Professional Documents

Culture Documents

Equity Research Report - Airtel: About The Company

Uploaded by

Revoori SaisumanthOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Research Report - Airtel: About The Company

Uploaded by

Revoori SaisumanthCopyright:

Available Formats

EQUITY RESEARCH REPORT - AIRTEL

About the Company

Founded in 1995, Bharti Airtel Limited is an integrated telecommunications

company with operations in 20 countries across Asia and Africa. Headquartered

in New Delhi, India, the Company ranks amongst the top 5 mobile service

providers globally in terms of subscribers.

In India, the Companys product offerings include 2G, 3G and 4G services, fixed

line, high speed broadband through DTH, enterprise services including national &

international long distance services to carriers. In the rest of the geographies, it

offers 2G, 3G mobile services. All these services are rendered under a unified

brand airtel. The Company also manages passive infrastructure pertaining to

telecom operations through its subsidiary and joint venture entity.

Bharti Airtel had over 262 million customers across its operations at the end of

March 2014. The operations of Bharti Airtel in India and South Asia are divided

into two distinct customer business units with clear focus on B2C and B2B

segments. B2C services includes mobile services; telemedia services; and digital

TV services. B2B services includes airtel business; and passive infrastructure

services.

Key Ratios

Mar 2016

Mar 2015

Mar 2014

Mar 2013

Mar 2012

Debt-Equity Ratio

2.25

1.60

1.25

1.26

1.22

Long Term Debt-Equity Ratio

1.84

1.17

0.98

0.99

0.98

Current Ratio

0.28

0.30

0.41

0.40

0.38

0.43

0.46

0.44

0.43

0.44

666.25

696.13

678.49

636.71

414.89

18.23

16.78

13.18

11.70

12.05

1.84

3.37

2.34

2.06

2.60

PBIDTM (%)

37.07

36.26

34.23

31.34

33.52

PBITM (%)

15.90

15.59

16.01

12.09

14.83

PBDTM (%)

28.44

31.63

27.39

25.47

27.81

CPM (%)

25.42

25.92

21.74

22.20

24.65

APATM (%)

4.25

5.26

3.52

2.95

5.95

ROCE (%)

11.47

11.07

10.29

7.38

8.83

Turnover Ratios

Fixed Assets

Inventory

Debtors

Interest Cover Ratio

EQUITY RESEARCH REPORT - AIRTEL

RONW (%)

10.45

10.15

5.29

4.21

8.11

Bharti Airtels average current ratio over the last 5 financial years has been 0.28

times which indicates that the Company has been facing liquidity problems to

meet its short term obligations. Bharti Airtels average long term debt to equity

ratio over the last 5 financial years has been 0.98 times which indicates that the

Company is comfortably placed to meet its obligations. Bharti Airtels average

interest coverage ratio over the last 5 financial years has been 6.61 times which

indicates that the company has been generating enough for the shareholders

after servicing its debt obligations.

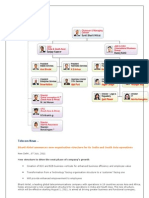

Ownership pattern

In its latest stock exchange filing dated 31 March 2016, Bharti Airtel reported a

promoter holding of 66.74 %. Large promoter holding indicates conviction and

sincerity of the promoters. We believe that a greater than 35 % promoter holding

offers safety to the retail investors.

At the same time, institutional holding in the Company stood at 25.60 %

(FII+DII). Large institutional holding indicates the confidence of seasoned

investors. At the same time, it can also lead to high volatility in the stock price as

institutions buy and sell larger stakes than retail participants

You might also like

- Outbound Hiring: How Innovative Companies are Winning the Global War for TalentFrom EverandOutbound Hiring: How Innovative Companies are Winning the Global War for TalentNo ratings yet

- Crs AirtelDocument20 pagesCrs AirtelManish SinghNo ratings yet

- Idea Vodafone Project FileDocument36 pagesIdea Vodafone Project FileSnehi Gupta50% (10)

- Krajewski OM11ge C09Document97 pagesKrajewski OM11ge C09mahmoud zregat100% (1)

- Managerial Economics and Business Strategy, 8E Baye Chap. 8Document49 pagesManagerial Economics and Business Strategy, 8E Baye Chap. 8love100% (2)

- Name of The Company Bharti Airtel Name of The Chairman Mr. Sunil Bharti Mittal Listed in Nse/Bse Financial Year End March 31Document7 pagesName of The Company Bharti Airtel Name of The Chairman Mr. Sunil Bharti Mittal Listed in Nse/Bse Financial Year End March 31Giridhar AmerlaNo ratings yet

- Bharti aIRTEL FinalDocument4 pagesBharti aIRTEL FinalPalak GuptaNo ratings yet

- Airtel's Advertising Strategies and SWOT AnalysisDocument21 pagesAirtel's Advertising Strategies and SWOT Analysisimdad1986No ratings yet

- FM-capital Structure AnalysisDocument19 pagesFM-capital Structure AnalysisNikhil ReddyNo ratings yet

- Company Profile AirtelDocument3 pagesCompany Profile Airtelcharacter2407100% (1)

- Advertising Strategy of Bharti Televentures LTDDocument21 pagesAdvertising Strategy of Bharti Televentures LTDaskarmrNo ratings yet

- 2004 05mainDocument175 pages2004 05mainSweta J MathNo ratings yet

- Indian Institute of Planning and Management (Delhi) : Master of Business AdministrationDocument47 pagesIndian Institute of Planning and Management (Delhi) : Master of Business AdministrationDeepak GaurNo ratings yet

- Bharti Airtel: Founded Headquarters Key PeopleDocument14 pagesBharti Airtel: Founded Headquarters Key Peoplemail2roy88No ratings yet

- AIRTEL1PPTDocument19 pagesAIRTEL1PPTpoojagkhandelwalNo ratings yet

- Introduction of AirtelDocument39 pagesIntroduction of AirtelAshutoshSharma50% (4)

- SWOT Analysis Bharti AirtelDocument37 pagesSWOT Analysis Bharti AirtelNitin Ahuja100% (1)

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- Airtel-Marketing Strategy NewDocument94 pagesAirtel-Marketing Strategy Newaccord123100% (1)

- Section 2 ReportDocument4 pagesSection 2 ReportAbhishek TyagiNo ratings yet

- Customer Insights Drive Business SuccessDocument67 pagesCustomer Insights Drive Business SuccessHem UpretiNo ratings yet

- Financial Ratio Analysis of Bharti AirtelDocument19 pagesFinancial Ratio Analysis of Bharti AirtelDivya Patel50% (2)

- Airtel-Overview of India's 2nd Largest Telecom OperatorDocument3 pagesAirtel-Overview of India's 2nd Largest Telecom OperatorAditya ChitaliyaNo ratings yet

- Brand Positioning of Bharti Airtel LimitedDocument40 pagesBrand Positioning of Bharti Airtel LimitedAshish SrivastavaNo ratings yet

- Analysis Bharti AirtelDocument70 pagesAnalysis Bharti Airtelshweta_4666450% (2)

- Idea Cellular Limited: Quarterly ReportDocument16 pagesIdea Cellular Limited: Quarterly ReportShilpa AgarwalNo ratings yet

- AirtelDocument26 pagesAirtelapi-3796907100% (10)

- Airtel Prokect For BBA Industry IntegratedDocument53 pagesAirtel Prokect For BBA Industry Integratedkabir070388No ratings yet

- Reliance Jio vs Airtel: A Comparative AnalysisDocument10 pagesReliance Jio vs Airtel: A Comparative AnalysisRashi MahajanNo ratings yet

- Bharti Airtel LimitedDocument28 pagesBharti Airtel Limited11pintu11No ratings yet

- Ans 1. The Type Merger and Acquisition Used in Vodafone India Company Is HorizontalDocument3 pagesAns 1. The Type Merger and Acquisition Used in Vodafone India Company Is Horizontalkanchan lataNo ratings yet

- Idea Vodafone Project FileDocument36 pagesIdea Vodafone Project FilePranjal jain100% (1)

- Bharti Airtel Report FinalDocument22 pagesBharti Airtel Report Finalapi-272974514No ratings yet

- S No. Headings Page NosDocument29 pagesS No. Headings Page Nosijain198950% (2)

- Project On AirtelDocument24 pagesProject On Airtelswastik DasNo ratings yet

- Imapct of International Business On AirtelDocument5 pagesImapct of International Business On Airtelneelabh1984No ratings yet

- Idea Cellular Telecommunication: Recent DevelopmentsDocument10 pagesIdea Cellular Telecommunication: Recent DevelopmentsAbhijeet PatilNo ratings yet

- FM Project ReportDocument6 pagesFM Project ReportmridhulaNo ratings yet

- Project Report on Bharti AirtelDocument26 pagesProject Report on Bharti AirtelJitesh JainNo ratings yet

- Recruitment, Selection Process of AirtelDocument36 pagesRecruitment, Selection Process of AirtelManish DiwaleNo ratings yet

- Micro-Environment Factors of AirtelDocument3 pagesMicro-Environment Factors of AirtelDeep NainwaniNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisDivam DamaNo ratings yet

- REPORT - Marketing-Strategy-of-Bharti-Airtel-LimitedDocument41 pagesREPORT - Marketing-Strategy-of-Bharti-Airtel-LimitedGaurav Srivastava0% (1)

- Bharti Airtel - SWAT and PESTAL AnalysisDocument7 pagesBharti Airtel - SWAT and PESTAL AnalysisArchu KamatNo ratings yet

- Bharti Airtel - SWAT and PESTAL AnalysisDocument7 pagesBharti Airtel - SWAT and PESTAL AnalysisArchu KamatNo ratings yet

- A Mini Project On AirtelDocument6 pagesA Mini Project On AirtelSagarNo ratings yet

- Airtel Org SstructureDocument5 pagesAirtel Org SstructureAntuvane AntuNo ratings yet

- Idea Cellular LTD.Document10 pagesIdea Cellular LTD.saurabhkumar0664No ratings yet

- A Marketing Project Report On Bharti Airtel LTD by Gaurav SwamiDocument74 pagesA Marketing Project Report On Bharti Airtel LTD by Gaurav Swaminipun_sabharwalNo ratings yet

- Project Report On Customer Satisfaction On Bharti Airtel: Govindaraju.B (1DS10MBA18)Document48 pagesProject Report On Customer Satisfaction On Bharti Airtel: Govindaraju.B (1DS10MBA18)Channabasappa M Kollari100% (1)

- 4 Stocks with Strong Fundamentals, Management Worth a LookDocument8 pages4 Stocks with Strong Fundamentals, Management Worth a LookPGM5HNo ratings yet

- "Market Potential of Data Product": A Project Report ONDocument51 pages"Market Potential of Data Product": A Project Report ONchavansnehalNo ratings yet

- FM Cia-3Document13 pagesFM Cia-3kowsheka.baskarNo ratings yet

- Air TelDocument7 pagesAir TelManoj KumarNo ratings yet

- Dissertation Report On Report On "Bharti Airtel Limited": Regional College of Management Autonomous BhubaneswarDocument24 pagesDissertation Report On Report On "Bharti Airtel Limited": Regional College of Management Autonomous BhubaneswarMukesh ParidaNo ratings yet

- Bharti Airtel LTD V/S Idea Cellular LTDDocument2 pagesBharti Airtel LTD V/S Idea Cellular LTDamalmpNo ratings yet

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterFrom EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNo ratings yet

- Summary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustFrom EverandSummary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustNo ratings yet

- JD Enu E&cDocument1 pageJD Enu E&cRevoori SaisumanthNo ratings yet

- AmulDocument17 pagesAmulRevoori SaisumanthNo ratings yet

- Airtel DLX Ar 2014-15Document284 pagesAirtel DLX Ar 2014-15Rohit KumarNo ratings yet

- IIT Kharagpur Student ResumeDocument2 pagesIIT Kharagpur Student ResumeRevoori SaisumanthNo ratings yet

- AccountingDocument3 pagesAccountingRevoori SaisumanthNo ratings yet

- 4239 SQFT Plot For Sale in DURAJPALLY, Suryapet - Property For Sale - QuikrHomesDocument5 pages4239 SQFT Plot For Sale in DURAJPALLY, Suryapet - Property For Sale - QuikrHomeskrishna chaitanyaNo ratings yet

- Faree2y's "ForsaDocument12 pagesFaree2y's "ForsaSawa SportNo ratings yet

- Cost Data PDFDocument30 pagesCost Data PDFGimhan GodawatteNo ratings yet

- Swot AnalysisDocument38 pagesSwot AnalysisAnis Lisa Ahmad100% (1)

- Marketing Unit 1Document38 pagesMarketing Unit 1Ritika AroraNo ratings yet

- Colgate Marketing StrategyDocument16 pagesColgate Marketing StrategyNagesh ShrivastavaNo ratings yet

- Ch-2 - Production Planning SystemDocument48 pagesCh-2 - Production Planning SystemRidwanNo ratings yet

- Starbucks Case StudyDocument26 pagesStarbucks Case StudyTayyaub khalidNo ratings yet

- ProbabilityDocument45 pagesProbabilityIIMnotesNo ratings yet

- 10 Principles of Organizational DNADocument5 pages10 Principles of Organizational DNAKelvin SumNo ratings yet

- Entrep Chapter 5Document12 pagesEntrep Chapter 5Sebastian CabunilasNo ratings yet

- Group Assignment 2 English ProfesionalDocument13 pagesGroup Assignment 2 English ProfesionalNurfadilla ZahraNo ratings yet

- Group3 pr2Document23 pagesGroup3 pr2Johnlloyd BarretoNo ratings yet

- Makalah Pemeliharaan BangunanDocument11 pagesMakalah Pemeliharaan BangunanazaNo ratings yet

- Gst66 Fill 13eDocument2 pagesGst66 Fill 13eJeff MNo ratings yet

- International Distribution ContractDocument3 pagesInternational Distribution ContractGlobal Negotiator100% (1)

- Music2go Players ManualDocument65 pagesMusic2go Players ManualKiran ShettyNo ratings yet

- Abstract NDocument25 pagesAbstract Nnuraini nabilahNo ratings yet

- The Impact of Culture On International MDocument16 pagesThe Impact of Culture On International Mstudent91No ratings yet

- Principles of Corporates CommunicationDocument29 pagesPrinciples of Corporates CommunicationLan Nhi NguyenNo ratings yet

- Parekh Anjali ResumeDocument1 pageParekh Anjali Resumeapi-529489747No ratings yet

- 10.6 Week Ten - Homework AssignmentDocument2 pages10.6 Week Ten - Homework Assignmentajmain faiqNo ratings yet

- Optimal Control and Dynamic Games PDFDocument351 pagesOptimal Control and Dynamic Games PDFNailulNellyIzzatiNo ratings yet

- FileDocument3 pagesFileabcabdNo ratings yet

- ENM 301 Speaking Examination - SVDocument1 pageENM 301 Speaking Examination - SVBích NgânNo ratings yet

- Giordano Case Write UpDocument6 pagesGiordano Case Write UpRaghav AggrawalNo ratings yet

- Recruitment & Selection of Sales Personnel FinaleDocument45 pagesRecruitment & Selection of Sales Personnel FinalezampakNo ratings yet

- (개정) 2022년 - 영어I - YBM (박준언) - 3과 - 적중예상문제 1회 실전 - OKDocument14 pages(개정) 2022년 - 영어I - YBM (박준언) - 3과 - 적중예상문제 1회 실전 - OK김태석No ratings yet