Professional Documents

Culture Documents

Acc101 Probset1 v2

Uploaded by

BamPanggatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc101 Probset1 v2

Uploaded by

BamPanggatCopyright:

Available Formats

ATENEO DE MANILA UNIVERSITY

JOHN GOKONGWEI SCHOOL OF MANAGEMENT

ACC101: COST ACCOUNTING

EXERCISES ON CVP AND JOB COSTING

PROBLEM SET #1A M.D. WONG

AY 2016-20167 | 1ST SEMESTER

DIRECTIONS: Answer the following on a clean sheet of paper (or scratch paper with one clean side). Please show

relevant solutions and box your final answer.

1.

Withee produces a quick setting concrete powder. Production of 15,000 tons was started in September,

14,000 tons were completed. Material costs were $394,670 for the month while conversion costs were

$201,730. There was no beginning work-in-process; the ending work-in-process was 20% complete.

What is the total cost of the product that was completed and transferred to finished goods?

What is the value of the ending work-in-process?

2.

The predetermined overhead rate for manufacturing overhead for 2012 is $4.00 per direct labor hour.

Employees are expected to earn $5.00 per hour and the company is planning on paying its employees

$100,000 during the year. However, only 75% of the employees are classified as "direct labor." What was the

estimated manufacturing overhead for 2012?

3.

Before prorating the manufacturing overhead costs at the end of 2012, the Cost of Goods Sold and Finished

Goods Inventory had applied overhead costs of $57,500 and $20,000 in them, respectively. There was no

Work-in-Process at the beginning or end of 2012. During the year, manufacturing overhead costs of $74,000

were actually incurred. The balance in the Applied Manufacturing Overhead was $77,500 at the end of 2012. If

the under or overapplied overhead is prorated between Cost of Goods Sold and the inventory accounts, how

much will be allocated to the Finished Goods Inventory?

4.

Before prorating the manufacturing overhead costs at the end of 2012, the Cost of Goods Sold and Finished

Goods Inventory had applied overhead costs of $57,500 and $20,000 in them, respectively. There was no

Work-in-Process at the beginning or end of 2012. During the year, manufacturing overhead costs of $74,000

were actually incurred. The balance in the Applied Manufacturing Overhead was $77,500 at the end of 2012. If

the under- or overapplied overhead is prorated between Cost of Goods Sold and the inventory accounts, how

much will be the Cost of Goods Sold after the proration?

5.

The Work-in-Process Inventory account of a manufacturing firm has a balance of $2,400 at the end of an

accounting period. The job cost sheets of two uncompleted jobs show charges of $400 and $200 for materials

used, and charges of $300 and $500 for direct labor used. Overhead is applied as a percentage of direct labor

costs. What is the predetermine rate?

6.

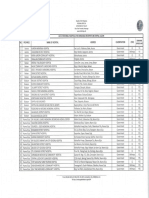

Tillman Corporation uses job costing and has two production departments, M and A. Budgeted manufacturing

costs for the year are as follows:

The actual direct material and direct labor costs charged to Job. No. 432 during the year were as follows:

Tillman applies manufacturing overhead to production orders on the basis of direct labor cost using

departmental rates predetermined at the beginning of the year based on the annual budget. What is the total

cost associated with Job. No. 432 for the year?

ATENEO DE MANILA UNIVERSITY

JOHN GOKONGWEI SCHOOL OF MANAGEMENT

ACC101: COST ACCOUNTING

7.

EXERCISES ON CVP AND JOB COSTING

PROBLEM SET #1A M.D. WONG

AY 2016-20167 | 1ST SEMESTER

The following selected data were taken from the books of the Bixby Box Company. The company uses job

costing to account for manufacturing costs. The data relate to June operations.

A) Materials and supplies were requisitioned from the stores clerk as follows:

Job 405, material X, $7,000.

Job 406, material X, $3,000; material Y, $6,000.

Job 407, material X, $7,000; material Y, $3,200.

For general factory use: materials A, B, and C, $2,300.

B) Time tickets for the month were chargeable as follows:

C) Other information:

Factory paychecks for $36,700 were issued during the month.

Various factory overhead charges of $19,400 were incurred on account.

Depreciation of factory equipment for the month was $5,400.

Factory overhead was applied to jobs at the rate of $3.50 per direct labor hour.

Job orders completed during the month: Job 405 and Job 406.

Selling and administrative costs were $2,100.

Factory overhead is closed out only at the end of the year.

a. If Job 406 was sold on account for $41,500, how much is the gross profit for the job?

b. The end of the month Work-in-Process Inventory balance would be?

c. The balance in the factory overhead account would represent the fact that overhead was?

8.

The following events took place at a manufacturing company for the current year:

(1) Purchased $95,000 in direct materials.

(2) Incurred labor costs as follows: (a) direct, $56,000 and (b) indirect, $13,600.

(3) Other manufacturing overhead was $107,000, excluding indirect labor.

(4) Transferred 80% of the materials to the manufacturing assembly line.

(5) Completed 65% of the Work-in-Process during the year.

(6) Sold 85% of the completed goods.

(7) There were no beginning inventories.

a. What is the company's Cost of Goods Sold?

b. What is the value of the ending Work-in-Process Inventory?

c. What is the value of the ending Finished Goods Inventory?

9.

Compute the Work-in-Process transferred to the finished goods warehouse on April 30 using the following

information:

ATENEO DE MANILA UNIVERSITY

JOHN GOKONGWEI SCHOOL OF MANAGEMENT

ACC101: COST ACCOUNTING

EXERCISES ON CVP AND JOB COSTING

PROBLEM SET #1A M.D. WONG

AY 2016-20167 | 1ST SEMESTER

10.

Two jobs were worked on during the year: Job A-101 and Job A-102. The number of direct labor-hours spent

on Job A-101 and Job A-102 were 1,200 and 1,000, respectively. The actual manufacturing overhead was

$37,000.

a. What is the predetermined manufacturing overhead rate per direct labor hour for the year?

b. What was the amount of manufacturing overhead applied to Job A-101?

c. What is the amount of the under- or overapplied manufacturing overhead?

11. The Update Company does not maintain backup documents for its computer files. In June, some of the current

data were lost, and you have been asked to help reconstruct the data. The following beginning balances on

June 1 are known:

Reviewing old documents and interviewing selected employees have generated the following additional

information:

The production superintendent's job cost sheets indicated that materials of $2,600 were included in the

June 30 Work-in-Process Inventory. Also, 300 direct labor-hours had been paid at $6.00 per hour for the

jobs in process on June 30.

The Accounts Payable account is only for direct material purchases. The clerk remembers clearly that the

balance in the Accounts Payable on June 30 was $8,000. An analysis of canceled checks indicated

payments of $40,000 were made to suppliers during June.

Payroll records indicate that 5,200 direct labor-hours were recorded for June. It was verified that there

were no variations in pay rates among employees during June.

Records at the warehouse indicate that the Finished Goods Inventory totaled $16,000 on June 30.

Another record kept manually indicates that the Cost of Goods Sold in June totaled $84,000.

The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and

an estimated $180,000 in manufacturing overhead costs.

a.

b.

c.

d.

e.

What is the ending balance in the Work-in-Process Inventory on June 30?

What is the amount of direct materials purchased during June?

What is the Cost of Goods Manufactured for June?

How much manufacturing overhead was applied to the Work-in-Process Inventory during June?

What is the ending balance in the Direct Materials Inventory on June 30?

ATENEO DE MANILA UNIVERSITY

JOHN GOKONGWEI SCHOOL OF MANAGEMENT

ACC101: COST ACCOUNTING

EXERCISES ON CVP AND JOB COSTING

PROBLEM SET #1A M.D. WONG

AY 2016-20167 | 1ST SEMESTER

12. The financial records for the Lee Manufacturing Company have been destroyed in a fire. The following

information has been obtained from a separate set of books maintained by the cost accountant. The cost

accountant now asks for your assistance in computing the missing amounts.

a. What is the amount of the materials purchased?

b. What is the value of the ending Work-in-Process inventory balance?

c. What is the value of the beginning Finished Goods Inventory?

13. Scottso Corporation applies overhead using a normal costing approach based upon machine-hours. Budgeted

factory overhead was $266,400, budgeted machine-hours were 18,500. Actual factory overhead was

$287,920, actual machine-hours were 19,050.

a. How much overhead would be applied to production?

b. How much is the Over- or underapplied overhead?

c. How much overhead would be applied to production?

14. Daguio Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year,

the total estimated manufacturing overhead was $224,580. At the end of the year, actual direct labor-hours

for the year were 18,200 hours, manufacturing overhead for the year was underapplied by $12,100, and the

actual manufacturing overhead was $219,580. The predetermined overhead rate for the year must have been

closest to what?

15. Wert Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing

overhead to jobs. Last year, the company's estimated manufacturing overhead was $1,200,000 and its

estimated level of activity was 50,000 direct labor-hours. The company's direct labor wage rate is $12 per

hour. Actual manufacturing overhead amounted to $1,240,000, with actual direct labor cost of $650,000. For

the year, manufacturing overhead was over- or underapplied by?

16. Craddock sells three products. Last month's results are as follows:

Total fixed costs are $100,000 marketing and $125,000 administrative.

Required:

a. What was the operating profit last month?

b. What is Craddock's break-even sales volume (at the given mix)?

c. What is Craddock's margin of safety?

ATENEO DE MANILA UNIVERSITY

JOHN GOKONGWEI SCHOOL OF MANAGEMENT

ACC101: COST ACCOUNTING

EXERCISES ON CVP AND JOB COSTING

PROBLEM SET #1A M.D. WONG

AY 2016-20167 | 1ST SEMESTER

17. You have been provided with the following information regarding the York Manufacturing Company:

This information is based on forecasted sales of 30,000 units.

Required:

a. What is the expected operating profit for the upcoming year?

b. What is the break-even point in units?

c. If $160,000 of operating profit is desired, how many units must be sold?

18. Rosy's Creations has budgeted annual fixed costs of $240,000 and an estimated variable cost ratio of 60%.

Required:

a. Compute Rosy's break-even point in sales dollars.

b. Compute Rosy's margin of safety if the company expects to earn revenues of $800,000.

c. Compute Rosy's expected operating profit at the $800,000 revenue.

19. The Ciao Line Buffet is a new buffet-style restaurant offering pizza and Italian dishes. The buffet has a fixed

price of $8.50 per person. The estimated food costs are $2.00 per person, regardless of volume. Fixed costs

are related to the number of buffet lines that are maintained, with the estimated costs as follows:

Determine the break-even point(s).

20. Colen Corporation produces and sells a single product. In January, the company sold 1,700 units. Its total sales

were $153,000, its total variable costs were $79,900, and its total fixed costs were $56,800.

Required:

a. Construct the company's contribution format income statement for January in good form.

b. Redo the company's contribution format income statement assuming that the company sells 1,600

units.

You might also like

- God of Mercy and Compassion - Lead Sheet in GDocument1 pageGod of Mercy and Compassion - Lead Sheet in GBamPanggat67% (3)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Amended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramDocument11 pagesAmended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramVaishaNo ratings yet

- Basic Tax OutlineDocument108 pagesBasic Tax OutlinestaceyNo ratings yet

- ACCA AAA MJ19 Notes PDFDocument156 pagesACCA AAA MJ19 Notes PDFOmer ZaheerNo ratings yet

- Startup Companies - PowerPointDocument16 pagesStartup Companies - PowerPointFranklin Rege100% (1)

- Act Exam 1Document14 pagesAct Exam 1aman_nsu100% (1)

- PananaligDocument1 pagePananaligBamPanggat100% (1)

- Chords Nothings Gonna Stop Us NowDocument2 pagesChords Nothings Gonna Stop Us NowBamPanggatNo ratings yet

- FIDIC Contracts Claims Management Dispute ResolutionDocument3 pagesFIDIC Contracts Claims Management Dispute ResolutionadamcyzNo ratings yet

- Philippine Laws on Credit TransactionsDocument5 pagesPhilippine Laws on Credit TransactionsCamille ArominNo ratings yet

- BSA QualifyingReviewer-6 PDFDocument12 pagesBSA QualifyingReviewer-6 PDFQueen ElleNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Cost Accounting Qualifying Exam Reviewer 2017Document12 pagesCost Accounting Qualifying Exam Reviewer 2017Adrian Francis100% (1)

- WorldCom CaseDocument9 pagesWorldCom CaseunjustvexationNo ratings yet

- International Monetary SystemDocument16 pagesInternational Monetary Systemriyaskalpetta100% (2)

- Advent Season Sunday Mass English Mass: RepertoireDocument23 pagesAdvent Season Sunday Mass English Mass: RepertoireIan CristopherNo ratings yet

- 12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaDocument2 pages12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaIrene Mae GomosNo ratings yet

- Efficio Survey Reveals Procurement ChallengesDocument13 pagesEfficio Survey Reveals Procurement ChallengesAditya JohariNo ratings yet

- At Kami'y Aawit : Panahon NG Adbiyento (Linggo)Document22 pagesAt Kami'y Aawit : Panahon NG Adbiyento (Linggo)BamPanggat100% (1)

- Telekom Bill: Page 1 of 6Document6 pagesTelekom Bill: Page 1 of 6Zulkhibri ZulNo ratings yet

- Problem Job Order CostingDocument6 pagesProblem Job Order CostingAlan Carlo Galvez100% (1)

- Tutorial 3 - Process CostingDocument5 pagesTutorial 3 - Process Costingsouayeh wejdenNo ratings yet

- Amended Guidelines Abot-Kamay Pabahay Program'Document30 pagesAmended Guidelines Abot-Kamay Pabahay Program'Ge-An Moiseah Salud AlmueteNo ratings yet

- Job Costing and Overhead ER PDFDocument16 pagesJob Costing and Overhead ER PDFShaira VillaflorNo ratings yet

- Day 06Document8 pagesDay 06Cy PenalosaNo ratings yet

- Prelims Reviewer For Cost AccountingDocument29 pagesPrelims Reviewer For Cost AccountingPamela Cruz100% (1)

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDocument34 pagesZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNo ratings yet

- CACCDocument3 pagesCACCMarielle JalandoniNo ratings yet

- Practice Problem Job CostingDocument4 pagesPractice Problem Job CostingDonna Zandueta-TumalaNo ratings yet

- Practice Questions - Class Excercises 2Document12 pagesPractice Questions - Class Excercises 2Chris With LuvNo ratings yet

- Discussion - Job CostingDocument3 pagesDiscussion - Job CostingHannah Jane ToribioNo ratings yet

- 2020 Practice MCQsDocument28 pages2020 Practice MCQsĐàm Quang Thanh TúNo ratings yet

- Managerial Accounting Canadian Canadian 10th Edition Garrison Test Bank DownloadDocument132 pagesManagerial Accounting Canadian Canadian 10th Edition Garrison Test Bank DownloadjoelmalonentadsbkficNo ratings yet

- Cost 531 2021 AssignmentDocument10 pagesCost 531 2021 AssignmentWaylee CheroNo ratings yet

- DocxDocument19 pagesDocxcherry blossomNo ratings yet

- Management Accounting Midterm TestDocument5 pagesManagement Accounting Midterm TestSơn HoàngNo ratings yet

- ACT 202 AssignmentDocument3 pagesACT 202 AssignmentFahim AnjumNo ratings yet

- Remedial 2Document6 pagesRemedial 2Jelwin Enchong BautistaNo ratings yet

- Chapter 7 CostDocument7 pagesChapter 7 CostgmamagloriaNo ratings yet

- Chapter 04 Testbank: StudentDocument43 pagesChapter 04 Testbank: StudentHiền DiệuNo ratings yet

- Accounting QuestionDocument8 pagesAccounting QuestionMusa D Acid100% (1)

- Acctg201 Exercises2Document18 pagesAcctg201 Exercises2sarahbeeNo ratings yet

- Cost Accounting Worksheet Chapter 3 ProblemsDocument5 pagesCost Accounting Worksheet Chapter 3 ProblemsMuhammad UsmanNo ratings yet

- Managerial Accouting TestDocument16 pagesManagerial Accouting TestBùi Yến NhiNo ratings yet

- Passaic County Community College AC-205 Quiz #1Document7 pagesPassaic County Community College AC-205 Quiz #1Giovanna CastilloNo ratings yet

- Exercises On Chapter 3 PDFDocument8 pagesExercises On Chapter 3 PDFhanaNo ratings yet

- Cost Accounting Mastery - 2Document2 pagesCost Accounting Mastery - 2Mark Revarez0% (1)

- Joc ProbDocument10 pagesJoc ProbSoothing BlendNo ratings yet

- Muhammad SalmanDocument9 pagesMuhammad SalmanSalman SaeedNo ratings yet

- Chapter 16 Job Process Costing and AnalysisDocument37 pagesChapter 16 Job Process Costing and AnalysisDavidStevePerezNo ratings yet

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- Job CostingDocument10 pagesJob CostingGeejayFerrerPaculdoNo ratings yet

- Hi HiDocument27 pagesHi HiQuế Hoàng Hoài Thương0% (1)

- Cost Accounting Finals - GONZALESDocument21 pagesCost Accounting Finals - GONZALESAdolph Christian GonzalesNo ratings yet

- Exam Review Unit I - Chapters 1-3Document24 pagesExam Review Unit I - Chapters 1-3Aaron DownsNo ratings yet

- Brewer Chapter 2 Alt ProbDocument6 pagesBrewer Chapter 2 Alt ProbAtif RehmanNo ratings yet

- Practice Test 1 New For Summer 2010Document16 pagesPractice Test 1 New For Summer 2010samcarfNo ratings yet

- A325 Chap 4 SolutionDocument5 pagesA325 Chap 4 SolutionAnita BroadusNo ratings yet

- Exam 2 Fall2013Document8 pagesExam 2 Fall2013Amanda RushNo ratings yet

- GA Co. production costs review quizDocument6 pagesGA Co. production costs review quizPhuong DungNo ratings yet

- Managerial Accounting Practice Problems2 PDFDocument9 pagesManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- Job Order Costing Self-Test #2Document8 pagesJob Order Costing Self-Test #2Jean NestaNo ratings yet

- Midterm Version 1Document57 pagesMidterm Version 1faensaNo ratings yet

- Job Order CostingDocument1 pageJob Order CostingVincent Pham100% (1)

- Multiple Choice - JOCDocument14 pagesMultiple Choice - JOCMuriel MahanludNo ratings yet

- Job Order Costing HMDocument11 pagesJob Order Costing HMYamato De Jesus NakazawaNo ratings yet

- Kuis Perbaikan UTS AKbi 2016-2017Document6 pagesKuis Perbaikan UTS AKbi 2016-2017Rizal Sukma PNo ratings yet

- COSTING METHODSDocument10 pagesCOSTING METHODSMarilyn FernandezNo ratings yet

- Acmas 2137 Final SADocument5 pagesAcmas 2137 Final SAkakaoNo ratings yet

- UGBA 102B Section02 - Handout - SolutionsDocument11 pagesUGBA 102B Section02 - Handout - SolutionsGwendolyn Chloe PurnamaNo ratings yet

- Tutorial 7Document4 pagesTutorial 7jasonNo ratings yet

- Exercise 1 - Cost Accumulation Procedure DeterminationDocument8 pagesExercise 1 - Cost Accumulation Procedure DeterminationstillwinmsNo ratings yet

- Demonstration ProblemsDocument3 pagesDemonstration Problemsnega guluma100% (1)

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Constructing Purchasing Power Parities Using a Reduced Information Approach: A Research StudyFrom EverandConstructing Purchasing Power Parities Using a Reduced Information Approach: A Research StudyNo ratings yet

- The Problem of Induction (David Hume)Document4 pagesThe Problem of Induction (David Hume)BamPanggatNo ratings yet

- A Holy Hour of HealingDocument12 pagesA Holy Hour of HealingBamPanggatNo ratings yet

- Session II - RiteDocument1 pageSession II - RiteBamPanggatNo ratings yet

- Were You There WhenDocument1 pageWere You There WhenBamPanggatNo ratings yet

- Preview: Anticle of AcharyDocument2 pagesPreview: Anticle of AcharyAlvin Francis Lozano100% (1)

- Preview: Anticle of AcharyDocument2 pagesPreview: Anticle of AcharyAlvin Francis Lozano100% (1)

- SourcesDocument1 pageSourcesBamPanggatNo ratings yet

- The Early Life and Education of St. Junipero SerraDocument19 pagesThe Early Life and Education of St. Junipero SerraBamPanggatNo ratings yet

- INTAC1: Introduction To Ateneo Culture and Traditions 1 First Semester, School Year 2011-2012 Elijah Justin S. Segovia Course SyllabusDocument3 pagesINTAC1: Introduction To Ateneo Culture and Traditions 1 First Semester, School Year 2011-2012 Elijah Justin S. Segovia Course SyllabusBamPanggatNo ratings yet

- Central LuzonDocument7 pagesCentral LuzonBamPanggatNo ratings yet

- SourcesDocument1 pageSourcesBamPanggatNo ratings yet

- Inom Tayo PlsDocument2 pagesInom Tayo PlsBamPanggatNo ratings yet

- HfjskaDocument2 pagesHfjskaBamPanggatNo ratings yet

- Abbot President Inquires About Monk's Extensive TravelsDocument1 pageAbbot President Inquires About Monk's Extensive TravelsBamPanggatNo ratings yet

- PressZRelease FINAL 10thZBishopZofZSaltZLakeZCityDocument1 pagePressZRelease FINAL 10thZBishopZofZSaltZLakeZCityBamPanggatNo ratings yet

- Directions Between Catholic Churches and SchoolsDocument1 pageDirections Between Catholic Churches and SchoolsBamPanggatNo ratings yet

- SugonDocument1 pageSugonBamPanggatNo ratings yet

- Pro Water PrivatizationDocument2 pagesPro Water PrivatizationBamPanggatNo ratings yet

- Easter BannerDocument1 pageEaster BannerBamPanggatNo ratings yet

- Airspeed Internatinal CorpDocument1 pageAirspeed Internatinal CorpBamPanggatNo ratings yet

- Contested Democracy0001Document17 pagesContested Democracy0001BamPanggatNo ratings yet

- App FormDocument2 pagesApp FormBamPanggatNo ratings yet

- ........Document3 pages........BamPanggatNo ratings yet

- Recommended Hymns & Songs Approved by ACBCDocument13 pagesRecommended Hymns & Songs Approved by ACBCBamPanggatNo ratings yet

- Joinpdf PDFDocument1,043 pagesJoinpdf PDFOwen Bawlor ManozNo ratings yet

- Diminishing MusharakahDocument45 pagesDiminishing MusharakahIbn Bashir Ar-Raisi0% (1)

- LMGTRAN Negotiable InstrumentsDocument36 pagesLMGTRAN Negotiable InstrumentsNastassja Marie DelaCruzNo ratings yet

- Final Draft Ifp 2018 PDFDocument443 pagesFinal Draft Ifp 2018 PDFhusnasyahidahNo ratings yet

- Maybank Moratorium FAQsDocument7 pagesMaybank Moratorium FAQsمحمدتوفيقNo ratings yet

- 3 Accounting Cycle UDDocument13 pages3 Accounting Cycle UDERICK MLINGWANo ratings yet

- JPM Asia Pacific Equity 2011-07-07 624664Document22 pagesJPM Asia Pacific Equity 2011-07-07 624664tommyphyuNo ratings yet

- Tutorial 2 Eco411 2013Document4 pagesTutorial 2 Eco411 2013Mohamad Izzuddin ZakariaNo ratings yet

- Banking Industry Adopts Augmented RealityDocument50 pagesBanking Industry Adopts Augmented RealityAkash KatiyarNo ratings yet

- The WheelDocument6 pagesThe Wheeldantulo1234No ratings yet

- COST ACCOUNTING HOMEWORKDocument6 pagesCOST ACCOUNTING HOMEWORKaltaNo ratings yet

- Asia Asindo Sukses, PT - PO00100764Document2 pagesAsia Asindo Sukses, PT - PO00100764KELOMPOK 4 E501 MEKTAN 2No ratings yet

- MCQ NpoDocument6 pagesMCQ NpoSurya ShekharNo ratings yet

- Glossary BAHARDocument372 pagesGlossary BAHARJasmine AishaNo ratings yet

- Case Study MMDocument4 pagesCase Study MMMehdi TaseerNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- Credit Rating AgenciesDocument20 pagesCredit Rating AgenciesKrishna Chandran PallippuramNo ratings yet

- Fsa SVBDocument5 pagesFsa SVBlakshya jainNo ratings yet