Professional Documents

Culture Documents

Flowchart Taxrem

Uploaded by

Yohanna J K GarcesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flowchart Taxrem

Uploaded by

Yohanna J K GarcesCopyright:

Available Formats

TAX REMEDIES WITH FLOW CHART

The Code provides the Government with two Remedies

1. Assessment

2. Collection

Two Kinds of assessment and Collection

1. Normal or ordinary

2. Abnormal or Extraordinary

Normal or Ordinary Assessment and Collection is available to the Government:

1. If the returned filed by the taxpayer is not false or fraudulent

2. Govt may make Assessment within 3 years after the last day prescribed by law

from the filing of the return not from the time of payment

3. When the return is filed beyond the period of filing prescribed by law, the 3 year

period shall be counted from the day of the filing of the return

Abnormal or Extra-ordinary Assessment and Collection is available to the Government:

1. If the taxpayers omits or fails to file his return

2. If the taxpayer filed the return but the return was fraudulent

3. If the return filed by the taxpayer was false

Two Remedies Under this kind of Assessment and Collection:

1. Assess and collect

-

prescriptive period is 10 years from the discovery of the non-filing of the return

or the fraudulent or false return

period of collection prescribes after 5 years from the date of final assessment

2. Collect without assessment

- there would be no prescriptive period for the assessment

- period for collection prescribes within 10 years from the discovery of non-filing

of the return or the fraudulent or false return

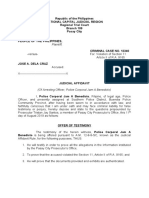

Procedure for Assessment

1. Pre-assessment Notice

2. Final Assessment Notice

PROCEDURE FOR ASSESSMENT:

Within 15 days from receipt of notice

File a Reply

Send

Notice

Again

Failed

to File

a

Preliminary

Assessment

Reply

Filed

Notice

a Reply

(PAN)

15 days upon receipt of PAN

Repeat PAN

File a Reply

Failed to File a

Reply

DECLARE IN DEFAULT,

SEND FORMAL LETTER OF

DEMAND & NOTICE TO PAY

TAX

Within 30 days from receipt of FAN

File a Protest

SUBMIT COMPLETE

SET OF

DOCUMENTS

BIR IS GIVEN 100

DAYS

TO DECIDE

PROTEST IS

DENIED

or

within 30 days from denial/lapse

APPEAL TO COURT

OF TAX APPEALS

Within 15 days from receipt

MOTION FOR

RECONSIDERATION

Within 15 days from receipt

APPEAL TO THE

COURT OF TAX

APPEALS

Within 15 days from receipt

EN BANC

APPEAL TO THE

SUPREME COURT

A.

Pre-Assessment Notice (PAN) - as a rule, PAN is issued to a taxpayer who fails to file a

return or files a return but fails pay the tax, pays the tax but the same is insufficient.

When is PAN is not necessary:

1.

2.

3.

4.

5.

When the finding for the deficiency tax is the result of Mathematical Error in the

computation of the tax appearing on the face of the return

When a discrepancy has been determined between the tax withheld and the

amount actually remitted by the withholding agent

When a tax payer opted to claim a refund or tax credit excess creditable

withholding tax for a taxable period was determined to have CARRIED OVER and

automatically applies the same amount claimed against the estimated tax liabilities

for the taxable quarter or quarters of the succeeding taxable year

When the EXCISE TAX DUE on excisable articles has not been paid.

When an article locally purchased or imported by an exempt person such as but

not limited to vehicles, capital equipment, machineries and spare parts has been

sold, traded or transferred to non=exempt persons

B. Final Assessment Notice (FAN) - as a rule FAN is issued when:

1. A taxpayer having received a PAN fails to respond within the period provided for by

the rules and regulations

2. The 5 instances enumerated where the pre- assessment is not necessary

C.

Protest- is a remedy afforded to the taxpayer in cases where the BIR issues a final

assessment to the taxpayer

Three (3) Forms of Protest:

1. Local Tax

2. Real Property Tax

3. Tariff and Customs Code

1.

Local Tax

Local Government Code provides when the local treasurer or his duly authorized

representative finds that correct taxes, fees or charges have not been paid, he shall

issue a notice of assessment stating the nature of the tax, fee or charge the amount of

deficiency, the surcharges, interest and penalties.

It is from this assessment that a taxpayer may file a protest within 60 days from

receipt of notice of assessment. If taxpayer does not file the protest within said period,

the assessment shall become final and executor.

Local treasurer shall decide the protest within 60 days from filing. He may either

grant or deny the protest.

GRANT - if he finds it wholly or partly meritorious

He shall issue a notice CANCELLING wholly or partly the assessment

DENY- wholly or partly if he finds that the assessment is wholly or partly CORRECT

with

NOTICE to the taxpayer.

The taxpayer is given a period of 30 days from receipt of denial or the lapse of 60day

period within w/c to appeal to the court of competent jurisdiction RTC.

RTC renders unfavorable decision, Taxpayer may appeal to CTA EN BANC

If still unfavorable, Taxpayer may appeal to SC

LOCAL TAX:

Tax Payer

File a Protest

within 60 days from receipt of notice of assessment

Failure to file

Assessment- becomes Final & Executory

may decide to

GRANT

Local

Treasurer

DENY

if correct

If meritorious

- Cancel Assessment Notice

w/ notice to the TP

30 days from receipt of denial or lapse

of 60 -day period

Appeal to

CTA EN

RTCBANC

SC

1. Real Property Tax made by a Tax Payer (TP) who is not satisfied with the action of

provincial or city assessor in the assessment of his property.

- A TP may within 60 days after from date of receipt of the written notice of assessment ,

appeal to the Local Board of Assessment Appeals (LBAA) of the province or city.

- Before this protest may be entertained, LGC requires TP first pay the tax (Payment

under protest)

- Protest may only be filed within 30 days from the payment of the tax (with annotation

on the receipt payment Under Protest)

- LBAA shall decide within 120 days from receipt of the appeal. The Board after hearing,

shall render a decision based on substantial evidence.

- LBAA renders unfavorable decision, TP may appeal to Central Board of Assessment

Appeals (CBAA).

- If still unfavorable, to CTA, then to SC

Tax Payer

File a Protest

Within 60 days from date of receipt of written notice of

assessment

Tax Payer

LBAA

pay tax (Payment under protest)

(within 120 days)

If unfavorable

CBBA

CTA

SC

2.

The Tariff and Custom Code- this includes those request for protest as well as for

forfeitures

First Situation:

If importer loses his case

-Appeal within 15 days Office of the Commissioner

-Importer may file appeal to the CTA sitting in Division within 30 days from

receipt of the decision

-Importer to file Motion for Reconsideration (MR)before the same division within

15 days, if still unfavorable,

-appeal before the CTA EN BANC

-if still unfavorable, importer may appeal within 15 days to SC

First Situation

Importer

Within 15 days appeal

Commis

sioner

CTA

Division

within 30 days from receipt of decision

If still unfavorable

MR

-within 15 days

CTA

Banc

If still unfavorable

En

Within 15 days if still unfavorable

SC

Second Situation- Importer prevails over the Government

-

There will be an automatic review within 5 days

Automatic Review shall be filed before:

1. Sec of Finance if value of commodity is 5M or more

2. Office of the Commissioner if value is less than 5M

The Commissioner is given a period of 30 days within which to decide.

If Commissioner REVERSES the ruling, he rules for the Govt, this decision

becomes final and executor.

If Commissioner AFFIRMS, the collector does not render a decision within

30 day period, then Automatic Review before the Secretary of Finance.

From the Automatic Review, the decision of the Secretary- if unfavorable

to importer, TP shall be appeal to CTA

Automatic

Review

To be filed to the Office of the Commissioner

30 days to decide

REVERSES

AFFIRMS

Final and

Executory

Automatic Review

Sec .of Finance

If unfavorable

CTA

You might also like

- FLOWCHART OF TAX REMEDIES by Pierre Martin D. ReyesDocument11 pagesFLOWCHART OF TAX REMEDIES by Pierre Martin D. ReyesKEMPNo ratings yet

- Sylt Academy Sues Student for Unpaid TuitionDocument8 pagesSylt Academy Sues Student for Unpaid TuitionmarjNo ratings yet

- Flowchart of Tax Refund RemediesDocument8 pagesFlowchart of Tax Refund RemedieschenezNo ratings yet

- Labor Settlement AgreementDocument2 pagesLabor Settlement AgreementJoyce MadridNo ratings yet

- Conflict of Laws Nationality Theory Case DigestsDocument11 pagesConflict of Laws Nationality Theory Case DigestsSam SaberonNo ratings yet

- Abs-Cbn v. Cta and NPC v. CbaaDocument2 pagesAbs-Cbn v. Cta and NPC v. CbaaRyan BagagnanNo ratings yet

- Indophil Textile Mills v. Adviento G.R. No. 171212Document7 pagesIndophil Textile Mills v. Adviento G.R. No. 171212Elijah AramburoNo ratings yet

- CIR vs TSC VAT Refund DisputeDocument2 pagesCIR vs TSC VAT Refund DisputeTheodore0176No ratings yet

- Banking LawsDocument72 pagesBanking LawsMariel MontonNo ratings yet

- Torts Cases For May 16 (26-30)Document18 pagesTorts Cases For May 16 (26-30)Rosalyn BahiaNo ratings yet

- Albano SL - Commercial LawDocument11 pagesAlbano SL - Commercial Lawjozb88No ratings yet

- Judicial Affidavit (Trial Technique) - AppropriateDocument7 pagesJudicial Affidavit (Trial Technique) - Appropriateann jhudelNo ratings yet

- PALS EvidenceDocument37 pagesPALS EvidenceIrish PDNo ratings yet

- 06 Mock - Verbal (2) - Class Sinagtala 2023Document9 pages06 Mock - Verbal (2) - Class Sinagtala 2023Elixer De Asis VelascoNo ratings yet

- Transportation Law Chapters 5 22 QADocument54 pagesTransportation Law Chapters 5 22 QA'Joshua Crisostomo'No ratings yet

- Digested Special Proceedings CasesDocument14 pagesDigested Special Proceedings CasesClark LimNo ratings yet

- Sample Counter AffidavitDocument2 pagesSample Counter AffidavitIllia ManaligodNo ratings yet

- Libel CasesDocument21 pagesLibel Casesgp_ph86No ratings yet

- Some New Cases of 2017 To 2019Document2 pagesSome New Cases of 2017 To 2019Ceasar AntonioNo ratings yet

- Perez Vs CA and BF Lifeman Insurance Corporation GR 112329Document3 pagesPerez Vs CA and BF Lifeman Insurance Corporation GR 112329Simon VertulfoNo ratings yet

- Facts:: Vda. de Manalo Vs CA GR No. 129242, January 16, 2001Document5 pagesFacts:: Vda. de Manalo Vs CA GR No. 129242, January 16, 2001Terence ValdehuezaNo ratings yet

- Pale AdrDocument44 pagesPale AdrRommel MondillaNo ratings yet

- ICARD vs. MASIGANDocument1 pageICARD vs. MASIGANShirley GarayNo ratings yet

- Republic of The Philippines Regional Trial Court Branch 26Document5 pagesRepublic of The Philippines Regional Trial Court Branch 26JenMarlon Corpuz AquinoNo ratings yet

- Loan Payment ComplaintDocument5 pagesLoan Payment ComplaintChristine Denise AbuelNo ratings yet

- Negative Pregnant Galofa Vs NeeDocument3 pagesNegative Pregnant Galofa Vs NeeLourdes EsperaNo ratings yet

- 178 Tax - CIR vs. First Express Pawnshop, GR Nos. 172045-46, 16 June 2009Document2 pages178 Tax - CIR vs. First Express Pawnshop, GR Nos. 172045-46, 16 June 2009Brandon BanasanNo ratings yet

- Tabuada Vs Tabuada DigestDocument3 pagesTabuada Vs Tabuada DigestAlly NisceNo ratings yet

- Flowchart of Remedies (NIRC)Document3 pagesFlowchart of Remedies (NIRC)Lorelyn FNo ratings yet

- Tax Remedies DiagramDocument15 pagesTax Remedies DiagramDomie AbataNo ratings yet

- Philippines murder evidenceDocument3 pagesPhilippines murder evidenceNika RojasNo ratings yet

- Besa Adverse ClaimDocument3 pagesBesa Adverse Claimjohn kenneth maguddayaoNo ratings yet

- Arraignment Script Philippines - Google SearchDocument2 pagesArraignment Script Philippines - Google SearchSarah Jane-Shae O. Semblante100% (1)

- Judicial Affidavit of Marco Apollo: (Please State Your Name and Personal Circumstances.)Document6 pagesJudicial Affidavit of Marco Apollo: (Please State Your Name and Personal Circumstances.)Jovy Norriete dela CruzNo ratings yet

- Remedies Under The LGC - Movido OutlineDocument20 pagesRemedies Under The LGC - Movido Outlinecmv mendoza100% (1)

- Le Roy V TathamDocument3 pagesLe Roy V TathamIc San PedroNo ratings yet

- G.R. No. 185715 January 19, 2011 People V Erlinda Capuno Y TisonDocument37 pagesG.R. No. 185715 January 19, 2011 People V Erlinda Capuno Y TisonkimNo ratings yet

- Canon 7Document14 pagesCanon 7AnneNo ratings yet

- Chattel MortgageDocument3 pagesChattel MortgageAlexylle Garsula de ConcepcionNo ratings yet

- Land dispute settled by Supreme CourtDocument6 pagesLand dispute settled by Supreme CourtRyanNo ratings yet

- Philippine court case over disputed family propertyDocument12 pagesPhilippine court case over disputed family propertyJevi RuiizNo ratings yet

- RULE 76-Rule 79Document45 pagesRULE 76-Rule 79Jucca Noreen SalesNo ratings yet

- Promissory NoteDocument1 pagePromissory NoteAj GauuanNo ratings yet

- Atty. Tamondong v. Judge Pasal (Full Text)Document7 pagesAtty. Tamondong v. Judge Pasal (Full Text)Charmaine GraceNo ratings yet

- Choice of Law - A SummaryDocument3 pagesChoice of Law - A SummaryRichardNo ratings yet

- British Overseas Airways Corp. G.R. No. L-65773-74: Supreme CourtDocument12 pagesBritish Overseas Airways Corp. G.R. No. L-65773-74: Supreme CourtJopan SJNo ratings yet

- Domalsin v. Spouses ValencianoDocument15 pagesDomalsin v. Spouses ValencianoAiyla AnonasNo ratings yet

- Digests On PartnershipDocument4 pagesDigests On PartnershipNeapolle FleurNo ratings yet

- Sample ReplevinDocument4 pagesSample ReplevinLee SomarNo ratings yet

- Motion to Reduce Bail in Qualified Theft CaseDocument2 pagesMotion to Reduce Bail in Qualified Theft CaseAttyKaren Baldonado-GuillermoNo ratings yet

- RP v. CA Tax Collection Case Presumption of ReceiptDocument6 pagesRP v. CA Tax Collection Case Presumption of ReceiptKarl MinglanaNo ratings yet

- Affidavit of Extraordinary PrescriptionDocument2 pagesAffidavit of Extraordinary PrescriptionPaul Joseph MercadoNo ratings yet

- Parke, Davis vs. Doctors' and TiburcioDocument2 pagesParke, Davis vs. Doctors' and TiburcioattyGezNo ratings yet

- Oppen Vs Compas DigestDocument3 pagesOppen Vs Compas DigestJR BillonesNo ratings yet

- Republic of The Philippines Regional Trial Court First Judicial Region Branch - Baguio CityDocument5 pagesRepublic of The Philippines Regional Trial Court First Judicial Region Branch - Baguio CityaldehNo ratings yet

- GROUP 1 Tax RemediesDocument6 pagesGROUP 1 Tax RemediesEunice Kalaw VargasNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- Tax RemediesDocument6 pagesTax RemediesArielle CabritoNo ratings yet

- Tax RemediesDocument6 pagesTax RemediesPATRICIA ANGELICA VINUYANo ratings yet

- TAX REMEDIES by Sababan Reviewer 2008 EdDocument10 pagesTAX REMEDIES by Sababan Reviewer 2008 EdNayadNo ratings yet

- Penalties RPCDocument1 pagePenalties RPCYohanna J K GarcesNo ratings yet

- Small ClaimsDocument66 pagesSmall ClaimsarloNo ratings yet

- Table of PenaltiesDocument3 pagesTable of PenaltiesYohanna J K GarcesNo ratings yet

- Rule On ForeclosureDocument4 pagesRule On ForeclosureAnonymous d6NosPxhYoNo ratings yet

- CanonDocument9 pagesCanonYohanna J K GarcesNo ratings yet

- Ra 6235 Anti Hijacking Law Act Prohibiting Acts Inimical To Civil AviationDocument2 pagesRa 6235 Anti Hijacking Law Act Prohibiting Acts Inimical To Civil Aviationprinze11202No ratings yet

- MerLaw InsuranceDocument102 pagesMerLaw InsuranceBantogen BabantogenNo ratings yet

- SCL-GBL in Digest MCQDocument32 pagesSCL-GBL in Digest MCQYohanna J K GarcesNo ratings yet

- Legal EthicsDocument12 pagesLegal EthicsHelen Grace AbudNo ratings yet

- DAP Case DigestDocument3 pagesDAP Case DigestSeffirion69No ratings yet

- Handouts - HandoutsDocument19 pagesHandouts - HandoutsYohanna J K GarcesNo ratings yet

- Notice of SaleDocument3 pagesNotice of SaleYohanna J K GarcesNo ratings yet

- RA 6645-Prescribing The Manner of Filling A Vacancy in The CongressDocument2 pagesRA 6645-Prescribing The Manner of Filling A Vacancy in The CongressRocky MarcianoNo ratings yet

- DAP Case DigestDocument3 pagesDAP Case DigestSeffirion69No ratings yet

- Cayetano vs. MonsodDocument2 pagesCayetano vs. MonsodYohanna J K GarcesNo ratings yet

- RA 7941 Partylist System - CONSTIDocument7 pagesRA 7941 Partylist System - CONSTIRogie FranciscoNo ratings yet

- Rule On ForeclosureDocument4 pagesRule On ForeclosureAnonymous d6NosPxhYoNo ratings yet

- PD 1807 - Procedure On The Waiving of Sovereign Immunity .....Document2 pagesPD 1807 - Procedure On The Waiving of Sovereign Immunity .....Rosa GamaroNo ratings yet

- RA 6645-Prescribing The Manner of Filling A Vacancy in The CongressDocument2 pagesRA 6645-Prescribing The Manner of Filling A Vacancy in The CongressRocky MarcianoNo ratings yet

- The Philippine Bill of 1902Document16 pagesThe Philippine Bill of 1902Yohanna J K GarcesNo ratings yet

- RA 7941 Partylist System - CONSTIDocument7 pagesRA 7941 Partylist System - CONSTIRogie FranciscoNo ratings yet

- R.A. No. 9189 - Oversea VotingDocument13 pagesR.A. No. 9189 - Oversea VotingYohanna J K GarcesNo ratings yet

- WWW - Denr.gov - PH Policy 1988 RA 1988-6656Document4 pagesWWW - Denr.gov - PH Policy 1988 RA 1988-6656rupertville12No ratings yet

- R.A. 8553 (Amending Sec. 41 (B), Local Government Code)Document1 pageR.A. 8553 (Amending Sec. 41 (B), Local Government Code)Yohanna J K GarcesNo ratings yet

- R.A. 7160 (Local Government Code)Document149 pagesR.A. 7160 (Local Government Code)Yohanna J K GarcesNo ratings yet

- Philippine Autonomy Act (Jones Law)Document10 pagesPhilippine Autonomy Act (Jones Law)Yohanna J K GarcesNo ratings yet

- R.A. 7160 (Local Government Code)Document149 pagesR.A. 7160 (Local Government Code)Yohanna J K GarcesNo ratings yet

- PIL SourcesDocument14 pagesPIL SourcesYohanna J K GarcesNo ratings yet

- PILNicaragua CaseDocument4 pagesPILNicaragua CaseYohanna J K GarcesNo ratings yet

- The First, First ResponderDocument26 pagesThe First, First ResponderJose Enrique Patron GonzalezNo ratings yet

- Final PaperDocument5 pagesFinal PaperJordan Spoon100% (1)

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Sto NinoDocument3 pagesSto NinoSalve Christine RequinaNo ratings yet

- Judgment at Nuremberg - Robert ShnayersonDocument6 pagesJudgment at Nuremberg - Robert ShnayersonroalegianiNo ratings yet

- Understanding Risk and Risk ManagementDocument30 pagesUnderstanding Risk and Risk ManagementSemargarengpetrukbagNo ratings yet

- Straight and Crooked ThinkingDocument208 pagesStraight and Crooked Thinkingmekhanic0% (1)

- Intern Ship Final Report Henok MindaDocument43 pagesIntern Ship Final Report Henok Mindalemma tseggaNo ratings yet

- CBSE Class 10 Geography Chapter 3 Notes - Water ResourcesDocument4 pagesCBSE Class 10 Geography Chapter 3 Notes - Water Resourcesrishabh gaunekarNo ratings yet

- UCSP Exam Covers Key ConceptsDocument2 pagesUCSP Exam Covers Key Conceptspearlyn guelaNo ratings yet

- Cross Culture Management & Negotiation IBC201 Essay TestDocument2 pagesCross Culture Management & Negotiation IBC201 Essay TestVu Thi Thanh Tam (K16HL)No ratings yet

- 2003 Patriot Act Certification For Bank of AmericaDocument10 pages2003 Patriot Act Certification For Bank of AmericaTim BryantNo ratings yet

- Reading Literature and Writing Argument 6th Edition Ebook PDFDocument33 pagesReading Literature and Writing Argument 6th Edition Ebook PDFsamantha.ryan702100% (33)

- A History of Oracle Cards in Relation To The Burning Serpent OracleDocument21 pagesA History of Oracle Cards in Relation To The Burning Serpent OracleGiancarloKindSchmidNo ratings yet

- 27793482Document20 pages27793482Asfandyar DurraniNo ratings yet

- March 3, 2014Document10 pagesMarch 3, 2014The Delphos HeraldNo ratings yet

- English For Informatics EngineeringDocument32 pagesEnglish For Informatics EngineeringDiana Urian100% (1)

- Guide to Sentence Inversion in EnglishDocument2 pagesGuide to Sentence Inversion in EnglishMarina MilosevicNo ratings yet

- Dedication: ZasmDocument15 pagesDedication: ZasmZesa S. BulabosNo ratings yet

- Seed Funding CompaniesDocument4 pagesSeed Funding Companieskirandasi123No ratings yet

- Gross Estate PDFDocument20 pagesGross Estate PDFSweet EmmeNo ratings yet

- New Earth Mining Iron Ore Project AnalysisDocument2 pagesNew Earth Mining Iron Ore Project AnalysisRandhir Shah100% (1)

- Carnival Panorama Deck Plan PDFDocument2 pagesCarnival Panorama Deck Plan PDFJuan Esteban Ordoñez LopezNo ratings yet

- Boardingpass VijaysinghDocument2 pagesBoardingpass VijaysinghAshish ChauhanNo ratings yet

- CHAPTER-1 FeasibilityDocument6 pagesCHAPTER-1 FeasibilityGlads De ChavezNo ratings yet

- Different Western Classical Plays and Opera (Report)Document26 pagesDifferent Western Classical Plays and Opera (Report)Chaorrymarie TeañoNo ratings yet

- Davies Paints Philippines FINALDocument5 pagesDavies Paints Philippines FINALAnonymous 0zrCNQNo ratings yet

- Sources and Historiography of Kerala CoinageDocument68 pagesSources and Historiography of Kerala CoinageRenuNo ratings yet

- Essential Rabbi Nachman meditation and personal prayerDocument9 pagesEssential Rabbi Nachman meditation and personal prayerrm_pi5282No ratings yet

- Appeal Procedure Change in Vietnam Limits New EvidenceDocument2 pagesAppeal Procedure Change in Vietnam Limits New EvidenceNguyen Thu HaNo ratings yet