Professional Documents

Culture Documents

Fin1 Eq2 Bsat

Uploaded by

Yu BabylanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin1 Eq2 Bsat

Uploaded by

Yu BabylanCopyright:

Available Formats

FIN1_EQ2

FIN1_EQ2

Problem 1. Today is Janets 23rd birthday. Starting today,

Janet plans to begin saving for her retirement. Her plan is to

contribute $1,000 to a brokerage account each year on her

birthday. Her first contribution will take place today. Her 42nd

and final contribution will take place on her 64th birthday. Her

aunt has decided to help Janet with her savings, which is why

she gave Janet $10,000 today as a birthday present to help get

her account started. Assume that the account has an expected

annual return of 10 percent. How much will Janet expect to

have in her account on her 65th birthday?

1,139,037.68

Problem 2. You have the opportunity to buy a perpetuity that

pays $1,000 annually. Your required rate of return on this

investment is 15 percent. You should be essentially indifferent

to buying or not buying the investment if it were offered at a

price of 6,666.67

Problem 1. Today is Janets 23rd birthday. Starting today,

Janet plans to begin saving for her retirement. Her plan is to

contribute $1,000 to a brokerage account each year on her

birthday. Her first contribution will take place today. Her 42nd

and final contribution will take place on her 64th birthday. Her

aunt has decided to help Janet with her savings, which is why

she gave Janet $10,000 today as a birthday present to help get

her account started. Assume that the account has an expected

annual return of 10 percent. How much will Janet expect to

have in her account on her 65th birthday?

1,139,037.68

Problem 2. You have the opportunity to buy a perpetuity that

pays $1,000 annually. Your required rate of return on this

investment is 15 percent. You should be essentially indifferent

to buying or not buying the investment if it were offered at a

price of 6,666.67

Problem 3. Assume that you will receive $2,000 a year in

Years 1 through 5, $3,000 a year in Years 6 through 8, and

$4,000 in Year 9, with all cash flows to be received at the end

of the year. If you require a 14 percent rate of return, what is

the present value of these cash flows? 11,714

Problem 3. Assume that you will receive $2,000 a year in

Years 1 through 5, $3,000 a year in Years 6 through 8, and

$4,000 in Year 9, with all cash flows to be received at the end

of the year. If you require a 14 percent rate of return, what is

the present value of these cash flows? 11,714

Problem 4. South Penn Trucking is financing a new truck with

a loan of $10,000 to be repaid in 5 annual end-of-year

installments of $2,504.56. What annual interest rate is the

company paying? 8%

Problem 4. South Penn Trucking is financing a new truck with

a loan of $10,000 to be repaid in 5 annual end-of-year

installments of $2,504.56. What annual interest rate is the

company paying? 8%

Problem 5. You recently received a letter from Cut-to-theChase National Bank that offers you a new credit card that has

no annual fee. It states that the annual percentage rate (APR)

is 18 percent on outstanding balances. What is the effective

annual interest rate? (Hint: Remember these companies bill

you monthly.)

19.56%

Problem 6. Jill currently has $300,000 in a brokerage account.

The account pays a 10 percent annual interest rate. Assuming

that Jill makes no additional contributions to the account, how

many years will it take for her to have $1,000,000 in the

account? 12.63 years

Problem 5. You recently received a letter from Cut-to-theChase National Bank that offers you a new credit card that has

no annual fee. It states that the annual percentage rate (APR)

is 18 percent on outstanding balances. What is the effective

annual interest rate? (Hint: Remember these companies bill

you monthly.)

19.56%

Problem 6. Jill currently has $300,000 in a brokerage account.

The account pays a 10 percent annual interest rate. Assuming

that Jill makes no additional contributions to the account, how

many years will it take for her to have $1,000,000 in the

account? 12.63 years

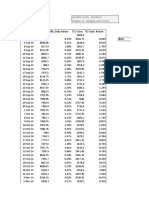

Problem 7. A bank recently loaned you $15,000 to buy a car.

The loan is for five years (60 months) and is fully amortized.

The nominal rate on the loan is 12 percent, and payments are

made at the end of each month. What will be the remaining

balance on the loan after you make the 4th payment? 8611.17

Problem 7. A bank recently loaned you $15,000 to buy a car.

The loan is for five years (60 months) and is fully amortized.

The nominal rate on the loan is 12 percent, and payments are

made at the end of each month. What will be the remaining

balance on the loan after you make the 4th payment?

Problem 8. Bill plans to deposit $200 into a bank account at

the end of every month. The bank account has a nominal

interest rate of 8 percent and interest is compounded monthly.

How much will Bill have in the account at the end of 2 years

(30 months)? 6,617.77

Problem 8. Bill plans to deposit $200 into a bank account at

the end of every month. The bank account has a nominal

interest rate of 8 percent and interest is compounded monthly.

How much will Bill have in the account at the end of 2 years

(30 months)? 6,617.77

Problem 9. You have just bought a security that pays $500

every six months. The security lasts for 10 years. Another

security of equal risk also has a maturity of 10 years, and pays

10 percent compounded monthly (that is, the nominal rate is 10

percent). What should be the price of the security that you just

purchased? 6,175.82

Problem 9. You have just bought a security that pays $500

every six months. The security lasts for 10 years. Another

security of equal risk also has a maturity of 10 years, and pays

10 percent compounded monthly (that is, the nominal rate is 10

percent). What should be the price of the security that you just

purchased? 6,175.82

Problem 10. Suppose you put $100 into a savings account

today, the account pays a nominal annual interest rate of 6

percent, but compounded semiannually, and you withdraw

$100 after 6 months. What would your ending balance be 20

years after the initial $100 deposit was made? 9.50

Problem 10. Suppose you put $100 into a savings account

today, the account pays a nominal annual interest rate of 6

percent, but compounded semiannually, and you withdraw

$100 after 6 months. What would your ending balance be 20

years after the initial $100 deposit was made? 9.50

Problem 11. You have $2,000 invested in a bank account that

pays a 4 percent nominal annual interest with daily

compounding. How much money will you have in the account

at the end of July (in 132 days)? (Assume there are 365 days

in each year.) 2029.14

Problem 11. You have $2,000 invested in a bank account that

pays a 4 percent nominal annual interest with daily

compounding. How much money will you have in the account

at the end of July (in 132 days)? (Assume there are 365 days

in each year.) 2029.14

Problem 12. If you buy a factory for $250,000 and the terms

are 20 percent down, the balance to be paid off over 30 years

at a 12 percent rate of interest on the unpaid balance, what will

be the amount of each 30 equal annual payments? 24,829

Problem 12. If you buy a factory for $250,000 and the terms

are 20 percent down, the balance to be paid off over 30 years

at a 12 percent rate of interest on the unpaid balance, what will

be the amount of each 30 equal annual payments? 24,829

<<<END>>>

<<<END>>>

You might also like

- Exercises - Corporate Finance 1Document12 pagesExercises - Corporate Finance 1Hông HoaNo ratings yet

- BT Chap 5Document4 pagesBT Chap 5Hang NguyenNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- TVM Practice ProblemsDocument1 pageTVM Practice Problemseath__No ratings yet

- Practices: Time Value of MoneyDocument9 pagesPractices: Time Value of MoneysovuthyNo ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and ExercisesPhương Nguyễn ThuNo ratings yet

- Optional Maths Revision Tutorial Questions: X X X A A A A A ADocument44 pagesOptional Maths Revision Tutorial Questions: X X X A A A A A ASaizchiNo ratings yet

- Time Value of MoneyDocument6 pagesTime Value of MoneyRezzan Joy Camara MejiaNo ratings yet

- Compound Interest Calculator: 30 ExercisesDocument4 pagesCompound Interest Calculator: 30 ExercisesDilina De SilvaNo ratings yet

- Time Value of Money Practice ProblemsDocument5 pagesTime Value of Money Practice ProblemsMarkAntonyA.RosalesNo ratings yet

- Homework Set I SolutionsDocument4 pagesHomework Set I SolutionsjondoedoeNo ratings yet

- ÁdDocument2 pagesÁdtuan phanNo ratings yet

- Business Finance: AssignmentDocument2 pagesBusiness Finance: AssignmentLucifer Morning starNo ratings yet

- Additional Time Value ProblemsDocument2 pagesAdditional Time Value ProblemsBrian WrightNo ratings yet

- Week1 in Class ExerciseDocument12 pagesWeek1 in Class Exercisemuhammad AdeelNo ratings yet

- Chapter 03, Math SolutionDocument8 pagesChapter 03, Math SolutionSaith UmairNo ratings yet

- Practice Time Value Money ProblemsDocument15 pagesPractice Time Value Money ProblemsraymondNo ratings yet

- Handout2 PDFDocument2 pagesHandout2 PDFTheresiaVickaaNo ratings yet

- Ch4ProbsetTVM13ed - MasterDocument4 pagesCh4ProbsetTVM13ed - MasterRisaline CuaresmaNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- TVM WorksheetsDocument4 pagesTVM WorksheetsRia PiusNo ratings yet

- TVM WorksheetsDocument4 pagesTVM WorksheetsRia Pius100% (1)

- Problem Set Time Value of MoneyDocument5 pagesProblem Set Time Value of MoneyRohit SharmaNo ratings yet

- PracticeDocument8 pagesPracticehuongthuy1811No ratings yet

- AnnuitiesquestionsDocument5 pagesAnnuitiesquestionsRamsha ChaudhryNo ratings yet

- QM Tutorial Simple and Compound InterestDocument6 pagesQM Tutorial Simple and Compound InterestLishalini GunasagaranNo ratings yet

- Sinking Funds & AnnuitiesDocument8 pagesSinking Funds & AnnuitiesRawlinson TolentinoNo ratings yet

- Practice Questions - Time Value of MoneyDocument1 pagePractice Questions - Time Value of MoneySedef ErgülNo ratings yet

- HWChapter 5Document20 pagesHWChapter 5Yawar Abbas KhanNo ratings yet

- Discounted Cash Flow Valuation Concept Questions and ExercisesDocument3 pagesDiscounted Cash Flow Valuation Concept Questions and ExercisesAnh TramNo ratings yet

- Debt and TaxDocument1 pageDebt and TaxChandramani JhaNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Concept Check Quiz: First SessionDocument27 pagesConcept Check Quiz: First SessionMichael MillerNo ratings yet

- Week 1 - Time Value of Money - MCQDocument10 pagesWeek 1 - Time Value of Money - MCQmail2manshaa100% (1)

- Practice Set - TVMDocument2 pagesPractice Set - TVMVignesh KivickyNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Calculating Time Value of MoneyDocument9 pagesCalculating Time Value of MoneyK59 Vu Nguyen Viet LinhNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Calculate compound interest, annuities, present & future valuesDocument1 pageCalculate compound interest, annuities, present & future valuesawaischeemaNo ratings yet

- Concepts 'N' Clarity: Time Value of MoneyDocument11 pagesConcepts 'N' Clarity: Time Value of MoneyKarla CorreaNo ratings yet

- Compound InterestDocument4 pagesCompound Interestapi-361284369No ratings yet

- Compound Interest, Present Value, Annuities and Finding The Interest RatesDocument41 pagesCompound Interest, Present Value, Annuities and Finding The Interest RatesCher Na100% (1)

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- Tutorial QuestionsDocument15 pagesTutorial QuestionsWowKid50% (2)

- Time Value of Money ProblemsDocument2 pagesTime Value of Money ProblemssabyasachibosuNo ratings yet

- FM A Assignment 19-40659-1Document11 pagesFM A Assignment 19-40659-1Pacific Hunter JohnnyNo ratings yet

- Test 6 ReviewDocument4 pagesTest 6 Reviewapi-298215585No ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- FINC 655 Exam #1 Problems and SolutionsDocument7 pagesFINC 655 Exam #1 Problems and SolutionsSheikh HasanNo ratings yet

- PSU Urdaneta Engineering Economics Problem SetDocument1 pagePSU Urdaneta Engineering Economics Problem SetMelissa Joy de GuzmanNo ratings yet

- XYZ MidtermDocument13 pagesXYZ MidtermbooksrfunNo ratings yet

- E120 Fall14 HW2Document2 pagesE120 Fall14 HW2kimball_536238392No ratings yet

- R05 Time Value of Money Practice QuestionsDocument10 pagesR05 Time Value of Money Practice QuestionsAbbas100% (1)

- Midterm RevisionDocument2 pagesMidterm Revisionhoantkss181354No ratings yet

- Lahore School of Economics Financial Management I Time Value of Money - 2 Assignment 3Document2 pagesLahore School of Economics Financial Management I Time Value of Money - 2 Assignment 3Ahmed ZafarNo ratings yet

- Practice Problems For Basic Finance Tools and CalculationsDocument2 pagesPractice Problems For Basic Finance Tools and CalculationsCamille LimNo ratings yet

- ExercisesTVMDocument2 pagesExercisesTVMKenza DerkaouiNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Life Can't Throw A Fast Ball: A Guide to Personal FinanceFrom EverandLife Can't Throw A Fast Ball: A Guide to Personal FinanceNo ratings yet

- 2008 - 2012 BookingDocument1 page2008 - 2012 BookingYu BabylanNo ratings yet

- ACC2 Partnership LiquidationDocument8 pagesACC2 Partnership LiquidationYu BabylanNo ratings yet

- ABC SongDocument1 pageABC SongYu BabylanNo ratings yet

- Presentation of Financial StatementsDocument40 pagesPresentation of Financial StatementsYu BabylanNo ratings yet

- Reporting Financial PerformanceDocument53 pagesReporting Financial PerformanceBrijesh NichaniNo ratings yet

- Course Outline - Human Rights Law (2016-2017)Document2 pagesCourse Outline - Human Rights Law (2016-2017)Yu BabylanNo ratings yet

- SHS Pas1Document58 pagesSHS Pas1Yu BabylanNo ratings yet

- SHS Pas1Document58 pagesSHS Pas1Yu BabylanNo ratings yet

- The Nature of Money, 206ppDocument206 pagesThe Nature of Money, 206ppLocal Money100% (1)

- Quiz# 4Document4 pagesQuiz# 4Yu BabylanNo ratings yet

- Ifrs 22 Aug 09 - VC - 2Document23 pagesIfrs 22 Aug 09 - VC - 2Yu BabylanNo ratings yet

- University of ST La Salle College of Business and Accountancy Bacolod City Accounting 1 - HM Midterm Exam AY 2015-2016, 1 SemesterDocument6 pagesUniversity of ST La Salle College of Business and Accountancy Bacolod City Accounting 1 - HM Midterm Exam AY 2015-2016, 1 SemesterYu BabylanNo ratings yet

- Accounting 1-Co and HMDocument6 pagesAccounting 1-Co and HMYu BabylanNo ratings yet

- Reporting Financial PerformanceDocument53 pagesReporting Financial PerformanceBrijesh NichaniNo ratings yet

- HM Acctg AnswersDocument1 pageHM Acctg AnswersYu BabylanNo ratings yet

- Chapter 01 - BrighamDocument17 pagesChapter 01 - BrighamAudreyMaeNo ratings yet

- HM PrelimsDocument9 pagesHM PrelimsYu BabylanNo ratings yet

- Classroom Policies Fundamentals of Accountancy 2nd Semester AY 2016-2017Document5 pagesClassroom Policies Fundamentals of Accountancy 2nd Semester AY 2016-2017Yu BabylanNo ratings yet

- FIN1S Prelim ExamDocument7 pagesFIN1S Prelim ExamYu BabylanNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Porijeklo I Funkcije NovcaDocument26 pagesPorijeklo I Funkcije NovcapestaliccNo ratings yet

- Chapter 3 FormulaDocument1 pageChapter 3 FormulaYu BabylanNo ratings yet

- IDS RemedialExamsDocument1 pageIDS RemedialExamsYu BabylanNo ratings yet

- Acc 255 Final Exam Review Packet (New Material)Document6 pagesAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaNo ratings yet

- 2 Corinthians 1: 20 - 22 Explains God's Promises in ChristDocument39 pages2 Corinthians 1: 20 - 22 Explains God's Promises in ChristYu BabylanNo ratings yet

- Fundamentals of Financial Management: Concise Third EditionDocument17 pagesFundamentals of Financial Management: Concise Third EditionEngr Fizza AkbarNo ratings yet

- Cash Budget IllustrationDocument1 pageCash Budget IllustrationYu BabylanNo ratings yet

- Cornell Media LunchDocument12 pagesCornell Media LunchYu BabylanNo ratings yet

- NOT To Sell in MayDocument23 pagesNOT To Sell in Maynom1237100% (1)

- Dow Chemical Company Annual Report - 1945Document17 pagesDow Chemical Company Annual Report - 1945fresnoNo ratings yet

- Guru Focus Interview With Arnold VandenbergDocument16 pagesGuru Focus Interview With Arnold VandenbergVu Latticework Poet100% (2)

- Beta Calculation: Zerodha Varsity - Module 4 Chapter 11 - Hedging With FuturesDocument4 pagesBeta Calculation: Zerodha Varsity - Module 4 Chapter 11 - Hedging With FuturesPrathamesh NaikNo ratings yet

- Repurchase Agreement (Repo) & Reverse RepoDocument10 pagesRepurchase Agreement (Repo) & Reverse RepoParth MajmudarNo ratings yet

- Notes On Cash and Cash EquivalentsDocument1 pageNotes On Cash and Cash EquivalentsMariz Julian Pang-aoNo ratings yet

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- Treasury and Federal Agency Securities: Chapter SummaryDocument20 pagesTreasury and Federal Agency Securities: Chapter SummaryasdasdNo ratings yet

- AEL Q1FY20 Performance HighlightsDocument10 pagesAEL Q1FY20 Performance HighlightsPoonam AggarwalNo ratings yet

- I003Document3 pagesI003concast_pankajNo ratings yet

- Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2GDocument149 pagesSpecifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2Gtim winkelmanNo ratings yet

- BCom - Third Year (External) Annual PatternDocument15 pagesBCom - Third Year (External) Annual PatternAshwini kumarNo ratings yet

- Chapter 1 AbcDocument24 pagesChapter 1 AbcChennie Mae Pionan SorianoNo ratings yet

- Fool's Gold-Gillian TettDocument14 pagesFool's Gold-Gillian TettAnkit KhandelwalNo ratings yet

- PQ PQ PQ PQ B/229 B/229 B/229 B/229 Parliamentary Parliamentary Parliamentary Parliamentary Questions Questions Questions QuestionsDocument6 pagesPQ PQ PQ PQ B/229 B/229 B/229 B/229 Parliamentary Parliamentary Parliamentary Parliamentary Questions Questions Questions QuestionsL'express Maurice100% (1)

- Cash and Cash Equivalents (CCE) Definition - InvestopediaDocument3 pagesCash and Cash Equivalents (CCE) Definition - InvestopediaBob KaneNo ratings yet

- Credit Suisse, Market Focus, Jan 17,2013Document12 pagesCredit Suisse, Market Focus, Jan 17,2013Glenn ViklundNo ratings yet

- Formation and Powers of SEBIDocument20 pagesFormation and Powers of SEBIMohd YasinNo ratings yet

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoNo ratings yet

- Value Investors Club - Kraton Performance Polymers (Kra)Document5 pagesValue Investors Club - Kraton Performance Polymers (Kra)Lukas SavickasNo ratings yet

- Green Shoe OptionDocument15 pagesGreen Shoe OptionNadeem Ahmad100% (1)

- Chapter 3 ProblemshhhDocument15 pagesChapter 3 Problemshhhahmed arfanNo ratings yet

- BAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTDocument1 pageBAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTVivek NambiarNo ratings yet

- Case Study - AutoZoneDocument2 pagesCase Study - AutoZoneedselNo ratings yet

- CHMSC-R6 Es2011 PDFDocument5 pagesCHMSC-R6 Es2011 PDFMaria Cristine D. AbsulioNo ratings yet

- Saad SB (Q (4+9) ) FinalDocument4 pagesSaad SB (Q (4+9) ) Finalayazmustafa100% (1)

- Finance Management Notes MbaDocument12 pagesFinance Management Notes MbaSandeep Kumar SahaNo ratings yet

- Negotiable Instruments ExplainedDocument50 pagesNegotiable Instruments ExplainedRolly AcunaNo ratings yet

- MS34Document2 pagesMS34Narasimha SastryNo ratings yet

- Supreme Court rules on case involving unpaid promissory noteDocument7 pagesSupreme Court rules on case involving unpaid promissory noteMik ZeidNo ratings yet