Professional Documents

Culture Documents

The Options of Projects Financing and Fu PDF

Uploaded by

xai_hafeezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Options of Projects Financing and Fu PDF

Uploaded by

xai_hafeezCopyright:

Available Formats

Australian Journal of Basic and Applied Sciences, 9(7) April 2015, Pages: 179-181

ISSN:1991-8178

Australian Journal of Basic and Applied Sciences

Journal home page: www.ajbasweb.com

The Options of Project Financing and Funding for Retrofitting Works as A Hybrid

Approach (HA) on Conserving The Historical Building in Malaysia

1

Muhammad Khairi Kamarudin, 1Aini Jaapar, 2Rosta Harun and 1Zaharah Yahya

Faculty of Architecture, Planning and Surveying, Universiti Teknologi MARA (UiTM) 40450 Shah Alam, Selangor Darul Ehsan, Malaysia.

Faculty of Environmental Studies, Universiti Putra Malaysia, 43400 UPM Serdang, Selangor Darul Ehsan, Malaysia

ARTICLE INFO

Article history:

Received 12 October 2014

Received in revised form 26 December

2014

Accepted 17 January 2015

Available online 28 February 2015

Keywords:

Retrofitting,

hybrid

approach,

conservation, reusing, historical

buildings, financing, funding and cash

flow.

ABSTRACT

Retrofitting the historical buildings in Malaysia is considered new since the prominent

retrofitted historical building was open to public in 2005. It is known as Kuala Lumpur

Performing Art Centre (KLPac). The transformation gives new looks externally and

internally to the buildings as well as additional of new spaces inside it apart from

reusing back the original structures and faade accordingly. As result, retrofitting

mechanism is considered as a Hybrid Approach (HA) in conservation works. Strong

cash flow and funding is vital and the key essential to a successfully retrofitting

historical buildings. Therefore the objective of this paper is to identify the project

financing and funding options for retrofitting works on the historical buildings in

Malaysia. Site visits, case studies, identification of retrofitted historical buildings,

reviewing secondary data and one to one interviews were done for this research.

2015 AENSI Publisher All rights reserved.

To Cite This Article: Muhammad Khairi Kamarudin, Aini Jaapar, Rosta Harun and Zaharah Yahya., The Options of Project Financing and

Funding for Retrofitting Works as A Hybrid Approach (HA) on Conserving The Historical Building in Malaysia. Aust. J. Basic & Appl.

Sci., 9(7): 179-181, 2015

INTRODUCTION

In general, every project needs funding in order

to achieve certain targets or goals (Chang, T.C., P.

Teo, 2009). The target normally will be based on the

idea or project brief that has been designed and

interpreted after few session of discussion between

the selected parties of the project (Harun, S.N.,

2011). A comprehensive project brief will have a

clear direction on how the project will be undertaken

until the completion of the project as planned (Wang,

H.J., Z.T. Zeng, 2010). The aim of this paper is to

determine the available options of project financing

& funding for retrofitting the historical buildings in

Malaysia.

This research was first carried out by identifying

the prominent retrofitted historical buildings in

Malaysia as case study followed by site visits to

retrofitted historical buildings in Melbourne &

Greeter City of Geelong, Australia. The options of

funding and financing sources for retrofitting the

historical buildings was determined by looking at

current scenario in project funding and financing

from secondary data and interviews.

Ontogenesis of Retrofitting Mechanism on

Historical Buildings in Malaysia:

Based on observation, site visits and interviews,

retrofitting is considered as new mechanism and style

in the architectural platform although it is originally

came from electrical engineering method of

plugging in new system that is not available during

the original construction (Dixon, T., M. Eames,

2013). Therefore by retrofitting the historical

buildings, the combination of the styles and materials

will creates the dominant and subservient style that

then creates a new overall faade looks (Cantell,

S.F., A.L. Huxtable, 2005). Thus, it can be

considered as a Hybrid Approach (HA) in

conservation works. The example of successful

retrofitted buildings in Australia could be seen in

Melbourne & City of Grater Geelong.

Kuala Lumpur Performing Art Centre (KLPac),

is the best example of successful retrofitted historical

buildings in Malaysia. KLPac was formally a

dockyard for locomotive trains of Malayan Railways

(KTMB) and was built in 1800 by the British. The

trains dockyard then officially became the Kuala

Lumpur performing art center in 2005 after it

undergo retrofitting construction in less than 1 year

by YTL Corporation. It used a Build-OperateTransfer contract (BOT) in its procurement strategy

with the total cost of RM 60 Million. KLPac then

Corresponding Author: Muhammad Khairi Kamarudin, Faculty of Architecture, Planning and Surveying, Universiti

Teknologi MARA (UiTM) 40450 Shah Alam, Selangor Darul Ehsan, Malaysia.

E-mail: mckhairi@yahoo.com

180

Muhammad Khairi Kamarudin et al, 2015

Australian Journal of Basic and Applied Sciences, 9(7) April 2015, Pages: 179-181

been transferred to Yayasan Budi Penyayang and

being operated by Actor Studio Malaysia until today.

This unique building symbolized the hardship of

Malaysia to become a developed county while

maintaining the authenticity of heritage and culture.

Desideratum of Project Financing and Funding on

Retrofitting Historical Buildings:

In Malaysia, conservation works of the historical

buildings such as mansion, bungalow, and shop

houses commonly funded by the owner of the

buildings itself. Meanwhile, the for historical

buildings that falls under Act 625-National Heritage

Act 2005 after the specific historical buildings being

selected by Department of Heritage to become

National Heritage Building (Hashim, A.E., 2012).

Conformed to chapter 4 of the act, the Federal

Government will fund (grant / loan) for the

conservation and preservation works of national

heritage buildings, but the fund will be managed by

the Department of Heritage or also known as

Commissioner since it is under their administration

and executive power .

Project Financing & Funding Options for

Retrofitting The Historical Buildings:

There are various types of funds to finance a

project. Internal funding and external funding are

two type of project financing and funding in

construction industry in Malaysia. Any project that

is being funded entirely by using its own funds or

under the companys account is considered as

internal funding while other than that is considered

using external findings if it come from external

sources (Kotval, Z., J. Mullin, 2009). External

sources of funds often classified into short tem,

intermediate term and long term. Trade credit,

factoring or blanket facility and overdraft facility

falls under short term financing while leasing and

mortgage falls under intermediate term financing. In

long term financing, there are bonds, debenture,

equity shares, public-private partnership (PPP),

private finance initiative (PFI) and product

development partnership PDP are the options that

could be use to obtain fund (Nasiha, N., 2013). The

table below shows the differences between the

options of external funding sources that is available

and suitable to be used in Malaysia:

Table 1: Differences between the options of external funding sources.

SHORT TERM

Funds for payment of costs associated with the building of a construction project

TRADE

The credit terms allowed by suppliers and sub-contractors are trade credits for which there are no cost

CREDIT

attached. Short term in 30 - 90 days.

FACTORING /

When companys payment periods are long, the debts can be factored out to a finance company or

BLANKET FACILITY

commercial banks that provide as such service. Cash received is equal the debt amount factored out less

the factoring charge at point of factoring.

OVERDRAFT

When bank approves the request for an overdraft (OD) facility in a given sum, As and when funds are

FACILITY

needed it could be drawn against the OD facility. Maximum withdrawal is based on the maximum of OD.

MEDIUM TERM

Frequently referred to as term financing / term loan. Associated with the purchase of machinery or

equipments for the permanent increase in the firm / company current asset such as material inventory.

LEASING /

Companys approaches commercial bank for a finance lease to buy a plant or equipment from a third party

MORTGAGE

vendor at an agreed rate of interest. The bank maintain charge on the item. The money is used to purchase

the required item from the vendor. The companys owns the asset.

LONG TERM

To secured companys main assets.

BONDS

Bonds maybe issued by large companies that undertaken mega projects. Repayable by specific agreed time

(example: maturing in 10, 15 or 20 years) or it can be converted at the investors discretion into equity

shares at pre agreed time at pre-agreed value.

DEBENTURES

These are long term loans secured by either the property for which the debenture was issued or on the

overall company properties or even on its overall operations. However the risk is high, if the company is

unable to repay the debenture by its due date, the debenture holders are at liberty to seize the assets that it

has secured and even foreclosure proceedings that can embarrass the company and thus impact its credit

standing in the financial and construction community

EQUITY SHARE

A company can raise its long term funds required. Normally done through its merchant bankers, listed

companies can issues a fresh lot of equity shares to the public for a stake in the company.

PPP

PPP involves the transfer to the private sector on the responsibility to finance and manage a package of

capital investment and services including the construction, management, maintenance, refurbishment, and

replacement of public sector assets. PPP is often used in state of municipal activities which is involving

services provided to the public need. Local government forms the third tier in the government structure in

Malaysia which it is one of the prominent parts. The public and private party may include in the contract

which would provide liabilities and undertaking of both parties of the project.

PFI

Built, Operate and Transfer (BOT), Built and Operate (BO), Built Lease Transfer (BLT) for new projects

and outright sale, lease, management buy-out and corporatisation for existing projects are the example of

PFI types in Malaysia. The main aim of PFI is to encourage private participation in the local construction

development and to reduce governments expenditure in providing public infrastructure and services.

PDP

An important trend in global health R&D are a type of public-private partnership called product

development partnerships (PDPs). PDPs are a unique, non-profit business model bringing together public,

private, academic and philanthropic sectors to develop technologies for global health. It can be adapted in

construction sector.

181

Muhammad Khairi Kamarudin et al, 2015

Australian Journal of Basic and Applied Sciences, 9(7) April 2015, Pages: 179-181

Summary and Conclusion:

Without a proper planned of cash flow and

limited funding, retrofitting the historical buildings

may have to stop half way, thus it will bring negative

impact to the surrounding, socially, economically

and to the environment. Cost benefit analysis (CBA),

sensitivity analysis and feasibility studies could be

done further to confirm the feasibility and viability of

the project and also to determine the returns rate

from the project if it is consider as an investment to

the project owner hence increasing the successful

rate of the project.

ACKNOWLEDGEMENT

Firstly, the research team acknowledges

financial support from the Government of Malaysia

via Malaysia Ministry of Educations through

Fundamental Research Grant Scheme (FRGS),

Universiti Teknologi MARA and University Putra

Malaysia.

REFERENCES

Cantell, S.F., A.L. Huxtable, 2005. The

Adaptive Reuse of Historic Industrial Buildings:

Regulation Barriers , Best Practices and Case Studies

Submitted in partial fulfillment of the requirement

for the degree Master of Urban and Regional

Planning Virginia Polytechnic Institute and State U.

Chang, T.C., P. Teo, 2009. The Shophouse

Hotel: Vernacular Heritage in a Creative City. Urban

Studies, 46(2): 341-367.

Dixon, T., M. Eames, 2013. Scaling up: the

challenges of urban retrofit. Building Research &

Information, 41(5): 499-503.

Harun, S.N., 2011. Heritage Building

Conservation in Malaysia: Experience and

Challenges. Procedia Engineering, 20: 41-53.

Hashim, A.E., H. Aksah, S.Y. Said, 2012.

Functional Assessment through Post Occupancy

Review on Refurbished Historical Public Building in

Kuala Lumpur. Procedia - Social and Behavioral

Sciences, 68: 330-340.

Kotval, Z., J. Mullin, 2009. The Revitalization

of New Englands Small Town Mills: Breathing New

Life into Old Places. Local Economy, 24(2): 151167.

Nasiha, N., M. Nadzri, M.N. Razali, 2013.

Implementation Public Private Partnership (PPP) in

Malaysia: A Review on Participation of Local

Government and Private Sector's in Land

Development, 25-26.

Wang, H.J., Z.T. Zeng, 2010. A multi-objective

decision-making process for reuse selection of

historic buildings. Expert Systems with Applications,

37(2): 1241-1249.

You might also like

- A Review of Construction Waste Management and Initiatives in Malaysia PDFDocument12 pagesA Review of Construction Waste Management and Initiatives in Malaysia PDFxai_hafeezNo ratings yet

- Modular ConstructionDocument20 pagesModular Constructionxai_hafeezNo ratings yet

- They Go To Cave They Sleep They Wake Up: It Is Beautifully Structured. Coincident? I Don't Think So!Document1 pageThey Go To Cave They Sleep They Wake Up: It Is Beautifully Structured. Coincident? I Don't Think So!xai_hafeezNo ratings yet

- 2-8 PetronasDocument33 pages2-8 Petronasfastidious_5No ratings yet

- Goldenratioandgoldenrectangle 130624054558 Phpapp02Document25 pagesGoldenratioandgoldenrectangle 130624054558 Phpapp02xai_hafeezNo ratings yet

- Enable and Challenges On Housing Industry MalysiaDocument18 pagesEnable and Challenges On Housing Industry Malysiaxai_hafeezNo ratings yet

- Proficiency Computer SkillsDocument6 pagesProficiency Computer Skillsxai_hafeezNo ratings yet

- Proforma 20142015 UthmDocument74 pagesProforma 20142015 Uthmxai_hafeez100% (1)

- Electronic Document Management in ConstructionDocument13 pagesElectronic Document Management in Constructionxai_hafeezNo ratings yet

- Collaborative Procurement in Construction Projects Performance Measures Case Study Iraninan Construction IndustryDocument8 pagesCollaborative Procurement in Construction Projects Performance Measures Case Study Iraninan Construction Industryxai_hafeezNo ratings yet

- Measurement and ApplicationDocument11 pagesMeasurement and Applicationxai_hafeezNo ratings yet

- Measurement and ApplicationDocument11 pagesMeasurement and Applicationxai_hafeezNo ratings yet

- What You Should Know About MegaprojectsDocument30 pagesWhat You Should Know About MegaprojectsJosé M. SánchezNo ratings yet

- Newton LawsDocument15 pagesNewton Lawsxai_hafeezNo ratings yet

- Notes Engineering SurveyDocument73 pagesNotes Engineering Surveyxai_hafeezNo ratings yet

- Managing Flood Problem in MalaysiaDocument5 pagesManaging Flood Problem in MalaysiaNicklaus TanNo ratings yet

- Stress N StrainDocument1 pageStress N Strainxai_hafeezNo ratings yet

- Business ManagementDocument13 pagesBusiness Managementxai_hafeez0% (1)

- Traditional Systems of Communication in Modern African DevelopmentDocument18 pagesTraditional Systems of Communication in Modern African Developmentxai_hafeez100% (1)

- Waves Basicsstuver 100518155745 Phpapp02Document35 pagesWaves Basicsstuver 100518155745 Phpapp02xai_hafeezNo ratings yet

- Effective Communication in ProjectDocument2 pagesEffective Communication in Projectxai_hafeezNo ratings yet

- Social Media A New Form of Social InteractionDocument9 pagesSocial Media A New Form of Social Interactionxai_hafeezNo ratings yet

- UiTM Senate approved academic calendarDocument2 pagesUiTM Senate approved academic calendarsilentsioNo ratings yet

- Physics 1Document72 pagesPhysics 1xai_hafeezNo ratings yet

- TIN Whiskers - ESA Journal Vol 10 11Document17 pagesTIN Whiskers - ESA Journal Vol 10 11xai_hafeezNo ratings yet

- An Investigation Into Psychological Stress Detection and Management OrganisationDocument10 pagesAn Investigation Into Psychological Stress Detection and Management Organisationxai_hafeezNo ratings yet

- Chapter 6 P2Document22 pagesChapter 6 P2Arif Ahmad100% (1)

- SMK ALOR PONGSU 34300 BAGAN SERAI, PERAK SCHEME OF WORK FOR FORM 4 PHYSICS YEARLY TEACHING PLAN 2013 SMK ALOR PONGSU 34300 BAGAN SERAI, PERAK SCHEME OF WORK FOR FORM 4 PHYSICS YEARLY TEACHING PLAN 2012 LEARNING AREA: 1. INTRODUCTION TO PHYSICS Week / Date Learning Objective Learning Outcomes Suggested Activities Notes Minimum Requirement & Sources 2/1-4/1 1.1 Understanding Physics A student is able to: • explain what physics is • recognize the physics in everyday objects and natural phenomena Observe everyday objects such as table, a pencil, a mirror etc and discuss hoe they are related to physics concepts. View a video on natural phenomena and discuss how they related to physics concepts. Discuss fields of study in physics such as forces, motion, heta, light etc. JPNP Module Ex: Vernier Callipers And Micrometer Screw Gauge 7/1-11/1 1.2 Understanding base quantities and derived quantities A student is able to: • explain what base quanDocument48 pagesSMK ALOR PONGSU 34300 BAGAN SERAI, PERAK SCHEME OF WORK FOR FORM 4 PHYSICS YEARLY TEACHING PLAN 2013 SMK ALOR PONGSU 34300 BAGAN SERAI, PERAK SCHEME OF WORK FOR FORM 4 PHYSICS YEARLY TEACHING PLAN 2012 LEARNING AREA: 1. INTRODUCTION TO PHYSICS Week / Date Learning Objective Learning Outcomes Suggested Activities Notes Minimum Requirement & Sources 2/1-4/1 1.1 Understanding Physics A student is able to: • explain what physics is • recognize the physics in everyday objects and natural phenomena Observe everyday objects such as table, a pencil, a mirror etc and discuss hoe they are related to physics concepts. View a video on natural phenomena and discuss how they related to physics concepts. Discuss fields of study in physics such as forces, motion, heta, light etc. JPNP Module Ex: Vernier Callipers And Micrometer Screw Gauge 7/1-11/1 1.2 Understanding base quantities and derived quantities A student is able to: • explain what base quanShu85No ratings yet

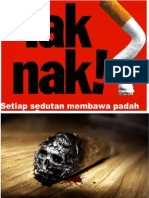

- Tak Nak RokokDocument7 pagesTak Nak Rokokxai_hafeezNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Holiday List 2021Document1 pageHoliday List 2021Bhargav ChintalapatiNo ratings yet

- American Split 2 PDFDocument131 pagesAmerican Split 2 PDFPlaying accountNo ratings yet

- Wide Sargasso Sea-WikipediaDocument4 pagesWide Sargasso Sea-Wikipediafiyert tNo ratings yet

- Martha Mitchell and The Watergate Scandle LisaleaksDocument33 pagesMartha Mitchell and The Watergate Scandle LisaleaksPaul CokerNo ratings yet

- AR Pertamina 2018 ENG LR PDFDocument380 pagesAR Pertamina 2018 ENG LR PDFRazansNo ratings yet

- c2 Cases 3Document166 pagesc2 Cases 3Myooz MyoozNo ratings yet

- Afm PDFDocument26 pagesAfm PDFcf34No ratings yet

- Africa Theological Seminary: Admissions@atseminary - Ac.keDocument3 pagesAfrica Theological Seminary: Admissions@atseminary - Ac.keandrea caphaceNo ratings yet

- Dealing With The Tax Issues: Discount and Premium BondsDocument4 pagesDealing With The Tax Issues: Discount and Premium BondsAntonio J FernósNo ratings yet

- Essay Writing About My Best FriendDocument6 pagesEssay Writing About My Best Friendezm8kqbt100% (2)

- How Starbucks Really Became A Coffee Giant - English (AutoDocument17 pagesHow Starbucks Really Became A Coffee Giant - English (AutoRidoNo ratings yet

- Trainspotting (Film) - WikipediaDocument13 pagesTrainspotting (Film) - WikipediaMartin KellyNo ratings yet

- Summer 2023 NewsletterDocument6 pagesSummer 2023 NewsletterChristine ParksNo ratings yet

- Paycheck 20211203 002360 Maurisha 202112231136Document1 pagePaycheck 20211203 002360 Maurisha 202112231136saraNo ratings yet

- DPSP WomenDocument6 pagesDPSP WomenYuvi SinghNo ratings yet

- The Grameen Bank Model Corporate Success PDFDocument11 pagesThe Grameen Bank Model Corporate Success PDFSamreet Singh100% (1)

- Spiritual DistressDocument4 pagesSpiritual DistressIsaias IsaiasNo ratings yet

- Inflation DefinitionDocument13 pagesInflation DefinitionBrilliantNo ratings yet

- DanielDocument1 pageDanielapi-547109595No ratings yet

- Steel BCGDocument40 pagesSteel BCGBinod Kumar PadhiNo ratings yet

- Municipal Courts Building Redevelopment Plan, Downtown St. Louis, MO - 2012Document17 pagesMunicipal Courts Building Redevelopment Plan, Downtown St. Louis, MO - 2012nextSTL.comNo ratings yet

- Chinese Love-Erotic PoetryDocument90 pagesChinese Love-Erotic PoetrygamahucherNo ratings yet

- Kenyon Frederic G., Books and Readers in Ancient Greece and Rome 1951Document80 pagesKenyon Frederic G., Books and Readers in Ancient Greece and Rome 1951kalliopi70100% (1)

- Year Zero PDFDocument4 pagesYear Zero PDFAbdallah Mohamed AboelftouhNo ratings yet

- Admiral Driving School - Content Calendar Aug-OctDocument4 pagesAdmiral Driving School - Content Calendar Aug-OctSophia PollardNo ratings yet

- Esp Module 2o21Document37 pagesEsp Module 2o21Cherry Lynn NorcioNo ratings yet

- Key ICT Trends Transforming EducationDocument11 pagesKey ICT Trends Transforming EducationPanashe MataranyikaNo ratings yet

- University of Oil and Gas,Ploieşti - British Cultural Studies - Samuel Beckett's Waiting for GodotDocument8 pagesUniversity of Oil and Gas,Ploieşti - British Cultural Studies - Samuel Beckett's Waiting for GodotmadalinaNo ratings yet

- Organization and Management ReviewerDocument13 pagesOrganization and Management ReviewerSunghoon ParkNo ratings yet

- Marginal Cost Curves CFA Level 1Document2 pagesMarginal Cost Curves CFA Level 1Noor NadiahNo ratings yet