Professional Documents

Culture Documents

Course Title: Cost Accounting Course Code: ACCT206 Credit Units: 3 Course Level: UG

Uploaded by

Uday Narain AgarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Course Title: Cost Accounting Course Code: ACCT206 Credit Units: 3 Course Level: UG

Uploaded by

Uday Narain AgarwalCopyright:

Available Formats

Course Title: Cost Accounting

Course Code: ACCT206

Credit Units: 3

Course Level: UG

P/S

SW/F

W

TOTAL

CREDIT

UNITS

3

Course Objectives: The objective of the course is to enable students to acquire sound Knowledge of concepts, methods and techniques of allocation and

control of various costs. To teach them different methods of costing and to make the students develop competence with their usage in managerial decision

making and control.

Pre-requisites: Basic Knowledge of Financial Accounting.

Course Contents/Syllabus:

Weightage (%)

Module - Introduction

Descriptors/Topics

Descriptors/Topics Meaning of Cost, Costing and Cost Accounting , Objectives & limitations of cost

accounting, Elements of Cost, components of costs, classification of costs, items specifically excluded from cost

accounting, Cost ascertainment- Cost object cost unit-Cost Center vs profit centre, Designing and installing a

Cost Accounting system Methods, techniques and systems of costing. Preparation of cost sheet Tenders and

Quotations..

15

Module II - Material Costing

Descriptors/Topics Books of Accounts leading to the Classification of materials Material Control techniques of

Inventory control Setting of stock levels EOQ, Inventory systems-Periodic and perpetual-Continuous stock taking,

Valuation of materials- Incoming materials and outgoing materials-Specific price method FIFO LIFO Simple

15

Average Method Weighted Average Method- (including materials returned to stores).

Module III Labour Cost

15

Descriptors/Topics Direct and Indirect labour, Control of labour cost by different departments( Including Meaning of

Time and Motion Study, Merit Rating, Job Analysis, Time keeping and Time booking), treatment of holiday pay- Idle

time- overtime and night shift allowance-causes and treatments, Methods of Wage Payment, Time rate and Piece Rate

Incentive Schemes Halsey Premium Plan, Halsey weir Premium Plan Rowan Bonus Plan Taylors and Merricks

differential piece rate systems..

Module IV Overheads

Descriptors/Topics Classification of overheads Procedure for accounting and control of overheads, Overhead

distribution stages Allocation of overheads Appointment of overheads Apportionment of Service department costs

to production departments Repeated Distribution method Simultaneous equation method, absorption of Overheads

Methods of Absorption Percentage of direct material cost Direct Labour Cost, Direct Labour hour rate and

Machine Hour Rate.

15

Module V Costing Methods

Descriptors/Topics Introduction - Job Costing Batch Costing Contract Costing, Process Costing principles

distinction between Process and Job Preparation of process accounts treatment of normal loss abnormal loss

abnormal gain Joint and By-products

20

Module VI Marginal Costing

meaning, advantages, marginal costing and absorption costing; Cost-Profit-Volume Analysis: break even point, margin

of safety, P/V Ratio, concept of key factor;break-even chart and its types;Decision making: costs for decision making,

variable costing and differential analysis as aids in making decisions fixation of selling price, exploring new market,

make or buy, product mix, operate or shut down, sell or process further decisions etc. Introduction to Standard

costing and Budgetary control

20

Student Learning Outcomes:

(a)After Completion of this course the student will be able to understand the basic concepts and processes used to determine product costs;

(b) Student will be able to interpret cost accounting statements;

(c) He will be able to analyse and evaluate information for cost ascertainment, planning, control and cost decision making.

Assessment/ Examination Scheme:

Theory L/T (%)

Lab/Practical/Studio (%)

End Term Examination

100

N.A

70

Theory Assessment (L&T):

Continuous Assessment/Internal Assessment

End Term Examination

Components (Drop down)

CT

Case Discussion

HA

Weightage (%)

10

10

Text Reading: Text: M.L. Agarwal: Cost Accounting

Jain & Narang: Cost Accounting

S.N. Maheshwari: Cost Accounting

M. N. Arora: Cost Accounting

70

You might also like

- Cost Accounting & Financial Management Vol. IDocument640 pagesCost Accounting & Financial Management Vol. Iseektheraj100% (6)

- CFA Level 1 Corporate Finance E Book - Part 2Document31 pagesCFA Level 1 Corporate Finance E Book - Part 2Zacharia VincentNo ratings yet

- Economics 100 Quiz 1Document15 pagesEconomics 100 Quiz 1Ayaz AliNo ratings yet

- Joel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationDocument28 pagesJoel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationSun ZhishengNo ratings yet

- Screen Proposed Solutions Based on Viability, Profitability and Customer NeedsDocument15 pagesScreen Proposed Solutions Based on Viability, Profitability and Customer Needsjeryline100% (1)

- Management AccountingDocument304 pagesManagement AccountingRomi Anton100% (2)

- Management Accounting (MBA)Document5 pagesManagement Accounting (MBA)Razzaqeee100% (1)

- Case Study On Delhivery. FinalDocument8 pagesCase Study On Delhivery. FinaldsgrNo ratings yet

- ASPD 2 Scrapped FinalDocument115 pagesASPD 2 Scrapped FinaliqraNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument148 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (3)

- SLM-BBA4 B06 - Cost and Management AccountingDocument154 pagesSLM-BBA4 B06 - Cost and Management Accountingjames17stevensNo ratings yet

- Objectives:: Semester Cost and Management AccountingDocument87 pagesObjectives:: Semester Cost and Management AccountingJon MemeNo ratings yet

- Management AccountingDocument320 pagesManagement AccountingAnandha Raj Munnusamy100% (1)

- Hotel Discount GridDocument85 pagesHotel Discount Gridmanishpandey1972No ratings yet

- STP of HPDocument4 pagesSTP of HPRitika80% (5)

- Cost and Management Accounting PDFDocument2 pagesCost and Management Accounting PDFRajat Goyal80% (5)

- Management AccountingDocument306 pagesManagement Accountinggordonomond2022100% (2)

- Cost Accounting and Financial ManagementDocument921 pagesCost Accounting and Financial Managementmalikkamran06552989% (18)

- 25 Cost AccountingDocument148 pages25 Cost AccountingTejo Jose100% (1)

- Mba-Iii-Cost Management NotesDocument113 pagesMba-Iii-Cost Management NotesPrasanna KumarNo ratings yet

- The Official Supply Chain Dictionary: 8000 Researched Definitions for Industry Best-Practice GloballyFrom EverandThe Official Supply Chain Dictionary: 8000 Researched Definitions for Industry Best-Practice GloballyRating: 4 out of 5 stars4/5 (4)

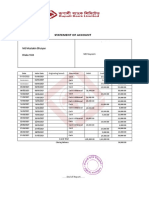

- Rupali Bank StatementDocument1 pageRupali Bank StatementMd YousufNo ratings yet

- Original Fairfield by MarriottDocument33 pagesOriginal Fairfield by MarriottUday Narain AgarwalNo ratings yet

- Format For Course CurriculumDocument2 pagesFormat For Course CurriculumNancygirdherNo ratings yet

- Core BBADocument195 pagesCore BBAMohammed MubeenNo ratings yet

- Cost and Capital Accounting For Decision MakingDocument2 pagesCost and Capital Accounting For Decision MakingRishi CharanNo ratings yet

- Cost Accountin Couse Out LineDocument6 pagesCost Accountin Couse Out Linem_waseem_bariNo ratings yet

- UNit Costing Study MaterialDocument42 pagesUNit Costing Study MaterialChetana SoniNo ratings yet

- Stage-3 S-303 - Cost and Management Accounting - Performance AppraisalDocument3 pagesStage-3 S-303 - Cost and Management Accounting - Performance AppraisalRehan RazaNo ratings yet

- Core Course XII 19UCO542: COST ACCOUNTINGDocument2 pagesCore Course XII 19UCO542: COST ACCOUNTINGcatherineNo ratings yet

- Cost Accounting 1 BBA 2020 ManualDocument122 pagesCost Accounting 1 BBA 2020 ManualSangulukani ChirwaNo ratings yet

- Management and Financial AccountingDocument5 pagesManagement and Financial AccountingSriya HalderNo ratings yet

- (BBA) Managerial Accounting GCUFDocument5 pages(BBA) Managerial Accounting GCUFnadirNo ratings yet

- Mba III Cost Management NotesDocument113 pagesMba III Cost Management NotesRavi Gupta67% (3)

- Cost Accountin Couse Out LineDocument3 pagesCost Accountin Couse Out Linem_waseem_bariNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument174 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (1)

- 1 Basics of CMA (2)Document39 pages1 Basics of CMA (2)khushi shahNo ratings yet

- Risk-Based Audit Course Covers Revenue, Cash, Receivables, InventoriesDocument1 pageRisk-Based Audit Course Covers Revenue, Cash, Receivables, InventoriesKristine Lirose BordeosNo ratings yet

- Cost 1Document21 pagesCost 1Victor VargheseNo ratings yet

- Syllbus of Cost Accounting - SemDocument10 pagesSyllbus of Cost Accounting - SemDarshit BhovarNo ratings yet

- Cost Accounting - UNIT 1 - MidDocument60 pagesCost Accounting - UNIT 1 - MidPrathamesh DivekarNo ratings yet

- Cost Accounting BookDocument148 pagesCost Accounting BookSharma Vishnu100% (2)

- COST MANAGEMENT TOOLS FOR STRATEGIC DECISIONSDocument106 pagesCOST MANAGEMENT TOOLS FOR STRATEGIC DECISIONSPrasannakumar SNo ratings yet

- Costing An Overview of Cost and Management Accounting 1 PDFDocument6 pagesCosting An Overview of Cost and Management Accounting 1 PDFkeerthi100% (2)

- Cost and Management AccountingDocument3 pagesCost and Management AccountingKendra LeslyNo ratings yet

- Sdoc 04 21 SiDocument37 pagesSdoc 04 21 Siramagowda416No ratings yet

- Introduction To Cost AccountingDocument27 pagesIntroduction To Cost Accountingnaman jainNo ratings yet

- Addie modelDocument5 pagesAddie modelsiaurustraumenNo ratings yet

- Management Control System CourseDocument3 pagesManagement Control System CourseKartikeyBhardwajNo ratings yet

- Management Accounting - Costing and Budgeting (Edexcel)Document21 pagesManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- Cost AccountingDocument20 pagesCost AccountingGargi MPNo ratings yet

- UG - B.Com - Commerce (English) - 102 53 - Cost Accounting - B.Com. - 5th Sem (Binder) - 6306Document288 pagesUG - B.Com - Commerce (English) - 102 53 - Cost Accounting - B.Com. - 5th Sem (Binder) - 6306RajanNo ratings yet

- Cost Accounting IIDocument62 pagesCost Accounting IIShakti S SarvadeNo ratings yet

- 25 Cost AccountingDocument148 pages25 Cost AccountingAbhirup RudraNo ratings yet

- Shafiulhaq Kaoon's Assignment of Cost Accounting PDFDocument9 pagesShafiulhaq Kaoon's Assignment of Cost Accounting PDFShafiulhaq Kaoon QuraishiNo ratings yet

- Unit - 2 - Cost AccountingDocument77 pagesUnit - 2 - Cost AccountingTapan RanaNo ratings yet

- Emphasis (14 Ed.) - New Delhi, India: Pearson. Ed.) .: Recommended BooksDocument1 pageEmphasis (14 Ed.) - New Delhi, India: Pearson. Ed.) .: Recommended BooksShaluRajtaNo ratings yet

- P2 Performance ManagementDocument3 pagesP2 Performance ManagementShane AndrewNo ratings yet

- ACCOUNTS & COSTINGDocument6 pagesACCOUNTS & COSTINGAshishchoubeyNo ratings yet

- Mbcii 5 Cost Accounting 2019Document115 pagesMbcii 5 Cost Accounting 2019Kanchan Mishra100% (1)

- Tt6602 Financial Management For Textile and Apparel L T P CDocument5 pagesTt6602 Financial Management For Textile and Apparel L T P CAnonymous GohKUCxhDNo ratings yet

- BBA 3rd Semester Syllabus 2023Document17 pagesBBA 3rd Semester Syllabus 2023chaurasiya6369No ratings yet

- Management Accounting Notes1Document170 pagesManagement Accounting Notes1Anish Gambhir100% (1)

- Commercial ManagementDocument4 pagesCommercial ManagementKendra LeslyNo ratings yet

- Cost AccountingDocument52 pagesCost Accountingd. CNo ratings yet

- Budget Preparation TechniquesDocument2 pagesBudget Preparation TechniquesPrathapa Naveen KumarNo ratings yet

- Minimum Wages Act of 1948 ExplainedDocument15 pagesMinimum Wages Act of 1948 ExplainedKomal Sharma100% (1)

- Faculty Certificate: Brand Availability" of Coca Cola Submitted by EnrollmentDocument1 pageFaculty Certificate: Brand Availability" of Coca Cola Submitted by EnrollmentUday Narain AgarwalNo ratings yet

- NTCC Planning Summer Internship 2017-18Document2 pagesNTCC Planning Summer Internship 2017-18Uday Narain AgarwalNo ratings yet

- Name of The Institute: Amity University, Up Weekly Progress ReportDocument2 pagesName of The Institute: Amity University, Up Weekly Progress ReportUday Narain AgarwalNo ratings yet

- 98ab4the Perfect SundialDocument1 page98ab4the Perfect SundialUday Narain AgarwalNo ratings yet

- 1242201541755583Document5 pages1242201541755583Uday Narain AgarwalNo ratings yet

- Hyundai H.R. PoliciesDocument11 pagesHyundai H.R. PoliciesUday Narain Agarwal50% (4)

- Income Tax Law Practice1 RBDocument11 pagesIncome Tax Law Practice1 RBUday Narain AgarwalNo ratings yet

- TVM Formulas (I, N)Document2 pagesTVM Formulas (I, N)basco23No ratings yet

- Bcci Annual ReportDocument123 pagesBcci Annual ReportUday Narain AgarwalNo ratings yet

- Assumptions in Microeconomic Theory: Microeconomics TheoriesDocument4 pagesAssumptions in Microeconomic Theory: Microeconomics Theoriestupe salcedoNo ratings yet

- SOBHA DEVELOPERS LTD Investor PresentationDocument29 pagesSOBHA DEVELOPERS LTD Investor PresentationSobha Developers Ltd.No ratings yet

- EatlahDocument33 pagesEatlahSo Helti IndonesiaNo ratings yet

- Resume Randi Maulana Barkah q4 2021Document2 pagesResume Randi Maulana Barkah q4 2021Randi Maulana BarkahNo ratings yet

- Infomercial ProjectDocument6 pagesInfomercial ProjectMichele McNickleNo ratings yet

- Loan 0 SignnnnDocument24 pagesLoan 0 SignnnnBertha SamponuNo ratings yet

- Basic Concepts in AuditingDocument29 pagesBasic Concepts in Auditinganon_672065362100% (1)

- Table - 23-7: Schedule 1g: Ending Inventories Budget, First Quarter, 20XXDocument4 pagesTable - 23-7: Schedule 1g: Ending Inventories Budget, First Quarter, 20XXeahpotNo ratings yet

- Aditya Birla Fashion & Retail-Analyst Meet Transcript 16th Sep 2015Document28 pagesAditya Birla Fashion & Retail-Analyst Meet Transcript 16th Sep 2015Ankur MittalNo ratings yet

- Factors of ProductionDocument31 pagesFactors of Productionpriya19990No ratings yet

- Argos Case Study by Dr. Zayar NaingDocument2 pagesArgos Case Study by Dr. Zayar Naingzayarnmb_66334156No ratings yet

- Proposed Chart of Accounts-8Document62 pagesProposed Chart of Accounts-8Zimbo Kigo100% (1)

- Big City Optical To Open 2 New Stores in Chicago Lakeview NeighborhoodDocument2 pagesBig City Optical To Open 2 New Stores in Chicago Lakeview NeighborhoodPR.comNo ratings yet

- Module: Competing in The Network EconomyDocument32 pagesModule: Competing in The Network EconomyKirti KiranNo ratings yet

- Perhitungan Bab 4 ChopraDocument5 pagesPerhitungan Bab 4 ChoprarobbyNo ratings yet

- Valuation Area Material Number Valuation Type Valuation Class Moving Average Price 3100 B113010028 7920 24.59 3100 B113010034 7920 23.80 48.39Document6 pagesValuation Area Material Number Valuation Type Valuation Class Moving Average Price 3100 B113010028 7920 24.59 3100 B113010034 7920 23.80 48.39radramanNo ratings yet

- Distribution Management ReviewerDocument11 pagesDistribution Management ReviewerSALEM, JUSTINE WINSTON DS.No ratings yet

- Strategic ManagementDocument17 pagesStrategic ManagementZaib NawazNo ratings yet

- Introduction To Business Plan PreparationDocument4 pagesIntroduction To Business Plan Preparationvernadell2109No ratings yet

- Market Integration g2Document59 pagesMarket Integration g2Roque RedNo ratings yet

- Kort Notes ISA'sDocument49 pagesKort Notes ISA'skateNo ratings yet