Professional Documents

Culture Documents

Chapter 3 New General Ledger

Uploaded by

Hasan Babu KothaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3 New General Ledger

Uploaded by

Hasan Babu KothaCopyright:

Available Formats

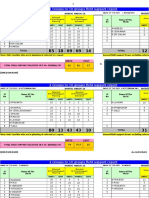

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Contents

1.

New General Ledger .................................................................................................................. 2

2.

Ledgers ........................................................................................................................................ 3

2.1

Define Currencies of Leading Ledger ................................................................................. 4

2.2

Define and Activate Non-Leading Ledgers......................................................................... 5

2.3

Assign Scenarios and Customer Fields to Ledgers .......................................................... 6

2.4

Activate Cost of Sales Accounting ....................................................................................... 8

2.5

Define Ledger Group ............................................................................................................. 9

2.6

Define Document Types for Entry View in Ledger .......................................................... 10

2.7

Define Document Types for Entry View in Ledger .......................................................... 11

2.8

Define Number Ranges for Entry View ............................................................................. 11

2.9

Activate New General Ledger Accounting........................................................................ 12

3.

Parallel Accounting .................................................................................................................. 13

3.1

Accounting Principles .......................................................................................................... 13

3.2

Assign Accounting Principles to Ledger Groups ............................................................. 13

4.

Document Splitting ................................................................................................................... 14

4.1

Define Document splitting Characteristics ........................................................................ 16

4.2

Activate Document splitting ................................................................................................. 17

4.3

Classify GL Accounts for Document splitting .................................................................. 18

4.4

Define Zero-Balance Clearing Account ............................................................................ 19

5.1

Define Valuation methods ................................................................................................... 21

5.2

Define Valuation Areas ........................................................................................................ 22

5.3

Assign Valuation Areas and Accounting Principles ........................................................ 22

5.4

Foreign Currency Valuation- Account Determination ..................................................... 23

6.

Real time integration of Controlling with Financial Accounting ......................................... 25

5.5

Define Variants for Real time integration .......................................................................... 26

5.6

Assign Variant for Real time integration to Company code ........................................... 27

5.7

Account Determination for Real time integration ............................................................. 27

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

1. New General Ledger

Let us understand this concept of SAP New GL structure and its use. Typically in SAP you can

depict parallel accounting. Which means you can carry out valuations and closing operations for

a company code according to local accounting principle and a second accounting principle

(parallel) i.e. the group accounting principle.

Till version 4.7 you could carry out the parallel accounting only by using

Additional accounts.

Certain GL accounts are common between 2 the accounting areas. Certain GL accounts

applicable only for local reporting Certain GL accounts applicable only for group reporting.

This kind of a set up requires 2 retained earnings accounts. The disadvantage of this set ups is

lot of GL accounts are required and sometimes reconciliations become difficult.

To do away with the above approach SAP has now introduced the SAP New GL

structure. In this approach parallel accounting is depicted using an Additional ledger.

The data for one accounting principle is stored in the general ledger. This ledger is known as

the Leading ledger or Leading valuation view. For each additional (parallel) accounting principle,

you create an additional ledger

The advantages of this approach are:1) You do not have to create any additional G/L accounts

2) You manage a separate ledger for each accounting principle

3) You can use the standard reporting functions to create a financial statement

4) You can have different fiscal year variants attached to each of the additional ledger.

5) You can make manual postings to any of the additional ledgers.

Configuration Scenario:

ABC Group of companies (Parent company) is a multinational company with companies across

the world with base in Germany. The company has decided to implement SAP for its subsidiary

ABC Electronics located in USA. ABC Group of companies have to use the common chart of

accounts. The currency in USA is USD. The Parent company wants the accounts to be

prepared based on Calendar year January to December. The Financial reporting should be in

EURO.

ABC Electronics Inc has a local reporting requirement as per Corporate Law

Based on the above requirements we need to configure the following using the SAP New GL

structure

Company code created 1009 ABC Electronics Inc.

The company code currency USD

Parallel currencies to be implemented EURO

Common chart of accounts COA

Ledger 0L (leading valuation view) reporting period Jan to Dec for group reporting

Ledger L9 (additional ledger) for local reporting under Corporate Law.

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

2. Ledgers

Define Ledgers for General Ledger Accounting

You define the ledgers that you use in General Ledger Accounting. The ledgers are based on a

totals table. SAP recommends using the delivered standard totals table FAGLFLEXT.

The following types of ledgers are available:

Leading Ledger

The leading ledger is based on the same accounting principle as that of the consolidated

financial statement. It is integrated with all subsidiary ledgers and is updated in all company

codes. You must designate one ledger as the leading ledger.

In each company code, the leading ledger automatically receives the settings that apply to that

company code: the currencies, the fiscal year variant, and the variant of the posting periods.

In our scenario the group reporting is handled by the Leading Ledger.

Non-Leading Ledger

The non-leading ledgers are parallel ledgers to the leading ledger. They can be based for

example on local accounting principles.

You must activate a non-leading ledger by company code.

For each ledger that you create, a ledger group of the same name is automatically created.

In our scenario the local reporting is handled by the Non- leading ledger.

Via Menus

Via Transaction Code

IMGFinancial Accounting( new) Financial Accounting Global

Settings(new) Ledgers LedgerDefine Ledgers for General Ledger

Accounting

SPRO

0L is the Leading Ledger (if already activated in your training system, no need to activate it

again)

Click on

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Update the following:-

Click on

2.1

Define Currencies of Leading Ledger

Via Menus

IMGFinancial Accounting( new) Financial Accounting Global

Settings(new) Ledgers LedgerDefine Currencies for Leading

Ledger

Via Transaction Code

SPRO

Here you specify the currencies to be applied in the leading ledger. You can make the following

settings for each company code

Click on

Update the following:-

Click

For company code 1009 USD has been defined as local currency and EUR as additional

currency.

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

2.2

Define and Activate Non-Leading Ledgers

IMGFinancial Accounting( new) Financial Accounting Global

Settings (new) Ledgers Ledger Define and Activate Non- Leading

Ledgers

Via Transaction Code

SPRO

Here you make the following settings for the non-leading ledgers for each Company code:

Via Menus

You activate the non-leading ledgers in the company code.

You can define additional currencies beyond that of the leading ledger.

The first currency of a non-leading ledger is always the currency of the leading ledger

(and hence that of the company code). For the second and third currencies of a nonleading ledger, you can only use currency types that you have specified for the

leading ledger.

You can define a fiscal year variant that differs from that of the leading ledger. If you

do not enter a fiscal year variant, the fiscal year variant of the company code is used

automatically.

You can specify a variant of the posting periods.

Click on

Update the following:-

Click on

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

2.3

Assign Scenarios and Customer Fields to Ledgers

Via Menus

Via Transaction Code

IMGFinancial Accounting( new) Financial Accounting Global

Settings(new) Ledgers Ledger Assign Scenarios and

Customer Fields to Ledgers

SPRO

In this IMG activity, you assign the following to your ledgers:

Scenarios:

This determines what fields in a ledger are updated when it receives posting from other

application components.

Custom Fields:

You can add custom fields (that you have already defined) to the ledger.

Versions:

This enables you to make general version settings for the ledger that depend on the fiscal

year. In the versions, you specify whether actual data is recorded, whether manual planning

is allowed, and whether planning integration with Controlling is activated.

Select

Click

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

To assign Profit center update you need to have profit center module active.

Click on

Click on

Update the following:-

Click on

and click on

and

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Select

Click on

Click on

Click on

2.4

Activate Cost of Sales Accounting

IMGFinancial Accounting( new) Financial Accounting Global

Settings(new)Ledgers Ledger Activate Cost of Sales Accounting

Via Transaction Code

SPRO

Cost of Sales Accounting: A type of profit and loss statement that matches the sales revenues

to the costs or expenses involved in making the revenue (cost of sales).

The expenses are listed in functional areas such as:

Manufacturing

Management

Sales and distribution

Research and development

Via Menus

Cost of sales accounting displays how the costs were incurred. It represents the economic

outflow of resources.

Click on

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

2.5

Define Ledger Group

IMGFinancial Accounting( new) Financial Accounting Global

Settings(new) Ledgers Ledger Define Ledger Group

Via Transaction Code

SPRO

Here you define ledger groups. A ledger group is a combination of ledgers for the purpose of

applying the functions and processes of general ledger accounting to the group as a whole.

Via Menus

When posting, for example, you can restrict the update of individual postings to a ledger group

so that the system only posts to the ledgers in that group.

You can combine any number of ledgers in a ledger group. In this way, you simplify the tasks in

the individual functions of General Ledger Accounting.

When a ledger is created, the system automatically generates a ledger group with the same

name. In this way, you can also post data to an individual ledger or access it when using

functions where you can only enter a ledger group and not ledgers.

You can change the name of the ledger group that was taken from the ledger.

You only have to create those ledger groups in which you want to combine several ledgers for

joint processing in a function.

You do not need to create a ledger group for all ledgers because the system

automatically posts to all ledgers when you do not enter a ledger group in a function.

Representative Ledger of a Ledger Group

The system uses the representative ledger of a ledger group to determine the posting period

and to check whether the posting period is open. If the posting period for the representative

ledger is open, the system posts in all ledgers of the group, even if the posting period of the

non-representative ledgers is closed. Each ledger group must have exactly one representative

ledger:

If the ledger group has a leading ledger, the leading ledger must always be identified as the

representative ledger.

If the ledger group does not have a leading ledger, you must designate one of the ledgers as

the representative ledger. If the ledger group has only one ledger, this ledger is then the

representative ledger. If the ledger group has more than one ledger, the system checks during

posting whether the representative ledger was selected correctly. This check is based on the

fiscal year variant of the company code:

We do not want to group the ledgers; therefore we do not do any configuration here.

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Select

Double click

Similarly, you can check L9 Ledgers.( No need to change anything here )

2.6

Define Document Types for Entry View in Ledger

IMGFinancial Accounting( new) Financial Accounting Global

Settings(new)Document Document Types Define Document

Types for Entry View in Ledger

Via Transaction Code

SPRO

Select your Non Leading Ledger

Via Menus

Press Enter and Provide below details

Click on

10

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

2.7

Define Document Types for Entry View in Ledger

IMGFinancial Accounting( new) Financial Accounting Global

Settings(new)Document Document Types Define Document

Types for General Ledger View

Via Transaction Code

SPRO

Select your Non Leading Ledger

Via Menus

Press Enter and provide below details

Click on

Similarly add all other document types for number range 99.

2.8

Define Number Ranges for Entry View

Via Menus

Via Transaction Code

IMGFinancial Accounting( new) Financial Accounting Global

Settings(new)Document Document Types Document Number

ranges for Entry View

SPRO

Provide Company code

Click on

11

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Click

2.9

and Click on

Activate New General Ledger Accounting

Via Menus

Via Transaction Code

IMGFinancial Accounting Financial Accounting Global Settings

Activate New General Ledger Accounting

FAGL_ACTIVATION

By activating New General Ledger Accounting, you achieve the following:

1) The functions for new General Ledger Accounting become available.

2) In the SAP Reference IMG, the previous Financial Accounting menu is replaced by the

Financial Accounting (New) menu. Under Financial Accounting Global Settings (New)

and General Ledger (New), you can make the settings for New General Ledger

Accounting.

3) You activate the tables of new General Ledger Accounting so that your posting data is

written to them.

If the New General Ledger is already activated in your system, this screen may not appear, then

you can ignore this step.

If you already use classic General Ledger Accounting in your production system, you need to

perform the migration of this data before you activate

12

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

3. Parallel Accounting

3.1

Accounting Principles

Via Menus

Via Transaction Code

IMGFinancial Accounting( new) Financial Accounting Global Settings

(new)Ledgers Parallel Accounting Define Accounting principles

SPRO

Here, you define your accounting principles. You then assign the desired ledger group to the

accounting principles. For performance reasons, you can combine several different accounting

principles in one entry; for example, you create one accounting principle for IAS/US GAAP. This

can be useful if, in an application, you have to create the data for each accounting principle,

even if the postings derived from the data are identical for each accounting principle.

Caution: The accounting principles that you have defined are available in various functions in

Financial Accounting, such as in the report for foreign currency valuation, in Manual Accruals.

SAP therefore advises you not to delete accounting principles.

Click on

and update the below details:

Click on

3.2

Assign Accounting Principles to Ledger Groups

Via Menus

Via Transaction Code

Click on

IMGFinancial Accounting( new) Financial Accounting Global Settings

(new) Ledgers Parallel Accounting Assign Accounting principles to

Ledger Groups

SPRO

and update the below details:

Click on

13

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

4. Document Splitting

You can use the document splitting procedure to split up line items for selected dimensions

(such as receivable lines by profit center) or to affect a zero balance setting in the document for

selected dimensions (such as segment). This generates additional clearing lines in the

document. Using the document splitting procedure is the prerequisite for as well as an essential

tool for drawing up completes financial statements for the selected dimensions at any time.

You can choose between displaying the document with the generated clearing lines either in its

original form in the entry view or from the perspective of a ledger in the general ledger views.

For document splitting to be possible, the individual document items and the documents must

be classified. Each classification corresponds to a rule in which it is specified how document

splitting

is

to

occur

and

for

which

line

items.

SAP delivers a set of standard rules that should usually prove sufficient. If not, you can define

your own set of rules and adapt these according to your needs.

14

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Document Splitting Method

The document splitting method defines how document splitting is performed.

For each document splitting method, you specify how the individual item categories are handled

in the individual business transactions. This includes, for example, whether the account

assignment of the customer item is copied from the revenue item in a customer invoice.

By assigning a document splitting method to a ledger, you activate document splitting for this

ledger according to the settings made in this method.

Business Transaction

A business transaction is an event that leads to value changes and thereby to data being

updated in Accounting.

For each business transaction, you can determine which item categories (can) appear in the

transaction.

Business transactions are only used in document splitting of New General Ledger Accounting

Business Transaction Variant

A business transaction variant is a special version of a business transaction.

In a business transaction variant, you can further limit the item categories that were specified in

the business transaction. Business transaction variants are only used in document splitting of

New General Ledger Accounting

Item category

The item category characterizes the items of an accounting document. It is derived from the

account type (such as asset and customer). In the G/L account area, there can be more than

one possible item category. An assignment has to be defined by means of the G/L account

number for the derivable item categories that are not automatically defined.

The item category is currently only used in document splitting in the General Ledger.

Example 1: Invoice

Suppose a vendor invoice containing the following items is entered:

Posting Key Account Segment Amount

31

Payables

-100

40

Expense 0001

40

40

Expense 0002

60

Document splitting then creates the following document in the General Ledger view:

Posting Key Account Segment Amount

31

Payables 0001

-40

31

Payables 0002

-60

40

Expense 0001

40

40

Expense 0002

60

15

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Example 2: Payment

The payment for the above vendor invoice then contains the following items when entered:

Posting Key Account

Segment Amount

50

Bank

-95

25

Payables

100

50

Cash Discount Received

-5

Document splitting then creates the following document in the General Ledger view:

Posting Key Account

Segment Amount

50

Bank

0001

-38

50

Bank

0002

-57

25

Payables

0001

40

25

Payables

0002

60

50

Cash Discount Received 0001

-2

50

Cash Discount Received 0002

-3

4.1

Define Document splitting Characteristics

IMGFinancial Accounting( new) General Ledger (New)

Business Transactions Document Splitting Define Document

Splitting Characteristics for General Ledger Accounting

Via Transaction Code

SPRO

In case of ABC Group, we have selected the following characteristics as criteria for document

splitting.

Via Menus

Click on

16

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Define Zero-Balance Clearing Account

For account assignment objects for which you want to have a zero balance setting, the system

checks whether the balance of account assignment object is zero after document splitting.

If this is not the case, the system generates additional clearing items. In this activity, you have to

create a clearing account for these additional clearing items.

You do not directly post to the zero balance clearing account. This is a system generated

posting to balance the books per segment or Profit center.

For example Dr Expense (Profit center PC1) and Cr Liabilities (Profit center PC2) then the

system balances not just the entry at the document level but also at the profit center level

So system generates an entry

Dr expense PC1

Cr zero balancing account PC1

Dr Zero balancing account PC2

Cr Liabilities PC2

Mandatory Field after Document Splitting

Specifies that the selected field must be filled with a value after document splitting.

Select the fields for which you require a complete balance statement and for which you cannot

accept any inaccuracies through unassigned postings.

If the indicator is set, then all postings where no value is set for the specified field after

document splitting are rejected with an error message.

4.2

Activate Document splitting

IMGFinancial Accounting( new) General Ledger (New) Business

Transactions Document Splitting Activate Document Splitting

Via Transaction Code

SPRO

Slitting method used here is a SAP delivered method, which contains splitting rules for different

transactions.

Via Menus

Click on

17

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

4.3

Classify GL Accounts for Document splitting

Via Menus

Via Transaction Code

IMGFinancial Accounting( new) General Ledger (New)

Business Transactions Document Splitting Classify GL Accounts

for Document Splitting

SPRO

Each business transaction that is entered is analyzed during the document splitting procedure.

In this analysis, the system determines for each line item whether it is an item that remains

unchanged or an item that should be split.

In order that document splitting recognizes how the individual document items are to be

handled, you need to classify them. You do this by assigning them to an item category. The item

category is determined by the account number. In this IMG activity, you need to assign the

following accounts in the system:

Revenue account

Expense account

Bank account/cash account

Balance sheet account

The classification of all other accounts is known to the system, so you do not have to enter

them here. You can enter an account interval since the system recognizes SAP-specific

classifications and does not allow SAP settings to be overwritten by your own settings.

Standard settings

Item categories are included in the standard SAP System. You can not define any additional

item categories. If the item categories included in the system do not meet your needs, contact

SAP

Click on

and provide Chart of Accounts

Update below details:

18

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Click on

4.4

Define Zero-Balance Clearing Account

Via Menus

Via Transaction Code

IMGFinancial Accounting( new) General Ledger (New)

Business Transactions Document Splitting Define Zero Balance

Clearing Account

SPRO

For account assignment objects for which you want to have a zero balance setting, the system

checks whether the balance of account assignment object is zero after document splitting.

If this is not the case, the system generates additional clearing items. In this activity, you have

to create a clearing account for these additional clearing items.

Select 000 and click on

19

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Click on

Click on

Example for Posting to Zero-Balance Clearing Account

For account assignment objects for which you want to have a zero balance setting, the system

checks whether the balance of account assignment object is zero after document splitting.

If this is not the case, the system generates additional clearing items. In this activity, you have to

create a clearing account for these additional clearing items.

This is a document splitting functionality which ensures that the Debit and Credit for the profit

center is equal with the help of zero balancing account. This account is used to create additional

line item to balance the entries for profit center in terms of Debit and Credit. Take an example of

entry without zero balanceDebit: Customer

Credit: Sales

100 Profit Center 50

100 Profit Center 100

Here the balance sheet for the profit center will not tally as there is difference in debit and credit.

When balancing field profit center is activated with zero balance account the entry will beDebit: Customer

100 Profit Center 50

Debit: Zero Balance account 100 Profit Center 100

Credit: Sales

100 Profit Center 100

Credit: To Zero Balance Acct 100 Profit Center 50

Thus the profit center balance sheet will always tally and the zero balance account will have

zero balance.

20

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

5. Valuation Methods and areas

5.1

Define Valuation methods

In this IMG activity, you define your valuation methods for the open items. With the valuation

method, you group specifications together which you need for the balance and individual

valuation.

Via Menus

IMGFinancial Accounting ( New) General Ledger Accounting (New)

Periodic processing Valuate Define valuation methods

Via Transaction Code

SPRO

Click on

Click on

The valuation is only displayed if the valuation difference between

the local currency amount and the valued amount is negative that is an exchange loss has

taken place. The valuation is carried out per item total.

The valuation is only displayed if, as a consequence, the new

valuation has a greater devaluation and/or a greater revaluation for credit entries than the

previous valuation. The valuation is calculated per item total.

If you select this procedure, revaluations are also taken into consideration .

21

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

If you select this method system only does a revaluation if applicable but

does not do devaluation where there is exchange loss.

5.2

Define Valuation Areas

Via Menus

Via Transaction Code

IMGFinancial Accounting ( New) General Ledger Accounting (New)

Periodic processing Valuate Define valuation areas

SPRO

Click on

Click on

5.3

Assign Valuation Areas and Accounting Principles

Via Menus

Via Transaction Code

IMGFinancial Accounting ( New) General Ledger Accounting (New)

Periodic processing Valuate Assign Valuation Areas and Accounting

Principles

SPRO

Click on

Click on

22

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

5.4

Foreign Currency Valuation- Account Determination

Financial Accounting ( New) General Ledger Accounting (New)

Periodic processing Valuate Foreign Currency valuation

Preparation for Automatic Postings for Foreign Currency Valuation

Via Transaction Code

OBA1

Create below GL Accounts in FS00 before performing this step

Via Menus

Double click on Transaction KDF and provide Chart of Accounts

23

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

Click on

Note: Similarly assign these Loss/Gain accounts for all the account for which you would like to

revaluate.

Loss: Here you enter the GL code for exchange loss, which is realized

Gain: Here you enter the GL code for exchange gain, which is realized.

Val. loss 1: Here you enter the GL code for unrealized exchange Loss on revaluation of open

items i.e. accounts receivable and accounts payable

Val. gain 1: Here you enter the GL code for unrealized exchange gain on revaluation of open

items i.e. accounts receivable and accounts payable

Bal. Sheet adj.1: Here you enter the GL code to which the receivable and payables adjustment

is posted during foreign currency valuation of open items.

24

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

6. Real time integration of Controlling with Financial Accounting

CO-FI real time reconciliation keeps the FICO books in harmony and data between them

remains reconciled. If you assign cross-PC or Business Area in CO, it posts data to FI and

FI and CO reports same balances PC wise and Bus Area wise. This is the reason behind

creation of FI document as you observed.

Why do we need CO-FI Reconciliation? A good receipt posting of Rs.100 has occurred

on internal order 1, which is assigned to company code one hundred percent of the value of

internal order No.1 is settled to internal order 2. This is assigned to company code 2.

A Settlement cost element is used for the settlement posting. When an order Settlement is

run, internal order 1 is credited with Rs.100 and internal order 2 is debited with Rs.100. The

balances of internal order 1 and internal order 2 are 0 and Rs.100, respectively. However,

the balances of company code 1 and 2 remain as they were prior to settlement. The reason:

settlement activity was internal to CO. No FI update occurred.

To place the FI company codes back in balance, the CO-FI reconciliation will be helpful. The

resulting FI postings would credit company code 1 for Rs.100 and debit company code 2 for

Rs.100. The internal CO activity will now have been accounted for in FI and company codes

are now in balance.

Posting Logic used in Reconciliation of CO with FI

Component Company Code

Posting

FI

CO

CO-FI

0001

0001

0001

CO

CO

FI-CO

0001

0002

0002

FI

0002

CO

CO

FI-CO

0001

0002

0002

FI

0002

Primary

Primary

No reconciliation

necessary

Primary (reposting)

Primary (reposting)

Reconciliation

Posting

Offsetting posting in

FI

Secondary

Secondary

Reconciliation

Posting

Offsetting posting in

FI

25

Account/Cost

Element

Amount

400000

400000

+500 USD

+500 USD

400000

400000

400000

-300 USD

+300 USD

+300 USD

200000 1)

-300 USD

600000

600000

210000 2)

-200 USD

+200 USD

+200 USD

215000 1)

-200 USD

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

1.

2.

For the reconciliation posting, the system creates an offsetting entry in FI in a company

code clearing account.

For secondary postings in CO, you must determine a clearing account in FI using

account determination, as secondary cost elements do not have an equivalent in FI. For

primary cost elements, you can specify a clearing account in the account determination,

to obtain a better overview of the reconciliation postings for example. However, this is

only strictly necessary for secondary postings.

The reconciliation posting was made here for company code 0002 only.

5.5

Define Variants for Real time integration

Via Transaction Code

IMGFinancial Accounting( new) Financial Accounting Global

Settings( new) Ledgers Real-time integration of controlling with

Financial Accounting Define Variants for Real Time Integration

SPRO

Click on

and update the below details:

Via Menus

Click on

26

venkat.emani@yahoo.com

CHAPTER 3 NEW GENERAL LEDGER CONFIGURATION

5.6

Assign Variant for Real time integration to Company code

Via Transaction Code

IMGFinancial Accounting( new) Financial Accounting Global

Settings( new)Ledgers Real-time integration of controlling with

Financial Accounting Assign Variants for Real Time Integration to

Company code

SPRO

Click on

and update the below details:

Via Menus

Click on

5.7

Account Determination for Real time integration

Via Menus

Via Transaction Code

Click on

IMGFinancial Accounting( new) Ledgers Real-time integration

of controlling with Financial Accounting Account Determination for

Real Time IntegrationDefine Account Determination for Real-Time

Integration

SPRO

and update below details.

Click on

27

venkat.emani@yahoo.com

You might also like

- New GL Configuration in Sap Ecc6Document29 pagesNew GL Configuration in Sap Ecc6Tani ShabNo ratings yet

- Configuring New General Ledger AccountingDocument52 pagesConfiguring New General Ledger AccountingJorge Da MataNo ratings yet

- Ledgers - SAP DocumentationDocument2 pagesLedgers - SAP DocumentationSrinivas MsrNo ratings yet

- Chapter 3 New General Ledger PDFDocument27 pagesChapter 3 New General Ledger PDFsowmyanavalNo ratings yet

- SAP New GL Configuration DocumentsDocument17 pagesSAP New GL Configuration DocumentsansulgoyalNo ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- NEW GL FUNCTIONALITY AUTOMATICALLY SPLITS ACCOUNTSDocument7 pagesNEW GL FUNCTIONALITY AUTOMATICALLY SPLITS ACCOUNTSpaiashokNo ratings yet

- Parallel Accounting in New General LedgerDocument5 pagesParallel Accounting in New General LedgerbrcraoNo ratings yet

- Common Errors in APP (Automatic Payment Program) - SAP BlogsDocument5 pagesCommon Errors in APP (Automatic Payment Program) - SAP BlogsAman VermaNo ratings yet

- Lockbox ConfigurationDocument22 pagesLockbox ConfigurationSagar ReddYNo ratings yet

- How To Create and Configure DME FileDocument3 pagesHow To Create and Configure DME FilesairamsapNo ratings yet

- THD - Document Splitting ConfigurationDocument16 pagesTHD - Document Splitting ConfigurationNaresh Kumar100% (1)

- Cross Company Code IssueDocument12 pagesCross Company Code IssueSATYANARAYANA MOTAMARRINo ratings yet

- Migrate Classic GL to NewGLDocument8 pagesMigrate Classic GL to NewGLtifossi6665No ratings yet

- Lock Box New SAP HANADocument22 pagesLock Box New SAP HANAkittuNo ratings yet

- Curso New GL SAPDocument47 pagesCurso New GL SAPFelipe VarelaNo ratings yet

- Year End Closing StepsDocument9 pagesYear End Closing StepsVijay RamNo ratings yet

- Chapter 24 Cost Center Accounting-1Document27 pagesChapter 24 Cost Center Accounting-1sowmyanavalNo ratings yet

- SAP FICO Depreciation AreasDocument2 pagesSAP FICO Depreciation AreasNeelesh KumarNo ratings yet

- Chapter 26 Profit Center AccountingDocument24 pagesChapter 26 Profit Center Accountingzachary kehoeNo ratings yet

- Chapter 30 LSMW and Balances Upload-1Document47 pagesChapter 30 LSMW and Balances Upload-1zachary kehoeNo ratings yet

- Useful Reports Tcode in SAP Financial AccountingDocument2 pagesUseful Reports Tcode in SAP Financial AccountingHuseyn Ismayilov50% (2)

- F-04 GL Account ClearingDocument8 pagesF-04 GL Account ClearingMillionn Gizaw0% (1)

- Sap Fi - Co Interview QuestionsDocument30 pagesSap Fi - Co Interview QuestionsTirupatirao Bashyam100% (1)

- Configuration Document Fi On S4 Hana 1809Document43 pagesConfiguration Document Fi On S4 Hana 1809Shah JeeNo ratings yet

- Asset Management Configuration GuideDocument23 pagesAsset Management Configuration GuideShine KaippillyNo ratings yet

- SAP Asset Accounting Changes-02jul21Document30 pagesSAP Asset Accounting Changes-02jul21Sekhar KattaNo ratings yet

- Clearing and Posting Specific To Ledger GroupsDocument5 pagesClearing and Posting Specific To Ledger GroupsNaveen SgNo ratings yet

- Cross-Company - Inter-Company Transactions - SAP BlogsDocument26 pagesCross-Company - Inter-Company Transactions - SAP Blogspuditime100% (1)

- Automatic Payment Program Run F110 - SAP TutorialDocument20 pagesAutomatic Payment Program Run F110 - SAP TutorialVenkateswarlu vNo ratings yet

- Sap Fi Retained Earnings AccountsDocument1 pageSap Fi Retained Earnings AccountsDebabrata SahooNo ratings yet

- Bad Debt ConfigrationDocument4 pagesBad Debt Configrationsudershan9No ratings yet

- Foreign Currency Valuation ConfigurationDocument9 pagesForeign Currency Valuation ConfigurationKRISHNANo ratings yet

- Cash Journal - Concept, Config, ManualDocument24 pagesCash Journal - Concept, Config, ManualKamonchai KNo ratings yet

- Sap New GL Configuration - Document - SMDocument23 pagesSap New GL Configuration - Document - SMArindam BhuinNo ratings yet

- Prerequisites: Parallel Accounting Using LedgersDocument4 pagesPrerequisites: Parallel Accounting Using LedgersjksdjkfhksjdhfNo ratings yet

- FIGL 322 Bank Reconciliation v07 PDFDocument92 pagesFIGL 322 Bank Reconciliation v07 PDFsandeep swamyNo ratings yet

- Q. 01 Explain The Client Concept of SAP?Document35 pagesQ. 01 Explain The Client Concept of SAP?Nithin JosephNo ratings yet

- Top 20 SAP FICO Interview Questions and Answers PDF - SVRDocument10 pagesTop 20 SAP FICO Interview Questions and Answers PDF - SVRManas Kumar SahooNo ratings yet

- TRM Template Desc en deDocument4 pagesTRM Template Desc en deSam KuNo ratings yet

- Sap Fi Asset Accounting Aa User GuideDocument29 pagesSap Fi Asset Accounting Aa User GuideHarsha B Narayanappa100% (1)

- SAP New GL #10 Document Splitting in Cross Company Code Vendor PaymentDocument9 pagesSAP New GL #10 Document Splitting in Cross Company Code Vendor Paymentspani92100% (1)

- Parallel Accounting in New General LedgerDocument7 pagesParallel Accounting in New General Ledgerfylee74100% (1)

- Chapter 18 Asset Management ConfigurationsDocument38 pagesChapter 18 Asset Management ConfigurationsSrinivas Yakkala100% (1)

- New GLAccountingDocument11 pagesNew GLAccountingapi-3709247100% (3)

- Special GLDocument4 pagesSpecial GLAmar NathNo ratings yet

- Finance Terms in FIDocument4 pagesFinance Terms in FIJitendra KatiyarNo ratings yet

- Recurring EntriesDocument10 pagesRecurring EntriesABNo ratings yet

- Accounting, Financial Close & Financial Closing Cockpit PDFDocument35 pagesAccounting, Financial Close & Financial Closing Cockpit PDFmario_jose33No ratings yet

- User Maual of Vendor Down PaymentDocument12 pagesUser Maual of Vendor Down PaymentAshwini Rajendra HukkireNo ratings yet

- SAP Year End Closing ProcessDocument10 pagesSAP Year End Closing ProcesssurendraNo ratings yet

- Specify Account Assignment Types For Account Assignment ObjeDocument3 pagesSpecify Account Assignment Types For Account Assignment ObjeharishNo ratings yet

- Configure Manual Accrual SettingsDocument7 pagesConfigure Manual Accrual Settingsramakrishna4pNo ratings yet

- Depreciation Key Calculation Methods and ParametersDocument10 pagesDepreciation Key Calculation Methods and ParametersM SAI SHRAVAN KUMAR100% (1)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- TS GT Scheme CodesDocument4 pagesTS GT Scheme CodesHasan Babu KothaNo ratings yet

- MRS - Nacharam - 11 01 2021 NewDocument32 pagesMRS - Nacharam - 11 01 2021 NewHasan Babu KothaNo ratings yet

- July 2020 Claims UpcountryDocument18 pagesJuly 2020 Claims UpcountryHasan Babu KothaNo ratings yet

- ADocument1 pageAHasan Babu KothaNo ratings yet

- Karim NagaDocument93 pagesKarim NagaHasan Babu KothaNo ratings yet

- YesterdayDocument1 pageYesterdayHasan Babu KothaNo ratings yet

- TodayDocument1 pageTodayHasan Babu KothaNo ratings yet

- Indian Languages - Working KnowledgeDocument46 pagesIndian Languages - Working KnowledgeHasan Babu KothaNo ratings yet

- Excel VBA IntroDocument95 pagesExcel VBA Introgh19612005No ratings yet

- 24 Male Male MR - Suleym 25 Male Male Mrs - Osbor 26 Male FemaleDocument1 page24 Male Male MR - Suleym 25 Male Male Mrs - Osbor 26 Male FemaleHasan Babu KothaNo ratings yet

- VBA - Basics and AdvancedDocument136 pagesVBA - Basics and Advancedmanjukn100% (5)

- Two Way Lookup in ExcelDocument1 pageTwo Way Lookup in ExcelHasan Babu KothaNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- Khan Muhammad Kawser AhmedDocument1 pageKhan Muhammad Kawser AhmedHasan Babu KothaNo ratings yet

- ADILABAD1CDocument222 pagesADILABAD1CHasan Babu KothaNo ratings yet

- Bambino Agro Industries Ltd closing stock report as of 19/10/2016Document147 pagesBambino Agro Industries Ltd closing stock report as of 19/10/2016Hasan Babu KothaNo ratings yet

- All Primary English SentencesDocument14 pagesAll Primary English SentencesSrinivas CherukuNo ratings yet

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetHasan Babu KothaNo ratings yet

- New Microsoft Office Excel WorksheetDocument250 pagesNew Microsoft Office Excel WorksheetHasan Babu KothaNo ratings yet

- Cash Management in MNCDocument20 pagesCash Management in MNCHasan Babu KothaNo ratings yet

- Tally Basic Short Cut KeysDocument2 pagesTally Basic Short Cut KeysgsparunNo ratings yet

- Share CommDocument1 pageShare CommHasan Babu KothaNo ratings yet

- Monthly Return For Value Added Tax: 1% Rate PurchasesDocument3 pagesMonthly Return For Value Added Tax: 1% Rate PurchasesHasan Babu KothaNo ratings yet

- New Text DocumentDocument2 pagesNew Text DocumentHasan Babu KothaNo ratings yet

- Cash Management in MNCDocument20 pagesCash Management in MNCHasan Babu KothaNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetHasan Babu KothaNo ratings yet

- Share CommDocument1 pageShare CommHasan Babu KothaNo ratings yet

- New Scribdword DocumentDocument1 pageNew Scribdword DocumentHasan Babu KothaNo ratings yet

- Navata Road Transport Walkin Drive For Experience On 25th To 27th August 2016Document2 pagesNavata Road Transport Walkin Drive For Experience On 25th To 27th August 2016Hasan Babu KothaNo ratings yet

- New Scribdword DocumentDocument1 pageNew Scribdword DocumentHasan Babu KothaNo ratings yet

- PCG Credential Ver2.0 - GeneralDocument26 pagesPCG Credential Ver2.0 - GeneralDimas CindarbumiNo ratings yet

- Us Gaap Ifrs ComparisonDocument169 pagesUs Gaap Ifrs ComparisonNigist Woldeselassie100% (2)

- Reviewer in Intermediate Accounting Mam F Revised 1docxDocument40 pagesReviewer in Intermediate Accounting Mam F Revised 1docxTACUYOG, Dhan Lesther D.No ratings yet

- Network Design Decisions in Supply Chain ManagementDocument41 pagesNetwork Design Decisions in Supply Chain ManagementJanmejai BhargavaNo ratings yet

- Accounting Cycle for a Service BusinessDocument5 pagesAccounting Cycle for a Service BusinessKristel Mae PayotNo ratings yet

- Northern Institute of ManagementDocument42 pagesNorthern Institute of ManagementsantoshguptNo ratings yet

- SaaS PDFDocument22 pagesSaaS PDFSmm SpdLoadNo ratings yet

- SRC Notes - Tambasacan 1.2Document9 pagesSRC Notes - Tambasacan 1.2Geymer IhmilNo ratings yet

- Accountancy Sample PaperDocument32 pagesAccountancy Sample PaperUjjwal TyagiNo ratings yet

- Retail Drug Store Financial Analysis and Audit RisksDocument9 pagesRetail Drug Store Financial Analysis and Audit RisksNeLson ALcanarNo ratings yet

- Essentials of Marketing ManagementDocument76 pagesEssentials of Marketing ManagementYodhia Antariksa100% (2)

- Entrepreneurship-1112 Q2 SLM WK6Document9 pagesEntrepreneurship-1112 Q2 SLM WK6April Jean CahoyNo ratings yet

- Maximizing Profits Through Efficient Inventory ManagementDocument17 pagesMaximizing Profits Through Efficient Inventory ManagementMonica Lorevella NegreNo ratings yet

- Unit 1 Material Financial AccountingDocument88 pagesUnit 1 Material Financial AccountingKeerthanaNo ratings yet

- Goods and Services DesignDocument4 pagesGoods and Services Designkim zamoraNo ratings yet

- BMC TemplateDocument2 pagesBMC TemplateVlad AlvazNo ratings yet

- An Organisation Study At": Internship Report ON by Prajwal A S Submitted ToDocument18 pagesAn Organisation Study At": Internship Report ON by Prajwal A S Submitted ToPRAJWAL A SNo ratings yet

- Time Value of Money: Brooks, (2013) Chapters 3, 4Document49 pagesTime Value of Money: Brooks, (2013) Chapters 3, 4DiannaNo ratings yet

- BCP Intro Deck Exec Sum ENG-CHI v.22.02.07.2Document3 pagesBCP Intro Deck Exec Sum ENG-CHI v.22.02.07.2hoang yenNo ratings yet

- Differences Between Cash and Master BudgetsDocument2 pagesDifferences Between Cash and Master BudgetsMathew Justin RajuNo ratings yet

- Marketing Presentation On AMUL RetailersDocument14 pagesMarketing Presentation On AMUL RetailersyogipatilNo ratings yet

- +supply Chain Course DescriptionsDocument1 page+supply Chain Course DescriptionsPalashShahNo ratings yet

- Firms in Competitive MarketsDocument41 pagesFirms in Competitive MarketsNita AstutyNo ratings yet

- Test Bank For Respiratory Care Anatomy and Physiology 3rd Edition BeacheyDocument24 pagesTest Bank For Respiratory Care Anatomy and Physiology 3rd Edition BeacheyKimColemanoayg100% (40)

- Cost Accounting Level 3/series 2-2009Document17 pagesCost Accounting Level 3/series 2-2009Hein Linn Kyaw100% (5)

- Governmental Accounting: Accountability: Term Used by GASB To Describe A Government's Duty To Justify The Raising andDocument14 pagesGovernmental Accounting: Accountability: Term Used by GASB To Describe A Government's Duty To Justify The Raising andAbdul Hakim MambuayNo ratings yet

- Marketing Assignment QuestionDocument4 pagesMarketing Assignment QuestionShamim RajaNo ratings yet

- Actividad 3. Evidencia 6Document3 pagesActividad 3. Evidencia 6Lina González0% (2)

- Tradewind Brochure 11x17Document2 pagesTradewind Brochure 11x17JAckNo ratings yet

- SegmentationDocument12 pagesSegmentationHarsimar Narula100% (1)