Professional Documents

Culture Documents

Remedies - Tax Administration

Uploaded by

Jade ViguillaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Remedies - Tax Administration

Uploaded by

Jade ViguillaCopyright:

Available Formats

Taxation Law Case Digests

Atty. Michael Montero

REMEDIES

1.

Tax Administration

Sections 2-3, 9-20, 244-246, and 290, Tax Code

SEC. 2. Powers and duties of the Bureau of Internal Revenue. - The Bureau of

Internal Revenue shall be under the supervision and control of the Department of

Finance and its powers and duties shall comprehend the assessment and

collection of all national internal revenue taxes, fees, and charges, and the

enforcement of all forfeitures, penalties, and fines connected therewith, including

the execution of judgments in all cases decided in its favor by the Court of Tax

Appeals and the ordinary courts. The Bureau shall give effect to and administer the

supervisory and police powers conferred to it by this Code or other laws.

SEC. 3. Chief Officials of the Bureau of Internal Revenue. - The Bureau of

Internal Revenue shall have a chief to be known as Commissioner of Internal

Revenue, hereinafter referred to as the Commissioner and four (4) assistant chiefs

to be known as Deputy Commissioners.

SEC. 9. - Internal Revenue Districts. - With the approval of the Secretary of

Finance, the Commissioner shall divide the Philippines into such number of

revenue districts as may form time to time be required for administrative purposes.

Each of these districts shall be under the supervision of a Revenue District Officer.

SEC. 10. - Revenue Regional Director. - Under rules and regulations, policies

and standards formulated by the Commissioner, with the approval of the Secretary

of Finance, the Revenue Regional director shall, within the region and district

offices under his jurisdiction, among others:

(a) Implement laws, policies, plans, programs, rules and regulations of the

department or agencies in the regional area;

(b) Administer and enforce internal revenue laws, and rules and regulations,

including the assessment and collection of all internal revenue taxes, charges and

fees.

(c) Issue Letters of authority for the examination of taxpayers within the region;

(d) Provide economical, efficient and effective service to the people in the area;

(e) Coordinate with regional offices or other departments, bureaus and agencies in

the area;

(f) Coordinate with local government units in the area;

(g) Exercise control and supervision over the officers and employees within the

region; and

(h) Perform such other functions as may be provided by law and as may be

delegated by the Commissioner.

SEC. 11. Duties of Revenue District Officers and Other Internal Revenue

Officers. - It shall be the duty of every Revenue District Officer or other internal

revenue officers and employees to ensure that all laws, and rules and regulations

affecting national internal revenue are faithfully executed and complied with, and to

aid in the prevention, detection and punishment of frauds of delinquencies in

connection therewith.

It shall be the duty of every Revenue District Officer to examine the efficiency of all

officers and employees of the Bureau of Internal Revenue under his supervision,

and to report in writing to the Commissioner, through the Regional Director, any

neglect of duty, incompetency, delinquency, or malfeasance in office of any internal

revenue officer of which he may obtain knowledge, with a statement of all the facts

and any evidence sustaining each case.

SEC. 12. Agents and Deputies for Collection of National Internal Revenue

Taxes. - The following are hereby constituted agents of the Commissioner:

(a) The Commissioner of Customs and his subordinates with respect to the

collection of national internal revenue taxes on imported goods;

(b) The head of the appropriate government office and his subordinates with

respect to the collection of energy tax; and

(c) Banks duly accredited by the Commissioner with respect to receipt of payments

internal revenue taxes authorized to be made thru bank.

Any officer or employee of an authorized agent bank assigned to receive internal

revenue tax payments and transmit tax returns or documents to the Bureau of

Internal Revenue shall be subject to the same sanctions and penalties prescribed

in Sections 269 and 270 of this Code.

SEC. 13. - Authority of a Revenue Offices. - subject to the rules and regulations

to be prescribed by the Secretary of Finance, upon recommendation of the

Commissioner, a Revenue Officer assigned to perform assessment functions in

any district may, pursuant to a Letter of Authority issued by the Revenue Regional

Director, examine taxpayers within the jurisdiction of the district in order to collect

the correct amount of tax, or to recommend the assessment of any deficiency tax

due in the same manner that the said acts could have been performed by the

Revenue Regional Director himself.

SEC. 14. Authority of Officers to Administer Oaths and Take Testimony. - The

Commissioner, Deputy Commissioners, Service Chiefs, Assistant Service Chiefs,

Revenue Regional Directors, Assistant Revenue Regional Directors, Chiefs and

Assistant Chiefs of Divisions, Revenue District Officers, special deputies of the

Commissioner, internal revenue officers and any other employee of the Bureau

thereunto especially deputized by the Commissioner shall have the power to

administer oaths and to take testimony in any official matter or investigation

conducted by them regarding matters within the jurisdiction of the Bureau.

SEC. 15. Authority of Internal Revenue Officers to Make Arrests and Seizures.

- The Commissioner, the Deputy Commissioners, the Revenue Regional Directors,

the Revenue District Officers and other internal revenue officers shall have

authority to make arrests and seizures for the violation of any penal law, rule or

regulation administered by the Bureau of Internal Revenue. Any person so arrested

shall be forthwith brought before a court, there to be dealt with according to law.

SEC. 16. Assignment of Internal Revenue Officers Involved in Excise Tax

Functions to Establishments Where Articles subject to Excise Tax are

Produced or Kept. - The Commissioner shall employ, assign, or reassign internal

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

revenue officers involved in excise tax functions, as often as the exigencies of the

revenue service may require, to establishments or places where articles subject to

excise tax are produced or kept: Provided, That an internal revenue officer

assigned to any such establishment shall in no case stay in his assignment for

more than two (2) years, subject to rules and regulations to be prescribed by the

Secretary of Finance, upon recommendation of the Commissioner.

SEC. 17. Assignment of Internal Revenue Officers and Other Employees to

Other Duties. - The Commissioner may, subject to the provisions of Section 16

and the laws on civil service, as well as the rules and regulations to be prescribed

by the Secretary of Finance upon the recommendation of the Commissioner,

assign or reassign internal revenue officers and employees of the Bureau of

Internal Revenue, without change in their official rank and salary, to other or special

duties connected with the enforcement or administration of the revenue laws as the

exigencies of the service may require: Provided, That internal revenue officers

assigned to perform assessment or collection function shall not remain in the same

assignment for more than three (3) years; Provided, further, That assignment of

internal revenue officers and employees of the Bureau to special duties shall not

exceed one (1) year.

SEC. 18. Reports of violation of Laws. - When an internal revenue officer

discovers evidence of a violation of this Code or of any law, rule or regulations

administered by the Bureau of Internal Revenue of such character as to warrant

the institution of criminal proceedings, he shall immediately report the facts to the

Commissioner through his immediate superior, giving the name and address of the

offender and the names of the witnesses if possible: Provided, That in urgent

cases, the Revenue Regional director or Revenue District Officer, as the case may

be, may send the report to the corresponding prosecuting officer in the latter case,

a copy of his report shall be sent to the Commissioner.

SEC. 19. Contents of Commissioner's Annual Report. - The annual Report of

the Commissioner shall contain detailed statements of the collections of the Bureau

with specifications of the sources of revenue by type of tax, by manner of payment,

by revenue region and by industry group and its disbursements by classes of

expenditures.

In case the actual collection exceeds or falls short of target as set in the annual

national budget by fifteen percent (15%) or more, the Commissioner shall explain

the reason for such excess or shortfall.

SEC. 20. Submission of Report and Pertinent Information by the

Commissioner.

(A) Submission of Pertinent Information to Congress. - The provision of Section

270 of this Code to the contrary notwithstanding, the Commissioner shall, upon

request of Congress and in aid of legislation, furnish its appropriate Committee

pertinent information including but not limited to: industry audits, collection

performance data, status reports in criminal actions initiated against persons and

taxpayer's returns: Provided, however, That any return or return information which

can be associated with, or otherwise identify, directly or indirectly, a particular

taxpayer shall be furnished the appropriate Committee of Congress only when

Atty. Michael Montero

sitting in Executive Session Unless such taxpayer otherwise consents in writing to

such disclosure.

(B) Report to Oversight Committee. - The Commissioner shall, with reference to

Section 204 of this Code, submit to the Oversight Committee referred to in Section

290 hereof, through the Chairmen of the Committee on Ways and Means of the

Senate and House of Representatives, a report on the exercise of his powers

pursuant to the said section, every six (6) months of each calendar year.

SEC. 244. Authority of Secretary of Finance to Promulgate Rules and

Regulations. - The Secretary of Finance, upon recommendation of the

Commissioner, shall promulgate all needful rules and regulations for the effective

enforcement of the provisions of this Code.

SEC. 245. Specific Provisions to be Contained in Rules and Regulations. The rules and regulations of the Bureau of Internal Revenue shall, among other

thins, contain provisions specifying, prescribing or defining:

(a) The time and manner in which Revenue Regional Director shall canvass their

respective Revenue Regions for the purpose of discovering persons and

property liable to national internal revenue taxes, and the manner in which

their lists and records of taxable persons and taxable objects shall be

made and kept; (b) The forms of labels, brands or marks to be required on

goods subject to an excise tax, and the manner in which the labelling,

branding or marking shall be effected; (c) The conditions under which and

the manner in which goods intended for export, which if not exported

would be subject to an excise tax, shall be labelled, branded or marked;

(d) The conditions to be observed by revenue officers respecting the

institutions and conduct of legal actions and proceedings; (e) The

conditions under which goods intended for storage in bonded warehouses

shall be conveyed thither, their manner of storage and the method of

keeping the entries and records in connection therewith, also the books to

be kept by Revenue Inspectors and the reports to be made by them in

connection with their supervision of such houses; (f) The conditions under

which denatured alcohol may be removed and dealt in, the character and

quantity of the denaturing material to be used, the manner in which the

process of denaturing shall be effected, so as to render the alcohol

suitably denatured and unfit for oral intake, the bonds to be given, the

books and records to be kept, the entries to be made therein, the reports

to be made to the Commissioner, and the signs to be displayed in the

business ort by the person for whom such denaturing is done or by whom,

such alcohol is dealt in; (g) The manner in which revenue shall be

collected and paid, the instrument, document or object to which revenue

stamps shall be affixed, the mode of cancellation of the same, the manner

in which the proper books, records, invoices and other papers shall be

kept and entries therein made by the person subject to the tax, as well as

the manner in which licenses and stamps shall be gathered up and

returned after serving their purposes; (h) The conditions to be observed

by revenue officers respecting the enforcement of Title III imposing a tax

on estate of a decedent, and other transfers mortis causa, as well as on

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

gifts and such other rules and regulations which the Commissioner may

consider suitable for the enforcement of the said Title III; (i) The manner

in which tax returns, information and reports shall be prepared and

reported and the tax collected and paid, as well as the conditions under

which evidence of payment shall be furnished the taxpayer, and the

preparation and publication of tax statistics; (j) The manner in which

internal revenue taxes, such as income tax, including withholding tax,

estate and donor's taxes, value-added tax, other percentage taxes, excise

taxes and documentary stamp taxes shall be paid through the collection

officers of the Bureau of Internal Revenue or through duly authorized

agent banks which are hereby deputized to receive payments of such

taxes and the returns, papers and statements that may be filed by the

taxpayers in connection with the payment of the tax: Provided, however,

That notwithstanding the other provisions of this Code prescribing the

place of filing of returns and payment of taxes, the Commissioner may, by

rules and regulations, require that the tax returns, papers and statements

that may be filed by the taxpayers in connection with the payment of the

tax. Provided, however, That notwithstanding the other provisions of this

Code prescribing the place of filing of returns and payment of taxes, the

Commissioner may, by rules and regulations require that the tax returns,

papers and statements and taxes of large taxpayers be filed and paid,

respectively, through collection officers or through duly authorized agent

banks: Provided, further, That the Commissioner can exercise this power

within six (6) years from the approval of Republic Act No. 7646 or the

completion of its comprehensive computerization program, whichever

comes earlier: Provided, finally, That separate venues for the Luzon,

Visayas and Mindanao areas may be designated for the filing of tax

returns and payment of taxes by said large taxpayers.

For the purpose of this Section, 'large taxpayer' means a taxpayer who satisfies

any of the following criteria;

(1) Value-Added Tax (VAT) - Business establishment with VAT paid or payable of

at least One hundred thousand pesos (P100,000) for any quarter of the preceding

taxable year;

(2) Excise tax - Business establishment with excise tax paid or payable of at least

One million pesos (P1,000,000) for the preceding taxable year;

(3) Corporate Income Tax - Business establishment with annual income tax paid

or payable of at least One million pesos (P1,000,000) for the preceding taxable

year; and

(4) Withholding tax - Business establishment with withholding tax payment or

remittance of at least One million pesos (P1,000,000) for the preceding taxable

year.

Provided, however, That the Secretary of Finance, upon recommendation of the

Commissioner, may modify or add to the above criteria for determining a large

taxpayer after considering such factors as inflation, volume of business, wage and

employment levels, and similar economic factors.

The penalties prescribed under Section 248 of this Code shall be imposed on any

violation of the rules and regulations issued by the Secretary of Finance, upon

recommendation of the Commissioner, prescribing the place of filing of returns and

payments of taxes by large taxpayers.

Atty. Michael Montero

SEC. 246. Non- Retroactivity of Rulings. - Any revocation, modification or

reversal of any of the rules and regulations promulgated in accordance with the

preceding Sections or any of the rulings or circulars promulgated by the

Commissioner shall not be given retroactive application if the revocation,

modification or reversal will be prejudicial to the taxpayers, except in the following

cases:

(a) Where the taxpayer deliberately misstates or omits material facts from his

return or any document required of him by the Bureau of Internal

Revenue; (b) Where the facts subsequently gathered by the Bureau of

Internal Revenue are materially different from the facts on which the ruling

is based; or (c) Where the taxpayer acted in bad faith.

SEC. 290. Congressional Oversight Committee. A Congressional Oversight Committee, hereinafter referred to as the Committee, is

hereby constituted in accordance with the provisions of this Code. The Committee

shall be composed of the Chairmen of the Committee on Ways and Means of the

Senate and House Representatives and four (4) additional members from each

house, to be designated by the Speaker of the House of Representatives and the

Senate President, respectively.

The Committee shall, among others, in aid of legislation:

(1) Monitor and ensure the proper implementation of Republic Act No. 8240; (2)

Determine that the power of the Commissioner to compromise and abate

is reasonably exercised; (3) Review the collection performance of the

Bureau of Internal Revenue; and (4) Review the implementation of the

programs of the Bureau of Internal Revenue.

In furtherance of the hereinabove cited objectives, the Committee is empowered to

require of the Bureau of Internal Revenue, submission of all pertinent information,

including but not limited to: industry audits; collection performance data; status

report on criminal actions initiated against persons; and submission of taxpayer

returns: Provided, however, That any return or return information which can be

associated with, or otherwise identify, directly or indirectly, a particular taxpayer

shall be furnished the Committee only when sitting in Executive Session unless

such taxpayer otherwise consents in writing to such disclosure.

DOF Order No. 007-02 (May 7, 2002)

Providing for the Implementing Rules of the First Paragraph of Section 4 of the

1997 NIRC, repealing for this purpose DO No. 005-99 amd Revenue Admin Order

No. 1-99

SUMMARY (This is all you need to know right here!): A ruling by the CIR shall be

presumed valid until overturned or modified by the Finance Secretary. The decision

of the CIR may be reviewed by the Finance Sec in 2 ways!

1. Through a REQUEST FOR REVIEW submitted by the taxpayer within 30

days from the receipt of such ruling, accompanied with a duplicate copy of

the BIR records, authenticated and certified by the BIR. The Request for

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

Review must conform to certain requisites (see Section 3) and failure to

follow the requisites may lead to the dismissal of the Finance Sec to

dismiss the requisite with prejudish.

2. Through a MOTU PROPRIO REVIEW by the Finance Sec, in which case,

he shall order the BIR to transmit the records within 15 days.

Finance Sec may affirm, reverse or modify the CIR ruling. In case of affirmation,

Finance Sec may rely wholly on the reasons of CIR. In case of reversal or

modification, the CIR ruling shall be deemed ineffective as of the date of receipt of

written notice of such reversal or modification (a) by the taxpayer; or (b) by the BIR,

WHICHEVER IS EARLIER.

Certification fees only apply to REQUESTS FOR REVIEW, not to motu proprio

review by the Finance Sec.

Facts: joke lang, walang facts

WHEREAS, Section 4 of the National Internal Revenue Code of 1997 vests with

the Commissioner of Internal Revenue exclusive and original jurisdiction to

interpret its provisions and other tax laws, subject to review by the Secretary of

Finance;

WHEREAS, DO 005-99, dated January 26, 1999 and Revenue Administrative

Order No. 1-99, dated February 5, 1999, implements the power of the Secretary of

Finance to review rulings of the Commissioner of Internal Revenue;

WHEREAS, there is need to further provide for the implementing rules of the first

paragraph of Section 4 of the NIRC.

NOW THEREFORE, I, JOSE ISIDRO N. CAMACHO, Secretary of Finance, by

virtue of the powers of supervision and control over the BIR granted to me by

Section 2 of the NIRC and Book IV, Title II, Chapter 4, Section 18 of the

Administrative Code of 1987, do hereby order:

SECTION 1. Scope of This Order. This Department Order shall apply to all

rulings of the BIR that implement the provisions of the NIRC and other tax laws.

SECTION 2. Validity of Rulings. A ruling by the CIR shall be presumed valid until

overturned or modified by the Secretary of Finance.

SECTION 3. Rulings Adverse to the Taxpayer. A taxpayer who receives an

adverse ruling from the CIR may, within 30 days from the date of receipt of such

ruling, seek its review by the Secretary of Finance. The request for review shall be

in writing and under oath, and must:

Atty. Michael Montero

a)

be addressed to the Secretary of Finance and be filed with the Legal

Office, Department of Finance, DOF Building, BSP Complex, Roxas

Boulevard corner Pablo Ocampo St., City of Manila;

b) contain the heading "Request for review of BIR Ruling No.______

c) allege and show that the request was filed within the reglementary period;

d) indicate the Tax Identification Number of the taxpayer;

e) allege the material facts upon which the ruling was requested;

f) state that exactly the same facts were presented to the BIR;

g) g) define the issues sought to be resolved; TCADEc

h) contain the facts and the law relied upon to dispute the ruling of the

Commissioner;

i) be signed by or on behalf of the taxpayer filing the appeal; provided that,

only lawyers engaged by the taxpayer and/or tax agents accredited by the

BIR may sign on behalf of the taxpayer;

j) be accompanied by a copy of the Commissioner's challenged ruling; and

k) contain a stamp of the Office of the Commissioner of Internal Revenue,

indicating that a copy of the request to review the ruling was received by

the Commissioner; and

l) specifically state that the taxpayer does not have a pending assessment

or case in an court of justice where the same issues are being considered.

Furthermore, the taxpayer must, at the time of filing of the request for review,

submit a duplicate copy of the records on file with the BIR pertaining to his request,

which set of records must be authenticated and certified by the BIR.

The Secretary of Finance may dismiss with prejudice a request for review that

fails to comply with these requirements.

SECTION 4. Motu proprio review by the Secretary of Finance. The Secretary of

Finance may, of his own accord, review a ruling issued by the CIR. In such a case,

the Secretary of Finance shall order the CIR to transmit a duplicate copy of the BIR

records. The CIR shall transmit such records within 15 days from receipt of notice

of the request for transmittal.

SECTION 5. Affirmation, reversal or modification by the Secretary of Finance.

The Secretary of Finance may affirm, reverse or modify a ruling of the

Commissioner of Internal Revenue. In the case of an affirmation, the Secretary of

Finance may rely wholly on the reasons stated in the ruling of the Commissioner of

Internal Revenue.

Subject to Section 246 of the Republic Act No. 8424, a reversal or

modification of the ruling shall terminate its effectivity upon the earlier date of the

receipt of written notice of such reversal or modification by the taxpayer or by the

BIR.

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

Atty. Michael Montero

SECTION 6. Certification Fee to be Imposed by the BIR. Except for review of

rulings under Section 4 the BIR may impose appropriate certification fees to carry

out the provisions of this Order.

Section 3. Repealing Clause. All existing rules and regulations or parts thereof

which are inconsistent with the provisions of these Regulations are hereby

amended, repealed or revoked accordingly.

SECTION 7. Repealing Clause. .Department Order No. 005-99 and Revenue

Administrative Order No. 1-99, as well as all other existing Department Orders and

issuances of the Commissioner of Internal Revenue that are inconsistent with this

Order are hereby repealed.

Section 4. Effectivity Clause. These Regulations shall take effect immediately.

SECTION 8. Effectivity. This Department Order shall take effect immediately.

Done in the City of Manila this 7th of May 2002.

(SGD.) JOSE ISIDRO N. CAMACHO

Secretary of Finance

Revenue Regulations 5-2012 (April 2, 2012)

Subject: Binding effect of rulings issued prior to Tax Reform Act of 1997

Date: April 2, 2012

Sec. of Finance: Cesar Purisima

CIR: Kim Jacinto-Henares

Summary: This RR establishes the policy on the binding effect of rulings issued

prior to the effectivity of the Tax Reform Act of 1997. All ruling issued prior to Jan.

1, 1998 shall no longer have any binding effect. Consequently, these rulings cannot

be invoked as basis for any current transaction/s. Neither can these ruling be used

as basis for securing legal tax opinions/rulings.

Section 1. Background - Republic Act No. 8424, or The Tax Reform Act of 1997

(hereinafter referred to as the Tax Code of 1997), which was approved on

December 11, 1997 has put in place the last phase of the comprehensive reform

package on tax laws which took effect on January 1, 1998. Pursuant to Section

244, in relation to Section 4 of the Tax Code of 1997, these Regulations are being

promulgated to establish the policy on the binding effect of rulings issued prior to

the effectivity of the Tax Code of 1997 on January 1, 1998.

Section 2. Coverage. All rulings issued prior to January 1, 1998 will no longer

have any binding effect. Consequently, these rulings cannot be invoked as basis

for any current business transaction/s. Neither can these rulings be used as basis

for securing legal tax opinions/rulings.

Revenue Regulations 14-2008 (November 26, 2008)

Summary: increased the coverage of withholding tax agents who are required to

withhold 1% from regular suppliers of goods and 2% from regular supplier of

services from the top 10,000 private corporations to the top 20,000 private

corporations.

Income payments made by the top 20,000 to local/resident suppliers and nonresident aliens engaged in trade or business in the Philippines, shall be withheld a

creditable income tax as follows:

Supplier of goods= 1%

Supplier of services= 2%

SECTION 1. Scope. Pursuant to the provisions of Section 244 of the Tax Code

of 1997, as amended, in relation to Section 57 (B) thereof, these Regulations are

hereby promulgated to further amend Section 2.57.2 (M) of Revenue Regulations

No. 2-98, as amended, increasing the coverage of withholding tax agents who are

required to withhold 1% from the regular suppliers of goods and 2% from the

regular suppliers of services from the top ten thousand (10,000) private

corporations to top twenty (20,000) private corporations.

SECTION 2. Amendment. Section 2.57.2 (M) of Revenue Regulations 2-98, as

amended, is hereby further amended to read as follows:

"Sec. 2.57.

Withholding of Tax at Source.

"Sec. 2.57.2.

Income payment subject to creditable withholding tax

and rates prescribed thereon. Except as herein otherwise provided, there shall

be withheld a creditable income tax at the rates herein specified for each class of

payee from the following items of income payments to persons residing in the

Philippines.

"xxx

xxx

xxx

"(M) Income payments made by the top twenty thousand (20,000) private

corporations to their local/resident supplier of goods and local/resident supplier of

services other than those covered by other rates of withholding tax. Income

payments made by any of the top twenty thousand (20,000) private corporations,

as determined by the Commissioner, to their local/resident supplier of goods and

local/resident supplier of services, including non-resident alien engaged in trade or

business in the Philippines

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

Supplier of goods One percent (1%)

Supplier of services Two percent (2%)

"Top twenty thousand (20,000) private corporations shall include a

corporate taxpayer who has been determined and notified by the Bureau of Internal

Revenue (BIR) as having satisfied any of the following criteria:

(a) Classified and duly notified by the Commissioner as a large taxpayer

under Revenue Regulations No. 1-98, as amended, or belonging to the

top five thousand (5,000) private corporations under RR 12-94, or to the

top ten thousand (10,000) private corporations under RR 17-2003, unless

previously de-classified as such or had already ceased business

operations (automatic inclusion);

(b) Any taxpayer with net VAT paid or payable for the preceding year of at

least P100,000;

(c) Any taxpayer with annual income tax paid or payable for the preceding

year of at least P200,000;

(d) Any taxpayer with percentage taxes for the preceding year of at least

P100,000;

(e) Any taxpayer whose gross sales for the preceding year is over

P10,000,000;

(f)Any taxpayer whose gross purchases for the preceding year is over

P5,000,000.

"The term "goods" pertains to tangible personal property. It does not

include intangible personal property, as well as real property.

"The term "local/resident suppliers of goods" pertains to a supplier from

whom any of the top twenty thousand (20,000) private corporations, as determined

by the Commissioner, regularly makes its purchases of goods. As a general rule,

this term does not include a casual purchase of goods, that is, purchase made from

a non-regular supplier and oftentimes involving a single purchase. However, a

single purchase which involves Ten thousand pesos (P10,000.00) or more shall be

subject to a withholding tax. The term "regular suppliers" refers to suppliers who

are engaged in business or exercise of profession/calling with whom the taxpayerbuyer has transacted at least six (6) transactions, regardless of amount per

transaction, either in the previous year or current year. The same rules apply to

local/resident supplier of services other than those covered by separate rates of

withholding tax. ECTAHc

"A corporation shall not be considered a withholding agent for purposes of

this Section, unless such corporation has been determined and duly notified in

writing by the Commissioner that it has been selected as one of the top twenty

thousand (20,000) private corporations.

"Any corporation which has been duly classified and notified as large

taxpayer by the Commissioner pursuant to RR 1-98, as amended, shall be

Atty. Michael Montero

automatically considered one of the top twenty thousand (20,000) private

corporations, provided, however, that its authority as a withholding agent shall be

effective only upon receipt of written notice from the Commissioner that it has been

classified as a large taxpayer, as well as one of the top twenty thousand (20,000)

private corporations, for purposes of these regulations.

"Any corporation shall remain a withholding agent for purposes of these

regulations, unless the Commissioner notifies it in writing that it shall cease to be

one. The following, however, are some of the reasons that a taxpayer shall

automatically cease to be a withholding agent, and therefore no prior written notice,

for purposes of these regulations, is required, to wit:

(a) closure/cessation of business/dissolution (for taxpayer with notice of

dissolution given to the BIR);

(b) merger/consolidation (for dissolved or absorbed corporation);

(c) any other form of business combination wherein by operation of law a

corporate taxpayer loses its juridical personality.

"The withholding agent shall submit on a semestral basis a list of its

regular suppliers of goods and/or services to the Large Taxpayers Assistance

Division/Large Taxpayers District Office in the case of large taxpayers duly notified

as such pursuant to RR 1-98, as amended, or Revenue District Office (RDO)

having jurisdiction over the withholding agent's principal place of business on or

before July 31 and January 31 of each year.

"A government-owned or -controlled corporation previously classified as

one of the top five thousand (5,000) corporations under RR 12-94, as amended,

shall cease to be a withholding agent or included in the top twenty thousand

(20,000) private corporations for purposes of these regulations but rather shall be

treated as one under the succeeding sub-section (N) since it is already withholding

1% or 2% of the amount paid for the purchase of goods/services from local/resident

suppliers.

"The Commissioner of Internal Revenue may recommend to the Secretary

of Finance the amendment/modification to any or all of the criteria in the

determination and selection of taxpayers forming part of the top twenty thousand

(20,000) private corporations after considering such factors as inflation, volume of

business, and similar factors. Provided, however, that the Commissioner is

empowered to conduct periodic review as to the number of taxpayers who ceased

to qualify under the category of top twenty thousand (20,000) private corporations

for purposes of delisting them or excluding them from the list and to identify

taxpayers to be added to the list of top twenty (20,000) private corporations.

"All taxpayers previously included in the list of top 5,000 private

corporations under RR 12-94, as amended, and those who qualified as top ten

thousand (10,000) private corporations under RR 17-2003 shall continue to

withhold one percent (1%) for supplier of goods and 2% for supplier of services

upon the effectivity of these Regulations, unless any of the following situations

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

occur: (a) the Commissioner communicates in writing that they have ceased to

qualify as taxpayers includible in the list of top twenty thousand (20,000) private

corporations, or (b) those officially identified to have ceased business operations,

or undergone any of the business combinations wherein by operation of law the

juridical personality of said taxpayers ceased."

SECTION 3. Repealing Clause. All existing rules and regulations or parts

thereof which are inconsistent with the provisions of these regulations are hereby

modified, amended, revoked or repealed accordingly.

SECTION 4. Effectivity. These regulations shall take effect fifteen (15) days

following publication in a newspaper of general circulation.

Revenue Regulations 16-2002 (October 11, 2002)

SUMMARY

All internal revenue taxes collected through AABs shall be credited to the

demand deposit accounts opened and maintained by the Bureau of Treasury

(BTr) for BIR in the head offices of AABs.

In filing a tax declaration and making payment to an AAB, the taxpayer must

accomplish and submit a BIR-prescribed deposit slip, which the bank teller

shall machine validate as evidence that the BIR tax payment has been

received and deposited to the account of the BTr.

Aside from the electronic payment system currently being used by some

taxpayers in paying their internal revenue taxes, the rest shall pay their tax

liabilities through any of the following modes:

1) over-the-counter cash payments (for each tax payment not exceeding P

10,000.00); 2) bank debit system; and

3) check payment system.

The following checks, however, are not acceptable as check payments for

internal revenue taxes: 1) accommodation checks; 2) second endorsed

checks; 3) stale checks; 4) postdated checks; 5) unsigned checks; and 6)

checks with alterations/erasures. Second indorsement of checks which are

payable to the Bureau of Internal Revenue or Commissioner of Internal

Revenue is absolutely prohibited. Each check should cover one tax type for

one return period only.

AABs are mandated to accept tax returns/payment forms partly paid through

any of the aforementioned modes of payment and partly through Tax Debit

Memos (TDM) duly and validly issued by the BIR. TDMs, however, are not

acceptable as payments for Withholding Taxes, Fringe Benefit Tax, and taxes,

fees and charges collected under special schemes/procedures/ programs of

the government/BIR.

Taxpayers are not required to enroll with any AAB where they intend to file

tax returns/payment forms and/or pay internal revenue taxes.

Any diversion, non-remittance or under-remittance of the taxes collected by

AABs through fault or negligence of the bank accepting such payment as well

Atty. Michael Montero

as the diversion of any payment for BIR taxes using the facilities of the bank

through fault or negligence of any of the banks personnel shall subject the

bank to civil and criminal liabilities.

SUBJECT : Modes of and Procedure for the Payment of Internal Revenue Taxes

Through Authorized Agent Banks Amending Revenue Regulations No. 4-97, as

amended by Revenue Regulations No. 6-98

SECTION 1.

Scope. Pursuant to Section 244 of the National Internal

Revenue Code of 1997 (CODE) in relation to Sections 8, 12, 56, 58, 81, 103, 114,

128, 130, 200 and 245, all of the same Code, these Regulations are hereby

promulgated to amend Revenue Regulations No. 4-97, as amended by Revenue

Regulations No. 6-98, on the provisions relative to acceptable modes of

payment of internal revenue taxes coursed through authorized agent banks

(AABs), the recording of such payments and issuance of validated BIRprescribed deposit slips which likewise serve as acknowledgment receipts

for payments of taxes deposited by taxpayers for BTR-BIR account, and the

control mechanisms to deter and detect the diversion of tax payments.

SECTION 2.

Recording of BIR Tax Payments by the AABs.

A)

All internal revenue taxes collected through authorized agent banks

(AABs) shall be credited to the demand deposit accounts opened and

maintained by the Bureau of Treasury (BIR) for BIR in the head offices of

AABs;

B) Head offices of AABs shall assign and maintain a separate general ledger

account for said BTr demand deposit accounts;

C) Using the online tellering system, the bank tellers shall immediately post

the BIR tax payments they collect by crediting the BTr demand deposit

accounts in the head offices of the AABs, instead of recording them as

mere payables to BTr at the end of each banking day in the AABs

backrooms.

D) In filing a tax declaration and making payment to an AAB, a taxpayer must

accomplish and submit a BIRprescribed deposit slip which AABs must

design, print and make available in all participating branches. The deposit

slip must in addition to those needed by the bank, provide for the following

information:

Transaction Date

Name of Taxpayer

TIN

BTR-BIR Account Number

Account Name which must be BTRBIR

Name of Drawee Bank

Check Number

Bank Debit Advice Number (for debit system payments)

Amount

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

E)

The bank teller shall machine validate the BIRprescribed deposit slip

accomplished by the taxpayer as evidence that the BIR tax payment was

deposited to the account of the BTr. Said deposit slip shall be

accomplished and issued in triplicate copies, distributed as follows:

original (taxpayers copy), duplicate (AABs copy) and triplicate (to be

attached to the tax return. Additionally, the AAB receiving the tax

return/payment form shall also machine validate and stamp mark the word

"Received" on the return/payment form as proof of filing the

return/payment form and payment of the tax by the taxpayer. The

machine validation on the return/payment form shall reflect the date of

payment, amount paid and transaction code, the name of the bank,

branch code, tellers code and tellers initials.

F) Before 12:00 NN of the following banking day, the head offices of the

AABs shall provide to BTR/BIR the daily total amount of BIR taxes they

collected.

G) After receipt of payment but not later than 24 hours thereafter, the AAB

branch shall encode into the LBDE System and transmit to the concerned

BIR Data Center, the below data and copy furnish the AAB head office.

1. Date of the transaction;

2. Name of the taxpayer;

3. Taxpayer Identification Number (TIN) of the taxpayer;

4. Tax type which is being paid for;

5. Return period for the tax type being paid for;

6. Amount of tax paid;

7. Name of the drawee bank and check number, for tax payments

through checks;

SECTION 3.

Modes of Payment to AABs. Aside from the electronic

payment system currently used by some taxpayers in paying their BIR taxes, the

rest shall pay their tax liabilities through any of the following modes: a) over

thecounter cash payments; b) bank debit system; or c) check payment system.

a)

b)

c)

Atty. Michael Montero

In the issuance and accomplishment of checks for the payment of internal

revenue taxes, as illustrated below, the taxpayer shall indicate in the space

provided for "PAY TO THE ORDER OF" the following data:

(1) presenting/collecting bank or the bank where the payment is to be coursed

and

(2) FAO (For the Account Of) Bureau of Internal Revenue as payee; and under

the "ACCOUNT NAME" the taxpayer identification number (TIN).

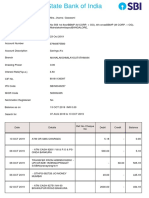

(Below is a sample of a tax check payment where the drawee bank and presenting

bank are different from each other.)

(Below is sample of a check tax payment drawn from and presented to the same

bank.)

"Overthecounter cash payment" - payment of tax liabilities to authorized

agent bank in the currencies (paper bills or coins) that are legal tender in the

Philippines. The maximum amount allowed per tax payment shall not exceed

ten thousand pesos (P10,000.00)

"Bank debit system" - system whereby a taxpayer, through a bank debit

memo/advice, authorizes withdrawals from his/its existing bank accounts for

payment of tax liabilities.

The bank debit system mode is allowed only if the taxpayer has a bank

account with the AAB branch where he/it intends to file and pay his/its tax

return/form/declaration, provided said AAB branch is within the jurisdiction of

the BIR Revenue District Office (RDO)/Large Taxpayers District Office (LTDO)

where the tax payment is due and payable.

"Checks" - bill of exchange or Order Instrument drawn on a bank payable on

demand.

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

The following checks are not acceptable as check payments for internal revenue

taxes:

1.

2.

3.

4.

5.

6.

Accommodation checks checks issued or drawn by a party other than

the taxpayer making the payment;

Second endorsed checks checks issued to the taxpayer as payee who

indorses the same as payment for taxes;

Stale checks checks dated more than six (6) months prior to

presentation to the authorized agent bank;

Postdated checks checks dated a day or several days after the date of

presentation to the authorized agent bank;

Unsigned checks checks with no signature of the drawer;

Checks with alterations/erasures.

AABs accepting checks for the payment of BIR taxes and other charges must

see to it that the check covers one tax type for one return period only.

Moreover, AABs must strictly comply with the systems and procedures for the

reception, processing, clearing and accounting of the checks to be prescribed

under a separate regulation.

Second indorsement of checks which are payable to the Bureau of Internal

Revenue or Commissioner of Internal Revenue is absolutely prohibited.

SECTION 4.

Tax Returns Partly Paid Thru Tax Debit Memos (TDMs).

AABs are mandated to accept tax returns/payment forms partly paid thru any

of the modes of payment mentioned in Section 3 hereof and partly thru TDMs

duly and validly issued by the BIR. Before accepting the BIR tax return/payment

form partly paid thru tax debit memo, the AAB shall insure that the number of the

TDM is indicated in the BIR tax return/payment form in the same manner that the

check number/drawee bank and bank debit advice number are indicated in the tax

return/payment form paid thru check or bank debit system, respectively. A

photocopy of the tax credit certificate (TCC), front and back page, which was the

source of the TDM, together with a copy of the TDM, must be required from the

taxpayer and attached to the BIR tax return/payment form.

TDMs are, however, not acceptable as payments for withholding taxes, including

Fringe Benefit Tax (clarified and implemented under RR No. 2-98, as amended,

and RR No. 3-98), and for taxes, fees and charges collected under special

schemes/procedures/programs of the Government / BIR as discussed and

elucidated in a separate revenue regulation. AABs shall see to it that this restriction

is strictly observed in the BIR tax returns/payment forms they receive.

SECTION 5.

Enrollment of Taxpayers with Authorized Agent Bank Not

Required. Taxpayers are not required to enroll with any AAB where they

Atty. Michael Montero

intend to file tax returns/payment forms and/or pay internal revenue taxes.

Taxpayers may file tax returns/payment forms and pay internal revenue taxes with

any AAB of the appropriate BIR office (Revenue District Office (RDO), Large

Taxpayers District Office (LTDO), or Large Taxpayers Service, etc., whichever is

applicable) where they are required to file the particular return/payment form.

SECTION 6.

Responsibility and Privilege of Taxpayers. Taxpayers shall

see to it that their tax returns/payment forms with payment are filed with and

internal revenue taxes paid to legitimate AABs of the BIR. Nonetheless, they

may confirm their tax payments with their home RDO/LTDO or LTDO/RDO where

they are required to file tax returns/payment form and pay internal revenue taxes.

SECTION 7.

Additional Liabilities/Responsibilities of Authorized Agent

Banks (AABs).

(a) Any diversion, non-remittance or under-remittance of the taxes collected

by AABs through fault or negligence of the bank accepting such payment as

well as the diversion of any payment for BIR taxes using the facilities of

the bank through fault or negligence of any of the banks personnel shall

subject the bank to civil and criminal liabilities provided for under

Sections 248 and 275 of the Tax Code, as amended, and other existing

laws, rules and regulations. AABs shall be liable to the BIR for double the

amount of taxes diverted and unremitted, plus the increments and

penalties prescribed by the Tax Code, as amended, but the total penalties

imposed may be reduced on meritorious grounds subject to the approval of the

majority of the members of the Management Committee (MANCOM) of the

BIR, composed of the Commissioner of Internal Revenue and the four (4)

Deputy Commissioners, where the Commissioner of Internal Revenue votes

for such reduction.

(b) The reports of AABs to be submitted to BTr/BIR (under Sec. 2) of all the tax

payments collected shall be in accordance with the forms prescribed by BIR.

(c) The requirements prescribed in these regulations shall be included in the

accreditation criteria to be mentioned in the Memorandum of Agreement to be

signed by and among the BTR, BIR and the AAB for compliance by all AABs.

Revenue Memorandum Circular 22-2012 (May 7, 2012)

Subject: Clarification on the implementation of Revenue Regulations No. 5 2012

Summary: BIR Rulings issued prior to Jan 1, 1998 remains valid only to the

taxpayer who was issued the ruling and covering the transactions subject of the

same ruling. These cannot be used as precedents by other taxpayers and lawyers.

This Circular is issued to clarify the implementation and proper interpretation of

Revenue Regulations No. 5 2012, to wit:

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

Taxation Law Case Digests

1.

2.

3.

4.

All BIR Rulings issued prior to Jan 1, 1998 are not to be used as

precedent by any taxpayer as a basis to secure rulings for themselves for

current business transaction/s or in support of their position against any

assessment.

All BIR Rulings issued prior to Jan 1, 1998 are not to be used by any BIR

action lawyer in issuing new rulings for request for rulings involving current

business transaction/s.

However, BIR Rulings issued prior to Jan 1, 1998 remains to be valid

but only:

a. To the taxpayer who was issued the ruling; and

b. Covering the specific transaction/s which is the subject of

the same ruling

BIR Rulings issued prior to Jan 1, 1998, shall remain valid as mentioned

above, unless expressly notified of its revocation or unless the legal basis

in law for such issuance has already been repealed/amended in the

current Tax Code.

5.

All concerned revenue officials and employees are hereby enjoined to give this

Circular as wide a publicity as possible.

Kim S. Jacinto-Henares

BIR Ruling No. 370-2011 (October 7, 2011)

(Just lifted this off from last sem. Dont worry I checked if mei kulang.)

Summary:

The case is about the PEACe bonds, and the tax to be imposed on the interest

income. In the 2001 BIR Rulings, they said that the bonds were exempt from the

20% Final tax. The 2001 Rulings interpreted the law incorrectly by saying that

since it was sold to any one entity it is not to be considered as deposited

substitutes and thus not to be charged a 20% Final Tax. This however was found

to be inaccurate as the law was found out to provide that these bonds are covered.

The interpretation of the phrase at ANY one time means the entire term of the

bond not just the original issuance. The 2001 Rulings were declared null and void

for adding an exemption that is not found in the law hence this ruling was given

retroactive effect. As a result, CODE-NGO must pay the present value of the

discount P4.86 B, because it did not pay upfront when it should have been

withheld upfront and paid at the time of issuance, they would have paid only P1.4

B. They cannot rely on the 2001 Rulings because they were in excess of what the

TAX CODE provides.

FACTS:

Hon. Cesar v. Purisima, Secretary of Finance, sent a letter dated September

2011 requesting for the proper tax treatment of the discount or interest income

Atty. Michael Montero

1

arising from the P34 billion worth of 10-year zero coupon treasury bonds

issued by the Bureau of Treasury (BTr) on October 18, 2001 Poverty

Eradication and Alleviation Certificates (PEACe Bonds)

Why the PEACe Bonds were issued

Stemmed from the proposal of the Caucus of Development NGO Networks

(CODE-NGO) sometime in March 2001 for the Dept of Finance (DOF) to issue

P15 billion worth of 10-year zero coupon treasury notes.

CODE-NGO will purchase the notes and sell them to investors.

The net proceeds from the sale estimated to be at P1.45 billion will be used by

CODE-NGO to establish a fund that will finance anti-poverty projects of NGOs

nationwide.

The original plan did not happen because BTr questioned the propriety of

issuing the bonds directly to CODE-NGO, not being a Government Securities

Eligible Dealer (GSED). They wanted an auction and they wanted that CODENGO get a GSED to join.

BTr sold the PEACe Bonds via auction to eligible GSEDs.

Taxation of the Interest Income

BTr provided in the Public Offering of Treasury Bonds the tax treatment of the

PEACe Bonds WILL NOT BE SUBJECT TO 20% FINAL WITHHOLDING

TAX.

The tax treatment was based on 3 BIR rulings (2001 Rulings) issued before

the auction.

o May 31 supposedly the Bonds were to be issued to a single entity,

CODE-NGO, the Bonds were NOT considered to be public borrowing,

2

they were NOT considered deposit subsitutes as defined by the Tax

Code so not subject to the 20% final withholding tax.

o August 16 They are not deposit substitutes because of the fact of their

original issuance to a single entity. Construction of the phrase, at any one

time to mean the original issuance.

o September 29 confirmed the 2 above

Auction

Treasury

bond

as

explained

to

me.

The

Bureau

of

Treasury

will

sell

the

bonds

to

an

entity

like

a

bank

for

example

and

the

bank

will

then

sell

the

bonds

to

whoever

may

be

interested,

natural

or

juridical

persons

can

buy,

for

example

si

Corporation

A.

the

bonds

will

earn

interest

and

thats

how

it

attracts

buyers.

So

to

illustrate:

BTr

issues

P1

billion

worth

ng

treasury

bonds

issues

them

to

Bank

X

who

pays

a

discounted

amount

say

like

P750

million

Bank

X

will

now

be

able

to

issue

these

to

Corporation

A,

Investor

B,

etc.

Corporation

A

and

Investor

B

will

earn

money

as

the

bonds

earn

interest.

(Sana

im

making

sense)

In

addition,

these

are

described

as

risk-free

kapag

galing

sa

government

since

all

they

have

to

do

is

to

print

money.

2

Deposit

substitutes

the

borrowing

of

fund

must

be

obtained

from

20

or

more

individuals

or

corporate

lenders

at

any

one

time.

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

10

Taxation Law Case Digests

RCBC was declared as the winning bidder lowest bid interest rate of 12.75%

for a total face value of P35 billion.

RCBC paid BTr P10.7 Billion for P 35 billion worth of treasury bonds, discount

of P24.3 billion.

RCBC sold the PEACe bonds to CODE-NGO. CODE-NGO sold it to RCBC

Capital for P12.1 billion = gain of P1.4 billion

2004 BIR Ruling no. 007-2004

Issued in response to request for confirmation of the BTr on the tax

consequences of its regular and special issuance of treasury bills and bonds

REVERSING THE 2001 Rulings.

The mere issuance of government debt instruments and securities is deemed

as falling within the coverage of deposit substitutes irrespective of the

number of lenders at the time of origination. Accordingly, since government

debt instrument and securities are not exempt from taxes, interest income

derived therefrom shall be subject to the following:

(c) 20% final tax imposed under sections 27 (D) (1) and 28 (A) (7) (a),

of the Tax Code, for domestic and resident foreign corporations

respectively;

The phrase at any one time is deemed to refer to the floatation of the debt

instrument or security.

In other words, since the actual number of bond holders or investors maybe at

maturity date of the financial instrument, more than 20 individuals or

corporation, the said direct lenders and indirect investors are deemed to be

what constitute public.

In light of such ruling, BIR issued Revenue Regulations No. 17-84:

o Deposit substitutes shall mean

In the case of other non-financial companies, including the national

or local government and its instrumentalities, all borrowings

through the issuance of debt instruments denoted as treasury

bonds, treasury bills, treasury notes, and similar instruments.

BIR also declared in another BIR Ruling that the tax due should be withheld

upfront.

ISSUES: Purisima raises the ff issues

1. W/N the interest income arising from PEACe Bonds shall be subject to the

20% Final Tax or, in the alternative, to Ordinary Income Tax 20% Final

Tax

2. How much is the tax due P4.86 billion (MAIN)

3. Who shall be liable to pay the tax due CODE-NGO

4. How will the tax be collected Withhold upfront

RATIO:

ISSUE 1: Subject to 20% Final Tax

The P24.3 billion discount on the issuance of the PEACe Bonds should be

subject to the 20% Final Tax on interest income from deposit substitutes.

Atty. Michael Montero

It is now settled that all treasury bond regardless of the number of

purchasers/lenders at the time of origination/issuance are considered deposit

substitutes.

In the case of zero coupon bonds, the discount (face value purchase price) is

treated as interest income of the purchaser

Section 27 (D) (1) of the 1997 Tax Code:

o Interest from Deposits and Yield or any other Monetary Benefit from

Deposit Substitutes and from Trust Funds and Similar Arrangements,

and Royalties. - A final tax at the rate of twenty percent (20%) is hereby

imposed upon the amount of interest on currency bank deposit and yield

or any other monetary benefit from deposit substitutes and from trust

funds and similar arrangements received by domestic corporations, and

royalties, derived from sources within the Philippines: Provided, however,

That interest income derived by a domestic corporation from a depository

bank under the expanded foreign currency deposit system shall be subject

to a final income tax at the rate of seven and one-half percent (7 1/2%) of

such interest income.

ISSUE 2: Amount of Tax Due

Manner of payment DOF Department Order No. 141-95 this should have

been followed.

o Treasury Bonds, the 20% final income tax shall be withheld on

discounts valued at present value on every original sale. Periodic

coupon payments on Treasury Bonds shall be subject to the 20% final

income tax to be withheld at the time the coupon payments are made.

o PRESENT VALUED BY THE NET YIELD ON THE SECURITY TO

ENSURE THE INTEREST TAXED AT 20% TO BE PAID UPFRONT

However, at the time of the issuance of the PEACe Bonds in 2001, the BTr

was not able to collect the final tax on the discount realized by RCBC as a

result of the 2001 Rulings.

Subsequently, the issuance of the 2004 Ruling modified and superseded the

2001 Rulings by stating that the TAX CODE is clear that the term public

means borrowing from 20 or more lenders at ANY one time.

o The word ANY indicates that the period contemplated is the entire term

of the bond and not merely the point of origination issuance.

o The Tax Code provision is clear and there is no need for statutory

construction.

Thus, by taking the PEACe Bonds out of the ambit of deposits substitutes and

exempting it from the 20% Final Tax, an exemption in favour of the PEACe

Bonds was created when no such exemption is found in the law.

THE 2001 rulings are null and void and cannot be given any legal effect

for being contrary to law.

o It is basic principle of administrative law that the interpretation given

by an administrative agency cannot run contrary to the law which it

seeks to implement.

o Administrative rules and regulations are intended to carry out,

neither to supplant nor to modify, the law.

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

11

Taxation Law Case Digests

Atty. Michael Montero

RCBC should have paid upon issuance and it would have paid only P1.4B,

20% of the value as of October 18, 2001.

o Since they did not pay they will have to pay now the present value of the

original discount P4.86B. (So basically, this ruling was given

retroactive effect)

ISSUE 3: Who shall be liable

RCBC merely acted as an agent or conduit of CODE-NGO by virtue of the

requirement by BTr that it is not a GSED.

CODE-NGO should pay because it is the beneficial owner of the PEACe

Bonds.

ISSUE 4: How will the tax be collected

BTr shall withhold the FINAL TAX due on the interest income derived from the

PEACe Bonds prior to its payment on the date of maturity.

Agdamag | Anderson |Aquino |De Guzman | Empaynado | Estremadura| Lopez| Macabagdal | Magtoto | Meer |Mercado| Militante |Pineda |Squillantini| Taruc

12

You might also like

- RemittanceDocument3 pagesRemittanceSalman Abrar100% (2)

- Remittance LetterDocument5 pagesRemittance LetterKhel Follero100% (2)

- Attorney Questions For Opposing AttyDocument5 pagesAttorney Questions For Opposing AttyDex MailNo ratings yet

- Extinguishment of Obligations: Payment, Performance and Loss of the Thing DueDocument39 pagesExtinguishment of Obligations: Payment, Performance and Loss of the Thing DueClaudine Marabut Tabora-RamonesNo ratings yet

- US Internal Revenue Service: I3520 - 1999Document12 pagesUS Internal Revenue Service: I3520 - 1999IRSNo ratings yet

- EFT ScamDocument1 pageEFT ScamTonya Banks0% (1)

- Cash Assignment Form 2013Document3 pagesCash Assignment Form 2013ARTHUR MILLERNo ratings yet

- What Happens If The Presentment Is Done BEFORE The Instrument Is Due?Document3 pagesWhat Happens If The Presentment Is Done BEFORE The Instrument Is Due?bmdadamsonNo ratings yet

- Concept of Offer and Acceptance in Law of ContractDocument4 pagesConcept of Offer and Acceptance in Law of ContractSimon JnrNo ratings yet

- Remittance ApplicationDocument2 pagesRemittance ApplicationChristy TiewNo ratings yet

- IRS Response LetterDocument3 pagesIRS Response Letternoname6100% (1)

- Jay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Document13 pagesJay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Scribd Government DocsNo ratings yet

- Contract of SaleDocument3 pagesContract of SaleMitch De OcampoNo ratings yet

- Negotiable InstrumentDocument15 pagesNegotiable InstrumentAngelitOdicta100% (2)

- Funky Bookkeeping 101 - MOCEE: by Anna Von ReitzDocument3 pagesFunky Bookkeeping 101 - MOCEE: by Anna Von ReitzWayne LundNo ratings yet

- Rights vs Liabilities in Contracts and Legal ClaimsDocument1 pageRights vs Liabilities in Contracts and Legal ClaimsNat WilliamsNo ratings yet

- Juris Postal Money OrderDocument3 pagesJuris Postal Money OrderBrent DagbayNo ratings yet

- Bank Letter AffidavitDocument1 pageBank Letter AffidavitYarod ELNo ratings yet

- Presentment of InstrumentDocument12 pagesPresentment of Instrumentefaf007No ratings yet

- 12 USC 411 FRN ObligationsDocument1 page12 USC 411 FRN ObligationszicjrurtNo ratings yet

- Why Your Loans Under The Fed System Should Be CancelledDocument1 pageWhy Your Loans Under The Fed System Should Be CancelledNat Williams100% (1)

- Bank Error in Your FavorDocument2 pagesBank Error in Your FavorgargramNo ratings yet

- Banking and The Duty of ConfidentialityDocument4 pagesBanking and The Duty of ConfidentialityMohamed YosryNo ratings yet

- First Schedule - Notice of Protest: Form of Protest Which Is Being Used When The Services of A Notary Cannot Be ObtainedDocument1 pageFirst Schedule - Notice of Protest: Form of Protest Which Is Being Used When The Services of A Notary Cannot Be ObtainedCruz HernandezNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActShyrine EjemNo ratings yet

- 1199 A 1 PDFDocument4 pages1199 A 1 PDFGerry Ruff100% (1)

- Bill of Exchange Promissory NoteDocument6 pagesBill of Exchange Promissory Notesatyendrain100% (1)

- Complete SF 1199A Direct Deposit FormDocument1 pageComplete SF 1199A Direct Deposit Formdonald trumpNo ratings yet

- Sales Sample Q Sans F 09Document17 pagesSales Sample Q Sans F 09Tay Mon100% (1)

- Stamp Duty CalculatorDocument2 pagesStamp Duty Calculatorjmathew_984887No ratings yet

- Certificate of Deposit 56Document8 pagesCertificate of Deposit 56bhaskaranbalamuraliNo ratings yet

- Production of Financial Documents For IRS and FinCENDocument8 pagesProduction of Financial Documents For IRS and FinCENJoshua Sygnal GutierrezNo ratings yet

- Notice of ProtestDocument1 pageNotice of ProtestDon CorleoneNo ratings yet

- IndorsementDocument1 pageIndorsementJason HenryNo ratings yet

- Debtor-Creditor LawDocument28 pagesDebtor-Creditor LawAnonymous QEVHZHWKJKNo ratings yet

- FOIA Hauser 2-6-17 ResponseDocument3 pagesFOIA Hauser 2-6-17 ResponseJonah MeadowsNo ratings yet

- A4 VinstructionsDocument1 pageA4 VinstructionsJacob Scott100% (1)

- How To Stop Creditors Harrassing Phone CallsDocument22 pagesHow To Stop Creditors Harrassing Phone CallsDave Falvey0% (1)

- Cash RemittanceDocument22 pagesCash Remittanceapi-26362375No ratings yet

- CP-22E IRS Response LetterDocument4 pagesCP-22E IRS Response LetterTRISTARUSA100% (2)

- Bills of ExchangeDocument11 pagesBills of Exchangesmilesam50% (2)

- 1951a How To Pay MortgageDocument52 pages1951a How To Pay MortgageAriesWayNo ratings yet

- Bill of ExchangeDocument3 pagesBill of ExchangeNisot Ihdnag100% (5)

- IRS clarification requestDocument7 pagesIRS clarification requestfisherre2000No ratings yet

- GPO CRECB 1933 pt1 v77 4Document68 pagesGPO CRECB 1933 pt1 v77 4Susan CrossNo ratings yet

- Instructions For Form 3520-A: Annual Information Return of Foreign Trust With A U.S. OwnerDocument4 pagesInstructions For Form 3520-A: Annual Information Return of Foreign Trust With A U.S. OwnerIRSNo ratings yet

- Bills of ExchangeDocument57 pagesBills of Exchangekamalsodhi24100% (5)

- The Negotiable Instruments Act 1881Document55 pagesThe Negotiable Instruments Act 1881Ashish Mishra100% (1)

- 3 Day Notice To ReportDocument1 page3 Day Notice To ReportMarsha MainesNo ratings yet

- ACS Student Loan DischargeDocument1 pageACS Student Loan DischargeSaAusetTauwieret100% (1)

- Credit Uniuon Terms and ConditionsDocument1 pageCredit Uniuon Terms and ConditionsTyler cruzNo ratings yet

- Presentment For PaymentDocument2 pagesPresentment For PaymentMarc CalderonNo ratings yet

- US Internal Revenue Service: Irb01-11Document112 pagesUS Internal Revenue Service: Irb01-11IRSNo ratings yet

- Accepted Offer Addendum-CounterDocument16 pagesAccepted Offer Addendum-Counterrealestate6199No ratings yet

- 1099aexampleDocument1 page1099aexampleMike GriffinNo ratings yet

- Bill of ExchangeDocument13 pagesBill of ExchangeShiwaniSharmaNo ratings yet

- Dorrell GrantDocument2 pagesDorrell GrantNat WilliamsNo ratings yet

- Manufacturing: Employers and Workers Involved in The Manufacturing of The FollowingDocument2 pagesManufacturing: Employers and Workers Involved in The Manufacturing of The FollowingJose Mari TrinidadNo ratings yet

- The Law On Sales Agency and Credit TransDocument5 pagesThe Law On Sales Agency and Credit TransIke100% (1)

- 80s Songs With LyricsDocument2 pages80s Songs With LyricsJade ViguillaNo ratings yet

- Modul NarrativeDocument30 pagesModul NarrativeAhmad Nicholas100% (4)

- Security Transactions - Digests - Sienna FloresDocument8 pagesSecurity Transactions - Digests - Sienna FloresJade ViguillaNo ratings yet

- Sec Memo No. 8, s2013Document2 pagesSec Memo No. 8, s2013Jennilyn TugelidaNo ratings yet

- Estate Settlement GuidelinesDocument4 pagesEstate Settlement GuidelinesOfel TactacNo ratings yet

- Handbook On Workers Statutory Monetary Benefits 2020 EditionDocument80 pagesHandbook On Workers Statutory Monetary Benefits 2020 EditionDatulna Benito Mamaluba Jr.No ratings yet

- Supreme Court: Custom SearchDocument6 pagesSupreme Court: Custom SearchJade ViguillaNo ratings yet

- 1905 January 2018 ENCS FinalDocument3 pages1905 January 2018 ENCS FinalSunmi GashinaNo ratings yet

- Tax Card 2018: Paralimni PaphosDocument12 pagesTax Card 2018: Paralimni PaphosJade ViguillaNo ratings yet

- Sectrans DigestDocument100 pagesSectrans DigestJade ViguillaNo ratings yet

- Research - Tax Evasion 2Document27 pagesResearch - Tax Evasion 2Jade ViguillaNo ratings yet

- PAGCOR Casino Regulatory Manual for Entertainment City LicenseesDocument366 pagesPAGCOR Casino Regulatory Manual for Entertainment City LicenseesPaige Lim100% (2)

- Application One-Time Taxpayer Philippine BIR Form No. 1904Document1 pageApplication One-Time Taxpayer Philippine BIR Form No. 1904Edd N Ros Adlawan100% (2)

- Supreme Court: Custom SearchDocument6 pagesSupreme Court: Custom SearchJade ViguillaNo ratings yet

- Sandiganbayan Authority to Suspend Congressman Under Anti-Graft LawDocument1 pageSandiganbayan Authority to Suspend Congressman Under Anti-Graft LawJade ViguillaNo ratings yet

- Tax Digests and Doctrines of 3D BATCH 2012 under Atty. Gonzales TCC, LGC and RemediesDocument44 pagesTax Digests and Doctrines of 3D BATCH 2012 under Atty. Gonzales TCC, LGC and RemediesLorenzo MartinezNo ratings yet

- Arroyo vs. de VeneciaDocument2 pagesArroyo vs. de VeneciaJade ViguillaNo ratings yet

- Guevarra V GuevarraDocument2 pagesGuevarra V GuevarraJade ViguillaNo ratings yet

- Sectrans Digest (Atty. Lerma)Document108 pagesSectrans Digest (Atty. Lerma)Jade ViguillaNo ratings yet

- 1 - DSWD V Judge BelenDocument2 pages1 - DSWD V Judge BelenJade ViguillaNo ratings yet

- Lepanto Consolidated Mining v. DumapisDocument2 pagesLepanto Consolidated Mining v. DumapisJade Viguilla75% (4)

- Alonso V Villamor Case Digest (CivPro)Document2 pagesAlonso V Villamor Case Digest (CivPro)Jade ViguillaNo ratings yet

- 4 - Cortes V Yu-TiboDocument2 pages4 - Cortes V Yu-TiboJade ViguillaNo ratings yet

- 29 - Agro Conglomerates V SorianoDocument2 pages29 - Agro Conglomerates V SorianoJade ViguillaNo ratings yet

- 03 - Aggabao V ParulanDocument2 pages03 - Aggabao V ParulanJade Viguilla100% (1)

- Villalva vs. RCBC Savings Bank on Insurance Policy DeliveryDocument3 pagesVillalva vs. RCBC Savings Bank on Insurance Policy DeliveryJade Viguilla100% (1)

- 8 - Navarro V PinedaDocument2 pages8 - Navarro V PinedaJade Viguilla100% (1)

- Internship ReportDocument18 pagesInternship ReportSofonias MenberuNo ratings yet

- IDB Annual Report 2017: Our Partners in Innovation and Progress/TITLEDocument65 pagesIDB Annual Report 2017: Our Partners in Innovation and Progress/TITLEDoge IronyNo ratings yet

- Op4291791 Let12msifnlagl Cop8366301 00000000005f5ukpDocument2 pagesOp4291791 Let12msifnlagl Cop8366301 00000000005f5ukpcanciones8652No ratings yet

- Guidelines and Instructions For Submission of On-Line Examination FormDocument3 pagesGuidelines and Instructions For Submission of On-Line Examination FormHolly SmithNo ratings yet

- Services of Askari BankDocument3 pagesServices of Askari BankAdeel KhanNo ratings yet

- Hand Book On Know Your Circular Andhra Bank PromotionDocument81 pagesHand Book On Know Your Circular Andhra Bank PromotionSubrat Satyaranjan KanungoNo ratings yet

- ECS-D Mandate FormDocument3 pagesECS-D Mandate FormNeelima DeyNo ratings yet

- Kotak MF Common Application With SIPDocument4 pagesKotak MF Common Application With SIPRakesh LahoriNo ratings yet

- Agrani Bank Nazma Apu-FinalDocument57 pagesAgrani Bank Nazma Apu-Finalmd. Piar AhamedNo ratings yet

- Agreements and Disclosures UbsDocument88 pagesAgreements and Disclosures UbsAxeliiNilssonNo ratings yet

- Subhsh KumarDocument174 pagesSubhsh KumarSubhash KumarNo ratings yet

- Onboarding Form (3)Document40 pagesOnboarding Form (3)Thanash KumarNo ratings yet

- Account StatementDocument12 pagesAccount StatementSMILLING CLOUDNo ratings yet

- Level Up Your CardingDocument114 pagesLevel Up Your Cardinggiopapiashvili9No ratings yet

- Fees and Commissions Guide For IndividualsDocument29 pagesFees and Commissions Guide For IndividualsDNo ratings yet

- Bil Celcom AprilDocument6 pagesBil Celcom AprilMakhtar JaafarNo ratings yet

- SBI Mob Number ChangeDocument3 pagesSBI Mob Number ChangesparshdevenNo ratings yet

- Your Statement: Smart AccessDocument2 pagesYour Statement: Smart Accessmohamed elmakhzniNo ratings yet

- Autonomous Pix NubankDocument21 pagesAutonomous Pix Nubankmatheus.lopesNo ratings yet

- DEFYNE - Esquire Application W - 3995 - 2495 112619 Old Logo PDFDocument3 pagesDEFYNE - Esquire Application W - 3995 - 2495 112619 Old Logo PDFFrancesco DiStefanoNo ratings yet

- DS82 Complete PDFDocument6 pagesDS82 Complete PDFAnonymous FQPDtx6No ratings yet

- QR Merchant Application FormDocument2 pagesQR Merchant Application FormМєяяїгг ВєяиндяԁNo ratings yet

- Publicbank Payment GuideDocument38 pagesPublicbank Payment Guidenishio fdNo ratings yet

- FAQ of Insurance Institute of IndiaDocument8 pagesFAQ of Insurance Institute of IndiaSachin KumarNo ratings yet