Professional Documents

Culture Documents

MODAUD2 - Unit 3 - Audit of Accounts and Notes Payable - T31516 - FINAL

Uploaded by

mimi96Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MODAUD2 - Unit 3 - Audit of Accounts and Notes Payable - T31516 - FINAL

Uploaded by

mimi96Copyright:

Available Formats

UNIT 3

AUDIT OF ACCOUNTS AND NOTES PAYABLE

Estimated Time: 3.0 HOURS

Discussion Question 3-1: Nature of Liabilities

1. Define the following:

a. Legal Obligation

b. Constructive Obligation

c. Obligating event

2. What are the initial recognition criteria for financial liabilities? How are these

initially and subsequently measured?

Discussion Questions 3-2: Substantive Procedures for Liabilities

Prepare an audit work program for the audit of short-term liabilities.

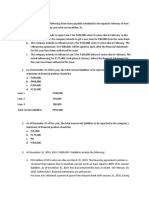

Problem 3-1: Classification of Liabilities

On December 31, 2016, the bookkeeper of Manna Company provided the following

information:

Accounts payable (net of P20,000 debit balance in creditors account)

Notes Payable (including note payable to bank on Dec. 31, 2017 of P1,000,000)

Salaries payable

SSS payable

Pag-ibig payable

Medicare payable

Withholding tax payable

Vat payable

Customers account with credit balances

Stock dividends payable

Serial bonds (payable in semiannual installments P1,000,000)

Accrued interest on bonds payable

Contested BIR assessment

Unearned rent income

P 640,000

1,500,000

800,000

30,000

5,000

15,000

60,000

120,000

50,000

800,000

10,000,000

300,000

600,000

100,000

In the December 31, 2016 statement of financial position, how much current liabilities

should be reported?

Problem 3-2: Classification of Liabilities

At December 31, 2016, Expert Company had a note payable of P2,500,000, due on

April 15, 2017. Expert expects to retire this debt with proceeds from the sale of its

100,000 ordinary shares. The shares were sold for P15 per share on March 2, 2017

prior to the issuance of year-end financial statements.

In Experts December 31, 2016 statement of financial position, what amount of the

notes payable should be excluded from current liabilities?

Auditing Practice II

Workbook

Third Term, AY 2015-2016

Page 1-1

Problem 3-3: Various liabilities

Due to an unexpected typhoon the other day, one of your clients, Yogi Bear Company,

had its books of accounts mixed up. You are now trying to help them compute the

correct amount of liabilities as of December 31, 2016.

Notes payable

Arising from purchase of goods

Arising from 5-year bank loans, on which available-for-sale

securities valued at P600,000 have been pledged as security,

with P75,000 due on December 31, 2017

Arising from advances from officers, due June 30, 2017

Reserve for general contingencies

Employees income tax withheld

Advances received from customers on purchase orders

Containers deposit

Accounts payable arising from purchase of goods, net of debit

balances of P25,000

Accounts receivable, net of credit balances, P65,000

Cash dividends payable

Stock dividends payable

Dividend in arrears on preferred stock not yet declared

Convertible bonds, due January 31, 2018

First mortgage serial bonds, payable in semiannual installments of

P75,000 due April 1 and October 1 of each year

Overdraft with Jelly Stone Bank

Cash in bank related to overdraft

Estimated damages to be paid as a result of unsatisfactory

performance on a contract

Estimated expenses on meeting guarantee for service

requirements on merchandise sold

Estimated premiums payable

Deferred revenue

Accrued interest on bonds payable

Common stock warrants outstanding

Common stock options outstanding

Unused letters of credit

Deficiency VAT assessment being contested

Notes receivable discounted

310,000

475,000

150,000

600,000

80,000

84,000

75,000

200,000

420,000

95,000

125,000

185,000

1,400,000

2,250,000

78,000

490,000

220,000

135,000

90,000

125,000

330,000

120,000

210,000

400,000

500,000

180,000

On January 15, 2017, the BIR assessed Yogi Bear Company an additional income

tax of P300,000 for the 2009 tax year. Yogi Bears legal counsel stated that it is likely

that the BIR will agree on a P200,000 settlement. The 2016 Financial Statements are

expected to be issued on March 31, 2017.

Required - Determine the correct balance of the following:

1. Total current liabilities

2. Total long term liabilities

3. Total liabilities

Auditing Practice II

Workbook

Third Term, AY 2015-2016

Page 1-2

Problem 3-4: Accruals

Your client, Puscha Corporation gave you the following schedule of accrued

expenses as at December 31, 2016.

Nature

Electricity

Water

Repairs

Amount

P285,000

18,400

30,200

You went over all payments made by the corporation from January 2, 2017 until

March 15, 2017, the date of your last day of field work and you ascertained the

following data:

Date of

Supporting

Nature

Amount

Documents

2016

Professional fees (check was prepared in January, 2017)

P90,000

2016

Professional fees ( check was dated and recorded in

45,000

2016, but check was released in January, 2017)

2016

Electricity

350,000

2016

Water

150,000

2016

Repairs

30,200

2016

Various Expenses

3,000

2017

Salaries

480,000

2017

Repairs

50,000

Required:

1. Prepare the adjusting journal entries on December 31, 2016.

2. Compute for the correct balances of accrued expenses.

Problem 3-5: Non-interest bearing notes payable in installment

Sir Price, Inc. (SPI) bought an equipment costing P1.5 million on December 31, 2016

paying P500,000 down payment and the balance in four equal annual installments.

SPI can borrow funds from a bank with a 10% interest rate. SPI recorded that

equipment at P1,500,000 in December 31, 2016.

Required:

1. What is the equipments cost as of December 31, 2016?

2. By how much should the cost be decreased?

3. How much interest expense should be reported for the year 2018?

4. What is the carrying value of the note at December 31, 2019?

Problem 3-6: Notes Payable

You were able to obtain the following information from the accountant of Itchy and

Scratchy Corporation related to the companys liabilities as of December 31, 2016.

Accounts payable

Notes payable trade

Notes payable bank

Wages and salaries payable

Interest payable

Mortgage notes payable 10%

Mortgage notes payable 12%

Bonds payable

Auditing Practice II

Workbook

730,000

235,800

1,200,000

65,000

?

750,000

1,850,000

2,500,000

Third Term, AY 2015-2016

Page 1-3

Provided below are the additional information pertaining to these liabilities:

a. All trade notes payable are due within six months from the end of the reporting

period.

b. Bank notes payable include two separate notes payable to Jetson Bank.

(1) A P400,000, 8% notes issued March 1, 2014, payable on demand. Interest is

payable every six months.

(2) A 1-year, P800,000, 11 % note issued January 2, 2016. On December 30,

2016, Itchy and Scratchy negotiated a written agreement with Jetson Bank to

replace the note with a 2-year, P800,000, 10% note to be issued January 2,

2017. The interest was paid on December 31, 2016.

c. The 10% mortgage note was issued October 1, 2013, with a term of 10 years.

Terms of the note give the holder the right to demand immediate payment if the

company fails to make a monthly interest payment within 10 days of the date the

payment is due. As of December 31, 2016, Itchy and Scratchy is three months

behind in paying its required interest payment.

d. The 12% mortgage was issued May 1, 2010, with a term of 20 years. The current

principal amount due is P1,850,000. Principal and interest payable annually on

April 30. A payment of P350,000 is due April 30, 2017. The payment includes

interest of P222,000.

e. The bonds payable is 10-year, 8% bonds, issued June 30, 2007. Interest is

payable semi-annually every June 30 and December 31.

Required: Based on the above and the result of your audit, compute the correct

balance of the following as of December 31, 2016:

1.

2.

3.

4.

Interest payable

Note payable bank to be reported under current liabilities

Total current liabilities

Total non-current liabilities

Problem 3-7: Current vs. Non-current

Included in Levans Corp.s liability account balances at December 31, 2016 were the

following:

14% note payable issued October 1, 2013, maturing September 30, 2017

16% note payable issued April 1, 2012 due on April 2017

P1,250,000

2,000,000

On December 31, 2016, Levan expects to refinance the P2,000,000 by the issuance

of a long-term note payable in lump-sum. The refinancing of the P2,000,000 is at the

discretion of Levan. Levans December 31, 2016 financial statements were issued on

March 31, 2017. On January 15, 2017, the entire P2,000,000 balance of the 16%

note was refinanced by issuance of a long-term obligation payable.

On the December 31, 2016 statement of financial position, what amount of the notes

payable should Levans classify as short-term obligation?

Auditing Practice II

Workbook

Third Term, AY 2015-2016

Page 1-4

You might also like

- 5.AUDITING ProblemDocument111 pages5.AUDITING ProblemAngelu Amper68% (22)

- UntitledDocument12 pagesUntitledMaykel BolañosNo ratings yet

- AP Pakyo CompanyDocument8 pagesAP Pakyo CompanyKristin Zoe Newtonxii PaezNo ratings yet

- CPAR - Auditing ProblemDocument12 pagesCPAR - Auditing ProblemAlbert Macapagal83% (6)

- Acc412 Pe QuestionsDocument5 pagesAcc412 Pe QuestionsMa Teresa B. CerezoNo ratings yet

- Accounts ReceivablesDocument10 pagesAccounts ReceivablesYenelyn Apistar Cambarijan0% (1)

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeDocument5 pagesIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoNo ratings yet

- Audit of Liabs 1Document2 pagesAudit of Liabs 1Raz MahariNo ratings yet

- Accounting Sample ProblemDocument2 pagesAccounting Sample ProblemMissie Jane AnteNo ratings yet

- Apllied Auditing Q&ADocument10 pagesApllied Auditing Q&APeterJorgeVillarante100% (2)

- Handouts 1 P1Document3 pagesHandouts 1 P1Cristopher IanNo ratings yet

- Adjusting journal entries for prepaid, unearned, and accrued itemsDocument4 pagesAdjusting journal entries for prepaid, unearned, and accrued itemsjemima manzanoNo ratings yet

- Fa 1 - Q1Document3 pagesFa 1 - Q1gon_freecs_4No ratings yet

- Quiz - ReceivablesDocument2 pagesQuiz - ReceivablesAna Mae HernandezNo ratings yet

- IA Chapters 4 9 ProblemsDocument6 pagesIA Chapters 4 9 ProblemsNica PasionaNo ratings yet

- Composition of Cash and Cash EquivalentDocument20 pagesComposition of Cash and Cash EquivalentYenelyn Apistar CambarijanNo ratings yet

- Receivable-to-Receivable-Financing (PRACTICE)Document3 pagesReceivable-to-Receivable-Financing (PRACTICE)liezelkatemesina82No ratings yet

- LIABDocument5 pagesLIABLorie Jae DomalaonNo ratings yet

- Prelim Examination 2018 With Answers PDFDocument6 pagesPrelim Examination 2018 With Answers PDFjudel ArielNo ratings yet

- Week 1 OutputDocument4 pagesWeek 1 OutputFria Mae Aycardo AbellanoNo ratings yet

- Quiz - Receivables FinalDocument1 pageQuiz - Receivables FinalAna Mae HernandezNo ratings yet

- Preparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...Document5 pagesPreparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...ehab_ghazallaNo ratings yet

- Quiz 02 - FAR - UCP - ANS KEYDocument9 pagesQuiz 02 - FAR - UCP - ANS KEYkarim abitagoNo ratings yet

- Unit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - Final - t31516Document9 pagesUnit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - Final - t31516mimi96No ratings yet

- Fundamentals of AccountingDocument50 pagesFundamentals of AccountingCarmina Dongcayan100% (2)

- Additionial TanongDocument28 pagesAdditionial Tanongboerd77No ratings yet

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNo ratings yet

- ACC 211 Quiz-LIABILITIESDocument1 pageACC 211 Quiz-LIABILITIESAeyjay ManangaranNo ratings yet

- Abm 1 AdjustingDocument19 pagesAbm 1 AdjustingCarmina DongcayanNo ratings yet

- Accounting - Prob.3Document2 pagesAccounting - Prob.3Dellosa, Jierstine Shaney R.No ratings yet

- Difficult 1st Yr AnsDocument4 pagesDifficult 1st Yr AnsMeiNo ratings yet

- Unit 2. Audit of Cash and Cash Transactions Handout Final t31516Document8 pagesUnit 2. Audit of Cash and Cash Transactions Handout Final t31516mimi96100% (1)

- Soal Asis PA2Document2 pagesSoal Asis PA2Fahmi HaritsNo ratings yet

- Identify Current and Non-Current LiabilitiesDocument4 pagesIdentify Current and Non-Current LiabilitiesAlexis KingNo ratings yet

- Financial Accounting Midterm ExamDocument20 pagesFinancial Accounting Midterm ExamkimkimNo ratings yet

- Chapter 9 - Audit of Liabilities RoqueDocument77 pagesChapter 9 - Audit of Liabilities RoqueCristina Ramirez90% (10)

- Schedule of Bonds Discount AmortizationDocument11 pagesSchedule of Bonds Discount AmortizationOndhotara AkasheNo ratings yet

- Adjusting Entries ProblemDocument3 pagesAdjusting Entries ProblemElla Mae SaludoNo ratings yet

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDocument8 pagesINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- PrE3 Final ExamDocument16 pagesPrE3 Final ExamLyca MaeNo ratings yet

- CB Chap 3Document39 pagesCB Chap 3Christianne Joyse MerreraNo ratings yet

- Accounting Test Bank 5Document2 pagesAccounting Test Bank 5likesNo ratings yet

- Auditing Problems Compilation of Questions ReceivablesDocument43 pagesAuditing Problems Compilation of Questions Receivableskimberly27% (11)

- Activity: Notes PayableDocument3 pagesActivity: Notes PayablePiaNo ratings yet

- Accounting Review and Tutorial Services in San Isidro, Nueva EcijaDocument8 pagesAccounting Review and Tutorial Services in San Isidro, Nueva EcijaEiuol Nhoj Arraeugse100% (3)

- Receivables ExercisesDocument5 pagesReceivables ExercisesChrystelle Gail LiNo ratings yet

- Ar 5Document1 pageAr 5Jesebel AmbalesNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Money Matters: Local Government Finance in the People's Republic of ChinaFrom EverandMoney Matters: Local Government Finance in the People's Republic of ChinaNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Hybrid and Derivative SecuritiesDocument30 pagesHybrid and Derivative Securitiesmimi96100% (2)

- Problems Stocks ValuationDocument3 pagesProblems Stocks Valuationmimi96No ratings yet

- Rules of The Stock Market GameDocument1 pageRules of The Stock Market Gamemimi96No ratings yet

- Dividend PolicyDocument38 pagesDividend PolicyhizelaryaNo ratings yet

- Exercises WMCCDocument5 pagesExercises WMCCmimi96No ratings yet

- Final Report FormatDocument3 pagesFinal Report Formatmimi96No ratings yet

- HOMEWORK (6 Problems) : The Following Problems (Nos. 2, 3, and 4) Are From The Textbook, New Edition (12)Document2 pagesHOMEWORK (6 Problems) : The Following Problems (Nos. 2, 3, and 4) Are From The Textbook, New Edition (12)mimi96No ratings yet

- EBIT EPS ProblemsDocument3 pagesEBIT EPS Problemsmimi960% (2)

- Modaud2 Unit 6 Audit of Leases t31516 FinalDocument3 pagesModaud2 Unit 6 Audit of Leases t31516 Finalmimi96No ratings yet

- Discussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSDocument7 pagesDiscussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSmimi96No ratings yet

- MODAUD2 Unit 10 Audit of Revenues T31516Document6 pagesMODAUD2 Unit 10 Audit of Revenues T31516mimi96No ratings yet

- Discussion Questions:: Auditing Practice II Third Term, AY 2015-2016 Workbook Page 1-1Document4 pagesDiscussion Questions:: Auditing Practice II Third Term, AY 2015-2016 Workbook Page 1-1mimi96No ratings yet

- Modaud2 Unit 6 Audit of Leases t31516 FinalDocument3 pagesModaud2 Unit 6 Audit of Leases t31516 Finalmimi96No ratings yet

- Cost of CapitalDocument69 pagesCost of Capitalmimi96No ratings yet

- Discussion Questions 9-1:: Unit 9 Completing The Audit Estimated Time: 1.5 HOURSDocument4 pagesDiscussion Questions 9-1:: Unit 9 Completing The Audit Estimated Time: 1.5 HOURSmimi96No ratings yet

- MODAUD2 Unit 5 Audit of Employee Benefits T31516 FINALDocument3 pagesMODAUD2 Unit 5 Audit of Employee Benefits T31516 FINALPinky Mae PortugalNo ratings yet

- Unit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - Final - t31516Document9 pagesUnit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - Final - t31516mimi96No ratings yet

- Analysis and Correction of Errors WorksheetDocument3 pagesAnalysis and Correction of Errors WorksheetDaphneNo ratings yet

- MODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALDocument7 pagesMODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALmimi96No ratings yet

- Unit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516Document8 pagesUnit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516mimi96No ratings yet

- t11. Aggregate Demand and Aggregate SupplyDocument78 pagest11. Aggregate Demand and Aggregate Supplymimi96No ratings yet

- Unit 5. Audit of Biological Assets & Agricultural Produce - Handout - Final - t31516Document4 pagesUnit 5. Audit of Biological Assets & Agricultural Produce - Handout - Final - t31516mimi96100% (2)

- Unit 5. Audit of Biological Assets & Agricultural Produce - Handout - Final - t31516Document4 pagesUnit 5. Audit of Biological Assets & Agricultural Produce - Handout - Final - t31516mimi96100% (2)

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDocument3 pagesMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- Unit 6. Audit of Investments, Hedging Instruments - Handout - Final - t31516Document8 pagesUnit 6. Audit of Investments, Hedging Instruments - Handout - Final - t31516mimi96No ratings yet

- Unit 4. Audit of Inventories - Handout - Final - t31516Document7 pagesUnit 4. Audit of Inventories - Handout - Final - t31516mimi96No ratings yet

- t12. Monetary and Fiscal Policy On Aggregate DemandDocument43 pagest12. Monetary and Fiscal Policy On Aggregate Demandmimi96No ratings yet

- Obl IconDocument21 pagesObl Iconmimi96No ratings yet

- Unit 2. Audit of Cash and Cash Transactions Handout Final t31516Document8 pagesUnit 2. Audit of Cash and Cash Transactions Handout Final t31516mimi96100% (1)

- The Online Medical Booking Store Project ReportDocument4 pagesThe Online Medical Booking Store Project Reportharshal chogle100% (2)

- Installation Instruction XALM IndoorDocument37 pagesInstallation Instruction XALM IndoorVanek505No ratings yet

- Board 2Document1 pageBoard 2kristine_nilsen_2No ratings yet

- MMW FinalsDocument4 pagesMMW FinalsAsh LiwanagNo ratings yet

- IELTS Vocabulary ExpectationDocument3 pagesIELTS Vocabulary ExpectationPham Ba DatNo ratings yet

- AVANTIZ 2021 LNR125 (B927) EngineDocument16 pagesAVANTIZ 2021 LNR125 (B927) EngineNg Chor TeckNo ratings yet

- HistoryDocument144 pagesHistoryranju.lakkidiNo ratings yet

- Cianura Pentru Un Suras de Rodica OjogDocument1 pageCianura Pentru Un Suras de Rodica OjogMaier MariaNo ratings yet

- Lesson 2 Mathematics Curriculum in The Intermediate GradesDocument15 pagesLesson 2 Mathematics Curriculum in The Intermediate GradesRose Angel Manaog100% (1)

- Programming Language Foundations PDFDocument338 pagesProgramming Language Foundations PDFTOURE100% (2)

- The Botanical AtlasDocument74 pagesThe Botanical Atlasjamey_mork1100% (3)

- Diemberger CV 2015Document6 pagesDiemberger CV 2015TimNo ratings yet

- Investigatory Project Pesticide From RadishDocument4 pagesInvestigatory Project Pesticide From Radishmax314100% (1)

- Instagram Dan Buli Siber Dalam Kalangan Remaja Di Malaysia: Jasmyn Tan YuxuanDocument13 pagesInstagram Dan Buli Siber Dalam Kalangan Remaja Di Malaysia: Jasmyn Tan YuxuanXiu Jiuan SimNo ratings yet

- Extensive Reading Involves Learners Reading Texts For Enjoyment and To Develop General Reading SkillsDocument18 pagesExtensive Reading Involves Learners Reading Texts For Enjoyment and To Develop General Reading SkillsG Andrilyn AlcantaraNo ratings yet

- Tatoo Java Themes PDFDocument5 pagesTatoo Java Themes PDFMk DirNo ratings yet

- Electrosteel Castings Limited (ECL) - Technology That CaresDocument4 pagesElectrosteel Castings Limited (ECL) - Technology That CaresUjjawal PrakashNo ratings yet

- 14 15 XII Chem Organic ChaptDocument2 pages14 15 XII Chem Organic ChaptsubiNo ratings yet

- For Coin & Blood (2nd Edition) - SicknessDocument16 pagesFor Coin & Blood (2nd Edition) - SicknessMyriam Poveda50% (2)

- Fiera Foods - Production SupervisorDocument1 pageFiera Foods - Production SupervisorRutul PatelNo ratings yet

- ULN2001, ULN2002 ULN2003, ULN2004: DescriptionDocument21 pagesULN2001, ULN2002 ULN2003, ULN2004: Descriptionjulio montenegroNo ratings yet

- Reservoir Rock TypingDocument56 pagesReservoir Rock TypingAffan HasanNo ratings yet

- ASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsDocument20 pagesASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsEng. Emílio DechenNo ratings yet

- Lecture 4Document25 pagesLecture 4ptnyagortey91No ratings yet

- Yanmar America publication listing for engine parts, service, and operation manualsDocument602 pagesYanmar America publication listing for engine parts, service, and operation manualsEnrique Murgia50% (2)

- PWC Global Project Management Report SmallDocument40 pagesPWC Global Project Management Report SmallDaniel MoraNo ratings yet

- (Variable Length Subnet MasksDocument49 pages(Variable Length Subnet MasksAnonymous GvIT4n41GNo ratings yet

- Create a seat booking form with Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulseDocument3 pagesCreate a seat booking form with Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulsebrandy57279No ratings yet

- 2019 May Chronicle AICFDocument27 pages2019 May Chronicle AICFRam KrishnaNo ratings yet

- MORTGAGE Short NotesDocument11 pagesMORTGAGE Short Noteshamzatariq015No ratings yet