Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

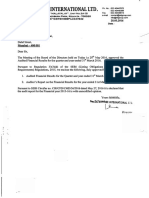

November 11, 2016

The Deputy Manager

Dept. of Corp. Services

BSE Limited

P. J. Towers, Dalal Street

Fort, Mumbai 400 001

The Company Secretary

The Calcutta Stock Exchange Association Ltd.

7, Lyons Range

Kolkata-700 001

Ref : Scrip Code 10013062(CSE),Scrip Code 511690 (BSE)

Sub: Submission of Q-II Results along with Limited Review Report by Statutory Auditors

Respected Sir or Madam,

With reference to the above and in compliance with Regulation 33(3) of SEBI LODR Regulations,

2015, we are enclosing with this letter, Provisional Financial Results (Un-audited) for the 2nd quarter

and half year ended on 30th September 2016 (Q-II) for the financial year ending on 31st March

2017 together with Limited Review Report by Statutory Auditors.

Kindly take the same on your record & oblige.

This is for the information of Members.

Thanking You,

Yours Faithfully,

For WARNER MULTIMEDIA LIMITED

JAGDISH PRASAD PUROHIT

(DIN : 00083125)

MANAGING DIRECTOR

Enclosed : As stated above

WARNER MULTIMEDIA LIMITED

Regd. Office : P-27 , Princep Street, 3rd Floor, Kolkata 700072

CIN-L92100WB1983PLC036338, Email: warner.multimedia@gmail.com,website:www.warnermultimedia.in

Statement of Unaudited Financial Results for the Quarter & 6 months ended 30th September 2016

Rs. in Lakhs

Particulars

Sr.

No.

1 Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

Total Income from Operations (Net)

2 Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

(c) Changes in Inventories of Finished Goods, Work-inProgress and Stock-in-Trade

3

4

5

6

7

8

9

3 Months

ended

30.09.2016

Preceding 3

Months ended

30.06.2016

Corresponding 3

Months ended

30.09.2015

Un-Audited

0.40

0.40

-

8.10

0.30

8.40

5.60

5.60

7.50

Corresponding

Corresponding 6

6 Months

Months ended

ended

30.09.2016

30.09.2015

Year to date

figures as on

31.03.2016

Un-Audited

Audited

8.10

0.70

8.80

12.40

12.40

7.91

0.21

8.12

7.50

6.00

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

Total Expenses

Profit/(Loss) from Operations before other Income, finance

cost and exceptional Expenses (1-2)

Other Income/(Loss)

1.68

2.15

3.83

1.67

3.10

12.27

1.80

2.90

4.70

3.35

5.25

16.10

3.60

5.50

9.10

6.69

0.42

10.09

23.20

(3.43)

-

(3.87)

-

0.90

-

(7.30)

-

3.30

-

(15.08)

-

Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3+4)

Finance Costs

(3.43)

-

(3.87)

-

0.90

-

(7.30)

-

3.30

-

(15.08)

-

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Exceptional Items

(3.43)

-

(3.87)

-

0.90

-

(7.30)

-

3.30

-

(15.08)

-

(3.43)

-

(3.87)

-

0.90

-

(7.30)

-

3.30

-

(15.08)

-

(3.43)

(3.43)

-

(3.87)

(3.87)

-

0.90

0.90

-

(7.30)

(7.30)

-

3.30

3.30

-

(15.08)

(15.08)

-

(3.43)

1,855.54

(3.87)

1,855.54

0.90

1,855.54

(7.30)

1,855.54

3.30

1,855.54

(15.08)

1,855.54

Profit(+)/Loss(-) from ordinary activities before Tax (7-8)

10 Tax Expense

Net Profit (+)/Loss(-) from ordinary activities after tax (911 10)

Lac)

12 Extra Ordinary Items (Net of Tax Expense of Rs.

13 Net Profit (+)/Loss(-) for the period (11-12)

14 Share of Profit/(Loss) of Associates*

15 Minority Interest*

Net Profit (+)/Loss(-) after tax, minority interest and Share

16 of Profit / (Loss) of Associates (13-14-15)

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance

18 Sheet

(1,981.42)

Earning Per Share (before extra-ordinary items) of Rs. 10/19 each (not annualized)

(i) a) Basic

b) Diluted

(0.02)

(0.02)

(0.02)

(0.02)

0.00

0.00

(0.04)

(0.04)

0.02

0.02

(0.08)

(0.08)

Earning Per Share (after extra-ordinary items) of Rs. 10/20 each (not annualized)

(ii) a) Basic

b) Diluted

(0.02)

(0.02)

(0.02)

(0.02)

0.00

0.00

(0.04)

(0.04)

0.02

0.02

(0.08)

(0.08)

Notes :

1. Segmental Report for the Quarter as per AS-17 of ICAI is not applicable for the Quarter.

2. Above results were reviewed by Audit Committee taken on record in Board Meeting held on 11th November, 2016.

3. The Auditors of the Company have carried out "Limited Review" of the above Financial Results.

Place : Kolkata

Date : 11th November, 2016.

For Warner Multimedia Limited

S/dJagdish Prasad Purohit

Managing Director

WARNER MULTIMEDIA LIMITED

Statement of Assets & Liabilities

Particulars

A

EQUITY & LIABILITIES

1 Shareholders' Fund

(a) Share Capital

(b) Reserves and Surplus

(c) Money Received against Share Warrants

Sub-Total - Share Holders Fund

2 Share Capital Money (Pending Allotment

3 Minority Interest*

4 Non Current Liabilities

(a) Long Term Borrowings

(b) Deferred Tax Liabilities (Net)

(c) Other Long Term Liabilities

(d) Long Term Provisions

Sub-Total - Long Term Liabilities

1,855.54

(1,988.72)

(133.18)

-

1,855.54

(1,981.42)

(125.88)

-

319.73

162.42

482.15

319.63

162.42

482.05

Sub-Total - Current Liabilities

2.80

424.80

0.16

427.76

2.80

424.80

0.16

427.76

TOTAL EQUITY & LIABILITIES

776.73

783.93

2.63

439.80

442.43

2.63

439.80

442.43

75.00

18.60

32.09

208.61

334.30

75.00

18.60

39.29

208.61

341.50

776.73

783.93

5 Current Liabilities

(a) Short Term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short Term Provisions

Rs. in Lakhs

As At

30th Sept 2016

31st March 2016

Un-Audited

Audited

ASSETS

1 Non-Current Assets

(a) Fixed Assets

(b) Goodwill on Consolidation*

(c) Non-Current Investments

(d) Deferred Tax Assets (Net)

(e) Long Term Loans & Advances

(f) Other Non-Current Assets

Sub-Total - Non Current Assets

2 Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash & Cash Equivalents

(e) Short Term Loans & Advances

(f) Other Current Assets

Sub-Total - Current Assets

TOTAL - ASSETS

You might also like

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document5 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Analysis of Unilever PakistanDocument7 pagesFinancial Analysis of Unilever Pakistanzainab malikNo ratings yet

- A - Review - of - Tax - Avoidance - in - China Beserta Indikator Penghindaran PajakDocument12 pagesA - Review - of - Tax - Avoidance - in - China Beserta Indikator Penghindaran Pajakkelas cNo ratings yet

- Entrep 07 Activity 1Document2 pagesEntrep 07 Activity 1Ronald varrie BautistaNo ratings yet

- Bản Sao Unit 5 Listening Stock Market for StudentsDocument3 pagesBản Sao Unit 5 Listening Stock Market for StudentsMai LêNo ratings yet

- Accounting BasicsDocument68 pagesAccounting BasicsEd Caty100% (1)

- Kelompok 1 (Intan)Document14 pagesKelompok 1 (Intan)Amanda VeronikaNo ratings yet

- Financial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsiDocument18 pagesFinancial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsifitriEmpiiNo ratings yet

- STM Assignment Workbook - v1.0Document20 pagesSTM Assignment Workbook - v1.0Neha SmritiNo ratings yet

- Codification Reference Guide (KPMG) (00663376)Document3 pagesCodification Reference Guide (KPMG) (00663376)bencho10150% (2)

- Problem 1Document3 pagesProblem 1Nicole Allyson AguantaNo ratings yet

- Matling Industrial and Commercial CorporationDocument5 pagesMatling Industrial and Commercial CorporationMaiti LagosNo ratings yet

- Ebook Legal Aspect of Corporate FinanceDocument92 pagesEbook Legal Aspect of Corporate Financenunur88No ratings yet

- Financial MGT ADocument390 pagesFinancial MGT ADeogratias ManyamaNo ratings yet

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- 11 The Cost of CapitalDocument43 pages11 The Cost of CapitalMo Mindalano MandanganNo ratings yet

- UK Vs USA Common Law Vs Common SenceDocument7 pagesUK Vs USA Common Law Vs Common SenceShlomo Isachar Ovadiah100% (1)

- Stock InvestmentDocument61 pagesStock InvestmentKurt Geeno Du VencerNo ratings yet

- Planes MovilnetDocument2 pagesPlanes MovilnetGabriel CastilloNo ratings yet

- Siyaram Silk Mills LTD: 19BM63122 Spandan Kumar Nanda 19BM63140 Vignesh VDocument3 pagesSiyaram Silk Mills LTD: 19BM63122 Spandan Kumar Nanda 19BM63140 Vignesh VHarshit Kumar SinghNo ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- Financial Analysis of Reliance Industries Limited MAKSUDDocument93 pagesFinancial Analysis of Reliance Industries Limited MAKSUDAsif KhanNo ratings yet

- Practice Set 8 Liabilities Part 1Document8 pagesPractice Set 8 Liabilities Part 1Hemabhimanyu MaddineniNo ratings yet

- Financial Management Module 8Document17 pagesFinancial Management Module 8Armand RoblesNo ratings yet

- O-Level-Accounts NotesDocument58 pagesO-Level-Accounts NotesKamranKhan100% (1)

- International Financial InstrumentsDocument25 pagesInternational Financial InstrumentsChintakunta Preethi100% (1)

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument3 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- AM 20482 Key Information Document CFD ETF AM UKDocument3 pagesAM 20482 Key Information Document CFD ETF AM UKTensonNo ratings yet

- Du Pont AnalysisDocument5 pagesDu Pont AnalysisBindal HeenaNo ratings yet

- Corporatre ValuationDocument46 pagesCorporatre ValuationVipin MehtaNo ratings yet

- Canterbury Institute of Management (CIM) : ACCT101 Foundations of AccountingDocument10 pagesCanterbury Institute of Management (CIM) : ACCT101 Foundations of AccountingSuman GautamNo ratings yet