Professional Documents

Culture Documents

CIR v. Kudos Metal Corporation

Uploaded by

Aldrin TangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR v. Kudos Metal Corporation

Uploaded by

Aldrin TangCopyright:

Available Formats

CIR v.

Kudos Metal Corporation,

G.R. No. 178087 dated May 5, 2010

DOCTRINE:

Valid Waiver Requires Strict Compliance With Procedures Prescribed In

Revenue Memorandum Order No. (RMO) 20-90 And Revenue Delegation

Authority Order No. (RDAO) 05-01

9. CTA En Banc: Agreed to 2 &3

ISSUE:

The CTA en banc erred in ruling that the governments right to assess unpaid taxes

of respondent prescribed

HELD:

The petition is bereft of merit.

FACTS:

1. Respondent Kudos Metal Corporation filed its Annual Income Tax Return

(ITR) for the taxable year 1998.

2. Pursuant to a Letter of Authority (Sept 7 1999), the BIR served upon

kudos Notices of Presentation of Records. Kudos failed to comply

with such. Hence. The BIR ossued a Subpoena Duces Tecum (Sept

21, 2006).

3. A review and audit of respondents records then ensued.

4. Dec 10 2001, the accountant of Kudos executed a Waiver of Defense

of Prescription which was followed by another Waiver of Defense of

Prescription on Feb 18 2003.

5. On Aug 25 2003, BIR issued a Prelim Assessment Notice for the

taxable year of 1998. This was followed by a Formal Letter of

Demand with Assessment Notice.

6. Respondent then challenged the assessments by filing its Protest

(Dec 3 2003)and its Legal Arguments and Documents in support of

protests against the assessments (Feb 2 2004)

7. BIR requested the immediate payment of the tax liabilities

Kind of Tax Amount

Income Tax P 9,693,897.85

VAT 13,962,460.90

EWT 1,712,336.76

Withholding Tax-Compensation 247,353.24

Penalties 8,000.00

Total P25,624,048.76

8. CTA: Right to assess has PRESCRIBED.

Issues on 1st waiver:

1. Assistant Commissioner is NOT THE REVENUE

OFFICIAL AUTHORIZED TO SIGN THE WAIVER, since

the tax case involved more than P1M.

2. Waiver failed to indicate the date of acceptance.

3. The fact of receipt by the taxpayer of his file copy was

not indicated on the original copy

The waivers executed by respondents accountant did not extend the period

within which the assessment can be made

Sec 203 NIRC: mandates the government to assess internal revenue

taxes within 4 years from the last day prescribed by law for the filing

of the tax return or the actual date of filing of such return, whichever

comes later.

Hence, an assessment notice issued after the three-year prescriptive

period is no longer valid and effective. Exceptions however are provided

under Sec 222 of the NIRC.

EXCEPTION: (Sec 22 NIRC) The period to assess and collect taxes

may only be extended upon a written agreement between the CIR

and the Taxpayer executed before the expiration of the 3-year period.

RMP20-90 issued on April 4, 1991 and RDAO 05-01 issued on Aug 2

2001 laydown the procedure for the proper execution of waiver.

1. The waiver must be in the proper form prescribed by

RMO 20-90. The phrase but not after ______ 19 ___,

which indicates the expiry date of the period agreed

upon to assess/collect the tax after the regular threeyear period of prescription, should be filled up.

2. The waiver must be signed by the taxpayer himself or

his duly authorized representative. In the case of a

corporation, the waiver must be signed by any of its

responsible officials. In case the authority is delegated

by the taxpayer to a representative, such delegation

should be in writing and duly notarized.

3. The waiver should be duly notarized.

4. The CIR or the revenue official authorized by him must

sign the waiver indicating that the BIR has accepted

and agreed to the waiver. The date of such

acceptance by the BIR should be indicated. However,

before signing the waiver, the CIR or the revenue official

authorized by him must make sure that the waiver is in

the prescribed form, duly notarized, and executed by the

taxpayer or his duly authorized representative.

5. Both the date of execution by the taxpayer and date of

acceptance by the Bureau should be before the

expiration of the period of prescription or before the

lapse of the period agreed upon in case a subsequent

agreement is executed.

6. The waiver must be executed in three copies, the

original copy to be attached to the docket of the case,

the second copy for the taxpayer and the third copy for

the Office accepting the waiver. The fact of receipt by the

taxpayer of his/her file copy must be indicated in the

original copy to show that the taxpayer was notified of

the acceptance of the BIR and the perfection of the

agreement.[19]

INFIRMITIES OF THE FIRST WAIVER:

1. Executed without the notarized written authority of Pasco to sign the

waiver in behalf of the respondent

2. The waivers failed to indicate the date of acceptance

3. The fact of receipt by the respondent of its file copy was not indicated

in the original copies of the waivers.

Due to the defects in the waivers, the period to assess or collect taxes was

not extended. Consequently, the assessments were issued by the BIR

beyond the three-year period and are void.

ESTOPPEL DOES NOT APPLY.

In the case of CIR v. Suyoc Consolidated Mining Company, estoppel was

applied AS AN EXCEPTION TO THE STATUTE OF LIMITATIONS on

collection of taxes and not on the assessment of taxes. There was a finding

that the taxpayer made several requests or positive acts to convince the

government to postpone the collection of taxes.

In this case, the assessments were issued BEYOND the prescribed period.

There was also no showing that the respondent made any request to

persuade the BIR to postpone the issuance of the assessments.

BIR cannot hide behind the doctrine of estoppel to cover its failure to comply

with RMO 20-90 and RDAO 05-01, which the BIR itself issued.

BIR failed to verify whether a notarized written authority was given by

the respondent to its accountant, and to indicate the date of

acceptance and the receipt by the respondent of the waivers.

Having caused the defects in the waivers, BIR must bear the

consequences and thus cannot shift the blame to the taxpayer.

We find no merit in petitioners claim that respondent is now estopped from

claiming prescription since by executing the waivers, it was the one which

asked for additional time to submit the required documents.

A waiver of the Statute of Limitations, being a derogation of taxpayers right

to security against prolonged and unscrupulous investigations, must be

carefully and strictly construed.

You might also like

- CIR-vs-Kudos-Metal-CorpDocument1 pageCIR-vs-Kudos-Metal-CorpLizzy WayNo ratings yet

- CIR v. SOJ & PAGCOR: Final Withholding Tax on Fringe BenefitsDocument4 pagesCIR v. SOJ & PAGCOR: Final Withholding Tax on Fringe BenefitsIan Villafuerte100% (1)

- Sps. Tan V BanteguiDocument4 pagesSps. Tan V Banteguinazh100% (1)

- Jardeleza V. PeopleDocument4 pagesJardeleza V. PeopleGrace0% (2)

- 5 - CIR vs. Hon. Raul M. GonzalezDocument6 pages5 - CIR vs. Hon. Raul M. GonzalezJaye Querubin-FernandezNo ratings yet

- Digest TaxDocument3 pagesDigest TaxAimee MilleteNo ratings yet

- CIR Vs Perf RealtyDocument2 pagesCIR Vs Perf RealtyEnav LucuddaNo ratings yet

- No Formal Assessment, Criminal Complaints PrematureDocument2 pagesNo Formal Assessment, Criminal Complaints PrematureFrances Abigail BubanNo ratings yet

- Solway vs.Document1 pageSolway vs.Sherelyn Flores VillanuevaNo ratings yet

- Liquigaz Philippines Corporation v CIR Assessment ValidityDocument3 pagesLiquigaz Philippines Corporation v CIR Assessment ValidityCrmnmarieNo ratings yet

- CIR v. Pascor Realty and Development DigestDocument1 pageCIR v. Pascor Realty and Development DigestKristineSherikaChy100% (1)

- CIR vs. V.Y. Domingo JewellersDocument2 pagesCIR vs. V.Y. Domingo JewellersRob100% (2)

- PEZA VAT Refund for Export EnterprisesDocument1 pagePEZA VAT Refund for Export EnterprisesAbdulateef SahibuddinNo ratings yet

- Team Pacific Vs DazaDocument2 pagesTeam Pacific Vs Dazaroquesa burayNo ratings yet

- CTA Dismissal of P&G Refund Claim ReversedDocument148 pagesCTA Dismissal of P&G Refund Claim ReversedMa. Consorcia GoleaNo ratings yet

- Case On TaxationDocument2 pagesCase On TaxationRussel Sirot50% (2)

- Cir vs. Phil. Global DigestDocument2 pagesCir vs. Phil. Global DigestG OrtizoNo ratings yet

- Cite As: 86 Misc.2d 1010, 383 N.Y.S.2d 833Document3 pagesCite As: 86 Misc.2d 1010, 383 N.Y.S.2d 833jNo ratings yet

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- CIR Vs Transitions Optical PhilippinesDocument2 pagesCIR Vs Transitions Optical PhilippinesJuls Rxs100% (1)

- Belleza - San Roque Power Corp. vs. Cir G.R. No. 180345, Nov. 25, 2009Document4 pagesBelleza - San Roque Power Corp. vs. Cir G.R. No. 180345, Nov. 25, 2009Noel Christopher G. BellezaNo ratings yet

- Commissioner of Internal Revenue vs. Mcgeorge Food Industries, IncDocument1 pageCommissioner of Internal Revenue vs. Mcgeorge Food Industries, IncRaquel DoqueniaNo ratings yet

- Cir Vs Enron DigestDocument2 pagesCir Vs Enron Digestjanpaul12No ratings yet

- Sps. Pacquiao Vs CTA DigestDocument10 pagesSps. Pacquiao Vs CTA DigestCyrus67% (3)

- CIR V Liquigaz Philippines CorporationDocument3 pagesCIR V Liquigaz Philippines CorporationAya BaclaoNo ratings yet

- Ipl CaseDocument4 pagesIpl CasestephclloNo ratings yet

- Nanox Philippines, Inc., vs. CirDocument2 pagesNanox Philippines, Inc., vs. CirNestor Jr. FariolanNo ratings yet

- Forum non conveniens disputeDocument45 pagesForum non conveniens disputeShaiNo ratings yet

- BIR Access to Taxpayer Records UpheldDocument3 pagesBIR Access to Taxpayer Records UpheldCareenNo ratings yet

- Case Digest - Aquino Vs NLRCDocument2 pagesCase Digest - Aquino Vs NLRCZh Rm100% (1)

- Bir RR 12-99Document7 pagesBir RR 12-99Cha AgaderNo ratings yet

- SOJ has jurisdiction over tax disputes involving GOCCsDocument3 pagesSOJ has jurisdiction over tax disputes involving GOCCsJennilyn Gulfan YaseNo ratings yet

- Gibbs vs. CIR and CTA rules on prescription of tax claimsDocument2 pagesGibbs vs. CIR and CTA rules on prescription of tax claimsIrish Asilo PinedaNo ratings yet

- Rcpi VS Provincial AssessorDocument3 pagesRcpi VS Provincial AssessorKath LeenNo ratings yet

- Kepco Vs CIR Case DigestDocument2 pagesKepco Vs CIR Case DigestFrancisca Paredes100% (1)

- Samar-I Electric Cooperative v. CIRDocument2 pagesSamar-I Electric Cooperative v. CIRTzarlene Cambaliza100% (1)

- H. Tambunting vs. CirDocument2 pagesH. Tambunting vs. Cirbehttina820100% (1)

- Commissioner of Internal Revenue, v. United Cadiz Sugar Farmers Association Multi-Purpose CooperativeDocument10 pagesCommissioner of Internal Revenue, v. United Cadiz Sugar Farmers Association Multi-Purpose CooperativeKit FloresNo ratings yet

- Petron Corp v Mayor Tiangco - Local gov't cannot impose biz tax on petroleum salesDocument1 pagePetron Corp v Mayor Tiangco - Local gov't cannot impose biz tax on petroleum salesCates013No ratings yet

- CIR v. LANCASTERDocument2 pagesCIR v. LANCASTERBaymaxNo ratings yet

- Army & Navy vs. TrinidadDocument1 pageArmy & Navy vs. TrinidadJoesil Dianne SempronNo ratings yet

- PNB Tax Credit RulingDocument3 pagesPNB Tax Credit RulingAto TejaNo ratings yet

- CIR v. AquafreshDocument3 pagesCIR v. AquafreshAira Marie M. Andal100% (1)

- CIR vs Chevron Holdings Inc CTA Case on VAT RefundDocument1 pageCIR vs Chevron Holdings Inc CTA Case on VAT RefundKenette Diane CantubaNo ratings yet

- CIR V Univation MotorDocument3 pagesCIR V Univation MotoriptrinidadNo ratings yet

- Cir vs. Team Energy CorpDocument3 pagesCir vs. Team Energy CorpKathrinaDeCastroINo ratings yet

- Commissioner of Internal Revenue v. Covanta Energy Philippine Holdings, Inc. DigestDocument3 pagesCommissioner of Internal Revenue v. Covanta Energy Philippine Holdings, Inc. DigestCharmila Siplon100% (1)

- BPI vs. CIR Prescriptive Period for Deficiency Tax AssessmentDocument2 pagesBPI vs. CIR Prescriptive Period for Deficiency Tax AssessmentJP Murao IIINo ratings yet

- Philippine Journalists Tax Waiver InvalidDocument2 pagesPhilippine Journalists Tax Waiver InvalidRudejane TanNo ratings yet

- Tumang V LaguioDocument2 pagesTumang V LaguioKarez MartinNo ratings yet

- Rohm Apollo Semiconductor Phil. vs. CirDocument3 pagesRohm Apollo Semiconductor Phil. vs. CirAnonymous VWz7VUNo ratings yet

- Zalamea Vs Court of Appeals and Transworld AirlinesDocument2 pagesZalamea Vs Court of Appeals and Transworld AirlinesistefifayNo ratings yet

- City of Manila V Grecia-CuerdoDocument2 pagesCity of Manila V Grecia-CuerdoCarey AntipuestoNo ratings yet

- SASAN JR. Vs NLRC (Digest)Document1 pageSASAN JR. Vs NLRC (Digest)NOLLIE CALISING100% (1)

- CIR v. United Salvage and Towage Phils. Inc.Document6 pagesCIR v. United Salvage and Towage Phils. Inc.Mitch BarandonNo ratings yet

- Phil Journalist Vs CIR - Case DigestDocument2 pagesPhil Journalist Vs CIR - Case DigestKaren Mae Servan100% (1)

- CIR v. Kudos MetalDocument2 pagesCIR v. Kudos MetalZ FNo ratings yet

- Tax CaseDocument6 pagesTax CaseAlvy Faith Pel-eyNo ratings yet

- Commissioner of Internal Revenue Vs Kudos Metal Corporation Gr. No. 178087 May 5, 2010Document13 pagesCommissioner of Internal Revenue Vs Kudos Metal Corporation Gr. No. 178087 May 5, 2010nildin danaNo ratings yet

- CIR v. Kudos Metal Corporation, G.R. No. 178087 Dated May 5, 2010.Document2 pagesCIR v. Kudos Metal Corporation, G.R. No. 178087 Dated May 5, 2010.brendamanganaanNo ratings yet

- Prejudicial Question Suspends Estafa CaseDocument9 pagesPrejudicial Question Suspends Estafa CaseJohzzyluck R. Maghuyop0% (1)

- Capuno V Pepsi ColaDocument1 pageCapuno V Pepsi ColaAldrin TangNo ratings yet

- Provincial Sheriff of Pampanga vs. CADocument1 pageProvincial Sheriff of Pampanga vs. CAAldrin TangNo ratings yet

- Garcia v Bisaya: Action for Reformation of Deed Dismissed for Lack of Cause of ActionDocument1 pageGarcia v Bisaya: Action for Reformation of Deed Dismissed for Lack of Cause of ActionAldrin TangNo ratings yet

- O Written Agreement After Counteroffers and AAC's AppraisalDocument1 pageO Written Agreement After Counteroffers and AAC's AppraisalAldrin TangNo ratings yet

- Paredes v. Espino DigestDocument1 pageParedes v. Espino DigestAldrin TangNo ratings yet

- 2019 ICT Syllabus FInalDocument9 pages2019 ICT Syllabus FInalOli ReyesNo ratings yet

- Callanta v. Carnation Phils. DigestDocument2 pagesCallanta v. Carnation Phils. DigestAldrin TangNo ratings yet

- Multi Realty Dev't Corp V Makati Tuscanay CondoDocument2 pagesMulti Realty Dev't Corp V Makati Tuscanay CondoAldrin TangNo ratings yet

- Espanol v. ChairmanDocument1 pageEspanol v. ChairmanAldrin TangNo ratings yet

- Garcia v Bisaya: Action for Reformation of Deed Dismissed for Lack of Cause of ActionDocument1 pageGarcia v Bisaya: Action for Reformation of Deed Dismissed for Lack of Cause of ActionAldrin TangNo ratings yet

- Tanguilig v. CA DigestDocument1 pageTanguilig v. CA DigestAldrin TangNo ratings yet

- Shoemaker v. La TondenaDocument1 pageShoemaker v. La TondenaAldrin TangNo ratings yet

- Biala Vs CADocument1 pageBiala Vs CAAldrin TangNo ratings yet

- Mariano vs. COMELECDocument1 pageMariano vs. COMELECAldrin TangNo ratings yet

- BSB Group Vs Sally GoDocument2 pagesBSB Group Vs Sally GoAldrin TangNo ratings yet

- Limbona vs. Mangelin case examines jurisdiction over autonomous governmentsDocument1 pageLimbona vs. Mangelin case examines jurisdiction over autonomous governmentsAldrin TangNo ratings yet

- 03 FABRIGAS V DEL MONTE DigestDocument2 pages03 FABRIGAS V DEL MONTE DigestAldrin TangNo ratings yet

- Central Mindanao University Vs DARABDocument1 pageCentral Mindanao University Vs DARABAldrin TangNo ratings yet

- Ligot v. MathayDocument2 pagesLigot v. MathayAldrin TangNo ratings yet

- Definition of TermsDocument2 pagesDefinition of TermsAldrin TangNo ratings yet

- Osmena Vs PendatunDocument2 pagesOsmena Vs PendatunAldrin TangNo ratings yet

- Labao v. ComelecDocument3 pagesLabao v. ComelecAldrin TangNo ratings yet

- Verendia Vs CADocument1 pageVerendia Vs CAAldrin TangNo ratings yet

- UP vs. ReginoDocument1 pageUP vs. ReginoAldrin TangNo ratings yet

- 160 Pamatong Vs ComelecDocument2 pages160 Pamatong Vs ComelecJulius Geoffrey TangonanNo ratings yet

- Limbona vs. Mangelin case examines jurisdiction over autonomous governmentsDocument1 pageLimbona vs. Mangelin case examines jurisdiction over autonomous governmentsAldrin TangNo ratings yet

- Baytan V ComelecDocument2 pagesBaytan V ComelecAldrin TangNo ratings yet

- Unido v. ComelecDocument2 pagesUnido v. ComelecAldrin TangNo ratings yet

- OPRES vs. BuenaobraDocument1 pageOPRES vs. BuenaobraAldrin TangNo ratings yet

- IC 38 Short Notes (2) 61Document1 pageIC 38 Short Notes (2) 61Anil KumarNo ratings yet

- Rich v. PalomaDocument7 pagesRich v. PalomaIpe ClosaNo ratings yet

- STATCON-TitleDocument2 pagesSTATCON-TitleAnna LesavaNo ratings yet

- Permiten A Raphy Pina Que Vaya Al Cumpleaños de Su HijaDocument3 pagesPermiten A Raphy Pina Que Vaya Al Cumpleaños de Su HijaMetro Puerto RicoNo ratings yet

- Sample Notice of Removal To Federal CourtDocument3 pagesSample Notice of Removal To Federal CourtStan Burman91% (11)

- United States v. Claude Verbal, II, 4th Cir. (2015)Document5 pagesUnited States v. Claude Verbal, II, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Gonzales Vs GonzalesDocument6 pagesGonzales Vs GonzalesJohnRouenTorresMarzoNo ratings yet

- Moot Court Memorial.Document16 pagesMoot Court Memorial.Nishant JasaniNo ratings yet

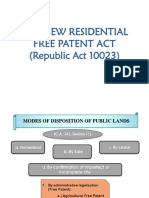

- The New Residential Free Patent Act (Republic Act 10023)Document17 pagesThe New Residential Free Patent Act (Republic Act 10023)Memphis RainsNo ratings yet

- Def MTDDocument24 pagesDef MTDHilary LedwellNo ratings yet

- Lorenzo vs Posadas inheritance tax disputeDocument3 pagesLorenzo vs Posadas inheritance tax disputeXsche XscheNo ratings yet

- Metroguards Security Agency Corporation vs. HilongoDocument2 pagesMetroguards Security Agency Corporation vs. HilongoAnonymous 5MiN6I78I0No ratings yet

- Tallado v. COMELECDocument2 pagesTallado v. COMELECEva Trinidad100% (3)

- The Law of Contract in South Africa: Fifth EditionDocument9 pagesThe Law of Contract in South Africa: Fifth Editionrayzvomuya063No ratings yet

- People Vs Quintos Badilla (2014)Document3 pagesPeople Vs Quintos Badilla (2014)John Lawrence RamasNo ratings yet

- Bradford Wedra v. Eugene S. Lefevre, Warden, Clinton Correctional Facility, 988 F.2d 334, 2d Cir. (1993)Document15 pagesBradford Wedra v. Eugene S. Lefevre, Warden, Clinton Correctional Facility, 988 F.2d 334, 2d Cir. (1993)Scribd Government DocsNo ratings yet

- TAMIL NADU PRISON MANUAL - Updated PDFDocument452 pagesTAMIL NADU PRISON MANUAL - Updated PDFmaharajanpal73% (11)

- DeSantis Response 3.9.23Document4 pagesDeSantis Response 3.9.23Christie ZizoNo ratings yet

- Art 22 Law 201Document24 pagesArt 22 Law 201Anjali MakkarNo ratings yet

- Partnership dissolution dispute at the Supreme CourtDocument6 pagesPartnership dissolution dispute at the Supreme CourtCatherine Cruz GomezNo ratings yet

- Philippine Court Documents Object to Evidence in Drug CasesDocument4 pagesPhilippine Court Documents Object to Evidence in Drug CasesDraei DumalantaNo ratings yet

- Doctrine of Ejusdem Generis - IV SemesterDocument13 pagesDoctrine of Ejusdem Generis - IV SemesterManas KumarNo ratings yet

- Roxas & Company Inc Vs DAMBA NFSWDocument111 pagesRoxas & Company Inc Vs DAMBA NFSWabo8008No ratings yet

- University of Botswana Department of Law Law 332: Evidence SEMESTER 2021/2022Document8 pagesUniversity of Botswana Department of Law Law 332: Evidence SEMESTER 2021/2022Doreen AaronNo ratings yet

- Legal Theory: Craik: Chapter 2 PP 7-47Document51 pagesLegal Theory: Craik: Chapter 2 PP 7-47Tiffany100% (1)

- Supreme Court Rules on Annulment of Sale of Real PropertyDocument13 pagesSupreme Court Rules on Annulment of Sale of Real PropertyKeith BalbinNo ratings yet

- Olivarez Realty V CastilloDocument2 pagesOlivarez Realty V CastilloOmsimNo ratings yet

- Judgments-Tm: Dr. P. Sree Sudha, LL.D Associate Professor DsnluDocument79 pagesJudgments-Tm: Dr. P. Sree Sudha, LL.D Associate Professor DsnluChintakayala SaikrishnaNo ratings yet

- Wal-Mart Stores V Guerra - Legal Case Analysis-1Document7 pagesWal-Mart Stores V Guerra - Legal Case Analysis-1Katherine SuarezNo ratings yet

- SI 2021-240 Legal Practitioners (Designated Legal Qualifi Cations) (Amendment) Notice, 2021 (No. 2)Document1 pageSI 2021-240 Legal Practitioners (Designated Legal Qualifi Cations) (Amendment) Notice, 2021 (No. 2)Innocent MajaNo ratings yet