Professional Documents

Culture Documents

Managerial Economics-102: Case Study 1: Factors Affecting Demand

Uploaded by

killerbboy67%(3)67% found this document useful (3 votes)

1K views5 pagesThis document discusses factors affecting demand for Marks & Spencer (M&S), a major British retailer. It outlines several weaknesses and threats facing M&S on the demand side, including losing market share in the grocery sector, outdated store layouts, rigid management practices, and declining demand for clothing overall. M&S has struggled to adapt to changes in the retail industry and respond effectively to competitors like Gap and H&M that have passed it by with more modern approaches.

Original Description:

ME

Original Title

Managerial Economics 102

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses factors affecting demand for Marks & Spencer (M&S), a major British retailer. It outlines several weaknesses and threats facing M&S on the demand side, including losing market share in the grocery sector, outdated store layouts, rigid management practices, and declining demand for clothing overall. M&S has struggled to adapt to changes in the retail industry and respond effectively to competitors like Gap and H&M that have passed it by with more modern approaches.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

67%(3)67% found this document useful (3 votes)

1K views5 pagesManagerial Economics-102: Case Study 1: Factors Affecting Demand

Uploaded by

killerbboyThis document discusses factors affecting demand for Marks & Spencer (M&S), a major British retailer. It outlines several weaknesses and threats facing M&S on the demand side, including losing market share in the grocery sector, outdated store layouts, rigid management practices, and declining demand for clothing overall. M&S has struggled to adapt to changes in the retail industry and respond effectively to competitors like Gap and H&M that have passed it by with more modern approaches.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

MANAGERIAL ECONOMICS-102

streamfood chains copied its formula. M&Ss share

of the British grocery market is under 3% and falling,

CASE STUDY 1: FACTORS AFFECTING DEMAND

Does M&S have a future?

The countrys most famous retailer Marks &

Spencers big store in Londons Kensington High

Street has just had a re-fit. Instead of the usual drab

M&S interior, it is now Californian shopping mall

meets modernist chrome and creamy marble floors.

Roomy walkways and designer displays have

replaced dreary row after row of clothes racks. By the

end of the year M&S will have 26 such stores around

Britain the first visible sign that the company is

making a serious effort to pull out of the nose-dive it

has been in for the past two years. Things have

become so bad that M&S, until recently a national

icon, is in danger of becoming a national joke.

.As the attacks grow in intensity, so do the doubts

about M&Ss ability to protect its core value: a

reputation for better quality that justified a slight

price premium at least in basic items.

It is a long time since any self-respecting teenager

went willingly into an M&S store to buy clothes.

Now even parents have learned to say no. Shoppers

in their thirties and forties used to dress like their

parents. Now many of them want to dress like their

kids. M&Ss makeover comes not a moment too

soon. Compared with the jazzy store layouts of rivals

such as Gap or Hennes & Mauritz, M&S shops look

like a hangover from a bygone era. The makeover

aims to bring it into the present.

People tended to join M&S straight from college

and work their way slowly up the ranks. Few senior

appointments were made from outside the

company. This meant that the company rested on its

laurels, harking back to innovations such as

machine-washable pullovers and chilled food.

Worse, M&S missed out on the retailing revolution

that began in the mid-1980s, when the likes of Gap

and Next shook up the industry with attractive

displays and marketing gimmicks. Their supply

chains were overhauled to provide what customers

were actually buying a surprisingly radical idea at

the time.

M&S, by contrast, continued with an outdated

business model. It clung to its Buy British policy

andit based its buying decisions too rigidly on its own

buyers guesses about what ranges of clothes would

sell, rather than reacting quickly to results from the

tills. Meanwhile, its competitors were putting

together global purchasing networks that were not

only more responsive, but were not locked into high

costs linked to the strength of sterling.

In clothing, moreover, M&S faces problems that

cannot be solved simply by improving its fashion

judgments. Research indicates that overall demand

for clothing has at best stabilised and may be set to

decline. This is because changing demographics

mean that an ever-higher share of consumer spending

is being done by the affluent over 45s. They are less

inclined than youngsters to spend a high proportion

of their disposable income on clothes.

The results of M&Ss rigid management approach

were not confined to clothes. The company got an

enormous boost 30 years ago when it spotted a gap

in the food market, and started selling fancy

convenience foods. Its success in this area capitalised

on the fact that, compared with clothes, food

generates high revenues per square metre of floor

space. While food takes up 15% of the floor space in

M&Ss stores it accounts for around 40% of sales.

But the company gradually lost its advantage asmain

compared with around 18% for its biggest

supermarket rival, Tesco.

M&S has been unable to respond to this competitive

challenge. In fact, rather than leading the way, it has

been copying rivals features by introducing in-house

bakeries, delicatessens and meat counters. Food sales

have been sluggish, and operating margins have

fallen as a result of the extra space and staff needed

for these services. Operating profits from food fell

from 247m in 1997 to 137m in 1999, while sales

stayed flat. Perhaps the most egregious example of

the companys insularity was the way it held out for

more than 20 years against the use of credit cards,

launching its own store card instead.

. When, in April this year, M&S eventually bowed to

the inevitable and began accepting credit cards, it

stumbled yet again. It had to give away around 3% of

its revenues from card transactions to the card

companies, but failed to generate a big enough

increase in sales to offset this. Worse, it had to slash

the interest rate on its own card, undermining the

core of its own finance business.

And this at a time when the credit-card business was

already becoming more competitive, with new

entrants offering rates as low as 5%.

If shrunk to its profitable core, M&S may become

an attractive target for another big retailer. At the

moment, however, while its food division may be

attractive to the likes of Tesco, the clothing side

represents a daunting challenge. Why take the risk

now, when the brand may be damaged beyond

repair?

Questions

1 Identify the main factors affecting the demand for

M&S products.

2 Analyse the weaknesses and threats on the

demand side of M&S, relating these to controllable

and uncontrollable factors.

tudy 5.1: Microsoft increasing or diminishing

returns?

accurately, as well as the considerable

investment by the software producer in

developing the package.

CASE STUDY 2 : MICROSOFT

INCREASING OR DIMINISHING RETURNS?

In some industries, securing the adoption of an

industry standard that is favourable to ones own

product is an enormous advantage. It can

involve marketing efforts that grow more

productive the larger the products market share.

Microsofts Windows is an excellent example.

The more customers adopt Windows, the more

applications are introduced by independent

software developers, and the more applications

that are introduced the greater the chance for

further adoptions. With other products the

market can quickly exhibit diminishing returns

to promotional expenditure, as it becomes

saturated. However, with the adoption of new

industry standards, or a new technology,

increasing returns can persist.

Microsoft is therefore willing to spend huge

amounts on promotion and marketing to gain

this advantage and dominate the industry. Many

would claim that this is a restrictive practice,

and that this has justified the recent anti-trust

suit against the company.

There is another side to the situation regarding

returns that should be considered.

Microsoft introduced Office 2000, a program

that includes Word, Excel, PowerPoint and

Access, to general retail customers in December

1999. It represented a considerable advance over

the previous package, Office 97, by allowing

much more interaction with the Internet. It also

allows easier collaborative work for firms using

an intranet. Thus many larger firms have been

willing to buy upgrades and pay the price of

around $230.

However, there is limited scope for users to take

advantage of these improvements. Office 97 was

already so full of features that most customers

could not begin to exhaust its possibilities. It has

been estimated that with Word 97 even

adventurous users were unlikely to use more

than a quarter of all its capabilities. In this

respect Microsoft is a victim of the law of

diminishing returns.Smaller businesses and

home users may not be too impressed with the

further capabilities of Office 2000.

Given the enormous costs of developing

upgrades to the package, the question is where

does Microsoft go from here. It is speculated

that the next version, Office 2003, may

incorporate a speech-recognition program,

making keyboard and mouse redundant. At the

moment such programs require a considerable

investment in time and effort from the user to

train the computer to interpret their commands

2

Questions

1 Is it possible for a firm to experience both

increasing and diminishing returns at the same

time?

2 What other firms, in other industries, might be

in similar situations to Microsoft, and inwhat

respects?

3 What is the nature of the fixed factor that is

causing the law of diminishing returns in

Microsofts case?

4 Are there any ways in which Microsoft can

reduce the undesirable effects of the law of

diminishing returns?

Some towns and cities are well served by health

clubs in both the premium and economy

segments of the market. When there is genuine

market competition, price elasticity of demand

should be higher.

ELASTICITY OF DEMAND - CASE STUDY 3:

HEALTH CLUBS

Elasticity of Demand for Health Clubs

The health club market provides an interesting

case study in using the concepts of price

elasticity of demand and income elasticity of

demand

Price Elasticity of Demand

Income Elasticity of Demand

Income elasticity measures the responsiveness

of demand to a change in consumers' real

income. Although some fitness fanatics may

regard their membership as a necessity (giving a

low but positive value for income elasticity), for

many consumers, an individual or family

membership is often seen as a luxury item in

their annual budget.

Normal luxury products have a highly positive

income elasticity of demand. When the economy

is strong, and incomes and employment are

rising, we expect to see strong growth in market

demand for health and fitness activities. This

encompasses health clubs together with other

activities (including sports-based holidays).

In an economic slowdown, discretionary

spending on health clubs may fall-although in

the short term, thousands of members are

committed to an annual fee.

Price elasticity of demand measures the

responsiveness of demand to a change in the

own price of a good or service. When demand is

inelastic (e.g. demand curve D1 in the diagram

above), consumer demand is relatively

insensitive to changes in price.

Elasticity tends to be low when the product is

viewed by the consumer as a necessity, or when

it takes up a small percentage of total income.

Elasticity is low when there are few close

substitutes and when the consumer has

developed a strong sense of brand loyalty. A

relatively elastic demand curve is shown by D2

in the same diagram.

What of the price elasticity of demand for health

club memberships?

Regular gym users regard their health club visits

as an important feature of their weekly exercise

regime. They are unlikely to cancel a

membership if fees rise from time to time. The

majority of gym members pay their

subscriptions using direct debit. They may take

some time to realise that their monthly charge

has changed. And, for most consumers, having

made the decision to commit themselves to a

membership of between Rs 2500 Rs 5000 per

month, a small rise in fees is unlikely to lead to a

cancelled membership.

4. REQUIREMENTS OF A GOOD FORECAST

A good forecast should satisfy the following criteria:

Time frame: The first factor that can

influence the choice of forecasting is the time frame

of the forecasting situation. Forecasts are generally

for points in time that may be a number of days,

weeks, months, quarters, or years in the future. This

length of time is called the time frame or time

horizon. The length of the time frame is usually

categorized as Immediate, Short term, Medium or

Long term. In general, the length of the time frame

will influence the choice of the forecasting technique.

Typically a longer time frame makes accurate

forecasting more difficult with qualitative forecasting

techniques becoming more useful as the time frame

lengthens.

Pattern of the data: The pattern of the data

must also be considered when choosing a forecasting

model. The components present i.e. trend, cycle,

seasonal or some combination of these will help

determine the forecasting model that will be used.

Thus it is extremely important to identify the existing

data pattern.

Cost/Economy of forecasting: Though the

firm is interested in accurate forecasts, the benefits of

accurate results must be weighed against the cost of

the method. While choosing a forecasting technique,

several costs are relevant. First, the cost of

developing the model must be considered. Second the

cost of storing the necessary data must be considered.

Some forecasting methods require the storage of a

relatively small amount of data, while other methods

require the storage of large amounts of data. Last, the

cost of the actual operation of the forecasting

technique is obviously very important. Some

forecasting methods are operationally simple, while

others are very complex. The degree of complexity

can have a definite influence on the total cost of

forecasting.

Accuracy desired: Accuracy in forecasting is

very important. The previous method must be

checked for want of accuracy by observing that the

predictions made in the past are accurate or not. The

accuracy of past forecasting can be checked against

present performance and of present forecasts against

future performance. In some situations a forecast that

is in error by as much as 20% may be acceptable. In

other situations a forecast that is in error by 1% might

be disastrous. The accuracy that can be obtained

using any particular forecasting method is always an

important consideration.

Availability of data: Immediate availability

of data is an important requirement and the method

employed should be able to produce good results

quickly. The technique which takes much time to

produce useful information is of no use. Historical

data on the variable of interest are used when

quantitative forecasting methods are employed. The

availability of this information is a factor that may

determine the forecasting method to be used. Since

various forecasting methods require different

amounts of historical data, the quantity of data

available is important. Beyond this, the accuracy and

the timeliness of the data that are available must be

examined, since the use of inaccurate or outdated

historical data will obviously yield inaccurate

predictions

Plausibility/Ease of operation and

understanding: The ease with the forecasting method

is operated and understood is important. Management

must be able to understand and have confidence in

the technique used. It has to understand clearly how

the estimate was made. Mathematical and statistical

techniques should be avoided if the management

cannot understand what the forecaster does.

Managers are held responsible for the decisions they

make and if they are to be expected to base their

decisions on predictions, they must be able to

understand the techniques used to obtain these

predictions. A manager simply will not have

confidence in the predictions obtained from a

forecasting technique he or she does not understand,

and if the manager does not have confidence in these

predictions, they will not be used in the decisionmaking process. Thus, the managers understanding of

the forecasting system is of crucial importance.

Durability: The forecast should be durable

and should not be changed frequently. The durability

of the forecasts depends on the simplicity and ease of

comprehension as well as on continuous link between

the past and the present and between present and the

future.

Flexibility: The technique used in

forecasting must be able to accommodate and absorb

frequent changes occurring in the economy.

board of directors that the price of each kit

should be reduced by Rs 4 which will

increase sales by 2000 kits per month and

this requires additional fixed cost of Rs 4000

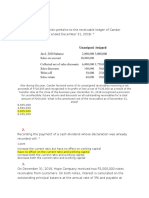

CASE STUDY 5:

BREAK EVEN ANALYSIS

Mentor Plcs Writing Materials

per month.

a) With reference to Mentor plc distinguish

between fixed cost and variable cost.

Mentor

Inc

produces

creative

writing

materials kit for school kids. Each kit

b)

Calculate the following[ Show relevant

workings]:

includes artistic pen sets, drawing pencil sets

i.

contribution per kit

ii.

the monthly output of kits

& fragrant erasers. Kits are sold by retail

shops across India. The kits are sold to

required to break even.

retailers for a premium price of Rs 44. In

iii.

their marketing, Mentor Inc justifies the

iv.

quality of the materials used. The Mentor

of safety at

the monthly level of profit at

present sales level.

brand is highly regarded by their target

c) Construct a break even graph

and

identify the following:

Cost details are:

Production cost Rs 20 per kit.

i.

break even output

Sales representative commission Rs

ii.

margin of safety at present

level of sales

3 per kit.

Transportation

and

iii.

miscellaneous

expenses Rs 1 per kit.

Fixed costs per month Rs 40,000.

The factory capacity is 5000 kits per month

and at present 4000 kits are sold per month.

The marketing manager has proposed to the

margin

present level of sales.

relatively high price by emphasizing the

market of 12 to 18 year old school kids.

the

monthly level of profit at

present sales level

d) Evaluate

the

marketing

managers

proposal to reduce price of each kit by

Rs 4

You might also like

- Burger MachineDocument3 pagesBurger MachineEvan CortesNo ratings yet

- Chapter 24 ConceptDocument4 pagesChapter 24 Conceptanon_406045620No ratings yet

- Imelda CafeteriaDocument6 pagesImelda CafeteriaJazzd Sy Gregorio100% (1)

- ECONOMICSDocument5 pagesECONOMICSSavitha Bhaskaran50% (4)

- Sony Corporation PhilippinesDocument17 pagesSony Corporation PhilippinesManuel BaalNo ratings yet

- Assignment No. 3 (Fishbone Analysis) Deadline: October 29, 2020 (12nn) - No ExtensionDocument2 pagesAssignment No. 3 (Fishbone Analysis) Deadline: October 29, 2020 (12nn) - No ExtensionJaninaNo ratings yet

- ReflectionDocument1 pageReflectionashley100% (1)

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Case Analyasis 4Document3 pagesCase Analyasis 4Marby MacobNo ratings yet

- Performance Management and Strategic PlanningDocument35 pagesPerformance Management and Strategic PlanningMuhammad ZulqarnainNo ratings yet

- The Case of ABSDocument3 pagesThe Case of ABSRizzy Jane PacitoNo ratings yet

- SwotDocument1 pageSwotMichael ArevaloNo ratings yet

- Assignment 1Document4 pagesAssignment 1Bling-Bling CimacioNo ratings yet

- PESTELDocument14 pagesPESTELAmy LlunarNo ratings yet

- Case 4 Super Selectos - Winning The War Against Multinational Retail ChainsDocument7 pagesCase 4 Super Selectos - Winning The War Against Multinational Retail ChainsKris Lara50% (2)

- AUDIT Journal 16Document9 pagesAUDIT Journal 16Daena NicodemusNo ratings yet

- Case study on American Home Products Corporation capital structureDocument2 pagesCase study on American Home Products Corporation capital structureDanny CastilloNo ratings yet

- Short Quiz (3 Items X 5 Points) : Quiz On Global Marketing Date: JAN.22.2021 ScoreDocument1 pageShort Quiz (3 Items X 5 Points) : Quiz On Global Marketing Date: JAN.22.2021 ScoreJean Rose Orlina100% (1)

- Final Term Assignment 2 on Partnership OperationsDocument2 pagesFinal Term Assignment 2 on Partnership OperationsAnne AlagNo ratings yet

- Samson Module 3 VcaDocument6 pagesSamson Module 3 VcaEizzel SamsonNo ratings yet

- Burned-N-Turned - Feeding The Fracking BoomDocument5 pagesBurned-N-Turned - Feeding The Fracking BoomKRISTINA NADINE SOLORIA VELASCONo ratings yet

- TaxDocument11 pagesTaxWilsonNo ratings yet

- Strategic Management Assessment Task 8: Market ResearchDocument4 pagesStrategic Management Assessment Task 8: Market ResearchJes Reel100% (1)

- BA10 Chap 8 P12Document8 pagesBA10 Chap 8 P12Liz CNo ratings yet

- Accounting 2 FinalDocument21 pagesAccounting 2 Finalapi-3731801No ratings yet

- India's largest sports goods manufacturer goes globalDocument4 pagesIndia's largest sports goods manufacturer goes globalAnusha Ramesh33% (3)

- BDO VS METROBANK: A Comparison of the Philippines' Top BanksDocument30 pagesBDO VS METROBANK: A Comparison of the Philippines' Top BanksLara Mae D. Caido100% (1)

- CH-06-Web, Nonstore-Based, and Other Firms of Nontraditional RetailingDocument39 pagesCH-06-Web, Nonstore-Based, and Other Firms of Nontraditional RetailingRama NaveedNo ratings yet

- Home Depot Financial Analysis in 1980sDocument4 pagesHome Depot Financial Analysis in 1980sYubaraj AdhikariNo ratings yet

- Porter Fuve Analysis by Jpmorgan ChaseDocument3 pagesPorter Fuve Analysis by Jpmorgan Chaseekta kriplaniNo ratings yet

- Chap 1 IntlmktDocument46 pagesChap 1 IntlmktAlexis RoxasNo ratings yet

- Chapter 1Document25 pagesChapter 1JeAnne100% (5)

- PepsiCo Operations Management Decision CriteriaDocument3 pagesPepsiCo Operations Management Decision Criteriak100% (1)

- Types of InnovationDocument3 pagesTypes of InnovationEsmyriadeNo ratings yet

- Module 1 Week 2 PE 004 Objectives and History in Basketball Darjay PachecoDocument5 pagesModule 1 Week 2 PE 004 Objectives and History in Basketball Darjay PachecoRocelle MalinaoNo ratings yet

- 4partnership DissolutionEDITED OnlineDocument15 pages4partnership DissolutionEDITED OnlinePaul BandolaNo ratings yet

- The BSP Seal LatestDocument5 pagesThe BSP Seal LatestJess Francis LicayanNo ratings yet

- Smucker's Focus on Ethics and Values Improves BusinessDocument3 pagesSmucker's Focus on Ethics and Values Improves BusinessvalNo ratings yet

- Fin Man - Module 3Document38 pagesFin Man - Module 3Francine PrietoNo ratings yet

- Strategy or Differentiation Strategy Marketing EssayDocument5 pagesStrategy or Differentiation Strategy Marketing EssayHND Assignment HelpNo ratings yet

- To What Extent Has The Pursuit of Wealth Become The Modern GoalDocument1 pageTo What Extent Has The Pursuit of Wealth Become The Modern GoalAshwin Joseph100% (1)

- STC Estate Tax Bank Ofthe WfkdfjsfnajsfhajdfnDocument41 pagesSTC Estate Tax Bank Ofthe WfkdfjsfnajsfhajdfnHartell Alvarez TorresNo ratings yet

- SM MegamallsDocument6 pagesSM Megamallsjona empalNo ratings yet

- Leading Telecommunications Provider in the Philippines - PLDTDocument31 pagesLeading Telecommunications Provider in the Philippines - PLDTAhnJelloNo ratings yet

- Mcdonals Vs Big Mak BurgerDocument60 pagesMcdonals Vs Big Mak BurgerNicole SantosNo ratings yet

- A Business, Such As A Partnership, As To File Its Partnership Agreement and Register Its Firm's Name With These Government Agencies, Except OneDocument1 pageA Business, Such As A Partnership, As To File Its Partnership Agreement and Register Its Firm's Name With These Government Agencies, Except OneJAHNHANNALEI MARTICIONo ratings yet

- PLDT Inc. SWOT Analysis: Distribution, Cost Leadership StrengthsDocument6 pagesPLDT Inc. SWOT Analysis: Distribution, Cost Leadership StrengthsEricca Joyce AndradaNo ratings yet

- Unit 4 Economics Market Structure.Document68 pagesUnit 4 Economics Market Structure.Devyani ChettriNo ratings yet

- Taxation Chapter 7Document13 pagesTaxation Chapter 7thebfilesNo ratings yet

- Short Answer Questions: 12-1 Parking Lot OptimizationDocument3 pagesShort Answer Questions: 12-1 Parking Lot OptimizationShane JesuitasNo ratings yet

- Manila Bulletin Publishing Corporation Sec Form 17a 2018Document128 pagesManila Bulletin Publishing Corporation Sec Form 17a 2018Kathryn SantosNo ratings yet

- Pfizer's Strategic Management Case AnalysisDocument8 pagesPfizer's Strategic Management Case AnalysisRosalie RodelasNo ratings yet

- XAppendixII - Compound Interest and Concept of Present ValueDocument7 pagesXAppendixII - Compound Interest and Concept of Present ValueBoyvic FlaminianoNo ratings yet

- Case 2Document5 pagesCase 2Yuan FuFu100% (1)

- Ba 194 Final Paper On Universal Robina CorpDocument4 pagesBa 194 Final Paper On Universal Robina CorpWakei MadambaNo ratings yet

- Chap 7Document2 pagesChap 7Gracia BalidiongNo ratings yet

- Case Analysis 1 - The Gap - FinalDocument11 pagesCase Analysis 1 - The Gap - FinalJeffrey O'Leary100% (1)

- OmbudsmanDocument1 pageOmbudsmanBOB MARLOWNo ratings yet

- Case Study: Does Marks and Spencer Have A Future?Document5 pagesCase Study: Does Marks and Spencer Have A Future?ellaytNo ratings yet

- Strategic ManagementDocument5 pagesStrategic ManagementCho Su NweNo ratings yet

- Industry Business Type List PDFDocument4 pagesIndustry Business Type List PDFkillerbboyNo ratings yet

- Wardha Dips 12-13Document19 pagesWardha Dips 12-13killerbboyNo ratings yet

- We Acknowledgement The Following Sources:: Ethics in Bussiness and Management - R.P.BanerjeeDocument1 pageWe Acknowledgement The Following Sources:: Ethics in Bussiness and Management - R.P.BanerjeekillerbboyNo ratings yet

- Wardha Dips 12-13Document19 pagesWardha Dips 12-13killerbboyNo ratings yet

- Logistics-Production, Logistics-Marketing and External Integration: Their Impact On PerformanceDocument20 pagesLogistics-Production, Logistics-Marketing and External Integration: Their Impact On PerformancefebriroNo ratings yet

- How The External and Internal Factors Affect To IVCDocument13 pagesHow The External and Internal Factors Affect To IVCUyen TietNo ratings yet

- How The External and Internal Factors Affect To IVCDocument13 pagesHow The External and Internal Factors Affect To IVCUyen TietNo ratings yet

- WTO and Its Role in The International Trade.Document19 pagesWTO and Its Role in The International Trade.Parth V. PurohitNo ratings yet

- Business Environment 201Document1 pageBusiness Environment 201killerbboyNo ratings yet

- Change ManagementDocument12 pagesChange ManagementkillerbboyNo ratings yet

- Business Environment 201Document1 pageBusiness Environment 201killerbboyNo ratings yet

- Fiscal Deficits and Inflation Stabilization in RomaniaDocument32 pagesFiscal Deficits and Inflation Stabilization in RomaniakillerbboyNo ratings yet

- E Hrmguide PDFDocument33 pagesE Hrmguide PDFsonuNo ratings yet

- E Hrmguide PDFDocument33 pagesE Hrmguide PDFsonuNo ratings yet

- Successful Branding: 5 Key Elements and 1 Mantra!Document9 pagesSuccessful Branding: 5 Key Elements and 1 Mantra!killerbboyNo ratings yet

- Conflict ManagementDocument13 pagesConflict ManagementkillerbboyNo ratings yet

- Stress ManagementDocument14 pagesStress ManagementkillerbboyNo ratings yet

- LeadershipDocument27 pagesLeadershipkillerbboyNo ratings yet

- Principles N Practices of Mgnt-101Document7 pagesPrinciples N Practices of Mgnt-101killerbboyNo ratings yet

- Decision Making ProcessesDocument17 pagesDecision Making ProcessesMoses NielsenNo ratings yet

- Mis Case Studies: Systemx Inc. Withdraws Rs. 1 Billion Softguide Acquisition OfferDocument8 pagesMis Case Studies: Systemx Inc. Withdraws Rs. 1 Billion Softguide Acquisition OfferkillerbboyNo ratings yet

- Decision Making - Day2 SlidesDocument16 pagesDecision Making - Day2 SlideskillerbboyNo ratings yet

- Sampling Techniques: An OverviewDocument34 pagesSampling Techniques: An OverviewAYONA P SNo ratings yet

- Measurement, Data Processing & Analysis (Second Test)Document7 pagesMeasurement, Data Processing & Analysis (Second Test)Scott GreenNo ratings yet

- Experiment #1 - Statistical Concepts & Calibration of EquipmentDocument4 pagesExperiment #1 - Statistical Concepts & Calibration of EquipmentChristopher GalindoNo ratings yet

- Conducting Exterior Exposure Tests of Paints On Wood: Standard Practice ForDocument7 pagesConducting Exterior Exposure Tests of Paints On Wood: Standard Practice Formanox007No ratings yet

- Week 3 Lesson on Parts of Speech and SubjectsDocument19 pagesWeek 3 Lesson on Parts of Speech and Subjectstimperez42No ratings yet

- Evaluation of Instrumental Color Difference With A Gray ScaleDocument5 pagesEvaluation of Instrumental Color Difference With A Gray ScaleFernando Da RosNo ratings yet

- Attributes of Information: ExamplesDocument12 pagesAttributes of Information: ExamplesTariku KolchaNo ratings yet

- FTIR Meat Science-BaksoDocument5 pagesFTIR Meat Science-BaksoShenina KnightleyNo ratings yet

- Cristians AlgorithmDocument13 pagesCristians AlgorithmJoao BorgesNo ratings yet

- Durascale ManualDocument9 pagesDurascale ManualDonald ClarkNo ratings yet

- Daily Dose of Data Science - ArchiveDocument354 pagesDaily Dose of Data Science - ArchiverodrigofmarquesNo ratings yet

- Intro RobDocument16 pagesIntro RobGanesh Babu100% (1)

- J Accpreerr SB AnsDocument2 pagesJ Accpreerr SB Ansapi-237740413No ratings yet

- Project 6 - Thera BankDocument13 pagesProject 6 - Thera BankFrancisco GuízarNo ratings yet

- Uncertainties and Error PropagationDocument28 pagesUncertainties and Error PropagationruukiNo ratings yet

- A Review On Credit Card Fraud Detection Using Machine LearningDocument5 pagesA Review On Credit Card Fraud Detection Using Machine LearningLuckysingh NegiNo ratings yet

- Automatic License Plate RecognitionDocument6 pagesAutomatic License Plate RecognitionkavithekiranNo ratings yet

- Spell Correction Static TranslationDocument10 pagesSpell Correction Static Translationchinni charanNo ratings yet

- C 271 - 99 Qzi3mqDocument2 pagesC 271 - 99 Qzi3mqAndre AlvesNo ratings yet

- Measurement of MicrostructureDocument9 pagesMeasurement of MicrostructurebetelgueseNo ratings yet

- Eva EmpDocument18 pagesEva Emphata669No ratings yet

- Module 1 1Document18 pagesModule 1 1Maria Rijan Neena OlivaNo ratings yet

- Examination For Physics 1Document6 pagesExamination For Physics 1Mark SantosNo ratings yet

- Experiment 5 Lab Report: Title ObjectiveDocument6 pagesExperiment 5 Lab Report: Title ObjectiveSheikh BajunaidNo ratings yet

- Radioimmunoassay (2002b)Document48 pagesRadioimmunoassay (2002b)api-19916399No ratings yet

- Basic TPM Workshop (Rev1)Document138 pagesBasic TPM Workshop (Rev1)Ahmad FirdausNo ratings yet

- Error Correction - ChandlerDocument30 pagesError Correction - Chandleroxford33No ratings yet

- Tech Testing MFADPSDE With Omicron 1MRS758886 ENaDocument30 pagesTech Testing MFADPSDE With Omicron 1MRS758886 ENaFredrikNo ratings yet

- Personality CategoriesDocument11 pagesPersonality Categoriesmmsaci100% (1)

- Universiti Teknologi Mara: Analytical Chemistry TEST2 / MAY 2020/CHM421Document2 pagesUniversiti Teknologi Mara: Analytical Chemistry TEST2 / MAY 2020/CHM421Erna HamidNo ratings yet

- Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) (The Surrounded by Idiots Series) by Thomas Erikson: Key Takeaways, Summary & AnalysisFrom EverandSurrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) (The Surrounded by Idiots Series) by Thomas Erikson: Key Takeaways, Summary & AnalysisRating: 4.5 out of 5 stars4.5/5 (2)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoFrom Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoRating: 5 out of 5 stars5/5 (21)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffFrom Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffRating: 5 out of 5 stars5/5 (12)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverFrom EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverRating: 4.5 out of 5 stars4.5/5 (186)

- The First Minute: How to start conversations that get resultsFrom EverandThe First Minute: How to start conversations that get resultsRating: 4.5 out of 5 stars4.5/5 (55)

- Think Faster, Talk Smarter: How to Speak Successfully When You're Put on the SpotFrom EverandThink Faster, Talk Smarter: How to Speak Successfully When You're Put on the SpotRating: 5 out of 5 stars5/5 (1)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Get to the Point!: Sharpen Your Message and Make Your Words MatterFrom EverandGet to the Point!: Sharpen Your Message and Make Your Words MatterRating: 4.5 out of 5 stars4.5/5 (280)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterFrom EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterRating: 5 out of 5 stars5/5 (1)

- Nonviolent Communication by Marshall B. Rosenberg - Book Summary: A Language of LifeFrom EverandNonviolent Communication by Marshall B. Rosenberg - Book Summary: A Language of LifeRating: 4.5 out of 5 stars4.5/5 (49)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobFrom EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobRating: 4.5 out of 5 stars4.5/5 (36)