Professional Documents

Culture Documents

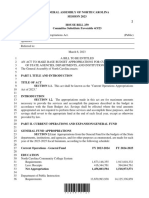

Chap 011

Uploaded by

ducacapupuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 011

Uploaded by

ducacapupuCopyright:

Available Formats

Chapter 11 - The Efficient Market Hypothesis

Chapter 11

The Efficient Market Hypothesis

Multiple Choice Questions

1. If you believe in the ________ form of the EMH, you believe that stock prices reflect all

relevant information including historical stock prices and current public information about the

firm, but not information that is available only to insiders.

A. semistrong

B. strong

C. weak

D. A, B, and C

E. none of the above

The semistrong form of EMH maintains that stock prices immediately reflect all historical and

current public information, but not inside information.

Difficulty: Easy

2. When Maurice Kendall examined the patterns of stock returns in 1953 he concluded that

the stock market was __________. Now, these random price movements are believed to be

_________.

A. inefficient; the effect of a well-functioning market

B. efficient; the effect of an inefficient market

C. inefficient; the effect of an inefficient market

D. efficient; the effect of a well-functioning market

E. irrational; even more irrational than before

Random price changes were originally thought to be driven by irrationality. Now, financial

economists believe random price changes occur because markets are informationally efficient.

Difficulty: Easy

11-1

Chapter 11 - The Efficient Market Hypothesis

3. The stock market follows a __________.

A. random walk

B. submartingale

C. predictable pattern that can be exploited

D. A and C

E. B and C

The stock market follows a sbumartingale.

Difficulty: Easy

4. A hybrid strategy is one where the investor

A. uses both fundamental and technical analysis to select stocks.

B. selects the stocks of companies that specialize in alternative fuels.

C. selects some actively-managed mutual funds on their own and uses an investment advisor

to select other actively-managed funds.

D. maintains a passive core and augments the position with an actively managed portfolio.

E. none of the above.

A hybrid strategy is one where the investor maintains a passive core and augments the

position with an actively managed portfolio.

Difficulty: Easy

5. The difference between a random walk and a submartingale is the expected price change in

a random walk is ______ and the expected price change for a submartingale is ______.

A. positive; zero

B. positive; positive

C. positive; negative

D. zero; positive

E. zero; zero

A random walk has an expected price change of zero and a submartingale has a positive

expected price change.

Difficulty: Easy

11-2

Chapter 11 - The Efficient Market Hypothesis

6. The difference between a random walk and a submartingale is the expected price change in

a random walk is ______ and the expected price change for a submartingale is ______.

A. negative; zero

B. negative; positive

C. zero; negative

D. zero; positive

E. zero; zero

A random walk has an expected price change of zero and a submartingale has a positive

expected price change.

Difficulty: Easy

7. Proponents of the EMH typically advocate

A. an active trading strategy.

B. investing in an index fund.

C. a passive investment strategy.

D. A and B

E. B and C

Believers of market efficiency advocate passive investment strategies, and an investment in an

index fund is one of the most practical passive investment strategies, especially for small

investors.

Difficulty: Easy

8. Proponents of the EMH typically advocate

A. buying individual stocks on margin and trading frequently.

B. investing in hedge funds.

C. a passive investment strategy.

D. A and B

E. B and C

Believers of market efficiency advocate passive investment strategies, and an investment in an

index fund is one of the most practical passive investment strategies, especially for small

investors.

Difficulty: Easy

11-3

Chapter 11 - The Efficient Market Hypothesis

11-4

Chapter 11 - The Efficient Market Hypothesis

9. If you believe in the _______ form of the EMH, you believe that stock prices reflect all

information that can be derived by examining market trading data such as the history of past

stock prices, trading volume or short interest.

A. semistrong

B. strong

C. weak

D. all of the above

E. none of the above

The information described above is market data, which is the data set for the weak form of

market efficiency. The semistrong form includes the above plus all other public information.

The strong form includes all public and private information.

Difficulty: Easy

10. If you believe in the _________ form of the EMH, you believe that stock prices reflect all

available information, including information that is available only to insiders.

A. semistrong

B. strong

C. weak

D. all of the above

E. none of the above

The strong form includes all public and private information.

Difficulty: Easy

11. If you believe in the reversal effect, you should

A. buy bonds in this period if you held stocks in the last period.

B. buy stocks in this period if you held bonds in the last period.

C. buy stocks this period that performed poorly last period.

D. go short.

E. C and D

The reversal effect states that stocks that do well in one period tend to perform poorly in the

subsequent period, and vice versa.

Difficulty: Easy

11-5

Chapter 11 - The Efficient Market Hypothesis

11-6

Chapter 11 - The Efficient Market Hypothesis

12. __________ focus more on past price movements of a firm's stock than on the underlying

determinants of future profitability.

A. Credit analysts

B. Fundamental analysts

C. Systems analysts

D. Technical analysts

E. All of the above

Technicians attempt to predict future stock prices based on historical stock prices.

Difficulty: Easy

13. _________ above which it is difficult for the market to rise.

A. Book value is a value

B. Resistance level is a value

C. Support level is a value

D. A and B

E. A and C

When stock prices have remained stable for a long period, these prices are termed resistance

levels; technicians believe it is difficult for the stock prices to penetrate these resistance

levels.

Difficulty: Easy

14. _________ below which it is difficult for the market to fall.

A. Intrinsic value is a value

B. Resistance level is a value

C. Support level is a value

D. A and B

E. B and C

When stock prices have remained stable for a long period, these prices are termed support

levels; technicians believe it is difficult for the stock prices to penetrate these support levels.

Difficulty: Easy

11-7

Chapter 11 - The Efficient Market Hypothesis

15. ___________ the return on a stock beyond what would be predicted from market

movements alone.

A. An excess economic return is

B. An economic return is

C. An abnormal return is

D. A and B

E. A and C

An economic return is the expected return, based on the perceived level of risk and market

factors. When returns exceed these levels, the returns are called abnormal or excess economic

returns.

Difficulty: Easy

16. The debate over whether markets are efficient will probably never be resolved because of

________.

A. the lucky event issue.

B. the magnitude issue.

C. the selection bias issue.

D. all of the above.

E. none of the above.

Factors A, B, and C all exist make rigid testing of market efficiency difficult or impossible.

Difficulty: Easy

17. A common strategy for passive management is ____________.

A. creating an index fund

B. creating a small firm fund

C. creating an investment club

D. A and C

E. B and C

The index fund is, by definition, passively managed. The other investment alternatives may or

may not be managed passively.

Difficulty: Easy

11-8

Chapter 11 - The Efficient Market Hypothesis

18. Arbel (1985) found that

A. the January effect was highest for neglected firms.

B. the book-to-market value ratio effect was highest in January

C. the liquidity effect was highest for small firms.

D. the neglected firm effect was independent of the small firm effect.

E. small firms had higher book-to-market value ratios.

Arbel divided firms into highly researched, moderately researched, and neglected groups

based on the number of institutions holding the stock.

Difficulty: Moderate

19. Researchers have found that most of the small firm effect occurs

A. during the spring months.

B. during the summer months.

C. in December.

D. in January.

E. randomly.

Much of the so-called small firm effect simply may be the tax-effect as investors sell stocks

on which they have losses in December and reinvest the funds in January. As small firms are

especially volatile, these actions affect small firms in a more dramatic fashion.

Difficulty: Moderate

20. Basu (1977, 1983) found that firms with low P/E ratios

A. earned higher average returns than firms with high P/E ratios.

B. earned the same average returns as firms with high P/E ratios.

C. earned lower average returns than firms with high P/E ratios.

D. had higher dividend yields than firms with high P/E ratios.

E. none of the above.

Firms with high P/E ratios already have an inflated price relative to earnings and thus tend to

have lower returns than low P/E ratio stocks. However, the P/E ratio may capture risk not

fully impounded in market betas so this may represent an appropriate risk adjustment rather

than a market anomaly.

Difficulty: Moderate

11-9

Chapter 11 - The Efficient Market Hypothesis

11-10

Chapter 11 - The Efficient Market Hypothesis

21. Jaffe (1974) found that stock prices _________ after insiders intensively bought shares.

A. decreased

B. did not change

C. increased

D. became extremely volatile

E. became much less volatile

Insider trading may signal private information.

Difficulty: Moderate

22. Banz (1981) found that, on average, the risk-adjusted returns of small firms

A. were higher than the risk-adjusted returns of large firms.

B. were the same as the risk-adjusted returns of large firms.

C. were lower than the risk-adjusted returns of large firms.

D. were unrelated to the risk-adjusted returns of large firms.

E. were negative.

Banz found A to be true, although subsequent studies have attempted to explain the small firm

effect as the January effect, the neglected firm effect, etc.

Difficulty: Moderate

23. Proponents of the EMH think technical analysts

A. should focus on relative strength.

B. should focus on resistance levels.

C. should focus on support levels.

D. should focus on financial statements.

E. are wasting their time.

Technical analysts attempt to predict future stock prices from historic stock prices; proponents

of EMH believe that stock price changes are random variables.

Difficulty: Moderate

11-11

Chapter 11 - The Efficient Market Hypothesis

24. Studies of positive earnings surprises have shown that there is

A. a positive abnormal return on the day positive earnings surprises are announced.

B. a positive drift in the stock price on the days following the earnings surprise

announcement.

C. a negative drift in the stock price on the days following the earnings surprise

announcement.

D. both A and B are true.

E. both A and C are true.

The market appears to adjust to earnings information gradually, resulting in a sustained period

of abnormal returns.

Difficulty: Moderate

25. Studies of negative earnings surprises have shown that there is

A. a negative abnormal return on the day negative earnings surprises are announced.

B. a positive drift in the stock price on the days following the earnings surprise

announcement.

C. a negative drift in the stock price on the days following the earnings surprise

announcement.

D. both A and B are true.

E. both A and C are true.

The market appears to adjust to earnings information gradually, resulting in a sustained period

of abnormal returns.

Difficulty: Moderate

26. Studies of stock price reactions to news are called

A. reaction studies.

B. event studies.

C. drift studies.

D. both A and D are true.

E. both B and D are true.

Studies of stock price reactions to news are called event studies.

Difficulty: Moderate

11-12

Chapter 11 - The Efficient Market Hypothesis

11-13

Chapter 11 - The Efficient Market Hypothesis

27. On November 22, 2005 the stock price of Walmart was $39.50 and the retailer stock index

was 600.30. On November 25, 2005 the stock price of Walmart was $40.25 and the retailer

stock index was 605.20. Consider the ratio of Walmart to the retailer index on November 22

and November 25. Walmart is _______ the retail industry and technical analysts who follow

relative strength would advise _______ the stock.

A. outperforming, buying

B. outperforming, selling

C. underperforming, buying

D. underperforming, selling

E. equally performing, neither buying nor selling

11/22: $39.50/600.30 = 0.0658; 11/25: $40.25/605.20 = 0.0665; Thus, K-Mart's relative

strength is improving and technicians using this technique would recommend buying.

Difficulty: Moderate

28. Work by Amihud and Mendelson (1986,1991)

A. argues that investors will demand a rate of return premium to invest in less liquid stocks.

B. may help explain the small firm effect.

C. may be related to the neglected firm effect.

D. B and C.

E. A, B, and C.

Lack of liquidity may affect the returns of small and neglected firms; however the theory does

not explain why the abnormal returns are concentrated in January.

Difficulty: Moderate

11-14

Chapter 11 - The Efficient Market Hypothesis

29. Fama and French (1992) found that the stocks of firms within the highest decile of

market/book ratios had average monthly returns of _______ while the stocks of firms within

the lowest decile of market/book ratios had average monthly returns of ________.

A. greater than 1%, greater than 1%

B. greater than 1%, less than 1%

C. less than 1%, greater than 1%

D. less than 1%, less than 1%

E. less than 0.5%, greater than 0.5%

This finding suggests either that low market-to-book ratio firms are relatively underpriced, or

that the market-to-book ratio is serving as a proxy for a risk factor that affects expected

equilibrium returns.

Difficulty: Moderate

30. A market decline of 23% on a day when there is no significant macroeconomic event

______ consistent with the EMH because ________.

A. would be, it was a clear response to macroeconomic news.

B. would be, it was not a clear response to macroeconomic news.

C. would not be, it was a clear response to macroeconomic news.

D. would not be, it was not a clear response to macroeconomic news.

E. none of the above.

This happened on October 19, 1987. Although this specific event is not mentioned in this

edition of the book, it is an example of something that would be considered a violation of the

EMH.

Difficulty: Moderate

11-15

Chapter 11 - The Efficient Market Hypothesis

31. In an efficient market, __________.

A. security prices react quickly to new information

B. security prices are seldom far above or below their justified levels

C. security analysts will not enable investors to realize superior returns consistently

D. one cannot make money

E. A, B, and C

A, B, and C are true; however, even in an efficient market one should be able to earn the

appropriate risk-adjusted rate of return.

Difficulty: Easy

32. The weak form of the efficient market hypothesis asserts that

A. stock prices do not rapidly adjust to new information contained in past prices or past data.

B. future changes in stock prices cannot be predicted from past prices.

C. technicians cannot expect to outperform the market.

D. A and B

E. B and C

Stock prices do adjust rapidly to new information.

Difficulty: Easy

33. A support level is the price range at which a technical analyst would expect the

A. supply of a stock to increase dramatically.

B. supply of a stock to decrease substantially.

C. demand for a stock to increase substantially.

D. demand for a stock to decrease substantially.

E. price of a stock to fall.

A support level is considered to be a level below that the price of the stock is unlikely to fall

and is believed to be determined by market psychology.

Difficulty: Easy

11-16

Chapter 11 - The Efficient Market Hypothesis

34. A finding that _________ would provide evidence against the semistrong form of the

efficient market theory.

A. low P/E stocks tend to have positive abnormal returns

B. trend analysis is worthless in determining stock prices

C. one can consistently outperform the market by adopting the contrarian approach

exemplified by the reversals phenomenon

D. A and B

E. A and C

Both A and C are inconsistent with the semistrong form of the EMH.

Difficulty: Moderate

35. The weak form of the efficient market hypothesis contradicts

A. technical analysis, but supports fundamental analysis as valid.

B. fundamental analysis, but supports technical analysis as valid.

C. both fundamental analysis and technical analysis.

D. technical analysis, but is silent on the possibility of successful fundamental analysis.

E. none of the above.

The process of fundamental analysis makes the market more efficient, and thus the work of

the fundamentalist more difficult. The data set for the weak form of the EMH is market data,

which is the only data used exclusively by technicians. Fundamentalists use all public

information.

Difficulty: Moderate

11-17

Chapter 11 - The Efficient Market Hypothesis

36. Two basic assumptions of technical analysis are that security prices adjust

A. rapidly to new information and market prices are determined by the interaction of supply

and demand.

B. rapidly to new information and liquidity is provided by security dealers.

C. gradually to new information and market prices are determined by the interaction of supply

and demand.

D. gradually to new information and liquidity is provided by security dealers.

E. rapidly to information and to the actions of insiders.

Technicians follow market data--price changes and volume of trading (as indicator of supply

and demand) believing that they can identify price trends as security prices adjust gradually.

Difficulty: Moderate

37. Cumulative abnormal returns (CAR)

A. are used in event studies.

B. are better measures of security returns due to firm-specific events than are abnormal

returns (AR).

C. are cumulated over the period prior to the firm-specific event.

D. A and B.

E. A and C.

As leakage of information occurs, the accumulated abnormal returns that are abnormal returns

summed over the period of interest (around the event date) are better measures of the effect of

firm-specific events.

Difficulty: Moderate

11-18

Chapter 11 - The Efficient Market Hypothesis

38. Studies of mutual fund performance

A. indicate that one should not randomly select a mutual fund.

B. indicate that historical performance is not necessarily indicative of future performance.

C. indicate that the professional management of the fund insures above market returns.

D. A and B.

E. B and C.

Studies show that all funds do not outperform the market and that historical performance is

not necessarily an indicator of future performance.

Difficulty: Easy

39. The likelihood of an investment newsletter's successfully predicting the direction of the

market for three consecutive years by chance should be

A. between 50% and 70%.

B. between 25% and 50%.

C. between 10% and 25%.

D. less than 10%.

E. greater than 70%.

The probability of successful prediction for 3 consecutive years is 23, or 12.5%.

Difficulty: Moderate

40. In an efficient market the correlation coefficient between stock returns for two nonoverlapping time periods should be

A. positive and large.

B. positive and small.

C. zero.

D. negative and small.

E. negative and large.

In an efficient market there should be no serial correlation between returns from nonoverlapping periods.

Difficulty: Moderate

11-19

Chapter 11 - The Efficient Market Hypothesis

41. The weather report says that a devastating and unexpected freeze is expected to hit Florida

tonight, during the peak of the citrus harvest. In an efficient market one would expect the

price of Florida Orange's stock to

A. drop immediately.

B. remain unchanged.

C. increase immediately.

D. gradually decline for the next several weeks.

E. gradually increase for the next several weeks.

In an efficient market the price of the stock should drop immediately when the bad news is

announced. If later news changes the perceived impact to Florida Orange, the price may once

again adjust quickly to the new information. A gradual change is a violation of the EMH.

Difficulty: Moderate

42. Matthews Corporation has a beta of 1.2. The annualized market return yesterday was

13%, and the risk-free rate is currently 5%. You observe that Matthews had an annualized

return yesterday of 17%. Assuming that markets are efficient, this suggests that

A. bad news about Matthews was announced yesterday.

B. good news about Matthews was announced yesterday.

C. no news about Matthews was announced yesterday.

D. interest rates rose yesterday.

E. interest rates fell yesterday.

AR = 17% - (5% + 1.2 (8%)) = +2.4%. A positive abnormal return suggests that there was

firm-specific good news.

Difficulty: Moderate

11-20

Chapter 11 - The Efficient Market Hypothesis

43. Nicholas Manufacturing just announced yesterday that its 4th quarter earnings will be 10%

higher than last year's 4th quarter. You observe that Nicholas had an abnormal return of -1.2%

yesterday. This suggests that

A. the market is not efficient.

B. Nicholas' stock will probably rise in value tomorrow.

C. investors expected the earnings increase to be larger than what was actually announced.

D. investors expected the earnings increase to be smaller than what was actually announced.

E. earnings are expected to decrease next quarter.

Anticipated earnings changes are impounded into a security's price as soon as expectations are

formed. Therefore a negative market response indicates that the earnings surprise was

negative, that is, the increase was less than anticipated.

Difficulty: Moderate

44. When Maurice Kendall first examined stock price patterns in 1953, he found that

A. certain patterns tended to repeat within the business cycle.

B. there were no predictable patterns in stock prices.

C. stocks whose prices had increased consistently for one week tended to have a net decrease

the following week.

D. stocks whose prices had increased consistently for one week tended to have a net increase

the following week.

E. the direction of change in stock prices was unpredictable, but the amount of change

followed a distinct pattern.

The first studies in this area were made possible by the development of computer technology.

Kendall's study was the first to indicate that markets were efficient.

Difficulty: Easy

11-21

Chapter 11 - The Efficient Market Hypothesis

45. If stock prices follow a random walk

A. it implies that investors are irrational.

B. it means that the market cannot be efficient.

C. price levels are not random.

D. price changes are random.

E. price movements are predictable.

A random walk means that the changes in prices are random and independent.

Difficulty: Easy

46. The main difference between the three forms of market efficiency is that

A. the definition of efficiency differs.

B. the definition of excess return differs.

C. the definition of prices differs.

D. the definition of information differs.

E. they were discovered by different people.

The main difference is that weak form encompasses historical data, semistrong form

encompasses historical data and current public information, and strong form encompasses

historical data, current public information, and inside information. All of the other definitions

remain the same.

Difficulty: Moderate

47. Chartists practice

A. technical analysis.

B. fundamental analysis.

C. regression analysis.

D. insider analysis.

E. psychoanalysis.

Chartist is another name for a technical analyst.

Difficulty: Easy

11-22

Chapter 11 - The Efficient Market Hypothesis

48. Which of the following are used by fundamental analysts to determine proper stock

prices?

I) trendlines

II) earnings

III) dividend prospects

IV) expectations of future interest rates

V) resistance levels

A. I, IV, and V

B. I, II, and III

C. II, III, and IV

D. II, IV, and V

E. All of the items are used by fundamental analysts.

Analysts look at fundamental factors such as earnings, dividend prospects, expectation of

future interest rates, and risk of the firm. The information is used to determine the present

value of future cash flows to stockholders. Technical analysts use trendlines and resistance

levels.

Difficulty: Moderate

49. According to proponents of the efficient market hypothesis, the best strategy for a small

investor with a portfolio worth $40,000 is probably to

A. perform fundamental analysis.

B. exploit market anomalies.

C. invest in Treasury securities.

D. invest in derivative securities.

E. invest in mutual funds.

Individual investors tend to have relatively small portfolios and are usually unable to realize

economies of size. The best strategy is to pool funds with other small investors and allow

professional managers to invest the funds.

Difficulty: Moderate

11-23

Chapter 11 - The Efficient Market Hypothesis

50. Which of the following are investment superstars who have consistently shown superior

performance?

I) Warren Buffet

II) Phoebe Buffet

III) Peter Lynch

IV) Merrill Lynch

V) Jimmy Buffet

A. I, III, and IV

B. II, III, and IV

C. I and III

D. III and IV

E. I, III, IV, and V

Warren Buffet manages Berkshire Hathaway and Peter Lynch managed Fidelity's Magellan

Fund. Phoebe Buffet is a character on NBC's "Friends" and Jimmy Buffet is "Wasting Away in

Margaritaville". Merrill Lynch isn't a person.

Difficulty: Moderate

51. Google has a beta of 1.0. The annualized market return yesterday was 11%, and the riskfree rate is currently 5%. You observe that Google had an annualized return yesterday of 14%.

Assuming that markets are efficient, this suggests that

A. bad news about Google was announced yesterday.

B. good news about Google was announced yesterday.

C. no news about Google was announced yesterday.

D. interest rates rose yesterday.

E. interest rates fell yesterday.

AR = 14% - (5% + 1.0 (6%)) = +3.0%. A positive abnormal return suggests that there was

firm-specific good news.

Difficulty: Moderate

11-24

Chapter 11 - The Efficient Market Hypothesis

52. Music Doctors has a beta of 2.25. The annualized market return yesterday was 12%, and

the risk-free rate is currently 4%. You observe that Music Doctors had an annualized return

yesterday of 15%. Assuming that markets are efficient, this suggests that

A. bad news about Music Doctors was announced yesterday.

B. good news about Music Doctors was announced yesterday.

C. no news about Music Doctors was announced yesterday.

D. interest rates rose yesterday.

E. interest rates fell yesterday.

AR = 15% - (4% + 2.25 (8%)) = -7.0%. A negative abnormal return suggests that there was

firm-specific bad news.

Difficulty: Moderate

53. QQAG has a beta of 1.7. The annualized market return yesterday was 13%, and the riskfree rate is currently 3%. You observe that QQAG had an annualized return yesterday of 20%.

Assuming that markets are efficient, this suggests that

A. bad news about QQAG was announced yesterday.

B. good news about QQAG was announced yesterday.

C. no significant news about QQAG was announced yesterday.

D. interest rates rose yesterday.

E. interest rates fell yesterday.

AR = 20% - (3% + 1.7 (10%)) = 0.0%. A positive abnormal return suggests that there was

firm-specific good news and a negative abnormal return suggests that there was firm-specific

bad news.

Difficulty: Moderate

11-25

Chapter 11 - The Efficient Market Hypothesis

54. QQAG just announced yesterday that its 4th quarter earnings will be 35% higher than last

year's 4th quarter. You observe that QQAG had an abnormal return of -1.7% yesterday. This

suggests that

A. the market is not efficient.

B. QQAG stock will probably rise in value tomorrow.

C. investors expected the earnings increase to be larger than what was actually announced.

D. investors expected the earnings increase to be smaller than what was actually announced.

E. earnings are expected to decrease next quarter.

Anticipated earnings changes are impounded into a security's price as soon as expectations are

formed. Therefore a negative market response indicates that the earnings surprise was

negative, that is, the increase was less than anticipated.

Difficulty: Moderate

55. LJP Corporation just announced yesterday that it would undertake an international joint

venture. You observe that LJP had an abnormal return of 3% yesterday. This suggests that

A. the market is not efficient.

B. LJP stock will probably rise in value again tomorrow.

C. investors view the international joint venture as bad news.

D. investors view the international joint venture as good news.

E. earnings are expected to decrease next quarter.

The positive abnormal return suggests that investors view the international joint venture as

good news.

Difficulty: Moderate

11-26

Chapter 11 - The Efficient Market Hypothesis

56. Music Doctors just announced yesterday that its 1st quarter sales were 35% higher than

last year's 1st quarter. You observe that Music Doctors had an abnormal return of -2%

yesterday. This suggests that

A. the market is not efficient.

B. Music Doctors stock will probably rise in value tomorrow.

C. investors expected the sales increase to be larger than what was actually announced.

D. investors expected the sales increase to be smaller than what was actually announced.

E. earnings are expected to decrease next quarter.

The negative abnormal return suggests that investors expected the sales increase to be larger

than what was actually announced.

Difficulty: Moderate

57. The Food and Drug Administration (FDA) just announced yesterday that they would

approve a new cancer-fighting drug from King. You observe that King had an abnormal return

of 0% yesterday. This suggests that

A. the market is not efficient.

B. King stock will probably rise in value tomorrow.

C. King stock will probably fall in value tomorrow.

D. the approval was already anticipated by the market

E. none of the above.

The approval was already anticipated by the market

Difficulty: Moderate

11-27

Chapter 11 - The Efficient Market Hypothesis

58. Your professor finds a stock-trading rule that generates excess risk-adjusted returns.

Instead of publishing the results, she keeps the trading rule to herself. This is most closely

associated with ________.

A. regret avoidance

B. selection bias

C. framing

D. insider trading

E. none of the above

This is an example of selection bias.

Difficulty: Moderate

59. At freshman orientation, 1,500 students are asked to flip a coin 20 times. One student is

crowned the winner (tossed 20 heads). This is most closely associated with ________.

A. regret avoidance

B. selection bias

C. overconfidence

D. the lucky event issue

E. none of the above

This is an example of the lucky event issue.

Difficulty: Moderate

60. Sehun (1986) finds that the practice of monitoring insider trade disclosures, and trading on

that information, would be ________.

A. extremely profitable for long-term traders

B. extremely profitable for short-term traders

C. marginally profitable for long-term traders

D. marginally profitable for short-term traders

E. not sufficiently profitable to cover trading costs

Answer E; not sufficiently profitable to cover trading costs

Difficulty: Moderate

11-28

Chapter 11 - The Efficient Market Hypothesis

61. If you believe in the reversal effect, you should

A. sell bonds in this period if you held stocks in the last period.

B. sell stocks in this period if you held bonds in the last period.

C. sell stocks this period that performed well last period.

D. go long.

E. C and D

The reversal effect states that stocks that do well in one period tend to perform poorly in the

subsequent period, and vice versa.

Difficulty: Easy

62. Patell and Woflson (1984) report that most of the stock price response to corporate

dividend or earnings announcements occurs within ____________ of the announcement.

A. 10 minutes

B. 45 minutes

C. 2 hours

D. 4 hours

E. 2 trading days

the correct answer is 2 hours.

Difficulty: Moderate

11-29

Chapter 11 - The Efficient Market Hypothesis

Short Answer Questions

63. Discuss the various forms of market efficiency. Include in your discussion the information

sets involved in each form and the relationships across information sets and across forms of

market efficiency. Also discuss the implications for the various forms of market efficiency for

the various types of securities' analysts.

The weak form of the efficient markets hypothesis (EMH) states that stock prices immediately

reflect market data. Market data refers to stock prices and trading volume. Technicians

attempt to predict future stock prices based on historic stock price movements. Thus, if the

weak form of the EMH holds, the work of the technician is of no value.

The semistrong form of the EMH states that stock prices include all public information. This

public information includes market data and all other publicly available information, such as

financial statements, and all information reported in the press relevant to the firm. Thus,

market information is a subset of all public information. As a result, if the semistrong form of

the EMH holds, the weak form must hold also. If the semistrong form holds, then the

fundamentalist, who attempts to identify undervalued securities by analyzing public

information, is unlikely to do so consistently over time. In fact, the work of the fundamentalist

may make the markets even more efficient!

The strong form of the EMH states that all information (public and private) is immediately

reflected in stock prices. Public information is a subset of all information, thus if the strong

form of the EMH holds, the semistrong form must hold also. The strong form of EMH states

that even with inside (legal or illegal) information, one cannot expect to outperform the

market consistently over time.

Studies have shown the weak form to hold, when transactions costs are considered. Studies

have shown the semistrong form to hold in general, although some anomalies have been

observed. Studies have shown that some insiders (specialists, major shareholders, major

corporate officers) do outperform the market.

Feedback: The purpose of this question is to assure that the student understands the

interrelationships across different forms of the EMH, across the information sets, and the

implications of each form for different types of analysts.

Difficulty: Moderate

11-30

Chapter 11 - The Efficient Market Hypothesis

64. What is an event study? It is a test of what form of market efficiency? Discuss the process

of conducting an event study, including the best variable(s) to observe as tests of market

efficiency.

A event study is an empirical test which allows the researcher to assess the impact of a

particular event on a firm's stock price. To do so, one often uses the index model and

estimates et, the residual term which measures the firm-specific component of the stock's

return. This variable is the difference between the return the stock would ordinarily earn for a

given level of market performance and the actual rate of return on the stock. This measure is

often referred to as the abnormal return of the stock. However, it is very difficult to identify

the exact point in time that an event becomes public information; thus, the better measure is

the cumulative abnormal return, which is the sum of abnormal returns over a period of time (a

window around the event date).

This technique may be used to study the effect of any public event on a firm's stock price;

thus, this technique is a test of the semistrong form of the EMH.

Feedback: The rationale for this question is to ascertain if the student understands the

methodology most commonly used as a test of the semistrong form of market efficiency.

Difficulty: Difficult

65. Discuss the small firm effect, the neglected firm effect, and the January effect, the tax

effect and how the four effects may be related.

Studies have shown that small firms earn a risk-adjusted rate of return greater than that of

larger firms. Additional studies have shown that firms that are not followed by analysts

(neglected firms) also have a risk-adjusted return greater than that of larger firms. However,

the neglected firms tend to be small firms; thus, the neglected firm effect may be a

manifestation of the small firm effect. Finally, studies have shown that returns in January tend

to be higher than in other months of the year. This effect has been shown to persist

consistently over the years. However, the January effect may be the tax effect, as investors

may have sold stocks with losses in December for tax purposes and reinvested in January.

Small firms (and neglected firms) would tend to be more affected by this increased buying

than larger firms, as small firms tend to sell for lower prices.

Feedback: The purpose of this question is to reinforce the interrelationships, that "effects"

may not always be independent and thus readily identifiable. Also these effects are widely

discussed in the financial press, and the January effect appears to be quite persistent.

Difficulty: Moderate

11-31

Chapter 11 - The Efficient Market Hypothesis

66. Why might the degree of market efficiency differ across various markets? State three

reasons why this might occur and explain each reason briefly.

1. Market efficiency depends on information being essentially free and costless to market

participants. In the U.S. markets this is the case to a large extent. The U.S. markets are well

developed and professional analysts often follow securities. Information is available on

television, in the press, and on the Internet. The opposite may be true in other markets, such as

those of developing countries, where there are fewer or no analysts and few market

participants with these resources. 2. Accounting disclosure requirements are different across

markets. In the U.S. firms must meet SEC requirements to be publicly traded. In other

countries the requirements may be different or nonexistent. This has implications about the

ease with which analysts can evaluate the company to determine its proper value. 3. Markets

for "neglected" stocks may be less efficient than markets for stocks that are heavily followed

by analysts. If analysts feel that it is not worthwhile to give their attention to particular stocks

then ample information about these stocks will not be readily available to investors.

Feedback: This question leads the student to look at some of the fundamental reasons for

market efficiency and why there may be differences among markets with regard to the

reasons. Alternative answers are possible.

Difficulty: Moderate

11-32

Chapter 11 - The Efficient Market Hypothesis

67. With regard to market efficiency, what is meant by the term "anomaly"? Give three

examples of market anomalies and explain why each is considered to be an anomaly.

Anomalies are patterns that should not exist if the market is truly efficient. Investors might be

able to make abnormal profits by exploiting the anomalies, which doesn't make sense in an

efficient market.

Possible examples include, but are not limited to, the following.

the small-firm effect - average annual returns are consistently higher for small-firm

portfolios, even when adjusted for risk by using the CAPM.

the January effect - the small-firm effect occurs virtually entirely in January.

the neglected-firm effect - small firms tend to be ignored by large institutional traders and

stock analysts. This lack of monitoring makes them riskier and they earn higher risk-adjusted

returns. The January effect is largest for neglected firms.

the liquidity effect - investors demand a return premium to invest in less-liquid stocks. This is

related to the small-firm effect and the neglected-firm effect. These stocks tend to earn high

risk-adjusted rates of return.

book-to-market ratios - firms with the higher book-to-market-value ratios have higher riskadjusted returns, suggesting that they are underpriced. When combined with the firm-size

factor, this ratio explained returns better than systematic risk as measured by beta.

the reversal effect - stocks that have performed best in the recent past seem to underperform

the rest of the market in the following periods, and vice versa. Other studies indicated that this

effect might be an illusion. These studies used portfolios formed mid-year rather than in

December and considered the liquidity effect.

Investors should not be able to earn excess returns by taking advantage of any of these. The

market should adjust prices to their proper levels. But these things have been documented to

occur repeatedly.

Feedback: This question tests whether the student grasps the basic concept of anomalies and

allows some choice in explaining some of them.

Difficulty: Moderate

11-33

You might also like

- Chap 026Document18 pagesChap 026ducacapupuNo ratings yet

- Test Bank Chapter 11 Investment BodieDocument37 pagesTest Bank Chapter 11 Investment BodieTami DoanNo ratings yet

- Index Models Chapter Key ConceptsDocument42 pagesIndex Models Chapter Key ConceptsducacapupuNo ratings yet

- Chap011 Text Bank (1) SolutionDocument23 pagesChap011 Text Bank (1) SolutionMuhammad HanafiNo ratings yet

- Macroeconomic and Industry Analysis Ch 17Document26 pagesMacroeconomic and Industry Analysis Ch 17Joshi YamaNo ratings yet

- Test Bank Chapter 8 Investment BodieDocument48 pagesTest Bank Chapter 8 Investment BodieTami DoanNo ratings yet

- Chap 027Document25 pagesChap 027ducacapupuNo ratings yet

- Chap 013Document30 pagesChap 013ducacapupu100% (1)

- Chapte - 25 - InternationalDiversification FinanceDocument43 pagesChapte - 25 - InternationalDiversification FinanceKlajdPanariti100% (1)

- Chap 012Document16 pagesChap 012Jeffrey MooketsaneNo ratings yet

- Chap006 Text BankDocument9 pagesChap006 Text BankPratik JainNo ratings yet

- Index Models MCQsDocument26 pagesIndex Models MCQsKen WhiteNo ratings yet

- Chap 007Document40 pagesChap 007ducacapupuNo ratings yet

- Chapter 5 AnswerDocument16 pagesChapter 5 AnswerLogeswary VijayakumarNo ratings yet

- Chap 027Document15 pagesChap 027rnaganirmitaNo ratings yet

- Chap 022Document25 pagesChap 022elipieNo ratings yet

- Chapter 27 The Theory of Active Portfolio ManagementDocument41 pagesChapter 27 The Theory of Active Portfolio ManagementmaryjoybarlisncalinaNo ratings yet

- Chap 019Document36 pagesChap 019skuad_024216No ratings yet

- Chap 006Document25 pagesChap 006Luqman AhmedNo ratings yet

- Chap 009Document24 pagesChap 009Hajrah AsifNo ratings yet

- Chap 012Document26 pagesChap 012ducacapupuNo ratings yet

- Chap007 Test Bank (1) SolutionDocument11 pagesChap007 Test Bank (1) SolutionMinji Michelle J100% (1)

- Hull: Fundamentals of Futures and Options Markets, Ninth Edition Chapter 1: Introduction Multiple Choice Test BankDocument5 pagesHull: Fundamentals of Futures and Options Markets, Ninth Edition Chapter 1: Introduction Multiple Choice Test BankfdvdfvNo ratings yet

- CH 7Document45 pagesCH 7yawnzz89100% (3)

- Chap021 Text Bank (1) SolutionDocument50 pagesChap021 Text Bank (1) Solutionandlesmason50% (2)

- Chap 019Document45 pagesChap 019ducacapupuNo ratings yet

- Chap 019Document41 pagesChap 019saud1411No ratings yet

- Chapter 05 Risk and Return Past and PrologueDocument30 pagesChapter 05 Risk and Return Past and PrologueThanh Lê0% (1)

- Mutual Funds and Investment Companies GuideDocument34 pagesMutual Funds and Investment Companies GuideducacapupuNo ratings yet

- Mutual Funds and Other Investment Companies: Multiple Choice QuestionsDocument9 pagesMutual Funds and Other Investment Companies: Multiple Choice QuestionsMorcy Jones100% (2)

- Behavioral Finance and Technical Analysis ChapterDocument17 pagesBehavioral Finance and Technical Analysis ChapterAsm Saiduzzaman SayeedNo ratings yet

- Test Bank Chapter 7 Investment BodieDocument44 pagesTest Bank Chapter 7 Investment BodieTami Doan100% (1)

- Chap 018Document71 pagesChap 018ducacapupuNo ratings yet

- Optimal Risky Portfolios MCQsDocument62 pagesOptimal Risky Portfolios MCQsJerine TanNo ratings yet

- Chap006 Text BankDocument14 pagesChap006 Text BankAshraful AlamNo ratings yet

- Test Bank Chapter 12 Investment BodieDocument32 pagesTest Bank Chapter 12 Investment BodieTami DoanNo ratings yet

- Bkm9e Answers Chap009Document9 pagesBkm9e Answers Chap009AhmadYaseenNo ratings yet

- Chapter10 APTDocument19 pagesChapter10 APTKlajd PanaritiNo ratings yet

- Chapter 01+02 Investment Bodie Test BankDocument73 pagesChapter 01+02 Investment Bodie Test BankTami DoanNo ratings yet

- Test Bank Chapter 10 Investment BodieDocument45 pagesTest Bank Chapter 10 Investment BodieTami DoanNo ratings yet

- Chapter 04 Mutual Funds KeyDocument38 pagesChapter 04 Mutual Funds KeyLuisLoNo ratings yet

- Test Bank Chapter 15 Investment BodieDocument42 pagesTest Bank Chapter 15 Investment BodieTami DoanNo ratings yet

- Chap 9Document7 pagesChap 9GinanjarSaputra0% (1)

- Chap023 Text Bank (1) SolutionDocument25 pagesChap023 Text Bank (1) SolutionPrabhpuneet PandherNo ratings yet

- Portfolio Selection Chapter SummaryDocument32 pagesPortfolio Selection Chapter SummaryMihai StoicaNo ratings yet

- Test Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177Document27 pagesTest Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177dieurobertp6cufvNo ratings yet

- Fins2624 Online Question Bank CH 15Document28 pagesFins2624 Online Question Bank CH 15AllenRuan100% (3)

- 70 724ef94aDocument56 pages70 724ef94adecentyNo ratings yet

- Chapter 11 The Efficient Market Hypothesis: Answer KeyDocument33 pagesChapter 11 The Efficient Market Hypothesis: Answer KeyGeorgina AlpertNo ratings yet

- Chapter 11 AnsDocument38 pagesChapter 11 AnsLuisLoNo ratings yet

- Arbel (1985) found that the January effect was highest for neglected firmsDocument38 pagesArbel (1985) found that the January effect was highest for neglected firmsAlfieNo ratings yet

- Investments Canadian Canadian 8th Edition Bodie Test BankDocument37 pagesInvestments Canadian Canadian 8th Edition Bodie Test Bankodilemelanie83au100% (24)

- Investments Canadian 7th Edition Bodie Test BankDocument38 pagesInvestments Canadian 7th Edition Bodie Test Bankemareategui100% (14)

- Fundamentals of Investments Valuation and Management Jordan 7th Edition Test Bank Full DownloadDocument57 pagesFundamentals of Investments Valuation and Management Jordan 7th Edition Test Bank Full Downloadwilliamunderwoodfkpiwrjbgz100% (35)

- Efficient Capital Markets and Behavioral Challenges: Multiple Choice QuestionsDocument16 pagesEfficient Capital Markets and Behavioral Challenges: Multiple Choice QuestionsCông Long NguyễnNo ratings yet

- TBChap 011Document76 pagesTBChap 011Kawser islamNo ratings yet

- Chap009 - FinalDocument39 pagesChap009 - FinalJhonGodtoNo ratings yet

- Test Bank For Investments Analysis and Management 14th Edition Charles P Jones Gerald R Jensen 2 Full DownloadDocument10 pagesTest Bank For Investments Analysis and Management 14th Edition Charles P Jones Gerald R Jensen 2 Full Downloadandrewwilsoncziqfwxgks100% (21)

- Valuation Method ExamsDocument75 pagesValuation Method ExamsRhejean Lozano100% (2)

- EMH Stock Market TutorialDocument4 pagesEMH Stock Market TutorialLinh KellyNo ratings yet

- Chap 024Document50 pagesChap 024ducacapupuNo ratings yet

- Chap 018Document71 pagesChap 018ducacapupuNo ratings yet

- Chap 027Document25 pagesChap 027ducacapupuNo ratings yet

- Chap 019Document45 pagesChap 019ducacapupuNo ratings yet

- Chap 015Document34 pagesChap 015ducacapupuNo ratings yet

- Chap 021Document41 pagesChap 021ducacapupuNo ratings yet

- Chap 022Document44 pagesChap 022ducacapupuNo ratings yet

- Chap 025Document22 pagesChap 025ducacapupuNo ratings yet

- Chap023 Text Bank (1) SolutionDocument25 pagesChap023 Text Bank (1) SolutionPrabhpuneet PandherNo ratings yet

- Chap 012Document26 pagesChap 012ducacapupuNo ratings yet

- Chap 007Document40 pagesChap 007ducacapupuNo ratings yet

- Chap 017Document40 pagesChap 017ducacapupuNo ratings yet

- Chap 013Document30 pagesChap 013ducacapupu100% (1)

- Mutual Funds and Investment Companies GuideDocument34 pagesMutual Funds and Investment Companies GuideducacapupuNo ratings yet

- Fluids Lab #2Document7 pagesFluids Lab #2ducacapupuNo ratings yet

- Chap 001Document21 pagesChap 001ajaw267No ratings yet

- Fluid Mechanics Exp No.1Document7 pagesFluid Mechanics Exp No.1ducacapupuNo ratings yet

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (29)

- State Bank of PakistanDocument16 pagesState Bank of PakistanBilawal ShabbirNo ratings yet

- Entrepreneurship Notes (1-8)Document58 pagesEntrepreneurship Notes (1-8)Lyle BanksNo ratings yet

- Activity Based CostingDocument12 pagesActivity Based CostingMuhammad Imran AwanNo ratings yet

- May RemovedDocument44 pagesMay RemovedAniket ReddyNo ratings yet

- Estimate Basis - NNPC Project - 1291 - 26!5!2018Document11 pagesEstimate Basis - NNPC Project - 1291 - 26!5!2018ashwani chandraNo ratings yet

- Wakata Commerce 2020Document5 pagesWakata Commerce 2020Nabuzaale JoanNo ratings yet

- Principles of Taxation For Business and Investment Planning 20th Edition Jones Test BankDocument36 pagesPrinciples of Taxation For Business and Investment Planning 20th Edition Jones Test Bankavadavatvulgatem71u2100% (21)

- JindalDocument12 pagesJindalsunny10119No ratings yet

- Principles of Taxation Law: Notes OnDocument62 pagesPrinciples of Taxation Law: Notes OnRaoof bin MohammedNo ratings yet

- A Quick Introduction To Hedge FundsDocument30 pagesA Quick Introduction To Hedge FundsA A MNo ratings yet

- ITC Covered Call Option Strategy - 24112020-1606213764Document3 pagesITC Covered Call Option Strategy - 24112020-1606213764Bobby TNo ratings yet

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocument16 pagesLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelSCRIBDerNo ratings yet

- Accountancy Revision Test (Partnership Fundamentals) Part-2Document3 pagesAccountancy Revision Test (Partnership Fundamentals) Part-2kadyangogi1No ratings yet

- Application Form For A Don Oliver Scholarship or Training GrantDocument3 pagesApplication Form For A Don Oliver Scholarship or Training Grantapi-26272310No ratings yet

- Factors affecting fluctuations in INRDocument11 pagesFactors affecting fluctuations in INRKarishma Satheesh KumarNo ratings yet

- 2015德国慕尼黑物流展展商名单Document27 pages2015德国慕尼黑物流展展商名单will wuNo ratings yet

- Impact of Goods and Service Tax On Consumers, GSTDocument70 pagesImpact of Goods and Service Tax On Consumers, GSTKkk JjjNo ratings yet

- The Wealth Report 2023Document35 pagesThe Wealth Report 2023kevinchung.sgNo ratings yet

- FIN 401 AssignmentDocument20 pagesFIN 401 AssignmentAnika NawarNo ratings yet

- Afar04 Business Combinations Mergers ReviewersDocument17 pagesAfar04 Business Combinations Mergers ReviewersPam G.100% (5)

- The Takeover Controversy: Analysis and Evidence Lähde PDFDocument59 pagesThe Takeover Controversy: Analysis and Evidence Lähde PDFNiklas NieminenNo ratings yet

- Updated Version of HB 259, The House's Proposed BudgetDocument416 pagesUpdated Version of HB 259, The House's Proposed BudgetSteven DoyleNo ratings yet

- Receipt for Second Installment Land PurchaseDocument1 pageReceipt for Second Installment Land Purchaserolando gualbert saliseNo ratings yet

- IJCRT2302494Document5 pagesIJCRT2302494nirupamNo ratings yet

- Asset Management: Concepts & Practices: January 2003Document13 pagesAsset Management: Concepts & Practices: January 2003Shabaaz Mohammed AbdulNo ratings yet

- FOREX MARKET GUIDEDocument198 pagesFOREX MARKET GUIDEMUKESH KUMARNo ratings yet

- On Eve of IndependenceDocument4 pagesOn Eve of IndependenceHarini BNo ratings yet

- Personal Loan Application DetailsDocument1 pagePersonal Loan Application DetailsKawsar AlamNo ratings yet

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocument37 pagesChapter 10 Accounting Cycle of A Merchandising BusinessArlyn Ragudos BSA1No ratings yet