Professional Documents

Culture Documents

Problem 3-2b Solution

Uploaded by

Abdul Rasyid RomadhoniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 3-2b Solution

Uploaded by

Abdul Rasyid RomadhoniCopyright:

Available Formats

PROBLEM 3-2B

(a)

J1

Debit

190

Date

May 31

Account Titles

Insurance Expense..............................

Prepaid Insurance ......................

($2,280 X 1/12)

Ref.

722

130

31

Supplies Expense ...............................

Supplies ($2,200 $750) ............

631

126

1,450

31

Depreciation ExpenseLodge...........

($3,000 X 1/12)

Accumulated Depreciation

Lodge ......................................

619

250

Depreciation ExpenseFurniture......

($2,700 X 1/12)

Accumulated Depreciation

Furniture .................................

621

31

Interest Expense .................................

Interest Payable..........................

[($35,000 X 12%) X 1/12]

718

230

350

31

Unearned Rent Revenue .....................

Rent Revenue .............................

(2/3 X $3,300)

209

429

2,200

31

Salaries Expense.................................

Salaries Payable .........................

726

212

750

31

142

Credit

190

1,450

250

225

150

225

350

2,200

750

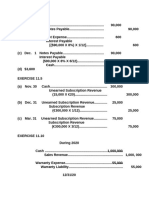

(b)

Cash

Date

Explanation

May 31 Balance

Ref.

Page 1 of 7

Debit

Credit

No. 101

Balance

3,500

PROBLEM 3-2B (Continued)

Supplies

Date

Explanation

May 31 Balance

31 Adjusting

Ref.

J1

Prepaid Insurance

Date

Explanation

May 31 Balance

31 Adjusting

Ref.

J1

Land

Date

Explanation

May 31 Balance

Ref.

Lodge

Date

Explanation

May 31 Balance

Ref.

Accumulated DepreciationLodge

Date

Explanation

Ref.

May 31 Adjusting

J1

Furniture

Date

Explanation

May 31 Balance

Ref.

Accumulated DepreciationFurniture

Date

Explanation

Ref.

May 31 Adjusting

J1

Page 2 of 7

Debit

Credit

1,450

Debit

Credit

190

Debit

Debit

Debit

Debit

Debit

No. 126

Balance

2,200

750

No. 130

Balance

2,280

2,090

Credit

No. 140

Balance

12,000

Credit

No. 141

Balance

60,000

Credit

250

Credit

Credit

225

No. 142

Balance

250

No. 149

Balance

15,000

No. 150

Balance

225

PROBLEM 3-2B (Continued)

Accounts Payable

Date

Explanation

May 31 Balance

Ref.

Unearned Rent Revenue

Date

Explanation

May 31 Balance

31 Adjusting

Ref.

J1

Salaries Payable

Date

Explanation

May 31 Adjusting

Ref.

J1

Interest Payable

Date

Explanation

May 31 Adjusting

Ref.

J1

Mortgage Payable

Date

Explanation

May 31 Balance

Ref.

Share CapitalOrdinary

Date

Explanation

May 31 Balance

Ref.

Rent Revenue

Date

Explanation

May 31 Balance

31 Adjusting

Ref.

J1

Page 3 of 7

Debit

Debit

Credit

Credit

2,200

Debit

Debit

Debit

Debit

Debit

No. 201

Balance

4,800

No. 209

Balance

3,300

1,100

Credit

750

No. 212

Balance

750

Credit

350

No. 230

Balance

350

Credit

No. 275

Balance

35,000

Credit

No. 311

Balance

46,380

Credit

2,200

No. 429

Balance

10,300

12,500

PROBLEM 3-2B (Continued)

Advertising Expense

Date

Explanation

May 31 Balance

Ref.

Depreciation ExpenseLodge

Date

Explanation

May 31 Adjusting

Depreciation ExpenseFurniture

Date

Explanation

May 31 Adjusting

Supplies Expense

Date

Explanation

May 31 Adjusting

Interest Expense

Date

Explanation

May 31 Adjusting

Insurance Expense

Date

Explanation

May 31 Adjusting

Salaries Expense

Date

Explanation

May 31 Balance

31 Adjusting

Ref.

J1

Ref.

J1

Ref.

J1

Ref.

J1

Ref.

J1

Ref.

J1

Page 4 of 7

Debit

Debit

250

Debit

225

Debit

1,450

Debit

350

Debit

190

Debit

750

Credit

No. 610

Balance

600

Credit

No. 619

Balance

250

Credit

No. 621

Balance

225

Credit

No. 631

Balance

1,450

Credit

No. 718

Balance

350

Credit

No. 722

Balance

190

Credit

No. 726

Balance

3,300

4,050

PROBLEM 3-2B (Continued)

Utilities Expense

Date

Explanation

May 31 Balance

(c)

Ref.

Debit

Credit

No. 732

Balance

900

MOUND VIEW MOTEL, INC.

Adjusted Trial Balance

May 31, 2011

Debit

Cash .................................................................... $ 3,500

Supplies ..............................................................

750

Prepaid Insurance ..............................................

2,090

Land ....................................................................

12,000

Lodge ..................................................................

60,000

Accumulated DepreciationLodge ..................

Furniture .............................................................

15,000

Accumulated DepreciationFurniture .............

Accounts Payable ..............................................

Unearned Rent Revenue ....................................

Salaries Payable .................................................

Interest Payable..................................................

Mortgage Payable...............................................

Share CapitalOrdinary ....................................

Rent Revenue .....................................................

Advertising Expense ..........................................

600

Depreciation ExpenseLodge..........................

250

Depreciation ExpenseFurniture.....................

225

Supplies Expense...............................................

1,450

Interest Expense.................................................

350

Insurance Expense.............................................

190

Salaries Expense................................................

4,050

Utilities Expense.................................................

900

$101,355

Page 5 of 7

Credit

250

225

4,800

1,100

750

350

35,000

46,380

12,500

$101,355

PROBLEM 3-2B (Continued)

(d)

MOUND VIEW MOTEL, INC.

Income Statement

For the Month Ended May 31, 2011

Revenues

Rent revenue ...................................................

Expenses

Salaries expense .............................................

Supplies expense............................................

Utilities expense..............................................

Advertising expense .......................................

Interest expense..............................................

Depreciation expenselodge ........................

Depreciation expensefurniture ...................

Insurance expense..........................................

Total expenses.........................................

Net income ..............................................................

$12,500

$4,050

1,450

900

600

350

250

225

190

8,015

$ 4,485

MOUND VIEW MOTEL, INC.

Retained Earnings Statement

For the Month Ended May 31, 2011

Retained Earnings, May 1 .......................................................

Add: Net income ....................................................................

Retained Earnings, May 31 .....................................................

Page 6 of 7

0

4,485

$4,485

PROBLEM 3-2B (Continued)

MOUND VIEW MOTEL, INC.

Statement of Financial Position

May 31, 2011

Assets

Land....................................................................

Lodge..................................................................

Less: Accumulated depreciationlodge ........

Furniture.............................................................

Less: Accumulated depreciationfurniture .....

Prepaid insurance..............................................

Supplies .............................................................

Cash....................................................................

Total assets.........................................

$60,000

250

15,000

225

$12,000

59,750

14,775

2,090

750

3,500

$92,865

Equity and Liabilities

Equity

Share capitalordinary .............................

Retained earnings ......................................

Liabilities

Accounts payable ......................................

Mortgage payable.......................................

Unearned rent.............................................

Salaries payable .........................................

Interest payable..........................................

Total equity and liabilities ...................................

Page 7 of 7

$46,380

4,485

4,800

35,000

1,100

750

350

$50,865

42,000

$92,865

You might also like

- Problems and Answers On ch.3, ACT 101Document19 pagesProblems and Answers On ch.3, ACT 101clara2300181No ratings yet

- Exercise 4-10 1Document3 pagesExercise 4-10 1hoàng anh lêNo ratings yet

- Problem Set BDocument14 pagesProblem Set BHiếu NguyễnNo ratings yet

- TT04 Closing ANSDocument7 pagesTT04 Closing ANSkhanhphamngoc1716No ratings yet

- Solutions Brief Accounting ExercisesDocument4 pagesSolutions Brief Accounting ExercisesHa Dang Huynh NhuNo ratings yet

- Debt Investments Journal EntriesDocument6 pagesDebt Investments Journal EntriesHaitham Ebrahim100% (1)

- Problem CHP 3 B MbaDocument18 pagesProblem CHP 3 B MbaAli Ahmad100% (2)

- Cookie Ch3Document7 pagesCookie Ch3Charmaine Bernados Brucal67% (3)

- Adjusted Trial Balance for Thayer Motel IncDocument18 pagesAdjusted Trial Balance for Thayer Motel IncDan M SummersNo ratings yet

- CHAPTER 3 SolutionDocument1 pageCHAPTER 3 SolutionQuỳnh'ss Đắc'ssNo ratings yet

- Tutorial Test 4 AnswerDocument5 pagesTutorial Test 4 AnswerHoang Bich Kha NgoNo ratings yet

- Solutions To ExercisesDocument38 pagesSolutions To ExercisesAnh KietNo ratings yet

- Prepare Financial StatementsDocument17 pagesPrepare Financial StatementsHayat AliNo ratings yet

- 193 15 13357 ACT AssignmentDocument14 pages193 15 13357 ACT AssignmentSaif UR RahmanNo ratings yet

- Reporting and Analyzing Receivables: QuestionsDocument25 pagesReporting and Analyzing Receivables: QuestionsAstrid LimónNo ratings yet

- Weygandt FA PPB Ch3 v2 PDFDocument34 pagesWeygandt FA PPB Ch3 v2 PDFMuhammad SherazNo ratings yet

- BADM 1050 Assignment # 1 - CLDocument4 pagesBADM 1050 Assignment # 1 - CLemilynelson1429No ratings yet

- Accrual accounting principles and adjusting journal entriesDocument11 pagesAccrual accounting principles and adjusting journal entrieszdgf dfg562465No ratings yet

- Ch10 ExercisesDocument15 pagesCh10 Exercisesjamiahamdard001No ratings yet

- Additional Problem Chap 3 SolutionDocument6 pagesAdditional Problem Chap 3 SolutionominNo ratings yet

- Sales Revenue ($250 X 6 Mos.) ......................................................................................................... $1,500Document4 pagesSales Revenue ($250 X 6 Mos.) ......................................................................................................... $1,500Iman naufalNo ratings yet

- Weygandt, Accounting Principles, 11e Chapter Nine Solutions To Challenge ExercisesDocument2 pagesWeygandt, Accounting Principles, 11e Chapter Nine Solutions To Challenge ExercisesHương ThưNo ratings yet

- 2-1A, 2A SolnDocument5 pages2-1A, 2A SolnA.K.M. Rubyat Hasan ApuNo ratings yet

- FA - Assignment Problems 4 Answer KeyDocument12 pagesFA - Assignment Problems 4 Answer KeyPratheek MedipallyNo ratings yet

- Financial Accounting (7th Edition) P4-2ADocument4 pagesFinancial Accounting (7th Edition) P4-2AMarsha MaeNo ratings yet

- Soal Debt InvestmentDocument5 pagesSoal Debt InvestmentKyle Kuro0% (1)

- Brief Exercises Adjusting The AccountsDocument5 pagesBrief Exercises Adjusting The AccountsYoussef Khaled Mahmoud ShawkyNo ratings yet

- ch03 Part9Document6 pagesch03 Part9Sergio HoffmanNo ratings yet

- Solutions to Bond ExercisesDocument31 pagesSolutions to Bond ExercisesMaha M. Al-MasriNo ratings yet

- Exercise (10) - SolutionDocument4 pagesExercise (10) - Solutionmohamed.khayrtNo ratings yet

- Solutions To Exercises - CHAP4Document16 pagesSolutions To Exercises - CHAP4InciaNo ratings yet

- AKM - Kelompok 5Document8 pagesAKM - Kelompok 5lailafitriyani100% (1)

- Bab 3 Jawaban (Penyesuaian)Document5 pagesBab 3 Jawaban (Penyesuaian)Lamtiur LidiaqNo ratings yet

- Chapter 7Document28 pagesChapter 7Shibly SadikNo ratings yet

- Marking Guide - Code 4 - Midterm FA - Sem 2 - 21.22Document3 pagesMarking Guide - Code 4 - Midterm FA - Sem 2 - 21.22TRANG NGUYỄN THỊ HÀNo ratings yet

- CC BalanceDocument4 pagesCC BalanceNovena TrimuktiNo ratings yet

- Imanuel Xaverdino - 01804220010 - Homework 01Document5 pagesImanuel Xaverdino - 01804220010 - Homework 01Imanuel XaverdinoNo ratings yet

- Chapter 02Document17 pagesChapter 02Alok SinhaNo ratings yet

- Financial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFDocument60 pagesFinancial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFClaudiaAdamsfowp100% (10)

- Final Revision 2022 For First YearDocument21 pagesFinal Revision 2022 For First YearRabie HarounNo ratings yet

- Toaz - Info Acc 557 Week 2 Chapter 3 E3 6e3 7e3 11p3 2a 100 Scored PRDocument26 pagesToaz - Info Acc 557 Week 2 Chapter 3 E3 6e3 7e3 11p3 2a 100 Scored PRDandy KrisnaNo ratings yet

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Document5 pagesRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTANo ratings yet

- Key Chapter 11Document3 pagesKey Chapter 11JinAe NaNo ratings yet

- Warren SM AppB FinalDocument4 pagesWarren SM AppB FinalRafael GarciaNo ratings yet

- Accounting Applications - Part 4 - Lecture 2Document7 pagesAccounting Applications - Part 4 - Lecture 2Ahmed Mostafa ElmowafyNo ratings yet

- Example 1: SolutionDocument7 pagesExample 1: SolutionalemayehuNo ratings yet

- ACCT 100 - Principles of Financial Accounting Fall 2020, Section 6 Week 10 Chapter 10 - LiabilitiesDocument2 pagesACCT 100 - Principles of Financial Accounting Fall 2020, Section 6 Week 10 Chapter 10 - LiabilitiesAli Zain ParharNo ratings yet

- Harrison Fa Ifrs 11e Ch09 SMDocument107 pagesHarrison Fa Ifrs 11e Ch09 SMAshleyNo ratings yet

- Harrison 5ce ISM Ch03Document105 pagesHarrison 5ce ISM Ch03PmNo ratings yet

- Optimize sales tax adjusting entriesDocument6 pagesOptimize sales tax adjusting entriesHuỳnh Thị Thu BaNo ratings yet

- Tutorial 3 - Questions - RevisedDocument2 pagesTutorial 3 - Questions - RevisedHuang ZhanyiNo ratings yet

- Extra Applications - Lecture Week 3Document6 pagesExtra Applications - Lecture Week 3soliman salmanNo ratings yet

- Jawaban S 3-2Document4 pagesJawaban S 3-2Lamtiur LidiaqNo ratings yet

- Tutorial 02 - SolutionsDocument3 pagesTutorial 02 - Solutionsraygains23No ratings yet

- WV DOT Design DirectivesDocument757 pagesWV DOT Design DirectivesRebi HamzaNo ratings yet

- ch03 Part4Document6 pagesch03 Part4Sergio HoffmanNo ratings yet

- Solutions WK 6Document8 pagesSolutions WK 6simamo4203No ratings yet

- Extra Applications - Lecture Week 3Document7 pagesExtra Applications - Lecture Week 3Muhammad HusseinNo ratings yet

- Pembahasan Ch 11 Intangible Assets LatihanDocument3 pagesPembahasan Ch 11 Intangible Assets LatihanWira DinataNo ratings yet

- Sample Mo A TemplateDocument32 pagesSample Mo A TemplateAbdul Rasyid RomadhoniNo ratings yet

- Week 9 Brand AuditDocument20 pagesWeek 9 Brand AuditAbdul Rasyid RomadhoniNo ratings yet

- Article 2016-Do Conservative Managers Give Smaller Bonuses To WOmenDocument8 pagesArticle 2016-Do Conservative Managers Give Smaller Bonuses To WOmenAbdul Rasyid RomadhoniNo ratings yet

- Article 2016-Do Conservative Managers Give Smaller Bonuses To WOmenDocument8 pagesArticle 2016-Do Conservative Managers Give Smaller Bonuses To WOmenAbdul Rasyid RomadhoniNo ratings yet

- Perceptual Map Jackfruit Chips: AJA RL Silvia AreviDocument2 pagesPerceptual Map Jackfruit Chips: AJA RL Silvia AreviAbdul Rasyid RomadhoniNo ratings yet

- Ahp LatianDocument14 pagesAhp LatianAbdul Rasyid RomadhoniNo ratings yet

- Mini Final ProjectDocument2 pagesMini Final ProjectAbdul Rasyid RomadhoniNo ratings yet

- Strategy Must Be Developed Consumer Behaviour ProjectDocument1 pageStrategy Must Be Developed Consumer Behaviour ProjectAbdul Rasyid RomadhoniNo ratings yet

- Script CialisDocument1 pageScript CialisAbdul Rasyid RomadhoniNo ratings yet

- (2014) Employee Compensation-The Neglected Area of HRM ResearchDocument4 pages(2014) Employee Compensation-The Neglected Area of HRM ResearchAbdul Rasyid RomadhoniNo ratings yet

- Table of Contents CB ProjectDocument2 pagesTable of Contents CB ProjectAbdul Rasyid RomadhoniNo ratings yet

- CM Article Summary PDFDocument10 pagesCM Article Summary PDFDhruba Jyoti DekaNo ratings yet

- DM Process Cit CitDocument2 pagesDM Process Cit CitAbdul Rasyid RomadhoniNo ratings yet

- A Study On The Developemnt of Fish Auction PlaceDocument2 pagesA Study On The Developemnt of Fish Auction PlaceAbdul Rasyid RomadhoniNo ratings yet

- Latihan FinanceDocument6 pagesLatihan FinanceAbdul Rasyid RomadhoniNo ratings yet

- Jamu BistratDocument2 pagesJamu BistratAbdul Rasyid RomadhoniNo ratings yet

- Capturing Market Without Destroying It: 6 Lessons from Sun Tzu's The Art of War Applied in BusinessDocument7 pagesCapturing Market Without Destroying It: 6 Lessons from Sun Tzu's The Art of War Applied in BusinessAbdul Rasyid RomadhoniNo ratings yet

- US Current Account DeficitDocument3 pagesUS Current Account DeficitAbdul Rasyid RomadhoniNo ratings yet

- Macro Week 11Document1 pageMacro Week 11Abdul Rasyid RomadhoniNo ratings yet

- Air AsiaDocument3 pagesAir AsiaAbdul Rasyid RomadhoniNo ratings yet

- Finance Task 1Document2 pagesFinance Task 1Abdul Rasyid RomadhoniNo ratings yet

- BCG Matrix Analysis of Starbucks' Business UnitsDocument1 pageBCG Matrix Analysis of Starbucks' Business UnitsAbdul Rasyid RomadhoniNo ratings yet

- Managerial Economics in A Global Economy, 5th Edition Chapter 1Document11 pagesManagerial Economics in A Global Economy, 5th Edition Chapter 1Muhammad Zeshan Laang86% (7)

- Aquaponics Business PlanDocument45 pagesAquaponics Business Plankriskee1383% (18)

- PR FinanceDocument2 pagesPR FinanceAbdul Rasyid RomadhoniNo ratings yet

- 2010-11-07 002519 Mid 2Document1 page2010-11-07 002519 Mid 2Abdul Rasyid RomadhoniNo ratings yet

- Sesi 2b Group CaseDocument7 pagesSesi 2b Group CaseAbdul Rasyid RomadhoniNo ratings yet

- The Competitive Advantage of NationsDocument6 pagesThe Competitive Advantage of NationsAbdul Rasyid RomadhoniNo ratings yet

- Jamu BistratDocument2 pagesJamu BistratAbdul Rasyid RomadhoniNo ratings yet

- Book 1Document3 pagesBook 1Abdul Rasyid RomadhoniNo ratings yet

- Research Grant GuidelinesDocument12 pagesResearch Grant GuidelinessckamoteNo ratings yet

- Homework Chapter 2: ExerciseDocument6 pagesHomework Chapter 2: ExerciseDiệu QuỳnhNo ratings yet

- Short Run Decision AnalysisDocument31 pagesShort Run Decision AnalysisMedhaSaha100% (1)

- Understanding 1 View ReportingDocument370 pagesUnderstanding 1 View ReportingSindhu RamNo ratings yet

- Final Exam Fin 2Document3 pagesFinal Exam Fin 2ma. veronica guisihanNo ratings yet

- Chapter 1 - True or False Part 2Document3 pagesChapter 1 - True or False Part 2Chloe Gabriel Evangeline ChaseNo ratings yet

- Q&A Section A AA025 - Lecturer EditionDocument40 pagesQ&A Section A AA025 - Lecturer EditionSyirleen Adlyna Othman100% (1)

- Auditing ProblemsDocument8 pagesAuditing ProblemsKheianne DaveighNo ratings yet

- Glencore Plc Annual Report 2021Document2 pagesGlencore Plc Annual Report 2021Dayu adisaputraNo ratings yet

- 2012 Payee Disclosure Report - Saskatchewan GovernmentDocument252 pages2012 Payee Disclosure Report - Saskatchewan GovernmentAnishinabe100% (1)

- Ms09 - Capital Budgeting (Reviewer's Copy)Document19 pagesMs09 - Capital Budgeting (Reviewer's Copy)Mikka Aira Sardeña100% (1)

- Deloitte TestDocument19 pagesDeloitte TestTrà HươngNo ratings yet

- Franchise Revenue Sharing MatrixDocument1 pageFranchise Revenue Sharing Matrixprep360No ratings yet

- Cash Basis Accrual ConceptsDocument46 pagesCash Basis Accrual ConceptsKim FloresNo ratings yet

- Atul Auto LTD.: Ratio & Company AnalysisDocument7 pagesAtul Auto LTD.: Ratio & Company AnalysisMohit KanjwaniNo ratings yet

- Quiz in PartnershipDocument5 pagesQuiz in PartnershipPrincessAngelaDeLeon0% (1)

- Mentoring AkDocument11 pagesMentoring Akkhoirul nasNo ratings yet

- Caf 7 Far2 STDocument690 pagesCaf 7 Far2 STMuhammad YousafNo ratings yet

- Cabcharge Research Report CAB ASXDocument4 pagesCabcharge Research Report CAB ASXzengooiNo ratings yet

- FRX2Any v.12.14.01 DEMO MANAGEMENT REPORTDocument3 pagesFRX2Any v.12.14.01 DEMO MANAGEMENT REPORTkrisNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Chapter 17 Flashcards - QuizletDocument34 pagesChapter 17 Flashcards - QuizletAlucard77777No ratings yet

- Las - Week 3.fabm II.Document21 pagesLas - Week 3.fabm II.Jason Tagapan GullaNo ratings yet

- Singapore Illustrative Financial Statements 2016Document242 pagesSingapore Illustrative Financial Statements 2016Em CaparrosNo ratings yet

- Larsen & ToubroDocument10 pagesLarsen & Toubropragadeesh jayaramanNo ratings yet

- Chapter 3 Cost Accounting CycleDocument11 pagesChapter 3 Cost Accounting CycleSteffany RoqueNo ratings yet

- OnlinePayslip Pages NewPayslipModuleDocument1 pageOnlinePayslip Pages NewPayslipModulerujean romy p guisando57% (7)

- Acr 4.2Document21 pagesAcr 4.2ASIKIN AJA0% (1)

- Financial Frictions and Fluctuations in VolatilityDocument55 pagesFinancial Frictions and Fluctuations in VolatilityHHHNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisLea AndreleiNo ratings yet