Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

-------------------------------=--------

COMPUCOM

IT: 14-15 EP/P, RIICO Industrial Area,

Sitapura, Jaipur -302022 (India)

Tel. 91-141-2770131, 5115901-02

Fax: 91-141-2770335,5115905

E-mail: cs@compucom.co.in

CI N:-L72200RJ 1995PLC009798

Software Limited

Date: 12.11.2016

No.: CSUBSE/NSEIl6-17/

1) The Secretary

BSELimited

1st Floor, New Trading Ring,

Rotunda Building, Phiroze Jeejeebhoy Towers,

Dalal Street, Fort, Mumbai-400001.

Stock Code: 532339

(BY BSE LISTING CENTRE)

2) The Secretary

National Stock Exchange of India Limited

Exchange Plaza, 5th Floor,

Plot No. CIl, G Block,

Bandra (East), Mumbai-400051.

Stock Code: COMPUSOFT

(BY NSE NEAPS)

Sub: - Outcome of Board Meeting held on 12.11.2016 pursuant to the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015 ("Regulations").

Dear Sir/Ma'am,

The Board of Directors in their Third meeting for the year 2016-2017 held on 12th November, 2016, inter alia

,

f

transacted following businesses:

1. Considered and approved the Unaudited Standalone Financial Results pursuant to Regulation 33 of Securities

and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 for the

quarter and half year ended 30th September, 2016 along with the Statement of assets and liabilities as on 30th

September, 2016 (enclosed herewith).

Further, the extract of the results would also be published in the newspapers in compliance with Regulation

47 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations,

2015;

Took on record the Limited Review Report for the quarter and half year ended 30th September, 2016.

Took on record Statutory, Legal and Secretarial Compliances for the quarter ended on 30th September, 2016.

Took on record statement pertaining to Grievance Redressal which was submitted to BSE pursuant to

Regulation 13 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements)

Regulations, 2015 for the quarter ended 30th September, 2016.

2.

3.

4.

Further, in accordance with the Securities and Exchange Board of India (Prohibition of Insider Trading)

Regulations, 2015 and Company's Code of conduct for Prohibition of Insider Trading, the "Trading Window"

for dealing in the shares of the Company will open from 15th November, 2016 for the Directors and Kei

Management Personnel/Designated

Employees / Connected Persons of the Company.

You are requested to take note of above and inform all concerned accordingly.

Thanking You,

~.~~:"::~-:~

eo::. " k!~!""J._;~;

d

For Compu~~~tPU""L.wat~~te

.,'

r'.

"vj \''',

~.1

\ r'" II

<0

i! '~l JAIPUR 1 S II

'A\

!.::' Ji

h")\

1-""i"Y

'i

Swa

mpany

~e~'~<:;')!

"~:-_

..*~.~-

;:.":::::=~"

CC: THE MANAGER,

The Calcutta Stock Exchange Limited

7, Lyons Range, Kolkata: 700001

i!

COMPUCOM SOFTWARE UMITED

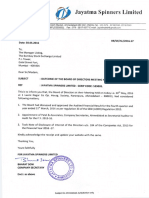

UNAUDITED FINANCIAL

RES~~'FC::C:~~T

14-16, EPIP. SITAPURA. JAIPUR-30202Zi

emall:Ca@Compucom.CO.ln.webslte:=:;.ZU~:~

Y~R

Quarter En ed

OoSe -16

a) Employee benefit expenses

b) Learning Solution Execution

c) Depreciation

From Operations

other

Income,

5) Profit from ~Inary

actlvttles

before finance

costa & ExceDUonalltems

6 Finance costs

_,:"rom from orumary

activities

a er nnance

costs but before ExceDtlonalltems

8 Exce tionalltems

rom

na

v es

10 Tax E

nses

_'!

14) Share of profllJ (lose)

16) Mlnortty Interest

',,,,'

E ui

TaJ:

Interest

and

Ca Ital F.V. Rs 21- each

18) Reserves excluding revaluation reserves as per

balance sheet of orevious accountln"'~:::

r

19 EP

Rs. Saslc and dllutecl

or Annual/sed

20) PUblic shareholding

- Number of shares (In lacs)

- Percentanoe of Sharehok!in'"

21) 1. Promoters

and promoter

group

Shareholdlng

a) PledgedfEncumbered

- Number of shares

. Percentage

shareholding

of shares (as a

of'promoter

% of

shareholding

. Percentage

1329.08

118.67

277.05

_ 367.16

59.94

789.33

828.70

625.44

500.38

65.82

group)

and promoter

2016

30

U"lIudl~

~-"-

1,428.38

Rs. lin Lacs

orations

Half Year ended

~I}-se .16

\.:><lU<f1ted

Year Ended

31-Mar_16

30-58 -15

UnaUdItlld

~2,';4i8J

AudJI8d

2,895,43

",,,,"'.,II

5.576.37

1428.38".~~~4j.83.

2895.43

114.4~~'\~:t5

324,70 ,_

516'-'~~.~

'.':-- 362.88

73442 .

22807

"of:"

227.50

6576.37

445.42

1,174.07

1,456.07

955.01

294.99

4 325.66

736.'31

.72

~_ .'''' ~~.98

~.._.~~o:::~\7:; ~~;:b~

2'~~~~

329.26

546.87

370.35

1,109.39

63.46

52.04

83,34

600.05

493.83

287.02

"115,5

9lJ3.89

45. 1

-.0<,-"

'<.1;"'26.81

-.~ ~,

38.07

563.51

41.09

589.37

.. ..

63.~8

167.2

615.63

~'.-

342.87

1,093.13

0'

92.48

194.64

351.71

642.18

164.81

350.83

321.81

320.36

194.54

642.18

350.83

...

"1

321.81

320.36

194.64

642.18

582.50

1 582,50

1 582.50

1 582.50

350.83

696.72

1 582.50

1 582.50

0.25

213.58

26.99

214.68

27.13

0."

0.44

'I

214.68

27.13

0.00

0.00

0.00

~r

,1\

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

577.67

217.00

27.43

"

0.00

I:

100

576.57

000

000

.0.00

0.00

576.57

576.57

100.00

'00

'00

'00

73.01

72.87

72.87

12.87

group)

of shares (as a % of the total share

72.78

!J il

all

~IJ

I

::11

'iII

j!I,.i

:1.;

.H'

l'

575.89

'

fj Ii

10743.94

0.81

214.68

27.13

ft '!

. -t~if

:1

0.40

~~4''-.

:::.::

l~ -;

78.13

173.47

320.36

:I[

":"~l~:

.,.

"

liil.

11.1,

~50.81

93.51

178,24

321.81

215.36

27.22

of shares (as a% of the total

of promoter

1314.77

0.41

. Percentage of shares (as a% of the lolal share

capital of the company)

b) Non-encumbered

Number of Shares (In Lacs)

.Percentage

30-50

the total

and promoter

ON SEPTEMBER

Indl..

-I'

of associates

16) Net prom after taxes, mlnortty

share of Droflt of associates

17 Paid-u

Atter

1,329.06

+ ..

4 Other Income

11 Profit From

rellna

Activities

12 Extra Oretina

Items

13) Net Profit for the pertod

1,314.77

120.98

241.14

367.27

Charges

before

Unaucll!I>d

t~dalone

.

~

d) Provision for bad debts and SLA deductl

f) Other Expenditure

ons

Total ExD&nses

3) Prom

30.Jun.16

UII.IUdlted

I. lI1(;om~ rro~_~-:atlona

(8) Net salas/Income from operations

(b) Other operating income

Total Income from o;"eratlons

Inetl

2. Expenses

E~DED

.. ~o.n, CIN. L722QORJ1995PLCOO9798

PartfculUB

0:00

574.25

100.00

12.57

capital of the company)

"

II

I

" 'I

'I it

n:1"

i

r:

,"'1

2. Investor Complaints:

Pending at the beginning of the quarter

Received during the quarter

Dispopsed off during the quarter

Remai~;ino ~nresolved at the end of the ~uarler

:1

NIL

NIL

NIL

NIL

i!

']

,.

11

SegmentwlH

revenue,

results

Segment Revenue

- Software & E-Govemance

Learning Solutions

'. Wind Power GenemUon

Total segment Revenue

Other income (net)

Total Revenue

segment net profit

- Software Services

- Learning Solutions

- Wind Power GeneraUon

Total segment profit

Other income

Total profit

Unallocable eJq)ellses

~:~t;,f~~:J:emoIOVed

lind capital

emplo

eel

Services

151.36

1,106.00

57,41

1,314.77

38.07

1,352.84

308.13'

2,212.19

123.51

2.643.83,

83.58;

106.34

1,246.02

76.02

1,428.38

41.09

1,469.47

461.71

4,938.79

175.87

5,676.37

185.19

6,761.66

199.99

2,573.55

121.89

2,895.43

93.51

2,988.94

2,727.4.1 :

'.

f See note 3\

79,41

366.89

25.06

471.36

38.07

&09.43

(9.38)

500.05

NA

Statement

Partlcula

156.77

1.106.19

66.10

1,329.06

45.51

1,374.57

90.00

334.05

33.54

467.59

45.51

603.10

(9.27)

493.83

NA

of Assets

223.00

591.78

102.41

276.44

62.69

441.64

93.51

635.05

(19.42)

516.63

169.43:

700.94

58.59,

928.96

63.58

1,012.64.

(18.65)

993.89'

55.67

157.52

42.47

256.66

41 10

296:77'

(9.75)

287.02

NA

54.29

869.07

185.19

1,064.26

39.26

1,015.00

NA

NA

NA

'il'

and Liabilities

Standalone

Financial

HalfYesr

ended

Sr. No.

30-Se

-18

31.Mar.16

Audited

Unaudited

EQUITY AND UABIUTIES

SHAREHOLDERS'

FUNDS

(a) Share Capital.

(b) Reserves & Surplus

(c) Money received against share WSlT8nts

Sul>-total-Shareholde~'

319.88

liabilities

TOTAL-EQUITY

AND UABtUTlES

ASSETS

Non-eurrent assets

(a) Fixed assets

(b ) Non-eurrent investments

(e) Deferred tax assets (net)

(d) Long-term loans and advances

(e) Other rion-eurrent assets

12,326.44

0

638.02

630.25

630.25

61.63

1,011.76

61.63

1,329.90

752.37

110.12

1,180.41

1,921.12

3,964.02

803,07

120.21

1.478.08

1,579.68

3,981.04

17 944.40

17 637.38

4,656.0~

909.62

100.84

353}9

895.54

Sub-total-Non-current

Sub-total-Current

liabilities

Current liabilities

(a) Short-term borrowings

(b) Trade payables

(cl Other current Ilabilities

(d) Short -term provisions

1,582.50

10,743.94

1,582.50

11.386.12

12,968.62

funds

Non-eurrent liabilities

(a) Long- term borrowings

(b) Deferred tax liabilities (net)

(e) Other long term iiabilllies

(d) Long term provisions

Sub-total-Non-eurrent

Results

Year ended

essets

Current assets

(a ) Trede receivables

(b) Cash and cash equivalents

(e) Short-term loans and advances

(d) Other current assets

Sub-total-Current

assets

6,915.84

._---~

.. .......

"

I CHARTERED

,-

ACCOUNTANTS]

3-C, JIIrdFloor, nlak Bhawan, nlak Marg, C-$cheme. JAIPUR _ 302005

Telefax +91 141 5104381 /5104382

email: smisra22@hotmail.com

LIMITED REVIEW REPORT

To

The Board of Directors

Compucom Software Limited

IT 14-15, EPIP Sitapura,

Jaipur

Sub: Unaudited Financial Results for the quarter ended on September 30,2016.

Ref: Limited Review of Financial Results

We have reviewed the accompanying statement of Unaudited Financial Results of Compucom

Software Limited ("the Company") for the quarter ended on September 30, 2016 ("the

Statement") together with notes there on ("the Statement"). The statement has been prepared by

the company pursuant to regulation 33 of the Securities and Exchange Board of India (Listing

Obligations and Disclosure Requirements) Regulations, 2015 which has been initialed by us for

identification purposes. This statement is the responsibility of the Company's Management and

has been approved by the Board of Directors. Our responsibility is to issue a report on these

fmancial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2410

"Review of Interim Financial Information Performed by the Independent Auditor of the Entity",

issued by the Institute of Chartered Accountants of India. This standard requires that we plan and

perform the review to obtain moderate assurance as to whether the Financial Statements are free

of material misstatement. A review is limited primarily to inquiries of Company personnel and

analytical procedures applied to financial data and thus provides less assurance than an audit. We

have not performed an audit and accordingly, we do not express an audit opinion.

Based on our review conducted as stated above, nothing has come to our attention that causes us

to believe that the accompanying Statement prepared in accordance with applicable Accounting

Standards and other recognized accounting practices and policies has not disclosed the

information required to be disclosed in terms of Regulation 33 of the SEBI (Listing Obligations

and Disclosure Requirements) Regulations, 2015 including the manner in which it is to be

disclosed, or that it contains any material misstatement.

Place: Jaipur

Date: November 12,2016

You might also like

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document8 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document3 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesConsolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document6 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- FY2011 ResultsDocument1 pageFY2011 ResultsSantosh VaishyaNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Industrial Machinery World Summary: Market Values & Financials by CountryFrom EverandIndustrial Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Outboard Motorboats World Summary: Market Sector Values & Financials by CountryFrom EverandOutboard Motorboats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Engineering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- PQ2Document2 pagesPQ2alellieNo ratings yet

- AKL Hal 601 603Document4 pagesAKL Hal 601 603BeNo ratings yet

- NotesDocument2 pagesNotesNoella Marie BaronNo ratings yet

- Unit .2 The Accounting Cycle For Service Giving BusinessDocument21 pagesUnit .2 The Accounting Cycle For Service Giving BusinessNikki100% (1)

- Working Capital Management of SeclDocument60 pagesWorking Capital Management of SeclSonia SadhuNo ratings yet

- Asset-V1 MITx+2.961.1x+3T2019+type@asset+block@1. Business Planning-5 PDFDocument17 pagesAsset-V1 MITx+2.961.1x+3T2019+type@asset+block@1. Business Planning-5 PDFLucas ArchilaNo ratings yet

- AccountingDocument5 pagesAccountingMoira C. VilogNo ratings yet

- Spiceland SM ch11 PDFDocument79 pagesSpiceland SM ch11 PDFmas aziz100% (3)

- Sme Discussion TemplateDocument5 pagesSme Discussion TemplateLeahmae OlimbaNo ratings yet

- Assignment 1 Financial and Managerial Accounting PDFDocument42 pagesAssignment 1 Financial and Managerial Accounting PDFNorNo ratings yet

- CASE STUDY 1 DemetilloEmnaceNepomucenoDocument16 pagesCASE STUDY 1 DemetilloEmnaceNepomucenoCheveem Grace EmnaceNo ratings yet

- G11 FABM Fourth QuarterDocument11 pagesG11 FABM Fourth QuarterFrancis Aaron RafananNo ratings yet

- Infosys Annual Report 2018-19Document1 pageInfosys Annual Report 2018-19Prachi SharmaNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisKana jillaNo ratings yet

- Ratio Formula Calculation Industry Average CommentDocument2 pagesRatio Formula Calculation Industry Average Commentjay balmesNo ratings yet

- Beta Watches Completed The Following Selected Transactions During 2016 andDocument1 pageBeta Watches Completed The Following Selected Transactions During 2016 andhassan taimourNo ratings yet

- ANSWERS - MODULE 5 For TeamsDocument4 pagesANSWERS - MODULE 5 For Teamsbhettyna noayNo ratings yet

- Residual Income ValuationDocument21 pagesResidual Income ValuationqazxswNo ratings yet

- System LimitedDocument11 pagesSystem LimitedNabeel AhmadNo ratings yet

- Balance Sheet Britannia Industries LTD (BRIT IN) - StandardizedDocument12 pagesBalance Sheet Britannia Industries LTD (BRIT IN) - Standardizedarchit sahayNo ratings yet

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With AnswersFlorie May HizoNo ratings yet

- Financial Accounting and Reporting - SLK - 02Document9 pagesFinancial Accounting and Reporting - SLK - 02Its Nico & SandyNo ratings yet

- Accounting - Questions 010812Document4 pagesAccounting - Questions 010812jhouvanNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument4 pagesApollo Hospitals Enterprise Limitedpaigesh1No ratings yet

- Bull Final Q223Document99 pagesBull Final Q223Elijah CherubNo ratings yet

- Annual Report: PT Intikeramik Alamasri Industri TBKDocument4 pagesAnnual Report: PT Intikeramik Alamasri Industri TBKCherry BlasoomNo ratings yet

- UntitledDocument25 pagesUntitledKatreen SamaniegoNo ratings yet

- Topic 7 OF ACCONTINGDocument11 pagesTopic 7 OF ACCONTINGCharlesNo ratings yet

- Lect 14TVDocument22 pagesLect 14TVsalman siddiquiNo ratings yet

- CourseHero FSDocument4 pagesCourseHero FSPraise BuenaflorNo ratings yet