Professional Documents

Culture Documents

Standalone Financial Results For June 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results For June 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

FOCUS

INDUSTRIAL

RESOURCES LTD.

/C' . '

\.::7 ~

r-.-.,

.,

n 0"-'

-A.J <J o J /

eso~urces

FOCUS INDUSTRIAL RESOURCES LIMITED

Regd Office :104,Mukand House,Commerclal Complex,Azadpur,Delhi110 033

CIN :L 15319DL 1985PLC021348

Uneudited Financial Results for the Quarter ended 30th September,2015

iRs. In Lakhs)

Statement of Unaudited Financial Results for the Quarter and Half year ended 30th September, 2~015 .

Quarter Ended

6 Months Ended

Particulars

3 months ended

Preceding 3 Corresponding 3 Year to date

Year to date Year ended

30"()92015

months ended

months ended

figures for

figures for the 31032015

current period previous year

30092014

30062015

ended

ended 3009

30"()92015

2014

PART I

1-.

(Refer Notes Selow)

1 Income from operations

(e)

(Unaudited)

Net salesl income from operations

(Unaudited)

40.13

(Unaudited)

35.13

(Una"dlted)

30.00

75.26

(Unaudited)

60.00

(Audited)

100 ~ 37

(Net of excise duty)

2.06

0.24

o ~ oo

2.30

0.00

6.15

4 2 ~ 19

35.37

30.00

77.56

60.00

106.52

(a) Cost of material s consumed

0.00

000

O ~ OO

0.00

0.00

0.00

(b) Purchase s of Siock-in-trade

O ~ OO

0.00

0.00

0.0 0

0.00

0.00

(c) Changes in inventories of fi nished goods , work-inprogress and stock-i n-trade

3.62

0.25

0.00

3.B7

0.00

1.97

(d) Employee benefits expense

(a) Depreciation and amort isation expense

6.25

3.50

6.26 1

3.70

4.95

1.83

12.5 1

7.20

9.42

5.83

21 ~ 25

18.04

44.34

32 .61

51 .52

" ~I

67.92

47.86

96.36

9.64

12.14

0.00

5.18

0.00

9.64

1 2 ~ 14

(b)

Other operating income

Total Income from operations (net)

2 Expenses

(f) Other expen ses(Any item exceeding 10% of the

total expenses relating to continuing operations to be

shown separately)

26.15

18.19

Total expenses

2 1 ~ 62

39. 52

28.40

3 Profit '(Loss) from operations before other Income,

finan ce costs and ex ceptional Items (12)

2.67

6.97

4 Other income

5 Profit '(Loss) from ordinary activities before finance

costs and exceptional items (3:!:. 4)

6 Finance costs

7 Profit' (Loss) from ordinary activities after finance

cost. but before exceptional items (5:!:. 6)

0.00

2.67

6.97

0.B2

1.U5

1.26

3.92

1.73

7.91

2.60

9.54'

6 ~ 63

6 ~ 06

8 Exceptional items

0.00

0.00

3.92

0.00

7.91

o ~ oo

1.85

0.00

6.06

O ~ OO

9.54

3.38

Profit ' (Loss) from ordinary activities before tax (7 +

O ~ OO

0.91

5~ 18

O ~ OO

10.

16

0.05

10.21

3.38

8)

to I ax expense

0.00

O ~ OO

0.00

0.00

0.00

3 ~ 15

11 Net Prollt '(Loss) from ordinary activities after tax (9

:!:.10)

12 Extraordin ary items (net of tax expense Rs. _ _ Lakhs)

1.85

6 ~ 06

3.92

7.9 1

9.54

0. 23

o ~ oo

000

0.00

o ~ oo

0.00

0.00

7.9 1

9.54

0.23

13 Nat Profit '(La) for the pariod (11:!:. 12)

14 Shma of profit' (loss) of associates

1

t5 Minority interest '

1

16 Net Profit' (Loss) after taxes, minority interest and

&haro of profit I (loss) of associates (13:!:. 14:!:. 15)

17 Paid-up equity share cap ital

(Face Value of the Share shall be indicated)

18 Reserve excluding Revalua tion Reserves as per

balance sheet of previous account ing year

19.1 Earnings per share (before extraordinary Items)

(of Rs. _ ,. each) (not annualised):

(a) Basic

Diluted

Earnings per share (after extraordinary items)

(b)

1~ . 1i

1.85

6.06

3 ~ 92

O ~ OO

0.00

0.00

0.00

0.00

000

1.85

6.06

3 ~ 92

1219.42

1219.42

0.00

0.00

0.00

0.00

0.00

000

0.00

7.91

9.54

0.23

1219.42

1219.42

1219.42

1219.42

0.00

0.00

0.00

953.10

0.02

0.05

0. 03

0.02

0 ~ 05

0.03

0.02

0 ~ 05

0.03

0.02

0.05

0~ 03

0.06

0. 08

O~ OO

0.06

0.08

0.00

0.06

0.08

O ~ OO

0.06

O.OB

0.00

l of Rs. _ , - each) (not annualised) :

18)

B~9ic

l u) Diluted

PART Ii

Particulars

3 months

ended

3009-2015

Preceding 3 Corresponding 3 Year to date

Year to date

Previous

months ended

months ended

figures for

figures for the year ended

30-062015

30"()92014

current period previous year 31"()3-201~

ended 30"()9 ended 30-092015

2014

V

Registered Office: 104, MUKAND HOUSE, COMMERCIAL COMPLEX, AZADPUR, DELH 1-110033

Ph.: 011-27676399,47039000 Fax: 011-27676399 Email id : info@focuslimited,in

CIN No. - L15319DL19S5PLC02134S Visit our Website : www.focusli mited,in

PARTICULARS OF SHAREHOLDING

1

Public shareholding

- Number of shares

- Percentage of shareholding

2 Promoters and Promoter Group Shareholding

a)

4572445 .00

37.50

4973967.00

40.79%

6447998.00

52.88%

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

7621754 .00

7220232.00

5746201 .00

10000%

100%

100%

62.50%

59.21%

47.12%

6447998.00 4973967.00

52.88%

40.80%

..

Pledged I Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding

01 promoter Bnd promoter group)

- Percentage of shares (as a % of the total share capital

of the company)

b)

Non - encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding

of the Promoter and Promoter group)

- Percentage of shares (as a % of the total share capital I

of the company)

'I

I

Particulars

""l

59.21%

3 months ended

30.09.2015

INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Received during the qua"er

NIL

NIL

Disposed of dUring the quarter

Remaining unresolved at the end of the qua"er

NIL

NIL

FOCUS INDUSTRIAL RESOURCES LIMITED

(Rs tn Lakhs)

Particulars

5746201.00 7220232.00

100%

100%

30-09-2015

31032015

EQUITY AND LIABILITIES

1 Shareholders' funds

(a) Share capital

(b) Reserves and surplus

1.219.42

961 .02

1.219.42

953.11 1

2,180.44

2.172.53 1

(c) Money received against share warrants

Sub-total - Shareholders' funds

2 Share application money pending allotment

3 Minority Interest

4 Non-current liabilities

(a) Long-term borrowings

(b) Deferred lax liabilities (net)

455.49

1.35

455.49

1.35

7.35

464.19

7.35

464.19

(c) Other long-term liabilities

(d) Long-term provisions

Sub-total - Non-current liabilities

5 Current liabilities

(a) Short-term borrowings

(b) Trade payables

399.66

1.78

(C) Other current liabilities

(d) Short-term provisions

1.73

Sub-total - Current liabilities

TOTAL EQUITY AND LIABILITIES

20.63

423.80

1.19

2.28

20.63

24.10

3,068.43

2,660.82

70.44

76.63

2.933.62

2.492.23

3,004.06

2,568.86

7.44

0.32

32.33

11.31

2.61

56.18

24.28

64.37

3.068.43

21.86

91.96

2,660.82

ASSETS

1 Non-current assets

(a) Fixed assets

(b) Goodwill on consolidation

(c) Non-current investments

(d) Deferred tax assets (net)

(e) Long-term loans and advances

(f) Other non-current assets

Sub-total - Non-current assets

2 Current assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short term loans and advances

(f) Other current assets

Sub-total - Current assets

TOTAL - ASSETS

:1

1 The auditor of the Company have Carried out a Limited Review for the financial result for the Quarter and half year ended on 30th September, 2015

In terms of Clause 41 of the Listing Agreement with Ihe Stock Exchanges.

2 The provision of Inceme Tax, Deferred tax assets/liahilities if any will be accounted for at the end of Ihe accounting year.

3 Tho above result was taken on record by the Board of Directors in the meeting held on 61h day of November, 2015 .

4. Previous period figures have been regrouped where ever neceesary to confrm to current quarter classifications.

The staloment is as per clause 41 of the Listing Agreement

Place Delhi.

Dale 06.11 .2015

You might also like

- C6 RS6 Engine Wiring DiagramsDocument30 pagesC6 RS6 Engine Wiring DiagramsArtur Arturowski100% (3)

- Interpretation of Arterial Blood Gases (ABGs)Document6 pagesInterpretation of Arterial Blood Gases (ABGs)afalfitraNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Hindustan Motors Case StudyDocument50 pagesHindustan Motors Case Studyashitshekhar100% (4)

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Britannia Industries Q2 FY2012 Financial ResultsDocument2 pagesBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434No ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Annual ReportDocument1 pageAnnual ReportAnup KallimathNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- FinancialResult 30062012Document3 pagesFinancialResult 30062012Raghu NathNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2015 (Result)Document11 pagesStandalone Financial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- BEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Document3 pagesBEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Kapil SharmaNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Numericals On MAT-115JBDocument2 pagesNumericals On MAT-115JBReema Laser100% (1)

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document8 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- FS2004 - The Aircraft - CFG FileDocument5 pagesFS2004 - The Aircraft - CFG FiletumbNo ratings yet

- Coffee Table Book Design With Community ParticipationDocument12 pagesCoffee Table Book Design With Community ParticipationAJHSSR JournalNo ratings yet

- Nokia MMS Java Library v1.1Document14 pagesNokia MMS Java Library v1.1nadrian1153848No ratings yet

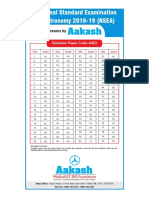

- National Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423Document1 pageNational Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423VASU JAINNo ratings yet

- Game Rules PDFDocument12 pagesGame Rules PDFEric WaddellNo ratings yet

- Sarvali On DigbalaDocument14 pagesSarvali On DigbalapiyushNo ratings yet

- Case StudyDocument2 pagesCase StudyBunga Larangan73% (11)

- Case 5Document1 pageCase 5Czan ShakyaNo ratings yet

- Agricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsDocument84 pagesAgricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsRachel vNo ratings yet

- PandPofCC (8th Edition)Document629 pagesPandPofCC (8th Edition)Carlos Alberto CaicedoNo ratings yet

- Social Media Exposure and Its Perceived Impact On Students' Home-Based Tasks ProductivityDocument9 pagesSocial Media Exposure and Its Perceived Impact On Students' Home-Based Tasks ProductivityJewel PascuaNo ratings yet

- Account Statement From 30 Jul 2018 To 30 Jan 2019Document8 pagesAccount Statement From 30 Jul 2018 To 30 Jan 2019Bojpuri OfficialNo ratings yet

- JurnalDocument9 pagesJurnalClarisa Noveria Erika PutriNo ratings yet

- House Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Document4 pagesHouse Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Raphael Eyitayor TyNo ratings yet

- Planning A Real Estate ProjectDocument81 pagesPlanning A Real Estate ProjectHaile SilasieNo ratings yet

- ITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFDocument280 pagesITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFMohamed AliNo ratings yet

- Nama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Document3 pagesNama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Yetri MulizaNo ratings yet

- Iso 9001 CRMDocument6 pagesIso 9001 CRMleovenceNo ratings yet

- Sentinel 2 Products Specification DocumentDocument510 pagesSentinel 2 Products Specification DocumentSherly BhengeNo ratings yet

- Kami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Document3 pagesKami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Anna HattenNo ratings yet

- Thin Film Deposition TechniquesDocument20 pagesThin Film Deposition TechniquesShayan Ahmad Khattak, BS Physics Student, UoPNo ratings yet

- Book Networks An Introduction by Mark NewmanDocument394 pagesBook Networks An Introduction by Mark NewmanKhondokar Al MominNo ratings yet

- FSRH Ukmec Summary September 2019Document11 pagesFSRH Ukmec Summary September 2019Kiran JayaprakashNo ratings yet

- Controle de Abastecimento e ManutençãoDocument409 pagesControle de Abastecimento e ManutençãoHAROLDO LAGE VIEIRANo ratings yet

- Guiding Childrens Social Development and Learning 8th Edition Kostelnik Test BankDocument16 pagesGuiding Childrens Social Development and Learning 8th Edition Kostelnik Test Bankoglepogy5kobgk100% (27)

- Catalogoclevite PDFDocument6 pagesCatalogoclevite PDFDomingo YañezNo ratings yet

- 3ccc PDFDocument20 pages3ccc PDFKaka KunNo ratings yet