Professional Documents

Culture Documents

Eternal Gardens vs Philamlife insurance approval

Uploaded by

Earl Larroder0 ratings0% found this document useful (0 votes)

366 views1 pageEternal Gardens Memorial Park Corp. vs. Philippine American Life Insurance Company

Original Title

Eternal Gardens Memorial Park Corp. vs. Philippine American Life Insurance Company

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEternal Gardens Memorial Park Corp. vs. Philippine American Life Insurance Company

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

366 views1 pageEternal Gardens vs Philamlife insurance approval

Uploaded by

Earl LarroderEternal Gardens Memorial Park Corp. vs. Philippine American Life Insurance Company

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

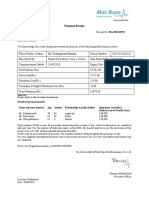

Eternal Gardens Memorial Park Corp. vs.

Philippine American Life Insurance Company

FACTS: (Philamlife) entered into an agreement denominated as Creditor Group Life Policy with

petitioner Eternal Gardens Memorial Park Corporation (Eternal). Under the policy, the clients of

Eternal who purchased burial lots from it on installment basis would be insured by Philamlife.

The amount of insurance coverage depended upon the existing balance of the purchased burial

lots. The policy was to be effective for a period of one year, renewable on a yearly basis.

On August 2, 1984, a certain John Chuang died with a balance of 100,000. After more than a

year (April 25, 1986), Philamlife had not furnished Eternal with any reply on its insurance claim

so its demanded its claim

RTC decided in favor of Eternal: It further ruled that due to Philamlifes inaction from the

submission of the requirements of the group insurance to Chuangs death as well as Philamlifes

acceptance of the premiums during the same period, Philamlife was deemed to have approved

Chuangs application. The RTC said that since the contract is a group life insurance, once proof of

death is submitted, payment must follow.

CA reversed RTC: Chuangs application was not enclosed in Eternals letter dated December 29,

1982. It further ruled that the non-accomplishment of the submitted application form violated

Section 26 of the Insurance Code. Thus, the CA concluded, there being no application form,

Chuang was not covered by Philamlifes insurance.

ISSUE: WON the inaction of the insurer on the insurance application be considered as approval

of the application?

HELD: YES. Eternal alleged that it provided a copy of the insurance application which was

signed by Chuang himself and executed before his death. Philamlife claims that the evidence

presented by Eternal is insufficient, arguing that Eternal must present evidence showing that

Philamlife received a copy of Chuangs insurance application.

Upon a partys purchase of a memorial lot on installment from Eternal, an insurance contract

covering the lot purchaser is created and the same is effective, valid, and binding until terminated

by Philamlife by disapproving the insurance application

Moreover, the mere inaction of the insurer on the insurance application must not work to

prejudice the insured The termination of the insurance contract by the insurer must be explicit

and unambiguous The fact of the matter is, the letter dated December 29, 1982, which Philamlife

stamped as received, states that the insurance forms for the attached list of burial lot buyers were

attached to the letter. Such stamp of receipt has the effect of acknowledging receipt of the letter

together with the attachments. Such receipt is an admission by Philamlife against its own

interest.

You might also like

- Fine Print Rule in Insurance ContractsDocument1 pageFine Print Rule in Insurance ContractschristimyvNo ratings yet

- Cebu Shipyard V William LinesDocument1 pageCebu Shipyard V William LinescrisNo ratings yet

- Biagtan v. Insular LifeDocument2 pagesBiagtan v. Insular LifeIldefonso Hernaez100% (2)

- Sbcasol Commrev 4b Insurance DigestsDocument59 pagesSbcasol Commrev 4b Insurance DigestsMariel MarielNo ratings yet

- Cathay Insurance v. CA (P Petitioner: RespondentsDocument1 pageCathay Insurance v. CA (P Petitioner: RespondentsAnne Dela CruzNo ratings yet

- Geagonia Vs CADocument1 pageGeagonia Vs CAkamiruhyunNo ratings yet

- 71 Garcia v. Hong Kong FireDocument2 pages71 Garcia v. Hong Kong FireCarl Ilagan100% (1)

- Gen. Insurance & American Home-DIGESTDocument1 pageGen. Insurance & American Home-DIGESTElsie CayetanoNo ratings yet

- RCBC Wins Insurance Proceeds CaseDocument13 pagesRCBC Wins Insurance Proceeds CaseClaudine Christine A. VicenteNo ratings yet

- INSURANCE - 6. Manila Mahogany Vs CADocument2 pagesINSURANCE - 6. Manila Mahogany Vs CADonna Joyce de BelenNo ratings yet

- Malayan Insurance Co. Vs ArnaldoDocument2 pagesMalayan Insurance Co. Vs ArnaldoRenz AmonNo ratings yet

- Great Pacific Life vs. CA Case DigestDocument3 pagesGreat Pacific Life vs. CA Case DigestLiana Acuba100% (1)

- Qua Chee Gan v. Law Union Rock - Breach of WarrantyDocument8 pagesQua Chee Gan v. Law Union Rock - Breach of WarrantyRegina AsejoNo ratings yet

- Civil Digest CompiledDocument10 pagesCivil Digest CompiledAmira acacNo ratings yet

- Argente v. West Coast Life InsuranceDocument2 pagesArgente v. West Coast Life InsuranceMan2x Salomon100% (1)

- UCPB General Insurance v. Masagana Telamart With Opinions (Yu)Document3 pagesUCPB General Insurance v. Masagana Telamart With Opinions (Yu)Peter Joshua OrtegaNo ratings yet

- 57 Ang Giok Chip v. SpringfieldDocument2 pages57 Ang Giok Chip v. Springfieldthornapple25No ratings yet

- 2 Pacific Banking Corporation V CA and Oriental AssuranceDocument3 pages2 Pacific Banking Corporation V CA and Oriental AssuranceKokoNo ratings yet

- Fortune Insurance and Surety Co, Inc. V CA DigestDocument2 pagesFortune Insurance and Surety Co, Inc. V CA DigestNatalia Armada100% (1)

- Federal Express Corporation vs. American Home Assurance CompanyDocument2 pagesFederal Express Corporation vs. American Home Assurance Companydelbertcruz50% (2)

- Union Manufacturing Co., Inc. and Republic Bank v. Philippine Guaranty Co., Inc. DigestDocument1 pageUnion Manufacturing Co., Inc. and Republic Bank v. Philippine Guaranty Co., Inc. DigestNinaNo ratings yet

- FedEx v. American Homes AssuranceDocument2 pagesFedEx v. American Homes AssuranceKenny EspiNo ratings yet

- FGU Insurance Vs CADocument2 pagesFGU Insurance Vs CAIldefonso HernaezNo ratings yet

- Great Pacific Life Insurance v. CADocument2 pagesGreat Pacific Life Insurance v. CAErxha LadoNo ratings yet

- PHILAMCARE HEALTH SYSTEMS, INC., Petitioner, vs. COURT OF APPEALS and JULITA TRINOS, RespondentsDocument2 pagesPHILAMCARE HEALTH SYSTEMS, INC., Petitioner, vs. COURT OF APPEALS and JULITA TRINOS, RespondentsBert NazarioNo ratings yet

- Digest of Fortune Insurance and Surety Co. v. CA (G.R. No. 115278)Document2 pagesDigest of Fortune Insurance and Surety Co. v. CA (G.R. No. 115278)Rafael Pangilinan100% (1)

- Philamcare Health Systems, Inc. vs. Court of Appeals (DIGEST)Document2 pagesPhilamcare Health Systems, Inc. vs. Court of Appeals (DIGEST)Ann Catalan100% (1)

- Panmalayan Insurance vs. CA on insurer's subrogation rightsDocument2 pagesPanmalayan Insurance vs. CA on insurer's subrogation rightsElerlenne Lim100% (2)

- Filipino Merchants Insurance v. CA DigestDocument2 pagesFilipino Merchants Insurance v. CA DigestMan2x Salomon100% (2)

- Oriental Assurance Vs CADocument2 pagesOriental Assurance Vs CAAthena SantosNo ratings yet

- Cathay Insurance Co. vs. Hon. Court of Appeals, and Remington Industrial Sales Corporation FactsDocument1 pageCathay Insurance Co. vs. Hon. Court of Appeals, and Remington Industrial Sales Corporation FactsRaven Claire MalacaNo ratings yet

- Development Ins. Corp. v. IACDocument1 pageDevelopment Ins. Corp. v. IACIldefonso HernaezNo ratings yet

- Insurance Cases 1Document4 pagesInsurance Cases 1JVLNo ratings yet

- Life Insurance Contract Requirement of Notice of AcceptanceDocument1 pageLife Insurance Contract Requirement of Notice of AcceptanceJoel MilanNo ratings yet

- Argente v. West Coast Life InsuranceDocument2 pagesArgente v. West Coast Life InsuranceJellyn100% (1)

- Manila Mahogany Manufacturing Corp vs. CADocument1 pageManila Mahogany Manufacturing Corp vs. CASamZacharyDumagan100% (1)

- Federal Express Corp. v. American Home Assurance Co.Document1 pageFederal Express Corp. v. American Home Assurance Co.Bigs BeguiaNo ratings yet

- de Lim v. Sun LifeDocument1 pagede Lim v. Sun LifeChari100% (1)

- Gulf Resorts Inc Vs Philippine Charter Insurance CorpDocument2 pagesGulf Resorts Inc Vs Philippine Charter Insurance CorpJ. LapidNo ratings yet

- Galarga v. SunlifeDocument3 pagesGalarga v. SunlifeBryce KingNo ratings yet

- UCPB v. Masagana Telemart (1999)Document2 pagesUCPB v. Masagana Telemart (1999)glecie_co12No ratings yet

- Insurance Licenses Required for Foreign Insurer and Local AgentDocument2 pagesInsurance Licenses Required for Foreign Insurer and Local AgentAbilene Joy Dela CruzNo ratings yet

- Concealment and Rep, Insular Life v. FelicianoDocument1 pageConcealment and Rep, Insular Life v. FelicianoEman AguileraNo ratings yet

- Great Pacific V CA G.R. No. L-31845 April 30, 1979Document5 pagesGreat Pacific V CA G.R. No. L-31845 April 30, 1979Lolph ManilaNo ratings yet

- Pioneer V Yap DigestDocument2 pagesPioneer V Yap DigestKath100% (1)

- Palileo v. CosioDocument4 pagesPalileo v. CosioHency TanbengcoNo ratings yet

- FILIPINAS COMPAÑÍA A DE SEGUROS Vs .TAN CHAUCODocument3 pagesFILIPINAS COMPAÑÍA A DE SEGUROS Vs .TAN CHAUCORenz Aimeriza AlonzoNo ratings yet

- Tan V. Ca GR NO. 48049 June 29, 1989 FactsDocument1 pageTan V. Ca GR NO. 48049 June 29, 1989 FactsFranzesca VinoyaNo ratings yet

- Prudential Guarantee and Assurance v. Trans-Asia Shipping LinesDocument1 pagePrudential Guarantee and Assurance v. Trans-Asia Shipping LinesAiza OrdoñoNo ratings yet

- American Home Assurance V Tantuco DigestDocument1 pageAmerican Home Assurance V Tantuco DigestAlexis Anne P. ArejolaNo ratings yet

- Malayan vs. Arnaldo - DigestDocument2 pagesMalayan vs. Arnaldo - Digestdamp_pradg100% (1)

- Insurance Co's Subrogation Rights UpheldDocument2 pagesInsurance Co's Subrogation Rights UpheldAnonymous XvwKtnSrMRNo ratings yet

- Palileo Vs CosioDocument2 pagesPalileo Vs CosioGabriel UyNo ratings yet

- New Life Enterprises V CADocument2 pagesNew Life Enterprises V CAPhi SalvadorNo ratings yet

- Rizal Surety V CADocument1 pageRizal Surety V CAcrisanto perezNo ratings yet

- SATURNINO v. PHILAM LIFEDocument2 pagesSATURNINO v. PHILAM LIFETricia CornelioNo ratings yet

- Andres V CrownDocument3 pagesAndres V CrownAnsis Villalon PornillosNo ratings yet

- Eternal vs. PhilamlifeDocument3 pagesEternal vs. PhilamlifeKingNoeBadongNo ratings yet

- Eternal Gardens v. PHILAMLIFEDocument3 pagesEternal Gardens v. PHILAMLIFESophiaFrancescaEspinosaNo ratings yet

- Memorial Park vs. Life Insurance Co. DisputeDocument8 pagesMemorial Park vs. Life Insurance Co. DisputeLolph ManilaNo ratings yet

- DLCD Forms Revised 2012Document46 pagesDLCD Forms Revised 2012Earl LarroderNo ratings yet

- Cooperative Status ChangesDocument24 pagesCooperative Status ChangesEarl LarroderNo ratings yet

- Request MedExamDocument1 pageRequest MedExamEarl LarroderNo ratings yet

- JA Investigating OfficerDocument2 pagesJA Investigating OfficerEarl LarroderNo ratings yet

- Civil Law Reviewer 2022Document12 pagesCivil Law Reviewer 2022Earl LarroderNo ratings yet

- Chain of Custody Form Nature of Case: Name of Suspect: BERTO MASIGASIG A.K.A. Tigas Time/Date/Place of Occurrence: Arresting Officer/Operating UnitDocument2 pagesChain of Custody Form Nature of Case: Name of Suspect: BERTO MASIGASIG A.K.A. Tigas Time/Date/Place of Occurrence: Arresting Officer/Operating UnitEarl LarroderNo ratings yet

- Request Determination PowderDocument1 pageRequest Determination PowderEarl LarroderNo ratings yet

- SALN BlankDocument3 pagesSALN BlankEarl LarroderNo ratings yet

- Philippine Drug Bust AffidavitDocument3 pagesPhilippine Drug Bust AffidavitEarl LarroderNo ratings yet

- Request MedExamDocument1 pageRequest MedExamEarl LarroderNo ratings yet

- Sworn Judicial Affidavit of Doctor Kris AquinoDocument6 pagesSworn Judicial Affidavit of Doctor Kris AquinoEarl LarroderNo ratings yet

- 2 SBU PW Criminal LawDocument41 pages2 SBU PW Criminal LawMary Grace BlancadNo ratings yet

- Request Powder DustingDocument1 pageRequest Powder DustingEarl LarroderNo ratings yet

- Receipt - Inventory of Seized ItemsDocument2 pagesReceipt - Inventory of Seized ItemsEarl LarroderNo ratings yet

- Request Powder DustingDocument1 pageRequest Powder DustingEarl LarroderNo ratings yet

- Civil Law Reviewer 2022Document12 pagesCivil Law Reviewer 2022Earl LarroderNo ratings yet

- Sample ComplaintDocument4 pagesSample ComplaintEarl LarroderNo ratings yet

- 2022 January Bar Exam Modified Pre Week Materials PDFDocument169 pages2022 January Bar Exam Modified Pre Week Materials PDFSyElfredGNo ratings yet

- Xu Alumni Information SurveyDocument2 pagesXu Alumni Information SurveyEarl LarroderNo ratings yet

- Sixto Chu vs. Mach Asia Trading Corp. (GR 184333, April 1 2013)Document1 pageSixto Chu vs. Mach Asia Trading Corp. (GR 184333, April 1 2013)Earl LarroderNo ratings yet

- Article 14. Sec. 1. Pierce v. Society of SistersDocument1 pageArticle 14. Sec. 1. Pierce v. Society of SistersEarl LarroderNo ratings yet

- Personal Data Sheet: Filipino Dual Citizenship by Birth by NaturalizationDocument4 pagesPersonal Data Sheet: Filipino Dual Citizenship by Birth by NaturalizationEarl LarroderNo ratings yet

- In Re LauretaDocument1 pageIn Re LauretaEarl LarroderNo ratings yet

- PT Profile (Editable) AFMARVELSDocument8 pagesPT Profile (Editable) AFMARVELSEarl LarroderNo ratings yet

- In Re LauretaDocument1 pageIn Re LauretaEarl LarroderNo ratings yet

- Director of Prisons v. Ang Cho Kio (conditional pardon violationDocument1 pageDirector of Prisons v. Ang Cho Kio (conditional pardon violationEarl LarroderNo ratings yet

- Notes For Ints Mid ExamDocument15 pagesNotes For Ints Mid ExamEarl LarroderNo ratings yet

- BCDA Vs COADocument6 pagesBCDA Vs COAEarl LarroderNo ratings yet

- SC rules Manila ordinance prohibiting short time hotel stays invalidDocument1 pageSC rules Manila ordinance prohibiting short time hotel stays invalidEarl LarroderNo ratings yet

- Marcos v. ManglapusDocument1 pageMarcos v. ManglapusEarl LarroderNo ratings yet

- Third Party Liability Insurance PDFDocument15 pagesThird Party Liability Insurance PDFAnonymous fk1QdO0% (1)

- Marketing-of-Financial-Services SAKSHIDocument9 pagesMarketing-of-Financial-Services SAKSHINageshwar SinghNo ratings yet

- TAX SITUS RULES UNDER PH LOCAL GOVERNMENT CODEDocument71 pagesTAX SITUS RULES UNDER PH LOCAL GOVERNMENT CODEErnie F. CanjaNo ratings yet

- Reliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy ScheduleDocument5 pagesReliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy Schedulezaid AhmedNo ratings yet

- Portuguese bank statement translationDocument4 pagesPortuguese bank statement translationalltime onetimeNo ratings yet

- An Analysis of The Workmen's Compensation Act, 1923Document16 pagesAn Analysis of The Workmen's Compensation Act, 1923tanmaya_purohit0% (1)

- Crop Insurance Schemes in MaharashtraDocument13 pagesCrop Insurance Schemes in MaharashtraDarshitaNo ratings yet

- Health InsuranceDocument1 pageHealth InsurancekishanprasadNo ratings yet

- Bancassurance Solution Brochure 16-11-06 1421289Document2 pagesBancassurance Solution Brochure 16-11-06 1421289alok0110No ratings yet

- ICICI Bank Sapphiro Credit Cards Membership KitDocument25 pagesICICI Bank Sapphiro Credit Cards Membership Kitshikharjain101995No ratings yet

- CM1A - 221 - EXAM - Final CleanDocument6 pagesCM1A - 221 - EXAM - Final CleanShuvrajyoti BhattacharjeeNo ratings yet

- ABSLI DigiShield Plan BrochureDocument6 pagesABSLI DigiShield Plan BrochureTushar SawaseNo ratings yet

- Sun Life Insurance Agent's Unlawful Dismissal CaseDocument5 pagesSun Life Insurance Agent's Unlawful Dismissal CaseTin LicoNo ratings yet

- Gold Prospecting and Metal Detecting Training in Cue W.A.: Training Course Information SheetDocument16 pagesGold Prospecting and Metal Detecting Training in Cue W.A.: Training Course Information SheetthailanNo ratings yet

- Instructions For Form 8962Document18 pagesInstructions For Form 8962jim1234uNo ratings yet

- Fa 43Document4 pagesFa 43api-309082881No ratings yet

- Pleaseur InsurenceDocument7 pagesPleaseur InsurencePingala SoftNo ratings yet

- Subcontractor Default InsuranceDocument18 pagesSubcontractor Default InsurancebdiitNo ratings yet

- Bajaj Allianz General Insurance Company LTD.: Contact No: Email - EnquiryDocument1 pageBajaj Allianz General Insurance Company LTD.: Contact No: Email - EnquirySayed AhmedNo ratings yet

- Gross Income: Definition Means All Gains, Profits, and IncomeDocument19 pagesGross Income: Definition Means All Gains, Profits, and IncomeKathNo ratings yet

- Sample Construction Joint Venture AgreementDocument18 pagesSample Construction Joint Venture AgreementAriaz BrinjiNo ratings yet

- Hong Kong Branch Dear Sir, I/We Request You To Establish With Your Correspondents in - (Country) Documentary Credit As Per Details BelowDocument5 pagesHong Kong Branch Dear Sir, I/We Request You To Establish With Your Correspondents in - (Country) Documentary Credit As Per Details BelowLalith11986No ratings yet

- Portfolio CheckupDocument84 pagesPortfolio CheckupBharat SahniNo ratings yet

- Csa SampleDocument12 pagesCsa SampleLaurice BarronNo ratings yet

- Bima Bachat Plan Licindiagov - inDocument5 pagesBima Bachat Plan Licindiagov - inSampiNo ratings yet

- 21 Valenzuela v. CADocument2 pages21 Valenzuela v. CARem SerranoNo ratings yet

- Contractors All RiskDocument5 pagesContractors All RiskArshad BashirNo ratings yet

- Risk Finance Decision Platform (RFDP) Solution Placemat - External Use - FinalDocument2 pagesRisk Finance Decision Platform (RFDP) Solution Placemat - External Use - FinalAM ENo ratings yet

- ICICI Pru Guaranteed Pension PlanDocument21 pagesICICI Pru Guaranteed Pension PlanNajuka BhandarkarNo ratings yet

- MA Auto Policy 8th EditionDocument37 pagesMA Auto Policy 8th EditionPrekelNo ratings yet