Professional Documents

Culture Documents

Principles of Project Finance

Uploaded by

Edgar Diaz NietoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principles of Project Finance

Uploaded by

Edgar Diaz NietoCopyright:

Available Formats

http://www.gowerpublishing.

com/isbn/9781409439820

The Principles of

Project Finance

Edited by

ROD Morrison

Morrison.indb 3

28/03/2012 11:19

chapter

2 Dos and Donts for

Successful Projects

Anne Baldock

Partner, Allen & Overy

There are many ways to define a successful project but no matter how hard we try, we

cannot get away from the fact that most people, when they speak of a project being

a good project rather than a bad one, are referring to a project that has been built on

time, to budget, had no teething troubles (either technically or revenue generation wise)

during its early years of operation and continues to roll on into the sunset with little

or no intervention from any party other than the operator and the ultimate customer/

purchaser of services. No matter that a project may have operated smoothly for the last

10 years and resulted in higher than expected returns for investors if, during those

crucial construction and commencement of operations months or years it has faltered in

any manner then it will never, repeat never, get to bear the proud badge of a successful

project.

What then can one take from this definition of a successful project that will assist

in bringing only good projects to fruition? Well, maybe one lesson is that not all projects

that falter in the early years are forever doomed to be problematic and loss making, but

surely, the lesson that seems to be screaming at us the loudest is that there is no substitute

in a projects context for good planning, common sense and a sensible, balanced and

healthy aversion to excessive risk. Yes, maybe the true lesson to be learned is the one that

has recently been taught so resoundingly to the banking community as a whole, namely,

there is no such thing as a free lunch.

Too often, even today, investors (both public and private) come to the project finance

market with the aspiration of financing their dream project with, as they see it, large

amounts of (other peoples) funding, whilst spreading the unpalatable risks associated

with their venture to others. Any investor coming to the table with this mindset must,

and will, be disabused of their notions fairly swiftly but the lingering dregs of this mindset

can and will make negotiating any project finance deal tortuous and lengthy and will

certainly not assist in attempting to keep the project to a set timetable!

My advice to those that hold the above view of project financing as a tool is do not

even attempt to undertake your venture using project financing. Most assets that are to

be project financed will be long term assets. Their viability will only become apparent

over the long term. Equity investors in projects should not believe that they are going to

get rich quickly. What they are undertaking is a long term investment that will bear fruit

and reap rewards over the medium to long term.

Morrison.indb 15

28/03/2012 11:19

16

The Principles of Project Finance

Bank investors in project finance transactions are, on the other hand, not likely to

ever get rich albeit they will make a comfortable living! They are making a much smaller

return over a much shorter period. They will seek to protect that small return by every

means they can possibly think of and then some this is not unreasonable (or perhaps

in some cases it is) but it is just a fact of project finance life. If a sponsor truly has faith

in his project he should be looking to protect his investment and to retain his project,

not to nickel and dime the lenders out of the protection they feel is necessary to protect

their return. If a healthy respect for the differences in approach between equity and debt

can be maintained at all times then many of the often tortuous negotiations can often

be short circuited.

A reasonable stance at the negotiating table not only assists in keeping projects to

time but also helps to forge a relationship with others around the table. A relationship

that will continue for a long time and which will be invaluable if rocky times ensue. It is

worth spending the time, up front, analysing your project, stress testing it and looking

hard at all the little shocks that will come at it throughout its life (certainly its early

life). To the extent that you are able to do this wearing multiple stakeholder hats and

anticipating each particular stakeholders requirements, then so much the better. You

should then be prepared to share that knowledge (good and bad) with others and to seek

a sensible way through the mire that is a Greenfield Project. Remember, if you wont take

a particular risk then the chances are, nobody else will. However, if you havent even

thought about a particular risk and that risk is brought to the table by others, then its a

dead cert that nobody else will take it. In order to argue convincingly that others should

share a risk then you have to be able, hand on heart, to say that you would be prepared

to take that risk yourself.

What then can each of the parties to a project financing transaction do to put

themselves in the space that is most likely to lead to a successful project? I set out below

some of my thoughts (as an observer and legal putter together of projects for over 20

years. I am sure that there are a number of other issues that I will have forgotten, I am

sure that there will be many reading this who will say no, shes wrong, we can be much

tougher than that and get away with it. I am sure that there are circumstances where

they will be right. However, what I offer here are some observations as an interested but

non-partisan bystander who generally stands-by right in the middle of the structuring

and negotiating action.

The Public Sector

My first set of observations/advice is made in respect of the public sector. I start here

mainly because many of those entering into project finance transactions from the public

sector side are doing so for the first time. They feel uncomfortable in their PF shoes.

They feel like the new boy starting in the fifth form of a rough comprehensive school

with a whole posse of sixth form private sector bullies who know exactly where all the

classrooms are and what the protocol for the school day is. Often, the project director is

only undertaking the project using PF techniques because it is currently the politically

chosen manner of doing things, a manner which may well change overnight, and he

has nothing to gain by making decisions that are not strictly within the brief he has

Morrison.indb 16

28/03/2012 11:19

Dos and Donts for Successful Projects

17

been handed. What then can public authorities do to try to assist in ensuring that they

procure, let and manage successful projects?

Number 1, Rule of law

The absolute number one requirement for successful projects is that they are undertaken

in a stable and sustainable environment where the contracts and the relevant governing

laws do what they say on the tin.

In this regard, it is not just the contractual framework that is important. Clearly, the

rights and obligations of the parties should be set out unambiguously and it is important

that difficult nettles are grasped at the outset and not fudged in an effort to reach some

false deadline for signing of documentation. However, the best contracts in the world

are worth nothing unless those rights are supported by robust, stable and equitable laws

which are enforced in a consistent and non-partisan manner by the relevant courts.

Better one contract where the project sponsors earn a little too much than to send

shockwaves through the entire market or stifle much-needed investment in a sector

by retrospectively amending contracts or imposing later tax regimes or regulatory

frameworks to try to counter such over-payment. Any ad-hoc attempts to adjust the

rights of the parties can lead to severe market unrest and a loss of confidence by other

project providers. If authorities are nervous of the private sector beginning to earn superprofits then far better to deal with this issue up-front by setting a limit on the amount

capable of being earned, taking an equity stake in the venture to share in the up-side or

inserting a re-balancing clause of the type enshrined in statute in Spain than to try to

fix the issue ex-post-facto.

At a time when one of the most precious resources globally is financial investment,

the need to retain the confidence of potential investors and the need to make the doing

of business in ones home country simple and straightforward is paramount. Outrage

in the Australian mining sector where additional taxation is being imposed by central

government is being mirrored by oil and gas exploration companies operating in the

North Sea. Such spats of anger should be listened to. At a time when the economic position

of so many countries is making it harder and harder to decide to invest, governments

(including those in established western democracies) will need to think long and hard

and take steps to ensure that the market view of stability and rule of law are maintained.

Number 2, Good advice

Get Good Advice, not just from those firms that specialise in giving advice to public

authorities or understand fully the finances and legal constraints placed upon public

bodies but from firms (financial, legal and technical) that are expert in the wider projects

and financial markets. These people are able to advise not just on what the outcome of the

current project or a particular action may be on the project in hand but can take a wider

view and advise on the consequences for other projects or the public bodys business

more generally. They can also act as minders to the public sector, having knowledge

of how similar projects have been undertaken elsewhere and whether the stance being

taken by one of the protagonists on this particular project is a stance that is generally held

in the market and/or what steps have been taken to mitigate or get around such a stance

or any particular risk in other situations.

Morrison.indb 17

28/03/2012 11:19

18

The Principles of Project Finance

In this respect, taking soundings from the market and interacting with potentially

interested bidders, financiers and financial investors ahead of time is a useful tip. The

UK Government learned this in a rather painful manner when their original attempt to

procure bids for the design, build, maintenance and financing of prisons within the UK as

private prisons financed through the PFI programme had to be withdrawn when funders

refused point blank to accept the risk of occupancy levels being used as the marker for

setting payment regimes. One cannot help but feel that this reluctance should hardly have

been a surprise to government. The banking market was grappling with new concepts

(PFI) in a new sector (prisons) where prison occupancy and prison sentencing policy

is clearly dictated and controlled by the government payer. Credit to the government

that these projects were eventually successfully resurrected and completed as availability

payment projects which went on to form the basis for all of the early PFI accommodation

projects undertaken by the UK government and to form the bedrock of the hugely

successful programme of PFI/PPP projects undertaken by the UK. A pity perhaps that the

lessons learned have not been highlighted to others in an effort to avoid repeats in other

countries.

Further examples of the advice received by government perhaps being a little too

public sector focussed are the UK NHS Lift Projects. The scheme (which took some 1824

months in gestation) was intended to ensure that a single procurement would suffice

to select the service provider that would be responsible for multiple projects to provide

local health care, doctors surgeries, dispensaries, clinics, etc to a particular local area. The

procurement strategy was faultless. However, the government had failed to anticipate the

manner in which multiple projects by the same consortium would effectively be financed

and the original structure required major surgery during procurement of the first projects

to ensure that the required pipeline could be met.

Number 3, Listen

Listen to your advisers and be prepared for push back prepare in advance for meetings

and manage your internal client as well as the external project provider.

Much of the time spent by public authorities in negotiating contracts with the private

sector arises as a result of an unwillingness to even try to understand the hopes and

aspirations of the private sector ahead of large-scale set piece all-party meetings. All too

often, the response of the public sector to comments and suggestions made by the private

sector are dismissed without any real consideration and, as a result, when explanations

are given as to why any such suggestion has been made, time is lost whilst such new

concepts have to be run up the chain of command internally after lengthy meetings

have already taken place. If public bodies approach the issues raised by the private sector

more empathetically rather than assuming that every change requested is an effort to do

down or get one over on the authority then far more constructive dialogues may be

undertaken at meetings and internal approvals can be sought ahead of time. Knowledge

of the authoritys wider stance on any particular issues gleaned during these pre-meeting

discussions can also, then, be used to good effect during negotiating meetings rather than

slowing down the process outside.

Good advisers will be able to understand much of what is being asked for and should

be listened to when reviewing commentaries/approaches being adopted. Indeed, to

dispatch ones advisers to request clarification of issues ahead of full party meetings and to

Morrison.indb 18

28/03/2012 11:19

Dos and Donts for Successful Projects

19

ask the question, why? can save much time and heartache during the key procurement

phase of any project.

This open approach will also assist in trying to decipher commentaries made by

competing bidders for the same project who choose to adopt a different negotiating style

to requests for responses to information. Many is the time when an authority has selected

the bidder who adopts the stance of everything is broadly acceptable provided we can

discuss a couple of issues with you after we are appointed only to discover further down

the line that those discussions are around exactly the same 105 issues which were the

requested amendments or points in respect of the information raised by other (perhaps

more straightforward) bidders. An understanding and open approach will assist in teasing

out the required information early on, as will the setting of clear parameters around the

type of answers and level of detail required by way of response.

By the same token, public authorities who have a set way of doing their transactions

and who are not prepared to adapt them should not run a process where they state that

they are going to be flexible and take account of bidder requirements where they are not.

Instances of this approach have been rife in the transport sector in the UK and elsewhere

and serve only to frustrate bidders who spend millions of pounds in bidding in earnest

and sharing their concerns, only to have them completely ignored when final bids are

requested.

Number 4, Train up

Finally, the advice that I would give to public authorities embarking on project finance or

PPP programmes for the first time is train your people.

In this context, I am not speaking of the project manager during procurement but

rather the people who will have to manage the living, breathing project through to

completion and beyond.

There is always much talk around the fact that good Project Managers in the public

sector just get to the position where they are comfortable in their shoes when they then

get moved on to other departments or promoted to other jobs and the knowledge of

how to get a project completed is lost to the public authority. Whilst it is true that this is

frustrating, this lack of expertise merely delays the project at the early stages whilst new

people get up to speed or makes the process of procuring a project a longer and more

tedious process than it perhaps should be. However, such difficulties pale to insignificance

in comparison to the differences over the life of a project between a successfully managed

and operated project and a dysfunctional one. The issue of lack of expertise at the outset

can easily be managed by, if necessary, hiring competent project manager consultants

whilst the mismanagement of a live project will have a far wider reaching effect than the

one-off procurement.

The training that public sector employees require for successful project management

is training as to the manner in which they should look to enforce the letter of the contract

and the options that might be available to them within the framework of the project

portfolio of the relevant public authority more widely. What matters is that the manager

seeks to obtain best performance from the project provider over the lifetime of the project

rather than just squeezing the contractual provisions available to them until the pips

squeak.

Morrison.indb 19

28/03/2012 11:19

20

The Principles of Project Finance

An operating contractor who is shown some give and take rather than being stung

with maximum penalties for minimum misdemeanours each time they occur will, in the

long run, provide better value. Whilst the penalty regimes and contractual rights set out

between the parties within the hard-fought contractual arrangements have their place

in a well-run project, they should not be taken as holy writ, but should be exercised and

enforced with discretion and sympathy and an eye on value rather than cost.

It should perhaps be remembered that all legally binding contracts ultimately give the

parties a right to sue for breach. Of course, in only a very few cases do the protagonists end

up suing their case in court. Compromises and settlements are by far the more prevalent

outcome. The settlement of an issue that is not fundamental to the performance of the

contract and that that suits both parties even if not catered for by the strict letter of

the contract is surely far more use to an ongoing project than a small (and often smallminded) victory on each minor point. Many is the time that a small missed target on dayto-day maintenance, answered help desk call-outs, etc have been utilised not to deduct

penalty points or deduct payments but to perhaps obtain a fresh lick of paint on tired

woodwork at the same time as maintenance is being carried out nearby or to repair or

redirect a sewer on another project run by the same service provider.

PPP and other project contracts should be viewed as contracts that drive performance

and drive value out of the services provided. They should not be seen as a revenue

generation scheme by the relevant receiving authority.

Joint Venturers and Consortia

Number 1, Know your partners

Unsurprisingly, the best operating consortia are those comprising groups of persons

coming together in a situation where respect, co-operation and understanding of the

needs of the other members is high and the bargaining position of the relevant parties is

equal. Unsurprising, also, is the fact that the stars are very rarely aligned in this manner.

In order to put together a bid, or any project for that matter, in a cohesive and coordinated fashion, it is important that the JV partners inequalities and expectations are

discussed and agreed well ahead of time. Any attempt to hide or fudge the issue will,

inevitably, show up at a later date, in a far more public forum and will potentially discredit

a bid and undermine the confidence of the letting party/financiers to that project.

Issues to be resolved in advance include:

joint and several or several liability;

tax positions of the parties and tax structuring issues;

creditworthiness issues and manner of dealing (upfront equity/bank LCs, etc.);

desire of the parties to finance on or off balance sheet; and

negotiation of/voting on contracts with associated third parties (e.g. construction/

O&M arrangements which are typically sourced out by the associates of the JV

members).

A failure to address such issues and an unwillingness to grasp the nettle but to leave

it to others (e.g. financiers/the public authority/their advisers or worst of all your co-

Morrison.indb 20

28/03/2012 11:19

Dos and Donts for Successful Projects

21

venturers) to point up the weaknesses in a JV or contracting structure generally leads

to protracted and unhappy negotiations and sets a project off on a wrong foot with a

mountain of trust and honesty to climb never a good beginning.

Number 2, Know your financiers

Recognize early in the process that the lenders will have specific needs think ahead

and do the preparation work for a project with a clear understanding of those needs to

prevent the need to repeat simple exercises two or three times.

For example, each funder will need to undertake KYC procedures when setting

up the new company, ensure that relevant documents are placed on a web portal that

each can access so that the exercise is only undertaken once by the company. If your

project is looking to utilize funds from international development banks then ensure

that environmental surveys and monitoring procedures that you set up are set up at the

outset in a manner that will mean that they comply with the World-Bank requirements.

A lesser standard will be a false economy in terms of cost and time at the end of the day.

Recognise that if equity is to be injected into the project pro rata with commercial

lenders then credit rating of the equity provider will be a key factor. If a bank LC is

required, start working on obtaining this early on in the project development. Do not

wait until two days prior to financial close when you have finally read the CP schedule to

the borrowing and discovered that you need to negotiate specific forms of LC to comply

with lender requirements or will have to seek unnecessary and complicated waivers for

non-compliant (in terms of strict wording) LCs.

Set up accounting systems and reporting systems on day one in a manner that should

satisfy the lenders and then take the time to read the information sections of the credit

documentation carefully. Far too often those negotiating credit documentation spend

their time arguing over materiality qualifications for covenants and events of default

and skim over the reporting requirements, many of which can be exceedingly onerous

on-going requirements for a project company to fulfil with limited personnel available to

them, and at the same time as trying to manage a construction programme or operational

facility. Remember, the reporting requirements are an on-going cost to the business.

Rarely should lenders need anything which the sponsors do not (or will not) find useful.

If large amounts of excess information and reports are being requested, a frank and open

dialogue should be had to ensure that the banks standard form has not overtaken

common sense on the project.

Number 3, Make the tough decisions early

Tempting though it may be if contracting parties are associated companies, dont try to

make the construction or operating contracts too onerous on the project company. A

construction contract or operating contract that has not been properly negotiated and

prepared (as if between two truly third parties) will not pass muster with financiers who

will seek to renegotiate a clearly one-sided contract often resulting in a far tougher

contract than might otherwise have sufficed.

The washing of a sponsor groups dirty washing in public is never an edifying

experience and again leads to wariness throughout the project which is not conducive to

long-term successful projects.

Morrison.indb 21

28/03/2012 11:19

22

The Principles of Project Finance

Although each project is individual to the needs of the parties and the associated

geographies/market needs, there is a clear risk allocation in projects within each relevant

sector which is broadly accepted within that sector. Sometimes, the differences between

sectors have no logical reason to exist beyond market precedent. However, it is important

that parties know what the generally accepted allocation is and highlight to other

participants in the project where the risk allocation in this particular case differs from

that norm. If this is done, together with a clear explanation as to why such an approach

has been adopted then such a stance will be far more likely to gain acceptance and

speedy resolution than where such issues have been negotiated behind closed doors and

presented to others as a fait accompli.

Sponsors should also clarify up-front the type and amount of completion support is

required. Too often, this all important element is fudged at heads of terms and term sheet

stages only to become the make or break point at the eleventh hour of negotiation when

all parties have expended too much time and effort into the process to be capable of either

backing out or backing down. Issues such as amount, principal or interest only, default

payment versus on-going payments, required completion tests (timing, parameters,

etc.) should be worked out in detail up-front in order to prevent major hiccoughs at a

later stage. I have just recently been working on a project that has been shelved after 18

months of work as a result of a fundamental misunderstanding of the nature and amount

of completions support being offered.

Number 4, Think about the future

When entering into a long-term financed position, parties should always have one eye on

the future and on how the project itself and also the project economics can be improved.

In this regard, thought should be given to whether or not a differential margin

should be required pre- and post- operations and/or whether the credit facility is easily refinanceable once the riskier (and therefore inherently more expensive) part of the project

has passed.

In this regard, the hedging arrangements put in on place day one will potentially

have a large impact on the economics of a refinancing case and the ability to negotiate

flexible hedging arrangements with embedded break provisions may (although initially

more expensive to procure) prove to be a better long-term economic investment.

This is an issue not just for the private sector sponsors of a project. The UK

government has often lamented the fact in public that its PPP sector has not evolved

into a conglomeration of companies holding many and various PPP assets and taking a

corporate holistic view across its portfolio, but has rather retained the structure of many

small single-purpose project vehicles undertaking their own small projects.

This seems an odd lament indeed when the documentation which has been fought

over and defended to the hilt, often against all rational instincts of those actually carrying

out the projects, provides such barriers to any other structure ever being adopted. The

requirement for 100 per cent interest rate hedging, the requirement for all re-financings

and change-of-control arrangements to obtain prior approval, the need for major

contractor changes to be approved, etc. all seem to lead inexorably to fossilization of

the project and an inability, or at least a major disincentive, for the private sector to drive

further values and structures out of the projects what a pity that such innovation and

creativity have been stifled at the altar of standardization.

Morrison.indb 22

28/03/2012 11:19

Dos and Donts for Successful Projects

23

All Parties

Dont say no, ask Why?

Too many parties to a transaction will argue for a position in negotiations because that

is the way the original document presented to the parties was drafted. Such documents

have often been drafted with no thought or only limited understanding as to the current

project needs and with the desire to protect a particular position in a particular manner.

What must be remembered is that the manner in which a particular issue is dealt with in

any document is almost certainly not the only way in which a particular position can be

protected or a particular outcome achieved.

There are, of course, times when a tough stance in documentation will need to be

taken and maintained. We have all at some stage banged our heads against the stone wall

that is the development banks standard form or ingrained policy. However, in the main,

a rigid position is not required and a partys desired aims and goals can often be achieved

in a manner which is far more palatable to the other side and which, in the context of

a long-term partnership arrangement, is probably far better suited to the task in hand.

Taking the time to understand why provisions have been presented in a certain

manner will usually assist parties to take their eyes off the page of negotiations and

concentrate on the consequences of their actions and the desired outcomes for the parties

and the project.

Conclusion

It is always difficult to predict at the outset which projects will be successful or even

what success will look like. To give a famous example, work on the Clifton Suspension

Bridge (one of Brunels best known civil engineering projects in the UK) was started in

1831, but then suspended due to riots which drove away investors, leaving no money for

the project, and construction ceased. Work recommenced in 1862 (after a concerted fundraising effort by colleagues of the, by then late Brunel, and admirers at the Institution

of Civil Engineers who felt it would be a fitting memorial. The project was completed in

1864, five years after Brunels death and 34 years after its commencement. The Clifton

Suspension Bridge still stands today, and over 4m vehicles traverse it every year. Who is

to say that this was not a successful project?

But by most peoples reckoning a successful project still remains a project that is

built in the time anticipated, that is completed at the cost which was anticipated, that

operates smoothly to provide services to the end-user at an affordable price and which

provides a sufficient return for the contractor, operator, supplier, sponsor and other

project stakeholders. One can only hope that some of the words written above will assist

those desiring to undertake successful projects to ensure that this highly improbable and

illusive confluence of events occurs.

Morrison.indb 23

28/03/2012 11:19

You might also like

- Coporate FinanceDocument6 pagesCoporate Financeplayjake18No ratings yet

- Mergers Complete Mini CourseDocument7 pagesMergers Complete Mini CoursensalemNo ratings yet

- Project FinancingDocument28 pagesProject Financingprateekratm1No ratings yet

- Pgcworking Capital Assessment PDFDocument39 pagesPgcworking Capital Assessment PDFChandani DesaiNo ratings yet

- Money and Banking Solve Mcq'sDocument15 pagesMoney and Banking Solve Mcq'sSoham ChatterjeeNo ratings yet

- Investment Banking Chapter 1Document27 pagesInvestment Banking Chapter 1ravindergudikandulaNo ratings yet

- Consumer FinanceDocument15 pagesConsumer FinanceforamnshahNo ratings yet

- Turnaround Management: Unlocking and Preserving Value in Distressed BusinessesFrom EverandTurnaround Management: Unlocking and Preserving Value in Distressed BusinessesNo ratings yet

- Foreign Exchange Business PlanDocument8 pagesForeign Exchange Business PlanbillrocksNo ratings yet

- ITT - Group Assignment - 3DDocument5 pagesITT - Group Assignment - 3DRitvik DineshNo ratings yet

- Corporate Finance NPV and IRR SolutionsDocument3 pagesCorporate Finance NPV and IRR SolutionsMark HarveyNo ratings yet

- A Brief History of Mutual FundsDocument2 pagesA Brief History of Mutual FundsPartha SarathiNo ratings yet

- Lecture1 IbDocument10 pagesLecture1 IbJack JacintoNo ratings yet

- Basel I II and IIIDocument52 pagesBasel I II and IIIAPPIAH DENNIS OFORINo ratings yet

- Summary of Louis C. Gerken & Wesley A. Whittaker's The Little Book of Venture Capital InvestingFrom EverandSummary of Louis C. Gerken & Wesley A. Whittaker's The Little Book of Venture Capital InvestingNo ratings yet

- Challenges in Murabahah Financin1Document7 pagesChallenges in Murabahah Financin1Ayu Syahirah IzzahNo ratings yet

- Due Diligence: An Impertinent Inquiry into MicrofinanceFrom EverandDue Diligence: An Impertinent Inquiry into MicrofinanceRating: 4 out of 5 stars4/5 (1)

- Brigade Metropolis Investment MemoDocument20 pagesBrigade Metropolis Investment Memoicasanova23No ratings yet

- Loan SyndicationDocument7 pagesLoan SyndicationYasir ArafatNo ratings yet

- Mining Capital: Methods, Best-Practices and Case Studies for Financing Mining ProjectsFrom EverandMining Capital: Methods, Best-Practices and Case Studies for Financing Mining ProjectsNo ratings yet

- The Failure of Wall Street: How and Why Wall Street Fails -- And What Can Be Done About ItFrom EverandThe Failure of Wall Street: How and Why Wall Street Fails -- And What Can Be Done About ItNo ratings yet

- Euro BondsDocument21 pagesEuro BondsKhan ZiaNo ratings yet

- Customer Profitability Analysis and Loan PricingDocument36 pagesCustomer Profitability Analysis and Loan PricingFahim RahmanNo ratings yet

- Share CapitalDocument21 pagesShare CapitalMehal Ur RahmanNo ratings yet

- Derivatives The Tools That Changed FinanceDocument202 pagesDerivatives The Tools That Changed FinanceShakeeb Ashai100% (1)

- Treasury Management AssignmentDocument4 pagesTreasury Management AssignmentJed Bentillo100% (1)

- BANKING INDUSTRY-Fundamental AnalysisDocument19 pagesBANKING INDUSTRY-Fundamental AnalysisGopi Krishnan.nNo ratings yet

- Foreign Exchange Operations: Master Trading Agreements, Settlement, and CollateralFrom EverandForeign Exchange Operations: Master Trading Agreements, Settlement, and CollateralNo ratings yet

- Financial management toolkit for MFIsDocument45 pagesFinancial management toolkit for MFIsAndreea Cismaru100% (3)

- Structured Financial Product A Complete Guide - 2020 EditionFrom EverandStructured Financial Product A Complete Guide - 2020 EditionNo ratings yet

- International DiversificationDocument43 pagesInternational Diversificationapi-3718600No ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingCharu ModiNo ratings yet

- Types of Loans: Executive SummaryDocument3 pagesTypes of Loans: Executive SummarynishthaNo ratings yet

- It Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesDocument24 pagesIt Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesAnonymous KN4pnOHmNo ratings yet

- Process and Asset Valuation A Complete Guide - 2019 EditionFrom EverandProcess and Asset Valuation A Complete Guide - 2019 EditionNo ratings yet

- SRZ PIF 2018 Permanent Capital Investment Vehicles PDFDocument19 pagesSRZ PIF 2018 Permanent Capital Investment Vehicles PDFRegis e Fabiela Vargas e AndrighiNo ratings yet

- Credit Policy GuidelinesDocument46 pagesCredit Policy GuidelinesRabi Shrestha100% (1)

- Long Term Capital ManagementDocument49 pagesLong Term Capital ManagementLiu Shuang100% (2)

- Mutual Fund Selection ProcessDocument11 pagesMutual Fund Selection ProcessspeedenquiryNo ratings yet

- Segmenting, Targeting and Positioning: Banking IndustryDocument7 pagesSegmenting, Targeting and Positioning: Banking IndustryAnthony ShindeNo ratings yet

- Recent Debt Market InnovationsDocument30 pagesRecent Debt Market Innovationsasifanis100% (1)

- Question and Answer - 52Document31 pagesQuestion and Answer - 52acc-expertNo ratings yet

- Indian Financial SystemDocument163 pagesIndian Financial SystemrohitravaliyaNo ratings yet

- Blackbook ValuationDocument63 pagesBlackbook Valuationsmit sangoiNo ratings yet

- Distribution Fitting Suggests Weibull or Lognormal for Weekly Demand DataDocument7 pagesDistribution Fitting Suggests Weibull or Lognormal for Weekly Demand DataEdgar Diaz NietoNo ratings yet

- Boletin Tecnico Marzo 2017pdfDocument15 pagesBoletin Tecnico Marzo 2017pdfEdgar Diaz NietoNo ratings yet

- CostosGuias ElAceroEnLaConstruccionDocument116 pagesCostosGuias ElAceroEnLaConstruccionEdgar Diaz NietoNo ratings yet

- CostosGuias ElAceroEnLaConstruccionDocument116 pagesCostosGuias ElAceroEnLaConstruccionEdgar Diaz NietoNo ratings yet

- Informe Harina de PescadoDocument31 pagesInforme Harina de PescadoNico Rocha93% (15)

- University of Chicago Press Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Journal of Political EconomyDocument11 pagesUniversity of Chicago Press Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Journal of Political EconomyEdgar Diaz NietoNo ratings yet

- Procesamiento Harina PescadoDocument5 pagesProcesamiento Harina PescadoEdgar Diaz NietoNo ratings yet

- CostosGuias ElAceroEnLaConstruccionDocument116 pagesCostosGuias ElAceroEnLaConstruccionEdgar Diaz NietoNo ratings yet

- Proceso de La Harina de PescadoDocument2 pagesProceso de La Harina de PescadoEdgar Diaz NietoNo ratings yet

- Boletin Tecnico Marzo 2017pdfDocument15 pagesBoletin Tecnico Marzo 2017pdfEdgar Diaz NietoNo ratings yet

- 201108-Eaf Dust Treatment For High Metal RecoveryDocument10 pages201108-Eaf Dust Treatment For High Metal RecoveryAgustine SetiawanNo ratings yet

- 2011-06 EAF DustTreatment ForHighMetalRecoveryDocument9 pages2011-06 EAF DustTreatment ForHighMetalRecoveryEdgar Diaz NietoNo ratings yet

- BLM Cost Estimating HDBK Dec2002Document158 pagesBLM Cost Estimating HDBK Dec2002osvald97No ratings yet

- prj14 130402114119 Phpapp01Document6 pagesprj14 130402114119 Phpapp01Edgar Diaz NietoNo ratings yet

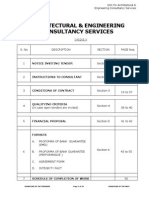

- Attachment 5 - Att05 SWF Schedule 01of01Document1 pageAttachment 5 - Att05 SWF Schedule 01of01Edgar Diaz NietoNo ratings yet

- 13 - Risk Modeling in A New ParadigmDocument20 pages13 - Risk Modeling in A New Paradigmvineet_bmNo ratings yet

- W Ss Working Note 1 AggregationDocument83 pagesW Ss Working Note 1 AggregationEdgar Diaz NietoNo ratings yet

- Iso Dis 45001Document46 pagesIso Dis 45001gmg210981No ratings yet

- 03 Valuation Guide - EnG - Jul14Document52 pages03 Valuation Guide - EnG - Jul14Carlos VillarrealNo ratings yet

- Location of Econom 029874 MBPDocument336 pagesLocation of Econom 029874 MBPEdgar Diaz NietoNo ratings yet

- MBA Managerial Economics EssentialsDocument193 pagesMBA Managerial Economics EssentialsRambabu UndabatlaNo ratings yet

- BE AnalysisDocument16 pagesBE AnalysisMohit UpadhyayNo ratings yet

- Engineering & Mining Journal - SEP 2012Document1 pageEngineering & Mining Journal - SEP 2012Edgar Diaz NietoNo ratings yet

- Manufacturing Plant Location Selection in Logistics Network Using Analytic Hierarchy ProcessDocument29 pagesManufacturing Plant Location Selection in Logistics Network Using Analytic Hierarchy ProcessEdgar Diaz NietoNo ratings yet

- Roque Benavides PresentationDocument21 pagesRoque Benavides PresentationEdgar Diaz NietoNo ratings yet

- Use and Abuse of Feasibility StudiesDocument12 pagesUse and Abuse of Feasibility StudiesEdgar Diaz NietoNo ratings yet

- Economic Location Theory and PracticeDocument30 pagesEconomic Location Theory and PracticeEdgar Diaz NietoNo ratings yet

- 010 MiningDocument4 pages010 MiningEdgar Diaz NietoNo ratings yet

- FINAL - Mining and Development in PeruDocument82 pagesFINAL - Mining and Development in PeruEdgar Diaz NietoNo ratings yet

- 1 NDA - EIL For GNFCDocument6 pages1 NDA - EIL For GNFCraghav joshiNo ratings yet

- Facts:: 1. Bagong Pagkakaisa vs. Secretary G.R. No. 167401 July 5, 2010Document5 pagesFacts:: 1. Bagong Pagkakaisa vs. Secretary G.R. No. 167401 July 5, 2010Renz Aimeriza AlonzoNo ratings yet

- Hyderabad IT Appointment LetterDocument6 pagesHyderabad IT Appointment LetterpurushothamNo ratings yet

- Garcia v. Mojica DigestDocument6 pagesGarcia v. Mojica DigestAnit Emerson100% (1)

- GHMC ActDocument1,122 pagesGHMC ActRaghu Ram100% (1)

- Torts 04 Negligence III - Pure Economic LossDocument15 pagesTorts 04 Negligence III - Pure Economic LossWayne LimNo ratings yet

- Serdy v. Alnasser Case No.: 20VECV00439 First Amended ComplaintDocument19 pagesSerdy v. Alnasser Case No.: 20VECV00439 First Amended ComplaintPeter Barker-HomekNo ratings yet

- Obligations Digests, Civil Law ReviewDocument112 pagesObligations Digests, Civil Law ReviewMadzGabiolaNo ratings yet

- Cisc V MsaplDocument2 pagesCisc V Msapljodelle11No ratings yet

- REP1 Rules For Ships Part A 1.1.2023 Corr1Document518 pagesREP1 Rules For Ships Part A 1.1.2023 Corr1Tordillo ECV56No ratings yet

- NBCCDocument56 pagesNBCCriverwilliamsNo ratings yet

- STAR TWO v. PAPER CITYDocument10 pagesSTAR TWO v. PAPER CITYnyx starkNo ratings yet

- Supreme Court rules private individual cannot be charged under Section 3(g) of R.A. 3019Document4 pagesSupreme Court rules private individual cannot be charged under Section 3(g) of R.A. 3019Omie Jehan Hadji-AzisNo ratings yet

- Plaint SUIT FOR SPECIFIC PERFORMANCE OF CONTRACTDocument2 pagesPlaint SUIT FOR SPECIFIC PERFORMANCE OF CONTRACTSankalp Parihar100% (11)

- Canada Employee Handbook 2021Document42 pagesCanada Employee Handbook 2021RSNo ratings yet

- Defendant's Memorandum For Case Management ConferenceDocument8 pagesDefendant's Memorandum For Case Management ConferenceThe LedgerNo ratings yet

- CHPT 4 Consumer Protection ActDocument22 pagesCHPT 4 Consumer Protection ActMangesh AherekarNo ratings yet

- Kenneth Gumbs and Yvonne Gumbs v. International Harvester, Inc., 718 F.2d 88, 3rd Cir. (1983)Document15 pagesKenneth Gumbs and Yvonne Gumbs v. International Harvester, Inc., 718 F.2d 88, 3rd Cir. (1983)Scribd Government DocsNo ratings yet

- Corp & Buss. Law Class 5 & 6 (15062019 - 22062019)Document37 pagesCorp & Buss. Law Class 5 & 6 (15062019 - 22062019)Anesh KumarNo ratings yet

- LEGT2741 Assignment (Week 5)Document9 pagesLEGT2741 Assignment (Week 5)Danny NgNo ratings yet

- SERVICE OF PROCESS AND NEGLIGENCEDocument5 pagesSERVICE OF PROCESS AND NEGLIGENCEPaolo Vittorio Perdigueros GonzalesNo ratings yet

- International Law Obligation of States to Enact Legislation to Fulfill Treaty TermsDocument17 pagesInternational Law Obligation of States to Enact Legislation to Fulfill Treaty TermsFbarrsNo ratings yet

- Anti Corruption Policies and ProceduresDocument20 pagesAnti Corruption Policies and ProceduresFerijanto WahjudiNo ratings yet

- Confidentiality Agreement: cr8v Web Solutions, IncDocument5 pagesConfidentiality Agreement: cr8v Web Solutions, Incfsbautista100% (1)

- Human Rights - Abuse of RightsDocument8 pagesHuman Rights - Abuse of RightsMika BanzuelaNo ratings yet

- ABC Training Center Website Redesign ProposalDocument4 pagesABC Training Center Website Redesign ProposalTrader Cafe'sNo ratings yet

- OPSS 801 Nov10Document5 pagesOPSS 801 Nov10Muhammad UmarNo ratings yet

- First Optima Realty Corporation vs. Securitron Security Services, Inc., 748 SCRA 534, January 28, 2015Document20 pagesFirst Optima Realty Corporation vs. Securitron Security Services, Inc., 748 SCRA 534, January 28, 2015Mark ReyesNo ratings yet

- Pledge - BailmentDocument3 pagesPledge - BailmentSaurabh SrirupNo ratings yet

- Television Commercial Production Contract: Form #15Document8 pagesTelevision Commercial Production Contract: Form #15onyinyechiNo ratings yet