Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

POST BOX NO 10077

TEL. NOS. +9122 2207

9351- 54

THE BOMBAY BURMAH TRADING CORPORATION , LIMITED

REGD . OFFICE: 9, WALLACE STREET,FORT,

MUMBAI 400 001, INDIA.

(4 LINES)

FAX ,0091-22- 2207 1612

6772

bbtct bam2 vsnl . net.in

Webs to www bbtcl com

CIN

L99999MH1863PL00002

Ref : GEN 16/2016 -2017/7

8th November, 2016.

The Secretary,

Bombay Stock Exchange Ltd.,

Phiroze Jeejeebhoy Towers,

Dalal Street,

MUMBAI 400 001.

Manager - Listing Department,

National Stock Exchange of India Ltd.,

Exchange Plaza, 5th Floor,

Plot No.C/1, 'G' Block,

Bandra-Kurla Complex,

Bandra (E),

MUMBAI 400 051.

Dear Sirs,

Sub : Submission of Unaudited Financial Results for the quarter ending 30th September,

2016 under Regulation 33 of the SEBI (LODR) Regulations, 2015.

Please find enclosed the Unaudited Financial Results of the Corporation for the quarter

ended 30th June, 2016 which was approved at the meeting of the Board of Directors held

today, the 8th November, 2016.

The Limited Review Report of the Auditors on the aforesaid results is also enclosed.

The Results are also being uploaded on our website www.bbtcl.com

Thanking you,

Yours faithfully,

For The Bombay Burmah Trading

Corporation Ltd.,

^

N. . Danwala

1^r Vic resident Corporate &

Company Secretary.

Encl : As above.

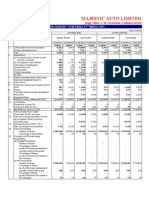

THE BOMBAY BURMAH TRADING CORPORATION, LIMITED

Registered Office 9. Wallace Street, Fort, Mumba1 400 001

CIN L99999MH1863PL0000002

(A)

Rupees in Lakhs

Statement of Unaudited Standalone Financial Results for the Quarter and Six months ended 30th September, 2016

3

Preceding

corresponding

months

3 months

3 months

ended

ended

30th

June

2016

30th

September

2016

Income from Operations

(a) Gross Sales , income from Operations

6 882 43

(b) Other Operating Income

Total income from Operations (net)

6213 35

13,451 47

7,364.3

6.746.98

39f

18.62

13101 .32

511,1 04

13 433.42

2 083 25

67 60

2.126 72

56 24

2,019 37

51.56

4,209.96

123 83

4,13793

89 04

1,81362

186 27

230 92

1.973 19

6,806.37

1,65962

16040

167 34

1.64096

6,842.42

1 758 97

1 809 23

182 63

207 19

8C3 2%

7,912.14

Profit / ( Loss ) from operations before other income , finance costs and

exceptional items (1-2)

(557.80)

Profit I (Loss ) from ordinary activities before finance costs and exceptional

items (3+4)

Profit / ( Loss ) from ordinary activities after finance costs but before

exceptional items (5-6)

figures for figures for the

current period previous year

ended in the

ended 30th ended 30th

previous year

30th September 30th September September

2016

2016

2016

Unaud led

Unaudited

(Refer Note 4)_

(Refer Note 4)

6.569 04

471 91

Expenses

a) Cost of materials consumed

b) Purchase of stock-in-trade

c) Changes in Inventories of finished goods .work - in-progress and stock - in-trade

(including bio-logical assets)

d) Employees benefits expense

e) Depreciation and amonsation expenses

f) Excise duty

q) Other expenses

Total expenses

Year to date I Year to date

(59.39)

649 65

2,178 39

1,438 92

3.622 85

368 90

438 11

3 425 24

335 68

'114 2'

14,718_50

11451.33

(233.80)

(617.18)

(17.91)

452 64

50361

413 09

956 25

888 64

(105 . 16)

444 . 22

179.29

339.07

870.73

892 62

811 36

819 93

1 703 98

1 633 04

(997.79)

(367.14)

(640.64)

(1,364.91)

(762.31)

(997 79)

(367.14)

(640.64)

(1,364.91)

(762.31)

(997.79)

(367.14)

(640.64)

(1.364.91)

(762.31)

(997.79)

(367.14)

(640.64)

(1,364.91)

(762.31)

(997.79)

(367.14)

(640.64)

(1.364.91)

(762.31)

1,232.12

(277.39)

(2,906.10)

954.73

234.34

(644.53)

(3,546.74)

(410.18)

Lxceptional Items

Profit I (Loss ) from ordinary activities before tax (7+8)

Tax expense

Net Profit / ( Loss ) from Ordinary Activities after tax (9-10)

Extraordinary items

13

Net Profit / ( Loss ) for the period ( 11+12)

14

15

Share of profit ! (loss) of associates

Minority Interest

Net Profit] ( Loss ) after taxes , minority interest and share of profit ! ( loss) of

associates ( 13+14+15)

Other Comprehensive Income ( net of tax)

Total Comprehensive Income ( after tax)

Paid-up equity share capital (Face value of the Share - Rs 2/-)

1.395 44

Earnings per share ( before extraordinary items)

(of Rs.21- each ) ( not annualised)

a) Basic

b) Diluted

Earnings per share (after extraordinary items)

(of Rs . 2/- each) ( not annualised)

a) Basic

b)

Diluted

(1

Btt rgi

1 395 44

1.395 44

(843.10)

1.395 44

(1 43)

(1 43)

(0 53)

(0 53)

(092)

(0 92)

(1 96)

If 96)

(1 09)

If 09)

(1 43)

43)

(0.53)

(0 53)

(092)

(092)

(1 96)

(196)

(1 09)

(1 09)

t+y

?r

P/ 4

^l

v t

1 395 44

(80.79)

J^ la

a9j ^

Segment Wise Revenue, Results, Assets, Liabilities and Capital Employed

Rupees in Lakhs

Particulars

Segment Revenue

a) Plantations (Tea)

Preceding

3 months

Corresponding

3 months

Year to date

figures for

Year to date

figures for the

ended

ended

ended in the

current period

previous year

30th

30th

previous year

ended 30th

ended 30th

September

2016

June

2016

30th September

2015

30th September

2016

September

2015

Unaudited

Unaudited

Unaudited

Refer Note 4)

Unaudited

Unaudited

(Refer Note 4)

2.212.93

2,181 14

2,16496

4,394 07

4,318 99

b) Plantations (Coffee)

1501 19

1.25641

903.96

2,75760

2,321 59

c) Auto Electrical Components

d) Investments

2 766 98

527.86

2,681 37

386 64

2.64988

640.07

5,44835

914 50

5 194 32

1,03943

e) Healthcare

626 87

592 19

564.57

1 219 06

1.188 97

f) Others

171 15

152 84

9826

323 99

258 76

7,806 . 98

7,250 . 59

7,021 . 70

15 , 057.57

14 , 322.05

7,250 . 59

7,021.70

15 , 057.57

14,322.05

Total

Less Inter Segment Revenue

Net Sales / Income from Operations

3

months

Segment Results

a) Plantations (Tea)

b) Plantations (Coffee)

c) Auto Electrical Components

d) Investments

e) Healthcare

0 Others

Total

Less i) Interest

ii) Other Un-allocable

7,806 . 98

(750 02)

40 39

(27 02)

44 62

(681 16)

62 76

(777 04)

85.01

619 62

(769.61)

304.02

602 38

341 30

278 33

312 97

527.86

126 14

57 49

343 . 16

(892 62)

(448 33)

386.64

110 40

83 66

876 . 62

(811 36)

(432 40)

640.07

140 81

26.59

502 . 04

(819 93)

(322 74)

914 50

236 54

141 15

1,219 . 79

(1.703 98)

(880.72)

1,039.43

265 46

131.81

1,573.49

(1.633 04)

(70236)

( 997.79 )

( 367.14 )

( 640.63 )

( 1,364.91)

(762.31)

expenditure net

Total Profit/ (Loss ) before Tax

Segment Assets

a) Plantations (Tea)

b) Plantations (Coffee)

c) Auto Electrical Components

d) Investments

e) Healthcare

0 Others

g) Unallocated

9.747.19

6.373 12

9,74719

7.85030

6,697.60

32.904 72

1.233 68

3,066.17

7.346 56

6.718.18

41.561 52

1.372 85

2.875.97

8,75693

6,47338

34,128.51

1.28087

3,05323

7.346 56

6,718.18

41,561.52

1.372 85

2,87597

4 603 28

3,94628

4 474 99

4,60328

4 474 99

63 , 670.03

74 , 097.25

64,669.32

74,097.25

1 268.98

1.211 93

1,332 75

1,26898

1,332.75

362 17

180 95

255 99

362 17

255.99

c) Auto Electncal Components

,10

2078

1,619.16

1,56374

2.078 10

1.56374

d) Investments

4000,00

4.000 00

4.500 00

4,00000

4,500 00

220 24

188 55

179 46

220 24

179 46

42.16

50.30

107.38

42 16

107.38

30 485 74

30 172 01

29072 12

30 485 74

29072 12

38 ,457.39

37,422 . 90

37 , 011.45

38,457.39

37 , 011.45

a) Plantations (Tea)

5.104 14

6,75934

8,41444

5.104 14

841444

b) Plantations (Coffee)

8 394.76

7,669.35

7.090.57

8,394 76

7,090.57

c) Auto Electrical Components

4,395.28

5,078.44

5,15444

4.39528

5,154.44

30 128 51

28.904 72

37.061 52

30,128 51

37061 52

Segment Liabilities

a) Plantations (Tea)

b) Plantations (Coffee)

e) Healthcare

f) Others

g) Unallocated

Total Segment Liabilities

7,971.27

8 756 93

6 473 38

34,128.51

1 280.87

3.053,23

64 , 669.32

Total Segment Assets

4

6 373.12

Capital Employed

(Segment Assets Less Segment Liabilities)

d) Investments

e) Healthcare

1.060.63

1045.13

1.193.39

1,060.63

1,193.39

f) Others

3 011 07

301587

276859

1011 07

2 768.59

g) Unallocated

Total Capital Employed

i2l^ 682 461

26,211.93

126.225

26,247.13

X24 597 1_?,

125.882 46)

(24,597 13)

37.085 81

26,211.93

37, 085.81

Notes:

1. Standalone Statement of Assets and Liabilities

Sr.

No.

Particulars

Unaudited

(A) ASSETS

(1) Non - current assets

(a) Property. Plant and Equipment

(b) Capital work-in-progress

(c) Other Intangible assets

(d) Biological Assets other than bearer plants

(e) Financial Assets

(i) Investments

(ii) Loans

(iii) Others

(f) Deferred tax assets (net)

Other non-current assets

Total - Non Current Assets

(2) Current assets

(a) Inventories

(b) Financial Assets

11.347.26

225 43

29.09

57.01

21,852.12

4,27322

30 0q

415 1

2.839 4

41,068.73

7,414.28

(ii) Trade receivables

3,49683

(iii) Cash and cash equivalents

(v) Loans

(vi) Others

983.63

6.852 11

72 08

c Other current assets

Total - Current Assets

Total Assets

(B)

Rs. in Lakhs

As at 30th

Se tember 2016

4,781 67

23,600.60

64 , 669.33

EQUITY AND LIABILITIES

Equity

(a) Equity Share capital

(b) Other Equity

Total - Equity

1,396.27

24,815.66

26, 211.93

Liabilities

(1) Non-current liabilities

(a) Financial Liabilities

(i) Borrowings

(ii) Other financial liabilities

(b) Provisions

Total - Non-Current Liabilities

678691

56.78

2.16

6 , 845.85

(2) Current liabilities

(a) Financial Liabilities

(i) Borrowings

(ii) Trade payables

(iii) Other financial liabilities

(b) Other current liabilities

(c) Provisions

Total - Current Liabilities

Total - Equity and Liabilities

23,059.59

1,68555

6,027 16

514.37

324 88

31,611.55

\ 64,669.33

Notes (continued):

2 The above financial results have been reviewed by the Audit Committee and having been recommended by it to the Board

for approval, were approved by the Board at its meeting held on 8th November. 2016.

3 Reconciliation of net loss as previously reported on account of transition from the previous Indian GAAP to Ind AS for the

quarter and six months ended 30 /09/2015.

Rs. In Lakhs

Six Months

Quarter ended

ended

Sr.

30/09/2015

Particulars

30 /0 9/2015

No.

Unaudited

Unaudited

(d)

Net loss for the period under Previous Indian GAAP

On account of depreciation and amortisation

On account of recognition of bio-logical assets at fair value

On account of acturial gain/(loss) on employement benefit recognised in Other

Comprehensive Income

On account of recognition of mark to market gain on forward contracts

(e)

Other Ind AS adjustments

a)

b

(c)

Net loss for the period under Ind AS

Other Comprehensive Income (nwt of tax)

Total Comprehensive Income for the period

(572. 34)

(17.59)

(33.03)

22.42

(658.02)

(3502)

113.90

44 83

(38 78)

(22.93)

(1.30)

22.73

( 640.64 )

(762.31)

2.906.10)

(80 79)

( 3,546 . 74)

(843.10)

4 The Company has adopted the Indian Accounting Standards (Ind AS) from 1st April 2016. The figures for the quarter and

six months ended 30/09/2015 are also Ind AS compliant They have not been subjected to limited review or audit.

However, the management has excercised necessary due diligence to ensure that the financial results provide a true and

fair view of the Corporation's affairs

5 Expenditure of Rs 539.58 lakhs (Previous period Rs.733 14 lakhs) incurred during the half year at the Coffee estates has

been carried forward and will be accounted against the current season's coffee crop from November. 2016.

6 Although there has been no increase in remuneration paid to the Managing Director , Mr Ness Wadia for Financial Year

2015-16. in view of inadequacy of Profits. the Corporation has made an application to the Central Government for

approval to the payment of of Rs . 289 98 lakhs ( excluding retirals of Rs 58 . 75 lakhs ) for the year as it is in excess of the

limits prescribed by schedule V of the Companies Act, 2013.

7 The figures for the previous period have been regrouped wherever necessery. '

On behalf of the Board

Ll/

Mumbai, Ness' ;Wadia

8th November, 2016 Managing Director

B S R & Co. LLP

Chartered Accountants

Telephone +91 (22) 4345 5300

Fax +91 (22) 4345 5399

5th Floor, Lodha Excelus,

Apollo Mills Compound

N. M. Joshi Marg, Mahalaxmi

Mtjmbai - 400 011

India

Limited Re \ iew Report on Quar t e r ly and Year to [ale unaudited Financial Results of The

;ornha) I;urnulh Trading Corporation, Limited pursuant to the Regulation 33 of the 51':131

(Listing Obligations and Disclosure Requirements ) Rc,,,ulations. 21)15

To The Board of Directors of

The F olll bav

Burlllabl Tr adin g Corporation,

L imited

We have reviewed the acconlpan\ in, statement of unaudited financial results ('the Statement) of

I lie Bonlha\ Hurnlah 'I radul, ( orporation. I muted ("tile ('onlpan\'') for the quarter and six months

ended 311 September 2(11(1. attached here\\ ith, heiilL submitted h\ the Conlpan\ pursuant to the

requirements of Repulalion 33 of the S1:1H1 (I.istin-e (bligation, and Disclosure Requirements)

Rcutdations. 201 ^. Allcnlion is drawn to the fact that the figures for the correspond in`, quarter and

si\ months ended 30 Seplenlher 2015. including the reconciliation of net prof if under Ind AS of the

correspond ill. quarter and six months \\ ith ncl profit reported under pre\ ions (iAAP. as reported in

these financial results have been appro\ed b\ the Conlpan\-s Hoard of Directors but have not been

subjected to rc\IC\\.

phis Statement is the responsihiIil\ ol'the ('onlpan\'s Mana,enlenl and has been appro\ed b\ the

Hoard of l )irectors in their nleelin" held on 8 No\ enlher 2016- ( )ill- responsibility is to issue a report

()It the Stalelllellt based on OIIr'L,\ Ic\\,

e conducted our r e\ ie\v in accordance \\ ith the Standard on Re\ ie \\ I:nt,auenle ni ( SRI:) 2 110,

rr / Inte l -im / l lhrnt icll 11 (1i,rnlcItir , ll /'t'r/iu'll,Ct / hl' I//c' /Ih /t'/1tnt /C/1l 111tlil0r u/ /Ilt 1L111i11

../?c'vic'1r

issued by the Institute of, Chartered Accounlant , of India . Phis Standard requires that we plan and

perform the revie w to ohtain moderate assurance as to \vlicther the financial statements are tike of,

material nlisstatenlenl . A re\ ie\\ Is limited prinlaril \

to inquiries of ( orllp;l\ personnel and

analytical procedure , applied to financial data and Ihus provides less assurance than an audit. We

have not perform e d an audit and aecordin ,l\.'\e do not express an audit opinion.

I'(;Ised oll our re\ le\\ corldtlclcd as abo \ c. nothing, has conic loom ;Illellllon that causes us to belle\e

that the accunlpam ii Statenlenl prepared in accordance \\ Olt applicable accounting standards i.e.

Ind AS prescribed under Section I3I of the Companies Act. 201 i. ' cad \yilh relevant rules issued

thereunder and other reco , ni,ed accounlinmg practices and policies has not disclosed file infornmtion

required to be disclosed in terms of Regulation 33 of the SI- HI (I fisting Obligations and Disclosure

Requirements) Re,ulalions . 2(115 and SI . lil Circular dalcd S .lul\ 2010 includin g the manner in

hich it is to be disclosed, or that it contains a ny material Ill isstalenlent.

Ior BSR&('o.

( IlclJ Ic'/ ('tl. Ic'c'Ollnltlnl.v

Firm's Registration No: 1012-18\V''\V'-1000

f C.3r'1f,

f

It .' ,.1

\'ija\ \lathur

2 1 11111ha1

8 \,(1\

c lll bcl 201

1'(11'1 //('/

0

,l^ 4 -1=

^IClllhl'I'tihll) No:

R S R & Co (a patuietship firm with

Registration No. DA612231 converted into

R S R & Co. LLP (a Limited Liability, Partnership

with LLP Registration No . AAB-81811

with effect from October 14, 2013

()4(147(1

Registered Office:

51h Floor, Lodha Excelus

Apollo Mills Compound

N. M. Joshi Marg . Mahalaxmi

Mumbai -400 011 In da

You might also like

- Freddie My LoveDocument8 pagesFreddie My LoveRacheal YoungNo ratings yet

- Disaster Recovery Policy v1.0Document4 pagesDisaster Recovery Policy v1.0CSKNo ratings yet

- EMS Term 2 Controlled Test 1Document15 pagesEMS Term 2 Controlled Test 1emmanuelmutemba919No ratings yet

- RBS MoonTrading13Jun10Document12 pagesRBS MoonTrading13Jun10loreelyNo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- 063 Coquia V Fieldmen's InsuranceDocument2 pages063 Coquia V Fieldmen's Insurancekeith105No ratings yet

- Batelco Services Bill - Tax InvoiceDocument3 pagesBatelco Services Bill - Tax InvoiceAysha Muhammad ShahzadNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- 2008 2009 - 31 Mar 2009Document3 pages2008 2009 - 31 Mar 2009Nishit PatelNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Havells Annual ReportDocument1 pageHavells Annual ReportSatyaki DeyNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- M iYN: Standalone Limited BoDocument5 pagesM iYN: Standalone Limited BoHimanshuNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document6 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- 16 Format of Financial Follow Up Report SbiDocument4 pages16 Format of Financial Follow Up Report SbiSandeep PahwaNo ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- HPCL Audited Results31Mar2013Document1 pageHPCL Audited Results31Mar2013Pranav DesaiNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Consolidated Financial Results For March 31, 2016 (Result)Document3 pagesConsolidated Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Balance Sheet: Titan Industries LimitedDocument4 pagesBalance Sheet: Titan Industries LimitedShalini ShreyaNo ratings yet

- Sebi Million Q3 1213 PDFDocument2 pagesSebi Million Q3 1213 PDFGino SunnyNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2010 12 31) PDFDocument1 pageAvt Naturals (Qtly 2010 12 31) PDFKarl_23No ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Wim Plast LTD.: CelloDocument5 pagesWim Plast LTD.: CelloAbhishek RanjanNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Indoco Remedies Limited Audited Financial Results for FY 2008-09Document1 pageIndoco Remedies Limited Audited Financial Results for FY 2008-09Nikhil RanaNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Balance SheetDocument2 pagesBalance Sheetgagandeepdb2No ratings yet

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- BATA INDIA 1Q FY2011 Earnings ReportDocument1 pageBATA INDIA 1Q FY2011 Earnings ReportSagar KadamNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Revised Financial Results For Sept 30, 2015 (Result)Document3 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Insiderspower: An Interanalyst PublicationDocument10 pagesInsiderspower: An Interanalyst PublicationInterAnalyst, LLCNo ratings yet

- Residential Status Problems - 3Document15 pagesResidential Status Problems - 3ysrbalajiNo ratings yet

- Sabah Malaysian Borneo Buletin April 2009Document28 pagesSabah Malaysian Borneo Buletin April 2009Sabah Tourism BoardNo ratings yet

- Grill Lunch MenuDocument2 pagesGrill Lunch Menuapi-230748243No ratings yet

- The Last Words of The BuddhaDocument6 pagesThe Last Words of The BuddhabnraoNo ratings yet

- Sd-Wan Zero-to-Hero: Net Expert SolutionsDocument11 pagesSd-Wan Zero-to-Hero: Net Expert SolutionsFlorick Le MahamatNo ratings yet

- Make My Trip SRSDocument24 pagesMake My Trip SRSAbhijeet BhardwajNo ratings yet

- Objectives of Community Based RehabilitationDocument2 pagesObjectives of Community Based Rehabilitationzen_haf23No ratings yet

- Andal's Thiruppavai Pasuram 27 For Day 27 of Margazhi (Jan 10, 2015 in USA)Document11 pagesAndal's Thiruppavai Pasuram 27 For Day 27 of Margazhi (Jan 10, 2015 in USA)Vj LaxmananNo ratings yet

- Unit 2 Looking at OthersDocument25 pagesUnit 2 Looking at OthersTipa JacoNo ratings yet

- G.R. No. L-26549 July 31, 1970 EUGENIO LOPEZ, Publisher and Owner of The "MANILA, CHRONICLE and JUAN T. GATBONTONDocument6 pagesG.R. No. L-26549 July 31, 1970 EUGENIO LOPEZ, Publisher and Owner of The "MANILA, CHRONICLE and JUAN T. GATBONTONnic mNo ratings yet

- Classification of Consumer GoodsDocument5 pagesClassification of Consumer GoodsSana KhanNo ratings yet

- Human Resource Management 14th Edition Mathis Test BankDocument23 pagesHuman Resource Management 14th Edition Mathis Test BankLindaClementsyanmb100% (13)

- Sapexercisegbi FiDocument18 pagesSapexercisegbi FiWaqar Haider AshrafNo ratings yet

- RGNULDocument6 pagesRGNULshubhamNo ratings yet

- Environmental Impact Assessment (Eia) System in The PhilippinesDocument11 pagesEnvironmental Impact Assessment (Eia) System in The PhilippinesthekeypadNo ratings yet

- EMDR Therapy Treatment of Grief and Mourning in Times of COVID19 CoronavirusJournal of EMDR Practice and ResearchDocument13 pagesEMDR Therapy Treatment of Grief and Mourning in Times of COVID19 CoronavirusJournal of EMDR Practice and ResearchIsaura MendezNo ratings yet

- Christopher Brown and Matthew Mahrer IndictmentDocument8 pagesChristopher Brown and Matthew Mahrer IndictmentCBSNewYork ScribdNo ratings yet

- Fair Value Definition - NEW vs. OLD PDFDocument3 pagesFair Value Definition - NEW vs. OLD PDFgdegirolamoNo ratings yet

- Newsletter No 3 - 5 May 2017Document3 pagesNewsletter No 3 - 5 May 2017Kate SpainNo ratings yet

- 109 Eradication and Control Programs Guinea Worm FINALDocument53 pages109 Eradication and Control Programs Guinea Worm FINALFebri Yudha Adhi Kurniawan100% (1)

- Frequently Asked Questions: For ResidentsDocument6 pagesFrequently Asked Questions: For ResidentsShuvajit NayakNo ratings yet

- Palarong Pambansa: (Billiard Sports)Document10 pagesPalarong Pambansa: (Billiard Sports)Dustin Andrew Bana ApiagNo ratings yet

- Political Violence and Terrorism SyllabusDocument3 pagesPolitical Violence and Terrorism Syllabusapi-292463552No ratings yet