Professional Documents

Culture Documents

rs2016 460 Attach

Uploaded by

Anonymous GF8PPILW5Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

rs2016 460 Attach

Uploaded by

Anonymous GF8PPILW5Copyright:

Available Formats

METROPOLITAN GOVERNMENT OF NASHVILLE AND DAVIDSON COUNTY

OFFICE OF THE MAYOR

Karl F. Dean

Mayor

METROPOLITAN COURTHOUSE

NASHVILLE, TENNESSEE 37201

FOR IMMEDIATE RELEASE

March 27,2015

Contact: Bonna Johnson

(615) 862-6461 direct

(615) 389-3405 cell

bonna.johnson@nashville.gov

Fact Sheet

Nashville Convention Center Redevelopment

NASHVILLE, Term.- Mayor Karl Dean and developers Spectrum I Emery and OliverMcMillan

armounced today a plan to redevelop the Nashville Convention Center. The 6.2-acre project is at

the comer ofFifth Avenue and Broadway.

The approximately $400 million project includes:

o 205,000 square feet of retail, restaurant and entertainment space

o A 50,000-square-foot home for the National Museum of African American Music

o A 27-story residential tower with approximately 350 apartment units

o A 24-story office tower with at least 300,000 square feet of office space

o Separate office space catering to Nashville's creative class

o Parking

o Renaissance Nashville Hotel meeting space

The developers, Spectrum I Emery and OliverMcMillan, will pay Metro $5 million cash for

the property at closing once they have secured full financing for their project. Metro will put

the $5 million into the Barnes Fund for Affordable Housing.

Beginning in Year 6 of the deal, the developers will pay the city $250,000 each year for the

next 25 years, resulting in a total payment to Metro of $ 11 .25 million ($5 million up front

plus $6.25 million over 25 years).

The developers will build space for the National Museum for African American Music at

Broadway and Fifth Avenue into their development. The value of that space will be at least

$11 million. The museum will be responsible for furnishing the space and covering the costs

of its exhibits.

The developers also will take the existing Nashville Convention Center structure as is and

spend an estimated $7 million to demolish it.

-more-

Page 2, Fact Sheet: Nashville C onvention Center Redevelopment

Spectrum I Emery and OliverMcMillan will help build new meeting space for the

Renaissance Nashville Hotel, which has a previously existing agreement with Metro as the

headquarters hotel for the Nashville Convention Center. The developers are expected to

spend a minimum of $7 million on that work, which the hotel's owner and the Metro

Convention Center Authority also will help pay for.

The Metro Development and Housing Agency, pending its board's approval, plans to make

available $25 million in tax-increment financing, a type of loan that's repaid with part or all

of the incremental increase in property tax revenue created by a project. The developers plan

to use that financing to pay for eligible expenses, which could include relocation of utilities,

construction of streets and construction of utility infrastructure, among other things.

o

The developers will be able to apply 75 percent of the new property tax revenue

toward paying off the loan. The other 25 percent, which is expected to be about $1.76

million per year, will go into Metro's general fund . Once the loan is repaid, which

should happen within 12-15 years, Metro's general fund will get all of the prope1ty

tax revenue.

The Convention Center Authority, pending its members' approval, will own and operate the

parking garage that will serve the retail component of the development with at least 781

parking spaces. The authority will pay $32 million to the developers, who will build the

garage. The authority will receive all revenue, which is expected to cover debt service.

The developers have estimated the following timeline for the project:

o

April-May, 2015: Government approvals, including Metro Council, MDHA,

Convention Center Authority

May-October, 2015:

Develop next phases of design for project

Retail and office pre-leasing

Milestone contractor pricing

Financing structure finalized

November-December, 2015:

Finalize construction documents

Finalize construction pricing

Continued retail leasing

Finalize equity and debt documentation

Close financing and property acquisition

First quarter, 2016: Demolition/excavation is planned

2016: Start parking construction

-more-

Page 3, Fact Sheet: Nashville Convention Center Redevelopment

o

Later 2016: Start construction of museum, retail, residential and office

components concurrently

Mid to Late 2017: Completion ofparkjng and retail building shell ; tenant space

improvements to start in a staggered sequence as spaces are being delivered

Late 2017: Marketing of residential units

Mid-20 18: Anticipated substantial leasing for office and retail

The developers will have until the end of 2015 to put together their fmancing. After that, they

can extend the deadline for three months at a time through the end of2016 but will be

required to pay Metro $250,000 each time they do so. If they can't make their financing work

by the end of 2016, the deal will be off and Metro will retain ownership of the convention

center property.

The deal is subject to Metro Council approval, with first reading scheduled for April 7.

###

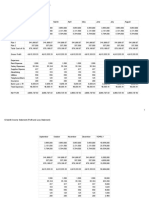

Nashville Convention Center Facility Redevelopment

SUM M ARY OF LOCAL ECONOMIC AND FISCAL EFFECTS

Mark L. Burton, PhD

Research Associate Professor

The University of Tennessee - Knoxville

mburton3@utk.edu

Repurposing and redeveloping existing facilities so that they are suited to forward-looking uses

is an important element in responsible metropolitan land use planning. Within this context the

current proposal is to redevelop the existing Nashville convention center, converting it to a

multiuse complex that will feature exclusive retail and dining alternatives, office and residential

spaces, and a home for the National Museum of African American Music. Both the necessary

redevelopment construction activity and the subsequent facility's operation will have

measurable impacts on the metro Nashville economy.

While transitory, the $390 million in construction expenditures is expected to contribute a total

of 4,660 job-years of additional regional employment and result in a one-time addition of more

than $306,ooo,ooo in personal incomes. Still, from a local economic standpoint, the lasting

impacts of the potential redevelopment are more sigrtificant than the transient construction

effects. To capture the ongoing economic impacts of the planned redevelopment, we used clientprovided employment and compensation data as the seeds within economic simulations that

also capture the broader indirect and induced effects. Next, these impacts were extended to

predict associated local fiscal changes. The fiscal analysis considered four elements. These

include (1) the property-based Central Business Improvement District (CBID) payment

associated with the redeveloped facility, (2) a proposed 25 percent share of total real property

taxes attributable to the redeveloped facility, (3) personal property tax revenues accruing as a

result of furniture, fixture, and equipment purchases, as well as other tenant improvements, and

(4) local sales tax revenues attributable to the both the redeveloped facility's operation and from

increased resident earnings. 1 Economic simulation results and related fiscal projections are

summarized in Table 1.

Table 1 - Summary of Estimated Ongoing Economic and Fiscal Effects

Impact Area

Change in Total Regional Employment

Change in Total Regional Incomes

Change in Loca l Revenues

Annuallmpact

2,753

$82,555,894

$7,943,403

20-Vear Total

2,753

$1,651,117,880

$158,867,521

The 25 percent share reflects a proposed program of tax increment financing (TIF) that includes a 75 percent

abatement of real property taxes on the subject property, assuming the duration will be 20 years, even though in all

ac~ality it will likely be paid off in 10-12 years.

2 Totals do not discount future incomes or revenues. Using a real discount rate of 5%, the corresponding present value

of changes to regional income is $1,028,828,920, while the present value of additional local revenues is $77,043.416.

48336369-8210.1

You might also like

- Mississippi AG Opposes Reproductive Care Privacy RuleDocument17 pagesMississippi AG Opposes Reproductive Care Privacy RuleJonathan AllenNo ratings yet

- Jimmie Allen Counterclaim Jane Doe 2Document19 pagesJimmie Allen Counterclaim Jane Doe 2Anonymous GF8PPILW5No ratings yet

- United States District Court Western District of Washington at SeattleDocument23 pagesUnited States District Court Western District of Washington at SeattleAnonymous GF8PPILW5No ratings yet

- ComplaintDocument7 pagesComplaintAnonymous GF8PPILW5No ratings yet

- Sumner County LawsuitDocument42 pagesSumner County LawsuitAnonymous GF8PPILW5No ratings yet

- Letter To Skrmetti and SutherlandDocument2 pagesLetter To Skrmetti and SutherlandAnonymous GF8PPILW5No ratings yet

- Ma23 27 LetterDocument19 pagesMa23 27 LetterAnonymous GF8PPILW5No ratings yet

- Jimmie Allen CounterclaimDocument24 pagesJimmie Allen CounterclaimAnonymous GF8PPILW5No ratings yet

- Response To Metro Notice of FilingDocument18 pagesResponse To Metro Notice of FilingAnonymous GF8PPILW5No ratings yet

- Lawsuit Vs Jimmie Allen & OthersDocument20 pagesLawsuit Vs Jimmie Allen & OthersAnonymous GF8PPILW5100% (1)

- Recommended Policy Actions To Reduce Gun Violence in TennesseeDocument4 pagesRecommended Policy Actions To Reduce Gun Violence in TennesseeAnonymous GF8PPILW5No ratings yet

- TNDP Resolution Re - SextonDocument2 pagesTNDP Resolution Re - SextonAnonymous GF8PPILW5No ratings yet

- Wilson Co Law SuitDocument15 pagesWilson Co Law SuitAnonymous GF8PPILW5No ratings yet

- 20230329161826738Document2 pages20230329161826738Anonymous GF8PPILW5No ratings yet

- Choice Lanes Website FAQs 06Document2 pagesChoice Lanes Website FAQs 06Anonymous GF8PPILW5No ratings yet

- 1606 12162 011123Document13 pages1606 12162 011123Anonymous GF8PPILW5No ratings yet

- Ma23 01Document1 pageMa23 01Anonymous GF8PPILW5No ratings yet

- Chief Drake LetterDocument2 pagesChief Drake LetterAnonymous GF8PPILW5No ratings yet

- pr23 05 BriefDocument135 pagespr23 05 BriefAnonymous GF8PPILW5No ratings yet

- PR23 03Document1 pagePR23 03Anonymous GF8PPILW5No ratings yet

- Show MultidocsDocument33 pagesShow MultidocsAnonymous GF8PPILW5No ratings yet

- Booker Beyer Lead Colleagues in Urging CPSC To Address Dangerous Indoor Air Pollutions Emitted by Gas StovesDocument4 pagesBooker Beyer Lead Colleagues in Urging CPSC To Address Dangerous Indoor Air Pollutions Emitted by Gas StovesAnonymous GF8PPILW5No ratings yet

- 2022.10.17 - Stamped Filed ComplaintDocument8 pages2022.10.17 - Stamped Filed ComplaintAnonymous GF8PPILW5No ratings yet

- Wittman No Budget No Pay Final 118thDocument4 pagesWittman No Budget No Pay Final 118thAnonymous GF8PPILW5No ratings yet

- Cicilline 14th Amd Bill TextDocument28 pagesCicilline 14th Amd Bill TextAnonymous GF8PPILW5No ratings yet

- Gender Diversity Philosophy at Harpeth HallDocument1 pageGender Diversity Philosophy at Harpeth HallAnonymous GF8PPILW5No ratings yet

- City of Forest Hills LawsuitDocument8 pagesCity of Forest Hills LawsuitAnita Wadhwani100% (1)

- HB0001Document11 pagesHB0001Anonymous GF8PPILW5No ratings yet

- Parrish Complaint ExhibitsDocument64 pagesParrish Complaint ExhibitsAnonymous GF8PPILW5No ratings yet

- Federal Funding Fallout: How Tennessee Public Schools Are Spending Billions in Relief FundsDocument17 pagesFederal Funding Fallout: How Tennessee Public Schools Are Spending Billions in Relief FundsAnonymous GF8PPILW5No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Smartcat-10609 Verbal Ability and Reading Comprehension Instructions For Questions 1 To 4: The Passage Given Below Is Followed by A Set ofDocument34 pagesSmartcat-10609 Verbal Ability and Reading Comprehension Instructions For Questions 1 To 4: The Passage Given Below Is Followed by A Set ofsrksamNo ratings yet

- Cambodia: (Cambodia) Power Transmission Lines Co., LTD., Power Transmission ProjectDocument45 pagesCambodia: (Cambodia) Power Transmission Lines Co., LTD., Power Transmission ProjectIndependent Evaluation at Asian Development BankNo ratings yet

- Capstone ProjectDocument10 pagesCapstone ProjectinxxxsNo ratings yet

- SAP FI (Financial Accounting) and CO (Controlling) OverviewDocument43 pagesSAP FI (Financial Accounting) and CO (Controlling) OverviewishtiaqNo ratings yet

- FSA AssignmentDocument5 pagesFSA AssignmentKarthik ArumughamNo ratings yet

- Q&A Section A AA025 - Lecturer EditionDocument40 pagesQ&A Section A AA025 - Lecturer EditionSyirleen Adlyna Othman100% (1)

- Cost TB C02 CarterDocument23 pagesCost TB C02 CarterArya Stark100% (1)

- GBI SD ExercisesDocument40 pagesGBI SD Exercisesdivyajeevan89No ratings yet

- After Tohoku: Do Investors Face Another Lost Decade From Japan?Document14 pagesAfter Tohoku: Do Investors Face Another Lost Decade From Japan?ideafix12No ratings yet

- Company financial statements and key metricsDocument6 pagesCompany financial statements and key metricsAther RamzanNo ratings yet

- 12-Month Income Statement Profit-And-Loss Statement - Sheet1Document2 pages12-Month Income Statement Profit-And-Loss Statement - Sheet1api-462952636100% (1)

- RMO NO. 44-2016 - DigestDocument1 pageRMO NO. 44-2016 - DigestGar La ARNo ratings yet

- Shinepukur Ceramics Limited: Balance Sheet StatementDocument9 pagesShinepukur Ceramics Limited: Balance Sheet StatementTahmid Shovon100% (1)

- 2285Document39 pages2285Michael BarnesNo ratings yet

- Venky's India Ltd. BUY: A Hen That Will Lay Golden EggsDocument8 pagesVenky's India Ltd. BUY: A Hen That Will Lay Golden EggsPratik BiswasNo ratings yet

- Indian Tax ManagmentDocument242 pagesIndian Tax ManagmentSandeep SandyNo ratings yet

- Homework Chapter 2: ExerciseDocument6 pagesHomework Chapter 2: ExerciseDiệu QuỳnhNo ratings yet

- Lecture 6 Exercise Financial AccountinngDocument34 pagesLecture 6 Exercise Financial AccountinngNaeem KhanNo ratings yet

- A Product Project Report On Gokul Cotton SeedsDocument31 pagesA Product Project Report On Gokul Cotton SeedspRiNcE DuDhAtRaNo ratings yet

- Audit of Receivables at Far Eastern UniversityDocument6 pagesAudit of Receivables at Far Eastern UniversityKenneth A. S. AlabadoNo ratings yet

- VAT and SD Rules 2016 EnglishDocument59 pagesVAT and SD Rules 2016 EnglishSadia Yasmin100% (3)

- Boston Chicken CaseDocument7 pagesBoston Chicken CaseDji YangNo ratings yet

- Master Budget Example MC Watters AIP8-13Document2 pagesMaster Budget Example MC Watters AIP8-13Muhammed muhabaNo ratings yet

- Bond PricingDocument70 pagesBond PricingSharika EpNo ratings yet

- Pre Mid Sem Family Law NotesDocument11 pagesPre Mid Sem Family Law NoteshaloXDNo ratings yet

- Guidelines For Travel Agents PDFDocument14 pagesGuidelines For Travel Agents PDFPragnendra RahevarNo ratings yet

- Law MCQDocument70 pagesLaw MCQAkshay TapariaNo ratings yet

- Nonresident Alien Engaged in Trade or BusinessDocument2 pagesNonresident Alien Engaged in Trade or BusinessHEARTHEL KATE BUYUCCANNo ratings yet

- (B) Superannuation Standard Choice Form - ShortDocument2 pages(B) Superannuation Standard Choice Form - ShortAnonymous FsIAZZ9llxNo ratings yet