Professional Documents

Culture Documents

Pag-IBIG Fund Multi Purpose Loan Application SLF001 V03

Uploaded by

Jazz AdazaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pag-IBIG Fund Multi Purpose Loan Application SLF001 V03

Uploaded by

Jazz AdazaCopyright:

Available Formats

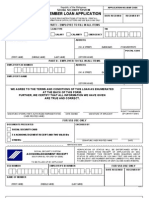

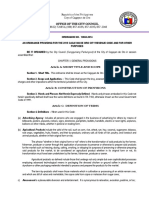

HQP-SLF-001

MULTI-PURPOSE LOAN (MPL)

APPLICATION FORM

Pag-IBIG MID No./RTN

APPLICATION No.

DATE OF BIRTH

PLACE OF BIRTH

CITIZENSHIP

EMAIL ADDRESS

CELL PHONE NUMBER (Required)

HOME TEL. NUMBER

APPLICANTS TAXPAYER

IDENTIFICATION NUMBER (TIN)

SSS/GSIS No.

BUSINESS TEL. NUMBER

NATURE OF WORK

DATE OF EMPLOYMENT

EMPLOYEE ID NUMBER

(To be filled out by applicant. Print this form back to back on one single sheet of paper)

Type or Print Entries

LAST NAME

FIRST NAME

NAME EXTENSION (e.g., Jr., II)

MIDDLE NAME

MAIDEN MIDDLE NAME

(For married women)

MOTHERS MAIDEN NAME

PRESENT HOME ADDRESS

Unit/Room No., Floor

SEX

MARITAL STATUS

Male

Single

Widower

Annulled

Female

Married

Legally Separated

Building Name Lot No., Block No., Phase No. House No. Street Name

Subdivision

Municipality/City

Province/State/Country (if abroad)

Barangay

NATIONALITY

PERMANENT HOME ADDRESS Unit/Room No., Floor

Building Name

Subdivision

Province/State/Country (if abroad)

Barangay

Municipality/City

ZIP Code

Lot No., Block No., Phase No. House No.

Street Name

ZIP Code

EMPLOYER/BUSINESS NAME

EMPLOYER/BUSINESS ADDRESS Unit/Room No., Floor

Building Name

Subdivision

Province/State/Country (if abroad)

Barangay

Municipality/City

Lot No., Block No., Phase No. House No.

PREVIOUS EMPLOYMENT DETAILS FROM DATE OF Pag-IBIG MEMBERSHIP

DESIRED LOAN AMOUNT

Max of 60% (24-59 mos.)

Max of 80% (at least 120 mos.)

Street Name LOAN PURPOSE

Non-Housing Related

Home Enhancement

Tuition/Educational Expense

ZIP Code

Health and Wellness

Livelihood

Max of 70% (60-119 mos.)

Other, please specify __________

Housing Related

House Repair

Minor home improvement

Others, specify _______________

(Use another sheet if necessary)

EMPLOYER/BUSINESS NAME

EMPLOYER/BUSINESS ADDRESS

In the event of the approval of my application for Multi-Purpose Loan, I hereby authorize

Pag-IBIG Fund to credit my loan proceeds through my Payroll Account/Disbursement Card

that I have indicated on the right portion.

SIGNATURE OF APPLICANT

FROM (mm/yy)

TO (mm/yy)

PAYROLL ACCOUNT/DISBURSEMENT CARD/PACKAGE UNIT ID

NAME OF BANK/BRANCH

APPLICATION AGREEMENT

This office agrees to collect the corresponding monthly

amortization on this loan and the MS of herein applicant

through salary deduction, together with the employer

counterpart, and remit said amounts to Pag-IBIG Fund on or

before the 15th day of each month, for the duration that the loan

remains outstanding. However, should we deduct the monthly

amortization due from the applicants salary but failed to remit it

on due date, this office agrees to pay the corresponding

penalty charged to applicant equivalent to % of any unpaid

amount for every month of delay and penalty for nonremittance equivalent to 1/10 of 1% per day of delay of the

amount payable from the date the loan amortization or

payments fall due until paid.

In consideration of the loan that may be granted by virtue of this application subject to the pertinent provisions of the

Implementing Rules and Regulations of Pag-IBIG Fund, I hereby waive my rights under R.A. No. 1405 and authorize

Pag-IBIG Fund to verify/validate my payroll account/disbursement card. Furthermore, I hereby authorize my present

employer, ______________________________________________________________________________ or any

employer with whom I may get employed in the future, to deduct the monthly membership savings (MS) and monthly

amortization due from my salary and remit the same to Pag-IBIG Fund. If the resulting monthly net take home pay after

deducting the computed monthly amortization on MPL falls below the monthly net take home pay as required under the

GAA/company policy, I authorize Pag-IBIG Fund to compute for a lower loanable amount.

I understand that should I fail to pay the monthly amortization due, I shall be charged with a penalty of % of any unpaid

amount for every month of delay.

If for any reason excess loan proceeds are erroneously credited to my payroll account/disbursement card, I hereby

authorize Pag-IBIG Fund to debit/deduct the excess amount from my account without need of further notice of demand.

Should my account balance be insufficient, the Fund has the right to demand for the excess amount to be refunded.

_________________________________________

I authorize Pag-IBIG Fund to disclose, submit, share or exchange any of my account information to legal and government

regulating agencies, other banks, merchant partners or third party in accordance with R.A. No. 9510 and other related or

pertinent laws and regulations. The credit information may also be transferred to service providers (e.g., Credit Information

Corporation, Bankers Association of the Philippines - Credit Bureau), likewise in accordance with laws and regulations.

HEAD OF OFFICE OR AUTHORIZED SIGNATORY

(Signature over Printed Name)

________________________________________________

DESIGNATION

I certify that the information given and any or all statements made herein are true and correct to the best of my knowledge

and belief. I hereby certify under pain of perjury that my signature appearing herein is genuine and authentic.

______________

Pag-IBIG

EMPLOYER ID NO.

__________________________________

Signature of Applicant over Printed Name

_______________

AGENCY CODE

______________

BRANCH CODE

PROMISSORY NOTE

For value received, I promise to pay on due date without need of demand to the order of PagIBIG Fund with principal office at Petron MegaPlaza, 358, Sen. Gil Puyat Avenue., City of Makati

the sum of Pesos:

(P_______________) Philippine Currency, with an interest at the rate of 10.75% per annum, for

the duration of the loan.

I hereby waive notice of demand for payment and agree that any legal action, which may arise

in relation to this note, may be instituted in the proper court of Makati City.

Finally, this note shall likewise be subject to the following terms and conditions:

1. I

shall

pay

the

amount

of

Pesos:

_______________________________

(P_______________) through salary deduction, whenever feasible, over a maximum

period of 24 months, with a grace period of 2 months. In case of suspension from work,

leave of absence without pay, insufficiency of take home pay at any time during the term of

the loan, payments should be made directly to the Fund or its accredited collecting agents.

2. Payments are due on or before the 15th day of the month starting on

_________________________ and 23 succeeding months thereafter.

3. Payments shall be applied according to the following order of priorities: Penalties, Interest

and Principal.

4. A penalty of % of any unpaid amount shall be charged to me for every month of delay.

5. I shall be considered in default in any of the following cases:

a. Any willful misrepresentation in any of the documents executed in relation hereto;

b. Failure to pay any three (3) consecutive monthly amortizations;

c. Failure to pay any three (3) consecutive membership savings;

d. Violation of any policies, rules, regulations and guidelines of the Pag-IBIG Fund.

6. In the event of default, the outstanding loan obligation shall become due and demandable. As

a consequence thereof, the outstanding loan obligation, consisting of the principal, interest and

penalties shall be subjected to offsetting against my Total Accumulated Value (TAV). However,

immediate offsetting of my outstanding loan obligation may be effected immediately upon

approval of my request, provided such request is based on the following justifiable reasons

and upon validation by the Fund: Borrowers unemployment; illness of the member-borrower or

any of his immediate family member as certified by a licensed physician, by reason thereof,

resulted in his failure to pay the required amortization when due; or death of any of his

immediate family members, by reason thereof, resulted in his failure to pay the required

amortization when due.

7. In the event of membership termination prior to loan maturity, any outstanding loan obligation,

shall be deducted from my TAV and/or any amount due me or my beneficiaries in the

possession of the Fund. In case of my death, the outstanding obligation shall be computed up

to the date of death. Any payment received after death shall be refunded to my beneficiaries.

8. In case of falsification, misrepresentation or any similar acts committed by me,

Pag-IBIG

Fund shall automatically suspend my loan privileges indefinitely. I shall abide with all the

applicable rules and regulations governing this lending program that

Pag-IBIG Fund may

promulgate from time to time.

Signed in the presence of:

___________________________________

Witness

(Signature over Printed Name)

__________________________________

Signature of Applicant over Printed Name

__________________________________

Witness

(Signature over Printed Name)

AUTHORITY TO DEDUCT (Optional)

In case of retirement/separation from employment, I hereby authorize my employer to deduct any outstanding MPL balance from my retirement

or separation benefits to fully settle my loan obligation. In the event that my retirement/separation benefits is not sufficient to settle the

outstanding balance of my MPL or my employer fails for whatever reason, to deduct the same from said retirement/separation benefits, I

hereby authorize Pag-IBIG Fund to apply whatever benefits are due me from the Fund to settle the said obligation.

SIGNATURE OF APPLICANT

THIS PORTION IS FOR Pag-IBIG FUND USE ONLY

CLAIM/HOUSING LOAN/STL VERIFICATION

PARTICULARS

WITH

WITHOUT

DV/CHECK / APPLICATION / P.N./AGREEMENT NO.

DATE FILED

VERIFIED

DATE

CLAIMS

HOUSING LOAN

MULTI-PURPOSE LOAN (MPL)

CALAMITY LOAN

LOAN AMOUNT GRANTED

INTEREST

LOAN APPROVAL

PREVIOUS LOAN BALANCE

LOAN PROCEEDS

REVIEWED BY

DATE

APPROVED BY

DISAPPROVED BY

DATE

THIS FORM CAN BE REPRODUCED. NOT FOR SALE

MONTHLY AMORTIZATION

DATE

(V03, 06/2016)

GUIDELINES AND INSTRUCTIONS

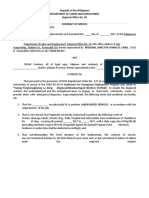

CERTIFICATE OF NET PAY

NAME OF BORROWER

For the month of:

_________________

Basic Salary

_________________

A.

B.

C.

Add: Allowances

_____________________

_____________________

_____________________

_____________________

Who May File

Any Pag-IBIG Fund member who satisfies the following requirements may apply for a Multi-Purpose Loan (MPL):

1. Has made at least twenty-four (24) membership savings (MS);

2. For members who have withdrawn their membership savings due to membership maturity, the reckoning date

of the updated 24 MS shall be the first MS following the month the member qualified to withdraw his MS due

to membership maturity;

3. Has five (5) MS for the last six (6) months as of month prior to date of loan application.;

4. If with existing Pag-IBIG Housing Loan, the account must not be in default as of the date of application; and

5. If with existing MPL and/or Calamity Loan, the account/s must not be in default as of date of application.

How to File

The applicant shall:

1. Secure the Multi-Purpose Loan Application Form (MPLAF) from any Pag-IBIG Fund Branch.

2. Accomplish 1 copy of the application form.

3. For releasing of loan proceeds through Payroll Account/Disbursement Card, attach photocopy of payroll

account/disbursement card/deposit slip (for newly-opened account).

4. Submit complete application, together with the required documents to any Pag-IBIG Fund Branch. Processing

of loans shall commence only upon submission of complete documents.

Loan Features

1. Loan Amount

A qualified Pag-IBIG member shall be allowed to borrow an amount based on the lowest of the following:

desired loan amount, loan entitlement, capacity-to-pay.

1.1 Loan Entitlement

The loan entitlement shall depend on the number of MS made, based on the following schedule:

__________

Number of MS

__________

24 - 59 months

60 - 119 months

At least 120 months

1.2 Capacity to Pay

An eligible borrowers loan shall be limited to an amount for which statutory deductions, monthly

repayment of principal and interest, and other obligations will not render the borrowers net take home

pay to fall below the minimum requirement as prescribed by the General Appropriation Act (GAA) or

company policy, whichever is applicable.

__________

__________

2.

_____________________

__________

3.

4.

Gross Monthly Income

__________

Less: Deductions

5.

_____________________

__________

_____________________

__________

_____________________

__________

_____________________

__________

_____________________

__________

Total Deductions

__________

Net Monthly Income

__________

6.

D.

I hereby authorize ____________________________,

our Fund Coordinator or Liaison Officer to file my MPL

Application and receive the Pag-IBIG Fund Check in

my behalf.

________________________________

Signature of Applicant over Printed Name

If the borrower has an existing Calamity Loan, the loanable amount shall be the difference between

80% of the borrowers TAV and the outstanding balance of his Calamity Loan; provided, it does not

exceed the borrowers loan entitlement.

Interest Rate

The loan shall bear an interest at the rate of 10.75% per annum for the duration of the loan.

Loan Term

The loan shall be repaid over a maximum period of twenty-four (24) months, with a grace period of two (2)

months.

Loan Release

The loan proceeds shall be released through any of the following modes:

a) Crediting to the borrowers cash card/disbursement card;

b) Crediting to the borrowers bank account through LANDBANKs Payroll Credit Systems Validation

(PACSVAL);

c) Check payable to the borrower;

d) Other similar modes of payments.

Loan Payments

5.1 The loan shall be repaid in equal monthly payments in such amounts as may fully cover the principal

and interest over the loan period. Said amortization shall be made, whenever feasible, through salary

deduction.

5.2 Payments shall be remitted to the Fund on or before the fifteenth (15th) day of each month, starting on

the third (3rd) month following the date on the DV/check.

5.3 The borrower may fully pay the outstanding balance of the loan prior to loan maturity.

5.4 The borrower shall pay directly to the Fund in case the borrower is unable to pay through salary

deduction for any of the following circumstances, such as but not limited to:

a. Suspension from work;

b. Leave of absence without pay;

c. Insufficiency of take home pay at any time during the term of the loan.

Penalties

A penalty of % of any unpaid amount shall be charged to the borrower for every month of delay. However,

for borrowers paying through salary deduction, penalties shall only be reversed upon presentation of proof

that non-payment was due to the fault of the employer. In such case, penalties due from the borrower shall

be charged to the employer.

Non-remittance of the total monthly amortization shall likewise subject the employer with a penalty of 1/10 of

1% per day of delay of the amounts payable from the date the monthly amortization or payments fall due

until paid.

7. Application of Payments

7.1 Payments shall be applied according to the following order of priorities:

a. Penalties; if any,

b. Interest; and

c. Principal

7.2 Accelerated Payments any amount in excess of the required monthly amortization shall be applied to

future amortizations.

8. Default

The borrower shall be in default in any of the following cases:

a. Any willful misrepresentation made by the borrower in any of the documents executed in relation hereto.

b. Failure of the borrower to pay any three (3) consecutive monthly amortizations.

c. Failure of the borrower to pay any three (3) consecutive MS.

d. Violation by the borrower of any of the policies, rules, regulations and guidelines of Pag-IBIG Fund.

Issued this _______ day of _________, 20__.

I certify under pain of perjury that the abovementioned information is true and correct.

___________________________________________

HEAD OF OFFICE/AUTHORIZED SIGNATORY

(Signature over printed name)

Loan Amount

Up to 60% of the Total Accumulated Value (TAV)

Up to 70% of TAV

Up to 80% of TAV

Other Provisions

1. The MPL and Calamity Loan shall be treated as separate and distinct from each other. Hence, the member

shall be allowed to avail of an MPL while he still has an outstanding Calamity Loan, and vice versa.

Application for loan on these two programs shall be governed by their corresponding guidelines. In no case,

however, shall the aggregate short-term loan exceed eighty percent (80%) of the borrowers TAV.

2. For borrowers with existing Calamity Loan at the time of availment of MPL, the outstanding loan balance of

the Calamity Loan shall not be deducted from the proceeds of the MPL.

3. In the event that an MPL account has a marginal balance of not more than P10.00 despite the payment of

the required 24 monthly amortization by the borrower, the Fund shall offset the said marginal balance from

the borrowers TAV.

4. In the event of membership termination prior to loan maturity, the outstanding loan obligation shall be

deducted from the borrowers TAV and/or any amount due him or his beneficiaries in the possession of the

Fund. In case of borrowers death, the outstanding obligation shall be computed up to the date of death. Any

payments received after death shall be refunded to the borrowers beneficiary.

5. An eligible member who is an active member under more than one employer shall have only one

outstanding MPL at any given time. At point of application, he shall choose which employer shall deduct and

remit his monthly MPL amortization.

6. A borrower may renew his MPL upon payment of at least six (6) monthly amortizations and he meets the

eligibility criteria. The proceeds of the new loan shall be applied to the borrowers outstanding MPL obligation

and the net proceeds shall then be released to him.

7. If TAV offsetting has been effected on the borrowers defaulting MPL, he may immediately apply for a new

MPL provided he has paid at least 6 monthly amortizations prior to default and meets the eligibility criteria.

However, if he has paid less than 6 monthly amortizations prior to default, he may apply for a new loan only

after two (2) years from date of TAV offsetting.

You might also like

- FLS020 HDMF Calamity Loan Application Form Aug 09 - 092809 - FDocument2 pagesFLS020 HDMF Calamity Loan Application Form Aug 09 - 092809 - FRochelle Esteban100% (2)

- Asian Homes - Pag-IBIG Multi-Purpose Loan ApplicationDocument1 pageAsian Homes - Pag-IBIG Multi-Purpose Loan ApplicationRodolfo Gamboa Pinzon100% (1)

- CONTRACT OF LEASE - RemataDocument2 pagesCONTRACT OF LEASE - RematarjpogikaayoNo ratings yet

- PVAO Pensioners ID Application GuideDocument2 pagesPVAO Pensioners ID Application GuideBohol FSEO Annex100% (2)

- Letter To U.S. Embassy On Behalf of ClientDocument3 pagesLetter To U.S. Embassy On Behalf of ClientsamijiriesNo ratings yet

- General Information SheetDocument1 pageGeneral Information SheetAgang Molina ColumnasNo ratings yet

- Joint Affidavit: Republic of The Philippines) City of Legazpi) S.S. X - XDocument1 pageJoint Affidavit: Republic of The Philippines) City of Legazpi) S.S. X - XJustine Ria AlmojuelaNo ratings yet

- Affidavit of Loss of Identification CardDocument2 pagesAffidavit of Loss of Identification Carddenvergamlosen0% (1)

- Auto Loan Application Form Motorcycle Loan Application Form: A Commercial Bank A Commercial BankDocument3 pagesAuto Loan Application Form Motorcycle Loan Application Form: A Commercial Bank A Commercial BankChristine GuyalaNo ratings yet

- Drug Testing Waiver Form: Dear Parents/Guardians/StudentsDocument1 pageDrug Testing Waiver Form: Dear Parents/Guardians/Studentsgrace revibesNo ratings yet

- Ra 9474 Truth in Lending Act PDFDocument7 pagesRa 9474 Truth in Lending Act PDFMarilyn DomalaonNo ratings yet

- Manila Science Recommendation FormDocument1 pageManila Science Recommendation FormWil MasongsongNo ratings yet

- The GoodwillDocument4 pagesThe Goodwillmesteru_alexandraNo ratings yet

- Certification & Ownership Form C1: Section One Certificate ADocument2 pagesCertification & Ownership Form C1: Section One Certificate ARichardwilsonNo ratings yet

- PingBills - Senate Bill 255: Benefits and Incentives of Barangay Tanod MembersDocument5 pagesPingBills - Senate Bill 255: Benefits and Incentives of Barangay Tanod MembersSenator Ping Lacson Media TeamNo ratings yet

- Residency AffidavitDocument2 pagesResidency Affidavitjemccourt7129No ratings yet

- Subscription Certificate PLDT Home Voice (Landline) and Data (Broadband) ServicesDocument3 pagesSubscription Certificate PLDT Home Voice (Landline) and Data (Broadband) Servicesneo14100% (1)

- Republic of The Philippines) City of Mandaluyong) S.S. Special Power of Attorney Know All Men by These PresentsDocument3 pagesRepublic of The Philippines) City of Mandaluyong) S.S. Special Power of Attorney Know All Men by These PresentsBuenavista MaeNo ratings yet

- Affidavit - Reuse Old SignatureDocument1 pageAffidavit - Reuse Old SignatureCompos MentisNo ratings yet

- Affidavit of DenialDocument2 pagesAffidavit of Denialattyglennchua28No ratings yet

- Affidavit-of-Undertaking - Docx NewDocument1 pageAffidavit-of-Undertaking - Docx NewSkevz BsceNo ratings yet

- Acknowdgement Reciept: The Balance One (1) Week On or Before The Date Stated On Thie Reciept or As Agreed OnDocument1 pageAcknowdgement Reciept: The Balance One (1) Week On or Before The Date Stated On Thie Reciept or As Agreed OnJerry LansanganNo ratings yet

- Acknowledgment ResiboDocument1 pageAcknowledgment ResiboManny SandichoNo ratings yet

- Authorisation Letter Format For BankDocument1 pageAuthorisation Letter Format For BankAvhi100% (1)

- Executive SummaryDocument3 pagesExecutive SummarykdamuNo ratings yet

- Application To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramDocument3 pagesApplication To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramrichardNo ratings yet

- Loan AgreementDocument1 pageLoan AgreementCarol Glitz100% (1)

- Affidavit of OwnershipDocument1 pageAffidavit of OwnershipJuri TabuenaNo ratings yet

- How to request a refund from the Civil Service CommissionDocument1 pageHow to request a refund from the Civil Service CommissionIsape Hope Maningo-Burguite Bagaipo100% (1)

- Provincial Human RecourceDocument1 pageProvincial Human RecourceJoseph Rosales Dela CruzNo ratings yet

- Disposition of Guards and Equipment Sample FormDocument1 pageDisposition of Guards and Equipment Sample Formapi-269948899100% (1)

- Affidavit For Delayed Registration of BirthDocument1 pageAffidavit For Delayed Registration of BirthAldrin AguasNo ratings yet

- Affidavit For Delayed Registration of BirthDocument1 pageAffidavit For Delayed Registration of BirthPHEmbassyRiyadhNo ratings yet

- CA Rules for Intel Communication to Change Name Deleting INTELDocument9 pagesCA Rules for Intel Communication to Change Name Deleting INTELChaNo ratings yet

- Affidavit of LossDocument2 pagesAffidavit of LosssamontedianneNo ratings yet

- ID Information SheetDocument1 pageID Information SheetRean Raphaelle Gonzales100% (1)

- Manok Na Pula! PDFDocument1 pageManok Na Pula! PDFEvan Maagad LutchaNo ratings yet

- Application For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFDocument2 pagesApplication For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFPhilip Floro0% (1)

- Check Printing TemplateDocument1 pageCheck Printing TemplateJessa Mariz Lecias CalimotNo ratings yet

- Daily Time RecordDocument1 pageDaily Time RecordAzultifiedNo ratings yet

- Sell vehicle deedDocument2 pagesSell vehicle deedRonaldNo ratings yet

- Sample PT JuneDocument2 pagesSample PT JuneJohanna Gwenn Taganahan Lomaad100% (1)

- Beneficiary Application FormDocument2 pagesBeneficiary Application FormAlok Raj100% (1)

- Pool Reservation FormDocument2 pagesPool Reservation Formadmin9696No ratings yet

- SSS Member Loan Application FormDocument2 pagesSSS Member Loan Application FormJr Sam90% (49)

- Non Deductability of Mandatory ContributionsDocument1 pageNon Deductability of Mandatory ContributionsJomar VillenaNo ratings yet

- Das Adela Del RosarioDocument3 pagesDas Adela Del Rosariog printNo ratings yet

- Annex V Contract of Service Tupad WorkersDocument3 pagesAnnex V Contract of Service Tupad WorkersChester DangliNo ratings yet

- Dole Rwa Form Updated 2020Document14 pagesDole Rwa Form Updated 2020Sherwin GuiuoNo ratings yet

- Affidavit Re: Termination of BusinessDocument2 pagesAffidavit Re: Termination of BusinessJoseph Alvin GaroNo ratings yet

- ParentalConsentForm KYCUpgrade PDFDocument1 pageParentalConsentForm KYCUpgrade PDFCarla CarlaNo ratings yet

- Personal Information Sheet PDFDocument2 pagesPersonal Information Sheet PDFRonelyn CalimbayanNo ratings yet

- 43735rmc No 5-2009 Annex CDocument1 page43735rmc No 5-2009 Annex CJM GapisaNo ratings yet

- Board Resolution 2023 002Document1 pageBoard Resolution 2023 002Stewart Paul TorreNo ratings yet

- Nanat Demand LetterDocument1 pageNanat Demand LetterAthena SalasNo ratings yet

- General Power of AttorneyDocument2 pagesGeneral Power of Attorneyshergin100% (1)

- Registry Number: - : Doc. No. - Page No. - Book No. - Series ofDocument1 pageRegistry Number: - : Doc. No. - Page No. - Book No. - Series ofAttyKaren Baldonado-GuillermoNo ratings yet

- SLF002 CalamityLoanApplication V05-2Document2 pagesSLF002 CalamityLoanApplication V05-2LouiseNo ratings yet

- Pag-IBIG MPL Application FormDocument2 pagesPag-IBIG MPL Application Formhailglee192580% (5)

- SLF002 Calamity Loan Application FormDocument2 pagesSLF002 Calamity Loan Application FormRoy NarapNo ratings yet

- Defective ContractsDocument1 pageDefective ContractsJazz AdazaNo ratings yet

- Final Demand Notice for Delinquent Business TaxesDocument3 pagesFinal Demand Notice for Delinquent Business TaxesJazz AdazaNo ratings yet

- DOF BLGF Local Treasury Operations Manual LTOMDocument608 pagesDOF BLGF Local Treasury Operations Manual LTOMResIpsa Loquitor98% (128)

- Local Finance Circular No. 2 93Document6 pagesLocal Finance Circular No. 2 93Jazz AdazaNo ratings yet

- Emergency NumbersDocument1 pageEmergency NumbersJazz AdazaNo ratings yet

- 2007-2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals&Ladot)Document125 pages2007-2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals&Ladot)Jay-Arh93% (98)

- CCTV AdvantagesDocument1 pageCCTV AdvantagesJazz AdazaNo ratings yet

- Ra 7160 IrrDocument263 pagesRa 7160 IrrAlvaro Garingo100% (21)

- CDP NarrativeDocument1 pageCDP NarrativeJazz AdazaNo ratings yet

- Witness Affidavit in Jeepney Accident CaseDocument4 pagesWitness Affidavit in Jeepney Accident CaseJazz Adaza100% (2)

- Taxation Bar QuestionsDocument65 pagesTaxation Bar QuestionsJazz Adaza100% (1)

- SFC List of Familiar SongsDocument18 pagesSFC List of Familiar SongsJazz AdazaNo ratings yet

- PC Express - Dealer's Price ListDocument2 pagesPC Express - Dealer's Price ListJazz AdazaNo ratings yet

- Labor and Agrarian LawsDocument35 pagesLabor and Agrarian LawsJazz AdazaNo ratings yet

- Asus Zenfone Max 3Document94 pagesAsus Zenfone Max 3Jazz AdazaNo ratings yet

- LABOR RELATIONS OVERVIEWDocument53 pagesLABOR RELATIONS OVERVIEWsusanamagtutoNo ratings yet

- Domondon Taxation Notes 2010Document79 pagesDomondon Taxation Notes 2010tynajoydelossantosNo ratings yet

- Cagayan de Oro City Revenue Code of 2015Document134 pagesCagayan de Oro City Revenue Code of 2015Jazz Adaza100% (1)

- A Divine Revelation of HellDocument95 pagesA Divine Revelation of Hellpurifysoul100% (5)

- 10 29 16 New Long Dealers PriceDocument3 pages10 29 16 New Long Dealers PriceVj TolentinoNo ratings yet

- The Great Formula in Passing The Bar Examinations: January 29, 2016Document6 pagesThe Great Formula in Passing The Bar Examinations: January 29, 2016Jazz AdazaNo ratings yet

- Bio Data FormDocument1 pageBio Data FormRaffy RoncalesNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthJazz AdazaNo ratings yet

- Cagayan de Oro Revenue Code of 2015Document134 pagesCagayan de Oro Revenue Code of 2015Jazz Adaza67% (6)

- Tax Pbcom V CirDocument1 pageTax Pbcom V CirJazz AdazaNo ratings yet

- Right to Self-Defense in International LawDocument10 pagesRight to Self-Defense in International LawJazz AdazaNo ratings yet

- City Treasurer's Office Cagayan de Oro Citizen's CharterDocument19 pagesCity Treasurer's Office Cagayan de Oro Citizen's CharterJazz AdazaNo ratings yet

- 2013 Bar Reviewerin Mercantile LawDocument177 pages2013 Bar Reviewerin Mercantile LawRey RodenNo ratings yet

- The Local Government Code of The PhilippinesDocument130 pagesThe Local Government Code of The PhilippinesJay SosaNo ratings yet

- Виписка з банкуDocument1 pageВиписка з банкуЛаріна ТетянаNo ratings yet

- LT E-BillDocument2 pagesLT E-BillShahbaz ShaikhNo ratings yet

- TVM Quiz ReviewerDocument3 pagesTVM Quiz ReviewerAra FloresNo ratings yet

- Fees Structure International School 2011-12Document5 pagesFees Structure International School 2011-12Ashish PanchalNo ratings yet

- DBS AR 2019 Final Final PDFDocument371 pagesDBS AR 2019 Final Final PDFDevi Nurusr100% (1)

- Gift CardDocument2 pagesGift CardSK Sabbir AhmedNo ratings yet

- 3.contractor Wise Details-CommitteeDocument114 pages3.contractor Wise Details-CommitteeGURUDEV ENGINEERSNo ratings yet

- Acquisition of Merrill Lynch by Bank of AmericaDocument26 pagesAcquisition of Merrill Lynch by Bank of AmericaNancy AggarwalNo ratings yet

- XYZ Company Statement of Cash Flows AnalysisDocument2 pagesXYZ Company Statement of Cash Flows AnalysisJasmine ActaNo ratings yet

- Aarti Jankar Roll No-9611Document54 pagesAarti Jankar Roll No-9611FIN 9611 Aarti JankarNo ratings yet

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsDocument3 pagesTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartNo ratings yet

- 227Document1 page227Yuuvraj SinghNo ratings yet

- BAIN REPORT European Banking PDFDocument32 pagesBAIN REPORT European Banking PDFRicardo EstellesNo ratings yet

- Revision of Service Charges - DepositDocument10 pagesRevision of Service Charges - DepositThe QuintNo ratings yet

- Presentation OnDocument90 pagesPresentation OnK V Sridharan General Secretary P3 NFPE100% (1)

- Murabaha - Application (Trade Finance)Document72 pagesMurabaha - Application (Trade Finance)Riz Khan100% (2)

- TOA Loans ReceivablesDocument9 pagesTOA Loans ReceivablesPachiNo ratings yet

- Functions of Central Bank in An EconomyDocument4 pagesFunctions of Central Bank in An EconomyShafiq MirdhaNo ratings yet

- Canadian Mortgage CalculatorDocument33 pagesCanadian Mortgage Calculatorvijay sainiNo ratings yet

- What Are The Functions, Attributes And, Kinds of MoneyDocument2 pagesWhat Are The Functions, Attributes And, Kinds of MoneyAngelie JalandoniNo ratings yet

- Statement of Axis Account No:917010039768564 For The Period (From: 12-01-2020 To: 12-08-2020)Document5 pagesStatement of Axis Account No:917010039768564 For The Period (From: 12-01-2020 To: 12-08-2020)Dr. DUSHYANTH N DNo ratings yet

- Ang Tek Lian Vs CADocument2 pagesAng Tek Lian Vs CALee Somar100% (1)

- Year-End Report - CBC MidDocument544 pagesYear-End Report - CBC MidYurih Khei Jham AluminumNo ratings yet

- CONSTRUCTION LOAN CHECKLIST Home Loan Application Checklist For Timberland Bank CustomersDocument1 pageCONSTRUCTION LOAN CHECKLIST Home Loan Application Checklist For Timberland Bank CustomersBekele AmanNo ratings yet

- M&M Payment RegisterDocument3 pagesM&M Payment RegistersppNo ratings yet

- Going To The BankDocument6 pagesGoing To The BankFigen ErgürbüzNo ratings yet

- Wealth Financial Advisor Associate in San Francisco Bay CA Resume Clemy LawDocument3 pagesWealth Financial Advisor Associate in San Francisco Bay CA Resume Clemy LawClemyLawNo ratings yet

- SWAP Agreements: Usman AliDocument16 pagesSWAP Agreements: Usman AliomeedjanNo ratings yet

- Complaint Affidavit For Filing of BP 22 CaseDocument2 pagesComplaint Affidavit For Filing of BP 22 CaseReginald FloresNo ratings yet

- UCO Bank Challan KCCBDocument1 pageUCO Bank Challan KCCBNitin JamwalNo ratings yet