernance.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|21

Thereisstillhugepotentialinthemarketforsecuritisationandotherdebtinstrumentslikecommercial

papersandcorporatebonds,andderivatives,whichwillhelpforeigninvestorshedgetheirexposure.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|22

11.

RECOMMENDATIONS&CONCLUSION

Themarketneedsmoreandmoregoodscrips.Theprocesswouldbeeasierifwecoulddrawattention

ofgoodissuersbyimprovingthemarketgovernancesystemandeliminatingscopeformanipulation.

Thereareonlylimitedinstances,suchasincommercialbanks/leasingcompanies,whereregulatorscan

imposeguidelinesrelatingtocapitalstructure.Hence,itmaybedifficulttoforceacorporatehouseto

listunlessitagreesatthetimeoflicensingorregistration.Inadequatedisclosurerequirement,anda

cultureoffamilyownedconglomeratesdetertheexpansionofcorporategovernanceintothelocal

industry.Theregulatorsneedtoplayanactiveroleinremovingthebureaucraticbottlenecks,and

promoterulesthatprovideincentivestothesegroupsofcompaniestolist.

Toexpeditethemarketdevelopmentprocess,itmaybeagoodideatodecideoncertainmilestonesand

linkthemtothedisbursementofDevelopmentCreditSupportoftheWorldBank.Thegovernmentis

makinggoodprogressinothersectors,includingmonetarymanagement,corporatisationofpublic

sectorbanksandothersthroughthislinkage.

ThemissinglinkbetweentheSEC,BangladeshBank,BangladeshTelecomRegulatoryCommissionand

otherregulatorybodiesisnowgettingestablished.Individually,theywerenotservingeachothers'

interests,andtherewasnoeffectivecoordinationamongthem,hencethecountrywasdeprivedof

greatinitiatives.AdedicatedfinancialmarketcellattheMinistryofFinancecouldbeformedto

coordinatewiththeseregulatorsaswellasotherministries.

Intermsofcreatingmarketdepth,moreprofitablestateownedenterprisesshouldbelisted.Thesupply

ofsecuritiescanbeincreasediftheSOEsareallowedtooperatethroughthestockexchanges.

FloatationofSOEscripsisexpectedtoexpandthemarketbycoupleoftimes.CorporatisationofSOEs

willbringintransparencyaswellasconfidenceonthegovernmentfinancialsystem.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|23

Incentiveforprivatesectorentrepreneurstoaccessthecapitalmarketshouldbemorenoticeable.Tax

gapbetweenlistedandnonlistedcompaniescouldbeincreased.Infrastructureprojectsshouldaccess

capitalmarkettoraisefinancingthroughbondsandcorporationsshouldraiseshorttermfinancing

throughcommercialpapers.Securitizationsshouldbeencouraged.Weneedtobeproactiveandtake

initiativestopromotenewproductsinthemarket.

Inamoredevelopedmarket,institutionalinvestorssuchasmerchantbanks,commercialbanks,

insurancecompanies,aremajortradersofsecurities.Weneedenforceableandmoreeffectivelawsand

rulestoattractforeigninstitutionalinvestors.

EquityresearchisnotyetverypopularinBangladesh,qualityofbrokerageshousesshouldbeassessed

bythequalityofresearchproducedbytheirindependentresearchdepartments.SECisexpectedtotake

aneducationalroleintheprocessbybringingininternationalresourcesandcreatinginvestors

awarenessthroughtelevisionandothermedia.LocalTVchannelsfocusonbusinessbutwealsoneed

educationfortheyounggenerationfinancialeducationforthecollegeanduniversitystudents,

irrespectiveoftheirdiscipline,shouldbepromoted.Youngpeoplehaveeveryrighttolearnthe

mechanismsofsaving,investingandtheimportanceofpersonalfinancialmanagement.

Qualityanalysisneedstoaddressthisvaluationissueinamoreproactivemanner.Theindependent

analystsshouldraisetheflagwhenascripisovervaluedorundervalued,theintrinsicvalueofatraded

securityshouldbecoveredintheresearchpaper.Investorsareperhapsdependingmuchonspeculative

analysisresultingintovolatilityinthemarketasopposedtofundamentalanalysis,whichcouldattract

morestablelongterminvestorswhoaresureabouttheirinvestmenttenureandexpectations.Itis

observedthatwheneverthereisadownturninthemarket,individualinvestorsgoonrampage.

However,theseinvestorsshouldunderstandthatdownturns,bearishtrendsandmarketcorrectionsare

anintegralpartofstockmarkets.

TheBangladeshcapitalmarketstillhasalongwaytogo.Therecentmeasurestakenbythetransitional

governmenthavealreadybeguntopositivelyimpactthemarkets.Ifmoreinvestorfriendlypolicy

reformsweretobeimplemented,thecapitalmarketwillundoubtedlyplayacriticalroleinleading

BangladeshtowardsbeingthenextAsiantigerwithgrowthcomparabletoIndia,Vietnamandtheother

mostdynamiceconomiesintheregion.

www.AssignmentPoint.com

InvestmentManagement:CapitalMarketofBangladesh|24

REFERENCES

Books:

CorporateFinance,StephenARoss,13thedition.McGrawHillInc.

NewsPapers:

TheDailyStarForum2008May

TheFinancialExpress,Thursday,December20,2007

Websites:

http://www.thedailystar.net/forum/2008/may/potential.htm

http://www.bangladeshbank.org/research/policynote/pn0708.pdf

http://www.thefinancialexpress

bd.com/search_index.php?news_id=20305&page=detail_news

http://en.wikipedia.org/wiki/Stock_market

http://en.wikipedia.org/wiki/Primary_market

www.AssignmentPoint.com

You might also like

- Modes of Investment of IBBL Grroup JobaDocument41 pagesModes of Investment of IBBL Grroup JobaShahriar NowabNo ratings yet

- Internship Report on National Bank of Pakistan's Mandian BranchDocument10 pagesInternship Report on National Bank of Pakistan's Mandian BranchUsman ManiNo ratings yet

- Govt. AccountingDocument5 pagesGovt. AccountingMohammad KamruzzamanNo ratings yet

- Investment Performance FinalDocument49 pagesInvestment Performance FinalAl AminNo ratings yet

- Aayanali 12345Document26 pagesAayanali 12345nasir mehmoodNo ratings yet

- Summit Bank Limited: Bank Road Branch (Ii), Sadder Rawalpindi For The Degree ofDocument12 pagesSummit Bank Limited: Bank Road Branch (Ii), Sadder Rawalpindi For The Degree ofIrsa SalmanNo ratings yet

- B2B E-commerce in Small Business: A case study of ShopUp PlatformDocument32 pagesB2B E-commerce in Small Business: A case study of ShopUp PlatformSelim KhanNo ratings yet

- Project Report On "Performance of Mutual Funds in Bangladesh"Document42 pagesProject Report On "Performance of Mutual Funds in Bangladesh"Shovan SahaNo ratings yet

- Internship Report On Askari Bank LimitedDocument46 pagesInternship Report On Askari Bank Limitedbbaahmad89100% (4)

- An Internship Report On Risk Management of Exim Bank BangladeshDocument64 pagesAn Internship Report On Risk Management of Exim Bank BangladeshSumantra Barai25% (4)

- Foreign Exchange System of City Bank LimitedDocument10 pagesForeign Exchange System of City Bank Limitedsibgat ullahNo ratings yet

- Internship Report BBADocument102 pagesInternship Report BBAfarukNo ratings yet

- Internship Report On Faysal Bank LimitedDocument48 pagesInternship Report On Faysal Bank Limitedbbaahmad89100% (2)

- Analysis of Credit Department, Risk Management Division & Performance of Bank Asia LimitedDocument83 pagesAnalysis of Credit Department, Risk Management Division & Performance of Bank Asia LimitedZahid Bin IslamNo ratings yet

- Report BCBLDocument98 pagesReport BCBLTanvir Ahamed100% (1)

- Internship Report On Foreign Exchange Operation at Standard Bank LimitedDocument53 pagesInternship Report On Foreign Exchange Operation at Standard Bank LimitedArifulIslamArifNo ratings yet

- Financial Analysis of Prime BankDocument72 pagesFinancial Analysis of Prime BankImran Khan0% (1)

- Internship Report of Investment Management On Shahjalal Islami Bank LimitedDocument80 pagesInternship Report of Investment Management On Shahjalal Islami Bank LimitedHazra Mohammad Sifullah0% (1)

- Customer Satisfaction at FSIBLDocument5 pagesCustomer Satisfaction at FSIBLNAZMUL ALAM RONYNo ratings yet

- FINAL Internship Report of Askari BankDocument127 pagesFINAL Internship Report of Askari BankHammad Ahmad100% (1)

- Internship Report: N. M. Baki Billah Lecturer, BRAC Business School Brac UniversityDocument35 pagesInternship Report: N. M. Baki Billah Lecturer, BRAC Business School Brac Universityanisul islamNo ratings yet

- Letter of Transmittal 01Document10 pagesLetter of Transmittal 01Md. Jasim UddinNo ratings yet

- Internship Report On Soneri Bank LimitedDocument78 pagesInternship Report On Soneri Bank LimitedZubair Khan50% (2)

- Internship Report BBADocument101 pagesInternship Report BBAKamal Uddin Suman57% (7)

- An Internship Report On: Supervised byDocument8 pagesAn Internship Report On: Supervised byarshed_69No ratings yet

- Capacity Building Initiative for SME LendingDocument12 pagesCapacity Building Initiative for SME LendingArsalan AqeeqNo ratings yet

- Report On DARAZ Bangladesh Prepared ForDocument31 pagesReport On DARAZ Bangladesh Prepared ForFarhanur RahmanNo ratings yet

- ZTBLDocument52 pagesZTBLSheikh Aqeel50% (2)

- After Editing RepoetDocument90 pagesAfter Editing RepoetFatima HarveyNo ratings yet

- SME (Small and Medium Enterprise) Banking Division of BRAC Bank LimitedDocument7 pagesSME (Small and Medium Enterprise) Banking Division of BRAC Bank Limitedmd.jewel ranaNo ratings yet

- Internship Report Tapping New Opportunit PDFDocument35 pagesInternship Report Tapping New Opportunit PDFRifat RontyNo ratings yet

- General Banking Activities of ICB Islamic Bank Limited Sylhet BranchDocument58 pagesGeneral Banking Activities of ICB Islamic Bank Limited Sylhet BranchMahmudul HasanNo ratings yet

- Intership Report On General Banking of Standard BankDocument44 pagesIntership Report On General Banking of Standard Bankporosh100100% (1)

- Credit Risk Management of NBL1Document119 pagesCredit Risk Management of NBL1Mir FaiazNo ratings yet

- Internship Report On Taskeater Bangladesh Ltd.Document32 pagesInternship Report On Taskeater Bangladesh Ltd.eleas abidNo ratings yet

- Foreign Exchange Operations of Southeast Bank Limited: Internship ReportDocument74 pagesForeign Exchange Operations of Southeast Bank Limited: Internship ReportudenbranNo ratings yet

- Internship Report On General Banking of Agrani Bank Limited: Submitted ToDocument41 pagesInternship Report On General Banking of Agrani Bank Limited: Submitted ToDipto Kumar BiswasNo ratings yet

- Asa University Bangladesh: Thesis Report On "Procedure of Foreign Trade Finance in AB Bank Limited"Document115 pagesAsa University Bangladesh: Thesis Report On "Procedure of Foreign Trade Finance in AB Bank Limited"Abdullah Al MahmudNo ratings yet

- Ihsan Internship ReportDocument41 pagesIhsan Internship ReportBasit RehmanNo ratings yet

- FIN101 Term-Paper-FinalDocument25 pagesFIN101 Term-Paper-FinalGopal DeyNo ratings yet

- Internship ReportDocument63 pagesInternship ReportNikita ChouhanNo ratings yet

- Foreign Remittance Activities of EXIM Bank LimitedDocument58 pagesForeign Remittance Activities of EXIM Bank LimitedMd Khaled NoorNo ratings yet

- Letter of Transmittal 1Document1 pageLetter of Transmittal 1Md Kutubul AlamNo ratings yet

- Service Marketing of Agrani BankDocument37 pagesService Marketing of Agrani BankNoman ParvezNo ratings yet

- Project On Demat AccountDocument62 pagesProject On Demat Accountsmruti bansod100% (1)

- Final Report - NishatDocument77 pagesFinal Report - NishatSajidNo ratings yet

- North South University: Internship ReportDocument34 pagesNorth South University: Internship ReportShuvroNo ratings yet

- Internship Report On "Compliance of The Rules & Regulation of BAS (Bangladesh Accounting Standard) 1 & 30 in Preparing The Financial Statements of EXIM Bank of Bangladesh Limited"Document43 pagesInternship Report On "Compliance of The Rules & Regulation of BAS (Bangladesh Accounting Standard) 1 & 30 in Preparing The Financial Statements of EXIM Bank of Bangladesh Limited"Rashel MahmudNo ratings yet

- Internship Report On Daraz Bangladesh LTDDocument59 pagesInternship Report On Daraz Bangladesh LTDSadia SabahNo ratings yet

- Recruitment and Selection Process of SeblDocument3 pagesRecruitment and Selection Process of SeblRuhul Amin RahatNo ratings yet

- Summer Training Report On Standard Chartered BankDocument97 pagesSummer Training Report On Standard Chartered BankAbhay KumarNo ratings yet

- Robin Inter (Repaired)Document140 pagesRobin Inter (Repaired)Lotus RahmanNo ratings yet

- Project On Demat Account FinalDocument74 pagesProject On Demat Account Finalgoyalraju073% (48)

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNo ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisNo ratings yet

- 20 Market Research Questions To Ask in Your Customer Survey - QuestionProDocument16 pages20 Market Research Questions To Ask in Your Customer Survey - QuestionProShailendra RajputNo ratings yet

- Sample Transfer of Title ComputationDocument1 pageSample Transfer of Title ComputationForiel FrancoNo ratings yet

- Chapter 4Document2 pagesChapter 4Lawliet RyuzakiNo ratings yet

- 14 - Ton Nu My Duyen - EBBA 11.1 - Assignment Topic 4Document4 pages14 - Ton Nu My Duyen - EBBA 11.1 - Assignment Topic 4Tôn Nữ Mỹ DuyênNo ratings yet

- Household Demand and Supply: MicroeconomicsDocument36 pagesHousehold Demand and Supply: MicroeconomicskakuNo ratings yet

- Practice Quiz - Attempt 1 QuestionsDocument42 pagesPractice Quiz - Attempt 1 Questionsbassil928No ratings yet

- 2008 JJC H2 Economics Prelim Exam AnswersDocument15 pages2008 JJC H2 Economics Prelim Exam AnswersChristabel TanNo ratings yet

- Principles of Economics 6th Edition Frank Solutions Manual 1Document6 pagesPrinciples of Economics 6th Edition Frank Solutions Manual 1penelope100% (39)

- 812 MarketingDocument12 pages812 MarketingAbhinav SainiNo ratings yet

- Keller Sbm3 Im 05Document9 pagesKeller Sbm3 Im 05Ali razaNo ratings yet

- Wyckoff - Pt. 2Document10 pagesWyckoff - Pt. 2Vincent Sampieri100% (1)

- Eco 111 Test 2 Final Nov 28 2021Document9 pagesEco 111 Test 2 Final Nov 28 2021thato motshegweNo ratings yet

- Forex ScamDocument4 pagesForex ScamfelixaliuNo ratings yet

- Theories of interest rates explainedDocument31 pagesTheories of interest rates explainedkhan_ssNo ratings yet

- Unit 1 What Does Ecoomics Study? History of Economic Thought I. Reading 1 A. VocabularyDocument12 pagesUnit 1 What Does Ecoomics Study? History of Economic Thought I. Reading 1 A. VocabularyLê Ngọc NiênNo ratings yet

- Wyckoff Stock Market InstituteDocument3 pagesWyckoff Stock Market InstitutePedroNo ratings yet

- A Speculators Choices Cosima Wagner Is An Optimist Who LikesDocument1 pageA Speculators Choices Cosima Wagner Is An Optimist Who LikesM Bilal SaleemNo ratings yet

- Investment Analysis and Portfolio Management: ERASMUS Assignment 2009-2010Document3 pagesInvestment Analysis and Portfolio Management: ERASMUS Assignment 2009-2010farrukhazeemNo ratings yet

- Black Case StudyDocument2 pagesBlack Case StudySwapnil LilkeNo ratings yet

- Case Study On MTR FoodsDocument9 pagesCase Study On MTR FoodsKhushbu PandeyNo ratings yet

- International Trade 3rd Edition Feenstra Solutions ManualDocument13 pagesInternational Trade 3rd Edition Feenstra Solutions ManualJenniferThompsongoacm100% (12)

- Digital InfluencersDocument103 pagesDigital InfluencersCarolina Espada e PenaNo ratings yet

- Designing The Distribution Network in A Supply ChainDocument43 pagesDesigning The Distribution Network in A Supply ChainTalha6775No ratings yet

- Review Test Submission - Quiz 5 - 2016 - EMIC2714 BFN ON PDFDocument7 pagesReview Test Submission - Quiz 5 - 2016 - EMIC2714 BFN ON PDFTumi Mothusi100% (1)

- Chapter 3 Demand and SupplyDocument9 pagesChapter 3 Demand and Supplyjbantolino18No ratings yet

- Evaluating a Company's Resources, Capabilities and CompetitivenessDocument2 pagesEvaluating a Company's Resources, Capabilities and CompetitivenessAlma CoronadoNo ratings yet

- LIC CaseDocument9 pagesLIC CaseSaurabh SinghNo ratings yet

- Varian Exercicios-WelfareDocument9 pagesVarian Exercicios-WelfareVante KimNo ratings yet

- Bancassurance - A New Feasible Strategy in Banking and Insurance Sector Moving Fast in India PDFDocument12 pagesBancassurance - A New Feasible Strategy in Banking and Insurance Sector Moving Fast in India PDFcrescidaNo ratings yet

- Q1. Do You Think This Is The Right Time To Make An Entry Into The Indian Food Delivery Market, After A Recent Debacle in That Space?Document2 pagesQ1. Do You Think This Is The Right Time To Make An Entry Into The Indian Food Delivery Market, After A Recent Debacle in That Space?Sanchit ParnamiNo ratings yet