Professional Documents

Culture Documents

A Study On Suuply Chain Management at Johnsons

Uploaded by

shailesh nikumbhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Suuply Chain Management at Johnsons

Uploaded by

shailesh nikumbhaCopyright:

Available Formats

Johnsons & johnsons Pvt Ltd

A STUDY OF SUPPLY CHAIN MANAGEMENT AT

JOHNSONS & JOHNSONS, MULUND

Project submitted to

S.A.V ACHARYA INSTITUTE OF MANAGEMENT

STUDIES

In partial fulfillment of the requirements for

Master of management studies

By

Shailesh M. Nikumbha

Roll no:

Marketing

Batch: 2015-2017

Under the guidance of

Prof .Prashant Mishra

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

A STUDY ON SUPPLY CHAIN MANAGEMENT AT JOHNSONS &

JOHNSONS, MULUND

Project submitted to

S.A.V ACHARYA INSTITUTE OF MANAGEMENT STUDIES

partial fulfillment of the requirements for

Master in Management Studies

By

SHAILESH NIKUMBHA

Roll No:

Specialization

MARKETING

By

Batch: 2015-2017

Under the guidance of

Prof Prashant Mishra

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

S.A.V ACHARYA INSTITUTE OF MANAGEMENT

STUDIES

SHELU

JULY 2016

Students Declaration

I hereby declare that this report submitted in partial fulfillment of the

requirement of MMS Degree of University of Mumbai to S.A.V

ACHARYA INSTITUTE OF MANAGEMENTSTUDIES. This is my

original work and is not submitted for award of any degree or diploma or

for similar titles or prizes.

Name

: NIKUMBHA SHAILESH MUKUND

Class

Roll No. :

Place

: SHELU

Date

Students

Signature:

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Certificate

This is to certify that the dissertation submitted In partial fulfillment for

the award of MMS degree of university of Mumbai to S.A.VACHARYA

INSTITUDE OF MANAGEMENT STUDIES is a result of the

confide research work carried out by Mr. SHAILESH MUKUND

NIKUMBHA under my supervision and guidance .no part of this report

has been submitted for award of any other degree, diploma or other

similar titles or prizes, The work has also not been published in any

journal / Magazines

Date : / /2016

Place: SHELU

Project Guide

Director

(Dr .C. SATYANRAYANA)

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

ACKNOWLEDGEMENT

I have great pleasure in expressing my sincere Thanks to those who have

spared their valuable time in helping me to archive the success in my project .

I would specially like to thanks and express my gratitude to my project guide,

Mr. Narayan Iyengar sir& Shaji sir, Gadgil sir

I would also like to Johnson &Johnson staff member who have encouraged me

and help me in my completion of this project

Finally, I would also take opportunity to thanx my parents and all my friends

and colleagues for their undying support during the preparation of this project

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

TABLE OF CONTENTS:

Chapter

No.

Particulars

Executive Summary

Introduction

Introduction to the subject/ topic

Introduction to the industry/sector

Introduction to the company

Literature Review (Secondary Data)

Research Methodology

Problem Definition

Objectives

Sources of data

Coverage of area

Research design

Sampling method

Sampling size

Tools of analysis

Limitations

Scope of the report

Analysis and Findings

Suggestions/Recommendations

SAV Acharya Institute of Management studies, Shelu

Page No.

Johnsons & johnsons Pvt Ltd

Conclusions

Bibliography and References

10

Annexure

List of symbols

Questionnaire

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

EXECUTIVE SUMMAREY

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

INTRODUCTION

INTRODUCTION TO PHARMA INDUSTERY

1) CIPLA

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Cipla

Limited is

an

Indian

multinational pharmaceutical and

biotechnology company, headquartered in Mumbai, India, Belgium, Surrey in

the European and Miami, Florida, in the United States; with manufacturing

facilities

in Goa(eight), Bengaluru (one), Baddi(one), Indore (one), Kurkumbh(one), Pata

lganga (one), and Sikkim (one), along with field stations in Delhi, Pune, and

Hyderabad .Cipla primarily develops medicines to treat cardiovascular, arthritis,

diabetes, weight control and depression; other medical conditions.

Fig 1.1 Cipla Mfg plant,Mumbai

Product and service

Cipla sells active pharmaceutical ingredients to other manufacturers as well as

pharmaceutical and personal care products, including Escitalopram (antidepressant), Lamivudine and Fluticasone propionate. They are the world's largest

manufacturer of antiretroviral

Operation

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Cipla has 34 manufacturing units in 8 locations across India and has presence in

170 countries. Exports accounted for 48% 49.48 billion (US$740 million) of its

revenue for FY 2013-14. Cipla spent INR 517 cr. (5.4% of revenue) in FY 2013-14

on R&D activities. The primary focus areas for R&D were development of new

formulations, drug-delivery systems and APIs (active pharmaceutical ingredients).

Cipla also cooperates with other enterprises in areas such as consulting,

commissioning, engineering, project appraisal, quality control, know-how transfer,

support, and plant supply.

As on 31 March 2013, the company had 22,036 employees (out of which 2,455

were women (7.30%) and 23 were employees with disabilities (0.1%)).During the

FY 2013-14, the company incurred 12.85 billion (US$190 million) on employee

benefit expenses

2) Glaxo smith Kline consumer health care:

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Fig

1.2

Glaxo Smith Kline

Glaxo was founded in the 1850s as a general trading company in Bunnythorpe,

New Zealand, by a Londoner, Joseph Edward Nathan. In 1904 it began producing

dried-milk baby food, first known as Defiance, then as Glaxo (from lacto), under

the slogan "Glaxo builds bonny babies."The Glaxo Laboratories sign is still

visible (right) on what is now a car repair shop on the main street of Bunnythorpe.

The company's first pharmaceutical product, produced in 1920, was vitamin d

Glaxo Laboratories opened new units in London in 1935. The company bought two

companies, Joseph Nathan and Allen & Hanburys in 1947 and 1958 respectively.

The Scottish pharmacologist David Jack was working for Allen & Hanbury's when

Glaxo took it over; he went on lead the company's R&D until 1987. After the

company bought Meyer Laboratories in 1978, it began to play an important role in

the US market. In 1983 the American arm, Glaxo Inc., moved to Research Triangle

Park (US headquarters/research) and Zebulon (US manufacturing) in North

Carolina.

Burroughs Wellcome & Company was founded in 1880 in London by the

American pharmacists Henry Wellcome and Silas Burroughs. The Wellcome

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Tropical Research Laboratories opened in 1902. In the 1920s Burroughs Wellcome

established research and manufacturing facilities in Tuckahoe, New York, which

served as the US headquarters until the company moved to Research Triangle

Park in North Carolina in 1971. The Nobel Prize winning scientists Gertrude B.

Elion and George H. Hitchingsworked there and invented drugs still used many

years later, such as mercaptopurine. In 1959 the Wellcome Company

bought Cooper, McDougall & Robertson Inc to become more active in animal

health. Glaxo and Burroughs Wellcome merged in 1995 to form Glaxo

Wellcome.Glaxo restructured its R&D operation that year, cutting 10,000 jobs

worldwide, closing its R&D facility in Beckenham, Kent, and opening a Medicines

Research Centre in Stevenage, Hertfordshire. Also that year, Glaxo Wellcome

acquired the California-based Affymax, a leader in the field of combinatorial

chemistry

SmithKline Beecham

In 1843 Thomas Beecham launched his Beecam's Pills laxative in

England, giving birth to the Beecham Group. In 1859 Beecham

opened its first factory in St Helens, Lancashire. By the 1960s

Beecham was extensively involved in pharmaceuticals

John k .smith opened its first pharmacy in Philadelphia in 1830. In 1865 Mahlon

Kline joined the business, which 10 years later became Smith, Kline & Co. In 1891

it merged with French, Richard and Company, and in 1929 changed its name

to Smith Kline & French Laboratories as it focused more on research. Years later it

bought Norden Laboratories, a business doing research into animal health,

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

and Recherche et Industrie Thrapeutiques in Belgium in 1963 to focus on

vaccines. The company began to expand globally, buying seven laboratories in

Canada and the United States in 1969. In 1982 it bought Allergan, a manufacturer

of eye and skincare products.

SmithKline & French merged with Beckman Inc. in 1982 and changed its name to

SmithKline Beckman. In 1988 it bought its biggest competitor, International

Clinical Laboratories, and in 1989 merged with Beecham to form SmithKline

Beecham plc. The headquarters moved from the United States to England. To

expand R&D in the United States, the company bought a new research center in

1995; another opened in 1997 in England at New Frontiers Science Park, Harlow

GlaxoSmithKlinee

Glaxo Wellcome and SmithKline Beecham announced their intention to merge in

January 2000. The merger was completed in December that year, forming

GlaxoSmithKline (GSK)The company's global headquarters are at GSK

House, Brentford, London, officially opened in 2002 by then-Prime Minister Toy

Blair. The building was erected at a cost of 300 million and as of 2002 was

home to 3,000 administrative staff Andrew Wittytook over as CEO in May 2008.

Witty joined Glaxo in 1985 and had been president of GSK's Pharmaceuticals

Europe since 200Chris Gent, former CEO of Vodafone, has been the chair since

January 200 Philip Hampton, chair of the Royal Bank of Scotland, replaced Gent

in September 2015

pharamaceutical

GSK manufactures products for major disease areas such as asthma, cancer,

infections, diabetes and mental health. Its biggest-selling in 2013

were Advair,Avodart, Flovent, Augmentin, Lovaza, and Lamictal; its drugs and

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

vaccines earned 21.3 billion that year. Other top-selling products include

its asthma/COPDinhalers Advair, Ventolin, and Flovent;

itsdiphtheria/tetanus/pertussis vaccine Infanrix and its hepatitis B vaccine; the

epilepsy drug Lamictal, and the antibacterial Augmentin.

Medicines historically discovered or developed at GSK and its legacy companies

and now sold as generics include amoxicillin and amoxicillinclavulanate,ticarcillin-clavulanate mupirocin, and ceftazidime for bacterial

infections, zidovudine for HIV infection, valacyclovir for herpes virus

infections, albendazolefor parasitiAmong these, albendazole, , amoxicillinclavulanate, allopurinol, mercaptopurine, mupriocin, pyrimethamine, ranitidine,

thioguanine, trimethoprim and zidovudine are listed on the World Health

Organization's list of essential medications.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Consumer healthcare

GSK's consumer healthcare division, which earned 5.2 billion in

2013, sells oral healthcare, including Aquafresh, Maclean's

and Sensodyne toothpastes; and drinks such as Horlicks, Boost, a

chocolate-flavoured malt drink sold in India, and

formerly Lucozade and Ribena, sold in 2013 to Suntory for

1.35bn.Other products include Abreva to treat cold sores; Night

Nurse, a cold remedy; Breathe Right nasal strips;

and Nicoderm and Nicorette nicotine replacement

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

3) P&G (PROCTER GAMBLE)

Procter & Gamble Co., also known as P&G, is an

American multinational consumer goods company headquartered in downtown

Cincinnati, Ohio, United States, founded by William and James Gamble, both from

the United Kingdom. Its products include cleaning agents, and personal

care products. Prior to the sale of Pringles to the Kellogg Company, its product line

also included foods and beverages.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Procter & Gamble Co., also known as P&G, is an

American multinational consumer goods company headquartered in downtown

Cincinnati, Ohio, United States, founded by William and James Gamble, both from

the United Kingdom. Its products include cleaning agents, and personal

care products. Prior to the sale of Pringles to the Kellogg Company, its product line

also included foods and beverages.

In 2014, P&G recorded $83.1 billion in sales. On August 1, 2014, P&G announced

it was streamlining the company, dropping around 100 brands and concentrating on

the remaining 65 brands, which produced 95 percent of the company's profits. A.G.

Lafley, the company's chairman, president and CEO until October 31, 2015, said

the future P&G would be "a much simpler, much less complex company of leading

brands that's easier to manage and operate".

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

David Taylor became P&G CEO and President effective November 1, 2015.

Company overview

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

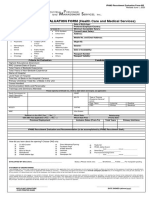

Fig no: Johnsons & johnsons headquarter US

Johnson & Johnson (JNJ) is one of the leading pharmaceuticals and healthcare

companies in the US.

The worlds largest and

most compressive manufacture of health care

product

Founded in 1886 Headquartered in new Brunswick ,new jersey

Sales of $72.2billion in 2015

265+operating companies in 60+countries 128,500+employess worldwide

Customers in over 200 countries

The worlds sixth largest consumer health company

The worlds eighth largest pharmaceutical company

The world fifth largest biologics company

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

The companys business is divided into three major segments:

1.

Pharmaceuticals

2.

Medical Devices and Diagnostics

3.

Consumer Products

The group is referred as Johnson and Johnson Family of Companies. It includes

around 275 subsidiary companies. It has operations in 60 countries. Its products are

sold in around 200 countries.

Share price performance

The above graph shows Johnson & Johnsons share price performance compared to

its peers. On an annualized basis, the company delivered returns of 13.4% from

February 2010 to February 2015. In the same timeframe, Merck & Co. (MRK),

Pfizer (PFE), and Bristol-Myers Squibb Co. (BMY) each delivered annual returns

of 14.2%, 18.5%, and 24.9%, respectively.During the same period, the annualized

return for the Health Care Select Sector ETF (XLV) was 20.38%.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Foundation and early history

ROBERT Wood Johnsons

Inspired by a speech by antiseptic advocate Joseph Lister, Robert Wood

Johnson joined his brothers James Wood Johnson and Edward Mead Johnson to

create a line of ready-to-use surgical dressings in 1885. The company produced its

first products in 1886 and incorporated in 1887.

Robert Wood Johnson served as the first president of the company. He worked to

improve sanitation practices in the nineteenth century, and lent his name to

a hospital in New Brunswick, New Jersey. Upon his death in 1910, he was

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

succeeded in the presidency by his brother James Wood Johnson until 1932, and

then by his son, Robert Wood Johnson II.

Robert Wood Johnson's granddaughter, Mary Lea Johnson Richards, was the first

baby to appear on a Johnson & Johnson baby powder label.

Johnson & Johnson was founded by three brothers in New Brunswick, New Jersey

in 1886. The company started its business operations by introducing a line of

ready-to-use surgical dressings. Surgical dressings are used to cover a wound to

promote healing and prevent further harm.

The company published Modern Methods of Antiseptic Wound Treatment. It was

considered to be one of the standard texts for antiseptic surgery in 1888. In the

same year, the company also introduced its commercial first aid kits to help

railroad workers. Later, it became standard in treating injuries.

The company transformed into a publicly traded company in 1943. It had a listing

on the NYSE in 1944. The companys common stock has also been part of the

Dow Jones Industrial Average since 1997. Its one of the Fortune 500 companies.

As of 2014, the group had ~126,500 employees at over 275 Johnson &

Johnson operating companies. The total revenue from all three business segments

was over $74.3 billion in 2014. It had net earnings of about 22% of the total

revenue.

Chairmen

Robert Wood Johnson I (18871910)

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

James Wood Johnson (19101932)

Robert Wood Johnson II (19321963)

Philip B. Hofmann (19631973)

Richard B. Sellars (19731976)

James E. Burke (19761989)

Ralph S. Larsen (19892002)

William C. Weldon (20022012)

Alex Gorsky (2012present)

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

VISION AND MISSIO

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

The company operates in three broad divisions; Consumer

Healthcare, Medical Devices and Pharmaceuticals.

Johnson & Johnson Family of Companies

Consumer

Medical Devices

Pharmaceuticals

Baby Care

Advanced Sterilization Products

Janssen

Skin & Hair Care

Animas Corporation

Janssen R&D LLC

Wound Care and

Biosense Webster

Janssen Healthcare

Topical

DePuy Synthes Companies of

Innovation

Oral Health Care

Johnson & Johnson

Janssen Pharmaceuticals

Womens Health

Ethicon, Inc.

Inc

McNeil Consumer

Janssen Diagnostics BVBA

Janssen Diagnostics

Healthcare

Johnson & Johnson Vision Care,

Janssen Therapeutics

Over-The-Counter

Inc.

Janssen Scientific

Medicines

LifeScan, Inc.

Affairs

Nutritionals

Mentor

McNeil-PPC, Inc

Healthcare

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Analyzing Johnson & Johnsons Three Main Business

Segments

Business segments

Johnson & Johnson (JNJ) introduced its commercial first aid kits and ready-to-use

surgical dressings in the late 1880s. Over a period of 128 years, the company

diversified its business into three major business segments:

1.

Pharmaceuticals

2.

Medical Devices and Diagnostics

3.

Consumer Products

Pharmaceuticals segment

The Pharmaceuticals segment is focused on five therapeutic areas including

immunology, infectious diseases, neuroscience, oncology, and cardiovascular and

metabolic diseases. Over 29 prescription drugs are part of this segment.

The segment distributes its products directly to retailers, wholesalers, hospitals,

and healthcare professionals for prescription use.

Medical Devices and Diagnostics segment

The Medical Devices and Diagnostics segment includes products used in the

orthopedic, surgical care, specialty surgery, cardiovascular care, diagnostics,

diabetes care, and vision care markets. This segment distributes its products to

wholesalers, hospitals, and retailers. The products are mainly used in

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

the professional fields by physicians, nurses, hospitals, and clinics. The company

completed the divestiture of its Ortho-Clinical Diagnostics business in June 2014.

Consumer Products segment

The Consumer Products segment deals with products for baby care, oral care, skin

care, wound care, womens health fields, nutritionals, and OTC (over-the-counter)

pharmaceutical products. These products are marketed to the general public.

Theyre sold through retail outlets and distributors across the globe.

Johnson & Johnsons structure is based on the principle of decentralized

management. Johnson & Johnsons executive committee is the main management

group thats responsible for the companys strategic operations and resource

allocation. The committee oversees and coordinates the activities of all three of the

companys segments.

Johnson & Johnson competes with various local and global companies in all of its

major products. However, the most significant competition is for the research and

development of new drugs. Other companies include Teva Pharmaceuticals

(TEVA), Pfizer (PFE), Merck and Co. (MRK), Boston Scientific (BSX), Stryker

(SYK), and Zimmer Holdings (ZMH).

Johnson & Johnson forms about 10.4% of the total assets of the Health Care Select

Sector SPDR ETF (XLV).

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

MULUND, INDIA

Johnson & Johnson Limited, Consumer Division

Business Facts

The 24-acre manufacturing facility in Mulund West, a suburb of Mumbai in India,

contains 6 buildings, covering 22,096 square meters of floor space.

The facility manufactures adhesive bandages, health and sanitary products.

Operations run 24-hours per day, 6 days per week with approximately 656

Employees.

Fig;

Mulund consumer Plant

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Fig: Mulund consumer Plant Product

Community and Social Engagement

Civic Activities:

Active member of Mutual Aid Response Group (MARG), an organization with

industries from Mulund to Kurla.

Annually conduct coloring competition in association with MARG and the

Directorate of Industrial Safety & Health for employees children in the MARG

Group.

Participated in the training program for local police personnel.

Provide and maintain a garden for the local residents around the facility.

Environmental, Health and Safety Performance

Environmental highlights:

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Achieved 10% absolute reduction of water use from 2005 to 2010. During this

same period, net trade sales increased.

We are committed to reducing our environmental footprint, and in 2005

implemented a hot melt coating process resulting in reduction of volatile organic

compounds (VOC) emission and generation of hazardous waste.

We have also eliminated the EO Sterilization process for Adhesive Products by

upgrading the manufacturing facility and controlling the Bio burden.

Year Hazardous waste generation (in kilograms)

2004 2,418

2005 6,208

2006 5,585

2007 7,008

2008 3,459

2009 2,006

2010 1,476

2011 1,054

Since 2000, the facility has used Design for Environment tools to redesign our

product packaging and processes, eliminating the use of PVC completely, and

reducing the amount of cardboard used for shipping.

Certified by TV (Technishe Uberwachungs Verein) for establishing and

managing the ISO 14001: 2004 Environmental Management Systems standard

since 2002.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Health and Safety highlights:

EHS training is incorporated into the orientation program for new employees.

Prior to purchasing any new machines or designing a new project we conduct a

comprehensive Aspect/Impact analysis for EHS.

No lost workday injuries since August 1998.

Awards and recognition:

The facility has won 42 National/State and 6 Mutual Aid Awards since 1981.

National/State awards are presented for the lowest accident free rates and lowest

accidents for the corresponding year. The Mutual Aid awards are presented for

EHS Industrial Award Competitions.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Johnson & Johnsons Global Business

Strategy Promotes Growth

Business strategy

Johnson & Johnson (JNJ) operates in nearly 60 countries. It sells

its products in about 200 countries. The following chart shows the

breakup of sales to customers by business segment.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Johnson & Johnsons operations

Nearly 55% of Johnson & Johnsons revenue comes from non-US markets. The

company focuses on the innovation of new products that bring value to people,

healthcare professionals, and health systems around the world.

The company operates 134 manufacturing facilities and eight innovation centers

across the globe. In the US, there are eight manufacturing facilities for the

Consumer Products segment, eight for the Pharmaceuticals segment, and 26 for the

Medical Devices and Diagnostics segment. There are 41 manufacturing facilities in

Europe, 15 in the Western Hemisphereexcept the US, and 36 in Africa and AsiaPacific.

Most of the manufacturing facilities outside the US serve more than one business

segment. Major research facilities are located not only in the US, but also in

Belgium, Brazil, Canada, China, France, Germany, India, Israel, Japan, the

Netherlands, Singapore, Switzerland, and the United Kingdom.

Consumer segment

The company introduced various products including moisturizers, body lotions,

body wash, anti-aging lotions, skin care products for sensitive skin, no-calorie

sweeteners, and pain relieving creams. The new products were mainly focused in

the US, the United Kingdom, Canada, and Australia. This determines the

companys efforts to maintain its market share in the Consumer Products segment

in the US and non-US markets.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Pharmaceuticals segment

The company is focused on developing and improving drugs in order to maintain

the revenue stream from this business segment. The patents for Remicadethe

companys largest selling productwill expire soon. In 2014, Remicade accounted

for 9.2% of the total revenue. Recently, the company launched Edurant, Olysio,

Xarelto, and Zytiga.

Medical Devices and Diagnostics segment

The company is mainly focused on orthopaedic products for joint reconstruction

and trauma. Apart from this, the company introduced various products for

oncology, cardiovascular care, surgical care, diabetes care, and vision care.

Johnson & Johnson already went for the divestiture of the Ortho-Clinical

Diagnostics business. Its exiting certain womens health products.

Other big pharma companies including Pfizer (PFE), Merck & Co. (MRK),

GlaxoSmithKline, and Novartis AG (NVS). Theyre constantly working to

increase their product range and market reach. Merck & Co. forms about 6% of the

total assets of the Health Care Select Sector SPDR ETF (XLV).

Exploring Johnson & Johnsons Pharmaceuticals Segment

Pharmaceuticals segment

Johnson & Johnson (JNJ) is the largest pharmaceutical company in the US. Its the

fastest growing company among the top ten companies globally. The

Pharmaceuticals segment contributes over 43% of the companys revenue.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

For 2014, the segment generated revenue of about $32.3 billion. This was due to

operational growth of 16.5% in worldwide pharmaceutical sales.

The Pharmaceuticals segment is focused on five therapeutic areas including

immunology, infectious diseases, neuroscience, oncology, and cardiovascular and

metabolic diseases. Over 29 prescription drugs are part of this segment.

The segment distributes its products directly to retailers, wholesalers, hospitals,

and healthcare professionals for prescription use. The company focuses on research

and development in these five therapeutic areas only. It doesnt have any plans to

expand into other areas of the Pharmaceuticals segment.

As a percentage of sales, the pre-tax profits for the Pharmaceuticals segment were

36.2% in 2014. This was achieved due to high margin products strong sales

volume growth.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Products

Remicade is an immunology drug. Its the largest selling drug in this segment. The

drug contributes nearly 9.2% of the companys total revenue. However, the patent

for this drug is going to expire in two sets. The first set will expire in 2015 for

some of the countries in Europe. The other set will expire in 2018 for the US.

Key contributors from this segment include:

immunology products including Remicade, Stelara, and Simponi Aria

infectious disease products including Olysio, Sovraid, and Prezista

oncology products including Zytiga and a new product called Imbruvica

oral anticoagulant Xarelto

neuroscience products including Invega, Sustenna, and Xeplion

Competition

Other big pharma companies include Pfizer (PFE), Merck and Co. (MRK),

Novartis AG (NVS), and GlaxoSmithKline (GSK). Pfizer forms about 7.80% of

the total assets of the Health Care Select Sector SPDR ETF (XLV).

Johnson & Johnsons Medical Devices and Diagnostics Segment

Medical devices segment

The Medical Devices and Diagnostics segment contributes over 37% of Johnson &

Johnsons (JNJ) revenue. For the last three years, the orthopedics franchise has

been a key driver for the companys growth in this segment.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

For 2014, the segment generated revenue of about $27.5 billion through the

worldwide sales of medical devices. This was a 3.4% decrease compared to the

year before. The decrease was partially due to the divestiture of the Ortho-Clinical

Diagnostics business to The Carlyle Group in June 2014. It was also due to the

negative impact of currencies.

As a percentage of sales, the pre-tax profit for this segment was 28.9% in 2014.

This was achieved due to a $1.9 billion gain on the divestiture of the OrthoClinical Diagnostics business and lower litigation expenses.

The company is planning to exit certain womens health products.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Products

The segment includes products used in the orthopaedic, surgical care, specialty

surgery, cardiovascular care, diagnostics, diabetes care, and vision care markets.

Key products from this segment are:

Orthopaedic franchise joint reconstruction, trauma, sports medicine, knee,

and hip products.

surgical care franchise sutures and the Endopath stapler

specialty surgery franchise biosurgical products and energy products

vision care franchise Acuvue and Vistakon products

cardiovascular care franchise Biosense Webster products and the

ThermoCool SmartTouch contact force sensing catheter

This segment distributes its products to wholesalers, hospitals, and retailers. The

products are mainly used in the professional fields by physicians, nurses, hospitals,

and clinics.

Brands

A few of the segments devices include:

DePuy Synthes for orthopaedic products

Cordis and Biosense Webster for cardiovascular products

Codman Neuro and DePuy Synthes for neurovascular diseases

Lifescan and Animas corporation for diabetes care

Vistakon and Acuvue for vision care products

Ethicon and Codman Neuro for general surgery products

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Ethicon and Mentor for aesthetics products

Acclarent for ear, nose, and throat conditions

Competition

For medical devices, other major companies include Medtronic (MDT), Boston

Scientific (BSX), Stryker (SYK), and Zimmer Holdings (ZMH). Johnson &

Johnson forms about 10.5% of the total assets of the Health Care Select Sector

SPDR ETF (XLV).

A Snapshot of Johnson & Johnsons Consumer Segment

Consumer segment

Johnson & Johnsons Consumer segment is focused on baby care, oral care, skin

care, and other consumer products. It contributes ~1920% of the companys

revenue.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

For 2014, this segment generated revenue of about $14.5 billion. It was an

operational increase of 1%. It was offset by the negative currency impact of 2.4%.

The total decrease was 1.4%compared to the year before. The company went for

the divestiture of womens sanitary protection products in the US, Canada, and the

Caribbean. The divestiture was completed by the end of 2013.

As a percentage of sales, the pre-tax profit was 13.4% in 2014. This was

achieved mainly due to the cost containment initiatives.

Products

The Consumer segment includes products for OTC (over-the-counter) sales, skin

care, baby care, oral care, wound care, and womens health. The key products from

this segment are:

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

OTC franchise analgesics and upper respiratory products

skin care franchise Aveeno, Neutrogena, and Dabao product lines

baby care franchise Johnsons baby products

oral care franchise Listerine products

wound care franchise Band-Aid, Bengay, and Neosporin products

These products are marketed to general public and sold through retail outlets and

distributors across the globe.

Brands

Consumer Products is a segment where the products are sold mainly due to the

brand reputation and the trust for its quality. A company like Johnson & Johnson

has over 100 brands. A major part of the brands is focused on consumer products.

A few of the major brands for this segment include:

Johnsons baby for baby care products

Aveeno, Neutrogena, Johnsons, Clean & Clear, and Dabao for skin care

products

Band-Aid, Bengay, Savlon, and Neosporin for wound care products

Listerine and Rembrandt for oral care products

Splenda and Benecol for nutritionals

Visine and Acuvue for vision care products

Tylenol, Sudafed, Pepcid and Benadryl for OTC medicines

Competition

For the Consumer Products segment, other major companies include Unilever NV

(UN), Nestle S.A. (NSRGY), Kimberly-Clark Corporation (KMB), and Procter &

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Gamble (PG). Johnson & Johnson (JNJ) forms about 10.4% of the total assets of

the Health Care Select Sector SPDR ETF (XLV).

Johnson & Johnsons Revenue Stream Increased in 2014

Revenue breakup

Johnson & Johnsons (JNJ) net revenue increased by 4.2% from $71.3 billion in

2013 to $74.3 billion in 2014. There was an operational increase of 6.1%. The

negative impact of currency was 1.9%.

Johnson & Johnson has three segmentsConsumer Products, Pharmaceuticals,

and Medical Devices and Diagnostics.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Consumer segment

The Consumer segments revenue for 2014 was $14.5 billion. It was 1.4% lower

than the revenue for 2013. It consisted of an operational increase of 1%. It had a

negative impact of 2.4% from currency. Sales in the US decreased by 1.3%. Sales

outside the US decreased by 1.4%.

The segments positive contributors were the sales of Tylenol and Motrin

analgesics, Zyrtec allergy OTC (over-the-counter) products, Aveeno and

Neutrogena skin care products, and Listerine oral care products.

Pharmaceuticals segment

The Pharmaceuticals segments revenue for 2014 was $32.3 billion. It was 14.9%

higher than the revenue for 2013. It consisted of an operational increase of 16.5%.

It had a negative impact of 1.6% from currency. Sales in the US increased by 25%.

Sales outside the US increased by 5%. The segments positive contributors were

new products as well as the companys existing core products.

Medical Devices and Diagnostics segment

The Medical Devices and Diagnostics segments revenue for 2014 was $27.5

billion. It was 3.4% lower than the revenue for 2013. It consisted of an operational

decrease of 1.6%. It had a negative impact of 1.8% from currency. Sales in the

US decreased by 4.3%. Sales outside the US decreased by 2.7%. The segments

positive contributors were orthopedic products, cardiovascular care products,

biosurgicals, and energy products in the specialty surgery business.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

As a percentage of sales, the pre-tax profits for consumer products,

pharmaceuticals, and medical devices in 2014 were 13.4%, 36.2%, and 28.9%,

respectively.

Other big pharma companies include Pfizer (PFE), Merck & Co. (MRK), and

Novartis AG (NVS). These companies are also in diversified segments. However,

the percentage contribution of pharmaceuticals is higher for these companies

compared to Johnson & Johnson. Merck & Co. forms about 6.46% of the total

assets of the Health Care Select Sector SPDR ETF (XLV).

Share price performance

The above graph shows Johnson & Johnsons share price performance compared to

its peers. On an annualized basis, the company delivered returns of 13.4% from

February 2010 to February 2015. In the same timeframe, Merck & Co. (MRK),

Pfizer (PFE), and Bristol-Myers Squibb Co. (BMY) each delivered annual returns

of 14.2%, 18.5%, and 24.9%, respectively.

What Were Johnson & Johnsons Outstanding Expenses?

Expenses

As a percentage of sales, Johnson & Johnsons (JNJ) net profit increased from

19.4% in 2013 to 22% in 2014. The company achieved lower expenses, as a

percentage of sales, for 2014compared to 2013.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Cost of product sold

Johnson & Johnson was able to improve its gross profit margins by concentrating

on the sale of high margin products. The company also made cost reduction efforts

across many businesses. As a percentage of sales, the company achieved a lower

cost of products sold by 0.7% in 2014 to 30.6%compared to 31.3% in 2013.

Selling, marketing, and administration expenses

Selling, marketing, and administration expenses include salaries, shipping and

handling, marketing and advertising, and other operating expenses incurred by the

company. With over 126,500 employees in over 275 Johnson & Johnson operating

companies, the company has to incur huge salary costs.

It noticed an increase of 0.6% in selling, marketing, and administration expenses

for 2014compared to the year before. However, comparing the expenses as a

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

percentage of sales, these expenses showed a dip of 1.1% at 29.5% in 2014

compared to 30.6% in 2013.

Research and development expenses

Johnson & Johnson is committed to investing in research and development. It aims

to deliver innovative and high quality products. As a percentage of sales, the

research and development expenses were nearly the same for 2014 and 2013. The

companys research and development focus shifted partially from the Medical

Devices and Diagnostics segment to the Consumer Products segment.

Net earnings

As a percentage of sales, the company was able to improve its net earnings to 22%

in 2014compared to 19.4% in 2013. This was due to increased sales in the

pharmaceutical business and a higher concentration on high margin products sales.

Also, the company focused on cost reduction efforts across many businesses.

Other big pharma companies include Eli Lily and Company (LLY), Merck &

Co. (MRK), and Novartis AG (NVS). Johnson & Johnson forms about 10.54% of

the total assets of the Health Care Select Sector SPDR ETF (XLV).

Johnson & Johnsons Gross Margin Increased

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Cost of products sold

The cost of products soldalso known as the cost of goods sold, or COGSis

the direct cost attributable to the production of goods. It includes the cost of raw

materials, packaging material, direct production costs, and certain freight costs. A

lower COGS means a higher gross margin for the company. COGS are also linked

to inventory turnover. Inventory turnover measures how fast the company turns

over its inventory within a year.

The above chart shows a comparison of COGS for big pharma companies with

headquarters in the US. Over three years, the trend is different for each company.

For Johnson & Johnson (JNJ), COGS decreased from 32.2% in 2012 to 30.6% in

2014. This resulted in an increase in gross margin from 67.8% in 2012 to 69.4% in

2014.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Increase in gross margin

Johnson & Johnson is a family of companies. It consists of over 265 operating

companies. The companys gross margin increased due to the following reasons:

higher sales of higher margin products

lower costs associated with strong volume growth in the Pharmaceuticals

segment

cost reduction efforts across many of the businesses

While the gross margin increased noticeably, the increase was partially offset by:

incremental intangible asset amortization expense related to Synthes and the

Medical Device Excise Tax

increased amortization expense due to the royalty buyout agreement with

Vertex for Incivo

total intangible asset amortization expense for 2013 was $1.4 billionit was

$1.1 billion for 2012

The change in COGS improved the net earnings to 22% of sales in 2014

compared to 19.4% in 2013.

Other big pharmaceutical companies

While the sales for Johnson & Johnson increased year-over-year, or YoY, for 2012

2014, the sales for big pharma companies like Pfizer (PFE), Merck & Co. (MRK),

Eli Lily and Company (LLY), and Bristol-Myers Squibb Co. (BMY) reduced

during the same period. This led to an increase in COGS for all of the other

companies.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Pfizer forms about 7.40% of the total assets of the Health Care Select Sector SPDR

ETF (XLV). In recent years, it noticed sales dip due to patents expiring for two of

its drugsLipitor and Viagra. Lipitor is a drug that lowers cholesterol. Viagra is a

drug for erectile dysfunction.

Johnson & Johnson Invested in Research and Development

Research and development

For a big pharma company like Johnson & Johnson (JNJ), research and

development, or R&D, plays a vital role in maintaining a healthy revenue stream.

These expenses relate to the process of discovering, testing, and developing new

products and improving the existing range of products. These expenses also ensure

product efficacy and regulatory compliances before the launch.

The above chart compares the R&D expenses for Johnson & Johnson, Pfizer

(PFE), Merck & Co. (MRK), Eli Lily and Company (LLY), and Bristol-Myers

Squibb Co. (BMY). As a percentage of sales, the R&D expenses for Johnson &

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Johnson were around 11.4% in 2014. For the Pharmaceuticals segment, the R&D

expenses were about 8.3%. For the Consumer Products segment, the expenses

were nearly 0.85%. For the Medical Devices and Diagnostics segment, the

expenses were about 2.2%.

The company has its own R&D centers strategically located in Asia-Pacific,

Boston, California, and London. It offers entrepreneurs quick access to all of the

resources for the Johnson & Johnson Family of Companies.

The company invests in R&D to ensure the delivery of high quality and innovative

products. It develops new drugs through R&D to be ready with new products and

patents by the time existing patents expire. This is a constant process. As a

result, R&D is important for any companys growth. The in-process R&D, or

IPR&D, refers to recently discontinued or delayed development projects.

For each segment, the contribution of R&D as of December 2014 is listed below:

Pharmaceuticals segment

ten major new product filings and over 25 brand line extensions between

2013 and 2017

11 new products already launched between 2009 and 2013

nearly 50 compounds in early development

nearly 100 ongoing discovery projects

Medical Devices and Diagnostics segment

30 major new product filings expected between 2014 and 2016

Consumer Products segment

20 key product launches expected globally in 2015

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Patent expiry

Johnson & Johnson lost exclusivity on two patented drugs in 2013Aciphex and

Concerta. Velcade is a cancer treatment drug. It lost exclusivity in 2014. One of the

key drugs is Remicade. Its for autoimmune diseases. Its expected to lose

exclusivity in the European Union in 2015. Its expected to lose exclusivity in

the US in 2018.

Teva Pharmaceutical Industries (TEVA) lost exclusivity on Copaxone. AstraZeneca

(AZN) lost exclusivity on Nexium. Merck & Co. (MRK) lost exclusivity on

Nasonex. Eli Lily and Company (LLY) lost exclusivity on Evista in 2014. Johnson

& Johnson forms 8.23% of the total assets of the iShares US Pharmaceuticals

(IHE) and 10.54% of the SPDR Health Care Select Sector ETF (XLV).

What Risks Does Johnson & Johnson Face?

Key risks

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in

addition to specific risks in the pharmaceutical industry. Through Enterprise Risk

Management, the company identifies potential events that could affect it.

It manages the associated risks and opportunities. The company provides assurance

that its stated objectives will be achieved.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Geographic risk

Johnson & Johnson operates in over 60 countries. Its products are sold in over 200

countries. Also, nearly 55% of its total revenue is from sales outside the US. The

widespread network reduces the geographic risk. Any changes in the social,

regulatory, and economic environment in one of the markets wont affect the

business adversely.

Currency risk

Currency risk is one of the major risks that can impact Johnson & Johnson. The

company receives nearly 55% its revenue from non-US markets. For 2014, the

company faced nearly a 2.4% negative impact of currencies in the Consumer

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Products segment, a 1.6% negative impact of currencies in the Pharmaceuticals

segment, and a 1.8% negative impact of currencies in the Medical Devices and

Diagnostics segment.

Legal risk

Johnson & Johnson is exposed to legal riskslike patent rights and prohibition

rules. For patent rights, the company is already looking for an extension for

its largest selling drugRemicade. The patents are set to expire in 2015 in some

European countries. The patents are expected to retire in 2018 in the US.

For 4Q14, one of the subsidiarys manufacturing facilities was charged for

allegedly violating regulations dealing with the handling of certain wastes. It was

charged by the California Department of Toxic Substances Control. The company

agreed to perform certain remedial actions and pay ~$400,000 to settle the claim.

Integration risk after a merger

The company tries to minimize the integration risk after a merger by maintaining a

decentralized management structure. Johnson & Johnsons executive committee is

the main management group thats responsible for the companys strategic

operations and resource allocation. The committee oversees and coordinates the

activities of the Consumer Products, Pharmaceutical, and Medical Devices and

Diagnostics segments.

Johnson & Johnson, Pfizer (PFE), Merck & Co. (MRK), and Gilead Sciences

(GILD) form over 30% of the total assets of the Health Care Select Sector SPDR

ETF (XLV).

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Where Does Johnson & Johnson Stand in the Industry?

Johnson & Johnson and its peers

Johnson & Johnson (JNJ) is a diversified company. It has operations in

the Consumer Products, Medical Devices and Diagnostic, and Pharmaceuticals

segments. Some of the other big pharma companies include Pfizer (PFE), Merck

and Co. (MRK), and Novartis AG (NVS).

For medical devices, large companies include Medtronic (MDT) and Boston

Scientific (BSX). For orthopedic implants, the major pharmaceutical companies

include Stryker (SYK) and Zimmer Holdings (ZMH). For consumer products,

other prominent companies include Procter & Gamble (PG) and Unilever NV

(UN).

Big pharma and healthcare companies generally carry high debt on accounting

balance sheets. Therefore, EV/EBITDA (enterprise value to earnings before

interest, tax, depreciation, and amortization) is often used to value capital-intensive

companies. The above chart shows Johnson & Johnsons forward EV/EBIDTA

multiple trend over five yearscompared to the industry trend.

EV/EBIDTA multiple

The forward EV/EBIDTA multiple represents the futuristic enterprise multiple over

the next 12 months. Johnson & Johnsons EV/EBIDTA multiple is much lower

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

than the industry average. Stocks like Bristol-Myers Squibb Co. (BMY) and Eli

Lily and Company (LLY) have a higher enterprise multiple.

PE multiple

The price-to-earnings, or PE, multiple is one of the simplest multiples used for

valuations. A forward PE multiple represents the estimates of the PE multiple for

the next 12 months. Analysts estimates suggest that Johnson & Johnsons forward

PE ratio increased from 15.5x in 2014 to 16.1x in 2015. The PE ratio is hovering

around 19x for the industry.

Also, the estimate for the PEG, or PE-to-growth, ratio is 2.76. The company is

trailing at a lower PE due to Remicades expected patent expiration. Its the largest

selling drug. It contributes to over 9% of the total revenue. However, the forward

PE is expected to be higher due to an estimated increase in sales and new product

launches.

When Johnson & Johnson is compared with its peersincluding Pfizer, Merck and

Co., and Eli Lily and Companyits the only company that had an increase in

revenue and net earnings year-over-year, or YoY, for the last three years.

Annualized returns

Johnson & Johnsons annualized returns are 14.14%, 19.77%, and 13.58%,

respectively, for one-year, three-years, and five-years. For the industry, the returns

are 16.19%, 20.54%, and 15.39%, for similar periods, respectively.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Ratings

Johnson & Johnson was awarded a AAA rating by Standard & Poors, Moodys,

and Fitch.

Johnson & Johnson, Merck and Co., Pfizer, and Gilead Sciences Inc. (GILD)

together form over 30% of the total assets of the Health Care Select Sector SPDR

ETF (XL

Understanding Johnson & Johnsons Ownership Structure

Ownership structure

Johnson & Johnson (JNJ) is a publicly traded company. It has been listed on New

York Stock Exchange since 1944. Its common stock is part of the Dow Jones

Industrial Average. The company is one of the Fortune 500 companies. Johnson &

Johnsons market capitalization is ~$280 billion.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Passive investors

The above graph shows Johnson & Johnsons ownership structure in January 2015.

Its dominated by passive investments. Passive investors arent involved with the

companys day-to-day activities. These investments account for more than 80% of

the total ownership structure. Black Rock, The Vanguard Group, and State Street

Corp. are the top three holders with 6.17%, 5.89%, and 5.72%, respectively, among

the investment research firms or the mutual fund investors in the company.

Banks, pension funds, government, and insurance companies together account for

about 11% ownership in Johnson & Johnson. The banks stake increased from

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

1.36% in January 2012 to 1.59% in January 2015. Pension funds stake decreased

from 3.83% in 2012 to 2.81% in 2015. The governments stake increased from

0.25% in 2012 to 1.37% in 2015.

Active investors

Active investors including hedge funds and individual investors. Together,

they account for ~2.5% ownership. Hedge funds holdings decreased from 2.38%

in 2012 to 1.55% in 2015.

Overall, there are 3,334 institutional owners holding 2.1 billion shares. Out of

these, 75.6% are floating shares. Insiders hold around 0.02% shares.

ETFs holdings

Johnson & Johnson is a major part of the Health Care Select Sector SPDR ETF

(XLV). It forms 10.54% of XLVs total assets. Other parts include Pfizer (PFE),

Merck & Co. (MRK), and Gilead Sciences (GILD) with 7.40%, 6.46%, and 5.94%

of XLVs total assets.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

What is Supply chain Management?

Supply chain management (SCM) is the oversight of materials, information, and

finances as they move in a process from supplier to manufacturer to wholesaler to

retailer to consumer. Supply chain management involves coordinating and

integrating these flows both within and among companies. It is said that the

ultimate goal of any effective supply chain management system is to reduce

inventory (with the assumption that products are available when needed). As a

solution for successful supply chain management

Fig: supply chain Diagram

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Supply chain management (SCM)

Major functions of supply chain are marketing, manufacturing ,procurement

,operations , inventory, warehousing ,distribution and customer service

The process begins with customer order and ends with delivery of goods and

service

These functions are managed through supply chain participants who could be many

at each stage in the chain.

Supply chain consist of all stages involved in servicing the customer to fulfill the

expectations

A supply chain is an extended enterprise where participants in the chain have

specific contributing roles to the goal of reaching the customer

How Do You Do Supply Chain

Management (SCM)?

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

A firms SCM efforts start with the development and execution of a long-term

supply chain strategy. Among other things, this strategy should:

Identify what supply chains the firm wants to compete in.

Help managers understand how the firm will provide value to the supply

chain.

Guide the selection of supply chain partners, including suppliers,

subcontractors, transportation providers, and distributors.

As firms struggle to understand what supply chains they compete in, it is often

valuable to map the physical flows and information flows that make up these

supply chains. From these maps, firms can begin to understand how they add

value, and what information is needed to make the supply chain work in the most

effective and efficient way possible.

Of course, the firms supply chain strategy does not exist in a vacuum. It must be

consistent with both the overall business strategy and efforts within such areas as

purchasing, logistics, manufacturing and marketing.

What is the Importance of Supply Chain

Management?

Supply Chain Management (SCM) is an essential element to operational efficiency.

SCM can be applied to customer satisfaction and company success, as well as

within societal settings, including medical missions; disaster relief operations and

other kinds of emergencies; cultural evolution; and it can help improve quality of

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

life. Because of the vital role SCM plays within organizations, employers seek

employees with an abundance of SCM skills and knowledge.Supply chain

management is critical to business operations and success for the following

reasons:

SCM is Globally Necessary

Basically, the world is one big supply chain. Supply chain management touches

major issues, including the rapid growth of multinational corporations and strategic

partnerships; global expansion and sourcing; fluctuating gas prices and

environmental concerns, each of these issues dramatically affects corporate

strategy and bottom line. Because of these emerging trends, supply chain

management is the most critical business discipline in the world today.

Reasons for SCM in Society

Supply chain management is necessary to the foundation and infrastructure within

societies. SCM within a well-functioning society creates jobs, decreases pollution,

decreases energy use and increases the standard of living. Two examples of the

effect of SCM within societies include:

o

Foundation for Economic Growth

A society with a highly developed supply chain infrastructure that includes

interstate highways, a large railroad network, ports and airports is able to trade

many goods at low cost. Business and consumers are able to obtain these goods

quickly, resulting in economic growth.

Reasons for SCM in Business

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Clearly, the impact that SCM has on business is significant and exponential. Two

of the main ways SCM affects business include:

o

Boosts Customer Service

SCM impacts customer service by making sure the right product assortment and

quantity are delivered in a timely fashion. Additionally, those products must be

available in the location that customers expect. Customers should also receive

quality after-sale customer support.

Improves Bottom Line

SCM has a tremendous impact on the bottom line. Firms value supply chain

managers because they decrease the use of large fixed assets such as plants,

warehouses and transportation vehicles in the supply chain. Also, cash flow is

increased because if delivery of the product can be expedited, profits will also be

received quickly.

Supply chain management helps streamline everything from day-to-day product

flows to unexpected natural disasters. With the tools and techniques that SCM

offers, youll have the ability to properly diagnose problems, work around

disruptions and determine how to efficiently move products to those in a crisis

situation.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

INTRODUCTION

We need different types of goods in our day-to-day life. We may buy some of these

items in bulk and store them in our house. Similarly, businessmen also need a

variety of goods for their use. Some of them may not be available all the time. But,

they need those items throughout the year without any break. Take the example of

a sugar factory. It needs sugarcane as raw material for production of sugar. You

know that sugarcane is produced during a particular period of the year. Since sugar

production takes place throughout the year, there is a need to supply sugarcane

continuously. But how is it possible? Here storage of sugarcane in sufficient

quantity is required. Again, after production of sugar it requires some time for sale

or distribution. Thus, the need for Storage arises both for raw material as well as

finished products.

Fig: Warehouse

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Storage involves Proper arrangement for preserving goods from the time of their

production or purchase Till the actual use. When this storage is done on a large

scale and in a specified manner it is called warehousing.

The place where goods are kept is called warehouse. The

person in-charge of warehouse is called warehouse-keeper.APTE

Warehousing refers to the activities involving storage of goods on a large-scale in a

systematic and orderly manner and making them available conveniently when

needed. In other words, warehousing means holding or preserving goods in huge

quantities from the time of their purchase or production till their actual use or sale.

Warehousing is one of the important auxiliaries to trade. It creates time utility by

bridging the time gap between production and consumption of goods.

The effective and efficient management of any organization requires that all its

constituent elements operate effectively and efficiently as individual SBUs /

facilities and together as an integrated whole corporate. Across the supply chains,

warehousing is an important element of activity in the distribution of goods, from

raw materials and work in progress through to finished

products .It is integral part to the supply chain network within which it operates

and as such its roles and objectives should synchronize with the objectives of the

supply chain. It is not a Stand-alone element of activity and it must not be a weak

link in the whole supply chain network.

Warehousing is costly in terms of human resources and of the facilities and

equipments required, and its performance will affect directly on overall supply

chain performance. Inadequate design or managing of warehouse systems will

jeopardize the achievement of required customer service levels and the

maintenance of stock integrity, and result in unnecessarily high costs.

The recent trends and pressures on supply chain / logistics-forever increasing

customer service levels, inventory optimization, time compression and cost

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

minimization have inevitably changed the structure of supply chains and the

location and working of warehouses within the supply chains network.

WAREHOUSING & INVENTORY MANAGEMENT

Certainly the old concept of warehouses as go downs to store goods has been

outdated. Warehouses perhaps better referred to as distribution centers; exist

primarily to facilitate the movement of materials to the end customer. There are

exceptions such as Strategic stock-holding, but in all commercial applications;

effective and more efficient movement of materials to the customer is the key, even

if some inventory has to be held to achieve this. Warehouses are built in all shapes

and sizes, form facilities of a few thousand square

meters handling modest throughputs, to-despite the previous comments-large

capital intensive installations with storage capacities in the 1,00,000- pallet-plus

range, and very high-hundreds of pallets per hour throughputs.

However, the concept of throughput rather than storage, and the pressure to

optimize inventory with improved customer service level have also seen the

development of distribution centers that do not hold stock-the stockless depot

such as trans-shipment depots with more cross-docking operations. Another issue

that has exercised companies in recent days has been the degree of technology to

utilize in warehousing operations. The choice spans from conventional

warehousing racking and shelving with fork-lift or even manual operations

through to fully automated systems with conveyors and automated guided vehicles

(AGVs) and from carousels to robotic applications. The reasons for the choice of a

particular technology level are not always clear cut, and run the gamut of financial,

marketing and other factors, from companys image or flexibility for future change

through to personal perception of the appropriateness of a particular technology to

a particular business or company.

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Need for Warehousing

Warehousing is necessary due to the following reasons.

(i) Seasonal Production- You know that agricultural commodities are harvested

during certain seasons, but their consumption or use takes place throughout t

Therefore, there is a need for proper storage or warehousing for these

commodities, from where they can be supplied as and when required.

(ii) Seasonal Demand- There are certain goods, which are demanded seasonally,

like woollen garments in winters or umbrellas in the rainy season. The production

of these goods takes place throughout the year to meet the seasonal demand. So

there is a need to store these goods in a warehouse to make them available at the

time of need.

(iii) Large-scale Production - In case of manufactured goods, now-a-days

production takes place to meet the existing as well as future demand of the

products. Manufacturers also produce goods in huge quantity to enjoy the benefits

of large-scale production, which is more economical. So the finished products,

which are produced on a large scale, need to be stored properly till they are cleared

by sales.

(iv) Quick Supply - Both industrial as well as agricultural goods are produced at

some specific places but consumed throughout the country. Therefore, it is

essential to stock these goods near the place of consumption, so that without

making any delay these goods are made available to the consumers at the time of

their need.

(V) Continuous Production- Continuous production of goods in factories requires

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Adequate supply of raw materials. So there is a need to keep sufficient quantity of

stock of raw material in the warehouse to ensure continuous production.

(vi) Price Stabilization- To maintain a reasonable level of the price of the goods in

the market there is a need to keep sufficient stock in the warehouses. Scarcity in

supply of goods may increase their price in the market. Again, excess production

and supply may also lead to fall in prices of the product by maintaining a balance

of supply of goods, warehousing leads to price stabilization

Issues affecting Warehousing

Since warehouses, stores and distribution centres have to operate as essential

component elements within supply chains net work, key decisions when setting up

such facilities must be determined by the overall supply chain strategies for service

and cost. The factors that should be considered include the following.

WAREHOUSING &

Market and product base stability

Long term market potential for growth and for how the product range may expand

will influence decisions on the size and location of a warehouse facility, including

space for prospective expansion. These considerations will also impact on the

perceived need for potential flexibility, which in turn can influence decisions on

the type of warehouse and the level of technology to be used.

Type of materials to be handled:

Materials handled can include raw materials, WIP, OEM Auto spare parts,

packaging materials and finished goods in a span of material types, sizes, weights,

products lives and other characteristics. The units to be handled can range from

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

individual small items through carton boxes, special storage containers for liquids,

drums, sacks, and palletized loads. Special requirements for temperature and

humidity may also have to be

Types of warehouse

After getting an idea about the need for warehousing, let us identify the different

types of warehouses. In order to meet their requirement various types of

warehouses came into Existence, which may be classified as follows.

i. Private Warehouses

ii. Public Warehouses

iii. Government Warehouses

iv. Bonded Warehouses

v. Co-operative Warehouses

i. Private Warehouses The warehouses which are owned and managed by the

Manufacturers or traders to store, exclusively, their own stock of goods are known

as private warehouses. Generally these warehouses are constructed by the farmers

near their fields, by wholesalers and retailers near their business centres and by

Manufacturers near their factories. The design and the facilities provided therein

are according to the nature of products to be stored

ii. Public Warehouses

The warehouses which are run to store goods of the general public are known as

public warehouses. Anyone can store his goods in these warehouses on payment of

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

rent. An individual, a partnership firm or a company may own these warehouses.

To start such warehouses a license from the government is required. The

government also regulates the functions and operations of these warehouses.

Mostly these warehouses are used by manufacturers, wholesalers, exporters,

importers, government agencies, etc

iii. Government Warehouses

These warehouses are owned, managed and controlled by central or state

governments or public corporations or local authorities. Both government and

private enterprises may use these warehouses to store their goods. Central

Warehousing Corporation of India, State Warehousing Corporation and Food

Corporation of India are examples of agencies maintaining government

warehouses.

iv. Bonded Warehouses - These warehouses are owned, managed and controlled

by government as well as private agencies. Private bonded warehouses have to

obtain license from the government. Bonded warehouses are used to store imported

goods for which import duty is yet to be paid. In case of imported goods the

importers are not allowed to take away the goods from the ports till such duty is

paid. These warehouses are generally owned by dock authorities and found near

the ports.

v. Co-operative Warehouses

These warehouses are owned, managed and controlled by co-operative societies.

They provide warehousing facilities at the most economical rates to the members

of their societ

Johnsons & johnsons warehouse

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Johnsons & Johnson 222 carry forward agent(CFA) in India

Motherhouse is Bhiwandi (MH) and Ghaziabad (UP )

This are five warehouse in Mulund plant (layout)

1) Main WH=14,449 sq. Ft.

2)BAND AID =2,969 sq. Ft.

3)IFC 1=9,636 sq. Ft.

4)M7= 3,000 sq. Ft

5) TALC = 8174 sq. Ft.

Fig : Talc warehouse

Fig:Main warehouse

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

MULUND LOCATION

BHIWANDI

ADI ENTERPRISE

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

VAKOLA

MLL

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Process of Warehouse

Handling of Material

Receiving : the carrier delivering material should report at a designated Area

in the warehouse The carrier will present document given by the supplier t

Warehouse personal to check for correctness of the document and verify PO

and document,

Proper document in the name of Johnson & Johnsons security Inward entry

on the reverse of document and correct name & Address of consignor &

consignee in the document and Excise invoice ,material name Description

code Quantity and unit ,vendor status ,transporters copy of the Excise

SAV Acharya Institute of Management studies, Shelu

Johnsons & johnsons Pvt Ltd

Invoice ,COA / test report, vendor batch no ( all Raw

material),Manufacturing Date / Exp Date of consignment ,LCN number ( all

printed packaging material )

Upon getting clearance from receiving section for document correctness

.Park vehicle in front of Unloading bay .place stopper on either side of the

wheel of vehicle to ensure the vehicle does not move

Unloaded the material batch wise /lot wise from the vehicle on the Pallet

Such that different Batch /lots of the material are store on separate pallet

The vehicle carrying Band aid material unloaded separately all cosmetic

material are cleared from the unloading bay before band aid material are

unloaded and vice versa

During unloading that material is protected from rain water or any dired

contamination

The warehouse supervisor verify and ensure that the remaining shelf life of

raw materials are as per the guide line The shelf life of active ingredient of

Band Aid should be than 3 and half years ,If less than it should be informed

to warehouse incharge ,Q&C and sourcing

Ensure to inspect the incoming drums and bags / Boxes for transit damages

Drums that are damaged in transit or subject to rough handling during and

unloading are to be rejected during the income warehouse inspection

Drums that have miner dents and not structurally damaged are Acceptable

Minor scratches rusts that are not in the patch of pouring are acceptable

Drums where the material have leaked or are stained with inspect /birds

dropping molds are unacceptable

Thick layer of dust /dirty or cartons and unusual print (such foot prints) are

unacceptable

Torn cartons with contents exposed or visible or unacceptable

Holes that are deep and penetrate into material inside are unacceptable