Professional Documents

Culture Documents

B F (ACC501) : Semester Fall 2015

Uploaded by

safarashOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B F (ACC501) : Semester Fall 2015

Uploaded by

safarashCopyright:

Available Formats

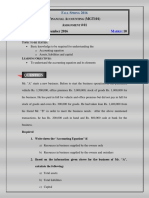

SEMESTER FALL 2015

BUSINESS FINANCE (ACC501)

ASSIGNMENT NO. 02

DUE DATE: 4TH FEBRUARY, 2016

MARKS: 20

Learning Objectives:

After attempting this assignment enthusiastically, the students will be able to:

Calculate different elements of Return.

Understand the calculations of Expected Return, Variance and Standard Deviation.

Question # 1

(5)

Suppose a stock had an initial price of Rs.62 per share, paid a dividend of Rs.1.50 per share during

the year, and had an ending share price of Rs.51.

1. What is the dividend yield?

2. What is the capital gain yield?

3. What is the percentage total return?

Question # 2:

(15)

Consider the following information on three stocks:

State of economy

Boom

Normal

Bust

Probability of

state of economy

0.20

0.50

0.30

Stock A

0.20

0.15

0.01

Rate of Return if State Occurs

Stock B

Stock C

0.35

0.60

0.12

.05

-0.25

-0.50

If your portfolio is invested 40 percent each in A and B and 20 percent in C:

1. What is the portfolio expected return?

2. What is the variance?

3. What is the standard deviation?

NOTE:

Complete calculations are required for every part of the problem. Incomplete

calculations will result in loss of marks.

IMPORTANT:

24 hours extra / grace period after the due date is usually available to overcome

uploading difficulties. This extra time should only be used to meet the

emergencies and above mentioned due dates should always be treated as final

to avoid any inconvenience.

OTHER IMPORTANT INSTRUCTIONS:

DEADLINE:

Make sure to upload the solution file before the due date on VULMS.

Any submission made via email after the due date will not be accepted.

FORMATTING GUIDELINES:

Use the font style Times New Roman or Arial and font size 12.

It is advised to compose your document in MS-Word format.

You may also compose your assignment in Open Office format.

Use black and blue font colors only.

RULES FOR MARKING

Please note that your assignment will not be graded or graded as Zero (0), if:

It is submitted after the due date.

The file you uploaded does not open or is corrupt.

It is in any format other than MS-Word or Open Office; e.g. Excel,

PowerPoint, PDF etc.

It is cheated or copied from other students, internet, books, journals etc.

Note related to load shedding: Please be proactive

Dear students!

As you know that Post Mid-Term semester activities have started

and load shedding problem is also prevailing in our country.

Keeping in view the fact, you all are advised to post your activities

as early as possible without waiting for the due date. For your

convenience; activity schedule has already been uploaded on

VULMS for the current semester, therefore no excuse will be

entertained after due date of assignments, quizzes or GDBs.

You might also like

- IELTS Writing Section (Academic) - How To Achieve A Target 8 Score!From EverandIELTS Writing Section (Academic) - How To Achieve A Target 8 Score!Rating: 3.5 out of 5 stars3.5/5 (7)

- Semester S 2016: Assignment NO. 01Document3 pagesSemester S 2016: Assignment NO. 01Muhammad Ilyas KhanNo ratings yet

- Fall 2019 - MGT501 - 1Document3 pagesFall 2019 - MGT501 - 1EDP SectionNo ratings yet

- Semester Fall 2019 H R M (MGT501) A # 1: Uman Esource Anagement SsignmentDocument3 pagesSemester Fall 2019 H R M (MGT501) A # 1: Uman Esource Anagement Ssignmentzohra jamaliNo ratings yet

- Entrepreneurial Process (4 Phases) To Effectively Start His Own VentureDocument2 pagesEntrepreneurial Process (4 Phases) To Effectively Start His Own VentureMovie NightNo ratings yet

- Semester Fall 2020: Enterprise Resource Planning (Mgmt-631) Assignment No. 2Document2 pagesSemester Fall 2020: Enterprise Resource Planning (Mgmt-631) Assignment No. 2Rapt NoNo ratings yet

- BUSINESS FINANCE ACC501 ASSIGNMENTDocument2 pagesBUSINESS FINANCE ACC501 ASSIGNMENTAtif RasheedNo ratings yet

- Fall 2022 - ACC501 - 1Document3 pagesFall 2022 - ACC501 - 1IhtramNo ratings yet

- Fall 2022 - ACC501 - 1Document3 pagesFall 2022 - ACC501 - 1Sth. Bilal BashirNo ratings yet

- Semester Spring 2021: Assignment N .1Document3 pagesSemester Spring 2021: Assignment N .1Sayed AssadullahNo ratings yet

- SEMESTER Spring 2020: Islamic Studies (ISL201)Document2 pagesSEMESTER Spring 2020: Islamic Studies (ISL201)abid princeNo ratings yet

- Accounting Equation and FinancialsDocument3 pagesAccounting Equation and FinancialsRabiya FiazNo ratings yet

- I M F (F 624) : Semester Fall 2020Document3 pagesI M F (F 624) : Semester Fall 2020Akram HussainNo ratings yet

- Spring 2020 - FIN624 - 1Document3 pagesSpring 2020 - FIN624 - 1Dark InstinctNo ratings yet

- Assignment - 2: Semester Fall 2020Document3 pagesAssignment - 2: Semester Fall 2020usmankhalidNo ratings yet

- FIN611 Advanced Financial Accounting Assignment 2Document2 pagesFIN611 Advanced Financial Accounting Assignment 2Amber KamranNo ratings yet

- Managerial Economics (Eco404) : Semester Fall 2015Document3 pagesManagerial Economics (Eco404) : Semester Fall 2015Erica LindseyNo ratings yet

- Developed By: Jawad Hassan: Question: What Type of Startup Is Most Suitable For Fatima Complying With Her PersonalDocument2 pagesDeveloped By: Jawad Hassan: Question: What Type of Startup Is Most Suitable For Fatima Complying With Her PersonalJohnNo ratings yet

- Spring 2021 FIN630 Assignment 1 Interest Coverage RatiosDocument3 pagesSpring 2021 FIN630 Assignment 1 Interest Coverage RatiosSayed AssadullahNo ratings yet

- Semester Fall 2020 Strategic Management (MGT603) Assignment # 02Document4 pagesSemester Fall 2020 Strategic Management (MGT603) Assignment # 02MalikusmanNo ratings yet

- Semester Spring 2015 Advance Research Methods (Sta730) Final AssignmentDocument2 pagesSemester Spring 2015 Advance Research Methods (Sta730) Final AssignmentMuhammad Salim Ullah KhanNo ratings yet

- Fall 2022 - HRM617 - 1Document2 pagesFall 2022 - HRM617 - 1Aysha ButtNo ratings yet

- Spring 2023 - MGT411 - 1Document2 pagesSpring 2023 - MGT411 - 1Rod WildermanNo ratings yet

- Semester S 2019: G, D & S (PAD603) Assignment NO. 01Document3 pagesSemester S 2019: G, D & S (PAD603) Assignment NO. 01Kashif Imran0% (1)

- Fall 2023 - ACC311 - 1Document3 pagesFall 2023 - ACC311 - 1nabila qayyumNo ratings yet

- Class NotesDocument3 pagesClass NotesambergullNo ratings yet

- Assignment #2 Returns AnalysisDocument3 pagesAssignment #2 Returns AnalysisAmina HamidNo ratings yet

- Semester Fall: Assignment N .2Document3 pagesSemester Fall: Assignment N .2Rabiya FiazNo ratings yet

- Leadership and Team ManagementDocument3 pagesLeadership and Team Managementmastermind_asia9389No ratings yet

- Knowledge Management - MGMT630 Assignment Marks: 10: Due Date: 28 Jan, 2020Document2 pagesKnowledge Management - MGMT630 Assignment Marks: 10: Due Date: 28 Jan, 2020Mahr Shoaib0% (1)

- FALL 2013 Investment Analysis and Portfolio Management (Fin630) Assignment No.01 Due Date: February 11, 2014 MARKS: 20Document2 pagesFALL 2013 Investment Analysis and Portfolio Management (Fin630) Assignment No.01 Due Date: February 11, 2014 MARKS: 20Usman QureshiNo ratings yet

- Fall 2023 - MGT602 - 1Document3 pagesFall 2023 - MGT602 - 1Gum NaamNo ratings yet

- Human Resource Development (HRM627) Assignment No. 02: D D: 3 August 2021 M: 10Document2 pagesHuman Resource Development (HRM627) Assignment No. 02: D D: 3 August 2021 M: 10Movie NightNo ratings yet

- Semester Spring 2022 Fundamentals of Auditing (ACC311) Assignment No.1Document3 pagesSemester Spring 2022 Fundamentals of Auditing (ACC311) Assignment No.1Mujtaba AhmadNo ratings yet

- Buisness FinanceDocument3 pagesBuisness Financearslan shahzadNo ratings yet

- Production/Operations Management (Mgt613) Assignment No.1 SPRING 2021Document2 pagesProduction/Operations Management (Mgt613) Assignment No.1 SPRING 2021Saqib MalghaniNo ratings yet

- Spring 2019 - MGT111 - 1Document2 pagesSpring 2019 - MGT111 - 1Suleyman KhanNo ratings yet

- Spring 2023 - HRM617 - 1Document2 pagesSpring 2023 - HRM617 - 1Dilawaiz MirzaNo ratings yet

- Semester Spring 2019: Islamic Studies (ISL201)Document2 pagesSemester Spring 2019: Islamic Studies (ISL201)aliNo ratings yet

- Assignment # 02: Marks: 10 Due Date: February 21, 2022Document3 pagesAssignment # 02: Marks: 10 Due Date: February 21, 2022Ali Raza NoshairNo ratings yet

- Assignment # 2 Fall-2020: Teacher's MessageDocument3 pagesAssignment # 2 Fall-2020: Teacher's MessageAbdussalam gillNo ratings yet

- C521 Syllabus Winter 2015-16Document17 pagesC521 Syllabus Winter 2015-16brunnomorenoNo ratings yet

- Semester Spring 2019: Sme Management (Mgt-601) AssignmentDocument3 pagesSemester Spring 2019: Sme Management (Mgt-601) Assignmentأفق جبئںNo ratings yet

- FNCE3477 S17 SyllabusDocument5 pagesFNCE3477 S17 SyllabusJavkhlangerel BayarbatNo ratings yet

- Spring 2022 - HRM61777Document2 pagesSpring 2022 - HRM61777Pre Cadet AcademyNo ratings yet

- All 2012 - FIN621 - 2 PDFDocument3 pagesAll 2012 - FIN621 - 2 PDFDua ShahNo ratings yet

- Fall 2023 - MGT201 - 1Document2 pagesFall 2023 - MGT201 - 1m.majedwarrichNo ratings yet

- Fall 2021 - ISL202 - 2Document2 pagesFall 2021 - ISL202 - 2Adnan JannNo ratings yet

- Caucasus School of BusinessDocument6 pagesCaucasus School of BusinessDavid ChikhladzeNo ratings yet

- FAC1502-101_2011_3_eDocument114 pagesFAC1502-101_2011_3_edrahlaga1No ratings yet

- Fall 2022 - MGT502 - 1Document2 pagesFall 2022 - MGT502 - 1Qazi SarmadNo ratings yet

- Thailand Macroeconomics Assignment Calculates Income and Tax MultipliersDocument3 pagesThailand Macroeconomics Assignment Calculates Income and Tax MultipliersAteeb ElahiNo ratings yet

- Assignment Brief of Unit 2 For Sem 3Document8 pagesAssignment Brief of Unit 2 For Sem 3uzair123465No ratings yet

- Final Exam InfoDocument13 pagesFinal Exam InfoEdithNo ratings yet

- Semester "Spring 2012": Financial Accounting (MGT101)Document3 pagesSemester "Spring 2012": Financial Accounting (MGT101)Waqar KhanNo ratings yet

- FIN711 Advanced Financial Accounting Assignment 01Document3 pagesFIN711 Advanced Financial Accounting Assignment 01محمد محبوب حسنNo ratings yet

- Spring 2022 - MGT201 - 1Document2 pagesSpring 2022 - MGT201 - 1The Contractor YTNo ratings yet

- Semester Fall: Assignment N .1Document3 pagesSemester Fall: Assignment N .1Rabiya FiazNo ratings yet

- Learning Plan Computer 7 ExcelDocument7 pagesLearning Plan Computer 7 ExcelRey ManNo ratings yet

- Spring 2014 - MGT411 - 2Document4 pagesSpring 2014 - MGT411 - 2abdmehNo ratings yet

- MGT501 Assignment 1: Benefits of Diverse HiringDocument1 pageMGT501 Assignment 1: Benefits of Diverse HiringsafarashNo ratings yet

- Screen clipping log May 5 2014Document9 pagesScreen clipping log May 5 2014safarashNo ratings yet

- Calculating return on assets and equity before and after investmentDocument2 pagesCalculating return on assets and equity before and after investmentsafarashNo ratings yet

- M (ECO403) : Semester Fall 2018Document4 pagesM (ECO403) : Semester Fall 2018safarashNo ratings yet

- Cost AccounitngDocument1 pageCost AccounitngsafarashNo ratings yet

- The Stockholders' ReportDocument1 pageThe Stockholders' ReportsafarashNo ratings yet

- DrawingsDocument1 pageDrawingssafarashNo ratings yet

- MGT501 Assignment 1: Benefits of Diverse HiringDocument1 pageMGT501 Assignment 1: Benefits of Diverse HiringsafarashNo ratings yet

- Kids DrawingsDocument2 pagesKids DrawingssafarashNo ratings yet

- CgsDocument1 pageCgssafarashNo ratings yet

- Qs 27 + 0.25P QD 75 - 0.15P: Microeconomics (Eco402)Document1 pageQs 27 + 0.25P QD 75 - 0.15P: Microeconomics (Eco402)safarashNo ratings yet

- CostingDocument1 pageCostingsafarashNo ratings yet

- 1 Fall 2017 - MGT619Document19 pages1 Fall 2017 - MGT619safarashNo ratings yet

- The Stockholders': Publicly Owned Corporations With MoreDocument1 pageThe Stockholders': Publicly Owned Corporations With MoresafarashNo ratings yet

- 2 Entry Step - (WD)Document11 pages2 Entry Step - (WD)safarashNo ratings yet

- 3 Sorce Docs - (HM)Document6 pages3 Sorce Docs - (HM)safarashNo ratings yet

- C G SDocument1 pageC G SsafarashNo ratings yet

- CostDocument1 pageCostsafarashNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationsafarashNo ratings yet

- ACCA ExcemptionDocument5 pagesACCA ExcemptionKuruvilla JobNo ratings yet

- Intel Video 3722Document2 pagesIntel Video 3722safarashNo ratings yet

- Practical Implementation of International Financial Reporting Standards - WWW - Enetlibrary.hostoiDocument153 pagesPractical Implementation of International Financial Reporting Standards - WWW - Enetlibrary.hostoiGilles ArmandNo ratings yet

- Teachers' Resource Manual for MathematicsDocument216 pagesTeachers' Resource Manual for Mathematicssafarash100% (1)

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentsafarashNo ratings yet

- Business Finance (ACC 501) Assignment NO.2 Question No.1Document2 pagesBusiness Finance (ACC 501) Assignment NO.2 Question No.1safarashNo ratings yet

- Reconcile Cash Book and Pass Book BalancesDocument1 pageReconcile Cash Book and Pass Book BalancessafarashNo ratings yet

- Reconcile Cash Book and Pass Book BalancesDocument1 pageReconcile Cash Book and Pass Book BalancessafarashNo ratings yet

- Time Table: Federal Public Service CommissionDocument1 pageTime Table: Federal Public Service CommissionzubairulhassanNo ratings yet

- BCom I and II Syllabus 2012 OnwardDocument20 pagesBCom I and II Syllabus 2012 OnwardZeeshan SaleemNo ratings yet

- CareEdge Ratings Update On Tyre IndustryDocument5 pagesCareEdge Ratings Update On Tyre IndustryIshan GuptaNo ratings yet

- IIP - Vs - PMI, DifferencesDocument5 pagesIIP - Vs - PMI, DifferencesChetan GuptaNo ratings yet

- Addmaths FolioDocument15 pagesAddmaths Foliomuhd_mutazaNo ratings yet

- 01 Fairness Cream ResearchDocument13 pages01 Fairness Cream ResearchgirijNo ratings yet

- Liquidating a Partnership with Capital DeficienciesDocument14 pagesLiquidating a Partnership with Capital DeficienciesMaria Kathreena Andrea AdevaNo ratings yet

- Fingal Housing Strategy AppendixDocument156 pagesFingal Housing Strategy Appendixdi TalapaniniNo ratings yet

- PDF1902 PDFDocument190 pagesPDF1902 PDFAnup BhutadaNo ratings yet

- Module 8 Benefit Cost RatioDocument13 pagesModule 8 Benefit Cost RatioRhonita Dea AndariniNo ratings yet

- Finland Country PresentationDocument28 pagesFinland Country PresentationLANGLETENo ratings yet

- Regenerative Braking SystemDocument27 pagesRegenerative Braking SystemNavaneethakrishnan RangaswamyNo ratings yet

- Contem ReviewerDocument9 pagesContem ReviewerKenNo ratings yet

- Reimbursement Receipt FormDocument2 pagesReimbursement Receipt Formsplef lguNo ratings yet

- Rationale Behind The Issue of Bonus SharesDocument31 pagesRationale Behind The Issue of Bonus SharesSandeep ReddyNo ratings yet

- Germany Vs Singapore by Andrew BaeyDocument12 pagesGermany Vs Singapore by Andrew Baeyacs1234100% (2)

- NBL Export-Import ContributionDocument41 pagesNBL Export-Import Contributionrezwan_haque_2No ratings yet

- Samurai Craft: Journey Into The Art of KatanaDocument30 pagesSamurai Craft: Journey Into The Art of Katanagabriel martinezNo ratings yet

- CIR vs. First Express PawnshopDocument1 pageCIR vs. First Express PawnshopTogz Mape100% (1)

- DCC 135Document193 pagesDCC 135Shariful IslamNo ratings yet

- 2013 Factbook: Company AccountingDocument270 pages2013 Factbook: Company AccountingeffahpaulNo ratings yet

- Dec. EarningsDocument1 pageDec. Earningsmorotasheila.smdcNo ratings yet

- Emirates Airlines Pilots Salary StructureDocument6 pagesEmirates Airlines Pilots Salary StructureShreyas Sinha0% (1)

- December 2011Document117 pagesDecember 2011Irfan AhmedNo ratings yet

- Equity vs. EqualityDocument5 pagesEquity vs. Equalityapi-242298926No ratings yet

- India CementsDocument18 pagesIndia CementsNanditha SivadasNo ratings yet

- Kanpur TOD Chapter EnglishDocument27 pagesKanpur TOD Chapter EnglishvikasguptaaNo ratings yet

- Hong Leong Bank auction of 5 Kuala Lumpur propertiesDocument1 pageHong Leong Bank auction of 5 Kuala Lumpur propertieschek86351No ratings yet

- 8 Sources of Funds For Nonprofits PDFDocument2 pages8 Sources of Funds For Nonprofits PDFskydawnNo ratings yet

- Lehman's Aggressive Repo 105 TransactionsDocument19 pagesLehman's Aggressive Repo 105 Transactionsed_nycNo ratings yet

- Ficha Tecnica y Certificado de Bituminoso MartinDocument2 pagesFicha Tecnica y Certificado de Bituminoso MartinPasion Argentina EliuNo ratings yet

- Accounting Chapter 10Document4 pagesAccounting Chapter 1019033No ratings yet