Professional Documents

Culture Documents

Form5IF Instructions Eng PDF

Uploaded by

Vijay Kumar Lokanadam0 ratings0% found this document useful (0 votes)

42 views2 pagesOriginal Title

Form5IF_Instructions_Eng.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

42 views2 pagesForm5IF Instructions Eng PDF

Uploaded by

Vijay Kumar LokanadamCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Write your Mobile Number on top of form to get SMS alerts

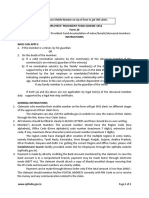

EMPLOYEES DEPOSIT LINKED INSURANCE SCHEME 1976

FORM 5(IF)

FOR CLAIMING INSURANCE AMOUNT IN CASE OF DEATH OF MEMBER

INSTRUCTIONS

WHO CAN APPLY:

1. Members of family (Nominees) nominated under EPF Scheme.

2. In case of no nomination, all members of family (except the major son, married daughters

having husband alive, and major son, married daughters having husband alive of the

deceased son of the deceased member.)

3. In case of no family, and no nomination, legal heir.

4. Guardian of a minor nominee/family member/legal heir.

GENERAL INSTRUCTIONS

1. The benefit under Employees Deposit Linked Insurance Scheme, 1976 is admissible to the

person(s) entitled to receive the Provident Fund accumulations of the deceased member only

if the members death occurred while in service.

2. The form should be submitted along with Form 20 (for claiming the Provident Fund dues and

Form 10 D/10C for Pension/Withdrawal Benefit as applicable) so that all the benefits under

the three Schemes may be processed.

3. All details should be written in BLOCK LETTERS and there should not be any overwriting.

4. In case the deceased member was a married female, her Husbands name should be

mentioned in the column 1 (b) of the form.

5. EPF Account Number: The account number should have the Region Code (two alphabets),

Office Code (three alphabets) code number (maximum 7 digits), extension (sub code, if any,

maximum three characters) and account number (maximum 7 digits).

The region codes have changed after creation of the multiple regions in some states,

namely Maharashtra, Tamil Nadu, Karnataka, West Bengal, Punjab, Gujarat, Andhra

Pradesh, Uttar Pradesh, Haryana and Delhi. For getting the correct Region and Office

Codes, please visit Establishment Search facility provided under link for Employees

through the epfindia website [epfindia.gov.in].

6. Details of Bank Account for receiving payment: Correct name, branch and address of the

Bank where the claimant is maintaining account should be furnished as payment is sent

directly to the Bank.

For ensuring correctness a copy of the blank/cancelled cheque should be attached

with the claim form.

Payment cannot be made through Postal Money Order as the maximum amount that can

be sent through MO is Rs 2000/- only.

www.epfindia.gov.in

Page 1 of 2

ATTESTATION OF THE CLAIM

The application should be got attested by the employer under whom the member was last

employed.

In case the establishment is closed and there is no Authorised Officer to attest the claim

form, it may be got attested with official seal by any of the following officials.

( 1) Magistrate( 2) A Gazetted Officer (3) Post/Sub-Post Master (4) President of the Village

Panchayat where there is not Union Board,( 5) Chairman/Secretary/Member of

Municipal/District Local Board,( 6) Member of Parliament/Legislative Assembly (7) Member of

CBT/Regional Committee EPF( 8) Manager of the Bank in which the Bank Account is

maintained (9) Head of any recognized educational institution

1.

2.

3.

4.

5.

DOCUMENTS TO BE ENCLOSED

Death Certificate of the member

Guardianship certificate if the claim on behalf of a minor family member/nominee/legal heir

is by other than the natural guardian.

Succession certificate in case of claim by the legal heir.

Copy of a cancelled/blank cheque of the bank account in which payment is opted.

In case the members were last employed under an establishment exempted under the EPF

Scheme 1952, the employer of such establishment should furnish the PF details of last 12

months under the Certificate part and also send an attested copy of the Members Nomination

Form.

www.epfindia.gov.in

Page 2 of 2

You might also like

- UAN Based Form10CDocument1 pageUAN Based Form10CNilesh RoyNo ratings yet

- Withdrawal Benefit Form for EPS PensionDocument4 pagesWithdrawal Benefit Form for EPS Pensionsandee1983No ratings yet

- Form 10-D Pension GuideDocument8 pagesForm 10-D Pension GuideSuganthi SukhiNo ratings yet

- SampleForm19 EnglishDocument2 pagesSampleForm19 EnglishShital KiranNo ratings yet

- EPFO - Form20Document4 pagesEPFO - Form20AbhilashPadmanabhanNo ratings yet

- Form10C Instructions EngDocument3 pagesForm10C Instructions EngWazidAliNo ratings yet

- Pen LCNM PDFDocument2 pagesPen LCNM PDFVijay Kumar Lokanadam0% (1)

- UAN Based Form19Document1 pageUAN Based Form19Chandrasekhar BabuNo ratings yet

- Form5IF PDFDocument4 pagesForm5IF PDFVijay Kumar LokanadamNo ratings yet

- Form 10 DDocument6 pagesForm 10 DilyaskureshiNo ratings yet

- Form20 Instructions Eng PDFDocument2 pagesForm20 Instructions Eng PDFVijay Kumar LokanadamNo ratings yet

- Form 31Document4 pagesForm 31hd99054No ratings yet

- Form 11 RevisedDocument3 pagesForm 11 RevisedakashsingheceNo ratings yet

- 5Document1 page5Bipin RawatNo ratings yet

- UAN Based Form10CDocument1 pageUAN Based Form10CNilesh RoyNo ratings yet

- Mail To CbseDocument1 pageMail To CbseVijay Kumar LokanadamNo ratings yet

- EPF SchemeDocument93 pagesEPF SchemeShirshak GhimireNo ratings yet

- EPFO Downloads ClaimformDocument2 pagesEPFO Downloads ClaimformVijay Kumar LokanadamNo ratings yet

- Employee's Pension Scheme, 1995Document52 pagesEmployee's Pension Scheme, 1995Satyam mishra100% (2)

- The Employees' Provident Fund Scheme, 1952Document3 pagesThe Employees' Provident Fund Scheme, 1952rakeshtrikha8668No ratings yet

- EPFO Downloads ReturnformsDocument3 pagesEPFO Downloads ReturnformsVijay Kumar LokanadamNo ratings yet

- The Employees' Provident Fund Scheme, 1952Document3 pagesThe Employees' Provident Fund Scheme, 1952rakeshtrikha8668No ratings yet

- The Employee's Deposit Linked InsuranceDocument6 pagesThe Employee's Deposit Linked InsuranceAnish GuptaNo ratings yet

- Windows Tuning Guide For Vspace 4Document9 pagesWindows Tuning Guide For Vspace 4Vijay Kumar LokanadamNo ratings yet

- EPFO Document FormatDocument1 pageEPFO Document FormatVijay Kumar LokanadamNo ratings yet

- 7 ASL NotificationDocument2 pages7 ASL NotificationVijay Kumar LokanadamNo ratings yet

- Epf ActDocument18 pagesEpf ActPraveen KumarNo ratings yet

- Kernel RegressionDocument18 pagesKernel RegressionVijay Kumar LokanadamNo ratings yet

- Jason SVM TutorialDocument34 pagesJason SVM TutorialNeha GundreNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Five recommendations for managing a cross-culture workforceDocument8 pagesFive recommendations for managing a cross-culture workforceAbdullah MujahidNo ratings yet

- 3 - 071.1.4acquisition, Development, Motivation, RetentionDocument5 pages3 - 071.1.4acquisition, Development, Motivation, RetentionShreekant ShahNo ratings yet

- Apex Mining Vs NLRC and CandidoDocument1 pageApex Mining Vs NLRC and CandidoLaw StudentNo ratings yet

- Pre Interview FormDocument3 pagesPre Interview FormUmair MehmoodNo ratings yet

- Job Security and LayoffDocument1 pageJob Security and Layoffpallab jyoti gogoiNo ratings yet

- The Great Pyramids of EgyptDocument4 pagesThe Great Pyramids of EgyptaninNo ratings yet

- PF Challan of Central Railway 107 Nos.Document1 pagePF Challan of Central Railway 107 Nos.Sukrut MayekarNo ratings yet

- Discourse Analysis - Be Careful With My Heart PDFDocument2 pagesDiscourse Analysis - Be Careful With My Heart PDFMic VillamayorNo ratings yet

- HRM Payroll SummaryDocument4 pagesHRM Payroll SummarywhattheeNo ratings yet

- Infosys HR Strategic TurnaroundDocument8 pagesInfosys HR Strategic TurnaroundPooja SinhaNo ratings yet

- Staff ContractDocument6 pagesStaff Contractapi-303451276No ratings yet

- Good Hands: Multipurpose CooperativeDocument2 pagesGood Hands: Multipurpose CooperativeMichie BantiloNo ratings yet

- Powerhouse Staff Builders Vs ReyDocument2 pagesPowerhouse Staff Builders Vs ReyAko Si Paula MonghitNo ratings yet

- Humor in The WorkplaceDocument46 pagesHumor in The WorkplaceVinay K Tangutur100% (2)

- HR Audit ChecklistDocument36 pagesHR Audit ChecklistSubhan Uddin Khattak100% (4)

- Return To Work Interview RecordDocument5 pagesReturn To Work Interview RecordFrancisco Ramirez100% (1)

- Professionals Podcasts - AchievementDocument4 pagesProfessionals Podcasts - AchievementFinga Hitam ManiesNo ratings yet

- Performance Evaluation in BankingDocument18 pagesPerformance Evaluation in BankingQuincy Osuoyah100% (1)

- Francisco V NLRCDocument2 pagesFrancisco V NLRCBenedict EstrellaNo ratings yet

- Job Shadowing QuestionaireDocument4 pagesJob Shadowing Questionairefocus16hoursgmailcomNo ratings yet

- A Handout in Health and Safety ManagementDocument10 pagesA Handout in Health and Safety ManagementroythomascNo ratings yet

- JCP Case StudyDocument4 pagesJCP Case StudyKaren FerrariNo ratings yet

- HRMS Table RelationshipDocument6 pagesHRMS Table RelationshipMitesh1605No ratings yet

- Human Resource ManagementDocument24 pagesHuman Resource ManagementCRESCENT LABSNo ratings yet

- Mariwasa vs. Leogardo-DigestDocument4 pagesMariwasa vs. Leogardo-DigestRose Mary G. EnanoNo ratings yet

- Compensation Survey and Questionnaire FinalDocument10 pagesCompensation Survey and Questionnaire FinalVarsha PremNo ratings yet

- Capital City Bank Case AnalysisDocument4 pagesCapital City Bank Case AnalysisTony PhanNo ratings yet

- McDonald's Employer BrandingDocument3 pagesMcDonald's Employer BrandingdiannageneNo ratings yet

- Affirmative Action, Equal Employment Opportunity & Non-Discrimination/Harassment Policy 1.10 Office of Human ResourcesDocument4 pagesAffirmative Action, Equal Employment Opportunity & Non-Discrimination/Harassment Policy 1.10 Office of Human ResourcesRahul BodhiNo ratings yet

- UFE vs. Vivar: Sales personnel not entitled to holiday pay; divisor should remain 251Document3 pagesUFE vs. Vivar: Sales personnel not entitled to holiday pay; divisor should remain 251kibb05No ratings yet