Professional Documents

Culture Documents

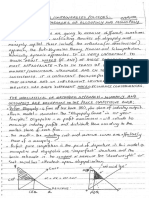

Tutorial 3 Week 3 Chapter 2

Uploaded by

drgaanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 3 Week 3 Chapter 2

Uploaded by

drgaanCopyright:

Available Formats

Mechanics of Futures Markets

41

Forward contracts differ from futures contracts in a number of ways. Forward

contracts are private arrangements between two parties, whereas futures contracts are

traded on exchanges. There is generally a single delivery date in a forward contract,

whereas futures contracts frequently involve a range of such dates. Because they are not

traded on exchanges, forward contracts do not need to be standardized. A forward

contract is not 1:1sually settled until the end of its life, and most contracts do in fact lead

to delivery of the underlying asset or a cash settlement at this time.

In the next few chapters we shall examine in more detail the ways in which forward

and futures contracts can be used for hedging. We shall also look at how forward and

futures prices are determined.

FURTHER READING

Gastineau, G. L., D. J. Smith, and R. Todd. Risk Management, Derivatives, and Financial

Analysis under SFAS No. 133. The Research Foundation of AIMR and Blackwell Series in

Finance, 200 1.

Jones, F. J., and R. J. Teweles. In: The Futures Game, edited by B. Warwick, 3rd edn. New Ycirk:

McGraw-Hill, 1998.

Jorion, P. "Risk Management Lessons from Long-Tenn Capital Management," European

Financial Management, 6, 3 (September 2000): 277-300.

Kawall~r, I. G., and P. D. Koch. "Meeting the Highly Effective Expectation Criterion for Hedge

Accounting," Journal of Derivatives, 1, 4 (Summer 2000): 79-87.

Lowenstein, R. When Genius Failed: The Rise and Fall of Long-Term Capital Management. New

York: Random House, 2000.

Questions and Problems (Answers in Solutions Manual)

2.1. Distinguish between the terms open interest and trading volume.

2.2. What is the difference between a local and a commission broker?

2.3. Suppose that you enter into a short futures contract to sell July silver for $10.20 per ounce

on the New York Commodity Exchange. The size of the contract is 5,000 ounces. The

initial margin is $4,000, and the maintenance margin is $3,000. What change in the

futures price will lead to a margin caii? What happens if you do not meet the margin caii?

2.4. Suppose that in September 2009 a company takes a long position in a contract on May

2010 crude oil futures. It closes out its position in March 2010. The futures price (per

barrel) is $68.30 when it enters into the contract, $70.50 when it closes out its position,

and $69.10 at the end of December 2009. One contract is for the delivery of 1,000 barrels.

What is the company's total profit? When is it realized? How is it taxed if it is (a) a hedger

and (b) a speculator? Assume that the company has a December 31 year-end.

2.5. What does a stop order to sell at $2 mean? When might it be used? What does a limit

order .to sell at $2 mean? When might it be used?

2.6. What is the difference between the operation of .the margin accounts administered by a

clearinghouse and those administered by a broker?

2.7. What differences exist in the way prices are quoted in the foreign exchange futures

market, the foreign exchange spot market, and the foreign exchange forward market?

42

CHAPTER 2

2.8. The party with a short position in a futures contract sometimes has options as to the

precise asset that will be delivered, where delivery will take place, when delivery will take

place, and so on. Do these options increase or decrease the futures price? Explain your

reasoning.

2.9. What are the most important aspects of the design of a new futures contract?

2.1 0. Explain how margins protect investors against the possibility of default.

2.11. A trader buys two July futures contracts on orange juice. Each contract is for the delivery

of 15,000 pounds. The current futures price is 160 cents per pound; the-initial margin is

$6,000 per contract, and the maintenance margin is $4,500 per contract. What price

change would lead to a margin call? Under what circumstances could $2,000 be withdrawn from the margin account?

2.12. Show that, if the futures price of a commodity is greater than the spot price during the

delivery period, then there is an arbitrage opportunity. Does an arbitrage opportunity

exist if the futures price is less than the spot price? Explain your answer.

2.13. Explain the difference between a market-if-touched order and a stop order.

2:14. Expl;;tin what a stotrlimit order to sell at 20.30 with a limit of 20.10 means.

2.15. At the end of one day a clearinghouse member is long 100 contracts, and the settlement

price is $50,000 per contract. The original margin is $2,000 per contract. On the following

day the member becomes responsible for clearing an additional20 long contracts, entered

into at a price of $51,000 per contract. The settlement price at the end of this day is

$50,200. How much does the member have to add to its margin account with the

exchange clearinghouse?

2.16. On July 1, 2009, a Japanese company enters into a forward contract to buy $1 million on

January 1, 2010. On September 1, 2009, it enters into a forward contract to sell $1 million

on January 1, 2010. Describe the profit or loss the company will make in yen as a function

of the forward exchange rates on July I, 2009, and September 1, 2009.

2.17. The forward price of the Swiss franc for delivery in 45 da:ys is quoted as 1.2500. The

futures price for a contract that will be delivered in 45 days is 0.7980. Explain these two

quotes. Which is more favorable_ for an investor wanting to sell Swiss francs?

2.18. Suppose you call your broker and issue instructions to sell one July hogs contract.

Describe what happens.

2.19. "Speculation in futures markets is pure gambling. It is not in the public interest to allow

speculators to trade on a futures exchange." Discuss this viewpoint.

2.20. Identify the comn;wdities whose futures contracts

Table 2.2.

hav~

the highest open interest in

2.21. What do you think would happen if an exchange started trading a contract in which the

quality of the underlying asset was incompletely specified?

2.22. "When a futures contract is traded on the floor of the exchange, it may be the case that the

open interest increases by one, stays the same, or decreases by one." Explain this statement.

2.23. Suppose that, on October 24, 2009, a company sells one April 2010 live cattle futures

contract. It closes out its position on January 21, 2010. The futures price (per pound) is

91.20 cents when it enters into the contract, 88.30 cents when it closes out its position,

and 88.80 cents at the end of December 2009. One contract is for the delivery of 40,000

Mechanics of Futures Markets

43

pounds of cattle. What is the total profit? How is it taxed if the company is (a) a hedger

and (b) a speculator? Assume that the company has a December 31 year-end.

2.24. A cattle farmer expects to have 120,000 pounds of live cattle to sell in 3 months. The live

cattle futures contract on the Chicago Mercantile Exchange is for the delivery of 40,000

pounds of cattle. How can the farmer use the contract for hedging? From the farmer's

viewpoint, what are the pros and cons of hedging?

2.25. It is July 2008. A mining company has just discovered a small deposit of gold. It will take

6 months to construct the mine. The gold will then be extracted on a more or less

continuous basis for 1 year. Futures contracts on gold are available on the New York

Commodity Exchange. There are delivery months every 2 months from August 2008 to

December 2009. Each contract is for the delivery of 100 ounces. Discuss how the mining

company might use futures markets for hedging.

Assignment Questions

2.26. A company enters into a short futures contract to sell 5,000 bushels of wheat for 450 cents

per bushel. The initial margin is $3,000 and the maintenance margin is $2,000. What price

change would lead to a margin call? Under what circumstances could $1,500 be withdrawn from the margin account?

2.27. Suppose that there are no storage costs for crude oil and the interest rate for borrowing or

lending is 5% per annum. How could you make money on January 8, 2007, by trading

June 2007 and December 2007 contracts? Use Table 2.2.

2.28. What position is equivalent to a long forward contract to buy an asset at K on a certain

date and a put option to sell it for K on that date.

2.29. The author's Web page (www.rotman.utoronto.ca/"'hull/data) contains daily closing

prices for crude oil and gold futures contracts. (Both contracts are traded on NYMEX.)

You are required to download the data and answer the following:

(a) How high do the maintenance margin levels for oil and gold have to be set so that

there is a 1% chance that an investor with a balance slightly above the maintenance

margin level on a particular day has a negative balance 2 days later? How high do

they have to be for a 0.1% chance? Assume daily price changes are normally

distributed with mean zero. Explain why NYMEX might be interested in this

calculation.

(b) Imagine an investor who starts with a long position in the oil contract at the

beginning of the period covered by the data and keeps the contract for the whole

of the period of time covered by the data. Margin balances in excess of the initial

margin are withdrawn. Use the maintenance margin you calculated in part (a) for a

1% risk level and assume that the maintenance margin is 75% of the initial margin.

Calculate the number of margin calls and the number of times the investor has a

negative margin balance. Assume that all margin calls are met in your calculations.

Repeat the calculations for an investor who starts with a short position in the gold

contract.

You might also like

- Futures TradingDocument74 pagesFutures TradingNathan50% (2)

- March StudynotesDocument133 pagesMarch StudynotesHuế Trịnh100% (5)

- Chapter 11 PPT Perloff Microecon 1eDocument33 pagesChapter 11 PPT Perloff Microecon 1edrgaan100% (2)

- Relative Strength RankingDocument12 pagesRelative Strength Rankingscriberone0% (1)

- Derivatives Test BankDocument36 pagesDerivatives Test BankNoni Alhussain100% (2)

- Futures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsFrom EverandFutures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsRating: 1 out of 5 stars1/5 (1)

- Microsoft Word - Bollinger Bands TutorialDocument13 pagesMicrosoft Word - Bollinger Bands Tutorialadoniscal100% (1)

- DerivativesDocument41 pagesDerivativesmugdha.ghag3921No ratings yet

- Summary of Freeman Publications's Iron Condor Options For BeginnersFrom EverandSummary of Freeman Publications's Iron Condor Options For BeginnersNo ratings yet

- Fundamentals of Futures and Options Markets 8th Edition Hull Solutions ManualDocument25 pagesFundamentals of Futures and Options Markets 8th Edition Hull Solutions ManualBeckySmithnxro98% (61)

- Algorithmic Trading and High Frequency TradingDocument147 pagesAlgorithmic Trading and High Frequency TradingJoseArnezNo ratings yet

- Risk and ReturnDocument43 pagesRisk and ReturnAbubakar OthmanNo ratings yet

- Chuong 2 Forward and Futures 2013 SDocument120 pagesChuong 2 Forward and Futures 2013 Samericus_smile7474100% (1)

- Full Download Fundamentals of Futures and Options Markets 8th Edition Hull Solutions ManualDocument20 pagesFull Download Fundamentals of Futures and Options Markets 8th Edition Hull Solutions Manualdwaulmary.v8zrh100% (27)

- Futures and Forwards: by Gopal Bhatta March 2009Document42 pagesFutures and Forwards: by Gopal Bhatta March 2009Rajiv LamichhaneNo ratings yet

- Support & Resistance GuideDocument3 pagesSupport & Resistance GuidesribabuNo ratings yet

- Series A Term Sheet SummaryDocument16 pagesSeries A Term Sheet SummaryJagmohan Singh SekhonNo ratings yet

- Dwnload Full Options Futures and Other Derivatives 10th Edition Hull Solutions Manual PDFDocument36 pagesDwnload Full Options Futures and Other Derivatives 10th Edition Hull Solutions Manual PDFwhalemanfrauleinshlwvz100% (11)

- Test Bank Financial InstrumentDocument13 pagesTest Bank Financial InstrumentMasi100% (1)

- Locked-In Range Analysis: Why Most Traders Must Lose Money in the Futures Market (Forex)From EverandLocked-In Range Analysis: Why Most Traders Must Lose Money in the Futures Market (Forex)Rating: 1 out of 5 stars1/5 (1)

- Book 1 Chapter 2Document4 pagesBook 1 Chapter 2Tanveer AhmadNo ratings yet

- Mechanics Futures MarketsDocument2 pagesMechanics Futures Marketsnew england brickNo ratings yet

- Chapter 3-Hedging Strategies Using Futures-29.01.2014Document26 pagesChapter 3-Hedging Strategies Using Futures-29.01.2014abaig2011No ratings yet

- Hull-OfOD8e-Homework Answers Chapter 02-Ver 02Document2 pagesHull-OfOD8e-Homework Answers Chapter 02-Ver 02Patrick BarkachiNo ratings yet

- 40 43Document4 pages40 43Luvnica VermaNo ratings yet

- Full Download Fundamentals of Futures and Options Markets 7th Edition Hull Solutions ManualDocument36 pagesFull Download Fundamentals of Futures and Options Markets 7th Edition Hull Solutions Manuallifelike.anenstkq2h100% (30)

- Dwnload Full Fundamentals of Futures and Options Markets 8th Edition Hull Solutions Manual PDFDocument35 pagesDwnload Full Fundamentals of Futures and Options Markets 8th Edition Hull Solutions Manual PDFbattleaxreconveyfo7g100% (8)

- Chapter 2 - Mechanics - Practice QuestionsDocument2 pagesChapter 2 - Mechanics - Practice QuestionsHamza NaeemNo ratings yet

- Dwnload Full Options Futures and Other Derivatives 8th Edition Hull Solutions Manual PDFDocument35 pagesDwnload Full Options Futures and Other Derivatives 8th Edition Hull Solutions Manual PDFwhalemanfrauleinshlwvz100% (10)

- Ch01 Forwrd and Futures, OptionsDocument34 pagesCh01 Forwrd and Futures, Optionsabaig2011No ratings yet

- Exercises Forward FuturesDocument1 pageExercises Forward FuturesNguyễn ThiNo ratings yet

- Derivatives Lecture Futures ForwardsDocument32 pagesDerivatives Lecture Futures ForwardsavirgNo ratings yet

- Futures and Forward MarketsDocument13 pagesFutures and Forward MarketsAlex Shi100% (1)

- Mechanics of Futures MarketsDocument20 pagesMechanics of Futures Marketsuuuuufffff0% (1)

- Chapter 1Document10 pagesChapter 1Luvnica VermaNo ratings yet

- Derivatives-Practice Questions-Students-BFSI-2020-21Document2 pagesDerivatives-Practice Questions-Students-BFSI-2020-21Sarah ShaikhNo ratings yet

- Ch02Hull Fund7eTestBankDocument2 pagesCh02Hull Fund7eTestBankRoopam Saxena0% (1)

- Hedging Strategies Using Futures ContractsDocument10 pagesHedging Strategies Using Futures ContractsAnonymous pPpTQrpvbrNo ratings yet

- Tutorial 4.solutionsDocument4 pagesTutorial 4.solutionsabcsingNo ratings yet

- 17.1.B. Forward Markets and Contracts and 17.1.C. Futures Markets and ContractsDocument8 pages17.1.B. Forward Markets and Contracts and 17.1.C. Futures Markets and ContractsAleksandra Bradić-MartinovićNo ratings yet

- Chapter 2 - Practice QuestionsDocument2 pagesChapter 2 - Practice QuestionsSiddhant AggarwalNo ratings yet

- Question and Problem-Sinh VienDocument4 pagesQuestion and Problem-Sinh Vienapi-3755121No ratings yet

- Chapter 2Document2 pagesChapter 2Amit JhaNo ratings yet

- Chapter Two Foreign ExchangeDocument55 pagesChapter Two Foreign ExchangeYuhao HuangNo ratings yet

- 04 Forward and Future Exchange RateDocument12 pages04 Forward and Future Exchange RateAdnan KamalNo ratings yet

- Hull OFOD11 e Solutions CH 02Document6 pagesHull OFOD11 e Solutions CH 02Vaibhav KocharNo ratings yet

- Group 3 (WordFinal)Document12 pagesGroup 3 (WordFinal)Joseph DoctoNo ratings yet

- Futures Markets (Overview) : Date of The Contract. The Date at Which The Payoff of The Contract Is DeterminedDocument19 pagesFutures Markets (Overview) : Date of The Contract. The Date at Which The Payoff of The Contract Is DeterminedDtdc SenthlNo ratings yet

- Specifications of Futures ContractDocument2 pagesSpecifications of Futures ContractMeer Mazhar AliNo ratings yet

- Currency Risk Management: Futures and Forwards: Example VI.1Document25 pagesCurrency Risk Management: Futures and Forwards: Example VI.1ravi_nyseNo ratings yet

- Exercises 1.1Document3 pagesExercises 1.1toantran.31211025392No ratings yet

- Introduction to Derivatives MarketsDocument37 pagesIntroduction to Derivatives MarketsMichael Thomas JamesNo ratings yet

- Practice Questions: Problem 1.1Document6 pagesPractice Questions: Problem 1.1Chekralla HannaNo ratings yet

- Futures and Forward ContractDocument25 pagesFutures and Forward Contractcost_ji051453No ratings yet

- Futures & Options MidtermDocument12 pagesFutures & Options MidtermLaten CruxyNo ratings yet

- Assignment For DerivativesDocument17 pagesAssignment For DerivativesMohammad ArsalanNo ratings yet

- Multiple Choice Questions Chap 8 - Options FuturesDocument6 pagesMultiple Choice Questions Chap 8 - Options FuturesThao LeNo ratings yet

- Tutorial 1.questionsDocument2 pagesTutorial 1.questionsabcsingNo ratings yet

- chapter_2&3_practice_problemsDocument2 pageschapter_2&3_practice_problemsashutoshusa20No ratings yet

- Chapter - 2&3 - Practice - Problems Hull Ed 10thDocument2 pagesChapter - 2&3 - Practice - Problems Hull Ed 10thAn KouNo ratings yet

- International Financial Management Canadian Canadian 3Rd Edition Brean Test Bank Full Chapter PDFDocument41 pagesInternational Financial Management Canadian Canadian 3Rd Edition Brean Test Bank Full Chapter PDFPatriciaSimonrdio100% (11)

- FIN B488F-Tutorial Answers - Ch01 - Autumn 2023Document4 pagesFIN B488F-Tutorial Answers - Ch01 - Autumn 2023Gabriel FungNo ratings yet

- Futures Hedging Problem ChapterDocument1 pageFutures Hedging Problem ChapterNhật Tân67% (3)

- Topic 04 Futures & Options 112Document69 pagesTopic 04 Futures & Options 112michaelsennidNo ratings yet

- MCQ - Chap 8 Futures and OptionsDocument6 pagesMCQ - Chap 8 Futures and Optionsquynhanh15042002No ratings yet

- Lecture 5Document9 pagesLecture 5Nhung Phuong Ha NguyenNo ratings yet

- Exchange Traded Stock, Option and Bond Limit and Market Order QuestionsDocument9 pagesExchange Traded Stock, Option and Bond Limit and Market Order QuestionsdrgaanNo ratings yet

- Driving Inequality - Frank S...Document3 pagesDriving Inequality - Frank S...drgaanNo ratings yet

- Candidates For 2016 Council ElectionsDocument1 pageCandidates For 2016 Council ElectionsdrgaanNo ratings yet

- Theories of Monopoly and OligopolyDocument10 pagesTheories of Monopoly and OligopolydrgaanNo ratings yet

- IrvingFisherDebtDeflationAndCrise PreviewDocument8 pagesIrvingFisherDebtDeflationAndCrise PreviewdrgaanNo ratings yet

- Schumpter On MonopolyDocument14 pagesSchumpter On MonopolydrgaanNo ratings yet

- Cost of Capital of UK CompaniesDocument8 pagesCost of Capital of UK CompaniesSonia AgarwalNo ratings yet

- Who Is Buying What: NigeriaDocument5 pagesWho Is Buying What: NigeriaBawonda IsaiahNo ratings yet

- Blue Prism Price List Updated 2021Document7 pagesBlue Prism Price List Updated 2021RMNo ratings yet

- Case 3 Report - 1208 2056Document26 pagesCase 3 Report - 1208 2056api-3748540No ratings yet

- Financial Statement Analysis Professor Julian YeoDocument31 pagesFinancial Statement Analysis Professor Julian YeoHE HUNo ratings yet

- Unit 1 Advertising 1Document13 pagesUnit 1 Advertising 1OopsbymistakeNo ratings yet

- Konganapuram, Idappadi Cycle Test-2 Hours:2 Hours Subject: Corporate Accounting-I Marks: 50 Answer All The QuestionDocument3 pagesKonganapuram, Idappadi Cycle Test-2 Hours:2 Hours Subject: Corporate Accounting-I Marks: 50 Answer All The Questionnandhakumark152No ratings yet

- Requirement Nos. 1 To 4: PROBLEM NO. 1 - Conviction CorporationDocument8 pagesRequirement Nos. 1 To 4: PROBLEM NO. 1 - Conviction CorporationMaeNo ratings yet

- TIFDDocument1 pageTIFDAtulNo ratings yet

- How MNCs Can Use Eurocurrency and Eurobond MarketsDocument3 pagesHow MNCs Can Use Eurocurrency and Eurobond MarketsLawrence StokesNo ratings yet

- Orbis BrochureDocument15 pagesOrbis BrochureBalakrishnan IyerNo ratings yet

- Hush PuppiesDocument20 pagesHush PuppiesZain AshrafNo ratings yet

- Acct Statement XX7080 23072023Document34 pagesAcct Statement XX7080 23072023Photoshoot TempleNo ratings yet

- Odin Technical Trader PDFDocument1 pageOdin Technical Trader PDFVijay MadhvanNo ratings yet

- International Financial Management Chapter 6 - Government Influence On Exchang RateDocument54 pagesInternational Financial Management Chapter 6 - Government Influence On Exchang RateAmelya Husen100% (2)

- Swap Free Accounts Commission 13.05.2020Document3 pagesSwap Free Accounts Commission 13.05.2020Ayman AlghanimNo ratings yet

- FINA 1303: Foundations of Financial InstitutionsDocument32 pagesFINA 1303: Foundations of Financial InstitutionsCynthia WongNo ratings yet

- FY-7.5 Student Activity Packet - Google DocsDocument6 pagesFY-7.5 Student Activity Packet - Google Docstarikhero755No ratings yet

- Lecture 4Document37 pagesLecture 4Charlie MagicmanNo ratings yet

- Secondary Market GuideDocument11 pagesSecondary Market GuideJeffry MahiNo ratings yet

- MCX Vs NseDocument4 pagesMCX Vs NseRishu SharmaNo ratings yet

- NIFTY ACCELERATOR-100%: PAYOFF (Market Linked Debentures Idea)Document2 pagesNIFTY ACCELERATOR-100%: PAYOFF (Market Linked Debentures Idea)Ashish ShrivastavaNo ratings yet