Professional Documents

Culture Documents

Steps Involved in Sanction

Uploaded by

Eagle Eye0 ratings0% found this document useful (0 votes)

26 views4 pagesThe document outlines 11 steps involved in the sanction and granting of pensions by the Government of Punjab. Key steps include:

1) Administrative departments notify a list of upcoming retirees to various authorities including the Accountant General of Punjab.

2) The Accountant General scrutinizes the retiree list and reconciles any discrepancies.

3) Retiring employees provide required documents and choose pension options 120 days before retirement.

4) The Pension Sanctioning Authority sanctions pensions 90 days before retirement based on documents and issues pension orders.

Original Description:

steps involved in sanctions

Copyright

© © All Rights Reserved

Available Formats

ODT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines 11 steps involved in the sanction and granting of pensions by the Government of Punjab. Key steps include:

1) Administrative departments notify a list of upcoming retirees to various authorities including the Accountant General of Punjab.

2) The Accountant General scrutinizes the retiree list and reconciles any discrepancies.

3) Retiring employees provide required documents and choose pension options 120 days before retirement.

4) The Pension Sanctioning Authority sanctions pensions 90 days before retirement based on documents and issues pension orders.

Copyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views4 pagesSteps Involved in Sanction

Uploaded by

Eagle EyeThe document outlines 11 steps involved in the sanction and granting of pensions by the Government of Punjab. Key steps include:

1) Administrative departments notify a list of upcoming retirees to various authorities including the Accountant General of Punjab.

2) The Accountant General scrutinizes the retiree list and reconciles any discrepancies.

3) Retiring employees provide required documents and choose pension options 120 days before retirement.

4) The Pension Sanctioning Authority sanctions pensions 90 days before retirement based on documents and issues pension orders.

Copyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

You are on page 1of 4

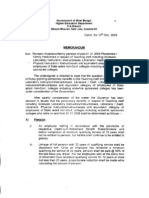

STEPS INVOLVED IN SANCTION / GRANT OF

PENSION IN PUNJAB

Posted on October 13, 2013 by admin

Following steps are involved in the grant of pension by Govt of

Punjab.

Step-1 (Action by Administrative Department)

Every Administrative department / Appointing Authority shall notify a

list of all government servants (both gazetted and non-gazetted)

who are due to superannuate in the ensuing calendar year. Such list

shall be issued in the last quarter of the outgoing calendar year and

circulated to all concerned, including the Accountant General,

Punjab.

Step-2.(Action by Accountant General Punjab).

The Accountant General, Punjab shall scrutinize the list circulated

by the AD / Appointing Authority and cross-check the details with

their own record and reconcile discrepancies, if any.

Step 3 (Action by Retiring Government Servant)

The retiring government servant shall provide the following

information (in the prescribed proforma (Annex-A) to the Pension

Sanctioning Authority, 120 days prior to the date of his retirement:(i) A list of family members

(ii) An undertaking / consent for making good any dues / recovery

established against him on any account during his life time / or after

his death.

(iii) Option for getting full pension or with commutation (maximum

upto 35% of gross pension).

Step 4 (Action by Pension Sanctioning Authority).

Immediately on the receipt of the aforesaid information / certificates,

the administrative cum financial sanction for pension/commutation

shall be accorded in favour of the retiring Government servant. The

pension shall be sanctioned in appropriate

form placed at Annex-B(I-IV) , with or without commutation, as

opted by the retiring government servant.This shall be subject to

recovery of any sum duly established against him during his service

or after

issuance of notification / orders of retirement. This action will be

completed by the Pension Sanctioning Authority (PSA) 90 days

before the date of superannuation of the retiring government

servant on the

basis of monthly salary slip, service record available with it and

information provided by retiring government servant.

Step 5 (Action by AG, Punjab).

On the receipt of Notification/Orders of retirement on

superannuation and sanction of pensionary benefits, the AG,

Punjab shall determine his pension/commutation and issue pension

authorization letter / pension payment order (PPO) to the retiring

government servant, under intimation to PSA, indicating its pension

cost center/specifically allocated by the latter, beside issuing

payment advice to the banker of the retiring government servant for

transfer credit of pensionary dues in the bank account in which his

last salary was credited.

Step 6 (Action by Pensioner).

The Pensioner drawing pension through direct credit shall produce

a life certificate to the Accountant General, Punjab bi-annually in the

prescribed proforma (Annex-C) in person or through his

representative or by post / courier service.

Step 7 (Action by Accountant General, Punjab)

In case the life certificate is not received in the office of the

Accountant General, Punjab, on the expiry of six months, he shall

stop the pension and send a letter at pensioners address informing

about the stoppage of his pension due to non-receipt of his life

certificate, under intimation to the Manager, of the concerned Bank

maintaining the account of the pensioner.

Step 8 (Action by Accountant General, Punjab).

In case, a pensioner produces the life certificate subsequently to

the Accountant General, Punjab, he will release / authorize the

pension, including arrears, to the concerned bank under intimation

to the pensioner.

Step 9 (Actions by Bank and Accountant General Punjab)

The Bank (Main Branch or its dealing Wing) and Accountant

General, Punjab shall carry out reconciliation on quarterly basis

regarding

new pension authorized, pension transferred to other places,

pension stopped/restored, pension discontinued, pension amended,

on the basis of full details and particulars of pensioners.

Reconciliation

statement shall be signed by the officers of BS-17 or above /

equivalents in banks and copies shall be retained as permanent

record. Any discrepancy shall be resolved within six weeks. The

responsibility for disciplinary action and reporting to crime

investigation agencies, if needed, will rest with the end where

fraud etc. is detected.

Step-10 (Action by Accountant General Punjab).

The Accountant General, Punjab shall send a copy of pension roll to

the Pension Sanctioning Authority in July and January each year.

The Pension Sanctioning Authority shall verify the bonafides of the

pensioners and report back to the Accountant General, Punjab for

any exceptions.

Step-11

The Additional Chief Secretary will hold monthly review of disposal

of pension cases on the basis of data provided by the Pension

Reform Unit of the Finance Department. The Chief Secretary may

review the disposal of such cases in the quarterly meeting of the

Administrative Secretaries to the Government of the Punjab.

You might also like

- Pension FaqDocument22 pagesPension FaqArjun JainNo ratings yet

- Pension Papers SuperanuationDocument19 pagesPension Papers SuperanuationNaeem RaoNo ratings yet

- Finance Depatment Notifications-2002 (55-164)Document96 pagesFinance Depatment Notifications-2002 (55-164)Humayoun Ahmad Farooqi100% (1)

- Moa PpsiDocument7 pagesMoa PpsiRandy LopezNo ratings yet

- Simplification of Pension Form CSR-25 (Revised)Document10 pagesSimplification of Pension Form CSR-25 (Revised)optimist_24100% (1)

- Coa Circular 97-002 (Cash Advance)Document9 pagesCoa Circular 97-002 (Cash Advance)Abajoy Albinio100% (2)

- Pao Gref RulesDocument21 pagesPao Gref RulesCS NarayanaNo ratings yet

- Assessment: Issues in Assessment & Reassessment Under I. T. ActDocument36 pagesAssessment: Issues in Assessment & Reassessment Under I. T. ActSUNILNo ratings yet

- Retirement Benefits OfficerDocument6 pagesRetirement Benefits OfficerbabachhunuNo ratings yet

- F Rules 7085 30102017Document4 pagesF Rules 7085 30102017manmohanNo ratings yet

- Office of The Principal Accountant General (A & E) Odisha, BhubaneswarDocument2 pagesOffice of The Principal Accountant General (A & E) Odisha, BhubaneswarmilucoolNo ratings yet

- AGLB Unit 3 PDFDocument26 pagesAGLB Unit 3 PDFDarshan b kNo ratings yet

- GPF RuleDocument1 pageGPF Rulelol9019No ratings yet

- Pension / T B: Erminal EnefitDocument38 pagesPension / T B: Erminal EnefitsaravananNo ratings yet

- Chapter13.Terminal BenefitsDocument82 pagesChapter13.Terminal BenefitsPalagiri SrinivasNo ratings yet

- Master Circular - Disbursement of Government Pension by Agency BanksDocument12 pagesMaster Circular - Disbursement of Government Pension by Agency BanksSrinivaasNo ratings yet

- Granting, Utilization and Liquidation of Cash AdvancesDocument8 pagesGranting, Utilization and Liquidation of Cash Advancesduskwitch100% (1)

- Pension / T B: Erminal EnefitDocument38 pagesPension / T B: Erminal EnefitsaravananNo ratings yet

- Sub Treasury Training ReportDocument7 pagesSub Treasury Training ReportsrmurralitharanNo ratings yet

- Revised Pension Bank 19.1.2012Document59 pagesRevised Pension Bank 19.1.2012Jaganmohan BhatrajuNo ratings yet

- RBI-guideline On Disbursement of PensionDocument20 pagesRBI-guideline On Disbursement of Pensionespee53No ratings yet

- Bgy. Disbursements Revised 5-8-07Document82 pagesBgy. Disbursements Revised 5-8-07AnnamaAnnamaNo ratings yet

- O.A. No.1311 of 2022 - J. 23.01.2023 (Pensionary Benefits)Document7 pagesO.A. No.1311 of 2022 - J. 23.01.2023 (Pensionary Benefits)ssandeepNo ratings yet

- New Pension SchemeDocument2 pagesNew Pension SchemegoldimbbsNo ratings yet

- Payroll and RemittancesDocument1 pagePayroll and RemittancesRhoxee ErinahNo ratings yet

- PFMS WithmarkingDocument6 pagesPFMS WithmarkingutkarshNo ratings yet

- Disbursement of Pension by Agency BanksDocument23 pagesDisbursement of Pension by Agency Banksabhishekchauhan0096429No ratings yet

- Admin Volume ThirdDocument114 pagesAdmin Volume ThirdRealNo ratings yet

- Search and SeizureDocument26 pagesSearch and SeizureShivansh JaiswalNo ratings yet

- Correction For e PPODocument6 pagesCorrection For e PPOPr AO Water ResourcesNo ratings yet

- Understanding AirDocument5 pagesUnderstanding AirakashNo ratings yet

- Frequently Asked Questions (Faqs) : Office of The Accountant General (A&E) - Ii, Maharashtra, NagpurDocument7 pagesFrequently Asked Questions (Faqs) : Office of The Accountant General (A&E) - Ii, Maharashtra, NagpurPranil NandeshwarNo ratings yet

- Memo - Ciap Submission of 2016 ReportsDocument2 pagesMemo - Ciap Submission of 2016 ReportsHoven MacasinagNo ratings yet

- 4.2 Aseessment Under GSTDocument19 pages4.2 Aseessment Under GSTPoorboyNo ratings yet

- Submission of Documents by Sampann Beneficiaries637020838284494332Document15 pagesSubmission of Documents by Sampann Beneficiaries637020838284494332ashutosh.b.p93No ratings yet

- Pension Transfer Procedure PakistanDocument1 pagePension Transfer Procedure PakistanaftabNo ratings yet

- Disbursement CH 5Document40 pagesDisbursement CH 5HohohoNo ratings yet

- Arrears PRC Cir - Memo.dt13!6!2018Document7 pagesArrears PRC Cir - Memo.dt13!6!2018Praveen BabuNo ratings yet

- Rev Pension Order Post 1.1.06Document5 pagesRev Pension Order Post 1.1.06arijit_ghosh_18No ratings yet

- Bc2010-1 Budget CircularDocument6 pagesBc2010-1 Budget CircularLecel LlamedoNo ratings yet

- GST Chapter-4Document18 pagesGST Chapter-4Madhu kumarNo ratings yet

- Article For Souvenir - GST AssessmentDocument6 pagesArticle For Souvenir - GST AssessmentKanhayalal SharmaNo ratings yet

- Commutation of Pension - Some Question and Answers On Retirement Benefits - Pensioners PortalDocument3 pagesCommutation of Pension - Some Question and Answers On Retirement Benefits - Pensioners PortalTvs ReddyNo ratings yet

- Circular No. - @1 - Date 2019Document17 pagesCircular No. - @1 - Date 2019Jennifer SaulongNo ratings yet

- AssessmentDocument7 pagesAssessmentGopiNo ratings yet

- Guidelines On The Implementation of The Social Pension For Indigent Senior Citizens (AO 15)Document27 pagesGuidelines On The Implementation of The Social Pension For Indigent Senior Citizens (AO 15)kenexdbNo ratings yet

- Delayed Submission of Liquidation Reports of Cash AdvancesDocument3 pagesDelayed Submission of Liquidation Reports of Cash AdvancesGrace RebrabNo ratings yet

- Basic Standards and PoliciesDocument47 pagesBasic Standards and PoliciesMark Alvin DelizoNo ratings yet

- Appeals and Assssments-AssignmentDocument6 pagesAppeals and Assssments-AssignmentArti ModiNo ratings yet

- FAQ Pension MattersDocument2 pagesFAQ Pension MattersgodabariNo ratings yet

- Pasos IpDocument2 pagesPasos IpFUENTES CORREDORNo ratings yet

- WN On National Pension System 2023 FBDocument4 pagesWN On National Pension System 2023 FBRavi Prakash MeenaNo ratings yet

- Kinds of AssessmentDocument6 pagesKinds of AssessmentmanikaNo ratings yet

- Pension RulesDocument3 pagesPension RulesMohit DuhanNo ratings yet

- COMMISSION ON AUDIT CIRCULAR NO. 75-10 November 20, 1975Document2 pagesCOMMISSION ON AUDIT CIRCULAR NO. 75-10 November 20, 1975Jerwin TiamsonNo ratings yet

- Assessment ProcedureDocument14 pagesAssessment ProcedurePragnya mahapatroNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Student's Lab Pack: Preteens 02 11 Weeks CourseDocument30 pagesStudent's Lab Pack: Preteens 02 11 Weeks CourseMi KaNo ratings yet

- Constitutional Law OutlineDocument28 pagesConstitutional Law OutlineCasey HartwigNo ratings yet

- Apollo Hospital Chennai: NO: 16, BSNL TELESHOPPE, Greams Road 044 2999 1606Document9 pagesApollo Hospital Chennai: NO: 16, BSNL TELESHOPPE, Greams Road 044 2999 1606Manas ChandaNo ratings yet

- 5 Facts You Should Know About The Green MarchDocument7 pages5 Facts You Should Know About The Green MarchDriss Baouche100% (1)

- A Daily Miracle2Document1 pageA Daily Miracle2LizZelencichNo ratings yet

- Kumpulan Soal UPDocument16 pagesKumpulan Soal UPTriono SusantoNo ratings yet

- Begc133em20 21Document14 pagesBegc133em20 21nkNo ratings yet

- Medico Legal CaseDocument2 pagesMedico Legal CaseskcllbNo ratings yet

- Solved MCQS For Mid Terms Papers Solved by JUNAID MALIK and TeamDocument23 pagesSolved MCQS For Mid Terms Papers Solved by JUNAID MALIK and TeamUrwa RiazNo ratings yet

- Manual GPS Trimble Portugues CFX-750 / FM-750Document246 pagesManual GPS Trimble Portugues CFX-750 / FM-750José Luis Mailkut Pires100% (5)

- Create PDF Book App in Android Studio - Download Free PDF Book Source Code PDFDocument6 pagesCreate PDF Book App in Android Studio - Download Free PDF Book Source Code PDFshafiq09090% (1)

- Karbohidrat: Gula, Pati & SeratDocument20 pagesKarbohidrat: Gula, Pati & SeratAlfi Syahrin SiregarNo ratings yet

- SLS Ginopol L24 151-21-3-MSDS US-GHSDocument8 pagesSLS Ginopol L24 151-21-3-MSDS US-GHSRG TNo ratings yet

- (Promotion Policy of APDCL) by Debasish Choudhury: RecommendationDocument1 page(Promotion Policy of APDCL) by Debasish Choudhury: RecommendationDebasish ChoudhuryNo ratings yet

- Students Name - Kendrick Joel Fernandes ROLL NO. 8250 Semester Vi Subject - Turnaround Management Topic-Industrial SicknessDocument15 pagesStudents Name - Kendrick Joel Fernandes ROLL NO. 8250 Semester Vi Subject - Turnaround Management Topic-Industrial SicknesskarenNo ratings yet

- ILO Report On Disability and Labour India - 2011wcms - 229259Document56 pagesILO Report On Disability and Labour India - 2011wcms - 229259Vaishnavi JayakumarNo ratings yet

- Listening Test Sweeney Todd, Chapter 4: 1 C. Zwyssig-KliemDocument3 pagesListening Test Sweeney Todd, Chapter 4: 1 C. Zwyssig-KliemCarole Zwyssig-KliemNo ratings yet

- Swot Analysis of PiramalDocument5 pagesSwot Analysis of PiramalPalak NarangNo ratings yet

- Preview-90187 Pno H UnlockedDocument5 pagesPreview-90187 Pno H UnlockedFilip SuciuNo ratings yet

- Lingua Franca Core: The Outcome of The Current Times: Yue ShuDocument4 pagesLingua Franca Core: The Outcome of The Current Times: Yue ShuThaiNo ratings yet

- Human Computer Interaction LECTURE 1Document19 pagesHuman Computer Interaction LECTURE 1mariya ali100% (2)

- Panama Canal - FinalDocument25 pagesPanama Canal - FinalTeeksh Nagwanshi50% (2)

- Birhane, E. 2014. Agroforestry Governance in Ethiopa Report WP 5Document50 pagesBirhane, E. 2014. Agroforestry Governance in Ethiopa Report WP 5woubshetNo ratings yet

- Pearson Edexcel A Level Economics A Fifth Edition Peter Smith Full Chapter PDF ScribdDocument67 pagesPearson Edexcel A Level Economics A Fifth Edition Peter Smith Full Chapter PDF Scribdrobert.eligio703100% (5)

- RMK Akl 2 Bab 5Document2 pagesRMK Akl 2 Bab 5ElineNo ratings yet

- Sample Information For Attempted MurderDocument3 pagesSample Information For Attempted MurderIrin200No ratings yet

- The Perception of Veggie Nilupak To Selected Grade 11 Students of Fort Bonifacio High SchoolDocument4 pagesThe Perception of Veggie Nilupak To Selected Grade 11 Students of Fort Bonifacio High SchoolSabrina EleNo ratings yet

- Natureview Case StudyDocument3 pagesNatureview Case StudySheetal RaniNo ratings yet

- Corruption CricketDocument21 pagesCorruption CricketAshwin NaraayanNo ratings yet

- Vdocuments - MX - Sri Thiruppugal Vidhana Shodasa Upachara Puja PDFDocument73 pagesVdocuments - MX - Sri Thiruppugal Vidhana Shodasa Upachara Puja PDFDomnick WilkinsNo ratings yet