Professional Documents

Culture Documents

CSR

Uploaded by

Hasan Babu KothaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CSR

Uploaded by

Hasan Babu KothaCopyright:

Available Formats

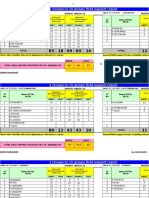

For the Calculation of C

Calculation of Net Profit as per section 198

Particulars

Net Profit Before Tax as per Financial Statements

Add: Credit shall be given as per sub-section (2), if not given

a

Bounties and subsidies received from:

- Central Government

- State Government

- Public Authorities

Less: Credit shall not be given as per sub-section (3), if given

a

Profit, by way of premium, on shares or debentures of the company which were

issued or sold by the company

b

Profit on sales by the company of forfeited shares

c

Profits of capital nature including profits from the sale of the understaing or any of

the undertakings of the company, or any part thereof

d

Profits from the sale of immovables property or fixed assets of a captial nature

comprised in the undertaking or any of the undertakings of the company unless the

business of the company consists, whether wholly or partly, of buying and selling

any such property or assets

e

Any changes in carring amount of any assets or of a liability recognised in equity

reserves including surplus in profit and loss account on measurement of the asset

or the liability at fair value

Less:

a

b

c

Sum shall be deducted as per sub-section (4), if not deducted

All the usual working charges

Director's remuneration

Bonus or commission paid or payable to any member of the company's staff, or to

engineer, technician, or person employed or engaged by the company, whether on

a whole time or on a part time basis

Any tax notified by the Central Government as being in the nature of a tax on

excess or abnormal profits

Any tax on business profits imposed for special reasons or in special circumstances

and notified by the Central government in this behalf

Interest on debentures issued by the company

f

g

h

i

j

Interest on mortgages executed by the company and on loans and advances

secured by a charge on its fixed assets or floating assets

Interest on unsecured loans and advances

Expenses on repairs, whether to immovable or to movable property, provided the

repairs are not of a capital nature

Outgoings, inclusive of contributions made under Section 181

Depreciation to the extent provided in Section 123

The excess of expenditure over income, which had arisen in computing the net

profits in accordance with Section 349 in any year which begins at or after the

commencement of this Act, in so far as such excess has not been deducted in any

subsequent year preceeding the year in respect of which the net profits have to be

ascertained

Any compensation or damages to be paid by virtue of any legal liability, including a

liability arising from a breach of contract

Any sum paid by way of insurance against the risk of meeting any liability such as

is referred to in the previous clause

o

Debts considered bad and written off or adjusted during the year of account

Add: Sum shall not be deducted as per sub-section (5), if deducted

a

Income tax and super tax payable by the company under the Income tax Act, 1961

or any other tax on the income of the company not falling uner clauses 3 (d) and

(e)

b

Any compensation, damages or payments made voluntarily the is to say, otherwise

than by virtue of any liability as referred in Clause 3(m)

c

Loss of capital nature including loss on sale of undertaking or any of the

undertakings of the company or of any part therof not including any excess

referred to in the proviso to Section 350 of the WDV of any assets which is sold,

discarded, demolished or destroyed over, its sale proceeds or its scrap value

d

Any change in carring amount of an assets or of a liability recognised in equity

reserve including surplus in profit and loss account on measurement of the assets

or the liability at fair value

Net Profit as per Section 198

Less:

1

Profit arising from any overseas branch or branches

2

Dividend received from Indian Companies covered U/s 135 of the act

Net Profit

Average Profit for preceding 3 years

Minimum amount of CSR

Actual Amount of Contribution

0

the Calculation of CSR U/S 135

FY 2014-15

FY2013-14

FY2012-13

###

###

###

(A)

2% of (A)

Remarks

Not Applicable

Credited directly to reserve and not in P&L

Not Applicable

Not Applicable

Included in above profit, hence deducted

Included in above profit, hence deducted

Already deducted

Already deducted

Already deducted

Not Applicable

Not Applicable

Not Applicable

Already deducted

Already deducted

Already deducted

Not Applicable

Depreciation as per Sch II of Companies Act,

2013.

Howerver, notification mentions if

financial

statements

are

prepared

in

accordance with provisions of the Companies

Act' 1956 shall not be required to be recalculated in accordance with the provisions

of the Act. Hence, already deducted

Not Applicable

Not Applicable

Not Applicable

Already deducted

Not deducted as PBT is considered to

calculate "Net Profit"

Not Applicable

Deducted from above profit, hence added

back

Deducted in above profit, hence added

You might also like

- July 2020 Claims UpcountryDocument18 pagesJuly 2020 Claims UpcountryHasan Babu KothaNo ratings yet

- MRS - Nacharam - 11 01 2021 NewDocument32 pagesMRS - Nacharam - 11 01 2021 NewHasan Babu KothaNo ratings yet

- TS GT Scheme CodesDocument4 pagesTS GT Scheme CodesHasan Babu KothaNo ratings yet

- Indian Languages - Working KnowledgeDocument46 pagesIndian Languages - Working KnowledgeHasan Babu KothaNo ratings yet

- Excel VBA IntroDocument95 pagesExcel VBA Introgh19612005No ratings yet

- TodayDocument1 pageTodayHasan Babu KothaNo ratings yet

- YesterdayDocument1 pageYesterdayHasan Babu KothaNo ratings yet

- 24 Male Male MR - Suleym 25 Male Male Mrs - Osbor 26 Male FemaleDocument1 page24 Male Male MR - Suleym 25 Male Male Mrs - Osbor 26 Male FemaleHasan Babu KothaNo ratings yet

- All Primary English SentencesDocument14 pagesAll Primary English SentencesSrinivas CherukuNo ratings yet

- ADILABAD1CDocument222 pagesADILABAD1CHasan Babu KothaNo ratings yet

- ADocument1 pageAHasan Babu KothaNo ratings yet

- Karim NagaDocument93 pagesKarim NagaHasan Babu KothaNo ratings yet

- Two Way Lookup in ExcelDocument1 pageTwo Way Lookup in ExcelHasan Babu KothaNo ratings yet

- VBA - Basics and AdvancedDocument136 pagesVBA - Basics and Advancedmanjukn100% (5)

- Khan Muhammad Kawser AhmedDocument1 pageKhan Muhammad Kawser AhmedHasan Babu KothaNo ratings yet

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetHasan Babu KothaNo ratings yet

- New Text DocumentDocument2 pagesNew Text DocumentHasan Babu KothaNo ratings yet

- Navata Road Transport Walkin Drive For Experience On 25th To 27th August 2016Document2 pagesNavata Road Transport Walkin Drive For Experience On 25th To 27th August 2016Hasan Babu KothaNo ratings yet

- Cash Management in MNCDocument20 pagesCash Management in MNCHasan Babu KothaNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- New Scribdword DocumentDocument1 pageNew Scribdword DocumentHasan Babu KothaNo ratings yet

- Monthly Return For Value Added Tax: 1% Rate PurchasesDocument3 pagesMonthly Return For Value Added Tax: 1% Rate PurchasesHasan Babu KothaNo ratings yet

- Cash Management in MNCDocument20 pagesCash Management in MNCHasan Babu KothaNo ratings yet

- Share CommDocument1 pageShare CommHasan Babu KothaNo ratings yet

- Tally Basic Short Cut KeysDocument2 pagesTally Basic Short Cut KeysgsparunNo ratings yet

- New Microsoft Office Excel WorksheetDocument250 pagesNew Microsoft Office Excel WorksheetHasan Babu KothaNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetHasan Babu KothaNo ratings yet

- New Scribdword DocumentDocument1 pageNew Scribdword DocumentHasan Babu KothaNo ratings yet

- Share CommDocument1 pageShare CommHasan Babu KothaNo ratings yet

- Bambino Agro Industries Ltd closing stock report as of 19/10/2016Document147 pagesBambino Agro Industries Ltd closing stock report as of 19/10/2016Hasan Babu KothaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Summer Internship Report on ARR Projection and Power Purchase Cost Optimization for BYPLDocument86 pagesSummer Internship Report on ARR Projection and Power Purchase Cost Optimization for BYPLFariyad AnsariNo ratings yet

- Estimating Walmarts Cost of CapitalDocument6 pagesEstimating Walmarts Cost of CapitalPrashuk Sethi0% (1)

- A Partial Adjusted Trial Balance Follows For Nolet LTD atDocument2 pagesA Partial Adjusted Trial Balance Follows For Nolet LTD atMiroslav GegoskiNo ratings yet

- A2 Advanced Investment Appraisal Technique新Document63 pagesA2 Advanced Investment Appraisal Technique新louisNo ratings yet

- Accounting treatment of ROU land acquisitionDocument3 pagesAccounting treatment of ROU land acquisitionVeronica RiveraNo ratings yet

- PLJ Volume 82 Number 1 - 03 - Myrvilen M. Alviar & Cherry Vi M. Saldua-Castillo - When Accounting Meets TaxDocument34 pagesPLJ Volume 82 Number 1 - 03 - Myrvilen M. Alviar & Cherry Vi M. Saldua-Castillo - When Accounting Meets TaxadonaiaslaronaNo ratings yet

- A Sample Sunflower Oil Production Business Plan TemplateDocument15 pagesA Sample Sunflower Oil Production Business Plan TemplateManase100% (8)

- Sub. Code 7Bcoe1ADocument11 pagesSub. Code 7Bcoe1AVELAVAN ARUNADEVINo ratings yet

- Outreach NetworksDocument15 pagesOutreach NetworksKaustav BhattacharjeeNo ratings yet

- Quick Books For LandlordsDocument207 pagesQuick Books For Landlordsabickerstaff100% (2)

- Foreign Currency Translation and ConsolidationDocument15 pagesForeign Currency Translation and ConsolidationYing LiuNo ratings yet

- Online Book AccountsDocument536 pagesOnline Book AccountsUnbeatable 9503No ratings yet

- Theory of AccountsDocument8 pagesTheory of AccountsAndrew WongNo ratings yet

- Investment PlanDocument23 pagesInvestment PlanKhizar WaheedNo ratings yet

- Chapter 13 - Statement of Cash FlowsDocument165 pagesChapter 13 - Statement of Cash FlowsElio BazNo ratings yet

- Financial Statement As of February 2018Document12 pagesFinancial Statement As of February 2018Jaijai Travel and ToursNo ratings yet

- Group 1. Stem DDocument58 pagesGroup 1. Stem Dlenard adiaNo ratings yet

- FIN - Cash ManagementDocument24 pagesFIN - Cash Management29_ramesh170No ratings yet

- Chapter 3/unit 4 Review Sheet 4/preparing The Income StatementDocument2 pagesChapter 3/unit 4 Review Sheet 4/preparing The Income Statementkamaljeet kaurNo ratings yet

- Acorn AAT L3 FinalAccountsPreparation MockExamOneDocument47 pagesAcorn AAT L3 FinalAccountsPreparation MockExamOneIra CașuNo ratings yet

- SA105-2018 (UK Property (SA105) - BlankisitDocument2 pagesSA105-2018 (UK Property (SA105) - BlankisitMal WilliamsonNo ratings yet

- Income Tax Guide UgandaDocument13 pagesIncome Tax Guide UgandaMoses LubangakeneNo ratings yet

- Cash ManagementDocument16 pagesCash Managementjayu91No ratings yet

- Computation Alexander Menlo Haydee Flores January 1 To 15Document3 pagesComputation Alexander Menlo Haydee Flores January 1 To 15USD 654No ratings yet

- BudgetDocument15 pagesBudgetJoydip DasguptaNo ratings yet

- 3 Decision MakingDocument6 pages3 Decision MakingAnushka DharangaonkarNo ratings yet

- Chapter 9 - Current Liabilities, Contingencies and Time ValueDocument8 pagesChapter 9 - Current Liabilities, Contingencies and Time ValueHareem Zoya WarsiNo ratings yet

- E Business Accounting Tally Notes IV SemDocument90 pagesE Business Accounting Tally Notes IV SemPrajwalNo ratings yet

- Accountancy-I Subjective PDFDocument4 pagesAccountancy-I Subjective PDFM Umar MughalNo ratings yet

- Cash Budget and Schedules for Garden SalesDocument11 pagesCash Budget and Schedules for Garden SalesAshish BhallaNo ratings yet