Professional Documents

Culture Documents

Eusipa Derivative Map

Uploaded by

GECopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eusipa Derivative Map

Uploaded by

GECopyright:

Available Formats

12 Y

based on multiple underlyings (multi-asset)

Any payouts attributable to the underlying

are used in favour of the strategy

Limited profit potential (Cap)

EUSIPA DERIVATIVE MAP

EUROPE

product is based on multiple underlyings

(multi-asset)

Any payouts attributable to the underlying

are used in favour of the strategy

Limited profit potential (Cap)

May 2012

EUROPEAN

STRUCTURED

INVESTMENT

PRODUCTS

ASSOCIATION

Tracker Certificates

(1300)

Outperformance

Certificates (1310)

Bonus Certificates

(1320)

Outperformance

Bonus Certificates (1330)

Twin-Win Certificates

(1340)

Market Expectation

Tracker Certificate (Bull): Rising underlying

Tracker Certificate (Bear): Falling

underlying

Market Expectation

Rising underlying

Rising volatility

Market Expectation

Underlying moving sideways or rising

Underlying will not breach Barrier

during product lifetime

Market Expectation

Rising underlying

Underlying will not breach Barrier

during product lifetime

Market Expectation

Rising or slightly falling underlying

Underlying will not breach Barrier

during product lifetime

AUSTRIA

FRANCE

GERMANY

ITALY

SWITZERLAND

SWEDEN

1 ANLAGEPRODUKTE

1 PROD. DINVESTISSEMENT

1 ANLAGEPRODUKTE

1 PRODOTTI DI INVESTIMENTO

1 INVESTERINGSPRODUKTER

1 ANLAGEPRODUKTE

11

CAPITAL PROTECTION PRODUCTS

11

11

11

11

11

11

1100

1110

1120

1130

1140

1199

Uncapped Capital Protection

Exchangeable Certificates

Capped Capital Protected

Capital Protection with Knock-Out

Capital protection with Coupon

Miscellaneous Capital Protection

12

YIELD ENHANCEMENT PRODUCTS

1200

1210

1220

1230

1240

1250

1260

1299

1200 Discount Zertifikate

Discount Certificates

Characteristics

Barrier Discount Certificates

Unlimited

participation

the

1220in Aktienanleihen

Reverse Convertibles

development

of

the

underlying

Barrier Reverse Convertibles

Capped Outperformance CertificatesReflects underlying price moves 1:1

(adjusted by conversion ratio and any

Capped Bonus Certificates

related fees)

1260 Express Zertifikate

Express Certificates

Miscellaneous Yield Enhancement Risk comparable to a direct investment

ANLAGEPRODUKTE MIT KAPITALSCHUTZ

Profit

Profit

1100 Equity protection senza cap

Loss

ANLAGEPRODUKTE OHNE KAPITALSCHUTZ

Loss

12

Loss

12

PRODUITS DE RENDEMENT

1200 Discount

Strike

Strike

1140 Strukturierte Anleihen

1199 Weitere Anlageprodukte mit Kapitalschutz

lyi

ng

1199 Altri prodotti a capitale protetto

lyi

ng

lyi

ng

lyi

ng

12

Strike

1199 Autres produits Capital Garanti lchance

Un

de

r

Loss

1199 Weitere Anlageprodukte mit Kapitalschutz

Un

de

r

Un

de

r

lyi

ng

Strike

Un

de

r

ANLAGEPRODUKTE OHNE KAPITALSCHUTZ

1200 Discount Zertifikate

12

Loss

PRODOTTI A CAP. NON PROT. E CONDIZ. PROT.

1200 Discount

LEVERAGE PRODUCTS

2 HEBELPRODUKTE

2 PROD. EFFET DE LEVIER

2 HEBELPRODUKTE

21

LEVERAGE PRODUCTS WITHOUT KNOCK-OUT

21

21

21

Kapitalskydd med maxniv

Kapitalskydd med knock-out

Kapitalskydd med kupong

Blandade Kapitalskyddade produkter

1130 Kapitalschutz-Zertifikat

1140 Kapitalschutz-Zertifikat mit Coupon

1199 Weitere Kapitalschutz-Zertifikate

12

AVKASTNINGSFRBTTRANDE INST.

12

RENDITEOPTIMIERUNG

Omvnd konvertibel

Autokupong/Omvnd konvertibel med barrir

1200

1210

1220

1230

Discount-Zertifikat

Discount-Zertifikat mit Barriere

Reverse Convertible

Barrier Reverse Convertible

Autocall / Expresscertifikat

Blandade avkastningsfrbttrande instrument

1260 Express-Zertifikat

1299 Weitere Renditeoptimierungs-Zertifikate

DELTAGANDEINSTRUMENT

13

PARTIZIPATION

Trackercertifikat

Tillvxtcertifikat

Bonuscertifikat

1300

1310

1320

1330

1340

1399

Tracker-Zertifikat

Outperformance-Zertifikat

Bonus-Zertifikat

Bonus-Outperformance-Zertifikat

Twin-Win-Zertifikat

Weitere Partizipations-Zertifikate

1200 Maxcertifikat

al

l

PRODUITS EFFET DE LEVIER CONSTANT

g

lyi

n

de

r

Un

de

Un

g

rly

in

Strike

Kn

oc

PRODUKTE MIT KONSTANTEM HEBEL

Loss

Knock-Out

Price of

underlying

Loss

Stop-Loss

Market Expectation

HVSTNGSINST. MED STOPP-LOSS Bull: Rising underlying

2200 Knock-Out warranter

2210 Mini Future

INSTRUMENT MED KONSTANT HVSTNG

ing

Knock-Out

Loss

SUPPORTING PARTNERS

ASSOCIATIONS

ASSOCIATIONS

SETIPA

EXCHANGES & DATAPROVIDERS

EXCHANGES & DATAPROVIDERS

2VDCHRG$WBG@MFD3Q@CDC

(MUDRSLDMS/QNCTBSR RRNBH@SHNM

SETIPA

SETIPA

SETIPA

2VDCHRG$WBG@MFD3Q@CDC(MUDRSLDMS/QNCTBSR RRNBH@SHNM

2VDCHRG$WBG@MFD3Q@CDC

(MUDRSLDMS/QNCTBSR RRNBH@SHNM

ISSUERS

ISSUERS

2399 Blandade instrument med konstant hvstng

Un

Loss

Characteristics

Characteristics

Characteristics

Small investment generating a leveraged

Small investment generating a leveraged

Small

investment

generating

a

EUROPEAN PRODUCT CATEGORIZATION

DISCLAIMER & COPYRIGHT

performance relative to the underlying

performance relative to the underlying

leveraged performance relative to the

Characteristics

Characteristicsof structured

2012 by Eusipa. Reproduction, publication or any other use is explicitly permitted

Eusipa intends to be a main

supporter of the efforts for transparency and understandability

and the sub-categorization according to the payoff profile of a product this solution combines the most

Increased

risk

of

total

loss

(limited

to

initial

Increased

risk of total

loss (limited

to initial

underlying

but only with full reference to the source

and without

any changes

or amendments.

investment

a standards

leveragedfor a uniform

Small

investment generating

aimportant

leveragedrequirements of all Eusipa members. Though the Eusipa categorization it is neither binding

investment products. Thus,Small

its members

have generating

agreed to set

categorization.

These

investment)

investment)

risk of total loss (limited to

differentiate on a first levelperformance

between Investment

and Leverage Products.

On a second

level, the

for national associations nor for issuers, Eusipa will

nevertheless recommend to all market participants Increased

to

relative Products

to the underlying

performance

relative

to the underlying

Immediately expires worthless in case the

Suitable

short term

speculation

initial investment)

Eusipa takes all reasonable steps to ensure

thefor

reliability

of the

published information.

system consists of Capital Protected

Products,

Yield Enhancement

Products,

adapttoits model unchanged.

Increased

risk of total

loss (limited toProducts, Participation

Increased

risk ofLeverage

total loss (limited

Barrier is breached during product lifetime

Immediately

worthless

in caseor

one

of

A residual value

maycan

be nevertheless

redeemed in no way guarantee

Eusipa

theexpires

correctness,

reliability

completeProducts with and without initial

Knock-Out

and

Constant

Leverage

Products.

With

both

the

top

level

distinction

investment)

initial investment)

Suitable for short term speculation or

the barriers is breached during product

following a stop loss event

Suitable for short term speculation or

Daily loss of time value (increases as

hedging

lifetime

Suitable for short term speculation or

hedging

product expiry approaches)

Small influence of volatility and small loss

Limited profit potential (Cap)

hedging

Daily loss of time value (increases as

Limited profit potential (Cap)

ofcategorization

time-value

Continuous monitoring required

Noother

influence

of volatility

The following

leading

market

participants

have

agreed

to

support

the

efforts

for

a

european

product

and

implement

it

on

websites

and

information

material.

product expiry approaches)

Continuous

monitoring

required

2VDCHRG$WBG@MFD

3Q@CDC(MUDRSLDMS

Continuous monitoring required

Continuous monitoring required

/QNCTBSR RRNBH@SHNM

Continuous monitoring required

Loss

2200

Warrant mit Knock-Out

Bear: Falling

underlying

2210 Mini-Future

Profit

2299 Blandade hvstngsinst. med stopp-loss

ly

r

de

in

g

Knock-Out

rly

lyi

n

Level

22

2300 Bull & Bear Certifikat

FinancingHebel

2399 Weitere Produkte mit konstantem

Constant2100

Leverage

Warrant Certificate

(2300) 2110 Spread Warrant

2199 Blandade hvstngsinst. utan stopp-loss

23

de

Strike

2399 Autres produits effet de levier constant

de

r

Ca

23

2300 Faktor-Zertifikate

Un

2399 Weitere Produkte mit konstantem Hebel

ll

2399 Miscellaneous Constant Leverage Products

2300 Leverages & Shorts

22 LEVERAGE

WITH KNOCK-OUT

ll

Ca

21 LEVERAGE

WITHOUT KNOCK-OUT

23

ut

2300 Faktor-Zertifikate

Pu

2300 Constant Leverage Certificate

P

ut

Pu

Profit

PRODUKTE

MIT KONSTANTEM HEBEL

Warrants

2100 Warranter

Price of Mini-Futures

2 HEBELPRODUKTE

HVSTNGSINST. UTAN STOPP-LOSS

ar

23

21

Be

Profit

CONSTANT LEVERAGE

PRODUCTS

23

Double Knock-Out

2100 Covered warrant

2110 Spread warrant

(2230)

2199 Altri prodotti a leva senza knock-out

2200

2210

2230

2299

22

Winwincertifikat

Blandade deltagandeinstrument

2 HVSTNGSINSTRUMENT

PRODOTTI A LEVA

PRODOTTI A LEVA SENZA KNOCK-OUT

Market Expectation

Market Expectation

Market Expectation

AVEC BARRIRE DSACTIVANTE

22

HEBELPRODUKTE MIT

KNOCK-OUT

PRODOTTI A LEVA

CON KNOCK-OUT

Mini-Future

(Long): Rising underlying

Underlying

moving sideways

Knock-Out (Call): Rising22underlying

Turbos

2200 Turbo

Knock-Out Produkte Mini-Future (Short): Falling underlying

Falling volatility

Knock-Out (Put): Falling2200

underlying

Turbos illimits / infinis

2210 Mini future

Stability Warrants

Profit

2299 Weitere Hebelprodukte

Autres produits de levierProfit

avec barrire

2299 Altri prodotti aProfit

mit Knock-Out

leva con knock-out

Knock-Out

k-

Market Expectation

22

HEBELPRODUKTE MIT KNOCK-OUT

Spread Warrant (Bull): Rising

2200 Knock-Out

Produkte

underlying

Spread Warrant (Bear): Falling

underlying

2299 Weitere Hebelprodukte mit Knock-Out

oc

Kn

2200

2210

2230

2299

Market Expectation

LEVERAGE PRODUCTS WITH KNOCK-OUT

Warrant (Call): Rising underlying,

Knock-Out Warrants

rising volatility

Mini-Futures Warrant (Put): Falling underlying,

Double Knock-Out

Warrants

rising

volatility

Miscellaneous Leverage with Knock-Out

Knock-Out Warrants

2100 Warrants

2100 Optionsscheine Mini-Futures

2110 Capps & Floors

(2210)

(2200)

2199 Autres prod. de levier sans barrire dsactivante 2199 Weitere Hebelprodukte ohne Knock-Out

ut

C

(2110)

2199 Weitere Hebelprodukte ohne Knock-Out

2

21

HEBELPRODUKTE OHNE KNOCK-OUT

Spread Warrants

2100 Optionsscheine

SANS BARRIRE DSACTIVANTE

k-

2100 Warrants Warrants

2110 Spread Warrants

(2100)

2199 Miscellaneous Leverage without Knock-Out

HEBELPRODUKTE OHNE KNOCK-OUT

KAPITALSCHUTZ

1100 Kapitalschutz-Zertifikat mit Partizipation

1110 Wandel-Zertifikat

1120

1130

1140

1199

Characteristics

Characteristics

Characteristics

Characteristics

Unlimited participation in the

Unlimited participation in the development

1220 Reverse ConvertiblesUnlimited participation in the development

1220 Aktienanleihen Unlimited participation in the development

1220

development of the underlying

of the underlying

of

the

underlying

of

the

underlying

1230 Reverse Convertibles knock-in

1230

Disproportional participation

Minimum

is equal to the Strike

A Bonus Certificate turns into 1240

a Tracker

the Outperformance

1240 Sprint

Sprint ZertifikateMinimum redemption is equal to 1240

conredemption

cap

(Outperformance) in a positive

the Barrier is never breached

Certificate after breaching the Barrier

Strike if the Barrier is never breached

1250 Bonus Capps

1250 Bonus conifcap

performance of the underlying

Minimum redemption is equal1260

to theExpress

Strike Zertifikate

Disproportional participation (Outperformance)

1260 Express Profits possible with rising and falling 1260

Reflects underlying price1299

movesAutres

1:1 produits de Rendement

underlying

if the Barrier is never breached

in a positive performance of the underlying

1299

when below the Strike

Falling underlying price converts into profit

Fees generally in the form of

Lower risk than a direct investment due to

An Outperformance Bonus Certificate

Risk comparable to a direct investment

until the Barrier

management fees or through the

the conditional capital protection

turns into an Outperformance Certificate

Any payouts attributable13to thePRODUITS DE PARTICIPATION

A Twin-Win Certificate turns into a Tracker

retention of payouts attributable to the

Larger Bonus payments or lower barriers can

after breaching the Barrier

PARTICIPATION PRODUCTS

13

underlying are used in favour

the (1301 100%beBear)

Certificate after breaching the Barrier 1300

underlying during the

lifetime

the

achieved at a greater risk if1300

the product

LowerZertifikate

risk than a direct investment

due Benchmark

to

1300 of

1300

100%

1300

Tracker Certificates

Indexof

/ Partizipations

Zertifikate

Index / Partizipations

strategy

Any payouts

to the underlying

product

is based on multiple underlyings

(multi-asset)

conditional capital protection1310 Outperformance

1310 Outperformance Zertifikate

1310

Outperformance Certificates

Outperformancethe

Zertifikate

senza attributable

cap

1310

arecap

used in favour of the strategy

Any payouts attributable to the

underlying

1320 Bonus

1320 Bonus Zertifikate

1320

1320 Bonus senza

Bonus Certificates

Bonus ZertifikateAny payouts attributable to the underlying

1320

are used in favour of the strategy

are used in favour of the strategy

Outperformance Bonus Certificates

1340 Twin Win

1340 Twin Win

Twin-Win Certificates

1340

1399 Autres produits de Participation

1399 Weitere Anlageprodukte ohne Kapitalschutz

1399 Weitere Anlageprodukte ohne Kapitalschutz

1399 Altri prodotti a cap non protetto e condiz. prot.

Miscellaneous Participation

1399

LEVERAGE PRODUCTS

22

1120 Equity protection con cap

Barrier

KAPITALSKYDDADE PRODUKTER

1100 Kapitalskydd utan maxniv

Barrier

Barrier

0

PRODOTTI A CAPITALE PROTETTO

Profit

1100 Kapitalschutz Zertifikate

Bu

ll

Bu

ll

PROD. CAPITAL GARANTI LCHANCE

1100 Capital Garanti

23 CONSTANT LEVERAGE

Profit

Un

de

r

ANLAGEPRODUKTE MIT KAPITALSCHUTZ

1100 Kapitalschutz Zertifikate

Un

1300

1310

1320

1330

1340

1399

13

Profit

a

Be

13 PARTICIPATION

1 INVESTMENT PRODUCTS

2300 Constant Leverage-Zertifikat

2099

Weitere Hebelprodukte

g

in

rly

U 14 Reference Entity Certificates: Investment products that are

e

nd

Loss

linked to a reference entity are classified in a dedicated category

due to their different mechanism and risks. For detailed information

please refer to the Swiss Derivative Map on svsp-verband.ch.

Characteristics

Small investment generating a leveraged performance relative

to the underlying

ness of the information published herein. The information published on the European

Increased risk of total loss (limited to initial investment)

Derivative Map in no way constitute a requirement, offer or recommendation to use a

Suitable forinstruments

short term speculation

service, to purchase or sell investment

or to carry out any other transaction.

The leverage

constant

for theonly

defined

period (e.g.published

daily) only

No investment or other decisions

shouldisbe

taken based

on information

price before

movements

of the

underlying in the same

herein. Please contact your Successions

investment of

advisor

making

a decision.

direction tend to have a positive effect on the performance,

price movements of the underlying in opposite directions a

negative effect

A Stop Loss and/or an automatic reset feature prevent the

value of the instrument to become negative

Continuous monitoring required

SETIPA

2VDCHRG$WBG@MFD

3Q@CDC(MUDRSLDMS

/QNCTBSR RRNBH@SHNM

2VDCHRG$WBG@MFD3Q@CDC

(MUDRSLDMS/QNCTBSR RRNBH@SHNM

SETIPA

SETIPA

SETIPA

2VDCHRG$WBG@MFD3Q@CDC(MUDRSLDMS/QNCTBSR RRNBH@SHNM

2VDCHRG$WBG@MFD3Q@CDC

(MUDRSLDMS/QNCTBSR RRNBH@SHNM

You might also like

- Sonobi Michael Connolly Lawsuit PDFDocument213 pagesSonobi Michael Connolly Lawsuit PDFAnonymous a4Nm6w3bNo ratings yet

- Structured Financial Product A Complete Guide - 2020 EditionFrom EverandStructured Financial Product A Complete Guide - 2020 EditionNo ratings yet

- Preview Chartbook in Gold We Trust Report 2021Document88 pagesPreview Chartbook in Gold We Trust Report 2021TFMetalsNo ratings yet

- Real Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksFrom EverandReal Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksNo ratings yet

- The Effective Investor: 20 Secrets for Ordinary People to Build Extraordinary WealthFrom EverandThe Effective Investor: 20 Secrets for Ordinary People to Build Extraordinary WealthNo ratings yet

- Electronic Exchanges: The Global Transformation from Pits to BitsFrom EverandElectronic Exchanges: The Global Transformation from Pits to BitsNo ratings yet

- Financial Fine Print: Uncovering a Company's True ValueFrom EverandFinancial Fine Print: Uncovering a Company's True ValueRating: 3 out of 5 stars3/5 (3)

- The Little Book of Valuation: How to Value a Company, Pick a Stock, and ProfitFrom EverandThe Little Book of Valuation: How to Value a Company, Pick a Stock, and ProfitRating: 4 out of 5 stars4/5 (7)

- Optimizing Corporate Portfolio Management: Aligning Investment Proposals with Organizational StrategyFrom EverandOptimizing Corporate Portfolio Management: Aligning Investment Proposals with Organizational StrategyNo ratings yet

- O2 Generation and Storage Air Separation Unit v1Document4 pagesO2 Generation and Storage Air Separation Unit v1AhNo ratings yet

- Accretion/Dilution Analysis EPS ImpactDocument27 pagesAccretion/Dilution Analysis EPS Impactrohitsahu1001No ratings yet

- Exam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesFrom EverandExam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesNo ratings yet

- Financial Risk Modelling and Portfolio Optimization with RFrom EverandFinancial Risk Modelling and Portfolio Optimization with RRating: 4 out of 5 stars4/5 (2)

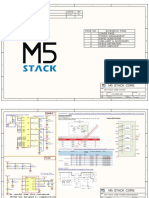

- M5 STACK CORE COVER PAGEDocument6 pagesM5 STACK CORE COVER PAGED RuNo ratings yet

- Value Investors Club - WAYFAIR INC (W)Document4 pagesValue Investors Club - WAYFAIR INC (W)Jorge VasconcelosNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Trading Long Strangles for Passive Income: A Great Passive Options Trading Strategy: Financial Freedom, #204From EverandTrading Long Strangles for Passive Income: A Great Passive Options Trading Strategy: Financial Freedom, #204No ratings yet

- Cautionary tales for the modern investor: The seven deadly sins of multi-asset investingFrom EverandCautionary tales for the modern investor: The seven deadly sins of multi-asset investingNo ratings yet

- Why You Suck At Investing And How You Can Easily and Dramatically Beat the Odds With a Brain Dead Easy, Set-It-And-Forget-It MethodFrom EverandWhy You Suck At Investing And How You Can Easily and Dramatically Beat the Odds With a Brain Dead Easy, Set-It-And-Forget-It MethodRating: 4 out of 5 stars4/5 (4)

- Trading and Investing using the Smart Plan MethodFrom EverandTrading and Investing using the Smart Plan MethodRating: 1 out of 5 stars1/5 (1)

- GMI Global Panel BookDocument29 pagesGMI Global Panel BookEira SolidorNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Alternative Investment Strategies A Complete Guide - 2020 EditionFrom EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNo ratings yet

- Goal Based Asset AllocationDocument32 pagesGoal Based Asset Allocationnilanjan1969No ratings yet

- Bias in Measuring Effective Bid-Ask SpreadsDocument62 pagesBias in Measuring Effective Bid-Ask SpreadsLuca PilottiNo ratings yet

- Hedge (Finance)Document7 pagesHedge (Finance)deepakNo ratings yet

- Investment Portfolio Management A Complete Guide - 2020 EditionFrom EverandInvestment Portfolio Management A Complete Guide - 2020 EditionNo ratings yet

- Leadership Risk: A Guide for Private Equity and Strategic InvestorsFrom EverandLeadership Risk: A Guide for Private Equity and Strategic InvestorsNo ratings yet

- Mergers and AcquisitionsDocument46 pagesMergers and Acquisitionszyra liam styles0% (1)

- A Century of Asset Allocation Crash RiskDocument56 pagesA Century of Asset Allocation Crash Riskpta123No ratings yet

- 2012 q3 Letter DdicDocument5 pages2012 q3 Letter DdicDistressedDebtInvestNo ratings yet

- Goldman Sachs Presentationppt409Document25 pagesGoldman Sachs Presentationppt409Swati AryaNo ratings yet

- Daily Strategy Note: The Joy of Put SellingDocument5 pagesDaily Strategy Note: The Joy of Put Sellingchris mbaNo ratings yet

- 50 Largest Hedge Funds in The WorldDocument6 pages50 Largest Hedge Funds in The Worldhttp://besthedgefund.blogspot.comNo ratings yet

- FINAL EVCA Handbook of Professional Standards 180112Document65 pagesFINAL EVCA Handbook of Professional Standards 180112sigitsutoko8765No ratings yet

- Relative Valuation - Aswath Damodaran PDFDocument91 pagesRelative Valuation - Aswath Damodaran PDFKanikkaNo ratings yet

- Munc (2011) Dynamic Asset AllocationDocument288 pagesMunc (2011) Dynamic Asset AllocationTrung PhanNo ratings yet

- Will These '20s Roar?: Global Asset Management 2019Document28 pagesWill These '20s Roar?: Global Asset Management 2019Nicole sadjoliNo ratings yet

- Hedge Funds Presentation Apr 08Document31 pagesHedge Funds Presentation Apr 08Marina BoldinaNo ratings yet

- JP01Document1,785 pagesJP01SKNo ratings yet

- Introduction To Animal Science For Plant ScienceDocument63 pagesIntroduction To Animal Science For Plant ScienceJack OlanoNo ratings yet

- 8-26-16 Police ReportDocument14 pages8-26-16 Police ReportNoah StubbsNo ratings yet

- Cellular Basis of HeredityDocument12 pagesCellular Basis of HeredityLadyvirdi CarbonellNo ratings yet

- RUKUS March 2010Document32 pagesRUKUS March 2010RUKUS Magazine29% (14)

- Myth and Realism in The Play A Long Day's Journey Into Night of Eugene O'neillDocument4 pagesMyth and Realism in The Play A Long Day's Journey Into Night of Eugene O'neillFaisal JahangeerNo ratings yet

- SPA For Banks From Unit OwnersDocument1 pageSPA For Banks From Unit OwnersAda DiansuyNo ratings yet

- Nursing Plan of Care Concept Map - Immobility - Hip FractureDocument2 pagesNursing Plan of Care Concept Map - Immobility - Hip Fracturedarhuynh67% (6)

- C. Drug Action 1Document28 pagesC. Drug Action 1Jay Eamon Reyes MendrosNo ratings yet

- VIDEO 2 - Thì hiện tại tiếp diễn và hiện tại hoàn thànhDocument3 pagesVIDEO 2 - Thì hiện tại tiếp diễn và hiện tại hoàn thànhÝ Nguyễn NhưNo ratings yet

- Medpet Pigeon ProductsDocument54 pagesMedpet Pigeon ProductsJay Casem67% (3)

- Schneider Electric PowerPact H-, J-, and L-Frame Circuit Breakers PDFDocument3 pagesSchneider Electric PowerPact H-, J-, and L-Frame Circuit Breakers PDFAnonymous dH3DIEtzNo ratings yet

- Poverty and Crime PDFDocument17 pagesPoverty and Crime PDFLudwigNo ratings yet

- SM RSJ 420 800Document77 pagesSM RSJ 420 800elshan_asgarovNo ratings yet

- Affidavit of Consent For Shared Parental AuthorityDocument2 pagesAffidavit of Consent For Shared Parental AuthorityTet LegaspiNo ratings yet

- Auditor General Insurance Regulation Dec 2011Document23 pagesAuditor General Insurance Regulation Dec 2011Omar Ha-RedeyeNo ratings yet

- Lesson Plan 7 Tabata TrainingDocument4 pagesLesson Plan 7 Tabata Trainingapi-392909015100% (1)

- Aging and Elderly IQDocument2 pagesAging and Elderly IQ317537891No ratings yet

- Fugro - Method Statement - For Geotechnical InvestigationDocument4 pagesFugro - Method Statement - For Geotechnical Investigationsindalisindi100% (1)

- AZ ATTR Concept Test Clean SCREENERDocument9 pagesAZ ATTR Concept Test Clean SCREENEREdwin BennyNo ratings yet

- ERS M22 PC4 FerryDocument2 pagesERS M22 PC4 FerryouakgoodNo ratings yet

- Supply Chain Management of VodafoneDocument8 pagesSupply Chain Management of VodafoneAnamika MisraNo ratings yet

- of Types of Nuclear ReactorDocument33 pagesof Types of Nuclear Reactormandhir67% (3)

- Lease Practice QuestionsDocument4 pagesLease Practice QuestionsAbdul SamiNo ratings yet

- Assessment Formal AssessmentDocument7 pagesAssessment Formal Assessmentashish33% (3)

- BCM Continuous ImprovementDocument22 pagesBCM Continuous ImprovementnikoNo ratings yet

- EO On Ban of Fireworks (Integrated)Document2 pagesEO On Ban of Fireworks (Integrated)Mario Roldan Jr.No ratings yet

- Bs8161 - Chemistry Laboratory Syllabus: Course ObjectivesDocument47 pagesBs8161 - Chemistry Laboratory Syllabus: Course ObjectiveslevisNo ratings yet

- Philippines implements external quality assessment for clinical labsDocument2 pagesPhilippines implements external quality assessment for clinical labsKimberly PeranteNo ratings yet

- General Specifications: Detail ADocument1 pageGeneral Specifications: Detail AJeniel PascualNo ratings yet

- Fitness WalkingDocument192 pagesFitness Walkingjha.sofcon5941100% (1)