Professional Documents

Culture Documents

Fortis CRISIL Report

Uploaded by

Abhishek Burad JainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fortis CRISIL Report

Uploaded by

Abhishek Burad JainCopyright:

Available Formats

GICS Industry : Health Care Providers & Service l Sub Industry : Health Care Facilities l Website : www.fortishealth.

com

Fortis Healthcare Ltd

Key Stock Indicators

CMP (as on 11Feb 2011Rs/share):

52-week range up to11 Feb 2011 (Rs)(H/L):

Market Cap as on 11 Feb 2011(Rs mn):

Enterprise Value as on 11 Feb 2011 (Rs mn):

Shares outstanding (mn) :

Free Float (%) :

Average daily volumes (12 months)

Beta (2 year) :

151.5

183.55/129.30

34,379

76,063

Incorporated in 1996, Fortis Healthcare Limited (FHL) provides a comprehensive range of primary,

secondary and tertiary healthcare services. The company has expertise across 4 specialities, namely

heart care, brain and spine care, bone and joint care and minimal access surgery. FHL has hospitals

and medical facilities in Amristar, Bengaluru, Chennai, Faridabad, Delhi, Mumbai, Mohali, Raipur,

Kolkata, Jaipur and Mauritius.

KEY HIGHLIGHTS

Landmark acquisitions in FY10

The company acquired the Greenfield Hospitals division of Wockhardt Hospitals Ltd, comprising 10

hospitals 2 in Mumbai, 5 in Bangalore and 3 in Kolkata. With this acquisition, the total number of

Fortis hospitals in India increased to 48, and its bed capacity rose to ~7,700. The acquired hospitals

deliver high-end critical care to both domestic and international patients in areas of cardiac, neuroscience, orthopedics, minimal invasive surgery, renal science, kidney and liver transplantation. The

second landmark deal was FHLs purchase of a 25% stake in Singapore-based Parkway Holding, the

leading private healthcare provider in Singapore and Malaysia.

Hospitals under construction and completed

Construction of the Shalimar Bagh hospital in West Delhi has been completed and operations will

commence after the company obtains a few statutory clearances. The hospital is spread over an

area of approximately 7.34 acres of land and will have 350 beds in the first phase. The hospital will

offer specialised cardiac care, orthopaedics, neuro-science, renal science, mother and child care

and gastroenterology services. The second upcoming hospital is the Fortis International Institute of

Medical and Bio-Science (FIIMBS), with 2 multi-speciality hospitals, having 750 beds, along with a

medical college for 500 students. The hospital is expected to be completed during the fourth

quarter of FY11. FIIMBS will have Centres of Excellence in oncology, trauma, paediatrics, mother

and child care, cosmetology, gastroenterology, neuro-science and renal care. Construction work is

also going on at one hospital that is bought from Wockhardt. This 414-bed hospital at EM Bypass

road, Kolkata is scheduled for commissioning in the second quarter of FY11 and would be a Centre

of Excellence in cardiac sciences, brain and spine, bone and joints as well as minimal access

surgeries for eastern India. A radiation oncology unit at the Mulund Hospital (Mumbai) will also be

commissioned by Q2 FY11. The company has undertaken projects to enhance bed capacity at

Jaipur and at the Fortis Escorts Heart Institute in Delhi.

Ma r-10

9,486.5

14.2

449.9

4.7

10.6

1.4

106.8

17.9

3.0

14.4

66.4

Shareholding (As on December 31, 2010)

FII

6%

DII

2%

Others

10%

Promoter

82%

1 -m

3 -m

1 2 -m

-1 6

10

-9

-8

-1 4

10

6000

40

4000

20

2000

V olumes (RHS )

FOR TIS

J an-11

YTD

8000

60

D ec -10

R e tur ns (% )

10000

80

O c t-10

Stock Performances vis--vis market

12000

100

Nov -10

Stiff competition from leading/ charitable hospitals and medical centres in the region

14000

120

S ep-10

Shortfall of good doctors and nurses

('000)

J ul-10

(index )

140

Aug-10

Public expenditure on health services as a percentage of GDP in India is very low

J un-10

Apr-10

Change in government policies towards healthcare may affect business

N IF T Y

Mar-09

6,354.0

13.0

205.5

3.2

6.0

0.9

74.6

14.1

9.8

11.6

25.8

n.m. : Not meaningful

May -10

F O R T IS

Mar-08

5,301.2

3.1

-1,091.4

-20.6

2.0

-4.8

n.m

7.7

n.m

142.5

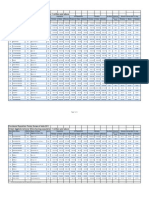

R evenue (R s m n)

E B ITD A m a rg ins (% )

P AT (R s m n)

P AT m a rg ins (% )

G ea ring (x)

E P S (R s /s ha re)

P E (x)

P /B V (x)

R oC E (% )

R oE (% )

E V/E B ITD A (x)

Indexed price chart

KEY RISKS

227

18.5

1,568,602

1.0

Key Financial Indicators

Mar-10

FORTIS

FORH:IN

10.0

0.0

F eb-10

NSE Ticker :

Bloomberg Ticker :

Face value / Share:

Div. Yield (%):

NIFTY

Note:

1) YTD returns are since April 1, 2010 to Feb 11, 2011.

2) 1-m, 3-m and 12-m returns are up to Feb 11, 2011.

.

CRISIL COMPANY REPORT | 1

Fortis Healthcare Ltd

BACKGROUND

Incorporated in 1996, Fortis was promoted by the erstwhile promoters of Ranbaxy Laboratories Ltd, Mr. Malvinder Singh and Mr. Shivinder Singh. Fortis grew

predominantly through acquisitions and has built only three greenfield hospitals at Mohali, Noida and Jaipur. Rest of its hospitals were acquired over the years. Key

acquisitions include the Escorts Heart Institute (Delhi) for Rs 5.9 billion (bn) in 2005 and 10 Wockhardt hospitals for Rs 9.1 bn in 2009. Out of the 10 acquired Wockhardt

hospitals, 8 are operational while 2 are in construction stage. FHL has hospitals and facilities in Amristar, Bengaluru, Chennai, Faridabad, Delhi, Mumbai, Mohali, Raipur,

Kolkata, Jaipur and Mauritius, among others.

COMPETITIVE POSITION

Peer Comparison

Revenue (Rs mn)

EBITDA ma rgins (%)

PAT (Rs mn)

PAT ma rgi ns (%)

Gea ri ng (x)

EPS (Rs /s ha re)

PE (x)

P/BV (x)

RoCE (%)

RoE (%)

EV/EBITDA (x)

Fortis Healthcare

Ltd

Mar-10

9,486.5

14.2

449.9

4.7

10.6

1.4

106.8

17.9

3.0

14.4

66.4

Apollo Hospitals

Enterprises Ltd

Mar-10

20,264.7

15.0

1,339.4

6.6

0.6

21.7

22.0

1.8

11.0

8.7

11.7

Indraprastha

Medical Corpn.

Mar-10

410,676.2

25.1

68,464.6

16.7

0.5

13.1

12.1

1.8

21.6

21.2

0.0

Lotus Eye Care

Hospital Ltd.

Mar-10

1,023,454.4

8.5

-21,208.4

-2.1

7.9

73.0

8.9

1.4

8.2

n.m.

0.0

n.m: Not meaningful

FINANCIAL PROFILE

Key Financial Indicators

Units

Top-line grows, margins improve in FY10

Revenue

FHL recorded a top-line of Rs 9.4 bn in FY10 as against a top-line of Rs 6.3 bn in FY09,

a growth of ~49%, boosted by the companys acquisition of the Greenfield Hospital

division of Wockhardt Hospitals Ltd and also due to growth in occupancies.

Operating margin increased by 120 basis points (bps) year-on-year in FY10 and stood

at 14.2% in FY10 while PAT margin increased by 150 bps. The company reported net

profit of Rs 450 million (mn) in FY10, up 119% from Rs 205 mn reported in FY09. This

was mainly due to 63.9% increase in operating profit and ~19% growth in other

income.

Rs mil li on

EBITDA ma rgins Per cent

Mar-08

Mar-09

Mar-10

5,301.2

6,354.0

9,486.5

3.1

13.0

14.2

-1,091.4

205.5

449.9

PAT

Rs mil li on

PAT ma rgi ns

Per cent

-20.6

3.2

4.7

Revenue growth Per cent

-3.4

19.9

49.3

EBITDA growth

Per cent

-67.7

398.7

63.9

PAT growth

Per cent

-4.2

n.m.

119.0

Gea ri ng

Ti mes

2.0

6.0

10.6

RoCE

Per cent

n.m

9.8

3.0

RoE

Per cent

0.0

11.6

14.4

INDUSTRY PROFILE

Hospitals

The market size of the healthcare delivery (hospitals) sector was around Rs 1,940 billion in 2009. The sectors pricing flexibility is constrained by low domestic per capita

income, negligible health insurance coverage and low government expenditure. The government has introduced various measures in an effort improve Indias healthcare

facilities. However these regulations do not have a direct impact on the performance of the sector as it is largely a non-discretionary expenditure for the consumers.

Hospitals are classified as providing primary, secondary and tertiary care based on the type of service rendered and the complexity of ailments the hospital is capable of

dealing with. Primary care facilities offer basic, point-of-contact medical services and healthcare prevention services in an outpatient setting. They are typically clinics with

one or more general practitioners on site. These hospitals do not have any intensive care units (ICUs) and there are no surgeries taking place. Secondary care hospital is the

first hospital a patient approaches for common ailments. They can be further classified as general secondary care typically having a bed size of 50-100 and specialty

secondary care hospitals with a typical bed size of 100-300. The essential medical specialties in general secondary care hospitals include internal medicine, general surgery,

obstetrics & gynecology (OBG), pediatrics, ENT, orthopedics and ophthalmology. Specialty secondary care hospitals treat specialties like gastroenterology, cardiology,

neurology, dermatology, urology, dentistry and oncology. Tertiary care hospitals typically have all the medical specialties under one roof typically having over 300 beds.

Tertiary care hospitals can be either single specialty or multi specialty hospitals. While the former caters to a specific ailment, the latter usually treats multi-organ failure,

high risk and trauma cases

CRISIL COMPANY REPORT | 2

Fortis Healthcare Ltd

ANNUAL RESULTS

Income Statement

(Rs million )

Net Sales

Operating Income

Mar-08

5,211.9

5,301.2

Mar-09

6,278.6

6,354.0

Mar-10

9,390.5

9,486.5

EBITDA

EBITDA Margin

165.4

3.1

824.9

13.0

1,351.8

14.2

Depreciation

Interest

Other Income

468.2

696.6

413.5

487.4

485.6

308.5

599.4

514.3

365.0

-895.8

-1,091.4

246.7

205.5

484.0

449.9

PAT Margin

-20.6

3.2

4.7

No. of shares (Mn No.)

226.7

226.7

317.3

-4.8

0.9

1.4

Mar-08

-586.0

-9.8

468.2

-864.7

Mar-09

160.4

-20.6

487.4

719.1

Mar-10

603.2

-166.6

599.4

276.6

-992.3

-1,296.9

-326.2

1,346.3

-1,007.0

-210.6

1,312.6

-11,886.5

-33,943.6

PBT

PAT

Earnings per share (EPS)

Cash flow

(Rs million )

Pre-tax profit

Total tax paid

Depreciation

Change in working capital

Balance sheet

(Rs million )

Equity share capital

Reserves and surplus

Tangible net worth

Deferred tax liablity:|asset|

Long-term debt

Short-term-debt

Total debt

Current liabilities

Total provisions

Total liabilities

Gross block

Net fixed assets

Investments

Current assets

Receivables

Inventories

Cash

Total assets

Mar-08

3,766.7

-1,315.3

2,451.4

-8.5

3,432.8

1,391.4

4,824.2

1,073.1

342.1

8,682.3

6,785.6

5,470.0

330.6

2,881.7

959.1

123.5

160.6

8,682.3

Mar-09

2,266.7

-1,179.1

1,087.6

12.2

4,944.9

1,606.6

6,551.5

1,049.7

1,036.9

9,737.9

6,934.2

5,943.9

541.3

3,252.8

1,335.1

132.6

579.5

9,738.0

Mar-10

3,173.2

2,003.9

5,177.2

-120.2

33,117.1

21,680.1

54,797.2

2,421.9

692.4

62,968.5

11,093.6

11,945.9

34,484.9

16,537.7

1,566.7

237.8

13,113.4

62,968.5

Revenue growth (%)

EBITDA growth(%)

PAT growth(%)

Mar-08

-3.4

-67.7

-4.2

Mar-09

19.9

398.7

n.m.

Mar-10

49.3

63.9

119.0

EBITDA margins(%)

Tax rate (%)

PAT margins (%)

3.1

-1.1

-20.6

13.0

8.3

3.2

14.2

30.2

4.7

Dividend payout (%)

Dividend per share (Rs)

BV (Rs)

Return on Equity (%)

Return on capital employed (%)

0.0

0.0

10.8

n.m.

n.m.

0.0

0.0

4.8

11.6

9.8

0.0

-13.5

8.5

14.4

3.0

Gearing (x)

Interest coverage (x)

Debt/EBITDA (x)

2.0

0.2

29.2

6.0

1.7

7.9

10.6

0.3

40.5

Ratio

Cash flow from operating activities

Capital Expenditure

Investments and others

Cash flow from investing activities

Equity raised/(repaid)

Debt raised/(repaid)

Dividend (incl. tax)

Others (incl extraordinaries)

-1,623.1

4,481.4

-3,753.3

0.0

1,741.1

-1,217.6

-30.1

1,727.3

0.0

-1,407.0

-45,830.1

9,210.2

48,245.7

-4,288.4

3,883.7

Cash flow from financing activities

Change in cash position

Opening cash

2,469.2

-146.2

306.8

290.2

418.9

160.6

57,051.2

12,533.7

579.5

Asset turnover (x)

Current ratio (x)

0.8

0.8

0.9

1.1

1.1

1.1

160.6

579.5

13,113.4

Gross current assets (days)

123

147

611

Closing cash

n.m : Not meaningful;

QUARTERLY RESULTS

Profit and los s ac c ount

(Rs million)

No of Months

S ep-10

% of Rev

Revenue

7,161.1

EBITDA

Interes t

S ep-09

% of Rev

% of Rev

100.0

1,940.8

100.0

2,433.6

34.0

334.4

1,352.5

18.9

77.6

232.9

3.3

PBT

774.0

PAT

743.7

Depreciation

J un-10

S ep-10

% of Rev

S ep-09

% of Rev

3,715.8

100.0

10,876.9

100.0

3,826.0

100.0

17.2

812.1

21.9

3,245.7

29.8

646.2

16.9

4.0

709.3

19.1

2,061.8

19.0

181.7

4.7

117.6

6.1

215.2

5.8

448.1

4.1

231.1

6.0

10.8

147.3

7.6

(111.3)

(3.0)

662.7

6.1

246.8

6.5

10.4

138.0

7.1

(133.0)

(3.6)

610.7

5.6

219.3

5.7

CRISIL COMPANY REPORT | 3

Fortis Healthcare Ltd

FOCUS CHARTS & TABLES

Per c ent

300

Qua rte rly sa le s & y-o-y g rowth

4,000

3,000

2,000

1,000

0

R s mn

800

250

600

200

400

150

Per c ent

1,600

1,400

1,200

1,000

800

600

400

200

0

-200

-400

Qua rte rly P AT & y-o-y g rowth

200

100

0

50

Per cent

80

70

60

50

40

30

20

10

0

-10

-20

S hareholding P attern (P er c ent)

Mar 2010

J un 2010

P rom oter

76.5

76.5

F II

3.6

5.2

D II

2.0

1.3

Others

18.0

17.0

S ep 2010

81.5

5.5

2.7

10.3

Dec 2010

81.5

6.3

2.0

10.2

S ep-10

J un-10

Mar-10

D ec -09

S ep-09

J un-09

Mar-09

D ec -08

OPM

B oard of Direc tors

Direc tor Name

Ma lvinder Mohan S ing h (Mr.)

Jun-10

Mar-10

Dec-09

Jun-09

Mar-09

Dec-08

Sep-10

Jun-10

Mar-10

Dec-09

Sep-09

Jun-09

Mar-09

Dec-08

Sep-08

Jun-08

Mar-08

-1

-1.5

-2

Sep-08

1

0.5

0

-0.5

Net profit growth y-o-y (RHS)

Movement in operating and net margins

Jun-08

EPS

Mar-08

Rs/share

2.5

2

1.5

Net Profit

Sep-09

Sales growth y-o-y (RHS)

S ep-08

Mar-08

S ep-10

J un-10

Mar-10

D ec -09

S ep-09

J un-09

Mar-09

D ec -08

S ep-08

J un-08

Mar-08

Sales

J un-08

-200

Sep-10

Rs mn

8,000

7,000

6,000

5,000

NPM

S hivinder Moha n S ing h (Mr.)

Des ig nation

N on-E xecutive C ha irm a n, P rom oterD irector

Ma na g ing D irector, P rom oter-D irector

G urcha ra n D a s (Mr.)

B a linder S ing h D hillon (Mr.)

S unil G odhwa ni (Mr.)

P reetinder S ingh J os hi (D r.)

N on-E xecutive

N on-E xecutive

N on-E xecutive

N on-E xecutive

D irector

D irector

D irector

D irector

R a ja n K a s hya p (Mr.)

Tejinder S ing h S herg ill (L t.G en.)

H a rpa l S ingh (Mr.)

S a vinder S ing h S odhi (J us tice)

N on-E xecutive

N on-E xecutive

N on-E xecutive

N on-E xecutive

D irector

D irector

D irector

D irector

Additional Disclosure

This report has been sponsored by NSE - Investor Protection Fund Trust (NSEIPFT).

Disclaimer

This report is based on data publicly available or from sources considered reliable. CRISIL Ltd. (CRISIL) does not represent that it is accurate or complete and hence, it should not be relied upon as

such. The data / report is subject to change without any prior notice. Opinions expressed herein are our current opinions as on the date of this report. Nothing in this report constitutes investment,

legal, accounting or tax advice or any solicitation, whatsoever. The subscriber / user assume the entire risk of any use made of this data / report. CRISIL especially states that, it has no financial

liability whatsoever, to the subscribers / users of this report. This report is for the personal information only of the authorised recipient in India only. This report should not be reproduced or

redistributed or communicated directly or indirectly in any form to any other person especially outside India or published or copied in whole or in part, for any purpose.

CRISIL is not responsible for any errors and especially states that it has no financial liability whatsoever to the subscribers / users / transmitters / distributors of this report. For information please

contact 'Client Servicing' at +91-22-33423561, or via e-mail: clientservicing@crisil.com.

CRISIL COMPANY REPORT | 4

You might also like

- Mini Paper PlantDocument12 pagesMini Paper PlantAbhishek Burad JainNo ratings yet

- ACE Curriculam 6 To 8Document148 pagesACE Curriculam 6 To 8Abhishek Burad JainNo ratings yet

- UN Population Data - India 2011Document8 pagesUN Population Data - India 2011Abhishek Burad JainNo ratings yet

- India's largest cities and their 2011 census populationsDocument2 pagesIndia's largest cities and their 2011 census populationsUjjwal GargNo ratings yet

- Mother & ChildcareDocument156 pagesMother & ChildcareAbhishek Burad JainNo ratings yet

- Excellence in Diagnostic CareDocument20 pagesExcellence in Diagnostic CareDominic LiangNo ratings yet

- Awakening Africa's Agricultural PotentialDocument4 pagesAwakening Africa's Agricultural PotentialAbhishek Burad JainNo ratings yet

- ValuationsDocument27 pagesValuationsblabitan100% (1)

- Private Valuation Company - PVT (English) PDFDocument55 pagesPrivate Valuation Company - PVT (English) PDFDesire Paul Gueye-massaNo ratings yet

- Srei Infrastructure Finance LTD - NSSPL Research 08-10-10Document8 pagesSrei Infrastructure Finance LTD - NSSPL Research 08-10-10Abhishek Burad JainNo ratings yet

- Uflex Limited - Natsons Research 28-05-2010Document8 pagesUflex Limited - Natsons Research 28-05-2010Abhishek Burad JainNo ratings yet

- Sintex Industries Natsons Research 26-07-2010Document8 pagesSintex Industries Natsons Research 26-07-2010Abhishek Burad JainNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MRF Microsec 260413Document5 pagesMRF Microsec 260413Aditya SoumavaNo ratings yet

- ICICI Prudential PPT12Document19 pagesICICI Prudential PPT12prince170586100% (2)

- ACCT 621 Practicing 1Document3 pagesACCT 621 Practicing 1Hashitha100% (1)

- Bridging the Gap in Home Loan ServicesDocument23 pagesBridging the Gap in Home Loan ServiceskplNo ratings yet

- Understanding Product Portfolios with the BCG Matrix and Shell's DPMDocument2 pagesUnderstanding Product Portfolios with the BCG Matrix and Shell's DPMAlfonso Joel V. GonzalesNo ratings yet

- Strategic Analysis of InfosysDocument35 pagesStrategic Analysis of InfosysAbhishek SrivastavaNo ratings yet

- Investment Dar - CI RatingDocument14 pagesInvestment Dar - CI RatingHamad Al SalemNo ratings yet

- Hul Annual Report 2011-12 tcm1255-436321 enDocument164 pagesHul Annual Report 2011-12 tcm1255-436321 enanurag kumarNo ratings yet

- Sample Level I Multiple Choice Questions - Ethics 2Document23 pagesSample Level I Multiple Choice Questions - Ethics 2Fayad CalúNo ratings yet

- Group M: Tunku Puteri Intan Safinaz School of AccountancyDocument3 pagesGroup M: Tunku Puteri Intan Safinaz School of AccountancyMuhammad SyazwanNo ratings yet

- Project On Retail Assets of BOB OkDocument76 pagesProject On Retail Assets of BOB OkKanchan100% (1)

- MBA Finance1YearDocument10 pagesMBA Finance1Yearshahmonali6940% (1)

- APPLIED AUDITING INVESTMENTSDocument5 pagesAPPLIED AUDITING INVESTMENTSMarinel AbrilNo ratings yet

- IFC's Commitment To Water & Wastewater in Emerging MarketsDocument14 pagesIFC's Commitment To Water & Wastewater in Emerging MarketsADBI EventsNo ratings yet

- Interpreting Financial StatementsDocument30 pagesInterpreting Financial StatementsAkshata Masurkar100% (2)

- Simple and Compound InterestDocument4 pagesSimple and Compound InterestVivek PatelNo ratings yet

- CitibankDocument50 pagesCitibankUtsav Mahendra100% (1)

- Fins2624 T1 2020 PS3Document3 pagesFins2624 T1 2020 PS3teoluoNo ratings yet

- Buying - And.selling.a.home - Ebook EEnDocument369 pagesBuying - And.selling.a.home - Ebook EEndwdgNo ratings yet

- Financial Management in Sick UnitsDocument22 pagesFinancial Management in Sick UnitsAnkit SinghNo ratings yet

- Rights of Minority ShareholdersDocument2 pagesRights of Minority ShareholdersRanadeep PoddarNo ratings yet

- SIMPower-Decision Making Guide-En enDocument37 pagesSIMPower-Decision Making Guide-En enHoang LongNo ratings yet

- Abf Ar 2017Document178 pagesAbf Ar 2017ahmedNo ratings yet

- Ias 16Document26 pagesIas 16Niharika MishraNo ratings yet

- Collector of Internal Revenue v. Club Filipino, Inc. de CebuDocument2 pagesCollector of Internal Revenue v. Club Filipino, Inc. de CebuJosephine Redulla LogroñoNo ratings yet

- Fresh - Group 3Document28 pagesFresh - Group 3Endless RajNo ratings yet

- Emerging Market Brands Will Go GlobalDocument28 pagesEmerging Market Brands Will Go GlobalReza TiantoNo ratings yet

- Project On Ticket Size ManagementDocument102 pagesProject On Ticket Size ManagementRaghav ChowdharyNo ratings yet

- Account-Opening-Individual - Meezan Sahulat Sarmayakari Account FinalDocument7 pagesAccount-Opening-Individual - Meezan Sahulat Sarmayakari Account FinalSalman ArshadNo ratings yet

- Accounts (A)Document3 pagesAccounts (A)Sameer Gupta100% (1)