Professional Documents

Culture Documents

Company/Finance/Financial Overview/31/Ashok Leyland Scbcombo1 0 Scbcombo2 0

Uploaded by

bidisha sarmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company/Finance/Financial Overview/31/Ashok Leyland Scbcombo1 0 Scbcombo2 0

Uploaded by

bidisha sarmaCopyright:

Available Formats

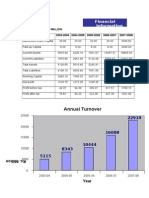

FINANCE - FINANCIAL OVERVIEW - Ashok Leyland Ltd (Curr: Rs in Cr.

) As on 31/10/2014

COMPANY/FINANCE/FINANCIAL OVERVIEW/31/Ashok LeylandscbCombo10scbCombo20

201303

201203

201103

201003

Equity Paid Up

266.07

266.07

133.03

133.03

Networth

3158.46

2898.97

2656.68

2335.58

Capital Employed

7594.18

6073.42

5303.41

4616.02

Gross Block (Excl. Reval. Res.)

6694.68

5943.07

5385.61

4685.46

Net Working Capital ( Incl. Def. Tax)

90.66

-225.09

0.14

806.84

Current Assets ( Incl. Def. Tax)

4356.9

4329.78

4007.2

4178.21

Current Liabilities and Provisions ( Incl. Def. Tax)

4266.24

4554.87

4007.06

3371.37

Total Assets/Liabilities (excl Reval & W.off)

11860.42 10628.29

9310.47

7982.22

Gross Sales

13947.98 14196.41 12392.78

8035.12

Net Sales

13130.62 13379.93 11416.88

7407.23

Other Income

396.9

200.51

44.45

91.17

Value Of Output

12858.63 13546.94

11582.1

7659.08

Cost of Production

10676.06 11394.39

9907.52

6226.46

Selling Cost

1166.72

872.64

535.51

162.52

PBIDT

1228.37

1298.04

1258.15

850.73

PBDT

851.49

1042.79

1069.23

748.88

PBIT

847.59

945.23

990.72

646.62

PBT

470.71

689.98

801.8

544.77

PAT

433.71

565.98

631.3

423.67

Adjusted PAT

163.07

562.27

629.92

383.61

CP

814.49

918.79

898.73

627.78

Revenue earnings in forex

1517.76

1645.95

1176.57

644.45

Revenue expenses in forex

742.24

796.58

734.21

518.04

Capital earnings in forex

0

0

0

0

Capital expenses in forex

280.64

184.22

92.41

284.66

Book Value (Unit Curr)

11.87

10.9

19.97

17.56

Book Value (Adj.) (Unit Curr)

11.87

10.9

19.97

17.56

Market Capitalisation

5840.24

8061.92

7569.41

7429.73

200903

133.03

2109.04

4067.18

3574.09

761.38

3240.6

2479.22

6536.71

6783.99

6098.42

91.23

6099.46

5382.71

117.35

547.18

386.86

368.77

208.45

190

178.79

368.41

983.06

589.4

0

293.82

15.85

15.85

2407.84

200803

133.03

2126.6

3014.1

2920.06

349.5

2891.22

2541.72

5533.53

9141.78

7935.48

84.18

8032.96

6814.79

194.63

891.82

815.51

714.46

638.15

469.31

450.76

646.67

812.77

378.57

0

136.17

15.99

15.99

4695.96

200703

132.39

1871.62

2512.02

2597.25

744.93

2715.13

1970.2

4457.8

8475.42

7320.37

111.56

7369.35

6303.7

170.7

783.92

755.08

633.35

604.51

441.29

425.77

591.86

658.25

274.18

0

243.52

14.14

14.14

5090.4

200603

122.16

1388.51

2080.44

2114.56

644.2

2240.02

1595.82

3668.95

6170.41

5329.81

87.34

5630.41

4738.78

117.3

618.96

578.31

492.95

452.3

327.32

302.47

453.33

472.38

152.02

0

71.87

11.37

11.37

4916.94

200503

118.93

1143.28

2023.69

1977.66

820.75

2162.64

1341.89

3346.24

4886.81

4247.65

81.36

4265.85

3618.41

76.01

494.62

464.22

385.41

355.01

271.41

250.42

380.62

545.24

133.47

0

42.69

9.61

9.61

2497.53

200403

118.93

1026.57

1525.47

1850.41

450.68

1465.08

1014.4

2507.55

3979.57

3440.54

57.24

3493.57

2950.96

52.3

442.32

382.91

345.87

286.46

193.58

196.61

290.03

302.86

114.12

0

14.94

86.32

86.32

3016.06

200303

118.93

933.61

1651.13

1786.19

579.59

1340.47

760.88

2412.01

3125.72

2757.27

52.44

2596.69

2174.7

51.72

368.69

273.07

265.72

170.1

120.21

123.78

223.18

209.89

90.51

0

23.5

78.5

78.5

1159.57

200203

118.93

1010.43

1898.42

1663.91

792.86

1558.68

765.82

2659.33

2696.61

2327.41

50.78

2432.01

2070.58

66.16

342.82

227.57

247.46

132.21

92.26

93.2

187.62

165.69

107.03

0

21.6

84.96

84.96

952.63

200103

118.93

1151.6

2084.61

1522.21

1022.29

1563.4

541.11

2615.5

2669.63

2314.98

43.47

2394.49

2013.07

62.97

322.45

190.29

234.1

101.94

91.68

90.75

180.03

171.72

120.89

0

28.12

96.83

96.83

560.16

200003

118.93

1112.34

2078.03

1466.61

1032.95

1464.24

431.29

2502.64

2676.46

2331

54.98

2359.85

1981.91

77.74

311.44

175.73

229

93.29

78.49

77.44

160.93

161.31

109.77

0

6.29

93.53

93.53

807.53

199903

118.93

1080.06

2042.22

1379.32

1049.06

1446.1

397.04

2433.87

2101.52

1875.14

87.74

1711.14

1498.84

56.45

253.34

99.51

177.15

23.32

20.37

6.7

96.56

178.57

50.4

0

27.98

90.81

90.81

505.45

Financial Years High & Low Prices

High Date (BSE)

High Price (BSE)

Low Date (BSE)

Low Price (BSE)

Year End Price Date (BSE)

Year End Price (BSE)

High Date (NSE)

High Price (NSE)

Low Date (NSE)

Low Price (NSE)

Year End Price Date (NSE)

Year End Price (NSE)

CEPS (annualised) (Unit Curr)

EPS (annualised) (Unit Curr)

EPS (Annualised) (Adjusted) (Unit Curr)

Dividend (annualised%)

Payout (%)

Cash Flow From Operating Activities

Cash Flow From Investing Activities

Cash Flow From Financing Activities

Rate of Growth (%)

ROG-Net Worth (%)

ROG-Capital Employed (%)

ROG-Gross Block (%)

ROG-Gross Sales (%)

ROG-Net Sales (%)

ROG-Cost of Production (%)

ROG-Total Assets (%)

ROG-PBIDT (%)

ROG-PBDT (%)

ROG-PBIT (%)

ROG-PBT (%)

ROG-PAT (%)

ROG-CP (%)

ROG-Revenue earnings in forex (%)

ROG-Revenue expenses in forex (%)

ROG-Market Capitalisation (%)

Key Ratios

Debt-Equity Ratio

Long Term Debt-Equity Ratio

Current Ratio

Turnover Ratios

Fixed Assets Ratio

Inventory Ratio

Debtors Ratio

Total Asset Turnover Ratio

Interest Cover Ratio

PBIDTM (%)

PBITM (%)

PBDTM (%)

CPM (%)

APATM (%)

ROCE (%)

RONW (%)

Debtors Velocity (Days)

Creditors Velocity (Days)

Assets Utilisation Ratio (times)

Value of Output/Total Assets

Value of Output/Gross Block

2-May-12 17-Feb-12

32.9

30.5

30-Aug-12 22-Dec-11

20.25

20.05

28-Mar-13 30-Mar-12

21.95

30.3

2-May-12 17-Feb-12

33.5

30.6

11-Sep-12 22-Dec-11

18.75

20

28-Mar-13 30-Mar-12

21.85

30.35

8-Nov-10

40.95

24-Feb-11

22.55

31-Mar-11

28.45

8-Nov-10

40.95

24-Feb-11

22.53

31-Mar-11

28.43

14-Jan-10

28.4

6-Apr-09

8.95

31-Mar-10

27.93

5-Mar-10

28.98

6-Apr-09

8.9

31-Mar-10

27.9

5-May-08

22.03

12-Dec-08

6.23

31-Mar-09

9.05

24-Apr-08

22.1

12-Dec-08

6.15

31-Mar-09

9.08

8-Jan-08

28.95

22-Jan-08

12.9

31-Mar-08

17.65

8-Jan-08

28.75

22-Jan-08

13.08

31-Mar-08

17.7

2-May-06

26.98

22-May-06

15.15

30-Mar-07

19.23

2-May-06

26.5

22-May-06

14.55

30-Mar-07

19.2

7-Mar-06

21.5

18-Apr-05

10.28

31-Mar-06

20.13

6-Mar-06

21.38

18-Apr-05

10.2

31-Mar-06

20.15

23-Apr-04

14.6

25-Aug-04

8.5

31-Mar-05

10.5

23-Apr-04

14.86

25-Aug-04

8.5

31-Mar-05

10.53

14-Jan-04

15.53

1-Apr-03

4.82

31-Mar-04

12.68

15-Jan-04

15.59

1-Apr-03

4.81

31-Mar-04

12.66

1-Jul-02

6.14

4-Apr-02

3.95

31-Mar-03

4.88

28-Jun-02

6.15

4-Apr-02

3.88

31-Mar-03

4.83

21-Feb-02

4.77

12-Apr-01

2.04

28-Mar-02

4.01

21-Feb-02

4.78

12-Apr-01

2.04

28-Mar-02

4.02

26-Apr-00

3.91

12-Oct-00

1.66

30-Mar-01

2.36

14-Jun-00

3.92

17-Oct-00

1.7

30-Mar-01

2.37

18-Aug-99

7.95

28-Apr-99

1.37

31-Mar-00

3.4

18-Aug-99

8.05

28-Apr-99

1.38

31-Mar-00

3.45

22-Apr-98

3.07

13-Oct-98

1

31-Mar-99

2.13

22-Apr-98

3.1

13-Oct-98

1

31-Mar-99

2.13

2.96

1.53

1.53

60

39

728.3

-1164.93

416.98

3.29

1.96

1.96

100

51

1147.31

-1054.1

-241.12

6.43

4.42

4.42

200

45

591.38

-917.73

-13.63

4.47

2.94

2.94

150

51

1090.06

-783.17

123.31

2.6

1.26

1.26

100

79

-525.58

-664.18

459.18

4.61

3.27

3.27

150

46

1065.69

-809.68

364.52

4.26

3.12

3.12

150

48

499.95

-722.2

-290.84

3.53

2.5

2.5

120

52

322.02

-133.59

-257.6

3.06

2.14

2.14

100

47

447.35

-155.45

280.38

23.43

15.32

15.32

75

49

540.68

-83.68

-334.98

18.12

9.47

9.47

50

53

361.27

-143.6

-275.8

15.78

7.76

7.76

45

58

370.03

-91.14

-159.34

14.73

7.3

7.3

40

55

354.66

-147.22

-46.68

13.15

6.21

6.21

35

56

94.34

-60.99

-99.17

8.01

1.6

1.6

10

62

432.98

-151.36

-184.96

8.95

25.04

12.65

-1.75

-1.86

-5.98

11.59

-5.37

-18.35

-10.33

-31.78

-23.37

-11.35

-7.79

-6.82

-27.56

9.12

14.52

10.35

14.55

17.19

14.93

14.15

3.17

-2.47

-4.59

-13.95

-10.35

2.23

39.89

8.49

6.51

13.75

14.89

14.94

54.23

54.13

50.97

16.64

47.89

42.78

53.22

47.18

49.01

43.16

82.57

41.73

1.88

10.74

13.49

31.1

18.44

21.46

21.84

22.11

55.48

93.58

75.35

161.34

122.98

70.4

-34.44

-12.11

208.56

-0.83

34.94

22.4

-25.79

-23.15

-21.3

18.13

-38.64

-52.56

-48.38

-67.34

-59.52

-43.03

20.95

55.69

-48.73

13.62

19.99

12.43

7.86

8.4

8.78

24.13

13.76

8

12.81

5.56

6.35

9.26

23.47

38.07

-7.75

34.79

20.74

22.83

37.36

37.35

30.63

21.5

26.65

30.57

28.48

33.65

34.82

30.56

39.35

80.36

3.53

21.45

2.8

6.92

26.27

25.48

32.13

9.64

25.14

24.58

27.9

27.4

20.6

19.1

-13.36

13.9

96.87

11.37

32.66

6.88

22.8

23.46

22.87

33.45

11.82

21.23

11.43

23.93

40.21

31.23

80.03

16.96

-17.19

9.96

-7.61

3.6

27.32

24.78

36.69

3.96

19.97

40.22

30.16

68.41

61.03

29.95

44.29

26.09

160.1

-7.6

-13.03

7.35

15.91

18.47

6.23

-9.3

7.55

19.99

7.38

28.66

30.29

18.95

26.68

-15.43

21.72

-12.26

-8.93

9.31

1.01

0.54

1.11

1.68

6.32

19.59

5.71

29.69

0.63

4.22

-3.51

-11.46

70.06

3.53

0.32

3.79

-0.26

-0.69

1.41

4.51

3.54

8.29

2.23

9.27

16.8

11.87

6.45

10.13

-30.63

2.99

1.75

6.33

27.36

24.31

35.62

2.83

22.93

76.6

29.27

300.04

285.32

66.66

-9.67

117.8

59.76

0.7

-11.97

12.99

1.87

3.17

-11

-12.13

-3.91

9.09

-8.26

12.88

10.65

8.53

7.76

-50.31

2.66

1.23

0.83

0.77

1.02

0.84

0.87

0.97

0.93

1.08

0.95

0.95

1.27

0.67

0.67

1.22

0.38

0.35

1.2

0.41

0.36

1.34

0.62

0.62

1.5

0.64

0.64

1.54

0.62

0.62

1.58

0.83

0.74

1.71

0.84

0.67

1.87

0.84

0.66

2.2

0.88

0.72

2.48

1.03

0.9

2.93

2.21

6.76

10.53

1.71

1.47

6.7

3.97

4

3.9

1.17

8.1

5.38

35

79

2.51

6.4

11.85

2.03

3.7

9.14

6.66

7.35

6.47

3.99

16.62

20.37

34

74

2.46

6.44

11.34

1.97

5.24

10.15

7.99

8.63

7.25

5.09

19.99

25.29

32

61

1.95

5.41

8.12

1.41

6.35

10.59

8.05

9.32

7.81

5.27

14.92

19.06

31

55

2.09

5.31

10.17

1.61

2.3

8.07

5.44

5.7

5.43

2.8

10.46

8.97

23

58

3.31

7.97

20.34

3.31

9.36

9.76

7.82

8.92

7.07

5.13

26.08

23.48

25

54

3.6

8.59

17.9

3.68

21.96

9.25

7.47

8.91

6.98

5.21

27.77

27.07

24

49

3.02

8.39

13.97

2.99

12.13

10.03

7.99

9.37

7.35

5.3

24.18

25.86

25

47

2.55

9.09

11.31

2.76

12.68

10.12

7.89

9.5

7.79

5.55

22.04

25.02

24

45

2.19

8.68

8.62

2.49

5.82

11.11

8.69

9.62

7.29

4.86

22

19.75

25

43

1.81

6.22

6.18

1.74

2.78

11.8

8.5

8.74

7.14

3.85

14.99

12.37

25

44

1.69

4.85

4.65

1.34

2.15

12.71

9.18

8.44

6.96

3.42

12.47

8.53

27

42

1.79

5.47

3.75

1.27

1.77

12.08

8.77

7.13

6.74

3.43

11.29

8.1

28

42

1.88

6.04

3.53

1.29

1.69

11.64

8.56

6.57

6.01

2.93

11.15

7.16

29

42

1.62

3.87

2.53

0.95

1.05

11.31

7.68

3.99

3.94

0.32

7.43

0.62

30

42

1.14

2.03

1.21

2.13

1.3

2.26

1.4

2.5

1.48

2.67

1.58

2.77

1.66

2.92

1.69

2.97

1.79

3.01

1.8

3.03

1.77

3.08

1.78

3.13

1.79

3.15

1.8

3.19

1.76

3.25

You might also like

- Ashok LeylandDocument6 pagesAshok Leylandkaaviya6No ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Application of Funds (In Rs. Crores)Document4 pagesApplication of Funds (In Rs. Crores)Basil SamlioneNo ratings yet

- BCMLanalysisDocument6 pagesBCMLanalysisVishal KinageNo ratings yet

- Description Variable 2008: Financial Leverege (Nfo/cse)Document9 pagesDescription Variable 2008: Financial Leverege (Nfo/cse)Nizam Uddin MasudNo ratings yet

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30No ratings yet

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- Oil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)Document16 pagesOil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)ravi198522No ratings yet

- Comparative Balance Sheet of BSNL LTDDocument19 pagesComparative Balance Sheet of BSNL LTDsmarty19b100% (2)

- Parle Product FinanciaDocument14 pagesParle Product FinanciaAbinash Behera100% (1)

- SOUTHREN CHIPS & CIRCUITS (P) LTD., Bangalore Balance Sheet For Year Ending 31 MarchDocument3 pagesSOUTHREN CHIPS & CIRCUITS (P) LTD., Bangalore Balance Sheet For Year Ending 31 MarchmuralikrishnavNo ratings yet

- We Are Not Above Nature, We Are A Part of NatureDocument216 pagesWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVNo ratings yet

- Tata Steel's Balance Sheet and Financial Ratios AnalysisDocument12 pagesTata Steel's Balance Sheet and Financial Ratios AnalysisDhwani ShahNo ratings yet

- Financial Analysis ToolDocument50 pagesFinancial Analysis ToolContessa PetriniNo ratings yet

- SAIL Consolidated Cash Flow 2012-2002Document1 pageSAIL Consolidated Cash Flow 2012-2002Utkarsh PandeyNo ratings yet

- Balance SheetDocument1 pageBalance SheetAshutosh KumarNo ratings yet

- Fortis HealthcareDocument3 pagesFortis HealthcareAnant ChhajedNo ratings yet

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- Bajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersDocument16 pagesBajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersCma Saurabh AroraNo ratings yet

- Pertemuan 45 2-3.b.-NERACADocument24 pagesPertemuan 45 2-3.b.-NERACAMuna RismaNo ratings yet

- Balance Sheet of Axis Bank: - in Rs. Cr.Document37 pagesBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet

- Rationale of Mergers & Acquisitions: Assignment 1Document6 pagesRationale of Mergers & Acquisitions: Assignment 1mujtabaansariNo ratings yet

- Group 9 - ONGC - MA ProjectDocument13 pagesGroup 9 - ONGC - MA ProjectShubham JainNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- Diamond Cutting Industry Retained EarningsDocument12 pagesDiamond Cutting Industry Retained EarningsVaibhav ShahNo ratings yet

- Analysis Report PsoDocument3 pagesAnalysis Report PsoMuhammad Waqas HafeezNo ratings yet

- Particulars 31-3-2011 31-3-2012 Increase Decrease Current AssetsDocument25 pagesParticulars 31-3-2011 31-3-2012 Increase Decrease Current AssetsJithendar ReddyNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- Finished Goods Consumed For Capital JobsDocument2 pagesFinished Goods Consumed For Capital JobsjoNANo ratings yet

- Financial Ratio Analysis of PSO and SPL (Shell) ........ TAHIR SAMIDocument35 pagesFinancial Ratio Analysis of PSO and SPL (Shell) ........ TAHIR SAMISAM100% (1)

- Previous Years: Bajaj Auto - in Rs. Cr.Document10 pagesPrevious Years: Bajaj Auto - in Rs. Cr.maddikaNo ratings yet

- Balance Sheet: (Except For Per Share Items)Document4 pagesBalance Sheet: (Except For Per Share Items)Monica ReyesNo ratings yet

- Bajaj Auto FinancialsDocument21 pagesBajaj Auto FinancialsJanendra YadavNo ratings yet

- HDFC Bank Balance Sheet and Profit Loss ReportsDocument7 pagesHDFC Bank Balance Sheet and Profit Loss ReportsSunny_Chatlani_8157No ratings yet

- Ace AnalyserDocument2 pagesAce Analyservahora123No ratings yet

- Comparative Income Statement 2007-2011Document7 pagesComparative Income Statement 2007-2011ramyakrishnamurthyNo ratings yet

- Analysis of financial ratios for multiple companies over 8 yearsDocument82 pagesAnalysis of financial ratios for multiple companies over 8 yearssamuel safoNo ratings yet

- Quarterly Acc 3rd 2011 12Document10 pagesQuarterly Acc 3rd 2011 12Asif Al AminNo ratings yet

- DR Umesh SolankiDocument29 pagesDR Umesh Solankivivek guptaNo ratings yet

- Analisis Laporan Keuangan PT XL AXIATA TBKDocument9 pagesAnalisis Laporan Keuangan PT XL AXIATA TBKmueltumorang0% (1)

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- STATE BANK OF INDIA ANALYSISDocument21 pagesSTATE BANK OF INDIA ANALYSISsarthak bhusalNo ratings yet

- Balance SheetDocument1 pageBalance SheetBharat AroraNo ratings yet

- 18 Horizontal & Vertical AnalysisDocument2 pages18 Horizontal & Vertical AnalysisChaudhry EzHarNo ratings yet

- Tata Steel - Chorus Acquistion: - Presented by Ashish Kumar Gaurav Sahai Nitish Bharadwaj Abhishek KumarDocument8 pagesTata Steel - Chorus Acquistion: - Presented by Ashish Kumar Gaurav Sahai Nitish Bharadwaj Abhishek KumarNitish BhardwajNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Consolidated AFR 31mar2011Document1 pageConsolidated AFR 31mar20115vipulsNo ratings yet

- Asset Liability Management at HDFC BankDocument31 pagesAsset Liability Management at HDFC BankwebstdsnrNo ratings yet

- Bajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeDocument25 pagesBajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeRohan NimkarNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- BhartiAndMTN FinancialsDocument10 pagesBhartiAndMTN FinancialsGirish RamachandraNo ratings yet

- Ratio Analysis of OngcDocument6 pagesRatio Analysis of OngcJatender SinghNo ratings yet

- Blackberry Financial StatementsDocument12 pagesBlackberry Financial StatementsSelmir V KlicicNo ratings yet

- Financial Information MAR 08Document1 pageFinancial Information MAR 08Sandeep SolankiNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument4 pagesApollo Hospitals Enterprise Limitedpaigesh1No ratings yet

- Financial Highlights: Hinopak Motors LimitedDocument6 pagesFinancial Highlights: Hinopak Motors LimitedAli ButtNo ratings yet

- Sources of Finance and Impact On Financial Statements Finance EssayDocument12 pagesSources of Finance and Impact On Financial Statements Finance EssayHND Assignment Help50% (2)

- Chapter-1 Introduction To Project Report: Comparative AnalysisDocument42 pagesChapter-1 Introduction To Project Report: Comparative AnalysisamoghvkiniNo ratings yet

- Introduction To Stock ExchangeDocument34 pagesIntroduction To Stock ExchangevivekdograNo ratings yet

- Report TemplateDocument1,846 pagesReport Templatehindu_for_everNo ratings yet

- 2019 FRM Pe2 020519Document176 pages2019 FRM Pe2 020519Anish Jagdish Lakhani67% (3)

- Our Banking Practice BrochureDocument16 pagesOur Banking Practice BrochureMarius AngaraNo ratings yet

- Soal "Fake" Uts B. Inggris (M. Rizki)Document2 pagesSoal "Fake" Uts B. Inggris (M. Rizki)hauraNo ratings yet

- Guide To Expert Options Trading: Advanced Strategies That Will Put You in The Money FastDocument16 pagesGuide To Expert Options Trading: Advanced Strategies That Will Put You in The Money Fastemma0% (1)

- Capital Market TerminologiesDocument4 pagesCapital Market Terminologiesnahid250100% (2)

- KYC Form GI Tech Limited ChennaiDocument1 pageKYC Form GI Tech Limited ChennaiwhiterupNo ratings yet

- SEC - Form 10.1 - Notice of Exempt Transactions PDFDocument3 pagesSEC - Form 10.1 - Notice of Exempt Transactions PDFRosa Alia S. Mendoza-MartelinoNo ratings yet

- Petrol Pump Financing Project Report6Document9 pagesPetrol Pump Financing Project Report6pradip_kumar0% (1)

- What Happened at Enron?: Ken Lay and Enron CorporationDocument22 pagesWhat Happened at Enron?: Ken Lay and Enron CorporationCostescu-Dinu ClaudiaNo ratings yet

- DRHP 20200928114343Document391 pagesDRHP 20200928114343SubscriptionNo ratings yet

- Banerji Aditya ResumeDocument1 pageBanerji Aditya Resumeapi-3092025070% (1)

- List of Brokerage Firms PDFDocument37 pagesList of Brokerage Firms PDFSajadChannaNo ratings yet

- Personal LoansDocument49 pagesPersonal Loansrohitservi50% (2)

- Afar JpiaDocument18 pagesAfar JpiaAken Lieram Ats AnaNo ratings yet

- (2013) Abdel-Kader - What Are Structural Policies PDFDocument2 pages(2013) Abdel-Kader - What Are Structural Policies PDF0treraNo ratings yet

- PDFDocument205 pagesPDFshree tradersNo ratings yet

- Lecture 9, Part 1 Graphical Patterns AnalysisDocument10 pagesLecture 9, Part 1 Graphical Patterns AnalysisHilmi AbdullahNo ratings yet

- Mergers Acquisitions in IndiaDocument162 pagesMergers Acquisitions in Indiashivam_2607No ratings yet

- Unit 6 PreparationDocument6 pagesUnit 6 Preparationapi-317284264No ratings yet

- Hybrid SyllabusDocument7 pagesHybrid SyllabusYOG RAJANINo ratings yet

- Chapter 2Document22 pagesChapter 2John Edwinson JaraNo ratings yet

- How To Succeed As A Sell Side Trader: Brent DonnellyDocument9 pagesHow To Succeed As A Sell Side Trader: Brent DonnellyAlvinNo ratings yet

- The Following Securities Are in Pascual Company S Portfolio of L PDFDocument1 pageThe Following Securities Are in Pascual Company S Portfolio of L PDFAnbu jaromiaNo ratings yet

- The Mauritius Union Assurance Co LTD ProfileDocument13 pagesThe Mauritius Union Assurance Co LTD ProfileSundeep El-NinoNo ratings yet

- MS&E 448 Final Presentation High Frequency Algorithmic TradingDocument29 pagesMS&E 448 Final Presentation High Frequency Algorithmic Trading123No ratings yet

- Accounting in ActionDocument38 pagesAccounting in ActionjaberalislamNo ratings yet