Professional Documents

Culture Documents

Financial Accounting March 2010 Marks Plan

Uploaded by

karlr9Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting March 2010 Marks Plan

Uploaded by

karlr9Copyright:

Available Formats

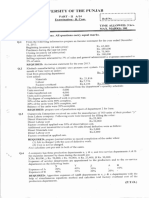

Financial Accounting Professional Stage March 2010

PROFESSIONAL STAGE FINANCIAL ACCOUNTING OT EXAMINERS COMMENTS

The performance of candidates in the March 2010 objective test questions section for the Professional Stage

Financial Accounting paper was good. Candidates performed well across all syllabus areas.

When practising OT items, care should always be taken to ensure that the principles underlying any

particular item are understood rather than rote learning the answer. In particular, candidates should ensure

that they read all items very carefully.

The following table summarises how well* candidates answered each syllabus content area.

Syllabus area

Number of questions

Well answered

Poorly answered

LO1

LO2

LO3

Total

15

13

*If 50% or more of the candidates gave the correct answer, then the question was classified as well

answered.

Brief comments on the two poorly answered questions, which covered LO1 (accounting and reporting

concepts) and LO2 (preparation of single company financial statements), are below (this paper was marked

under the new electronic marking system and no further information regarding responses was available):

Item 1

This item asked which roles are undertaken by the International Accounting Standards Committee

Foundation (IASCF). Candidates clearly do not understand the structure that surrounds and supports the

International Accounting Standards Board.

Item 2

This item, required candidates to identify which adjustments should be recognised as a prior period error.

Four short scenarios were provided which included a settled legal claim, a computational error, a fraud and a

revised tax liability.

The Institute of Chartered Accountants in England and Wales 2010

Page 1 of 13

Financial Accounting Professional Stage March 2010

MARK PLAN AND EXAMINERS COMMENTARY

The mark plan set out below was used to mark these questions. Markers are encouraged to use discretion

and to award partial marks where a point was either not explained fully or made by implication. More marks

are available than could be awarded for each requirement, where indicated. This allows credit to be given for

a variety of valid points, which are made by candidates.

Question 1

Overall marks for this question can be analysed as follows:

Total: 18

General comments

This question is a typical question testing the preparation of an income statement and statement of financial

position from a trial balance. A number of adjustments were required, including the reversal of a provision,

an inventory valuation issue, an adjustment for the over provision of tax and deferred revenue.

(a)

Karonga plc Statement of financial position as at 31 December 2009

ASSETS

Non-current assets

Property, plant and equipment (W5)

943,435

Current assets

Inventories (W3)

Trade receivables (1,075,000 60,750 (W4))

Cash and cash equivalents

1,161,000

1,014,250

189,500

2,364,750

Total assets

EQUITY AND LIABILITIES

Equity

Ordinary share capital

Retained earnings (28,090 + 227,895)

3,308,185

1,325,000

255,985

1,580,985

Non-current liabilities

Bank loan

Current liabilities

Trade and other payables (583,700 + 12,500(W1))

Taxation (W5)

1,025,300

596,200

105,700

701,900

Total equity and liabilities

The Institute of Chartered Accountants in England and Wales 2010

3,308,185

Page 2 of 13

Financial Accounting Professional Stage March 2010

Karonga plc Income Statement for year ended 31 December 2009

Revenue (W1)

6,196,400

Cost of sales (W2)

(3,506,501)

Gross profit

Administrative expenses (W2)

2,689,899

(2,315,434)

Operating profit

Finance costs

Profit before tax

Income tax expense (105,700 8,300)

374,465

(49,170)

325,295

(97,400)

Net profit for the period

227,895

Note: Marks will be awarded if items are included in a different line item in the income statement

provided that the heading used is appropriate.

W1 Revenue adjustment

Trial balance revenue

Fitness machine deposits (250 x 50)

6,208,900

(12,500)

6,196,400

W2 Expenses

Trial balance

Opening inventory

Less: closing inventory (W3)

Bad debt reversal (W4)

Depreciation charge buildings (12,710 (40% / 60%)

Depreciation charge plant & equipment

Provision reversal

Admin

expenses

2,324,000

(1,650)

5,084

(12,000)

2,315,434

Cost of

sales

3,553,100

1,093,800

(1,161,000)

7,626

12,975

3,506,501

W3 Inventory adjustment

Closing inventory

Net realisable value write down (20 - 15) x 500 items

1,163,500

(2,500)

1,161,000

W4 Bad debt

Opening allowance

Movement in year (balancing figure)

62,400

(1,650)

Closing allowance (53,750 + 7,000)

60,750

The Institute of Chartered Accountants in England and Wales 2010

Page 3 of 13

Financial Accounting Professional Stage March 2010

W5 Property, plant and equipment

Trial balance L&B

Trial balance P&E

Cost

985,500

103,800

Depreciation charge for year (103,800 / 8yrs)

Depreciation charge for year ((985,500

350,000) / 50yrs)

At 31 December 2009

Acc dep

88,970

31,210

12,975

12,710

1,089,300

145,865

943,435

As in previous sittings, candidates were clearly very well-prepared for this type of question. Almost all

candidates produced a well-laid out income statement and statement of financial position with all narrative

and sub-totals completed. Some candidates lost presentation marks for the statement of financial position

by not adding across numbers in brackets, failing to complete sub-totals or by having incomplete or

abbreviated narrative. On the income statement the most common presentational failing was to not

include a sub-total for profit from operations. However, overall presentation is improving with each sitting.

As ever, candidates should remember that this type of question requires financial statements to be in a

form suitable for publication.

Workings generally were set out clearly, with the standard cost matrix generally being produced.

Candidates must remember that if they do not provide clear workings for calculations and their final

answer is incorrect they risk gaining no marks for a working that may be worth 2 or 3 marks. Clear

workings, even if only bracketed will score partial marks for incorrect answers.

Most candidates were able to deal with the more straightforward adjustments such as the depreciation

charges, closing inventory and adjusting revenue for the payments made in advance, although the

corresponding entry in current liabilities was not always included.

Common errors included the treatment of the tax figures which seemed to cause some confusion as to

how to deal with the over provision from the previous year. Candidates commonly put the same figure in

the income statement and statement of financial position, although this was split between whether it was

the income tax charge or the liability.

Candidates often used the correct brought forward and carried forward figures for the specific bad debt

allowance but missed the additional allowance that needed making of 7,000. Other candidates correctly

calculated the carried forward figure and hence calculated that an adjustment of 1,650 was needed but

then either didnt recognise this in the income statement or added it to expenses rather than deducting it.

Only a few candidates carried the double entry through completely by deducting the full closing allowance

from trade receivables, 7,000 was a more common deduction.

The treatment of the legal provision also caused a few problems. Very few candidates realised that the

provision needed reversing. A mix of treatments were seen with candidates either including the provision

in the statement of financial position or providing for it in the current year even though it was a brought

forward balance.

Total possible marks

Maximum full marks

The Institute of Chartered Accountants in England and Wales 2010

18

18

Page 4 of 13

Financial Accounting Professional Stage March 2010

Question 2

Overall marks for this question can be analysed as follows:

Total: 19

General comments

This question tested the preparation of a consolidated statement of cash flows and supporting note. A

subsidiary was disposed of during the year. Missing figures to be calculated included dividends paid (to the

group and to the non-controlling interest), interest paid, tax paid, depreciation and amortisation charge for the

year and proceeds from the issue of share capital following a bonus issue during the year.

Chitipa plc

Consolidated statement of cash flows for the year ended 31 December 2009

Cash flows from operating activities

Cash generated from operations (Note)

331,900

Interest paid (W1)

(73,000)

Income tax paid (W2)

(76,050)

Net cash from operating activities

Cash flows from investing activities

Purchase of property, plant and equipment

(360,000)

Disposal of Thyolo Ltd net of cash disposed of (200,000

192,100

7,900)

Net cash from investing activities

Cash flows from financing activities

Repayment of borrowings (736,300 561,700)

(174,600)

Proceeds from share issue (W4 & W5)

175,000

Dividends paid (W6)

(27,500)

Dividends paid to non-controlling interest (W7)

(11,850)

Net cash used in financing activities

Net increase in cash and cash equivalents

Cash and cash equivalents at beginning of period

Cash and cash equivalents at end of period

182,850

(167,900)

(38,950)

(24,000)

172,500

148,500

Note: Reconciliation of profit before tax to cash generated from operations

Profit before tax (222,000 + 12,600)

Finance cost

Depreciation charge (W3)

Impairment loss on goodwill (373,700 364,200)

Increase in inventories (401,300 393,800)

Increase in trade and other receivables (496,300 475,200 + 25,400)

Increase in trade and other payables ((21,700 5,000) (11,700 7,000) +

36,100)

Cash generated from operations

The Institute of Chartered Accountants in England and Wales 2010

234,600

71,000

22,700

9,500

(7,500)

(46,500)

48,100

331,900

Page 5 of 13

Financial Accounting Professional Stage March 2010

Workings

(1) Interest paid

Cash ()

C/d

73,000

5,000

78,000

B/d

CIS

7,000

71,000

78,000

(2) Income tax paid

Cash ()

C/d

76,050

33,900

109,950

B/d

CIS (69,900 + 3,750)

36,300

73,650

109,950

(3) PPE

B/d

Additions

695,000

360,000

Disposal of sub

Deprecation charge ()

C/d

1,055,000

308,900

22,700

723,400

1,055,000

(4) Share capital

C/d

550,000

550,000

B/d

Bonus issue

Cash received ()

400,000

100,000

50,000

550,000

(5) Share premium

Bonus issue

C/d

50,000

215,000

265,000

B/d

Cash received ()

140,000

125,000

265,000

(6) Retained earnings

Dividends in SCE ()

Bonus issue

C/d

27,500

50,000

303,140

380,640

B/d

CIS

295,100

85,540

380,640

(7) Non-controlling interest

Cash ()

Disposal (306,100 x 20%)

C/d

11,850

61,220

448,260

521,330

B/d

CIS

The Institute of Chartered Accountants in England and Wales 2010

490,800

30,530

521,330

Page 6 of 13

Financial Accounting Professional Stage March 2010

Candidates generally performed well on this question, adopting a good exam technique that allowed them to

gain a good pass in this question but miss out some of the more tricky areas. Presentation of the statement

of cash flows was good, although candidates often missed sub-totalling each section and the date for the

period for which the cash flow was prepared was missed by a significant minority of candidates.

Candidates generally calculated the repayment of borrowings correctly and the purchase of property, plant

and equipment, although a minority of candidates showed the latter as an inflow of cash rather than outflow.

Interest paid was also generally shown correctly. A common mistake was in relation to the income tax

expense where a significant number of candidates missed the tax expense in respect of the discontinued

operation.

The calculation of the proceeds from the share issue were mixed with candidates gaining the marks for the

brought forward and carried forward figures but often getting the entries for the bonus issue back to front. The

calculation for the cash flows from the disposal of the subsidiary was one of the most disappointing areas

with candidates showing all kinds of long and complicated net assets workings, when a, simple netting off of

two figures was required.

Candidates seemed happy with the T-account for dividends paid, although the treatment of the bonus issue

was not always correctly dealt with, sometimes it was shown on the wrong side of the T-account or missed

entirely. However, the calculation of the dividend paid to the non-controlling interest was disappointing with a

good majority of candidates simply electing to ignore the calculation entirely. Candidates who did show a

working for this generally were unable to calculate the disposal value or simply missed it out.

A good attempt at producing the reconciliation of profit before tax to cash generated from operations was

made by almost all candidates. Common errors however included not including the profit before tax for the

discontinued operation, adding back the loss on disposal even though it was not included in the parents

profit before tax figure, ignoring the impact of the goodwill impairment and deducting the individual assets

and liabilities at disposal in the movements calculations, rather than adding them, or ignoring them

completely.

Total possible marks

Maximum full marks

The Institute of Chartered Accountants in England and Wales 2010

19

19

Page 7 of 13

Financial Accounting Professional Stage March 2010

Question 3

Overall marks for this question can be analysed as follows:

Total: 22

General comments

This question required the preparation of a consolidated statement of financial position. The group has an

associate, with the acquisition of a subsidiary during the year. A fair value adjustment in relation to a piece of

equipment, with depreciation adjustment, was required. Inter-company trading had taken place during the

year between the parent and associate company and a suspense account needed eliminating, which was

created on the acquisition of property, plant and equipment on deferred payment terms.

Rumphi plc

(a) Consolidated statement of financial position as at 31 December 2009

000

Assets

Non-current assets

Property, plant and equipment (W8)

Intangibles

Goodwill

Investment in associate (W7)

Current assets

Inventories

Trade and other receivables (120,840 + 945,600)

Cash and cash equivalents (72,600 + 189,500)

000

1,488,350

36,000

143,723

108,585

1,776,658

52,960

1,066,440

262,100

1,381,500

3,158,158

Total assets

Equity and liabilities

Equity attributable to Rumphi plc shareholders

Ordinary share capital

Retained earnings (W5)

Attributable to the equity holders of Rumphi plc

Non-controlling interest (W4)

930,000

802,840

1,732,840

348,948

2,081,788

Non-current liabilities

Deferred payment (W8)

Current liabilities

Trade and other payables (236,380 + 470,330)

Taxation (172,000 + 157,660)

Total equity and liabilities

40,000

706,710

329,660

1,036,370

3,158,158

Workings

(1) Group structure

Rumphi

245,000 / 350,000 = 70%

Luwa Ltd

The Institute of Chartered Accountants in England and Wales 2010

14,175 / 56,700 = 25%

Dedza Ltd

Page 8 of 13

Financial Accounting Professional Stage March 2010

(2) Net assets Luwa Ltd

Share capital

Share premium account

Retained earnings

Goodwill on business

PPE FV uplift

FV depreciation adjustment (12,000 / 8yrs x 4/12)

31 Dec 2009

350,000

125,000

748,260

(71,600)

12,000

(500)

1,163,160

Acquisition

350,000

125,000

600,710

(71,600)

12,000

1,016,110

Post acq

147,550

(500)

147,050

(3) Goodwill Luwa Ltd

900,000

(1,016,110)

304,833

188,723

(45,000)

143,723

Consideration transferred

Net assets at acquisition (W2)

Non-controlling interest at acquisition (1,016,110 (W2) x 30%)

Less: Impairment

(4) Non-controlling interest Luwa Ltd

Share of net assets (1,163,160 (W2) x 30%)

348,948

(5) Retained earnings

751,320

(1,700)

102,935

(45,000)

13,285

(10,000)

(8,000)

802,840

Rumphi plc

Less:PURP (6,800 x 25%)

Luwa Ltd (147,050 (W2) x 70%)

Less: Impairment

Dedza Ltd ((145,695 92,555) x 25%))

Less: Impairments to date

Machine depreciation adjustment (W8)

(6) PURP

%

100

(60)

40

Sale price

Cost

Gross profit

13,600 x = 6,800

Dedza Ltd

34,000

(20,400)

13,600

(7) Investment in associate Dedza Ltd

Original cost

Add: Share of post acquisition increase in retained earnings

Less: Impairment to date

Less: Share of PURP

107,000

13,285

(10,000)

(1,700)

108,585

(8) Property, plant and equipment

Rumphi plc

Luwa Ltd

Fair value adjustment

FV depreciation adjustment (W2)

New machine (80,000 40,000)

Depreciation adj on new machine (40,000 / 5 yrs)

The Institute of Chartered Accountants in England and Wales 2010

800,300

644,550

12,000

(500)

40,000

(8,000)

1,488,350

Page 9 of 13

Financial Accounting Professional Stage March 2010

The majority of candidate answers to this question were very good. Most notably candidates coped far

better with the provision for unrealised profit on sales made by the parent to the associate than they have

at previous sittings. Where errors were made in respect of the provision for unrealised profit it was by

deducting the full amount of the unrealised earnings from retained earnings and investment in associate

rather than the parents share. A significant minority of candidates made the adjustment to consolidated

inventory instead of to the investment in associate.

Presentation was very good, although candidates still seem to not complete statements in some way,

most typically by not showing the sub total before the non-controlling interest line and therefore they

inevitably lose marks.

Workings were generally well laid out, although the property, plant and equipment workings were often

squashed on the face of the statement of financial position which made it quite difficult to read. This was

compounded by the fact that these scripts were scanned for electronic marking and therefore squashed

workings became even harder to read. Candidates should be made aware of this, to try and avoid such an

approach in the future.

The majority of candidates made a good attempt at the net assets working. However, a number of

common errors were made in this area including not deducting the goodwill recognised by the subsidiary,

instead candidates included this as part of consolidated intangible assets, and forgetting that the fair value

uplift on the equipment meant that additional depreciation needed to be calculated. For candidates that

did appreciate that additional depreciation should be recognised they often missed that it was only four

months worth, rather than a full year. Another common error was not including the subsidiarys share

premium in the net assets working but instead showing it on the face of the consolidated statement of

financial position.

One surprising error was that whilst almost all candidates correctly calculated the percentages of the

subsidiary and the associate held by the parent, a significant minority of candidates subsequently mixed

up the associate percentage (25%) with the non-controlling interest percentage (30%).

Other common errors included correctly adding the 40,000 due on the new machine to consolidated

property, plant and equipment but either showing the corresponding liability as current or not showing a

corresponding liability at all, or simply adding 80,000 to property, plant and equipment rather than only

40,000.

A worrying few consolidated either only four-twelfths or 70% of the subsidiarys assets and liabilities.

Total possible marks

Maximum full marks

The Institute of Chartered Accountants in England and Wales 2010

22

22

Page 10 of 13

Financial Accounting Professional Stage March 2010

Question 4

Overall marks for this question can be analysed as follows:

Total: 21

General comments

The first part of this question is a single topic question focusing on non-current assets, including aspects on

leasing. Candidates were required to prepare a finance lease calculation, assess a research and development

project and also carry out an impairment review. Parts b) and c) covered concepts issues, with a discussion on

substance over form and how the four qualitative characteristics related to lease transactions.

Blantyre Ltd

(a) Summary of costs included in income statement for the year ended 31 December 2009

Administrative expenses:

Depreciation (85,000 / 5yrs)

17,000

Amortisation (192,000 / 4yrs x 6/12 months)

24,000

Impairment of know-how (W3)

11,000

Research costs

70,000

Promotional advertising costs

15,000

Staff training costs

13,000

Finance costs (W1)

6,400

Statement of financial position as at 31 December 2009 (extracts)

Non-current assets

Property, plant and equipment (85,000 17,000)

Intangible assets (120,000 15,000 + 157,000)

68,000

262,000

Non-current liabilities

Finance lease liabilities (W1)

43,200

Current liabilities

Finance lease liabilities (62,400 43,200) (W1)

19,200

(1) Finance lease

Deposit

Instalments (4 x 24,000)

Fair value of asset

Finance charges

5,000

96,000

(85,000)

16,000

SOTD = (4 x 5) 2 = 10

B/fwd (85,000 5,000) = 80,000

Year ended

31 December 2009

31 December 2010

B/f

80,000

62,400

Interest

(16,000 x 4/10) 6,400

(16,000 x 3/10) 4,800

Payment

(24,000)

(24,000)

C/f

62,400

43,200

(2) Technical Know-how

Original cost

Legal costs

Manufacturing supervisors time

Testing costs

(3) Impairment

Carrying amount at 31 Dec 2009 (192,000 24,000)

Recoverable amount

Impairment

The Institute of Chartered Accountants in England and Wales 2010

180,000

4,000

3,200

4,800

192,000

168,000

(157,000)

11,000

Page 11 of 13

Financial Accounting Professional Stage March 2010

In part (a) most candidates picked up a considerable number of marks for correct calculations, however many

lost marks for their statement of financial position extracts, as these were not properly presented.

The majority of candidates made a good attempt at the leasing table. The most common error was to not

deduct the deposit of 5,000 paid upfront. Candidates however often made a mistake in allocating the lease

liability between current and non-current, with a significant minority of candidates allocating the full 24,000

payment as current thereby not understanding that it should only be the capital element of this.

Common errors included calculating an incorrect sum-of-digits figure, taking the fair value of 152,000 as the

recoverable amount of the technical know-how rather than the estimated future cash flows of 157,000, not

excluding 13,000 staff training costs from the amount originally recognised for the technical know-how and

failing to compare the amortised carrying amount of the technical know-how to the recoverable amount.

Total possible marks

Maximum full marks

13

13

(b)

Substance over form is an accounting concept that should be applied to all accounting areas in accordance

with the IASB Framework. Leasing is an example of the application of this concept.

To recognise the substance of a transaction, its economic reality should be reflected rather than merely its

legal form.

IAS 17, Leases looks at the economic reality of a lease through the assessment of which party carries the risks

and rewards of ownership, rather than looking at legal ownership. If the effect of the lease transaction is such

that in commercial effect it is similar to borrowing the money and buying the asset outright, both IAS 17 and the

IASB Framework require the asset and in effect a related loan to be recognised.

Conversely, if the risks and rewards of ownership remain with the lessor, as they do in an operating lease, then

in effect the substance of the transaction is the same as its legal form and no asset or corresponding liability

should be recognised.

Answers to part (b) were adequate, with most candidates quoting a reasonable definition of substance over

form, recognising that the way finance leases are accounted for is an example of this concept and discussing

the transfer of risks and rewards. However, most candidates focused on the recognition of the asset with no

mention of a corresponding liability. Whilst some candidates discussed the fact that assets held under

operating leases are not capitalised because the risks and rewards are not transferred, it was rare to see the

point that for operating leases substance is the same as legal form.

Total possible marks

Maximum full marks

4

3

(c)

Qualitative characteristics and IAS 17.

Relevance

Information is relevant if it can influence the economic decisions of users. By showing the true substance of a

finance lease, a company is made to show the debt that it has in its financial statements. This may influence

potential lenders in the future. The commitments note in relation to operating leases and the liability note in

relation to finance leases will also provide potential lenders essential information on what the companys

commitments and obligations already are.

Reliability

Information is reliable if it is free from error or bias, complete and portrays events in a way that reflects their

reality.

The Institute of Chartered Accountants in England and Wales 2010

Page 12 of 13

Financial Accounting Professional Stage March 2010

To be reliable information must faithfully represent a transaction. IAS 17 does this by following the overriding

criteria of substance over form.

Comparability

Users must be able to compare information with that of previous periods or with that of another entity.

Comparability is achieved through consistency and disclosure.

IAS 17 does require some subjectivity when a company assesses the risks and rewards of ownership.

However, detailed disclosure requirements, including setting out the companys accounting policies will help

with comparability.

In addition, IAS 17 ensures that financial statements are comparable between a company that has taken out a

loan to acquire an asset or one that has entered into a finance lease.

Understandability

Information must be readily understandable to users so that they can perceive its significance. It is dependent

on how information is presented.

There may be some confusion in looking at the non-current assets owned by a company, as these will include

those assets that are held under finance leases. However, the accounting policies will explain this and it is

assumed that users have a reasonable level of knowledge.

Answers to part (c) were often poor. Most marks were scored from brief general points about the four

qualitative characteristics. Reliability was probably the characteristic that was dealt with the best although

some candidates strayed into IAS 16 and discussed whether it was more reliable to record an asset at its

historic cost or its fair value. Points were often repeated and often placed under the wrong characteristic. With

regards to understandability, many cited very complex notes as an example of the application of this concept.

Total possible marks

Maximum full marks

The Institute of Chartered Accountants in England and Wales 2010

8

5

Page 13 of 13

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ACCA F2 Management Accounting Sales VariancesDocument12 pagesACCA F2 Management Accounting Sales VariancesLiam Bourke50% (2)

- File SPI TambahanDocument76 pagesFile SPI Tambahansyarifah SPNo ratings yet

- Corporate Governance in Bangladesh: Challenges and OpportunitiesDocument10 pagesCorporate Governance in Bangladesh: Challenges and OpportunitiesOnek KothaNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument39 pagesFinancial Statement Analysis: K R Subramanyam John J WildGilang W Indrasta0% (1)

- Fs ZZZZZDocument1 pageFs ZZZZZkarlr9No ratings yet

- FSZZDocument1 pageFSZZkarlr9No ratings yet

- FSZZZZDocument1 pageFSZZZZkarlr9No ratings yet

- FDocument1 pageFkarlr9No ratings yet

- FsDocument1 pageFskarlr9No ratings yet

- FSZZZDocument1 pageFSZZZkarlr9No ratings yet

- FSZDocument1 pageFSZkarlr9No ratings yet

- Waazvc ZsaassDocument1 pageWaazvc Zsaasskarlr9No ratings yet

- WaazvDocument1 pageWaazvkarlr9No ratings yet

- Waazvc ZsaaDocument1 pageWaazvc Zsaakarlr9No ratings yet

- FDocument1 pageFkarlr9No ratings yet

- WaazvcDocument1 pageWaazvckarlr9No ratings yet

- Waazvc ZsaDocument1 pageWaazvc Zsakarlr9No ratings yet

- Waazvc ZsaasDocument1 pageWaazvc Zsaaskarlr9No ratings yet

- Waazvc ZsDocument1 pageWaazvc Zskarlr9No ratings yet

- ZCXXDDocument1 pageZCXXDkarlr9No ratings yet

- Waazvc ZDocument1 pageWaazvc Zkarlr9No ratings yet

- WaazDocument1 pageWaazkarlr9No ratings yet

- Fra Tutorial 4 Capital StructureDocument4 pagesFra Tutorial 4 Capital Structurekarlr9No ratings yet

- WaaDocument1 pageWaakarlr9No ratings yet

- WaaDocument1 pageWaakarlr9No ratings yet

- SsazczxDocument1 pageSsazczxkarlr9No ratings yet

- ZCDocument1 pageZCkarlr9No ratings yet

- WDocument1 pageWkarlr9No ratings yet

- ZCXXDocument1 pageZCXXkarlr9No ratings yet

- ZCXDocument1 pageZCXkarlr9No ratings yet

- ZDocument1 pageZkarlr9No ratings yet

- SsazczDocument1 pageSsazczkarlr9No ratings yet

- SsazczxzDocument1 pageSsazczxzkarlr9No ratings yet

- SsazcDocument1 pageSsazckarlr9No ratings yet

- RICS ARC CompetencyDocument2 pagesRICS ARC CompetencySujithNo ratings yet

- Cost AccountingDocument26 pagesCost AccountingHussnain AliNo ratings yet

- Topic 1 - Audit - An OverviewDocument22 pagesTopic 1 - Audit - An OverviewPara Sa PictureNo ratings yet

- Student Of: "Financial Ratio Analysis of Mangalore Refinery and Petrochemicals LTD (MRPL)Document6 pagesStudent Of: "Financial Ratio Analysis of Mangalore Refinery and Petrochemicals LTD (MRPL)Khalid SayedNo ratings yet

- BDO Unibank Vol2 2014Document184 pagesBDO Unibank Vol2 2014Dark ShadowNo ratings yet

- S4HANA2022 Availability Dependencies en XXDocument76 pagesS4HANA2022 Availability Dependencies en XXKiran JadhavNo ratings yet

- Legazpi - Room Assignments: October 2013 Certified Public Accountants (CPA) Board ExaminationDocument5 pagesLegazpi - Room Assignments: October 2013 Certified Public Accountants (CPA) Board ExaminationScoopBoyNo ratings yet

- Amazon Spain Approves 2019 AccountsDocument78 pagesAmazon Spain Approves 2019 AccountsLaura Gomez SánchezNo ratings yet

- Class 12 Solution AccountDocument45 pagesClass 12 Solution AccountChandan ChaudharyNo ratings yet

- MS Session - 1&2 AFMDocument50 pagesMS Session - 1&2 AFMMubashir AhmedNo ratings yet

- The Accounting CycleDocument98 pagesThe Accounting CycleEhsan Sarparah100% (2)

- Guidance on Auditing Fixed AssetsDocument8 pagesGuidance on Auditing Fixed Assetsmandarab76No ratings yet

- House Hearing, 112TH Congress - Accounting and Auditing Oversight: Pending Proposals and Emerging Issues Confronting Regulators, Standard Setters, and The EconomyDocument354 pagesHouse Hearing, 112TH Congress - Accounting and Auditing Oversight: Pending Proposals and Emerging Issues Confronting Regulators, Standard Setters, and The EconomyScribd Government DocsNo ratings yet

- Quiz On Introduction To AccountingDocument3 pagesQuiz On Introduction To AccountingCeejay MancillaNo ratings yet

- Si - 1Document1 pageSi - 1Kuro YukiNo ratings yet

- BAB 3 Job Order Costing - Cost Flows and External ReportingDocument48 pagesBAB 3 Job Order Costing - Cost Flows and External ReportingNurainin AnsarNo ratings yet

- Ratio Analysis of Orion Pharmaceuticals LimitedDocument64 pagesRatio Analysis of Orion Pharmaceuticals Limitedrifat67% (3)

- Bangladesh Bank CercularDocument13 pagesBangladesh Bank Cercularfarhanakhyer76No ratings yet

- 18 Audit and Auditors 1657952321Document102 pages18 Audit and Auditors 1657952321Jayesh MPNo ratings yet

- Government Auditing Lesson 1 1Document8 pagesGovernment Auditing Lesson 1 1Aubrey Jean ZantuaNo ratings yet

- Aafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiDocument35 pagesAafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiMuhammad Sohaib AzharNo ratings yet

- Alison Krauss CompanyDocument3 pagesAlison Krauss Companymagdy kamelNo ratings yet

- FAC1502 Study Unit 6 2021Document22 pagesFAC1502 Study Unit 6 2021edsonNo ratings yet

- FY 2008 SMGR Semen+Indonesia (Persero) TBKDocument89 pagesFY 2008 SMGR Semen+Indonesia (Persero) TBKRiki Ariyadi 2002110906No ratings yet

- Basic Cost AccountingDocument322 pagesBasic Cost Accountingmartin16046450% (2)

- KanchanDocument84 pagesKanchanJyoti KumariNo ratings yet