Professional Documents

Culture Documents

Receivables - Create A Customer Profile

Uploaded by

manukleoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Receivables - Create A Customer Profile

Uploaded by

manukleoCopyright:

Available Formats

29/08/2016

ReceivablesCreateaCustomerProfile|ERPWebTutorERPWebTutor

Oracle Financials

Receivables Create a Customer Profile

Why use Customer Proles?

CustomerProles are used to group customers with similar credit worthiness, businessvolume, and payment cycles. For each

prole class you can dene informationsuch as credit limits, payment terms, statement cycles, invoicing, and

discountinformation. You can also dene amount limits for your nance charges,dunning, and statements for each currency

which you dobusiness.

Dene your standard customer proles in the Customer ProleClasses window. These proles contain generic options you ca

use to group your

customers into broad categories. For example, you might dene three categories:one for prompt paying customers with

favorable credit limits; one for latepaying customers with high nance charge rates; and a third for customers whomostly pa

time, with discount incentives for early payment. You can also usethe prole class DEFAULT, which the system provides.

Assign a proleclass to each of your customers and addresses in the Customers window. Thecustomer prole class you assig

provides the default values, then you canoptionally customize these values to meet your specic requirements for

eachcustomer or address. If a prole is assigned to both a customer and one of thatcustomers addresses, the options set fo

the address take precedence over thoseset at the customer level.

Navigation:AR Manager > Customers > Prole Class

http://archive.erpwebtutor.com/lesson/receivablescreatecustomerprofile/

1/6

29/08/2016

ReceivablesCreateaCustomerProfile|ERPWebTutorERPWebTutor

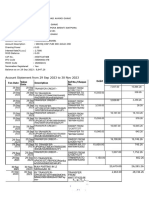

See the screenshots below. Clink the images to enlarge.

The following section will explain the variouselds that we see on the Prole Setup screen:

Fields Available at theCustomer Prole Class, Customer Account, or Site Level

AutomaticCash Rule Set: Determines the sequence of AutoCash Rules that PostQuickCash uses to update the customers

account balances. If an Automatic CashRule Set is not dened at the prole class or customer account or site level,then

Receivables uses the Automatic Cash Rule Set that you specify in the SystemOptions window.

AutoReceipts IncludeDisputed Items: Check the AutoReceipts Include Disputed Items check boxto include debit items that h

been placed in dispute when you createautomatic receipts for customers.

Balance Forward Billing: To send a single,consolidated bill to customers assigned to this prole class, select the Enablecheck

box. If you select the Enable check box, select the bill level and type ofprinting format for the balance forward bill.

BillLevel: The level, account or site, at which you can generate balanceforward bills.

Selecting Account as the Bill Level at the customerprole class or account prole level lets you generate a single

consolidatedaccount level bill for all sites (with Balance Forward Billing enabled) for anoperating unit.

The Bill Level at the site prole level is a read-onlyeld, defaulted from the account prole level. To generate site level bills,yo

must select Site as the bill level at the customer prole class or accountprole level and enable Balance Forward Billing at the

prolelevel.

Collector Name: Enter adefault Collector for customer accounts or sites.

Credit Analyst: Select thedefault credit analyst for customer accounts or sites. The credit analyst isresponsible for monitorin

http://archive.erpwebtutor.com/lesson/receivablescreatecustomerprofile/

2/6

29/08/2016

ReceivablesCreateaCustomerProfile|ERPWebTutorERPWebTutor

the creditworthiness of the account and for assistingin the resolution of credit-related issues. Oracle Credit

Managementautomatically assigns this analyst to credit review requests.

Credit Classication: Select the defaultcredit classication for customers assigned to this prole class. Updatedclassication

are assigned to the customer, either in Credit Management orthrough the Assign Customer Credit Classication concurrent

program. CreditManagement uses the credit classication for credit reviews.

Note: When a credit review is performed for acustomer who has relationships with other customer accounts and sites,

CreditManagement consolidates this information in the casefolder.

Credit Check: Ifyou select the Credit Check box, then Oracle Order Management will check thecustomers credit before creat

a new order, provided that the Payment Termand Order Type associated with the order also require credit checking.Receivab

does not check your customers credit when you create transactionsin Receivables.

Credit Limit:The total amount of credit in this currency to give to customers with thisprole. This eld is used by Oracle Orde

Management. If credit checking isactive for this customer and their outstanding credit balance exceeds thisamount, then all n

orders for this customer are automatically put on hold inOracle Order Management.

A customers outstanding credit balance iscalculated using Credit Check Rules that you dene in Oracle

OrderManagement.Formore information, see: Dene Credit Checking Rules in the Oracle OrderManagement Implementatio

Manual.

Note:If you are using Oracle Credit Management, then you should update credit limitsonly via the submission of credit

recommendations following a creditreview.

Currency: Thecurrency for which you want to dene amount limits. You dene currencies inthe Currencies window.

Dunning:To enable Oracle Advanced Collections to send dunning letters to customers withpast due items, check the Send

Dunning Letters check box.

EnableLate Charges: To assess late charges for customer accounts or sites,select the Enable Late Charges box.

GroupingRule: Enter the grouping rule to use for customers.

Match Receipts By: Enter a Match Receipts byrule to indicate the document type that customers will use to match receiptsw

invoices during AutoLockbox validation (optional).

Minimum and Maximum Charge Per Invoice: If thelate charge amount that Receivables calculates for a past due debit item i

thiscurrency is outside the entered range, then Receivables assesses the enteredminimum or maximum charge.

MinimumCustomer Balance: If the customer balance of past due items in thiscurrency is less than the minimum amount th

you specify here, then Receivablesdoes not assess late charges. Receivables ignores this option when the selectedlate charge

calculation method is Average Daily Balance.

MinimumInvoice Balance: If the balance of a past due invoice in this currency isless than the minimum invoice amount that

specify here, then Receivablesdoes not assess late charges on this item.

MinimumReceipt Amount: Oracle Receivables does not generate automatic receiptsin this currency that is less than this

amount. You can also dene a minimumreceipt amount for a receipt method. Receivables will use the larger of the twominim

receipt amounts when creating automatic receipts.

MinimumStatement Amount: The minimum outstanding balance in this currency that acustomer must exceed in order for

Receivables to generate a statement. Forexample, if you enter 100 in U.S. dollars, then Receivables does not generate

astatement if the customers outstanding balance is less than or equal to 100USD. The default minimum statement amount i

http://archive.erpwebtutor.com/lesson/receivablescreatecustomerprofile/

3/6

29/08/2016

ReceivablesCreateaCustomerProfile|ERPWebTutorERPWebTutor

Order Credit Limit: The maximum amount of anindividual order. This eld is used by Oracle Order Management. If

creditchecking is active for this customer and they exceed this amount on a new order,all new orders for this customer are p

on credit hold in Oracle Order Management.

The default order credit limit is the amount you enter inthe Credit Limit eld. If you enter a Credit Limit, you must either ente

anOrder Credit Limit or accept the default. The limit per order must be less thanor equal to the Credit Limit. You must enter

Credit Limit before entering an

Order Credit Limit.

Note: If you areusing Oracle Credit Management, then you should update credit limits only viathe submission of credit

recommendations following a creditreview.

Remainder RuleSet: Enter a Remainder Rule Set to specify how Post QuickCash applies anyleftover receipt amounts created

partial receipt application (optional). Ifyou do not enter a Remainder Rule Set, Receivables marks the remaining

amountUnapplied.

Review Cycle: Selecta review cycle period from the list of values. The periodic review cyclespecies how often to perform a c

review in Credit Management. Forexample, you can specify that the creditworthiness of an account is reviewedeach month.

Receipt Grace Days:Enter the number of Receipt Grace Days that you allow customers with thisprole to be overdue on rece

before they will be assessed late charges. Forexample, if you enter 10, customers have 10 days beyond the transaction due

dateto pay before they incur a penalty or late charges.

Note:Receipt grace days aect whether late charges are calculated for balanceforward bills using the Average Daily Balance

method.

Send Credit Balance: To send statements tocustomers, even if they have a credit balance, select the Send Credit Balanceche

box.

Statements: To sendstatements to customers, select the Send Statement check box.

Statement Cycle: If you select the SendStatement check box, enter a Statement Cycle. Statement cycles indicate howoften to

print your statements.

TaxPrinting: To indicate how to print tax on invoices for customers to whomyou assign this prole class, enter a Tax Printing

value. If you did not entera default Tax Printing value in the System Options window and you do not specifyone here, then

Receivables uses Total Tax Only as the default value when youprint invoices.

Payment Terms:Enter the default payment terms for customers. The payment terms available forselection depend on wheth

you enabled balance forward billing.

Toenable the update of default payment terms when entering transactions forcustomers, check the Override Terms check bo

To provide discount incentivesfor early payment to customers using this prole class, check the AllowDiscount check box. If y

allow discounts, enter the number of Discount GraceDays after the discount term date that customers using this prole class

cantake. If you do not allow discounts, Receivables skips this eld.

Tolerance: Enter the credit check tolerance(percentage over the credit limit). If a customer account exceeds this tolerancewh

credit checking is performed, then new orders for this account are put onhold. Fields Available Only at the Customer Account

SiteLevels.

These elds are available only at the customer account proleor customer account site prole level, in the Customer set

ofpages.

Account Status: Thestatus of this account. You can dene additional account statuses in theReceivables Lookups window by

selecting the lookup type Account Status.

http://archive.erpwebtutor.com/lesson/receivablescreatecustomerprofile/

4/6

29/08/2016

ReceivablesCreateaCustomerProfile|ERPWebTutorERPWebTutor

ClearingDays: You can enter a number of Clearing Days (optional) in the Customerset of pages. This is the number of days th

will take for a bank to clear areceipt that has been remitted (for factored receipts, this is also the numberof days after the

maturity date when the customer risk of non-payment iseliminated).

Collectible (% ):The percentage amount of this customers account balance that you expect tocollect regularly.

Credit Hold:If credit checking is active for your customer and the customer exceeds itscredit limit, then all new orders for the

customer are put on hold in OrderManagement, and Order Management automatically initiates a credit reviewrequest.

If the credit analyst determines that a customer should beplaced on credit hold, then Credit Management automatically place

the customer

on credit hold by selecting the Credit Hold check box on the Account Prolesubtab of the Accounts Overview page.

After you place the credit hold,you cannot create new orders in Order Management, nor can you create invoicesfor this

customer in Oracle Projects. However, you can still create newtransactions for this customer in Receivables.

Attention: Youcan use the Credit Hold check box to manually place customer accounts or siteson credit hold. If you use Cred

Management, however, then do not make manualupdates because Credit Management automatically updates thisbox.

CreditRating: The credit rating for this customer. You can dene additionalcredit rating names in the Receivables Lookups

window by selecting the lookuptype Credit rating for customers.

Attention: Credit Management does not usethe credit rating for credit reviews. Instead, it uses the credit classicationthat is

assigned to the customer either in Credit Management, or through theAssign Customer Credit Classication concurrent prog

MinimumDunning Amount: If a customer has a past due balance in this currencythat is greater than the minimum dunning

amount specied for this currency,then Oracle Advanced Collections selects this customer for dunning, providedthat the sco

engine or strategy uses this value.

Attention:If you have dened a dunning site for a customer and have set

theAR_USE_STATEMENTS_AND_DUNNING_SITE_PROFILE prole option to Yes, you mustdene a minimum dunning amount f

the customer.

MinimumDunning Invoice Amount: You can also dene the minimum invoice amount ina specic currency for a customer

account or site. If a customer does not haveany past due items in a specic currency with balances greater than the

minimuminvoice amount that you specify for this currency, then Advanced Collectionsdoes not select this customer for dunn

in this currency.

For example,a customers site has a minimum dunning amount of $100 and a minimum dunninginvoice amount of $40. If th

site has four past due USD invoices, each with abalance of $30, then Advanced Collections will not select this site for dunning

this currency, even though its total past due balance ($120) exceeds itsminimum dunning amount.

Next CreditReview: The next credit review date for an account is calculated basedupon the last review date and the review c

period. All eligible accountsmeeting the criteria are selected when you submit the Periodic Credit Reviewconcurrent program

Credit Management.

Risk Code: The credit risk code foryour customer. You can dene additional risk codes in the Receivables Lookupswindow by

selecting the lookup type Customer credit risk.

Note: These content is from Oracle AR Documentation asof Feb2012

Relevant SQL Query:

SELECT *FROMar_customer_prole_classes_v

WHERE prole_calss_name =TRAINING

http://archive.erpwebtutor.com/lesson/receivablescreatecustomerprofile/

5/6

29/08/2016

ReceivablesCreateaCustomerProfile|ERPWebTutorERPWebTutor

Questions

All content present on this website is property of ERPWebTutor.com and subject to international copyright laws. 2012-2014

http://archive.erpwebtutor.com/lesson/receivablescreatecustomerprofile/

6/6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- History of Microfinance in NigeriaDocument9 pagesHistory of Microfinance in Nigeriahardmanperson100% (1)

- HCL It City Lucknow Private LimitedDocument10 pagesHCL It City Lucknow Private Limitedmathur1995No ratings yet

- AFISCO Insurance Pool Ruled Taxable CorporationDocument2 pagesAFISCO Insurance Pool Ruled Taxable Corporationstickygum08100% (2)

- Aw T Fusion Tax Flow and Tax ScenariosDocument15 pagesAw T Fusion Tax Flow and Tax ScenariosmanukleoNo ratings yet

- 54706-AIM Documents ListDocument4 pages54706-AIM Documents Listlearnoracle19No ratings yet

- GL Consolidation: A Guide to Combining Financial ResultsDocument3 pagesGL Consolidation: A Guide to Combining Financial ResultsmanukleoNo ratings yet

- Journal Entry Template FusionDocument10 pagesJournal Entry Template FusionmanukleoNo ratings yet

- Interfaces and Conversions in Oracle ApplicationsDocument32 pagesInterfaces and Conversions in Oracle Applicationsvidyasagar00729No ratings yet

- Advanced Journal Approval RulesDocument19 pagesAdvanced Journal Approval Rulesvarachartered283No ratings yet

- SEO-optimized title for NGO society registration documentDocument4 pagesSEO-optimized title for NGO society registration documentmanukleoNo ratings yet

- Oracle Cloud WHT PayablesDocument6 pagesOracle Cloud WHT PayablesmanukleoNo ratings yet

- Fixed Assets Mass Additions White PaperDocument13 pagesFixed Assets Mass Additions White PaperVinay SinghNo ratings yet

- Updated Manu Kant Oracle Finance FunctionalDocument8 pagesUpdated Manu Kant Oracle Finance FunctionalmanukleoNo ratings yet

- Allocation ManagerDocument29 pagesAllocation ManagerSandeepNo ratings yet

- Income Tax RulesDocument8 pagesIncome Tax RulesmanukleoNo ratings yet

- Payment AdministratorDocument1 pagePayment AdministratormanukleoNo ratings yet

- Web ADIDocument2 pagesWeb ADImanukleoNo ratings yet

- Balance Sheet As Per Schedule VIDocument85 pagesBalance Sheet As Per Schedule VImanukleoNo ratings yet

- Oracle Financials BR DocsDocument52 pagesOracle Financials BR Docsmanukleo100% (1)

- Strategy for Running a Change Management OrganisationDocument39 pagesStrategy for Running a Change Management OrganisationypraviNo ratings yet

- SASCheatDocument2 pagesSASCheatKalaiyarasan VenkatesanNo ratings yet

- Navigating The PM and PPM Software SectorDocument11 pagesNavigating The PM and PPM Software SectormanukleoNo ratings yet

- Building An Effective Change Management Organisation PDFDocument55 pagesBuilding An Effective Change Management Organisation PDFCindyNo ratings yet

- Oracle GL Training TopicsDocument3 pagesOracle GL Training TopicsmanukleoNo ratings yet

- Important Question in Finance FunctionalDocument7 pagesImportant Question in Finance FunctionalqeulkiteNo ratings yet

- Art of Project Planning PDFDocument6 pagesArt of Project Planning PDFmanukleoNo ratings yet

- Deposit Structure for Membership - ALPHA CATEGORYDocument1 pageDeposit Structure for Membership - ALPHA CATEGORYmanukleoNo ratings yet

- Saurabh Sharma ASP Net WCF 5years 2017Document4 pagesSaurabh Sharma ASP Net WCF 5years 2017manukleoNo ratings yet

- Journal Import 311017 Journal Import OutputDocument12 pagesJournal Import 311017 Journal Import OutputmanukleoNo ratings yet

- ZONE-2: Agent Copy Web Check-InDocument1 pageZONE-2: Agent Copy Web Check-InmanukleoNo ratings yet

- Oracle Apps Financial Consultant ResumeDocument6 pagesOracle Apps Financial Consultant ResumemanukleoNo ratings yet

- Rup 9 PDFDocument4 pagesRup 9 PDFmanukleoNo ratings yet

- Viewing Data and Understanding Business Views in JD EdwardsDocument21 pagesViewing Data and Understanding Business Views in JD EdwardsmanukleoNo ratings yet

- Bank Statement2023 12 02 15 56 04 7980Document5 pagesBank Statement2023 12 02 15 56 04 7980kazeemshaikNo ratings yet

- Executive Summary My ReportDocument1 pageExecutive Summary My ReportNirob Hasan VoorNo ratings yet

- Activate ISD BSNL PrepaidDocument2 pagesActivate ISD BSNL PrepaidJitesh AgarwalNo ratings yet

- The Karnataka Pawnbrokers Act, 1961Document17 pagesThe Karnataka Pawnbrokers Act, 1961Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- A Study of Factors Affecting Selection of Financial Institution For Consumer Durable Loan - A Case Study On Emi-Card Offered by Bajaj FinservDocument43 pagesA Study of Factors Affecting Selection of Financial Institution For Consumer Durable Loan - A Case Study On Emi-Card Offered by Bajaj FinservShirish BagalNo ratings yet

- History of HSBC in AsiaDocument35 pagesHistory of HSBC in AsiaMonir HosenNo ratings yet

- NAFSCOB-Branch OperationsDocument379 pagesNAFSCOB-Branch OperationsAshoak VarmaNo ratings yet

- List of Kenya Counties and WardsDocument199 pagesList of Kenya Counties and WardsAnonymous E9xmcrKgSkNo ratings yet

- Top State Bank Customers in DelhiDocument56 pagesTop State Bank Customers in Delhidoon devbhoomi realtorsNo ratings yet

- 10 Steps To Making A MillionDocument10 pages10 Steps To Making A Millionadeng96No ratings yet

- China Bank December 2019 Holiday Banking ScheduleDocument8 pagesChina Bank December 2019 Holiday Banking ScheduleTheSummitExpressNo ratings yet

- HSBC's Global Operations and Financial PerformanceDocument40 pagesHSBC's Global Operations and Financial PerformanceIndu yadavNo ratings yet

- Statement of Account: Statement Date Credit Limit Minimum Payment Payment Due DateDocument4 pagesStatement of Account: Statement Date Credit Limit Minimum Payment Payment Due Datemyusuf_engineerNo ratings yet

- Certificate of Existence Group and Ind AnnuityDocument1 pageCertificate of Existence Group and Ind AnnuityRajesh MukkavilliNo ratings yet

- Case-Metropolitan Bank v. CA 194 SCRA 169Document5 pagesCase-Metropolitan Bank v. CA 194 SCRA 169Ouro BorosNo ratings yet

- 3rd PillarDocument3 pages3rd PillarKent Braña TanNo ratings yet

- Precious Metal AgreementDocument25 pagesPrecious Metal AgreementlboninsouzaNo ratings yet

- MOA of Actuarial Societ of BangladeshDocument22 pagesMOA of Actuarial Societ of BangladeshActuarial Society of BangladeshNo ratings yet

- Commercial Banks: Investopedia)Document3 pagesCommercial Banks: Investopedia)Minmin WaganNo ratings yet

- Edward Fagan Disbarment 2009 Disciplinary Review Board To Supreme Court of New JerseyDocument31 pagesEdward Fagan Disbarment 2009 Disciplinary Review Board To Supreme Court of New JerseyeliahmeyerNo ratings yet

- Account Details and Transaction History SummaryDocument11 pagesAccount Details and Transaction History Summaryizzat emirNo ratings yet

- Study online at quizlet.com/_1lwdnhDocument3 pagesStudy online at quizlet.com/_1lwdnhPatriciaNo ratings yet

- Thy Name Is LIC: About UsDocument63 pagesThy Name Is LIC: About UsMahendraNo ratings yet

- Coinbase UK and CB Payments User Agreement 14 March 2018 PDFDocument37 pagesCoinbase UK and CB Payments User Agreement 14 March 2018 PDFLiezel DahotoyNo ratings yet

- Civil ProcedureDocument3 pagesCivil Procedureangeline100% (1)

- SFI Regional Coordinator ManualDocument38 pagesSFI Regional Coordinator ManualMorgan JohnstoneNo ratings yet

- Novy ChargesDocument41 pagesNovy ChargesGavin RozziNo ratings yet