Professional Documents

Culture Documents

Final Exam

Uploaded by

Genee Gregorio0 ratings0% found this document useful (0 votes)

24 views1 pagelaw

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentlaw

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views1 pageFinal Exam

Uploaded by

Genee Gregoriolaw

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

I.

FINAL EXAM

NEGOTIABLE INSTRUMENT

2014-2015

EXPLAIN WITH LEGAL BASIS

1. A make a note payable to the order of B. B negotiates it to C, C to D, D to E, E to F.

a. Can A give notice

b. If F notifies D, can E give notice of dishonor

2. I promise to pay to B or order P1, 000.00 at the PNB Sgd. A, maker who will pay

directly to B?

3. A, accommodation maker, makes a note in favor of payee B. B indorse to C, C to D, D to

E, E to F.

If F did not present the note for payment to A, can hold B, C, D, or E liable?

4. M makes a note payable to the order of P for P10, 000.00 and delivers the same to P.

without the consent of M; P changed the amount to 40,000.00. P then indorsed the note

to A, A to B, B to C, and C to H, holder. Can H enforced payment against M?

II.

TRUE OR FALSE (RIGHT MINUS WRONG)

1. When an instrument is negotiated to a prior party, the prior party can go after the

intervening parties for the amount of the instrument.

2. A holder may still be a holder in due course even if the instrument is not dated.

3. Payment in good faith before maturity which is made by the principal debtor to the

holder and without notice that his title is defective discharges the instrument.

4. The cancellation of a negotiable instrument which is made by the holder is presumed

to have been intentionally.

5. When the principal debtor becomes the holder in his own right before maturity, the

instrument is discharged by confusion or merger.

6. An absolute and unconditional renunciation made by the holder before, at or after

maturity in favor of the principal debtor discharges the instrument.

7. The certification of a check by a bank is equivalent to acceptance, and when

procured by the holder, the drawer and indorsers are discharged.

8. Acceptance is the significations by the maker of his assert to pay the instrument.

9. Presentment for payment is the production of the negotiable instrument to the

drawer for payment

10. Acceptance to pay only at a particular place is a conditional acceptance

I.

FINAL EXAM

NEGOTIABLE INSTRUMENT

2014-2015

EXPLAIN WITH LEGAL BASIS

1. A make a note payable to the order of B. B negotiates it to C, C to D, D to E, E to F.

c. Can A give notice

d. If F notifies D, can E give notice of dishonor

2. I promise to pay to B or order P1, 000.00 at the PNB Sgd. A, maker who will pay

directly to B?

3. A, accommodation maker, makes a note in favor of payee B. B indorse to C, C to D, D to

E, E to F.

If F did not present the note for payment to A, can hold B, C, D, or E liable?

4. M makes a note payable to the order of P for P10, 000.00 and delivers the same to P.

without the consent of M; P changed the amount to 40,000.00. P then indorsed the note

to A, A to B, B to C, and C to H, holder. Can H enforced payment against M?

II.

TRUE OR FALSE (RIGHT MINUS WRONG)

1. When an instrument is negotiated to a prior party, the prior party can go after the

intervening parties for the amount of the instrument.

2. A holder may still be a holder in due course even if the instrument is not dated.

3. Payment in good faith before maturity which is made by the principal debtor to the

holder and without notice that his title is defective discharges the instrument.

4. The cancellation of a negotiable instrument which is made by the holder is presumed

to have been intentionally.

5. When the principal debtor becomes the holder in his own right before maturity, the

instrument is discharged by confusion or merger.

6. An absolute and unconditional renunciation made by the holder before, at or after

maturity in favor of the principal debtor discharges the instrument.

7. The certification of a check by a bank is equivalent to acceptance, and when

procured by the holder, the drawer and indorsers are discharged.

8. Acceptance is the significations by the maker of his assert to pay the instrument.

9. Presentment for payment is the production of the negotiable instrument to the

drawer for payment

10. Acceptance to pay only at a particular place is a conditional acceptance

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Civ Pro (Riano) PDFDocument110 pagesCiv Pro (Riano) PDFJude-lo Aranaydo100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Rep PDFDocument1 pageRep PDFCruzHeng09181No ratings yet

- Crimpro FlowchartsDocument6 pagesCrimpro FlowchartsAnsis Villalon Pornillos100% (3)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Gustilo Vs RealDocument11 pagesGustilo Vs Realfritz frances danielleNo ratings yet

- Burgundy vs. ReyesDocument11 pagesBurgundy vs. ReyesDanet Galang SoldevillaNo ratings yet

- March 2018 - Notes - ObliconDocument37 pagesMarch 2018 - Notes - ObliconGenee GregorioNo ratings yet

- CRALaw - Labor Law Pre Week (2018)Document153 pagesCRALaw - Labor Law Pre Week (2018)freegalado100% (17)

- 17 Lecture Note Criminal Law EnforcementDocument13 pages17 Lecture Note Criminal Law EnforcementRegina MuellerNo ratings yet

- Code of Judicial ConductDocument14 pagesCode of Judicial ConductmariellepsantiagoNo ratings yet

- Systems of Registration.: LAND TITLES-refers To That Upon The Thing Which TheDocument2 pagesSystems of Registration.: LAND TITLES-refers To That Upon The Thing Which TheGenee GregorioNo ratings yet

- Tax1 Notes With TrainDocument57 pagesTax1 Notes With TrainYeahboi100% (1)

- Tax1 Notes With TrainDocument57 pagesTax1 Notes With TrainYeahboi100% (1)

- Class SyllabusDocument6 pagesClass SyllabusAnonymous qNE5a7dcNo ratings yet

- Systems of Registration.: LAND TITLES-refers To That Upon The Thing Which TheDocument2 pagesSystems of Registration.: LAND TITLES-refers To That Upon The Thing Which TheGenee GregorioNo ratings yet

- CPN-CSPC Protocol 26nov2014 PDFDocument136 pagesCPN-CSPC Protocol 26nov2014 PDFGenee GregorioNo ratings yet

- Land PDFDocument127 pagesLand PDFacheron_pNo ratings yet

- Change of PlaintiffDocument1 pageChange of PlaintiffGenee GregorioNo ratings yet

- Cases Covered by Katarungang Pambarangay ProceedingsDocument3 pagesCases Covered by Katarungang Pambarangay ProceedingsGenee GregorioNo ratings yet

- As Can Be Gleaned From Its AvermentsDocument1 pageAs Can Be Gleaned From Its AvermentsAnonymous qNE5a7dcNo ratings yet

- RA 9262 BrieferDocument2 pagesRA 9262 Briefernhaeizy100% (5)

- Rule of Procedure for Environmental Cases SimplifiedDocument8 pagesRule of Procedure for Environmental Cases SimplifiedJeoffrey Agnes Sedanza PusayNo ratings yet

- Primer Rules of Procedure For Environmental Cases-CIVIL ACTIONDocument7 pagesPrimer Rules of Procedure For Environmental Cases-CIVIL ACTIONkasamahumanrights100% (3)

- 17 Lecture Note Criminal Law EnforcementDocument13 pages17 Lecture Note Criminal Law EnforcementRegina MuellerNo ratings yet

- Summary of AM No. 09-6-8-SC (Rules On Environmental Cases)Document7 pagesSummary of AM No. 09-6-8-SC (Rules On Environmental Cases)phiongskiNo ratings yet

- Understanding Environmental Case Defenses and ProceduresDocument29 pagesUnderstanding Environmental Case Defenses and ProceduresKaryl Mae Bustamante OtazaNo ratings yet

- BbaDocument3 pagesBbaGenee GregorioNo ratings yet

- Labor law exam discussion and matching questionsDocument2 pagesLabor law exam discussion and matching questionsGenee GregorioNo ratings yet

- Contact On TypeDocument4 pagesContact On TypeGenee GregorioNo ratings yet

- Chapter 1Document5 pagesChapter 1Genee GregorioNo ratings yet

- Labor law exam discussion and matching questionsDocument2 pagesLabor law exam discussion and matching questionsGenee GregorioNo ratings yet

- History of LawDocument14 pagesHistory of LawBryan Doorgaya100% (1)

- Subido vs. CADocument4 pagesSubido vs. CAGRNo ratings yet

- Literature Review On Organisational JusticeDocument8 pagesLiterature Review On Organisational Justiceafdtslawm100% (1)

- by James Crawford. Cambridge, Cambridge University Press, 2013. 912 Pp. 90.00 (Hardcover)Document5 pagesby James Crawford. Cambridge, Cambridge University Press, 2013. 912 Pp. 90.00 (Hardcover)Ruwhelle ShelomethNo ratings yet

- Fuller and The Internal Morality of Law PDFDocument1 pageFuller and The Internal Morality of Law PDFAngelineNo ratings yet

- 4710 - Security OfficerDocument4 pages4710 - Security OfficercruscadenNo ratings yet

- People v. PanisDocument5 pagesPeople v. PanisMRNo ratings yet

- KERHCFBDocument30 pagesKERHCFBPratap K.PNo ratings yet

- Law of Crimes - II CRPC - Single SlideDocument55 pagesLaw of Crimes - II CRPC - Single Slidevijay chopraNo ratings yet

- Indian Evidence Act SummaryDocument175 pagesIndian Evidence Act SummaryA2 Sir Fan PageNo ratings yet

- Remedial Law - Case Digest - Week ViDocument19 pagesRemedial Law - Case Digest - Week ViAlicia Jane NavarroNo ratings yet

- Concepts of Offer, Acceptance and Discharge of ContractsDocument5 pagesConcepts of Offer, Acceptance and Discharge of ContractsMujah ClarkeNo ratings yet

- Abdula V Guiani CDDocument3 pagesAbdula V Guiani CDAriel LunzagaNo ratings yet

- Ordinance No Blowing of HornsDocument2 pagesOrdinance No Blowing of HornsDodj DimaculanganNo ratings yet

- Motion For Contempt - DETRDocument10 pagesMotion For Contempt - DETRMichelle RindelsNo ratings yet

- Legality of Object & ConsiderationDocument26 pagesLegality of Object & Considerationjjmaini13100% (1)

- Union Bank Vs CaDocument4 pagesUnion Bank Vs CaDianne YcoNo ratings yet

- M.santhi VS Pradeep Yadav Madras High CourtDocument23 pagesM.santhi VS Pradeep Yadav Madras High CourtMukul RawalNo ratings yet

- Summer Internship Report 30Document22 pagesSummer Internship Report 30Jatin SinghNo ratings yet

- Crimes Against PersonDocument6 pagesCrimes Against PersonJane Marry Magno MolinaNo ratings yet

- Employment contract and compensationDocument9 pagesEmployment contract and compensationYolly DiazNo ratings yet

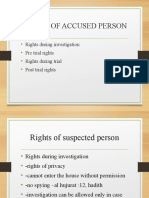

- Rights of Accused PersonDocument15 pagesRights of Accused PersonWawa RoSliNo ratings yet

- Patent Related Misconduct Issues in U S LitigationDocument251 pagesPatent Related Misconduct Issues in U S LitigationvmanriquezgNo ratings yet

- 63 Lim Vs PacquingDocument12 pages63 Lim Vs PacquingSan Vicente Mps IlocossurppoNo ratings yet

- Abetment IPC - Definition, Meaning, Ingredients of Abetment Under The IPCDocument29 pagesAbetment IPC - Definition, Meaning, Ingredients of Abetment Under The IPCbharath palacharlaNo ratings yet

- Contract Agreement - PaintingDocument2 pagesContract Agreement - PaintinggaylebugayongNo ratings yet

- Malpractice and Negligence - EditedDocument5 pagesMalpractice and Negligence - Editedwafula stanNo ratings yet

- 11 Indemnity and GuaranteeDocument9 pages11 Indemnity and GuaranteeNitish PokhrelNo ratings yet