Professional Documents

Culture Documents

Chapter 11 1a Eoc

Uploaded by

KimTiếnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 11 1a Eoc

Uploaded by

KimTiếnCopyright:

Available Formats

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-1A

Equipment Replacement Decision

(LO2)

CHECK FIGURE

(2) Net advantage of new machine: $36,000

Murl Plastics, Inc. purchased a new machine one year ago at a cost of $75,000. Although the machine operates well,

the president of Murl Plastics, Inc. is wondering if the company should replace it with a new electronically operated

machine that has just come on the market. The new machine would slash annual operating costs by 60%, as shown

in the comparative data below:

Purchase cost new

Estimated useful life new

Annual operating costs

Annual straight-line depreciation

Remaining book value

Salvage value now

Salvage value in 5 years

Proposed New

Present Machine

Machine

$80,000

$100,000

8 years

5 years

$40,000

$16,000

$10,000

$20,000

$70,000

$16,000

$0

$0

In trying to decide whether to purchase the new machine, the president has prepared the following analysis:

Book value of the old machine

Less salvage value

Net operating loss from disposal

$70,000

16,000

$54,000

Even though the new machine looks good, said the president, we cant get rid of that old machine if it means

taking a huge loss on it. Well have to use the old machine for at least a few more years.

Sales are expected to be $310,000 per year, and selling and administrative expenses are expected to be

$140,000 per year, regardless of which machine is used.

Required:

1. Prepare a summary income statement covering the next 5 years, assuming:

a. That the new machine is not purchased.

b. That the new machine is purchased.

2. Determine the desirability of purchasing the new machine using only relevant costs in your analysis.

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-2A

Dropping or Retaining a Product

(LO3)

CHECK FIGURE

(1) Discontinuing the racing bikes would decrease net operating income by $17,000

The Regal Cycle Company manufactures three types of bicyclesdirt bikes, mountain bikes, and racing bikes. Data

on sales and expenses for the past quarter follow:

Sales

Less variable manufacturing and selling expenses

Contribution margin

Less fixed expenses:

Advertising, traceable

Depreciation of special equipment

Salaries of product-line managers

Common allocated costs*

Total fixed expenses

Net operating income (loss)

*Allocated on the basis of sales dollars

Mountain

Total

Dirt Bikes

Bikes

$240,000

$80,000 $100,000

95,000

32,000

35,000

145,000

48,000

65,000

Racing

Bikes

$60,000

28,000

32,000

19,000

17,000

27,000

60,000

123,000

$ 22,000

6,000

6,000

9,000

15,000

36,000

$(4,000)

6,000

5,000

8,000

20,000

39,000

$ 9,000

7,000

6,000

10,000

25,000

48,000

$ 17,000

Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to

whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale

value and does not wear out.

Required:

1. Should production and sale of the racing bikes be discontinued? Show computations to support your answer.

2. Recast the above data in a format that would be more usable to management in assessing the long-run

profitability of the various product lines.

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-3A

Discontinuing a Flight

(LO3)

CHECK FIGURE

(1) Decrease in net operating income if the flight is dropped: $8,700

Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the companys

performance, consideration is being given to dropping several flights that appear to be unprofitable.

A typical income statement for one such flight (flight 482) is given below (per flight):

Ticket revenue (200 passengers 50% occupancy $240 per

passenger)...........................................................................................................................

$24,000

Less variable expenses (200 passengers 50% occupancy $60

per passenger).....................................................................................................................

6,000

Contribution margin...............................................................................................................

18,000

Less flight expenses:

Salaries, flight crew............................................................................................................

5,100

Flight promotion.................................................................................................................

700

Depreciation of aircraft......................................................................................................

1,600

Fuel for aircraft...................................................................................................................

6,000

Liability insurance..............................................................................................................

4,200

Salaries, flight assistants....................................................................................................

800

Baggage loading and flight preparation.............................................................................

1,400

Overnight costs for flight crew and assistants at destination.............................................

400

Total flight expenses..............................................................................................................

20,200

Net operating loss..................................................................................................................

$(2,200)

The following additional information is available about flight 482:

a. Members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid by the flight.

b. One-third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the

insurance company, the destination of the flight is in a high-risk area. The remaining two-thirds would be

unaffected by a decision to drop flight 482.

c. The baggage loading and flight preparation expense is an allocation of ground crews salaries and depreciation

of ground equipment. Dropping flight 482 would have no effect on the companys total baggage loading and

flight preparation expenses.

d. If flight 482 is dropped, Pegasus Airlines has no authorization at present to replace it with another flight.

e. Depreciation of aircraft is due entirely to obsolescence. Depreciation due to wear and tear is negligible.

f. Dropping flight 482 would not allow Pegasus Airlines to reduce the number of aircraft in its fleet or the number

of flight crew on its payroll.

Required:

1. Prepare an analysis showing what impact dropping flight 482 would have on the airlines profits.

2. The airlines scheduling officer has been criticized because only about 50% of the seats on Pegasus Airlines

flights are being filled compared to an average of 60% for the industry. The scheduling officer has explained

that Pegasus Airlines average seat occupancy could be improved considerably by eliminating about 10% of the

flights, but that doing so would reduce profits. Explain how this could happen.

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-4A

Make or Buy a Component

(LO4)

CHECK FIGURE

(1) The part can be made inside the company for $5.00 less per unit.

Troy Engines manufactures a variety of engines for use in heavy equipment. The company has always produced

most of the parts for its engines, including all of the pistons. An outside supplier has offered to produce and sell one

type of piston to Troy Engines at a price of $39.00 per unit. To evaluate this offer, Troy Engines has gathered the

following information relating to its own cost of producing the piston internally:

30,000 Units

Per Unit

Per Year

Direct materials

$21

$ 630,000

Direct labor

6

180,000

Variable manufacturing overhead

4

120,000

Fixed manufacturing overhead, traceable*

9

270,000

Fixed manufacturing overhead, allocated

12

360,000

Total cost

$52

$1,560,000

*One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value).

Required:

1. Assuming that the company has no alternative use for the facilities that are now being used to produce the

pistons, should the outside suppliers offer be accepted? Show all computations.

2. Suppose that if the pistons were purchased, Troy Engines could use the freed capacity to launch a new product.

The segment margin of the new product would be $250,000 per year. Should Troy Engines accept the offer to

buy the pistons for $39.00 per unit? Show all computations.

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-5A

Accept or Reject a Special Order

(LO5)

CHECK FIGURE

(1) Net increase in profits: $60,500

Polaski Company manufactures and sells a single product called a ret. Operating at capacity, the company can

produce and sell 20,000 rets per year. Costs associated with this level of production and sales are given below:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling expense

Fixed selling expense

Total cost

Unit

$12.00

6.00

4.00

7.00

3.00

4.00

$36.00

Total

$240,000

120,000

80,000

140,000

60,000

80,000

$720,000

The rets normally sell for $42.00 each. Fixed manufacturing overhead is constant at $140,000 per year within

the range of 15,000 through 20,000 rets per year.

Required:

1. Assume that due to a recession, Polaski Company expects to sell only 15,000 rets through regular channels next

year. A large retail chain has offered to purchase 5,000 rets if Polaski Company is willing to accept a 15%

discount off the regular price. There would be no sales commissions on this order; thus, variable selling

expenses would be slashed by 80%. However, Polaski Company would have to purchase a special machine to

engrave the retail chains name on the 5,000 units. This machine would cost $5,000. This would be a one-time

order that would have no effect on regular sales. Determine the impact on profits next year if this special order

is accepted.

2. Refer to the original data. Assume again that Polaski Company expects to sell only 15,000 rets through regular

channels next year. The U.S. Army would like to make a one-time-only purchase of 5,000 rets. The Army would

pay a fixed fee of $7.00 per ret, and in addition it would reimburse Polaski Company for all costs of production

(variable and fixed) associated with the units. There would be no variable selling expenses of any type

associated with this order. If Polaski Company accepts the order, by how much will profits be increased or

decreased for the year?

3. Assume the same situation as that described in (2) above, except that the company expects to sell 20,000 rets

through regular channels next year. Thus, accepting the U.S. Armys order would require giving up regular sales

of 5,000 rets. If the Armys order is accepted, by how much will profits be increased or decreased from what

they would be if the 5,000 rets were sold through regular channels?

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-6A

Utilization of a Constrained Resource

(LO6)

CHECK FIGURE

(2) Hours required: 154,500 DLHs

The Walton Toy Company manufactures a line of dolls and a doll dress sewing kit. Demand for the dolls is

increasing, and management requests assistance from you in determining an economical sales and production mix

for the coming year. The company has provided the following information:

Product

Debbie

Trish

Sarah

Mike

Sewing kit

Demand Selling

Next Year Price per Direct

(units)

Unit

Materials

80,000

$34.40

$4.80

50,000

18.00

1.00

40,000

39.80

6.20

45,000

28.00

1.80

340,000

20.00

2.90

Direct

Labor

$ 8.00

5.00

12.00

8.00

4.00

The following additional information is available:

a. The companys plant has a capacity of 150,000 direct labor-hours per year on a single-shift basis. The

companys present employees and equipment can produce all five products.

b. The direct labor rate is $20.00 per hour; this rate is expected to remain unchanged during the coming year.

c. Fixed costs total $530,000 per year. Variable overhead costs are $6.00 per direct labor-hour.

d. All of the companys nonmanufacturing costs are fixed.

e. The companys present inventory of finished products is negligible and can be ignored.

Required:

1. Determine the contribution margin per direct labor-hour expended on each product.

2. Prepare a schedule showing the total direct labor-hours that will be required to produce the units estimated to be

sold during the coming year.

3. Examine the data you have computed in (1) and (2) above. Indicate how much of each product should be made

so that total production time is equal to the 150,000 direct labor-hours available.

4. What is the highest price, in terms of a rate per hour, that Walton Toy Company should be willing to pay for

additional capacity (that is, for added direct labor time)?

5. Identify ways in which the company might be able to obtain additional output so that it would not have to leave

some demand for its products unsatisfied.

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-7A

Make or Buy Analysis; Equipment Replacement Decision

(LO2, LO4)

CHECK FIGURE

(1) fl 20,800 advantage to buy

In my opinion, we ought to stop making our own drums and accept that outside suppliers offer, said Wim

Niewindt, managing director of Antilles Refining N.V., of Aruba. At a price of 19.28 florins per drum, we would be

paying 6.12 florins less than it costs us to manufacture the drums in our own plant. Since we use 40,000 drums a

year, that would be an annual cost savings of 244,800 florins. (The currency in Aruba is the florin, denoted below

by fl.) Antilles Refinings average cost to manufacture one drum is given below (based on 40,000 drums per year):

Direct material

Direct labor

Variable overhead

Fixed overhead (fl 2.40 general company overhead,

fl 1.00 depreciation and, fl 0.60 supervision)

Total cost per drum

fl 13.00

5.00

3.40

4.00

fl 25.40

A decision about whether to make or buy the drums is especially important at this time since the equipment

being used to make the drums is completely worn out and must be replaced. The choices facing the company are:

Alternative 1: Purchase new equipment and continue to make the drums. The equipment would cost fl 400,000 ; it

would have a 5-year useful life and no salvage value. The company uses straight-line depreciation.

Alternative 2: Purchase the drums from an outside supplier at fl 19.28 per drum under a 5-year contract.

The new equipment would be more efficient than the equipment that Antilles Refining has been using and,

according to the manufacturer, would reduce direct labor and variable overhead costs by 50%. The old equipment

has no resale value. Supervision cost (fl 24,000 per year) and direct materials cost per drum would not be affected

by the new equipment. The new equipments capacity would be 80,000 drums per year. The company has no other

use for the space being used to produce the drums.

The companys total general company overhead would be unaffected by this decision.

Required:

1. To assist the managing director in making a decision, prepare an analysis showing what the total cost and the

cost per drum would be under each of the two alternatives given above. Assume that 40,000 drums are needed

each year. Which course of action would you recommend to the managing director?

2. Would your recommendation in (1) above be the same if the companys needs were: (a) 50,000 drums per year

or (b) 80,000 drums per year? Show computations to support your answer, with costs presented on both a total

and a per drum basis.

3. What other factors would you recommend that the company consider before making a decision?

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-8A

Shutting Down or Continuing to Operate a Plant

(LO3)

CHECK FIGURE

(1) $56,400 disadvantage to close

(Note: This type of decision is similar to that of dropping a product line.)

Birch Company normally produces and sells 50,000 units of RG-6 each month. RG-6 is a small electrical relay

used in the automotive industry as a component part in various products. The selling price is $28.00 per unit,

variable costs are $22.00 per unit, fixed manufacturing overhead expenses total $420,000 per month, and fixed

selling expenses total $88,000 per month.

Strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Companys sales to

temporarily drop to only 26,000 units per month. Birch Company estimates that the strikes will last for about two

months, after which sales of RG-6 should return to normal. Due to the current low level of sales, however, Birch

Company is thinking about closing down its own plant during the strike. If Birch Company does close down its

plant, it is estimated that fixed manufacturing overhead expenses can be reduced to $300,000 per month and that

fixed selling expenses can be reduced by 10%. Start-up expenses at the end of the two-month shutdown period

would total $2,000. Since Birch Company uses just-in-time (JIT) production methods, no inventories are on hand.

Required:

1. Assuming that the strikes continue for two months, as estimated, would you recommend that Birch Company

close its own plant? Show computations in good form.

2. At what level of sales (in units) for the two-month period should Birch Company be indifferent between closing

the plant or keeping it open? Show computations. (Hint: This is a type of break-even analysis, except that the

fixed cost portion of your break-even computation should include only those fixed costs that are relevant [i.e.,

avoidable] over the two-month period.)

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

Introduction to Managerial Accounting, 1st Edition, by Folk, Garrison, and Noreen

Alternate Problems-Set A, Chapter 11

PROBLEM 11-9A

Relevant Cost Analysis in a Variety of Situations

(LO3, LO4, LO5)

CHECK FIGURE

(1) $91,200 incremental net operating income

(2) $21.30 break-even price

Andretti Company has a single product called Daks. The company normally produces and sells 72,000 Daks each

year at a selling price of $28.00 per unit. The companys unit costs at this level of activity are given below:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling expense

Fixed selling expense

Total cost per unit

$12.00

2.50

1.80

3.20

1.20

3.00

$23.70

($230,400 total)

($216,000 total)

A number of questions relating to the production and sale of Daks follow. Each question is independent.

Required:

1. Assume that Andretti Company has sufficient capacity to produce 90,000 Daks each year without any increase

in fixed manufacturing overhead costs. The company could increase its sales by 20% above the present 72,000

units each year if it were willing to increase the fixed selling expenses by $60,000. Would the increase fixed

expenses be justified?

2. Assume again that Andretti Company has sufficient capacity to produce 90,000 Daks each year. A customer in a

foreign market wants to purchase 15,000 Daks. Import duties on the Daks would be $1.40 per unit, and costs for

permits and licenses would be $15,000. The only selling costs that would be associated with the order would be

$2.60 per unit shipping cost. You have been asked by the president to compute the per unit break-even price on

this order.

3. The company has 800 Daks on hand that have some irregularities and are therefore considered to be seconds.

Due to the irregularities, it will be impossible to sell these units at the normal price through regular distribution

channels. What unit cost figure is relevant for setting a minimum selling price?

4. Due to a strike in its suppliers plant, Andretti Company is unable to purchase more material for the production

of Daks. The strike is expected to last for 2 months. Andretti Company has enough material on hand to continue

to operate at 40% of normal levels for the two-month period. As an alternative, Andretti Company could close

its plant down entirely for the two months. If the plant were closed, fixed overhead costs would continue at 50%

of their normal level during the two-month period; the fixed selling costs would be reduced by 25% while the

plant was closed. What would be the dollar advantage or disadvantage of closing the plant for the two-month

period?

5. An outside manufacturer has offered to produce Daks for Andretti Company and to ship them directly to

Andretti Company customers. If Andretti Company accepts this offer, the facilities that it uses to produce Daks

would be idle; however, fixed overhead costs would be reduced by 80%. Since the outside manufacturer would

pay for all the costs of shipping, the variable selling costs would be only 2/3 of their present amount. Compute

the unit cost that is relevant for comparison to whatever quoted price is received from the outside manufacturer.

The McGraw-Hill Companies, Inc., 2002. All rights reserved.

You might also like

- Optimize Round Trampoline ProductionDocument17 pagesOptimize Round Trampoline ProductionBảo Anh Phạm100% (1)

- Past Tense WorksheetDocument2 pagesPast Tense WorksheetMada TuicaNo ratings yet

- Final SB BTDocument85 pagesFinal SB BTNgan Tran Nguyen ThuyNo ratings yet

- Irregular Past Tense QuizDocument1 pageIrregular Past Tense QuizKristen Hammer100% (1)

- Class Participation Rubric 2018Document1 pageClass Participation Rubric 2018Putu NgurahNo ratings yet

- Lesson - Parallelism.Answers - Tips.Prim 2Document6 pagesLesson - Parallelism.Answers - Tips.Prim 2Ichwalsyah SyNo ratings yet

- Class Participation RubricDocument1 pageClass Participation RubricCarl KenyonNo ratings yet

- University of El Salvador Score: - English Composition I Student: - Date. - Rubric For Evaluation of The ParagraphDocument5 pagesUniversity of El Salvador Score: - English Composition I Student: - Date. - Rubric For Evaluation of The Paragraphrolandoguzma7021No ratings yet

- Garden Sales Cash NeedsDocument4 pagesGarden Sales Cash NeedsVivienne Rozenn LaytoNo ratings yet

- CIMA F2 Summary - v1Document28 pagesCIMA F2 Summary - v1Federico BelloNo ratings yet

- Paragraph Structure: A. Definition of A ParagraphDocument7 pagesParagraph Structure: A. Definition of A Paragraphnakkalong0% (1)

- Make or Buy Analysis and Target CostingDocument14 pagesMake or Buy Analysis and Target CostingGloriana FokNo ratings yet

- ch08Document4 pagesch08ghsoub777No ratings yet

- Actg 10 - MAS Midterm ExamDocument24 pagesActg 10 - MAS Midterm Examjoemel091190100% (1)

- F5 CKT Mock1Document8 pagesF5 CKT Mock1OMID_JJNo ratings yet

- Exam PracticeDocument13 pagesExam PracticeDeepshikha Goel100% (1)

- Tutorial 9 S2 - 2012-13 Segment Reporting and Transfer PricingDocument3 pagesTutorial 9 S2 - 2012-13 Segment Reporting and Transfer PricingrachmmmNo ratings yet

- 2.4 Dec 04 - QDocument9 pages2.4 Dec 04 - Qomarkhalid3000No ratings yet

- Lsbf.p4 Mock QuesDocument21 pagesLsbf.p4 Mock Quesjunaid-chandio-458No ratings yet

- QuestionsDocument9 pagesQuestionsTsiame Emmanuel SarielNo ratings yet

- Case 14-63Document2 pagesCase 14-63KamruzzamanNo ratings yet

- Chapter 19 Alternate Problems Problem 19.1A: Alternate Problems For Use With Financial and Managerial Accounting, 12eDocument12 pagesChapter 19 Alternate Problems Problem 19.1A: Alternate Problems For Use With Financial and Managerial Accounting, 12eKathryn Teo0% (1)

- Additional ProblemsDocument4 pagesAdditional ProblemstoabhishekpalNo ratings yet

- 6e Brewer CH11 B EOCDocument15 pages6e Brewer CH11 B EOCrapgracelimNo ratings yet

- Extra Relevant Cost QuestionsDocument5 pagesExtra Relevant Cost QuestionsΧριστόςκύριοςNo ratings yet

- Chapter 8Document10 pagesChapter 8marketingbufordrd50% (2)

- Class Test Dec 10Document6 pagesClass Test Dec 10trudes100No ratings yet

- Exam281 20131Document10 pagesExam281 20131Jonathan Altamirano BurgosNo ratings yet

- SmithCompXM Sample Questions1Document13 pagesSmithCompXM Sample Questions1FrankNo ratings yet

- Depreciation in Final AccountsDocument26 pagesDepreciation in Final Accountsndagarachel015No ratings yet

- E) DepreciationDocument40 pagesE) DepreciationOtieno EdwineNo ratings yet

- Variable Costing and Absorption Costing CalculationsDocument4 pagesVariable Costing and Absorption Costing Calculationsgio gioNo ratings yet

- Incremental Analysis Week 10 Practice ProblemsDocument2 pagesIncremental Analysis Week 10 Practice ProblemsLulu LuthfiyahNo ratings yet

- Chapter 11 H WK ProblemsDocument2 pagesChapter 11 H WK ProblemsCyn SyjucoNo ratings yet

- ACC 3200 Quiz 8Document7 pagesACC 3200 Quiz 8Jazzel MartinezNo ratings yet

- Docx 1Document10 pagesDocx 1Anna Marie AlferezNo ratings yet

- CH 26 Exercises ProblemsDocument5 pagesCH 26 Exercises ProblemsAhmed El KhateebNo ratings yet

- Ade Meyli (Hal 337-364)Document47 pagesAde Meyli (Hal 337-364)Untung PriambodoNo ratings yet

- 10Document2 pages10itachi uchihaNo ratings yet

- Chapter 25 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesDocument2 pagesChapter 25 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesTien Thanh DangNo ratings yet

- Use The Information Provided Here To Answer The Questions in Parts 1, 2, and 3 of The Mini-ProjectDocument2 pagesUse The Information Provided Here To Answer The Questions in Parts 1, 2, and 3 of The Mini-ProjectNando Germes0% (1)

- Tutorial 4Document6 pagesTutorial 4FEI FEINo ratings yet

- CA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesDocument17 pagesCA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesAyush ThÃkkarNo ratings yet

- Exam 19111Document6 pagesExam 19111atallah97No ratings yet

- Sample Final 11BDocument11 pagesSample Final 11Bjosephmelkonian1741100% (1)

- Assignment 1Document5 pagesAssignment 1kamrulkawserNo ratings yet

- Lecture 8 NotesDocument9 pagesLecture 8 NotesAna-Maria GhNo ratings yet

- POA 2008 ZA + ZB CommentariesDocument28 pagesPOA 2008 ZA + ZB CommentariesEmily TanNo ratings yet

- Acca QNSDocument10 pagesAcca QNSIshmael OneyaNo ratings yet

- Catalina Tooling Company Is Considering Replacing A Machine That HasDocument1 pageCatalina Tooling Company Is Considering Replacing A Machine That HasMiroslav GegoskiNo ratings yet

- DeVry ACCT 434 Final Exam 100% Correct AnswerDocument9 pagesDeVry ACCT 434 Final Exam 100% Correct AnswerDeVryHelpNo ratings yet

- f5 2014 Jun Q PDFDocument7 pagesf5 2014 Jun Q PDFCynthia ohanusiNo ratings yet

- SOLUTIONS OF EXERCISES_MANAGEMENT ACCOUNTING_CHAPTER 2_3_4Document9 pagesSOLUTIONS OF EXERCISES_MANAGEMENT ACCOUNTING_CHAPTER 2_3_4ngochoangbich2004No ratings yet

- Accounting for Plant Assets and Depreciation GuideDocument49 pagesAccounting for Plant Assets and Depreciation GuideFurQan KhanNo ratings yet

- Homework AssignmentDocument11 pagesHomework AssignmentHenny DeWillisNo ratings yet

- Revques t3 Sub 2011Document37 pagesRevques t3 Sub 2011Rod Lester de GuzmanNo ratings yet

- Benchmarking Bus Service EfficiencyDocument5 pagesBenchmarking Bus Service EfficiencyMevika MerchantNo ratings yet

- Soal Tugas Problem Product CostingDocument2 pagesSoal Tugas Problem Product CostingMaria DiajengNo ratings yet

- Relevant Costing TestbankDocument9 pagesRelevant Costing TestbankPrecious Vercaza Del RosarioNo ratings yet

- Assignment ProblemsDocument3 pagesAssignment ProblemsCertified Public AccountantNo ratings yet

- Research PhilosophyDocument4 pagesResearch Philosophygdayanand4uNo ratings yet

- Building Bridges Innovation 2018Document103 pagesBuilding Bridges Innovation 2018simonyuNo ratings yet

- 2015 Ssang Yong Rexton Y292 Service ManualDocument1,405 pages2015 Ssang Yong Rexton Y292 Service Manualbogdanxp2000No ratings yet

- Commuter Cleaning - Group 10Document6 pagesCommuter Cleaning - Group 10AMAL ARAVIND100% (1)

- P.E 4 Midterm Exam 2 9Document5 pagesP.E 4 Midterm Exam 2 9Xena IngalNo ratings yet

- Complicated Grief Treatment Instruction ManualDocument276 pagesComplicated Grief Treatment Instruction ManualFrancisco Matías Ponce Miranda100% (3)

- Mundane AstrologyDocument93 pagesMundane Astrologynikhil mehra100% (5)

- As If/as Though/like: As If As Though Looks Sounds Feels As If As If As If As Though As Though Like LikeDocument23 pagesAs If/as Though/like: As If As Though Looks Sounds Feels As If As If As If As Though As Though Like Likemyint phyoNo ratings yet

- LTD Samplex - Serrano NotesDocument3 pagesLTD Samplex - Serrano NotesMariam BautistaNo ratings yet

- Tanroads KilimanjaroDocument10 pagesTanroads KilimanjaroElisha WankogereNo ratings yet

- Art 1780280905 PDFDocument8 pagesArt 1780280905 PDFIesna NaNo ratings yet

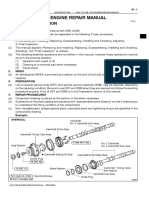

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- Neligence: Allows Standards of Acceptable Behavior To Be Set For SocietyDocument3 pagesNeligence: Allows Standards of Acceptable Behavior To Be Set For SocietyransomNo ratings yet

- What Blockchain Could Mean For MarketingDocument2 pagesWhat Blockchain Could Mean For MarketingRitika JhaNo ratings yet

- Tutorial 3 Ans Tutorial 3 AnsDocument3 pagesTutorial 3 Ans Tutorial 3 AnsShoppers CartNo ratings yet

- Faxphone l100 Faxl170 l150 I-Sensys Faxl170 l150 Canofax L250seriesDocument46 pagesFaxphone l100 Faxl170 l150 I-Sensys Faxl170 l150 Canofax L250seriesIon JardelNo ratings yet

- Cost Allocation Methods & Activity-Based Costing ExplainedDocument53 pagesCost Allocation Methods & Activity-Based Costing ExplainedNitish SharmaNo ratings yet

- BI - Cover Letter Template For EC Submission - Sent 09 Sept 2014Document1 pageBI - Cover Letter Template For EC Submission - Sent 09 Sept 2014scribdNo ratings yet

- Political Philosophy and Political Science: Complex RelationshipsDocument15 pagesPolitical Philosophy and Political Science: Complex RelationshipsVane ValienteNo ratings yet

- Improve Your Social Skills With Soft And Hard TechniquesDocument26 pagesImprove Your Social Skills With Soft And Hard TechniquesEarlkenneth NavarroNo ratings yet

- Tadesse JaletaDocument160 pagesTadesse JaletaAhmed GemedaNo ratings yet

- Advanced VLSI Architecture Design For Emerging Digital SystemsDocument78 pagesAdvanced VLSI Architecture Design For Emerging Digital Systemsgangavinodc123No ratings yet

- Italy VISA Annex 9 Application Form Gennaio 2016 FinaleDocument11 pagesItaly VISA Annex 9 Application Form Gennaio 2016 Finalesumit.raj.iiit5613No ratings yet

- RA 4196 University Charter of PLMDocument4 pagesRA 4196 University Charter of PLMJoan PabloNo ratings yet

- Brain Chip ReportDocument30 pagesBrain Chip Reportsrikanthkalemla100% (3)

- FPR 10 1.lectDocument638 pagesFPR 10 1.lectshishuNo ratings yet

- 2010 Economics Syllabus For SHSDocument133 pages2010 Economics Syllabus For SHSfrimpongbenardghNo ratings yet

- Mari 1.4v2 GettingStartedGuide PDFDocument57 pagesMari 1.4v2 GettingStartedGuide PDFCarlos Vladimir Roa LunaNo ratings yet

- Detailed Lesson Plan in Bread and Pastry Production NC IiDocument3 pagesDetailed Lesson Plan in Bread and Pastry Production NC IiMark John Bechayda CasilagNo ratings yet

- Toshiba l645 l650 l655 Dabl6dmb8f0 OkDocument43 pagesToshiba l645 l650 l655 Dabl6dmb8f0 OkJaspreet Singh0% (1)