Professional Documents

Culture Documents

Emerging Stock Markets and Global Economic System: The Nigeria Experience

Uploaded by

TI Journals PublishingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Emerging Stock Markets and Global Economic System: The Nigeria Experience

Uploaded by

TI Journals PublishingCopyright:

Available Formats

Int. j. econ. manag. soc. sci., Vol(4), No (7), July, 2015. pp.

442-444

TI Journals

International Journal of Economy, Management and Social Sciences

www.tijournals.com

ISSN:

2306-7276

Copyright 2015. All rights reserved for TI Journals.

Emerging Stock Markets and Global Economic System:

The Nigeria Experience

Owolabi Adesegun Oluwasanmi *

Department of banking and finance, school of business studies, the Federal Politechnic, Ado - Ekiti, Nigeria.

Owoola R. Ibukun-Falayi

Department of accounting, school of business studies, the Federal Politechnic, Ado - Ekiti, Nigeria.

*Corresponding author: tayeowoeye@yahoo.co.uk

Keywords

Abstract

Stock markets

Global economic system

Nigeria stock markets

This paper investigates the relationship between global economy activities and Nigeria stock market development.

Data for the Nigerian stock exchange market, Central Bank of Nigeria, Security and Exchange Commission,

International Monetary Funds (IMF) of various years were made use of for the period of 10 years, i.e. 2003 to 2013.

The study made use of regression analysis technique (OLS) to analyze the collected data. The study found out those

global economy activities is positively significant to Nigeria stock market development. The study recommends

that the Nigerian stock market should respond positively to the trend of global economy development.

1.

Introduction

Financial market, especially stork market, have grown considerably in developed and developing countries over the last two decades several

factors have aided in their growth, importantly improved macroeconomic fundamentals, such as more monetary stability and higher economic

growth general economic and specific stock markets reform, including privatization of state-owned enterprises, financial liberalization and an

improved institutional framework for investors, have further encouraged capital markets development.

Financial globalization has also advance in the last two decades with increased cross-border capital flows, tighter links among financial markets,

and greater commercial presence or foreign financial firms in countries around the world. An important element of the globalization trend has

been increased stock exchange activities taking place abroad, most notably for emerging market, but also for developed countries. This has

informed nation all over the world to reform their financial market. (Stijin, Daniela, and Sergio, 2004)

Global economy reforms are expected to foster domestic market development through their impact on the stock market internationalization

process. According to the argument, poor domestic environment prompt firms and investors to use international markets more intensively. A

poor domestic environment has long been considered one of the main reasons, for capital flight and greater use by domestic residents of financial

services offered abroad (see, for example, Collier, Hoeffler, and Pattillo, 2000). Over the last decades, there has been on increasing migration of

securities markets activities to major international financial centers, such as New York and London.

Despite the intense reforms effort, the performance of local stock markets in many developing countries like Nigeria has been disappointing.

Although some markets, this growth was not as significant as the one witnessed by the most advance nations. Other countries experience an

actual determination of their domestic stock markets. Stock markets in many developing countries remain illiquid and segmented, with trading

and capitalization concentrated on few stocks. The large number of policy initiative and the dismal performance of stock market have raised

several questions. Is it possible that stock market do not respond to reforms and that the policy prescriptions were based just on cross-country

evident? Is more time needed to see the full fruits of reforms? Dues the reforms agenda need to be rethought?

With the above stated questions, it shows that there are number of fundamental factors that affect both the development of the local stock market

and the degree of global economy activities. The fact that the processes of local stock market development and global economy activities are

driven by the same factors is not consistent with the argument that explains globalization as a result of a poor domestic environment.

The paper objective is to investigate the impact of the global economy activities has on the development of the Nigeria stock market.

The paper is structured as follows: section II Provides the review of literature, section III presents the method of the study, section IV discusses

the result of the study, lastly the section IV conclude the study.

2.

Literature review

Globalization is an integral part of human history. In its more generic and broader sense, it is the part of the movement of history. All through

the history of man, thy have noticed a force which seems to push for greater integration of human activities. Emphasis today is however, more

focused on the economic aspect of the process. Globalization, therefore, is the process of increased integration of domestic economy with the

rest of the world to create a coherent global economy (Omah, Fadeyo, Adisa, and Osamor, 2013).

The effect of global economy activities on the development of Nigeria stock market development has been frequently analyzed with various

date, measure and methods. Chanda, (2001) uses index of capital account openness to show that more developing countries have suffered from

globalization than other, while Rodrik (1998) as well as Alesina, Vittorio, Milesi-Ferreti, (1994) found no affect of capital account openness.

The stock market operation refers to the arrangement of financial investment, the buying and selling of shares and the procurement of loans and

debentures in the transactional environment. The financial investment could be short, medium or long term in nature and the investments are

basically carried out in the form of shares/stocks/bonds or other forms of investment such as debenture (Omah, et al, 2013).

It is well known that many emerging markets are not fully integrated into world markets (see Bekaert and Campbell, (1995), Henry, (2000)] and

Bekaert, Ehrmann, Fratzscher, and Mehl, (2013). Segmentation is first and foremost caused by regulations that make it difficult for the foreign

investors to buy equity in the particular country.

443

Emerging Stock Markets and Global Economic System: The Nigeria Experience

International Journal of Economy, Management and Social Sciences Vol(4), No (7), July, 2015.

The stock market and more general financial liberalization process that took place at the end of the 80s and throughout the 90s relaxed a lot of

the regulation, creating the emerging market asset class in the process. The globalization process may serve to integrate emerging market with

global capital market, but how is this measured? The focus on globalization is based on two aspects; they are first, economic openness as

measured by the trade liberalization Dummy, taken from Wacziarg and Welch, (2008). They call a country open to trade when it satisfies a

number of criteria regarding tariff and non-tariff barriers. Its a zero-one dummy. Second, financial openness for which the study shows

indicators: the capital account openness index from Quinn and Toyoda (2008), and the equity market openness indicator Bekaert, Harvey and Ng

(2005). The capital account index score the degree capital account openness between 0 and 1 based on IMF data. The equity markets measure

takes the ratio of invest able to total market capitalization.

For global asset managers; globalization has been considered a fundamental issue. It increased country correlation, and changed systematic risk

measure and may therefore undermine standard asset allocation model, however, the integration process is far from complete. The third largest

market in the world (china), for example, is largely closed to foreign investment. More importantly, a relation of restrictions on foreign investor

does not necessarily lead to integrations as other factors may effectively segment the market from global capital market, this shows that there is

still a sharp contrast between emerging and developed market, with emerging markets showing mostly medium to low scores on there indicators

of corporate governance, political stability and corruption (Geert, and Campbell, 2013).

Lot of studies has been carried out to show the effect of global stock market on the development of emerging stock market. In a study based on

stylized facts and econometric method, Uwatt (2004), observed that globalization could potentially benefit the African economy. He concluded

that potential benefits derivable by African countries stock market development depended largely on how fast they could be integrated into the

rest of the world and their preparedness to meet the global financial stock market activities resulting from globalization. Akinboyo,(2003), study

on Nigeria appeared to support the need for preparedness on the part of African countries. This view was supported by Olayinka and Ogundiran

(2004).

Akinlo, (2003) examined the impact of globalization on the stock market and observes that globalization through foreign direct investment has a

significant impact on capital formation and factor productivity. Dollar and Kraay (2004) studied the effects of globalization on poor developing

countries and noted that over half of them that experienced globalization gained large increases in trade and considerable reduction in tariffs.

3.

Method of the study

Model specification

The linkage between merging stock market and global economy development has occupied a central position in the development literate,

Samuel, (1996); Leiun and Zeros, (1996); Onsode, (1998) etc. in investigating this link, the study adopts the neoclassical growth model to

explain this link. The model is retransformed into the general aggregate production function. This approach has get a wide application in

econometric analysis, for example, Akinlo and Odusola, (2000); Levine and Zeros, (1996); and obstfeld, (1994).

The function state that:

g= f(Li Ki T). (I)

Where:

g= growth of GDP

l=Labour

K= Capital formation/ investment

T= Technology

The application of this method, however, has been extended to incorporate, other determinates of economic activities link, for stock market,

market capitalization trade volume, for global economy activity; data from the Bank of New York, which cach the three major stock exchange

in the U.S, NYSE, NASDAQ; and AMEX, and data on volume traded by foreign frims on the London stock exchange (LSE).

In line with the above specification, the model that is adopted by this study is specified thus:

NSE= f(MC, TV).(II)

Where:

NSE= Nigeria stock exchange

MC= market capitalization

TV= trade volume

AND

GEA=f (3 stock market capitalization USA & London

GEA=f(3.SMC, LSE)..(III)

The estimated form of the model is as given below

GEA (3SMC+LSE)= a+ b, mc+l22 TV + U..(IV)

Where:

U= error term

Model estimation techniques

Regression analysis of the ordinary least square is adopted in this study to test the relationship between the Nigeria stock market and the global

economy activities.

Equation (IV) may be estimate using ordinary least square technique (OLS. The equation will also be subjected to a dynamic estimation using

the lagged structure of the variables.

Sources of Data

This study used data concerning the period of 2003 to 2013. These data were sourced mainly from different sense of Nigeria stock exchange fact

books, Nigeria stock exchange annual report and account (various issues), central Bank of Nigeria bulleting, international monetary funds

reports (IMF), and would back repents.

Owolabi Adesegun Oluwasanmi *, Owoola R. Ibukun-Falayi

444

International Journal of Economy, Management and Social Sciences Vol(4), No (7), July, 2015.

4.

Result

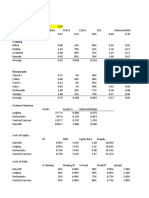

The regression results for ratio of market capitalization indicate that general stock market development is affected by selected variables.

Financial openness also positively affects stock market development. The results for the ratio of Nigeria stock value trade to GDP indicate that

the value stock value trade affect by the same variable that drives stock market development in general.

The result also show that some factors drive Nigeria stock marlet development and global economy market, in the same direction, however, the

estimated coefficient do not reveal whether the domestic stock market development and global economy development are similarly sensitive to

change in fundamentals. The result shows that the domestic stock market is not positively significance as that of the global stock market.

The ratio of the value traded abroad (i.e both 3smc and LSE) to the value traded domestically also increase with the level of economic

development and financial openness. Government deficit has a greater impact on Nigeria domestic value traded, i.e, a greater government deficit

crowds out domestic market trading more than global stock market.

The regression result also show that the more developed the economy, the greater the shave of capital raised abroad. Government deficit is only

statistically significant with a negative coefficient in one specification domestic.

The lack of significance of many of the variables may be explained by the fact that the ratio of capital raised abroad to capital raised

domestically is very volatile from year to year, partly due to the lumping nature of capital raising with individual capital; issues impacting the

ratio significantly. But it could also reflect that the capital raising trends domestically and abroad are not distinctly affected by these economic

fundamentals

5.

Conclusion

The emerging stock market only represents 15% of World equity market capitalization, but more than 30% of the World GDP. This does not

necessarily make emerging markets interesting investment. Since the liberalization process in the late 80s and early 90s, the correlation between

emerging stock markets and global or developed stock markets (like that of New York and London) has increased substantially and valuation

ratios have partially converged.

However, recent research by Bekaert et al (2011) suggests that emerging stock markets are still not fully integrated into the global economy or

stock market; therefore, emerging markets should still be viewed as a separate class.

The paper empirical analysis suggests that the underlying factors affecting the development of a local stock market also increase the

globalization of the market. In particular, the paper show that, while better fundamentals lead to an increase in domestic activity and

globalization, better fundamentals actually also spur an increase in capital raising, listing, and trading in foreign exchanges relative to domestic

activity.

While the study shed light on the domestic stock market development and globalization process, most of the issues on the more general financial

sector development strategy go beyond this analysis. More research is needed, for example, on what constitutes not only the minimum legal, but

also the institutional setup for an active first-stage financing market and possibly secondary market, and whether or not that includes some

formal stock exchange for the trading of public shares.

References

Akinboyo, O.I. (2003). Globalization, Information Technology and the Nigeria Financial System, Employment Generation in Nigeria: Selected papers for the 2006

Annual Conference of the Nigeria Economic Society in Calabar, 22 24, August, 185 208.

Akinlo, E.A. (2003). Globalization, International Investment and Stock Market Growth in Sub-Saharan Africa. International Exchange Division Research

Administration Department, IDE_JETRD, Japan, 10(38), 1 78.

Akinlo, E.A. and Odusola, A.F. (2000). An Alternative Framework for Assessing the impact of Nigerias Naira Depreciation on output and inflation, Final

Research work to be published by African Economic research Consortium, Nairobi, Kenya.

Alesina, A., Vittorio, G., and Milesi-Ferreti, G.M. (1994). The Political Economy of Capital Countries. In: Leonardo Leiderman and Assaf Razin (eds). Capital

Mobility: The Impact on Consumption, Investment and Growth, Cambridge University Press, Cambridge, 287 521.

Bekaert, G. and Campbell, R.H. (1995). Time-Varying World Market Integrated, Journal of Finance, 50, 403 444.

Bekaert, G., Ehrmann, M., Fratzscher, M., and Mehl, A. (2013). Global Contagion and Equity Crises, working paper.

Bekaert, G., Harvey, C.R., and Ng, A. (2005). Market Integration and Contagion, Journal of Business, 78(1), 39 69.

Chanda, A. (2001). The Influence of Capital Controls on Long Run Growth: Where and How much? North Carolina State University, Mimco.

Collier, P., Hoeffler, A., and Pattillo, C. (2000). Flight Capital as Portfolio Choice, World Bank Economic Review, 15, 55 80.

Dollar, D. and Kraay, A. (2004). Trade, Growth, and Poverty, World Bank Discussion Paper, Washington D. C.

Geert, B. and Campbell, R.H. (2013). Emerging Equity Markets in a Globalizing World, 59(1), 1 24.

Henry, B.P. (2000). Stock Market Liberalization, Economic Reform, and Emerging Market Equity Prices, Journal of Finance, 55(2), 529 564.

Levine, R. and Zeros, S. (1996). Stock Market Development and Long-run Economic Growth, The World Bank Review, 10(2).

Obstfeid, M. (1994). Risks Taking, Global Diversification and Growth, American Economic Review, 84(5), 1310 1329.

Olayiwola, K. and Ogundiran, O. (2004). Positioning Nigeria in the knowledge society in a Globalizing Era, Globalization and Nigerias Economic Development:

Proceeding of the one day seminar of the Nigeria Economic Society, Ibadan.

Omah, I., Fadayo, M.O., Adisa, A.J., and Osamor, I.P. (2013). Globalization: Emerging Trend in Nigerian Capital Market Operation, European Scientific Journal,

8(9), 114 -127.

Onosode, G.O. (1998). The Capital Market and Nigerias Economic Development, at a one day seminar organized by Nigerian Economic Society at the Institute

of International Affairs, Lagos, 21st January, 1998.

Quinn, D.P. and Toyoda, A.M. (2008). Does Capital Account Liberalization Lead to Economic Growth? Review of Financial Studies, 21(3), 1403 1449.

Rodrik, D. (1998). Who Needs Capital Account Convertibility? In: Stanley Fischer, et al (eds). Should the IMF Pursue Capital Account Convertibility? Essay in,

International Finance, 207, Department of Economics, Princeton University, Princeton, N.J, 55 65.

Samuel, C. (1996). Stock Market and Investment: The Governance Role of the Market, the World Bank Review, 10(2).

Stijin, C., Daniel, K., and Sergio, L. S. (2004). Stock Market Development and Internalization: Do Economic Fundamentals Spur Both Similarly? Journal of

Empirical Finance, 16(2), 1 3.

Uwatt, B.U. (2004). Globalization and Economic Growth: The African Experience. Globalization and Nigerias Economic Development: Proceeding of the oneday Seminar of the Nigerian Economic Society, Ibadan.

Wacziarg, R. and Welch, K. H. (2008). Trade Liberalization and Growth: New Evidence, World Bank Economic Review, 22(2), 187 231.

You might also like

- Language Free Character Recognition Using Character Sketch and Center of Gravity ShiftingDocument5 pagesLanguage Free Character Recognition Using Character Sketch and Center of Gravity ShiftingTI Journals PublishingNo ratings yet

- Investigating A Benchmark Cloud Media Resource Allocation and OptimizationDocument5 pagesInvestigating A Benchmark Cloud Media Resource Allocation and OptimizationTI Journals PublishingNo ratings yet

- The Impact of Economic Growth and Trade On The Environment: The Canadian CaseDocument11 pagesThe Impact of Economic Growth and Trade On The Environment: The Canadian CaseTI Journals PublishingNo ratings yet

- Economic Impacts of Fertilizers Subsidy Removal in Canola Production in IranDocument5 pagesEconomic Impacts of Fertilizers Subsidy Removal in Canola Production in IranTI Journals PublishingNo ratings yet

- Does Book-to-Market Ratio Matter in Profitability of Momentum Investment Strategy in Tehran Stock Exchange?Document5 pagesDoes Book-to-Market Ratio Matter in Profitability of Momentum Investment Strategy in Tehran Stock Exchange?TI Journals PublishingNo ratings yet

- Assessment of Some Factors Affecting The Mechanical Properties of Potato TubersDocument6 pagesAssessment of Some Factors Affecting The Mechanical Properties of Potato TubersTI Journals PublishingNo ratings yet

- Numerical Optimization of Biogas Absorber Geometry For Highest Methane Purity of The Egyptian BiogasDocument5 pagesNumerical Optimization of Biogas Absorber Geometry For Highest Methane Purity of The Egyptian BiogasTI Journals PublishingNo ratings yet

- The Ideal Type of University in Knowledge Society and Compilating Its Indicators in Comparison To The Traditional UniversityDocument5 pagesThe Ideal Type of University in Knowledge Society and Compilating Its Indicators in Comparison To The Traditional UniversityTI Journals PublishingNo ratings yet

- The Right To Clean and Safe Drinking Water: The Case of Bottled WaterDocument6 pagesThe Right To Clean and Safe Drinking Water: The Case of Bottled WaterTI Journals PublishingNo ratings yet

- Factors Affecting Medication Compliance Behavior Among Hypertension Patients Based On Theory of Planned BehaviorDocument5 pagesFactors Affecting Medication Compliance Behavior Among Hypertension Patients Based On Theory of Planned BehaviorTI Journals PublishingNo ratings yet

- Empirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachDocument12 pagesEmpirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachTI Journals PublishingNo ratings yet

- The Impact of El Nino and La Nina On The United Arab Emirates (UAE) RainfallDocument6 pagesThe Impact of El Nino and La Nina On The United Arab Emirates (UAE) RainfallTI Journals PublishingNo ratings yet

- Dynamic Hysteresis Band Fixed Frequency Current ControlDocument4 pagesDynamic Hysteresis Band Fixed Frequency Current ControlTI Journals PublishingNo ratings yet

- The Simulation of Conditional Least Squares Estimators and Weighted Conditional Least Squares Estimators For The Offspring Mean in A Subcritical Branching Process With ImmigrationDocument7 pagesThe Simulation of Conditional Least Squares Estimators and Weighted Conditional Least Squares Estimators For The Offspring Mean in A Subcritical Branching Process With ImmigrationTI Journals PublishingNo ratings yet

- Simulation of Control System in Environment of Mushroom Growing Rooms Using Fuzzy Logic ControlDocument5 pagesSimulation of Control System in Environment of Mushroom Growing Rooms Using Fuzzy Logic ControlTI Journals PublishingNo ratings yet

- Effects of Priming Treatments On Germination and Seedling Growth of Anise (Pimpinella Anisum L.)Document5 pagesEffects of Priming Treatments On Germination and Seedling Growth of Anise (Pimpinella Anisum L.)TI Journals PublishingNo ratings yet

- Flexural Properties of Finely Granulated Plastic Waste As A Partial Replacement of Fine Aggregate in ConcreteDocument4 pagesFlexural Properties of Finely Granulated Plastic Waste As A Partial Replacement of Fine Aggregate in ConcreteTI Journals PublishingNo ratings yet

- Novel Microwave Assisted Synthesis of Anionic Methyl Ester Sulfonate Based On Renewable SourceDocument5 pagesNovel Microwave Assisted Synthesis of Anionic Methyl Ester Sulfonate Based On Renewable SourceTI Journals PublishingNo ratings yet

- Unstable Economy: Reflections On The Effects and Consequences in The Event of Deflation (The Case of Italy)Document12 pagesUnstable Economy: Reflections On The Effects and Consequences in The Event of Deflation (The Case of Italy)TI Journals PublishingNo ratings yet

- Prediction of Output Energy Based On Different Energy Inputs On Broiler Production Using Application of Adaptive Neural-Fuzzy Inference SystemDocument8 pagesPrediction of Output Energy Based On Different Energy Inputs On Broiler Production Using Application of Adaptive Neural-Fuzzy Inference SystemTI Journals PublishingNo ratings yet

- A Review of The Effects of Syrian Refugees Crisis On LebanonDocument11 pagesA Review of The Effects of Syrian Refugees Crisis On LebanonTI Journals Publishing100% (1)

- Evaluation of Efficiency of A Setup Designed For Analysis of Radon Using Electronic Radon DetectorDocument7 pagesEvaluation of Efficiency of A Setup Designed For Analysis of Radon Using Electronic Radon DetectorTI Journals PublishingNo ratings yet

- Relationship Between Couples Communication Patterns and Marital SatisfactionDocument4 pagesRelationship Between Couples Communication Patterns and Marital SatisfactionTI Journals PublishingNo ratings yet

- Documentation of Rice Production Process in Semi-Traditional and Semi-Mechanized Systems in Dargaz, IranDocument5 pagesDocumentation of Rice Production Process in Semi-Traditional and Semi-Mechanized Systems in Dargaz, IranTI Journals PublishingNo ratings yet

- How Does Cooperative Principle (CP) Shape The News? Observance of Gricean Maxims in News Production ProcessDocument6 pagesHow Does Cooperative Principle (CP) Shape The News? Observance of Gricean Maxims in News Production ProcessTI Journals Publishing100% (1)

- The Investigation of Vegetation Cover Changes Around of Hoze-Soltan Lake Using Remote SensingDocument3 pagesThe Investigation of Vegetation Cover Changes Around of Hoze-Soltan Lake Using Remote SensingTI Journals PublishingNo ratings yet

- Allelopathic Effects of Aqueous Extracts of Bermuda Grass (Cynodon Dactylon L.) On Germination Characteristics and Seedling Growth of Corn (Zea Maize L.)Document3 pagesAllelopathic Effects of Aqueous Extracts of Bermuda Grass (Cynodon Dactylon L.) On Germination Characteristics and Seedling Growth of Corn (Zea Maize L.)TI Journals PublishingNo ratings yet

- Comparison of Addicted and Non-Addicted University Students in Loneliness and Mental HealthDocument3 pagesComparison of Addicted and Non-Addicted University Students in Loneliness and Mental HealthTI Journals PublishingNo ratings yet

- The Changes of College Students Value Orientation For Womens Social AdvancementDocument5 pagesThe Changes of College Students Value Orientation For Womens Social AdvancementTI Journals PublishingNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Comparative and Common Size Financial StatementsDocument24 pagesComparative and Common Size Financial StatementsTanish Bohra100% (1)

- International Financial MarketsDocument42 pagesInternational Financial MarketsVamsi Kumar0% (1)

- Post Graduate Diploma in International Business Operations / Master of CommerceDocument4 pagesPost Graduate Diploma in International Business Operations / Master of CommerceKunal SharmaNo ratings yet

- Leveraged Buyout (LBO) : The LBO Analysis - Main StepsDocument9 pagesLeveraged Buyout (LBO) : The LBO Analysis - Main StepsaminafridiNo ratings yet

- 02 - Investor Acc MethodDocument31 pages02 - Investor Acc MethodLukas PrawiraNo ratings yet

- Projects Solutions PfaDocument89 pagesProjects Solutions PfaNaresh KumarNo ratings yet

- DSP Mutual Fund OverviewDocument5 pagesDSP Mutual Fund OverviewSarika AroteNo ratings yet

- SYNOPSIS of CURRENCY Derivatives Kumud Ranjan Mishra From Lingayas UniversityDocument17 pagesSYNOPSIS of CURRENCY Derivatives Kumud Ranjan Mishra From Lingayas UniversityKumud RanjanNo ratings yet

- Working Capital Management of L&TDocument18 pagesWorking Capital Management of L&TDeepak Jaiswal0% (1)

- Discount and Finance House of IndiaDocument25 pagesDiscount and Finance House of Indiavikram_bansal_5No ratings yet

- NR7 Forex Trading Strategy: What Is The NR7 Pattern?Document5 pagesNR7 Forex Trading Strategy: What Is The NR7 Pattern?Nikos KarpathakisNo ratings yet

- AIA Fixed Rate Home Loan BriefDocument1 pageAIA Fixed Rate Home Loan BriefPervindran RaoNo ratings yet

- Report - Divis LabDocument7 pagesReport - Divis LabAnonymous y3hYf50mTNo ratings yet

- Unit I VDocument231 pagesUnit I Vsimran bansalNo ratings yet

- Marriott Cost of CapitalDocument3 pagesMarriott Cost of Capitalanmolsaini01No ratings yet

- Script - How To Survive RecessionDocument5 pagesScript - How To Survive RecessionMayumi AmponNo ratings yet

- Interco Case Solution: The Value of The Equity of The Firm (FTE Approach) by Utilizing The 12% Cost of EquityDocument2 pagesInterco Case Solution: The Value of The Equity of The Firm (FTE Approach) by Utilizing The 12% Cost of EquityMai Anh ThuNo ratings yet

- Week 3 BUS 650 Assignment Finance Goff ComputerDocument12 pagesWeek 3 BUS 650 Assignment Finance Goff Computermenafraid100% (4)

- Practical Exercise 1-Banking Documents and FormsDocument8 pagesPractical Exercise 1-Banking Documents and FormsSakthirama VadiveluNo ratings yet

- AA2 Chapter 11 SolDocument16 pagesAA2 Chapter 11 SolJoan RomeroNo ratings yet

- Market Volume StopDocument14 pagesMarket Volume Stopvanthai06996No ratings yet

- D Mart AnalysisDocument2 pagesD Mart Analysisanon_493704527No ratings yet

- PUNB's Facilities for Bumiputera EntrepreneursDocument12 pagesPUNB's Facilities for Bumiputera EntrepreneursEdgy EdgyNo ratings yet

- Multiple Choice Questions: Topic Covered Are As FollowsDocument3 pagesMultiple Choice Questions: Topic Covered Are As FollowsBikash SahuNo ratings yet

- Security Valuation: Learning OutcomesDocument38 pagesSecurity Valuation: Learning OutcomesMadhuratha MuraliNo ratings yet

- Why Organisations Hold CashDocument13 pagesWhy Organisations Hold CashAjay Kumar TakiarNo ratings yet

- Stats 242: Algorithmic Trading and Quantitative Strategies Summer 2011Document9 pagesStats 242: Algorithmic Trading and Quantitative Strategies Summer 2011Veeken ChaglassianNo ratings yet

- Chingu WorksheetDocument74 pagesChingu Worksheetanis khanNo ratings yet

- Indian Money MarketDocument20 pagesIndian Money Marketsubha_bkpNo ratings yet

- Accounting exam covers financial reportingDocument6 pagesAccounting exam covers financial reportingMarriz Bustaliño TanNo ratings yet