Professional Documents

Culture Documents

National Taxes in The Philippines

Uploaded by

Jheiy-em Evangelista0 ratings0% found this document useful (0 votes)

82 views3 pagesNational Taxes in the Philippines

Original Title

National Taxes in the Philippines

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNational Taxes in the Philippines

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

82 views3 pagesNational Taxes in The Philippines

Uploaded by

Jheiy-em EvangelistaNational Taxes in the Philippines

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

National Taxes in the Philippines

Capital Gains Tax is a tax imposed on the

gains presumed to have been realized by the

seller from the sale, exchange, or other

disposition of capital assets located in the

Philippines, including pacto de retro sales and

other forms of conditional sale.

Documentary Stamp Tax is a tax on

documents, instruments, loan agreements and

papers evidencing the acceptance,

assignment, sale or transfer of an obligation,

rights, or property incident thereto. Examples

of documentary stamp tax are those that are

charged on bank promissory notes, deed of

sale, and deed of assignment on transfer of

shares of corporate stock ownership.

Donors Tax is a tax on a donation or gift,

and is imposed on the gratuitous transfer of

property between two or more persons who

are living at the time of the transfer. Donors

tax is based on a graduated schedule of tax

rate.

Estate Tax is a tax on the right of the

deceased person to transmit his/her estate to

his/her lawful heirs and beneficiaries at the

time of death and on certain transfers which

are made by law as equivalent to testamentary

disposition. Estate tax is also based on a

graduated schedule of tax rate.

Income Tax is a tax on all yearly profits

arising from property, profession, trades or

offices or as a tax on a persons income,

emoluments, profits and the like. Selfemployed individuals and corporate taxpayers

pay quarterly income taxes from 1st quarter to

3rd quarter. And instead of filing quarterly

income tax on the fourth quarter, they file and

pay their annual income tax return for the

taxable year. Individual income tax is based on

graduated schedule of tax rate, while

corporate income tax in based on a fixed rate

prescribe by the tax law or special law.

Percentage Tax is a business tax imposed

on persons or entities who sell or lease goods,

properties or services in the course of trade or

business whose gross annual sales or receipts

do not exceed the amount required to register

as VAT-registered taxpayers. Percentage

taxes are usually based on a fixed rate. They

are usually paid monthly by businesses or

professionals. However, some special

industries and transactions pay percentage tax

on a quarterly basis.

Value Added Tax is a business tax imposed

and collected from the seller in the course of

trade or business on every sale of properties

(real or personal) lease of goods or properties

(real or personal) or vendors of services. It is

an indirect tax, thus, it can be passed on to the

buyer, causing this to increase the prices of

most goods and services bought and paid by

consumers. VAT returns are usually filed and

paid monthly and quarterly.

Excise Tax is a tax imposed on goods

manufactured or produced in the Philippines

for domestic sale or consumption or any other

disposition. It is also imposed on things that

are imported.

Withholding Tax on Compensation is the

tax withheld from individuals receiving purely

compensation income. This tax is what

employers withheld in their employees

compensation income and remit to the

government through the BIR or authorized

accrediting agent.

Expanded Withholding Tax is a kind of

withholding tax which is prescribed only for

certain payors and is creditable against the

income tax due of the payee for the taxable

quarter year. Examples of the expanded

withholding taxes are those that are withheld

on rental income and professional income.

Final Withholding Tax is a kind of

withholding tax which is prescribed only for

certain payors and is not creditable against the

income tax due of the payee for the taxable

year. Income Tax withheld constitutes the full

and final payment of the Income Tax due from

the payee on the said income. An example of

final withholding tax is the tax withheld by

banks on the interest income earned on bank

deposits.

Withholding Tax on Government Money

Payments is the withholding tax withheld by

government offices and instrumentalities,

including government-owned or -controlled

corporations and local government units,

before making any payments to private

individuals, corporations, partnerships and/or

associations.

Local Taxes in the Philippines

Tax on Transfer of Real Property

Ownership tax imposed on the sale,

donation, barter, or on any other mode of

transferring ownership or title of real property.

Tax on Business of Printing and

Publication tax on the business of persons

engaged in the printing and/or publication of

books, cards, posters, leaflets, handbills,

certificates, receipts, pamphlets, and others of

similar nature.

Franchise Tax tax on businesses enjoying a

franchise, at the rate not exceeding fifty

percent (50%) of one percent (1%) of the

gross annual receipts for the preceding

calendar year based on the incoming receipt,

or realized, within its territorial jurisdiction.

Tax on Sand, Gravel and Other Quarry

Resources tax imposed on ordinary stones,

sand, gravel, earth, and other quarry

resources, as defined under the National

Internal Revenue Code, as amended,

extracted from public lands or from the beds of

seas, lakes, rivers, streams, creeks, and other

public waters within its territorial jurisdiction.

Professional Tax an annual professional tax

on each person engaged in the exercise or

practice of his profession requiring

government examination.

Amusement Tax tax collected from the

proprietors, lessees, or operators of theaters,

cinemas, concert halls, circuses, boxing

stadia, and other places of amusement.

Annual Fixed Tax For Every Delivery Truck

or Van of Manufacturers or Producers,

Wholesalers of, Dealers, or Retailers in,

Certain Products an annual fixed tax for

every truck, van or any vehicle used by

manufacturers, producers, wholesalers,

dealers or retailers in the delivery or

distribution of distilled spirits, fermented

liquors, soft drinks, cigars and cigarettes, and

other products as may be determined by the

sangguniang panlalawigan, to sales outlets, or

consumers, whether directly or indirectly,

within the province.

Tax on Business taxes imposed by cities,

municipalities on businesses before they will

be issued a business license or permit to start

operations based on the schedule of rates

prescribed by the local government code, as

amended. Take note that the rates may vary

among cities and municipalities. This is usually

what businesses pay to get their Business

Mayors Permit.

Fees for Sealing and Licensing of Weights

and Measures fees for the sealing and

licensing of weights and measures at such

reasonable rates as shall be prescribed by the

sangguniang bayan of the municipality or city.

Fishery Rentals, Fees and Charges

rentals, fees or charges imposed by the

municipality/city to grantees of fishery

privileges in the municipal/city waters, e.g.,

fishery privileges to erect fish corrals, oysters,

mussels or other aquatic beds or bangus fry

areas and others as mentioned in the local

government code, as amended.

Community Tax tax levied by cities or

municipalities to every inhabitant of the

Philippines eighteen (18) years of age or over

who has been regularly employed on a wage

or salary basis for at least thirty (30)

consecutive working days during any calendar

year, or who is engaged in business or

occupation, or who owns real property with an

aggregate assessed value of One thousand

pesos (P1,000.00) or more, or who is required

by law to file an income tax return. Community

tax is also imposed on every corporation no

matter how created or organized, whether

domestic or resident foreign, engaged in or

doing business in the Philippines.

Taxes that may be levied by the barangays

on stores or retailers with fixed business

establishments with gross sales of receipts of

the preceding calendar year of Fifty thousand

pesos (P50,000.00) or less, in the case of

cities and Thirty thousand pesos (P30,000.00)

or less, in the case of municipalities, at a rate

not exceeding one percent (1%) on such gross

sales or receipts.

Service Fees or Charges fees or charges

that may be collected by the barangays for

services rendered in connection with the

regulations or the use of barangay-owned

properties or service facilities, such as palay,

copra, or tobacco dryers.

Barangay Clearance a reasonable fee

collected by barangays upon issuance of

barangay clearance a document required for

many government transactions, such as when

applying for business permit with the city or

municipality.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Cause of ActionDocument6 pagesCause of ActionJheiy-em EvangelistaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- Philippine Legal Forms 2015bDocument394 pagesPhilippine Legal Forms 2015bJoseph Rinoza Plazo100% (14)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Taxation Principles Review ProblemsDocument79 pagesTaxation Principles Review ProblemsArya CollinNo ratings yet

- In-N-OUT Burger Vs SehwaniDocument12 pagesIn-N-OUT Burger Vs SehwaniJheiy-em EvangelistaNo ratings yet

- Value Added TaxDocument6 pagesValue Added Taxarjohnyabut80% (10)

- MCQ - CPWD CHAPTER 5 - CashDocument9 pagesMCQ - CPWD CHAPTER 5 - CashBeauty Queen100% (1)

- ERC Philippines power plant inspection standardsDocument4 pagesERC Philippines power plant inspection standardsAubry GarciaNo ratings yet

- 2017 BRB Labor LawDocument74 pages2017 BRB Labor LawJheiy-em EvangelistaNo ratings yet

- Alfiada Vs HosolesDocument1 pageAlfiada Vs HosolesJheiy-em EvangelistaNo ratings yet

- Intellectual Property Law Case DigestDocument2 pagesIntellectual Property Law Case DigestJheiy-em EvangelistaNo ratings yet

- 2016 Bar Examinations (Civil Law)Document5 pages2016 Bar Examinations (Civil Law)Jheiy-em EvangelistaNo ratings yet

- 2017 BRB Commercial Law 2Document121 pages2017 BRB Commercial Law 2Jheiy-em EvangelistaNo ratings yet

- Political Law Case DigestsDocument38 pagesPolitical Law Case DigestsJheiy-em EvangelistaNo ratings yet

- Court Jurisdiction 2Document6 pagesCourt Jurisdiction 2Jheiy-em EvangelistaNo ratings yet

- Full Cases On Remedial LawDocument37 pagesFull Cases On Remedial LawJheiy-em EvangelistaNo ratings yet

- Court Jurisdiction 2Document6 pagesCourt Jurisdiction 2Jheiy-em EvangelistaNo ratings yet

- Cebu Bohol 2017Document6 pagesCebu Bohol 2017Jheiy-em EvangelistaNo ratings yet

- Phil Pharmawealth Vs PfizerDocument7 pagesPhil Pharmawealth Vs PfizerJheiy-em EvangelistaNo ratings yet

- RWS UniversalStudiosSingapore ParkMap PDFDocument1 pageRWS UniversalStudiosSingapore ParkMap PDFJheiy-em EvangelistaNo ratings yet

- Res inter alios acta rule applied in Tamargo vs Awingan caseDocument17 pagesRes inter alios acta rule applied in Tamargo vs Awingan caseJheiy-em EvangelistaNo ratings yet

- IHL FactsheetDocument4 pagesIHL FactsheetJheiy-em EvangelistaNo ratings yet

- Evidence CasesDocument106 pagesEvidence CasesJheiy-em EvangelistaNo ratings yet

- Evidence Cases Rule 129Document59 pagesEvidence Cases Rule 129Jheiy-em EvangelistaNo ratings yet

- Evidence Case 12-7Document44 pagesEvidence Case 12-7Jheiy-em EvangelistaNo ratings yet

- Alfredo T. Romualdez, G.R. No. 161602Document68 pagesAlfredo T. Romualdez, G.R. No. 161602Jheiy-em EvangelistaNo ratings yet

- LTD CasesDocument63 pagesLTD CasesJheiy-em EvangelistaNo ratings yet

- Evidence Case Digests (JM)Document7 pagesEvidence Case Digests (JM)Jheiy-em EvangelistaNo ratings yet

- Evidence Rule 128: RICO ROMMEL ATIENZA, Petitioner, G.R. No. 177407Document33 pagesEvidence Rule 128: RICO ROMMEL ATIENZA, Petitioner, G.R. No. 177407Jheiy-em EvangelistaNo ratings yet

- 195670Document11 pages195670Liaa AquinoNo ratings yet

- Prekins Vs RoxasDocument2 pagesPrekins Vs RoxasJheiy-em EvangelistaNo ratings yet

- Spec Pro CasesDocument14 pagesSpec Pro CasesJheiy-em EvangelistaNo ratings yet

- Transportation Law CasesDocument70 pagesTransportation Law CasesJheiy-em EvangelistaNo ratings yet

- Conflict Cases 11-23Document39 pagesConflict Cases 11-23Jheiy-em EvangelistaNo ratings yet

- Solution - Exercise Chapter 7 - ACC117Document3 pagesSolution - Exercise Chapter 7 - ACC117nurhidayah sadonNo ratings yet

- Pengembalian Biaya Pendaftaran NATASYA DEFIANADocument3 pagesPengembalian Biaya Pendaftaran NATASYA DEFIANASMA Yos Sudarso MetroNo ratings yet

- Model Test Paper - 1 IPCC Group-I Paper - 4 Taxation May - 2017Document28 pagesModel Test Paper - 1 IPCC Group-I Paper - 4 Taxation May - 2017Kshitij AgrawalNo ratings yet

- NikeDocument3 pagesNikeAdhiraj MukherjeeNo ratings yet

- Veraval Express Third Ac Economy (3E) : Electronic Reserva On Slip (ERS)Document1 pageVeraval Express Third Ac Economy (3E) : Electronic Reserva On Slip (ERS)Pranay PatelNo ratings yet

- Wa0043.Document12 pagesWa0043.Santosh Kumar GuptaNo ratings yet

- Instructions For Form IT-201: Full-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-201: Full-Year Resident Income Tax ReturntinpenaNo ratings yet

- PWC Tanzania Tax Datacard 2011 20121170527Document6 pagesPWC Tanzania Tax Datacard 2011 20121170527Zimbo KigoNo ratings yet

- STATEMENT Format SviDocument4 pagesSTATEMENT Format SviSUMIT SAHANo ratings yet

- Client Prepaid Form: Customer InformationDocument2 pagesClient Prepaid Form: Customer InformationTony GaryNo ratings yet

- Hindustan Petroleum Corporation Limited: Price ListDocument10 pagesHindustan Petroleum Corporation Limited: Price ListVizag Roads33% (3)

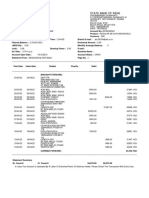

- Bank StatementDocument5 pagesBank StatementAshwani KumarNo ratings yet

- Transaction Details PayPalDocument1 pageTransaction Details PayPalChristine Eunice RaymondeNo ratings yet

- TaxDocument3 pagesTaxArven FrancoNo ratings yet

- Snack Spot - Process FlowchartsDocument3 pagesSnack Spot - Process FlowchartsMuhammad Yoosuf ShahNo ratings yet

- Bouncing Checks Law: Batas Pambansa Bilang No. 22Document8 pagesBouncing Checks Law: Batas Pambansa Bilang No. 22Chara etangNo ratings yet

- Assess Pro FinalDocument194 pagesAssess Pro Finalmsnethrapal100% (2)

- Sudev Podder 084Document1 pageSudev Podder 084ssd dNo ratings yet

- Siddharth Menon WorkbookDocument69 pagesSiddharth Menon WorkbookNavneet YadavNo ratings yet

- Short Term CapitalDocument21 pagesShort Term CapitalGNR ASSOCIATESNo ratings yet

- PM4Biz Report 20200816 20200824Document2 pagesPM4Biz Report 20200816 20200824Tarun VBRSITNo ratings yet

- Vat RuleDocument105 pagesVat Ruleshankar k.c.No ratings yet

- Quantitative Aptitude Hk-Ngtech PercentageDocument4 pagesQuantitative Aptitude Hk-Ngtech PercentageSatish Bhat75% (8)

- Solved Diane and Peter Were Divorced in 2010 The Divorce AgreementDocument1 pageSolved Diane and Peter Were Divorced in 2010 The Divorce AgreementAnbu jaromiaNo ratings yet

- Unit 2 - Income From Other SourcesDocument9 pagesUnit 2 - Income From Other SourcesRakhi DhamijaNo ratings yet

- PCDocument1 pagePCtpsroxNo ratings yet