Professional Documents

Culture Documents

Accounts 11

Uploaded by

Thakur Manu PratapCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts 11

Uploaded by

Thakur Manu PratapCopyright:

Available Formats

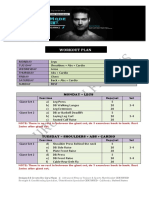

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

SYLLABUS BREAKUP

UNITS

MARKS

Part A: Financial AccountingI

Unit 1. Theoretical Framework

Unit 2. Accounting Process and Special Accounting Treatment

Part B: Financial AccountingII

Unit 3. Financial statements of Sole Proprietorship:

from complete and Incomplete Records

Unit4. Financial Statements of Not-for Profit Organisations

Unit5. Computers in Accounting

Part C: Project Work

15

35

15

15

10

100

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

MONTH WISE SYLLABUS BREAKUP

April & May (Unit 1)

1.

Introduction to Accounting

2.

Basic Accounting Terms

July

1.

Theory Base of Accounting (Unit 1)

2.

Accounting Equation (Unit 2)

3.

Rules of Debit and Credit (Unit 2)

4.

Source Documents and Preparation of vouchers (Unit 2)

5.

Journal, Ledger posting and preparation of Trial Balance (Unit 2)

August

Cash Book and ledger (Unit 2)

September

1.

Bank Reconciliation statement (Unit 2)

October

1.

Subsidiary Books and ledger posting unit (2)

2.

Depreciation

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Revision For Half Yearly Examination

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

November

1.

Provision and Reserves

2.

Accounting for Bills of Exchange

3.

Rectification of Errors (Unit 2)

December

1.

Rectification of Errors (continues) (Unit 2)

2.

Financial statements of Sole Proprietorship (Unit 3)

January (Unit 4)

Financial Statements of Not-for-Profit Organisations.

Accounts from Incomplete Records

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Revision For Annual Examination

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

=======================================

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

ASSIGNMENT

Introduction to Accounting

Q.1. Define Accounting and state its objectives.

Q.2. Accounting is an Art as well as a Science. Explain the statement.

Q.3. Differentiate between Book Keeping & Accounting.

Q.4. Accounting information should be comparable. Do you agree with this statement?

Give reason.

Q.5. List any four users who have indirect interest in accounting.

Q.6. Explain any two limitations of Accounting.

Q.7. Explain the qualitative characteristics of Accounting information.

Q.8. If the accounting information is not clearly presented, which of the qualitative

characteristics of the accounting information is violated?

3Q.9. Accounting can also be recognized as a language because it communicates each

and every thing about the business activities, viz. profitability, solvency and its

future prospects to various users viz. management, investors, creditors, banks etc.

Books of accounts are its script and rules of debit and credit are its style i.e.,

ways of expression. Like any other language, one needs to study accounting in

such a way that one is able to learn, converse in and communicate the same in

best possible manner. Identify the value(s) being reflected by the functions of

accounting.

Sol: value(s):

(i)

Human Interaction: By communicating the profitability solvency of the

business to its users viz. Management, investors, etc.

(ii)

Transparency: By recording all the activities of business, it will show the true

and fair position of the business entity.

(iii) Sharing: By sharing its information with users viz. Management, investors,

banks, creditors, etc.

Basic Accounting Terms

Q.1. Define the following terms:(i)

Trade Receivables

(ii)

Capital

(iii) Current Assets

(iv)

(v)

(vi)

Discount

Financial Transaction.

Non Current Liabilities

Q.2. Differentiate between

(i)

Capital Expenditure and Revenue Expenditure.

(ii)

Revenue Expenditure and Deferred Revenue Expenditure.

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.3. Debts or obligations that the business enterprise has to pay are known as liabilities.

For example, goods purchased on credit, loan taken from bank or any financial

institution etc. Liabilities are to be shown on the liabilities side of the Balance

Sheet. Identify the value(s) being reflected above.

Sol: The values are:

(i)

Honesty: By showing all its obligation or debts on the liability side, business

entities can prove that they are honest.

(ii)

Recognition: By recognizing its obligation or debts under the separate head

known as liabilities in the Balance Sheet.

=============================================

Theory Base of Accounting

Q.1. Why is it necessary for accountants to follow accounting principles?

Q.2. Complete the following sentences with appropriate words:(i)

(ii)

(iii)

(iv)

(v)

(vi)

Everything a firm owns, it also owes out to somebody. This co-incidence is

explained by the _____________concept.

If a firm believes that some of its debtors may default, it should act on this

by making sure that all possible losses are recorded in the books. This is an

example of the _________ concept.

The___________ concept states that if straight line method of depreciation is

used in one year, then it should also be used in the next year.

The fact that a business is separate & distinguishable from its owner is best

exemplified by the ___________concept.

A firm may hold stock which is heavily in demand consequently, the market

value of this stock may be increased. Normal accounting procedure is to

ignore this because of the ____________ concept.

The management of a firm is remarkably incompetent but the firms

accountants cannot take this into account while preparing book of accounts

because of __________concept.

Q.3. Why is it necessary to adopt a consistent basis for the preparation of financial

statements? Explain.

Q.4. What is Matching concept? Why should a business concern follow this concept?

Discuss.

Q.5. Discuss the concept based on the premise do not anticipate profits but provide for

all losses.

Q.6. What is the difference between IFRS and Indian GAAP or Accounting Standards?

Q.7. Explain Cash Basis of Accounting.

Q.8. What is the difference between Cash Basis of Accounting and Accrual Basis of

Accounting?

4

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.9. State any two disadvantages of Cash Basis of Accounting.

Q.10. State any two advantages of Accrual Basis of Accounting.

Q.11. Going concern means with the expectation of continuing indefinitely. This

concept underlines the assumption that the enterprise has neither any intention nor

any necessity to close the business. The chances to cease to operate the business

are too remote. Identify the value(s) involved in the assumption of going concern.

Sol: The values are:

(i)

Growth: By following the Going Concern Assumption, the business activities

are to be carried out for growth and future prospects.

(ii)

Preparing for the future: By following the assumption of going concern;

entity always intend to prepare for the future.

=============================================

Recording of Business Transactions

Accounting Equation

Q.1. Which of the following is correct?

(i)

Assets = Liabilities capital

(ii)

Assets = Capital liabilities

(iii) Assets = liabilities + capital

(iv) Assets = external equities

Q.2. Which of the following is correct?

(i)

Opening capital = Closing capital + additional capital- profit Drawings.

(ii)

Opening capital = Closing capital + Drawing Additional capital loss.

(iii) Opening capital = Closing capital + Drawing Additional capital Profit.

Q.3. Accounting equation holds good under all circumstances Justify this statement

with the help of five illustrations.

Q.4. (i)

(ii)

(iii)

Sonu started a business on 1. 1. 2005 with a capital of Rs. 10,000 & a loan

of Rs. 5,000 borrowed from Bharat. On 31st December 2005, his assets

were Rs. 30,000. Find out his capital as on 31. 12. 2005 & Profit made or

losses incurred during the year 2005.

If in the above problem during 2005, the proprietor had introduced

additional capital of Rs. 5, 000 & had withdrawn Rs. 3,000 for personal

purposes, find out the profit.

If in the above problem on 31st Dec 05, apart from loan, Sonu owes Rs.

2500 to a supplier of goods, Find out his capital as on 31st Dec 05 & Profit.

Q.5. Prepare Accounting Equation from the following:(i)

Started business with cash Rs. 75, 000 & goods Rs. 25,000.

(ii)

Paid rent Rs. 2,000.

5

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

(iii)

(iv)

Bought goods for cash Rs. 30,000 & on credit for Rs. 44,000.

Goods costing Rs. 50,000 sold at a profit of 25% out of which Rs. 27,500

received in cash.

(v)

Purchased a Motor cycle for personal use for Rs. 20,000.

(vi) Purchased furniture from Shyam for Rs.15,000.

(vii) Rent due but not received Rs.500.

(viii) Payment made to Creditors Rs.42, 000 in full settlement.

(ix) Rent paid Rs. 12,000 for 15 months.

(x)

Purchased a computer from computer plaza worth Rs. 45,000. 50%

payment made in cash and remaining is to be paid three months later.

Q.6. Prepare Accounting equation from the following & also prepare a Balance sheet :(i)

(ii)

(iii)

Reema started business with cash Rs. 1, 50,000

Bought goods for cash Rs. 80,000 & on credit for Rs. 40,000.

Sold goods to Anil costing Rs.20,000 at a profit of 10% and allowed him

10% Trade Discount and 10% Cash Discount. Received half of the amount

in cash and balance half by cheque.

(iv) 1/4th of the remaining goods were sold at a profit of 10% on cost and half of

the payment was received in cash.

(v)

Paid for rent Rs. 2,000 & for salaries Rs. 4,000.

(vi) Goods costing Rs. 20,000 sold for Rs. 18,500 for cash.

(vii) Wages Outstanding Rs. 1,200.

(viii) Rent paid in advance Rs.1,100.

(ix) Commission received in advance Rs. 600.

Q.7. Give one example of each of the following transactions

(i)

Increase in asset, Increase in liability.

(ii)

Decrease in asset, Decrease in liability.

(iii) Increase in assets, Increase in capital.

(iv) Decrease in assets, Decrease in capital.

(v)

Increase in Asset, Decrease in Asset.

(vi) Increase in Liability, Decrease in Liability.

Q.8. Which value is reflected in the concept of accounting equation?

Ans. Value:- Equality In accounting equation, assets are equal to Capital and liabilities.

Hence, the value of equality is reflected in the concept of accounting equation.

=============================================

Rules of Debit and Credit

Q.1. What is an account?

Q.2. Explain Representative Personal Accounts.

6

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.3. Classify the following (both Traditional and Modern Classification) :(i)

Bank A/c

(iv) Outstanding Salary A/c

(v)

Bank Overdraft A/c

(ii)

Salary A/c

(iii) Capital A/c

Q.4. On which side will the increase in the following accounts be recorded?

(i)

Purchases A/c

(iv) Capital A/c

(vi) Creditors A/c

(ii)

Building A/c

(iii) Rent received A/c

Q.5. All business transactions can be recorded in the books of account by using the

traditional approach or modern approach of accounting equation. Identify the

values which are being reflected by the rules of debiting and crediting the business

transactions.

Sol: The values are:

(i)

Recognition: The value of recognition by recognizing the account to be

debited or credited is being reflected.

(ii)

Transparency: By recording all the transaction as per the rule, the entities

can show true and fair view of business concern.

Source Documents and Preparation of Vouchers

Q.1. Differentiate between Debit note and Credit note

Q.2. How is Accounting Voucher prepared?

Q.3. The documents which provide evidence of business transactions are called source

documents. These source documents provide all necessary information about the

nature of business transactions and all the amount involved therein. Identify the

values being reflected by preparing all source of documents.

Sol: The values are:

(i)

Responsibility: By preparing all source documents, management fulfills its

responsibility towards all stakeholders.

(ii)

Respect for law: By maintaining the source documents entity not only

follows the guidelines issued by the Institute of Chartered Accountants of

India but can also show these documents as evidence in the court of law.

Journal, Ledger and Trial Balance

Q.1. What is narration?

Q.2. What is an opening entry?

Q.3. What is a compound entry? Give example.

Q.4. Why Journal is called Book of Original Entry?

Q.5. Differentiate between Trade Discount and Cash Discount.

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.6. Journalise the following transactions:

(i)

Paid rent of building Rs. 12,000, Half of the building is used by the

proprietor for residential use.

(ii)

Paid fire insurance of the above building in advance Rs. 1,000.

(iii) Paid life Insurance premium Rs. 2,000.

(iv) Paid income tax Rs. 3,000

(v)

Salary due to clerk Rs. 500.

(vi) Charge depreciation on furniture @ 10% p.a. for one month (Furniture

Rs. 12,000)

(vii) Provide interest on capital (Rs. 60,000) at 15% p.a. for six months.

(viii) Charge interest on drawing (Rs. 10,000) at 18% p.a. for two months.

Q.7. Journalise the following transactions: (i)

Purchased a motorcar for Rs. 60,000 & paid Rs. 5,000 for its repair &

renewal.

(ii)

Received Rent Rs. 500

(iii) Goods worth Rs. 2,000 were distributed as free samples.

(iv) Charge depreciation on Motorcar Rs. 6,500.

(v)

Rent due to landlord Rs. 1,000 & salary due to clerks Rs. 8,000.

(vi) Rs.750 due from Sanjay Gupta is bad debts.

(vii) Goods uninsured worth Rs. 5,000 were destroyed by fire

(viii) Cash Rs. 500 & goods worth Rs 2,000 were stolen by an employee.

(ix) Goods destroyed by fire: cost price Rs.40,000, Sale price Rs. 50,000.

(x)

Sold household furniture for Rs. 5,000 in cash and paid the money into

business.

(xi) Goods costing Rs. 80,000 sold to Anuj at an invoice price 20% above cost

less 20% trade discount.

(xii) Goods destroyed by fire Rs. 20,000. Insurance company admitted the claim

85% and the claim was received.

Q.8. Journalise the following transactions:

(i)

Cheque received from Ram and not deposited into bank the same day.

(ii)

Collection of dividend by bank on our behalf.

(iii) Cheque received from Ram deposited into the bank.

(iv) Deposited cheque dishonoured.

(v)

Repayment of bank loan by issue of cheque.

Q.9. Complete the journal by filling entries corresponding to the narration or narration

corresponding to the journal entries given below:

Date

2008

March 1

Particulars

L.F

Dr

To

(Being goods sold to sunny of

list price Rs. 20,000 at 10%

trade discount)

8

Debit (Rs.)

Credit (Rs.)

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

March 3

March 4

March 8

March 12

March 15

March 23

March 27

March 31

Assignment Booklet

(Class - XI : ACCOUNTS)

Dr

To Cash A/c

To

(Being cash paid Rs. 11,500, in

full settlement of Rams

account of Rs. 12,000)

Dr

Dr

To sales A/c

(Being goods sold for cash of

the list price Rs. 15,000 at 10%

trade discount & 1% cash

discount)

Machinery A/c

Dr

To Bank A/c

(Being ---------------------------)

Advertisement A/c

Dr

To

(Being goods costing Rs. 9,000

distributed as free sample)

50,000

50,000

9,000

9,000

Dr

To Sales A/c

(Being goods sold to sunil on

credit costing Rs. 26,000 at a

profit of 20% on cost)

Dr

To

To

(Being Rent paid Rs. 7,000 and

rent due Rs. 3,000 to the

landlord)

Cash A/c

Dr

Bad debts A/c

Dr

To

(Being 25 paise in a rupee

received from the estate of

Gajan on his insolvency)

Depreciation A/c

Dr

To Machinery A/c

(Being ---------------------------)

6,000

600

600

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.10. Goods worth Rs. 5,000 were destroyed by fire and the insurance company

admitted the claim of Rs. 3,500.

(i)

Journalise the above transaction.

(ii)

Identify the values involved in the above transaction.

Sol:

Date

Particulars

L.F. Debit

Credit

(Rs.)

(Rs.)

Loss by fire A/c

Dr.

5,000

To Purchases A/c

5,000

(Being goods destroyed by fire)

Insurance Company A/c

Dr.

3,500

Profit & Loss A/c

Dr.

1,500

To Loss by Fire A/c

5,000

(Being insurance company admitted the claim)

Values:

(i)

Safety: The business has worked towards safety by taking insurance policy

for goods.

(ii)

Responsibility: The business has shown responsible behavior by insuring the

goods and preparing for any future contingencies.

Q.11. Why is ledger called Principal Book of accounts?

Q.12. (i)

The following balances appeared in the books of Sh. Ashok chakravarti as

on 1st January 1994:-

Assets

Cash Rs. 20,000; Stock Rs. 45,000; Anil Brothers Rs.15,600; Gopal

Rs.22,000; Machinery Rs.60,000;

Liabilities Mohan Kapur Rs. 4,000.

Following transaction took place in January 1994:

1994:Jan 3

Sold goods for cash Rs. 5,000 and on credit Rs.8,000 to Anil bros.

Jan5

Anil Bros. returned goods for Rs.2,000

Jan 7

Purchased goods from Mohan Kapur, list price Rs.6,000 valued at

Rs. 5,400

Jan 8

Bought goods of the list price of Rs. 20,000 from Raghu Thakur, less

15% trade discount and 5% cash discount and paid 60% price

immediately.

Sol:

Pass Journal entries for the above transactions, post them into ledger, balance the

accounts and prepare Trial Balance.

(ii)

Identify the value(s) involved in the above case.

Value: Division of Work:- By maintaining various journals and ledgers accounts.

10

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.13. Journalise the following transactions, post them into ledger, balance the accounts

& prepare Trial Balance

(i)

Started Business with cash Rs. 1,00,000

(ii) Purchase goods Rs. 10,000 from Ram

(iii) Sold goods for cash RS. 10,000 (Cost of Rs. 8,000)

(iv) Drawings Rs. 1,000

(v) Rent paid Rs. 500

Q.14. What are the objectives of Trial Balance?

Q.15. Identify the value(s) reflected in preparing Trial Balance.

Sol:

The values are:

(a)

Doing your Best: By preparing Trial Balance, the entities can show true and

fair view of the business concern.

(b)

Honesty: By preparing Trial Balance, the Management can show the value

of honesty towards all stakeholders.

=============================================

Bills of Exchange

Q.1. Fill in the blanks:

(i)

A bill of exchange is an _________in writing given by creditors to the

debtors.

(ii)

The debtor on whom the bill of exchange is drawn is called the________.

(iii) A promissory note is a _________ in writing given by the debtor to the

creditor.

(iv) When a bill is endorsed by the drawer, he is called an __________.

(v)

A bill of exchange is called a ________ by one who is liable to pay it on the

due date.

(vi) The person other than the original creditor, to whom the amount in the bill is

made payable is Known as the _________of the bill.

Q.2. A bill for Rs. 10,000 is drawn by A on B and accepted by the latter. Show what

Journal entries would be recorded in the books of both the parties under each of

the following circumstances.

(i)

If A retained the bill till the due date and then realized it on maturity.

(ii)

If A discounted it with his Bank for Rs. 9,800.

(iii) If a endorsed the bill to Z in settlement of a debt of Rs. 9,500.

(iv) If a sent the bill to his bank for collection.

Q.3. Amit draws on Raj three Bills of Exchange for Rs. 5,000, Rs. 8,000 and Rs. 10,000

respectively for goods sold to him on 1st Dec, 2011. These bills were for one

month, two months and three months respectively. The first bill was endorsed to

Rihan. The second bill was discounted with the bank on 4th December, 2011 @

10% p.a. discount and the third bill was sent to bank for collection on 28th

11

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

February, 2012. On the due dates all the bills were duly met by Raj. The bank sent

collection advice for the third bill after deducting Rs. 40 as collection charges. Pass

journal entries in the books of Amit and Raj.

Q.4. On 1st January, 2011, Hiten owed Rs. 40,000 to Abhishek. On 1st February, he

sent a promissory note to Abhishek for the amount payable, after 3 months. On the

due date, the promissory note was dishonoured, noting charges being Rs. 100.

Give the journal entries in the books of Abhishek in each of the following cases:(i)

The promissory note is held till maturity.

(ii)

The promissory note is endorsed in favour of Ritesh in full settlement of a

debt of Rs. 41,000.

(iii) The promissory note is discounted with the bank at 10% p.a. immediately.

Q.5. A drew a bill of Rs. 1,000 on B for 3 months which was duly accepted by the latter.

A endorsed the bill to C in full payment of his own acceptance to C for a like

amount. C endorsed the bill to B. Pass Journal entries in the books of A,B and C.

Q.6. Leena sold goods to Meena on 1st March, 2009 for Rs. 68,000 and drew two Bills

of Exchange of the equal amount upon Meena payable after three months. Leena

immediately discounted the first bill with her bank at 12% p.a. The bill was

dishonoured by Meena and Bank paid Rs. 55 as noting charges.

The second bill was retired on 4th May, 2009 under a rebate of 6% p.a. with

mutual agreement.

(i)

Journalise the above in the books of Leena and Meena.

(ii)

Identify the value(s) which according to you have been violated in the above

case.

Sol: Values violated:

(a)

Responsibility: By not honouring the bill.

(b)

Courtesy: Meena has not shown courtesy towards Leena by not honouring

the bill on due date.

Q.7. On 15th April, 2009 A agrees to draw on B, who is his Debtor for Rs. 2,400, three

bills of exchange : No. 1 for Rs. 700 at 1 month, No. 2 for Rs. 800 at 2 months,

and No. 3 for Rs. 900 at 3 months. B accepts and returns these bills to A. On 20th

April, 2009 A endorsed the first bill to his creditor C, in full settlement of his

account for Rs. 710. He discounted the second bill on 22nd April for Rs. 792.

The first bill was met on maturity. The second bill was dishonoured Rs. 10 being

the noting charges. A agreed to draw on B a fourth bill for Rs. 825 at 3 months.

The third and fourth bills were met on the due dates. Record the Journal entries in

the books of A, B and C.

Q.8. On 15th January, 2006 Sachin sold goods for Rs. 30,000 to Narain and drew upon

later a bill for the same amount payable after 3 months. The bill was accepted by

Narain. The bill was discounted by Sachin from his bank for Rs. 29,250 on 31st

January, 2006. On maturity the bill was dishonoured. He further agreed to pay Rs.

12

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

10,500 in cash including Rs. 500 interest and accept a new bill for two months for

the remaining Rs. 20,000. The new bill was duly met by Narain on maturity. Give

the Journal entries in the books of Sachin.

Q.9. B owed to A Rs. 60,000 on 1st January, 2009. On the same date, A drew upon B a

bill for the amount at 2 months and B returned the bill duly accepted. A got the bill

discounted at his bank @ 15% p.a. Before the bill was due for payment, B told A

that he will not able to pay the full amount and requested A to accept Rs. 20,000

immediately and draw upon him another bill for the remaining amount for 2

months together with interest @ 18% p.a. A agreed. The second bill was duly met.

Give the Journal entries in the books of both A and B.

=============================================

Cash Book

Q.1. Cash Book is both journal as well as ledger. Explain the statement.

Q.2. Define the following:(i)

Contra Entry

(ii)

Bank Charges

(iii) Bank Overdraft

Q.3. Multiple choice questions:

(i)

Cash book is used to record

(a)

All receipts only,

(b)

All payments only

(c)

All cash & credit sales

(d)

All receipts & payments of cash

(ii)

Which of the following is correct?

(a)

Cash book is a journal & not a ledger.

(b)

Cash book is ledger & not a journal.

(c)

Cash book is both a journal & a ledger.

(iii)

When a firm maintains a simple cashbook, it need not maintain

(a)

Sales journal

(b)

Purchase journal

(c)

General Journal

(d)

Cash A/c in the Ledger

(e)

Bank A/c in the ledger

(iv)

When a cheque is returned dishonoured, it is recorded in ;

(a)

Cash column on the Cr. side.

(b)

Cash column on the Dr. side.

(c)

Bank column on the Cr. side.

(vi)

If the Dr. as well as Cr. Aspects of a transaction are recorded in the cash

book itself, it is called:

(a)

an opening entry

13

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

(b)

(c)

(d)

(vii)

Assignment Booklet

(Class - XI : ACCOUNTS)

a compound entry

a transfer entry

a contra entry

Bank column of cash book may show:

(a)

Only a Dr. balance

(b)

Only a Cr. Balance

(c)

Either Dr. or a Cr. Balance

(viii) When a firm maintains Double column cash Book, it need not maintain:

(a)

Cash A/c in the ledger

(b)

Bank A/c in the ledger

(c)

Discount A/c in the ledger

(d)

Both cash A/c & Bank A/c in the ledger.

Q.4. (i)

2011

April 1

April 1

April 2

April 3

April 5

April 6

April 7

April 8

April 9

April 10

April 11

April 12

April 13

April 14

April 15

April 16

April 17

(ii)

Sol:

Prepare a Triple Column Cash Book from the following transactions of Mr.

Shiv Kumar of Chandigarh.

Commenced business with cash Rs. 1,50,000.

Purchased furniture for Rs. 20,000.

Deposited Rs. 70,000 in the newly opened Bank Account.

Purchased goods from Mohan worth Rs. 15,000.

Purchased goods from Gopal worth Rs. 20,000 at 10% Trade Discount and

5% Cash Discount.

Sold goods to Mahesh for Rs. 5,000.

Sold goods to Rachit for Rs. 10,000.

Received cheque from Mahesh. Allowed him Cash discount @ 5%.

Withdrew Rs. 30,000 from the bank out of which Rs. 12,000 were used to

pay domestic expenses.

Received a B/R from Rachit.

Maheshs cheque deposited in the bank.

Paid Rs. 5,000 as Donation to a Blind School.

Rachits B/R discounted through bank at a discount of 10%.

Maheshs cheque returned dishonoured.

Paid cheque to Mohan after deducting a cash discount of 5%.

Paid to cleaner in cash Rs. 600.

Loan given to Rajesh Rs. 10,000.

Identify the value(s) involved in the above transactions.

Values:

(a)

Responsibility: Owner has shown responsibility towards society by paying

donations to a blind school.

(b)

Courtesy: Owner has shown courtesy by allowing discount to debtors for

prompt payments.

14

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.5. Prepare a Triple Column Cash Book from the following transactions:

2011

Sept 1

Cash in hand

Bank Overdraft

Sept 2

Cash received from the sale of shares

Sept 4

Received from Mohan a cheque for Rs. 980 in full

Settlement of a claim of Rs. 1,000

Sept 4

Received a cheque from subhash for the sale of goods

Sept 6

Discounted bill for Rs. 10,000 returned dishonoured.

Sept 10

Mohans cheque returned dishonoured

Sept 12

Received from Ved Rs. 6,000, half of the amount was

deposited into bank on the same day.

Sept 13

Received a cheque from Ram Lal on account Rs. 290

and allowed him discount of Rs. 40.

Sept 14

Paid Bills Payable by cheque

Sept 15

Instructed the bank to issue a Bank draft for Rs. 5,000 in

favour of Suresh. The bank charged Rs. 10 for issuing the

draft.

Sept 16

Placed an order with Vikas for goods Rs. 1,000 and sent

cheque for Rs. 1,000 with the order.

Sept 17

Withdrew from bank for paying income tax.

Sept 18

B/R endorsed in favour of Mohit returned dishonoured.

Sept 19

Cheque received from Anil Rs. 15,000 and endorsed it in

favour of Sugandh in full settlement of Rs. 16,200.

Rs.

40,000

15,000

5,000

22,000

600

1,000

Q.6. Prepare a Triple Column Cash Book from the following transactions:2011

April 1

Cash in Hand Rs. 5,000; Overdraft at bank Rs. 15,000.

April 3

Further Capital introduced Rs. 20,000 out of which Rs. 16,000 deposited in

the bank.

April 5

Sold goods for cash Rs. 13,000.

April 6

Settled the account of Mohan Rs. 750 by paying cash Rs. 680.

April 10

An amount of Rs. 500 due from Gupta Brothers written off as bad debts in

the previous year, now recovered.

April 11

Received a cheque for Rs. 700 from Anil; endorsed to Rahul on 19th April.

April 13

Purchased goods from Manmohan Rs. 10,000.

April 15

Shyam who owed Rs. 400 became bankrupt and paid 60 paise in a rupee.

April 16

Cash purchases Rs. 800 less trade discount 5%.

April 18

Received cheque from Rakesh Rs. 3,450. Allowed him discount Rs. 100.

April 19

Withdrew for office use Rs. 2,000.

April 20

Purchased postage stamps Rs. 50.

April 21

Paid for office furniture Rs. 500.

April 22

Purchased typewriter for Rs. 1,500.

15

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

April 23

April 24

April 25

April 26

April 27

April 28

April 29

April 29

April 29

Paid for furniture repair Rs. 150.

Purchased a mobile for personal use Rs. 4,000.

Paid for V.P.P of goods from Luckhnow Rs. 275.

Sent money order to Lakshman Rs. 250.

Money order commission Rs. 10.

Received from Ram, who owes Rs. 4,000, Rs. 1,500 only on account.

Interest allowed by bank Rs. 200.

Income tax paid by cheque Rs. 1,500.

Recovered from the Manager Rs. 200 being excess travelling allowance

drawn by him.

April 29

Settled a debt of Rs. 1,200 by cheque receiving a discount of 5%.

April 29

Purchased 50 bonds for Rs. 100 each at Rs. 95 each and paid for them by

cheque.

April 30

Received a money order Rs. 500.

Received Rs. 2,000 for a Bill of Exchange from Hari Ram and deposited the

same into bank.

Paid Rs. 5,000 on account of repayment of loan from Bank including Rs.

1,000 as interest on Loan.

Sold goods for Rs. 12,500, received cheque for them, discount allowed 1%.

Deposited with the bank the entire balance after retaining Rs. 1,000 at office.

Q.7. Enter the following transactions in the three columnar cash book with cash, bank

and discount columns:

Oct, 2010

1

Cash in hand Rs. 5,000; Bank overdraft Rs. 9,500.

3

Sold goods to Ram on credit Rs. 10,000.

5

Bought goods from Mahesh for Rs. 8,000 and paid by cheque under 2%

discount.

7

Received two cheques from Ram for Rs. 4,000 and for Rs. 6,000.

9

Cheque received from Ram for Rs. 4,000 was deposited in bank but chque

for Rs. 6,000 was endorsed to Sohan in full settlement of his claim for Rs.

6,200.

11

Withdrew cash from bank for office use Rs. 3,000.

15

Withdrew cash from bank for domestic use Rs. 2,000.

18

Bought furniture for Rs. 4,000 and issued cheque. Also paid carriage charges

Rs. 100.

21

Bought goods for cash Rs. 3,000 and paid carriage charges Rs. 50.

25

Goods sold for cash Rs. 5,000; 60% amount deposited in bank.

27

Bank charges interest Rs. 500 and bank charges were Rs. 200.

30

Deposited the cash into bank in excess of Rs. 4,000.

=============================================

16

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Subsidiary Books

Q.1. Multiple choice Questions:

(i)

Purchases Book is used to record:

(a)

All purchases of goods.

(b)

All credit purchases.

(c)

All credit purchases of goods.

(d)

All credit purchases of assets other than goods.

(ii)

Sales Book is used to record:

(a)

All sales of goods.

(b)

All credit sales.

(c)

All credit sales of assets other than goods.

(d)

All credit sales of goods.

(iii)

Purchases Return Book is used to record:

(a)

Return of goods purchased for cash.

(b)

Return of fixed assets purchased on credit.

(c)

Return of goods purchased on credit.

(iv)

Sales Returns Book is used to record:

(a)

Return of fixed assets sold on credit.

(b)

Return of goods sold for cash.

(c)

Return of goods sold on credit.

Q.2.(i)From the following transactions, prepare the Purchases Book of Jindal & Co., a

saree dealer.

Date

3.1.2006

8.1.2006

15.1.2006

31.1.2006

Particulars

Purchased on credit from Goyal Mills, Surat, 55 Polyester Sarees@ Rs.100,

Less :Trade discount @10%

Purchased for cash from Garg Mills ,Kota, 50 Kota Sarees @ Rs.40.

Purchased on credit from Mittal Mills, Bangalore 10 Silk sarees @ Rs.260,

Less :Trade discount @10%

Purchased on credit from Bansal & Co. 2 typewriters @ Rs.3,500

(ii)

Sol:

Identify the value(s) involved in the above transactions.

Values:

(a)

Division of work: Business has shown division of work by dividing books of

original entries into various special purpose journals.

(b)

Courtesy: Suppliers have shown courtesy by allowing discounts.

Q.3. From the following transactions, prepare the Sales Return Book of Gupta & Co, a

saree dealer.

Date

Particulars

5.1.2006 Goyal & Co.,Rohtak, Returned 2 Polyester Sarees @ Rs.125

10.1.2006 Accepted return of goods(which were sold for cash) from Garg & Co, Bhiwani,10

Kota Sarees @Rs.50

17

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

17.1.2006 Mittal & Co, Hisser returned 2 Silk sarees @ Rs.325

31.1.2006 Mohan Returned old Typewriter@ Rs.500

Q.4. From the following information prepare Sales Book of Sheesh Mahal furniture

House :

2005

April 1

Sold goods to Rahul Furniture House, Karnal

14 Almirahs @ Rs. 2,000 each.

04 Sofasets @ Rs. 5,250 each

Trade discount 15%

April 12

Sold on credit to Neelam Machinery Store

4 old Machinery @ Rs. 350 per machine

2 old type writers for Rs. 840 per type writer

April 15

Sold goods to Prem Furniture House, Faridabad

60 Chairs @ Rs. 420 each

Less 5% Trade discount

April 20

Sold goods to Rohan Furniture House, New Delhi

210 Chairs @ Rs. 200 each

60 Tables @ Rs. 560 each

Less: discount 10%

April 28

Sold to Sunlight Furntiure Co. for cash

100 Chairs @ Rs. 150 each

40 Tables @ Rs. 200 each.

=============================================

Provision & Reserves

Q.1. What is meant by provision?

Q.2. What is meant by Reserve?

Q.3. Differentiate between Provisions and Reserves.

Q.4. Differentiate between General Reserve and Specific Reserve.

Q.5. Multiple Choice Questions:

(i)

(ii)

(iii)

Provision is :

(a)

charge against the profits

(b)

Appropriation of profits

If the amount of any Known Liability cannot be determined with substantial

accuracy:

(a)

A definite liability should be created

(b)

A provision should be created

(c)

A reserve should be created

If the amount of any known liability can be determined with substantial

accuracy:

18

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

(a)

(b)

(c)

Assignment Booklet

(Class - XI : ACCOUNTS)

A definite liability should be created

A provision should be created

A reserve should be created

Q.6. Provision means setting aside a part of the profits for meeting a liability in future,

the amount of which is not known accurately at the time of finalization of financial

statements. Identify the values being reflected in creating provisions.

Sol: The values are:

(i)

Preparing for future: Entity prepares itself for the future by creating provision

out of profits for meeting liability in the future.

(ii)

Safety: By creating the provision entity secures itself from the actual loss

arising in the future.

(iii) Recognition: Provision is a charge against profits and by recognizing the

provision management shows a true and fair financial position of the entity.

(iv) Responsibility: By creating the provision entity shows its responsibility

towards the investors/owners by securing them from the future liability.

=============================================

Depreciation

Q.1. Define Depreciation.

Q.2. State the objectives for providing depreciation.

Q.3. State the merits of Straight Line Method.

Q.4. State the demerits of Written Down Value Method.

Q.5. Distinguish between Depreciation & Obsolescence.

Q.6. Multiple choice Questions:(i)

Depreciation is related to

(a)

Current asset

(c)

Fixed asset

(b)

Investment

(ii)

The amount of depreciation remains constant year after year under:

(a)

Written Down Value Method

(b)

Straight line Method

(iii) Depreciation is:

(a)

A fall in the original cost of an asset

(b)

A fall in the Market value of an asset

Q.7. (i)

X ltd. which closes its books of account every year on 31st march, purchased

on 1st October, 2001 machinery costing Rs. 4,40,000. It purchased further

machinery on 1st April, 2002 costing Rs.5,20,000. On 30th June 2003, the

first machine was sold for Rs. 2,50,000 & on the same date a fresh machine

was installed at a cost of Rs. 3,00,000. On 1st July 2004, the second

machine purchased on 1st April 2002 was sold for Rs. 3, 25,000.

19

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Sol:

Assignment Booklet

(Class - XI : ACCOUNTS)

The company writes off depreciation at 10%p.a. on fixed installment method

each year. Show the Machinery A/c for all the four years

(ii)

Identify the value(s) being reflected in the above case:

Values shown by business are:

(a)

Preparing for future: Business has prepared for future by providing

depreciation on Machinery.

(b)

Respect for law: Business has shown respect for law by charging

depreciation on Machinery.

Q.8. A company whose accounting year is a calendar year, purchased on 1st April, 2003

machinery costing Rs. 30,000.

It purchased further machinery on 1st October, 2003 costing Rs. 20,000 and on 1st

July, 2004 costing Rs. 10,000

On 1st January, 2005 one-third of the machinery installed on 1st April, 2003

became obsolete and was sold for Rs. 3,000.

Show how Machinery Account would appear in the books of the company. It

being given that machinery was depreciated by Fixed Installment method at 10%

p.a. What would be the value of Machinery Account on 1st January, 2006?

Q.9. On 1st January, 2004, machinery was purchased by X for Rs. 50,000. On 1 st July,

2005, additions were made to the extent of Rs. 6,400.

On 30th June, 2007 machinery, the original value of which was Rs. 8,000 on 1st

January, 2004, was sold for Rs. 6,000. Depreciation is charged at 10% p.a. on the

original cost.

Show the Machinery Account for the years from 2004 to 2007 in the books of X.

X closes the books on 31st December.

Q.10. Raja Textiles co. which closes its books on 31st Dec, Purchased a machine on 1-11988 for Rs. 50,000. On 1-7-1989, it purchased an additional machine for

Rs. 30,000. The part of the machine which was purchased on 1-1-1988 costing

Rs. 10,000 was sold for Rs. 3,600 on 30 June 1991.Prepare Machinery A/c for four

Years, if the depreciation is provided @ 10% p.a. on Diminishing Balance method.

Q.11. A company whose accounting year is the calendar year purchased on 1st April,

2001 machinery costing Rs. 30,000. It further purchased machinery on 1st

October, 2001 costing Rs. 20,000 and on 1st July, 2002 costing Rs. 10,000.

On 1st January, 2003 one-third of the machinery installed on 1st April, 2001

became obsolete and was sold for Rs. 3,000.

Show how the Machinery Account would appear in the books of company if

Depreciation is charge at 10% p.a. on Written Down Value Method.

Q.12. The following information relates to Tit-Bit & Companys Machinery Account:

Amount (in Rs.)

Balance of Machinery Account as on 1st January, 2006

6,00,000

st

Machinery purchased on 1 July, 2006

2,50,000

20

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Q.13.

Q.14.

Q.15.

Q.16.

Assignment Booklet

(Class - XI : ACCOUNTS)

On 1st October, 2006, a machine, the original cost of which was Rs. 80,000 (which

was purchased on 1st April, 2005) was sold for Rs. 60,000.

Assume that Depreciation was charged @ 10% p.a. on the Diminishing Balance

Method. Show the Machinery Account in the books of Tit-Bit & Company for the

year ended 31st December, 2006.

ABC Ltd. Purchased on 1st April, 2006 a small plant for Rs. 1,00,000. On 1st

October, 2006 an additional plant was purchased costing Rs. 50,000. On 1st

October, 2007 the plant purchased on 1st April, 2006, having become obsolete,

was sold for Rs. 40,000. Depreciation is provided @10% p.a. on the original cost

on 31st March every year. Show the Machinery and Provision for Depreciation

Accounts for the years 2006-07 and 2007-08.

On 1st April, 2003, X Ltd. Purchased a machinery for Rs. 12,00,000. On 1st

October, 2005, a part of the machinery purchased on 1st April, 2003 for Rs. 80,000

was sold for Rs. 45,000 and a new machinery at the cost of Rs. 1,58,000 was

purchased and installed on the same date. The company has adopted the method

of providing 10% p.a. depreciation on the Diminishing Balance of the machinery.

Show the necessary Ledger accounts assuming that (i) Provision for Depreciation

Account is not maintained, (ii) Provision for Depreciation Account is maintained.

The accounting year ends on 31st March.

On 1st January, 2000 X Ltd. Purchased from Y Ltd. a plant costing Rs. 4,00,000 on

installment basis payable as follows:

on 1st January, 2000

Rs. 1,00,000

on 1st July, 2000

Rs. 1,00,000

st

on 1 January, 2001

Rs. 1,00,000

st

on 1 January, 2002

Rs. 1,00,000

The company spent Rs. 10,000 on transportation and installation of the plant. It

was decided to provide for Depreciation on the Straight Line Method. Useful life of

the plant was estimated at 5 years. It was also estimated that at the end of the

useful life, realizable value of the plant wuld be Rs. 12,000 (gross) and dismantling

cost of plant, to be paid by company was estimated at Rs. 2,000. The plant was

destroyed by fire on 31st December, 2003 and an insurance claim of Rs. 50,000

was admitted by the insurance company. Prepare the Plant Account and

Accumulated Depreciation Account assuming that the company closes its books on

31st December every year.

A machine was purchased on 1st October, 1998 at a cost of Rs. 3,00,000 & Rs.

20,000 were spent on its installation. The Depreciation is written off at 10% p.a. on

diminishing Balance Method. The books are closed on 31st March every Year.

The machine was sold for Rs. 1,30,000 on 1st July 01. Show the machinery A/c &

Provision for Depreciation A/c for all the years.

=============================================

21

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Bank Reconciliation Statement

Q.1. Who prepares a Bank Reconciliation Statement?

Q.2. When can a Bank Reconciliation Statement be prepared?

Q.3. Why is the preparation of BRS necessary?

Q.4. State any two causes of disagreement between the balances shown by the Cash

book & Passbook.

Q.5. (a)

The bank column of a Cash Book showed a debit balance of Rs. 45,000 on

30th June, 2011. From the following particulars, ascertain the Bank Balance

that would appear in the Bank Pass Book:

(i)

Two cheques one for Rs. 4,000 and another for Rs. 6,000 were collected by

the bank in the first week of July, 2011 although they were banked on 26th

June, 2011.

(ii)

Out of total cheques, amounting to Rs. 8,000 issued as donations to Mandir,

Mosques, Gurudwara and church; cheques amounting to 3,400 have been

presented for payment in June 2011, cheques aggregating Rs. 2,500 were

encashed in July 2011 and the rest have not been presented at all.

(iii) On 29th June, 2011 the bank credited the sum of Rs. 1500 in error.

(iv) A cheque of Rs. 600 received, deposited and credited by bank, was

accounted as a receipt in the cash column of the Cash Book.

(v)

Bank has made payment of Rs. 5,000 for fire insurance premium during the

month of June under standing order.

(vi) The Bank has paid a bill payable amounted to Rs. 10,000 but it has not

been entered in the Cash Book and a bill receivable of Rs. 5,000 which was

discounted with the bank was dishonoured by the drawer on the due date.

(vii) Withdrawal Column of the Pass Book undercast by Rs. 200.

(viii) Bank collected a cheque of Rs. 600 but wrongly credited it to the account of

another customer.

(ix) The credit balance of Rs. 1,500 as on Page 10 of the Pass Book was

recorded on Page 11 as a debit balance.

(x)

Pass Book showed that bank had collected Rs. 4,000 as interest on Govt.

Securities.

(b)

Identify the value(s) involved in the above transactions.

Sol:

Values:

(i)

Secularism: By giving donations to Mandir, Mosque, Gurudwara and

Church, business has shown the value of secularism.

(ii)

Safety: By paying insurance premium, business has ensured safety from any

possible fire accident.

(iii) Doing Your best: By investing in government securities, business has played

safely.

22

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.6. Prepare a Bank Reconciliation Statement as on 31st March, 2011 from the

following information:

(i)

Balance as per the Pass Book is Rs. 22,000.

(ii)

Dividend directly collected by bank Rs. 125.

(iii) Payment of a cheque of Rs. 450 was recorded twice in the Pass Book.

(iv) Bank recorded a cash deposit of Rs. 2,589 as Rs. 2,598.

(v)

Bills for collection not advised by the bank but credited to the account, Rs.

16,000.

(vi) A cheque for Rs. 7,500 drawn on the Savings Account has been shown as

drawn on current Account.

(vii) A cheque of Rs. 2,000 received form Mr. Gupta was recorded in the Cash

Column of the Cash Book but was not banked.

(viii) Cheques amounting to Rs. 8,000 drawn on 25th March, 2011 of which

cheques or Rs. 5,000 were encashed on 2nd April, 2011.

(ix) A bill of Rs. 10,000 was retired by the bank under rebate of Rs. 150 but the

full amount was credited in the Cash Book.

(x)

Cheques of Rs. 10,000 were sent to the bank for collection. Out of these,

cheques of Rs. 2,000 and of Rs. 1,000 were credited respectively on 7th April

and 9th April.

Q.7. On 31st December, 2008, the Cash Book of a merchant showed a bank

overdraft of Rs. 1,50,000. From the following particulars, prepare a Bank

Reconciliation Statement and show what balance the Bank Pass Book would

indicate on 31st December, 2008.

(i)

A cheque of Rs. 15,000 received from Gopal and deposited in the bank was

dishonoured but the non-payment advice was not received from the bank till

1st January, 2009.

(ii)

A post-dated cheque for Rs. 100 has been debited in the bank column of the

Cash Book but under no circumstances was it possible to present it.

(iii) During the month, the total amount of cheques for Rs. 94,000 were

deposited into the bank but out of them, one cheque for Rs. 11,160 has

been entered into the Pass Book on 5th January.

(iv) During the month, cheques for Rs. 89,500 were drawn in favour of creditors.

Of them, one creditor for Rs. 38,500 encashed his cheque on 7th January

whereas another for Rs. 4,320 has not yet been encashed.

Q.8. Prepare a Bank Reconciliation Statement from the following particulars as on

31st December, 2008, when the Pass Book shows a debit balance of Rs. 4,500.

(i)

Rs. 800 in respect of dishonoured cheque were entered in the Pass Book but

not in the Cash Book.

(ii)

Cheques amounting to Rs. 8,000 drawn on 25th December of which cheques

of Rs. 5,000 cashed in January, 2009.

23

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

(iii)

Cheques paid into bank for collection of Rs. 5,000 but cheques of Rs. 2,200

could be collected in December, 2008.

(iv) Cheques dishonoured and debited by the bank but not given effect to it in

the Ledger Rs. 800.

(v)

Bank charges debited by the bank but Debit Memo not received from the

bank Rs. 50.

(vi) A bill for Rs. 6,000 dishonoured on 30th December, 2008 and bank paid

Noting charges Rs. 20.

This bill was discounted on 30th October, 2008.

(vii) The Bank Pass Book shows credit for Rs. 1,000 representing Rs. 400 paid by

debtor directly into the bank and Rs. 600 collected directly by the bank in

respect of interest on investment.

(viii) A cheque of Rs. 1,080 credited in the Pass Book on 28th December, being

dishonoured is debited again in the Pass Book on 1st Jaunuary, 2009. There

was no entry in the Cash Book about the dishonour of the cheque until 15th

January.

(ix) Out of Rs. 20,500 paid in by Mr. X in cash and by cheques on 31st

December, cheques amounting to Rs. 7,500 were collected on 7th January.

(x)

Out of cheques amounting to Rs. 7,800 drawn by him on 27th December, a

cheque for Rs. 2,500 was encashed on 3rd January.

(xi) A bill for Rs. 3,000 (discounted with the bank in November) dishonoured on

31st December, 2008 and noting charges paid by the bank Rs. 100.

=============================================

Rectification of Errors

Q.1. What is a Suspense Account?

Q.2. What is a Rectifying Entry?

Q.3. If a Trial Balance tallies, can it be concluded that there are no errors?

Q.4. Name the errors which do not affect the Trial Balance.

Q.5. Name the errors which affect the Trial Balance.

Q.6. (a)

(i)

(ii)

(iii)

(iv)

(v)

(vi)

Rectify the following errors:Goods for Rs.5,500 were purchased from Modern Traders on credit, but no

entry has yet been passed.

Purchase Return for Rs.1,500 not recorded in the books.

Goods for Rs.2,000 sold to Geeta Traders on credit were entered in the

sales book as Rs.200 only.

Goods of the value of Rs.1,800 returned by Sunil & co. were included in

stock, but no entry was passed in the Books.

Goods purchased for Rs.900, entered in the purchases book as Rs.9,000.

An invoice for goods sold to X was overcast by Rs.100

24

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

(b)

Sol:

Identify the value(s) involved in the above case.

Values shown by the business are:

(i)

Honesty: By rectifying the mistakes business has shown the value of honesty.

(ii)

Respect for Law: By showing true and fair view of the business concern.

Q.7. Give Journal entries to rectify the following errors:(i)

Goods purchased from Ajay for Rs.2,600 were recorded in Sales Book by

mistake.

(ii)

Goods taken by proprietor for Rs.1,000 has not been entered in the books at

all.

(iii) A cheque of Rs.500 received from X was credited to the account of Y &

debited to cash instead of Bank A/c.

(iv) A cheque of Rs. 1,300 received from Ram Lal was dishonoured & debited to

General Expense A/c.

(v)

A cheque of Rs.6,500 received for the loss of stock by fire from Insurance

Company has been deposited in the proprietors Bank A/c.

(vi) A sum of Rs.3,000 drawn by the proprietor for his private travel was debited

to Traveling Expense A/c.

(vii) Credit purchase of Rs.500 from Ajay was posted to the credit of Vijay.

(viii) An amount of Rs.1,600 due from Chandan Lal was written off as Bad debt

in previous year, was unexpectedly received this year, & has been credited

to the A/c of Chandan Lal.

Q.8. In taking out a Trial Balance, An Accountant finds an excess debit of

Rs.1,098.Being desirous of closing his books he places the difference to Suspense

A/c and later on he detects the following errors:(i)

Goods purchased from Surinder for Rs. 350 has been credited to his A/c as

Rs. 530.

(ii) Goods sold to Dinesh for Rs. 800 have been debited to his A/c as Rs. 880

(iii) A cheque of Rs. 1,250 received from a debtor had been correctly entered in

the Cash Book but posted to his personal A/c as Rs. 1,200.

(iv) Rs. 780, paid for freight on Machinery Purchased was debited to Freight A/c

as Rs. 708.

(v)

Goods of the value of Rs. 130 returned by a customer, Navin Kumar had

been posted to the debit of his A/c.

(vi) Rs. 1,440 paid for Repairs to Motor Car were debited to Motor Car A/c as

Rs. 1400.

(vii) Rs. 500 being purchase return were posted to the debit of Purchase A/c.

Give necessary rectifying entries & prepare Suspense A/c.

Financial Statements of Sole Proprietorship

Q.1. What is prepaid expense?

Q.2. What is Outstanding Expense?

25

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.3. What is accrued income?

Q.4. Multiple choice Question:

(i)

Salaries & wages appearing in Trial Balance are shown

(a)

On the debit side of Trading A/c.

(b)

On the debit side of P&L A/c.

(c)

On the liabilities side of Balance sheet

(ii)

Wages & salaries appearing in Trial Balance are shown

(a)

On the debit side of Trading A/c.

(b)

On the debit side of P&L A/c.

(c)

On the liabilities side of the Balance sheet.

(iii)

Apprenticeship Premium received appearing in Trial Balance is shown:

(a)

On the debit side of P&L A/c.

(b)

On the credit side of P&L A/c.

(c)

On the asset side of Balance sheet.

(iv)

Prepaid Insurance appearing in the Trial Balance is shown :

(a)

On the credit side of Trading A/c.

(b)

On the asset side of Balance sheet.

(c)

On the credit side of P&L A/c.

(v)

Goodwill is:

(a)

Current Asset

(b)

Fictitious Asset

(vi)

(c)

(d)

Drawings are deducted from:

(a)

Sales

(c)

Returns outward

Tangible Asset

Intangible Asset

(b)

(d)

Purchases

Capital.

Q.5. State with reasons whether the following items of expenditure are of capital or

revenue nature:

(i)

A second-hand car was purchased for a sum of Rs. 50,000. A sum of Rs.

10,000 was spent on its overhauling.

(ii)

Rs. 2,500 paid for the installation of a new machine.

(iii) Repairs for Rs. 5,000 necessitated by negligence.

(iv) Cost of annual taxes paid and the annual insurance premium paid on the

car mentioned above.

(v)

Cost of airconditioning of the office of the General Manager.

Q.6. Calculate the Gross Profit when Total Purchases during the year are Rs. 8,00,000;

Return Outwards Rs. 20,000; Direct Expenses Rs. 60,000 and 2/3 rd of the goods

are sold for Rs. 6,10,000.

Q.7. From the following information, prepare the Trading Account for the year ended

31st March, 2011:

26

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Amount (in Rs.)

Opening Stock

1,00,000

Wages

Purchases

2,80,000

Freight

Closing Stock

80,000

Carriage Inwards

The percentage of Gross Profit on sales is 20%.

Q.8. Pass Journal Entries for the following:(i)

For recording Closing Stock A/c in Trading A/c.

(ii)

For adjusting purchases for closing Stock.

(iii) For transferring gross profit to Profit and Loss Account.

(iv) For transferring Wages A/c to Trading Account.

(v)

For transferring Sales A/c to Trading Account.

(vi) For transferring Net Profit to Capital A/c.

(vii) For transferring Net Loss to Capital A/c.

(viii) For adjusting Rent A/c for pre-paid rent.

Amount (in Rs.)

2,000

3,600

1,000

Q.9.(a)

From the following Trial Balance extracted from the books of A, prepare

Trading & P&L A/c for the year ending 31st Dec, 2006 & a Balance sheet as on

that date:Trial Balance

Particulars

Furniture

Motor Vehicles

Building

Share in X Ltd.

Capital A/c

Bad debts

Prov. For bad Debts

Debtors & Creditors

Stock on Jan 1,2006

Purchases & sales

Bank Overdraft

Sales return & purchase return

Excise Duty

Interest on Bank overdraft

Commission

Cash in hand

Taxes & Insurance

Charity

Salaries

Dr.

640

4,250

7,500

2,000

Cr.

12,500

125

3,800

3,460

5,475

200

450

118

200

2,500

15,450

2,850

125

375

650

782

1250

3,300

34,000

The following adjustments are to made:

(i)

Stock in trade on 31st Dec, 2006 was Rs. 3,250.

27

34,000

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

(ii)

(iii)

(iv)

(v)

(b)

Sol:

Depreciate Building at 5% & Furniture at 10%. Motor Vehicles @20% p.a.

Salaries Rs. 300 & taxes Rs. 200 are outstanding.

Insurance Premium amounting to Rs. 100 is prepaid.

Write off a further Rs. 100 as Bad debts & provision for doubtful debts is to

be made equal to 5% on Debtors

(vi) Rs 85 is due for interest on Bank overdraft.

(vii) One third of the commission received is in respect of work to be done next

year.

Which values are shown by business?

Values shown by business are:

(i)

Respect for law: By paying Excise duty the business has shown respect for

law.

(ii)

Empathy: By paying charity, the business has shown empathy towards

weaker section of the society.

(iii) Safety: Business has worked towards safety by making some investments

outsides the business i.e., in shares in X Ltd.

Q.10. From the following balances, prepare Final A/c of Mr. Bal Gopal:Particulars

Life

Insurance

Premium(self)

Stock(1-1-2005)

Return Inward

Furniture

Freehold property

Carriage Inwards

Advertising

S. Creditors

Return Outwards

Commission(cr)

Lighting

Loan from Bank

Wages & salaries

Amount

500

Particulars

Capital

P&M

Purchases

S.Debtors

Coal, gas & water

Carriage outwards

Sales

Discount (Dr)

Rent for premises sublet

Trade expenses

Stationery

Interest charged by Bank

Cash

7,500

1,000

4,600

10,000

400

200

4,850

500

600

250

5,000

7,500

Amount

40,000

12,500

36,000

10,500

1,000

100

60,000

400

500

8,650

2,000

450

7,900

Adjustments

(i)

Stock on 31st Dec 2005 was Rs. 10,000 & stationery unused at the end was

Rs. 400.

(ii)

Rent of premises sublet received in advance Rs. 100.

(iii) Provision for doubtful debts is to be created @ 10% on Debtors

(iv) Provision for Discount on Debtors is to be created @ 2%.

(v)

Stock of the value of Rs. 4,000 was destroyed by fire on 25th Dec 2005. A

claim of Rs. 3,000 has been admitted by Insurance Co.

28

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

(vi)

Assignment Booklet

(Class - XI : ACCOUNTS)

Bank Loan has been taken at 12% p.a. interest.

=============================================

Accounting for not-for-profit organisation

Q.1. Give two examples of Not- for -Profit Organisations.

Q.2. What is the purpose of setting up of a Not- for- profit organisation.

Q.3. Give two major sources of income of Not- for-profit organisation.

Q.4. Name the financial statements prepared by Not- for -profit organisations.

Q.5. Not- for- profit organisations do not maintain any capital account, What do they

maintain instead of capital account?

Q.6. A not for- profit organisation prepares Receipts and Payment A/c in spite of the

fact that they maintain cash book, which contains all this information Why?

Q.7. Explain the term deficit.

Q.8. What do you understand by Honorarium?

Q.9. Name the account which shows the classified summary of transactions of a Cash

Book in a not- for -profit organisation.

Q.10. What do Opening and Closing Balances of Receipt and Payment A/c show?

Q.11. What type of Account is the Income & Expenditure A/c?

Q.12. Name the account prepared by Not-For-Profit organisations which records Receipts

and Payments of Current Period only.

Q.13. Explain Fund-based Accounting.

Q.14. Explain the term endowment fund in brief.

Q.15. Name any two items which are shown in the debit side of Receipt and Payment

Account but are not shown in the Income and Expenditure Account.

Q.16. Differentiate between Receipts and Payments Account and Cash Book.

Q.17. Extract of Receipt and Payment A/c for the year ended March 31, 2006 are given

below.

Receipt

Subscriptions

Rs.

2004 2005

2,500

2005 2006

26,750

2006 2007

1,000

30,250

Additional information:Total No. of Members: 230

29

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Annual Membership fee: Rs.125

Subscriptions Outstanding on April 01, 2005: Rs. 2,750

Prepare a Statement showing all relevant items of subscription Viz income,

advance, outstanding etc.

Q.18. (i)

(ii)

Show the following information in financial statement of a Not- for- Profit

Organisation.

Details

Amount(Rs.)

Match expenses

16,000

Match Fund

8,000

Donation for Match fund

5,000

Sale of Match tickets

7,000

What will be the effect, if match expenses go up by Rs.6,000 other things

remaining the same?

Q.19. Prize fund Rs.22,000; Interest on prize fund investment Rs.3,000; Prize given

Rs.5,000; Prize fund Investment 18,000. How would you treat above items in the

case of a not- for-profit organisation?

Q.20. Extract of a Receipt and Payment A/c for the year ended on March 31, 2006

Payments:Stationery Rs. 23,000

Additional Information

Details

Stock of stationery

Creditors for Stationery

April 1, 2005

4,000

9,000

March 31,2006

3,000

2,500

Q.21. What amount of sports material will be posted to Income and Expenditure Account

for the year ended March31,2006 as expenditure?

Rs.

Stock of sports materials as on April 1,2006

7,500

Creditors for sports material as on April 1,2006

2,000

Stock of sport material as on March 31,2007

6,200

Amount paid for sports material during the year 2006-2007 17,000

Advance paid for sports material as an March 31,2007

3,500

Creditors for sports material as on March 31,2007

1,200

Q.22. How would you treat the following items in the case of a Not-For-Profit

Organisation?

(i)

Tournament Fund Rs. 20,000; Tournament Expenses Rs. 6,000; Receipts

from Tournament Rs. 8,000.

(ii)

Billiard Match Expenses Rs. 2,500.

(iii) Prize Fund Rs. 10,000; Interest on Prize Fund Investments Rs. 1,000; Prize

paid Rs. 2,000; Prize Fund Investments Rs. 8,000.

30

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

(iv)

Receipts from Cinema Show Tickets Rs. 5,000; Expenses on Cinema Show

Rs. 1,500.

(v)

Expenditure on construction of Pavilion Rs. 6,00,000. The construction

work is in progress and not yet completed. Pavilion Fund as on 31 st March,

2010 Rs. 8,00,000. Donation for Pavilion received on 15th September,

2010 Rs. 10,00,000; Capital Fund as at 31st March, 2010 Rs. 20,00,000.

How will you deal with the above items while preparing the final accounts of

a social club for the year ended 31st March, 2011?

Q.23. How will you deal with the following case while preparing the final accounts of

National Club for the year ended 31st March, 2010:

RECEIPTS AND PAYMENTS ACCOUNT (AN EXTRACT)

(for the year ended 31st March, 2010)

Dr.

Cr.

Receipts

Amount Payments

Amount

(in Rs.)

(in Rs.)

To Sale of Sports Materials

By Creditors for Sports Materials

30,500

(Book value Rs. 10,000) 13,000 By Cash Purchases of Sports Materials 5,000

Additional Information:-

Sports Materials

Creditors for Sports Materials

As at 1st April, 2009

In Rs.

10,000

3,500

As at 31st March, 2010

In Rs.

12,500

7,500

Q.24. The Treasurer of Royal Tennis Club presented the following Receipts and

Payments Account for the year ended 31st March, 2009:

RECEIPTS AND PAYMENTS ACCOUNT

(for the year ended 31st March, 2009)

Dr.

Cr.

Receipts

Cash at Bank (Opening)

Subscriptions

Court Hire

Amount(

in Rs.)

10,200

24,000

2,700

Payments

Purchases of Balls

Creditors for Refreshments

Marking and Repairing of Tennis Courts

Construction of New Court

Sundry Expenses

Cash at Bank (Closing)

71,100

He also provides the following additional information:

(i)

The Clubs Tennis Courts were valued at Rs. 1,00,00 on 1st April, 2008.

31

Amount(

in Rs.)

4,000

22,000

3,800

25,000

3,100

13,200

71,100

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

(ii)

Particulars

1.4.2008 31.3.2009

(in Rs.)

(in Rs.)

Tennis Ball in hand (At cost)

400

900

Creditors for Refreshments

4,000

3,000

Subscription Outstanding

2,000

3,500

st

Prepare the Income and Expenditure Account for the year ended 31 March, 2009 and

show the Balance Sheet as at that date.

Q.25. From The following Receipts and Payments A/c of sonic club and from the given

additional information prepare Income & Expenditure A/c for the year ending 31st

Dec, 2006 and the Balance sheet as on that date :Receipt & Payment A/c

Dr.

for the year ending 31st Dec, 2006

Cr.

Receipts

To Balance b/d

To Subscriptions

To interest on Investment @

8% P.a.for full year

Rs.

1,90,000

6,60,000

Payments

By Salaries

By Sports equipment

Rs.

3,30,000

4,00,000

40,000

By Balance C/d

1.60,000

8,90,000

8,90,000

Additional Information:(i)

The Club had received Rs. 20,000 for sub in 2005 for 2006

(ii)

Salaries had been paid only for 11 month

(iii) Stock of Sports equipment on 31st Dec,2005 was Rs.3,00,000 and on 31st

Dec,2006 Rs.6,50,000

Q.26.(a)

Following is the Receipts and Payments Account of ABC Club for the year

ending 31st March 2007. The Club was formed for the welfare of Blind children.

Receipts

Balance B/d

Subscriptions

(Including

Rs.100 for 2005-06 and

Rs.150 for 2007-08)

Interest & Investments

Sale of Furniture

(Book Value of Rs.250)

Realisation from charity show

Rs.

615

Payments

Salaries

Stationery

Rs.

3,120

3,550

2,025

300

Meeting expenses

Library Books

Investments

450

1,000

1,000

7,490

Balance c/d

285

1,000

1,635

7,490

Additional Information:(i)

On 1st April, 2006 the club had investments worth Rs.40,000, furniture

Rs.3,000, library books Rs.5,000 and salary outstanding Rs.260.

(ii)

On 31st March ,2007, salary outstanding are Rs.330.

32

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

(b)

Sol:

Assignment Booklet

(Class - XI : ACCOUNTS)

Prepare Income and Expenditure A/c for the year ending 31st March 2007 and the

Balance Sheet on that date.

Identify the value(s) involved in the above case.

Values:

(i)

Responsibility: By forming a not for profit organization for the welfare of

blind children.

(ii)

Doing your Best: By conducting charity shows for the welfare of blind

children.

=============================================

Accounts from Incomplete Records

Q.1. Choose the correct answer:

(i)

Incomplete record mechanism of book, keeping is:

(a) Scientific

(b) Unsystematic

(c) Unscientific

(d) Both (b) and (c)

(ii)

Opening capital is ascertained by preparing:

(a) Total debtors account

(b)

Total creditors account

(c) Cash A/c

(d)

Opening statement of affairs

(iii)

Generally, incomplete records are maintained by a:

(a) Trader

(c) Society

(b)

(d)

Company

Government

(iv)

When closing capital is less than opening capital, it denotes:

(a)Profit

(b)

Loss

(c) Loss if there is no drawing (d)

None

(v)

Credit purchase during the year is ascertained by preparing:

(a) Total creditors account

(b) Cash account

(c) Total debtors account

(d) Opening statement of affairs.

(vi)

When closing capital is greater than opening capital, it denotes:

(a) Profit

(b) Loss

(c) Profit if there is no introduction of fresh capital

(d) No profit

(vii)

If opening capital is Rs 60,000, drawings Rs. 5,000 capital introduced during

the period Rs. 10,000, closing capital Rs. 90,000. The value of profit earned

during the period will be:

(a) Rs. 20,000

(b) Rs. 25,000

(c) Rs. 30,000

(d) Rs. 40,000

Q.2. What practical difficulties are encountered by a trader due to incompleteness of

accounting records?

33

DELHI PUBLIC SCHOOL

Indirapuram, Ghaziabad

Assignment Booklet

(Class - XI : ACCOUNTS)

Q.3. Mrs. Shweta started her readymade garments business on April1, 2004 with a

capital of Rs. 50,000. She did not maintained her books according to double entry

system. During the year she introduced fresh capital of Rs. 15,000. She withdraw

Rs. 10,000 for personal use. On March 31, 2005 her assets and liabilities were as

follows:Total creditors Rs. 90,000; total debtors Rs. 1,25,600; stock Rs. 24,750; cash at

bank Rs. 24,980. Calculate profit or loss made by Mrs. Shweta during the first year

of her business using the statement of affairs method.

Q.4. The following information is obtained from the books of Mohan lal Trader:Debtors on April 01, 2005

50,000

Debtors on March 31, 2006

70,000

Cash received from debtors

60,000

Discount allowed

1,000

Bills receivable

30,000

Bad debts

3,000

Calculate credit sales

Q.5. Mr. Om Prakash did not keep his books of accounts under double entry system.

From the following information available from his records, prepare profit and loss

account for the year ending on March 31, 2005 and a balance sheet as at that

date, depreciating the washing equipment @ 10%.

Dr.

Receipts

To Bal b/d

To cash sales

To Received from debtors

Summary of cash

Amount

8,000

40,000

30,000