Professional Documents

Culture Documents

Corporate Guide - Singapore, August 2016

Uploaded by

tth28288969Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Guide - Singapore, August 2016

Uploaded by

tth28288969Copyright:

Available Formats

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Market Outlook & Strategy

FSSTI

REVIEW: The FSSTI rose 0.98% mom to 2,868.69 in July. The latter part of July saw a heavy

sell-off in O&M stocks (-12% to -36% mom) as Swiber Holdings applied to be placed into judicial

management. The weak sentiment spilled over to banks, particularly DBS, which announced that

it had S$700m exposure to Swiber Holdings. Otherwise, earnings season is in full swing and

there have been a lot of earnings disappointments notably from SPH, CD REIT, Ezra, SIA and

M1. Wilmar fell 5.0% mom after issuing a profit warning. On the external front, equity markets

were encouraged by the Fed Reserves move to keep the policy FFTR unchanged at 0.25-0.5%

in July and its more positive outlook on the US economy.

STRATEGY: We have been defensive and stock selective, buying on weakness and preferring

solid blue chips with dividend yields and strong financials. Valuations look fair, with the FSSTI

trading at 2017 PE of 14.5x vs long-term mean valuation of 15.4x. We believe valuations are

likely to remain below mean on weaker growth prospects and lower-than-mean ROE, with GDP

growth at the lower end of the 1-3% forecast range. Investment themes for 2H16 include: a) M&A

fever, b) dividend yields with catalysts, c) recovering tourist arrivals, and d) going global. On our

BUY list are OCBC, City Dev, Singtel, ST Eng, Frasers L&I Trust, A-REIT, K-REIT and First

Resources. Mid-cap gems we like include CAO, NeraTel, Valuetronics and Katrina Holdings.

SELL SIA Eng, StarHub and M1.

From 1/8/2015 to 29/7/2016

3300

3200

3100

3000

2900

2800

2700

2600

2500

2400

Aug

Sector

0.515

0.555

7.8

China Everbright

0.635

0.60

Fortune Reit HK$

9.20

9.91

7.7

Wilmar

3.26

3.09

(5.2)

Venture

8.28

8.90

7.5

Genting HK US$

0.29

0.275

(5.2)

FSSTI

(S$)

Jun

Jul

% Chg

(S$)

Jun

Jul

% Chg

China Aviation

1.23

1.46

18.7

Noble

0.20

0.162

(19.0)

THBEV

0.91

1.035

13.7

Delfi

2.89

2.47

(14.5)

0.885

0.985

11.3

Sembcorp Marine

4.52

5.03

11.3

Bumitama

1.505

1.63

8.3

SIIC Environment

1.63

1.765

8.3

Oxley

Genting SP

0.725

0.785

8.3

SuntecReit

Silverlake

Sheng Siong

BukitSem

SMRT

AusNet Services

* Top 100 companies by market capitalisation

Refer to last page for important disclosures.

1.55

1.41

(9.0)

0.765

0.70

(8.5)

(6.5)

0.62

0.58

0.415

0.39

(6.0)

1.77

1.67

(5.6)

(5.5)

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

SECTOR RATINGS & STOCK RECOMMENDATIONS

Aviation

Finance

Healthcare

LandTransport

Media

OilServices

Plantation

Property

REITs

Shipping

Shipyard

Technology

Telecoms

Others

TOP GAINERS & LOSERS*

Sep

Jul/Jun (% Chg)

3.6

(1.5)

1.7

4.2

(4.3)

(29.3)

(3.2)

3.3

1.0

0.0

(4.3)

7.5

1.2

3.3

Weighting*

Market Weight

Overweight

Market Weight

Market Weight

Market Weight

Underweight

Overweight

Overweight

Overweight

Market Weight

Market Weight

Overweight

Underweight

Top Buys

ST Engrg

OCBC

Raffles Medical

ComfortDelGro

Bumitama, First Resources

City Devt, Wing Tai

FLT, AREIT, KREIT

Sembcorp Ind

Venture

SingTel

1.0

* Refers to business prospects & earnings growth of the sector for the next 12 months.

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Valuation screens (Price/Book and Price/Earnings)

Stocks trading 2SD below Mean

2016

P/B (x)

Mean

P/B (x)

-2SD

P/B (x)

Sabana REIT

0.61

0.91

0.70

Sabana REIT

2016

PE (x)

10.1

Mean

PE (x)

14.9

-2SD

PE (x)

10.4

Stocks trading 1SD below Mean

2016

P/B (x)

Mean

P/B (x)

-1SD

P/B (x)

0.15

0.36

0.32

0.83

0.29

1.51

1.84

1.43

1.99

0.92

0.46

0.93

0.80

1.29

0.43

2016

PE (x)

10.1

11.3

3.7

12.3

20.2

Mean

PE (x)

14.9

15.7

5.2

15.9

22.7

-1SD

PE (x)

12.6

13.4

4.3

13.8

21.3

Ezra

Ezion

Nam Cheong

Sembcorp Ind

Pacific Radiance

Sabana REIT

Bumitama

Triyards

CACHE

Frasers HTrust

Stocks trading 2SD above Mean

2016

Mean

P/B (x)

P/B (x)

SATS

COSCO Corp

Raffles Medical

+2SD

P/B (x)

3.15

2.00

2.93

2016

PE (x)

122.9

37.5

Mean

PE (x)

24.3

23.6

+2SD

PE (x)

61.2

37.5

Stocks trading 1SD above Mean

2016

P/B (x)

SATS

Raffles Medical

MapletreeInd

IHH

Starhill Gbl

COSCO Corp

SIA Engineering

Raffles Medical

SATS

MapletreeInd

Mean

P/B (x)

+1SD

P/B (x)

3.15

4.29

1.25

2.39

0.94

2.00

2.84

1.12

1.97

0.76

2.47

3.83

1.19

2.29

0.91

2016

PE (x)

122.9

26.7

37.5

21.4

17.2

Mean

PE (x)

24.3

15.9

23.6

13.9

13.6

+1SD

PE (x)

42.7

21.6

30.5

17.9

15.8

Analysts Top Alpha* Picks

Analyst

Company

Rec

Upside/

(Downside)

%

Market

Cap

(S$m)

2016

PE

(x)

2016

P/B

(x)

2016

Yield

(%)

Remarks

Edison Chen

China Aviation

BUY

30.1

1,264.6

12.6

1.5

2.7

CAO, APACs largest physical jet fuel trader, holds a monopoly in supplying imported jet fuel to the

whole of China, making it a proxy to Chinas global aviation boom. Together with its stake in the

exclusive refueller for SPIA, CAO has two solid growing sources of recurring income. Management

also has a five-year plan to double profits to US$120m through organic and M&A growth.

Vikrant Pandey/Derek Chang

Frasers L&I Tr

BUY

9.1

1,410.9

22.0

1.1

6.3

FLT provides the best growth prospects (10% 3-year CAGR) amongst REITs within our coverage

on top of a high 6.5% yield. It is also a potential play on the strengthening Australian dollar

Andrew Chow/Nicholas Leow

Katrina

BUY

20.0

86.9

17.5

5.7

3.2

Undervaluation relative to peer. Catalyst from better than expected 2017F growth from new outlets

and online channel.

Jonathan Koh

OCBC

BUY

21.9

36,066.1

10.5

1.0

4.2

There are early signs that OCBCs conservative approach to recognise NPLs early is bearing some

fruits. An oil & gas loan in Malaysia that was restructured and recognised as NPL a year ago was

upgraded in 2Q16. 50% of its NPLs in the oil & gas sector are not overdue

Ajith/Sophie Leong

ST Engineering

BUY

6.4

10,273.0

20.3

4.2

4.1

On balance, we believe that companies with resilient earnings will see valuation multiples expand

and STE, which trades at 20x 12 month forward PE could see its valuation rise towards 24x if

earnings surprise to the upside.

* Denotes a timeframe of 1 to 6 months and not UOBKH usual 12 months investment horizon for stock recommendation

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Sector Performance

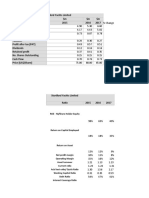

------------------- PE ------------------2015

2016F

2017F

(x)

(x)

(x)

AVIATION

18.8

26.2

26.2

FINANCE

9.5

10.3

HEALTHCARE

53.0

48.4

LAND TRANSPORT

20.8

MEDIA

19.0

------------- EPS Growth -----------2015

2016F

2017F

(%)

(%)

(%)

(0.1)

Net

Margin

(%)

ROA

(%)

ROE

(%)

7.1

4.8

9.8

4.1

Price/

NTA ps

(x)

Net Cash

(Debt) to

Equity

(%)

Market

Cap.

(%)

Total

Market

Cap.

(S$m)

3.5

2.0

19.3

8.1

32,519

--------- Yield --------2015

2016F

(%)

(%)

36.1

(28.3)

10.1

4.3

(9.6)

2.1

n.a.

1.0

12.1

4.2

4.0

1.2

n.a.

27.9

112,622

39.2

10.0

9.1

23.5

11.7

3.3

5.0

0.6

0.5

6.0

(17.9)

5.2

21,107

19.9

18.4

9.4

4.9

7.8

7.6

5.2

13.1

3.0

2.9

3.3

(5.7)

2.1

8,568

23.5

23.0

(20.3)

(18.3)

2.2

27.3

5.1

8.8

5.3

4.2

1.9

(19.0)

1.5

6,112

OIL SERVICES

7.3

n.a.

6.2

(74.4)

n.a.

n.a.

7.8

1.3

3.5

0.9

0.9

0.3

(126.0)

0.3

1,176

PLANTATION

17.2

15.5

11.7

(17.1)

10.1

32.8

2.6

2.3

6.0

2.2

2.0

1.3

(75.6)

7.2

28,863

PROPERTY

10.7

17.3

16.6

(35.7)

(39.2)

4.3

25.0

2.9

6.8

2.5

2.4

0.7

(54.2)

6.9

27,909

REITS

19.6

18.4

17.6

2.0

3.8

3.3

51.5

3.2

5.1

6.0

6.2

1.0

(55.7)

11.0

44,422

SHIPPING

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

(4.1)

(2.8)

(10.4)

0.0

0.0

1.1

(117.0)

0.8

3,387

SHIPYARD

12.2

10.2

11.2

(56.0)

19.4

(8.6)

5.5

2.3

7.0

5.2

3.7

0.9

(88.0)

5.3

21,430

TECHNOLOGY

16.0

15.6

14.7

101.4

3.4

6.4

5.8

6.2

8.3

5.6

5.6

2.0

21.3

0.6

2,467

TELECOMS

17.2

17.1

15.9

2.1

0.4

7.3

21.5

9.6

17.4

4.3

4.5

6.2

(39.9)

18.8

75,887

OTHERS

5.1

33.7

25.2

164.5

(85.2)

34.0

65.4

14.6

21.3

2.1

2.2

1.0

33.1

4.1

16,647

OVERALL

13.1

15.5

14.5

(4.3)

(17.5)

7.2

16.7

1.9

9.7

3.9

3.7

1.4

(30.5)

100.0

403,117

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Corporate Statistics

Company

Ticker

Rec

Price

29/7/16

(S$)

Last

Year

End

2015

(S$m)

Net Profit

2016F

(S$m)

AVIATION

SIA

SIA SP

SIA Engineering SIE SP

SATS

SATS SP

ST Engineering STE SP

Sector

HOLD

SELL

HOLD

BUY

10.98

3.70

4.37

3.29

3/16

3/16

3/16

12/15

FINANCE

DBS

OCBC

SGX @

UOB@

Sector

DBS SP

OCBC SP

SGX SP

UOB SP

BUY

BUY

NR

NR

15.41

8.60

7.53

18.20

12/15

12/15

6/16

12/15

HEALTHCARE

IHH

IHH SP

Raffles Medical RFMD SP

Sector

HOLD

BUY

2.23

1.575

12/15

12/15

329.0

69.3

398.2

363.0

73.4

436.4

LAND TRANSPORT

ComfortDelGro CD SP

SMRT

MRT SP

Sector

BUY

HOLD

2.82

1.63

12/15

3/16

MEDIA

SPH

Sector

SPH SP

HOLD

3.78

OIL SERVICES

Ezion

Ezra

Nam Cheong

Pacific Radiance

Triyards

Sector

EZI SP

EZRA SP

NCL SP

PACRA SP

ETL SP

HOLD

SELL

SELL

SELL

HOLD

0.30

0.05

0.067

0.21

0.34

804.4

176.6

220.6

529.0

1,730.6

EPS

2017F 2015 2016F 2017F

(S$m) (cents) (cents) (cents)

354.7 314.7

155.9 159.9

229.0

244.0

502.9

523.5

1,242.6 1,242.1

2015

(x)

PE

DPS

2016F 2017F 2015 2016F

(x)

(x) (cents) (cents)

Yield

Hist

Net

2015 2016F CFPS Margin ROA

(%)

(%)

(S$)

(%)

(%)

ROE

(%)

No of

Shares

(m)

Market

Cap.

(S$m)

Book Price/ Net Cash/(Debt) to

NTA ps NTA ps Mkt Cap Equity

(S$)

(x)

(%)

(%)

Avg Daily

52-Wk Price Turnover

High Low 52-Wk

(S$)

(S$)

('000)

69.0

15.7

19.9

17.1

26.6

30.2

13.9

20.6

16.2

19.1

26.6

14.3

22.0

16.9

19.1

15.9

23.5

22.0

19.3

18.8

36.3

26.6

21.2

20.3

26.2

41.2

26.0

19.9

19.5

26.2

45.0

14.0

15.0

15.0

24.7

21.0

16.7

13.5

4.1

3.8

3.4

4.6

4.1

2.2

5.7

3.8

4.1

3.5

1.97

0.20

0.26

0.23

5.3

15.9

13.0

8.4

7.1

3.4

10.2

10.7

6.4

4.8

6.4

12.6

15.0

24.8

9.8

1,199.9

1,124.1

1,124.1

3,122.5

13,174.4 10.20

4,159.2 1.32

4,912.1 1.25

10,273.0 0.40

32,518.7

1.1

2.8

3.5

8.2

2.0

19.5

14.8

9.0

(1.4)

10.7

20.1

39.7

28.5

(6.3)

19.3

11.67

4.00

4.49

3.47

9.57

3.20

3.38

2.67

1,614

273

2,098

3,401

4,454.0 4,052.3 4,077.4 177.0

3,903.0 3,442.9 3,546.1 95.2

348.6

349.0

369.5

32.6

3,209.0 3,043.9 3,149.6 194.0

11,914.6 10,888.1 11,142.7 128.6

160.2

81.7

32.6

187.9

116.3

161.2

83.8

34.5

194.5

118.7

8.7

9.0

23.1

9.4

9.5

9.6

10.5

23.1

9.7

10.3

9.6

10.3

21.8

9.4

10.1

60.0

36.0

28.0

90.0

60.0

36.0

28.0

75.2

3.9

4.2

3.7

4.9

4.2

3.9

4.2

3.7

4.1

4.0

n.a.

n.a.

0.38

n.a.

n.a.

n.a.

42.7

n.a.

n.a.

1.0

1.0

17.9

1.0

1.0

11.7

12.4

35.5

11.5

12.1

2,531.5

4,193.7

1,071.6

1,619.6

39,010.1 14.35

36,066.1 6.99

8,069.5 0.75

29,476.2 15.58

112,621.8

1.1

1.2

10.1

1.2

1.2

n.a.

n.a.

10.7

n.a.

n.a.

n.a.

n.a.

87.5

n.a.

n.a.

20.37

10.35

8.07

22.26

13.01

7.41

6.61

16.8

6,329

6,545

2,304

3,047

4.0

4.1

4.0

4.4

4.3

4.4

5.5

4.9

5.4

55.6

38.9

53.0

50.5

37.0

48.4

40.3

32.4

39.2

1.0

2.0

0.9

2.0

0.4

1.3

0.6

0.4

1.3

0.5

0.07

0.14

11.0

16.9

11.7

2.9

9.4

3.3

4.5

12.1

5.0

8,231.6

1,746.6

18,356.5

2,750.9

21,107.4

0.35

0.35

6.3

4.6

6.0

(8.3)

3.4

(6.8)

(20.6)

14.6

(17.9)

2.3

1.675

1.76

1.293

54

1,778

301.9

109.3

411.2

339.0

383.9

14.1

92.6 81.3 7.2

431.6

465.3

11.2

15.8

6.1

11.7

17.9

5.3

12.7

20.0

22.7

20.8

17.9

26.8

19.9

15.8

30.5

18.4

9.0

4.0

9.1

3.3

3.2

2.5

3.0

3.2

2.1

2.9

0.32

0.21

7.3

8.4

7.6

5.8

4.2

5.2

13.3

12.3

13.1

2,155.9

1,526.5

6,079.7

2,488.2

8,567.9

0.80

0.59

3.5

2.8

3.3

6.6

(23.7)

(2.2)

16.9

(64.3)

(5.7)

3.15

1.675

2.56

1.12

6,033

2,583

8/15

321.7

321.7

260.0 265.6 19.9

260.0

265.6

19.9

16.3

16.3

16.6

16.6

19.0

19.0

23.2

23.5

22.7

23.0

20.0

16.0

5.3

5.3

4.2

4.2

0.23

27.3

27.3

5.1

5.1

8.8

8.8

1,616.9

6,112.0

6,112.0

2.02

1.9

1.9

(10.6)

(10.6)

(19.0)

(19.0)

4.25

3.5

4,054

12/15

8/15

12/15

12/15

8/15

50.6

58.9

10.0

5.3

36.6

161.4

101.5

(123.6)

(16.8)

(19.0)

30.0

(28.0)

4.2

(4.2)

(0.8)

(2.6)

9.2

(0.3)

7.0

(0.4)

(0.1)

(0.8)

11.3

2.2

10.4

1.6

14.0

28.9

3.0

7.3

7.2

n.a.

n.a.

n.a.

3.7

n.a.

4.3

n.a.

n.a.

n.a.

3.0

6.2

0.0

0.0

0.0

1.0

1.0

0.0

0.0

0.0

1.0

1.0

0.0

0.0

0.0

4.8

2.9

0.9

0.0

0.0

0.0

4.8

2.9

0.9

0.14

0.08

0.01

0.06

0.17

10.5

8.0

3.0

3.1

10.1

7.8

1.2

1.2

0.8

0.4

6.8

1.3

2.9

3.9

2.2

0.9

14.3

3.5

2,085.8

2,942.4

2,103.1

725.8

324.5

625.7

147.1

140.9

152.4

110.3

1,176.5

0.86

0.25

0.21

0.77

0.89

0.3

0.2

0.3

0.3

0.4

0.3

(304.7)

(956.4)

(312.4)

(383.8)

(149.3)

(382.8)

(125.0)

(182.5)

(102.4)

(106.4)

(55.1)

(126.0)

0.765

0.138

0.23

0.44

0.52

454.9

83.9

538.8

170.7

(10.6)

(2.7)

(5.8)

36.6

188.3

2.9

3.1

0.5

0.7

11.4

2.4

0.29 17,048

0.048 67,268

0.07 6,198

0.20

831

0.23

303

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Corporate Statistics

Company

Ticker

Rec

PLANTATION

Bumitama

FirstRes

GoldenAgri

IndoAgri @

Wilmar

Sector

BAL SP

FR SP

GGR SP

IFAR SP

WIL SP

BUY

BUY

BUY

HOLD

SELL

PROPERTY

CapitaLand

CityDev

GuocoLand

Ho Bee Land

OUE @

Wing Tai

Sector

CAPL SP

CIT SP

GUOL SP

HOBEE SP

OUE SP

WINGT SP

SHIPPING

NOL

Sector

SHIPYARD

COSCO Corp

Keppel Corp

Sembcorp Ind

Sembcorp Marine

Yangzijiang

Sector

Price

29/7/16

(S$)

Last

Year

End

2015

(S$m)

Net Profit

2016F

(S$m)

EPS

2017F 2015 2016F 2017F

(S$m) (cents) (cents) (cents)

2015

(x)

PE

DPS

2016F 2017F 2015 2016F

(x)

(x) (cents) (cents)

Yield

Hist

Net

2015 2016F CFPS Margin ROA

(%)

(%)

(S$)

(%)

(%)

ROE

(%)

0.70

1.615

0.36

0.46

3.09

12/15

12/15

12/15

12/15

12/15

91.8

148.4

(23.0)

6.0

1,452.1

1,675.2

109.5 148.9

158.7

195.9

321.6

383.4

51.0

78.2

1,215.8 1,659.8

1,856.6 2,466.3

5.2

9.4

(0.2)

0.4

22.8

7.0

6.2

10.0

2.5

3.5

19.0

7.7

8.5

12.4

3.0

5.4

25.9

10.3

13.4

17.2

n.a.

107.7

13.6

17.2

11.2

16.1

14.4

13.1

16.3

15.5

8.3

13.1

12.1

8.5

11.9

11.7

0.5

2.5

0.5

0.5

8.0

2.2

3.0

0.5

0.4

6.7

0.7

1.5

1.4

1.1

2.6

2.2

3.1

1.9

1.4

0.9

2.2

2.0

0.06

0.12

0.02

0.07

0.37

16.1

23.8

(0.3)

0.4

2.7

2.6

6.7

6.8

(0.2)

0.2

2.7

2.3

BUY

BUY

BUY

BUY

NR

BUY

3.17

8.51

1.87

2.21

1.50

1.74

12/15

12/15

6/15

12/15

12/15

6/15

1,065.7

773.4

226.4

242.2

156.4

150.3

2,614.3

725.8

550.2

125.2

110.7

89.6

15.1

1,616.6

739.2

571.2

136.4

93.0

71.4

74.2

1,685.4

23.1

83.6

19.5

36.3

17.2

19.2

28.9

15.3

60.5

11.3

16.6

9.1

1.9

17.6

15.6

62.8

12.3

13.9

7.3

9.3

18.3

13.7

10.2

9.6

6.1

8.7

9.1

10.7

20.7

14.1

16.6

13.3

16.4

91.8

17.3

20.4

13.5

15.2

15.9

20.6

18.6

16.6

9.0

16.0

5.0

7.0

5.0

3.0

8.0

16.0

5.0

4.0

4.5

6.0

2.8

1.9

2.7

3.2

3.3

1.7

2.5

2.5

1.9

2.7

1.8

3.0

3.4

2.4

0.25 22.4

1.09 23.4

0.20 19.5

0.37 186.4

0.18 36.2

0.21 22.2

25.0

2.3

3.9

2.5

5.9

2.1

3.1

2.9

6.1

8.9

8.1

8.9

4.0

4.9

6.8

NOL SP

HOLD

1.30

12/15

(303.1)

(303.1)

(341.8)

(341.8)

(132.6)

(132.6)

(11.7)

(11.7)

(13.1)

(13.1)

(5.1)

(5.1)

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

0.0

0.0

0.0

0.0

0.0

0.0

0.58

(4.1)

(4.1)

(2.8)

(2.8)

COS SP

KEP SP

SCI SP

SMM SP

YZJSGD SP

SELL

HOLD

BUY

HOLD

SELL

0.29

5.25

2.77

1.41

0.87

12/15

12/15

12/15

12/15

12/15

(570.0)

1,524.6

548.9

(289.7)

537.9

1,751.7

(25.5)

84.0

29.2

(13.9)

14.0

14.9

0.2

53.6

29.6

8.5

10.6

17.8

0.3

50.1

29.2

5.0

9.6

16.3

n.a.

6.2

9.5

n.a.

6.2

12.2

122.9

9.8

9.3

16.5

8.2

10.2

88.9

10.5

9.5

28.0

9.1

11.2

0.0

34.0

11.0

6.0

4.5

0.0

22.0

10.4

3.5

3.7

0.0

6.5

4.0

4.3

5.2

5.2

0.0

4.2

3.7

2.5

4.2

3.7

(0.19) (16.2)

0.98 14.8

0.52

5.8

(0.08) (5.8)

0.17 15.4

5.5

BUY

8.90

12/15

154.1

154.1

55.8

55.8

57.7

57.7

61.3

61.3

15.9

16.0

15.4

15.6

14.5

14.7

50.0

50.0

5.6

5.6

5.6

5.6

0.71

TECHNOLOGY

Venture Corp

VMS SP

Sector

5.3

7.3

974.9 911.5

529.0 522.0

178.4 105.0

404.8

367.8

2,092.4 1,913.6

158.2

158.2

168.2

168.2

5.8

5.8

No of

Shares

(m)

17.6 1,757.5

14.2 1,584.1

(0.4) 12,837.6

0.5 1,447.8

7.3 6,403.4

6.0

Market

Cap.

(S$m)

Book Price/ Net Cash/(Debt) to

NTA ps NTA ps Mkt Cap Equity

(S$)

(x)

(%)

(%)

Avg Daily

52-Wk Price Turnover

High Low 52-Wk

(S$)

(S$)

('000)

1,230.3

2,558.3

4,621.5

666.0

19,786.5

28,862.5

0.32

0.57

0.40

0.66

2.22

2.2

2.8

0.9

0.7

1.4

1.3

(40.8)

(17.0)

(80.9)

(125.4)

(78.8)

(73.1)

(86.8)

(41.2)

(72.8)

(66.7)

(78.4)

(75.6)

0.955

2.13

0.44

0.63

3.75

0.66

602

1.435 2,681

0.28 25,012

0.41

906

2.46 8,691

4,274.4

909.3

1,183.4

703.3

981.6

793.9

13,549.8

7,738.2

2,212.9

1,554.4

1,472.4

1,381.4

27,909.1

4.02

9.85

2.95

3.97

4.33

3.97

0.8

0.9

0.6

0.6

0.3

0.4

0.7

(84.5)

(36.6)

(97.1)

(97.8)

(199.2)

(45.0)

(77.0)

(65.1)

(31.6)

(65.6)

(54.5)

(75.0)

(19.7)

(54.2)

3.4

9.47

2.29

2.36

1.94

1.93

2.67 12,035

6.61 1,913

1.685

148

1.815

133

1.485

407

1.46 1,107

(10.4)

(10.4)

2,605.6

3,387.2

3,387.2

1.18

1.1

1.1

(111.8)

(111.8)

(117.0)

(117.0)

1.305

(5.6)

5.0

3.0

(3.3)

6.1

2.3

(52.1)

14.2

9.1

(10.6)

11.8

7.0

2,239.2

1,817.9

1,787.5

2,089.8

3,837.1

649.4

9,544.0

4,951.5

2,946.6

3,338.3

21,429.7

0.34

6.03

2.83

1.14

1.21

0.8

0.9

1.0

1.2

0.7

0.9

(763.0)

(76.8)

(133.0)

(102.0)

3.7

(101.5)

(637.4)

(66.0)

(116.8)

(117.7)

2.7

(88.0)

0.535

7.77

3.96

2.73

1.315

6.2

6.2

8.3

8.3

277.2

2,467.3

2,467.3

4.45

2.0

2.0

16.3

16.3

21.3

21.3

9.00

0.77

8,214

0.275 6,747

4.64 6,291

2.16 5,910

1.295 3,767

0.85 11,832

7.65

594

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Corporate Statistics

Company

Ticker

Rec

Price

29/7/16

(S$)

TELECOMS

M1

Singtel

StarHub

Sector

M1 SP

ST SP

STH SP

SELL

BUY

SELL

2.62

4.18

3.92

12/15

3/16

12/15

178.5

3,870.8

372.3

4,421.6

OTHERS

Genting HK US$

Genting SP

SingPost

SuperGroup

Sector

GENHK SP

GENS SP

SPOST SP

SUPER SP

HOLD

BUY

HOLD

HOLD

0.275

0.785

1.435

0.805

12/15

12/15

3/16

12/15

2,904.9

75.2

248.9

47.3

3,276.3

OVERALL

Last

Year

End

2015

(S$m)

Net Profit

2016F

(S$m)

EPS

2017F 2015 2016F 2017F

(S$m) (cents) (cents) (cents)

158.6 158.2

3,973.9 4,292.8

314.0

318.0

4,446.5 4,769.0

2015

(x)

PE

DPS

2016F 2017F 2015 2016F

(x)

(x) (cents) (cents)

Yield

Hist

Net

2015 2016F CFPS Margin ROA

(%)

(%)

(S$)

(%)

(%)

ROE

(%)

No of

Shares

(m)

Market

Cap.

(S$m)

Book Price/ Net Cash/(Debt) to

NTA ps NTA ps Mkt Cap Equity

(S$)

(x)

(%)

(%)

19.1

24.3

21.5

23.8

16.9

24.9

18.1

23.9

16.9

26.9

18.3

25.6

13.7

17.2

18.2

17.2

15.5

16.8

21.6

17.1

15.5

15.5

21.4

15.9

15.3

17.5

20.0

13.4

18.7

20.0

5.8

4.2

5.1

4.3

5.1

4.5

5.1

4.5

0.32

0.38

0.37

15.4

22.8

15.2

21.5

16.9

9.0

19.1

9.6

44.2

937.2

15.6 15,943.5

221.2 1,731.7

17.4

2,455.6

66,643.8

6,788.1

75,887.5

0.33

0.75

(0.06)

8.0

5.6

n.a.

6.2

(13.3)

(14.2)

(6.1)

(13.5)

(81.5)

(38.0)

(147.7)

(39.9)

(26.2)

48.4

35.1

313.5

383.5

0.6

157.6 178.4 10.9

48.5

51.0

4.2

493.4

661.2

13.9

(0.2)

2.6

7.0

4.3

2.1

0.7

3.2

7.9

4.6

2.8

1.1

125.8

13.2

19.0

5.1

n.a.

30.3

20.6

18.5

33.7

52.1

24.7

18.2

17.6

25.2

0.0

1.5

7.0

2.2

0.0

1.5

7.0

2.6

0.0

1.9

4.9

2.7

2.1

0.0

1.9

4.9

3.2

2.2

0.38 306.2

0.03

3.1

0.12 21.6

0.06

9.3

65.4

40.5

0.6

10.8

7.3

14.6

48.5 8,482.5

1.0 12,094.0

16.5 2,161.3

9.3 1,115.5

21.3

3,153.8

9,493.8

3,101.5

898.0

16,647.0

0.90

0.59

0.29

0.46

0.4

1.3

5.0

1.8

1.0

63.9

37.7

(5.0)

12.9

33.4

26.0

48.9

(12.8)

22.4

33.1

16.2

17.4

13.1

15.5

14.5

3.9

3.7

16.7

1.9

1.4

(24.7)

(30.5)

30,791.0 25,971.6 27,893.7

19.7

9.7

403,116.7

Avg Daily

52-Wk Price Turnover

High Low 52-Wk

(S$)

(S$)

('000)

3.14

4.36

3.97

2.190 1,546

3.380 23,331

3.240 2,293

0.35

0.27

0.90.66 20,654

1.95 1.285

1.105 0.68

2,118

6,174

1,140

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Corporate Statistics

Avg Daily

Company

Ticker

REITs

Ascendas Reit

Ascott REIT

CACHE

CapitaCom Trust

CapitaMall Trust

CDL Htrust

FrasersCT

Frasers HTrust

Frasers L&I Tr

Kep REIT

MapletreeInd

MapletreeLog

PLife REIT

Sabana REIT

Starhill Gbl

Suntec REIT

Sector

AREIT SP

ART SP

CACHE SP

CCT SP

CT SP

CDREIT SP

FCT SP

FHT SP

FLT SP

KREIT SP

MINT SP

MLT SP

PREIT SP

SSREIT SP

SGREIT SP

SUN SP

Rec

BUY

BUY

BUY

BUY

HOLD

HOLD

HOLD

BUY

BUY

BUY

SELL

BUY

HOLD

BUY

BUY

HOLD

Price

29/7/16

(S$)

Last

Year

End

Net Profit

2015

2016F

(S$m)

(S$m)

2017F

(S$m)

2.45

1.13

0.865

1.505

2.14

1.47

2.14

0.785

0.99

1.065

1.81

1.055

2.55

0.53

0.8

1.67

3/16

12/15

12/15

12/15

12/15

12/15

9/15

9/15

9/15

12/15

3/16

3/16

12/15

12/15

6/16

12/15

351.7

71.6

52.4

233.9

404.1

88.7

101.3

45.3

68.5

119.5

190.6

145.4

65.3

41.0

109.9

174.1

2,263.2

380.4

77.6

66.5

320.3

384.0

86.4

102.1

55.2

73.2

154.7

201.5

179.4

71.2

42.8

125.8

198.7

2,519.9

358.9

76.7

63.0

291.0

387.7

82.6

101.6

53.5

64.1

151.1

189.3

174.6

71.0

38.6

115.3

200.3

2,419.2

2015

(cents)

EPU

2016F

(cents)

2017F

(cents)

2015

(cents)

14.6

4.6

6.6

7.9

11.6

9.0

11.1

3.7

4.8

3.7

10.8

5.9

10.8

5.6

5.1

6.9

7.8

13.3

4.7

7.0

9.8

11.0

8.3

11.1

3.9

4.5

4.7

10.5

7.0

11.7

5.2

5.3

7.9

8.1

14.1

4.7

7.4

10.6

10.8

8.6

11.1

4.0

5.1

4.7

11.2

7.2

11.8

5.2

5.8

7.7

8.3

15.4

8.1

8.5

8.6

11.3

10.1

11.6

6.2

n.a.

6.8

11.2

7.4

13.3

6.9

5.1

10.0

DPU

2016F 2017F

(cents) (cents)

15.6

8.2

8.3

9.3

11.2

9.1

11.8

6.1

6.3

6.6

10.8

7.5

11.9

6.1

5.2

10.3

16.4

8.4

8.7

10.1

11.1

9.4

11.8

6.1

6.5

6.6

11.5

7.6

12.0

6.1

5.3

10.2

2015

(%)

6.3

7.1

9.8

5.7

5.3

6.8

5.4

8.0

n.a.

6.4

6.2

7.0

5.2

12.9

6.4

6.0

6.0

Yield

Debt to

2016F 2017F Asset ROA

(%)

(%)

(%)

(%)

6.4

7.2

9.6

6.2

5.2

6.2

5.5

7.7

6.3

6.2

6.0

7.1

4.7

11.6

6.5

6.2

6.2

6.7

7.5

10.1

6.7

5.2

6.4

5.5

7.8

6.6

6.2

6.3

7.2

4.7

11.5

6.6

6.1

6.4

37.0

40.4

39.8

29.8

35.7

36.3

28.5

38.1

26.0

39.0

28.2

35.6

37.8

41.1

35.0

34.9

35.3

3.9

1.6

4.3

3.6

4.0

3.5

4.0

2.2

4.1

1.62

5.3

2.9

3.9

3.4

3.6

2.0

3.2

ROE

(%)

6.7

3.3

6.7

4.5

6.2

5.6

5.9

3.9

5.6

2.6

8.0

5.7

6.3

5.8

5.8

3.2

5.1

No of

shares

(m)

Market

Cap.

(S$m)

2,674.4

1,649.2

896.4

2,956.3

3,542.3

990.1

919.4

1,379.8

1,425.1

3,271.9

1,801.2

2,492.5

605.0

737.7

2,181.2

2,533.3

6,552.4

1,863.6

775.4

4,449.3

7,580.5

1,455.4

1,967.4

1,083.2

1,410.9

3,484.6

3,260.3

2,629.6

1,542.8

391.0

1,745.0

4,230.7

44,422.0

Book Price/

Net Cash/(Debt) to

52-Wk Price Turnover

NTA ps NTA ps Mkt Cap Equity High Low 52-Wk

(S$)

(x)

(%)

(%)

(S$)

(S$)

('000)

2.04

1.32

0.87

1.77

1.89

1.57

1.90

0.80

0.89

1.4

1.37

1.00

1.67

0.81

0.93

2.13

1.2

0.9

1.0

0.9

1.1

0.9

1.1

1.0

1.1

0.7

1.3

1.1

1.5

0.7

0.9

0.8

1.0

(54.5)

(96.3)

(66.5)

(49.8)

(43.0)

(59.1)

(36.0)

(68.3)

(27.7)

(87.88)

(30.2)

(66.9)

(41.1)

(109.3)

(60.2)

(68.8)

(56.0)

(65.5)

(82.5)

(66.1)

(42.4)

(48.6)

(55.0)

(40.4)

(67.0)

(30.8)

(65.6)

(39.9)

(70.6)

(62.7)

(71.5)

(52.0)

(54.0)

(55.7)

2.57

1.295

1.085

1.585

2.25

1.575

2.23

0.83

1

1.1

1.81

1.11

2.65

0.825

0.87

1.81

2.09

1.045

0.805

1.225

1.845

1.215

1.795

0.68

0.895

0.9

1.35

0.91

2.08

0.505

0.695

1.425

10,395

1,834

2,036

8,456

9,097

1,303

1,004

212

12,387

3789.8

2,622

4,306

609

645

1,662

5,360

Note:

If year end is before June, earnings are shown in the previous period

@ Consensus forecast

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Economics

GDP by Sector (Real) (yoy % chg)

Total GDP

Goods Producing Industries

Manufacturing

Construction

Services Producing Industries

Wholesale & Retail Trade

Transport & Storage

Hotels & Restaurants

Information & Communications

Financial Services

Business Services

Trade Figures (Nominal) (yoy % chg)

Total Exports

Total Imports

Non-oil Domestic Exports

Monetary Data (End of period)

Loans Growth (yoy % chg)

M1 (yoy % chg)

M2 (yoy % chg)

Prime Lending Rate (%)

3mth Interbank Rate (%)

Exchange Rates (S$/US$)

Foreign Reserves (S$b)

Other Macro Variables (yoy % chg)

Industrial Production Index (2015=100)

Retail Sales Index (Current)

Visitor Arrivals

Inflation (2009=100)

Unemployment Rate sa (%) (end of period)

Changes in Employment

2014

2015

2016F

2017F

3Q15

4Q15

1Q16

2Q16

Mar 16

Apr 16

May 16

Jun 16

2.9

2.7

2.6

3.0

3.2

1.7

1.7

1.1

3.6

7.7

2.9

2.0

(3.4)

(5.2)

2.5

3.4

6.1

(0.0)

0.2

4.2

5.3

1.5

2.2

1.3

0.8

2.9

1.9

2.3

1.3

1.9

3.3

2.4

1.0

3.2

3.0

3.2

2.5

2.8

3.1

3.8

2.0

3.4

2.7

2.7

1.9

(4.3)

(6.2)

1.6

3.6

6.8

0.3

0.9

4.8

4.8

1.5

1.8

(4.0)

(6.7)

4.9

2.8

6.9

(0.9)

0.9

3.3

2.4

0.8

1.8

0.6

(1.0)

6.2

1.4

1.8

(0.4)

1.5

3.2

2.4

0.3

2.8

n.a.

0.8

2.7

1.7

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

1.0

(0.4)

(1.2)

(7.3)

(11.9)

(0.2)

(0.1)

(0.1)

(2.5)

(6.0)

(1.5)

1.9

(8.0)

(9.1)

(2.2)

(5.7)

(9.9)

(3.5)

(11.6)

(7.4)

(9.1)

(4.7)

(6.7)

0.1

(14.3)

(9.0)

(15.7)

(8.1)

(12.0)

(7.9)

(2.2)

(0.9)

11.6

(3.6)

(6.6)

(2.3)

11.5

4.2

1.9

5.35

0.46

1.3150

337.8

1.1

1.2

3.2

5.35

1.19

1.4081

348.9

(2.1)

6.3

6.2

5.38

1.10

1.3800

357.6

(3.0)

8.6

6.1

5.38

1.75

1.4000

375.6

1.4

1.9

2.5

5.35

1.14

1.4148

356.0

(1.2)

0.1

1.5

5.35

1.19

1.4081

351.0

(1.8)

(1.8)

2.1

5.35

1.06

1.3511

332.0

(2.7)

1.6

4.3

5.35

0.93

1.3490

334.9

(1.8)

(1.8)

2.1

5.35

1.06

1.3511

332.0

(0.8)

0.8

2.8

5.35

1.01

1.3445

336.5

(0.7)

2.6

3.1

5.35

1.00

1.3796

340.2

(2.7)

1.6

4.3

5.35

0.93

1.3490

334.9

2.7

0.4

(3.0)

1.0

1.9

130.1

(5.1)

4.4

2.5

(0.5)

1.9

31.7

2.5

2.8

9.4

(0.8)

2.3

40.0

3.2

2.3

5.1

1.5

2.4

30.0

(5.7)

5.4

5.9

(0.6)

2.0

12.6

(6.2)

3.5

4.5

(0.7)

1.9

16.1

(0.5)

3.3

13.8

(0.8)

1.9

13.0

1.1

n.a.

n.a.

(0.9)

2.1

5.5

0.1

5.2

16.8

(1.0)

n.a.

n.a.

2.9

3.2

15.1

(0.5)

n.a.

n.a.

0.8

3.0

9.8

(1.6)

n.a.

n.a.

(0.3)

n.a.

n.a.

(0.7)

n.a.

n.a.

Source: CEIC, Forecasts - UOB

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Ranking By Market Parameters

Highest PE (x) #

Forward

Highest P/NTA (x) *

Hist.

Highest Dividend

Yield (%) *

122.9

91.8

50.5

37.0

30.3

26.8

26.6

25.5

24.8

24.2

StarHub

SGX

Silverlake

DTAC 200US$

Golden Energy

Dairy Farm 900 US$

M1

Sheng Siong

THBEV

ST Engineering

24.0

8.8

7.5

7.3

6.7

6.3

6.1

5.9

5.4

4.6

HPH Trust US$

OUE HT

Kep Infra Tr

Far East HTrust

AscottREIT

MapletreeLog

CMPacific

CapitaRChina

CDL HTrust

MapletreeGCC

Forward

Lowest P/NTA (x) *

Hist.

Lowest Dividend

Yield (%) *

COSCO Corp

Wing Tai

IHH

Raffles Medical

Genting SP

SMRT

SIA Engineering

Frasers L&I Tr

OUE @

Ascott REIT

Lowest PE (x) #

Triyards

Yangzijiang

Sembcorp Ind

DBS

Keppel Corp

Ezion

Sabana REIT

OCBC

Bumitama

Wilmar

3.3

8.5

9.2

9.5

9.5

9.8

10.0

10.4

10.6

11.9

Noble

OUE Ltd

Genting HK US$

Wing Tai

Yuexiu Prop

HKLand US$

Perennial Hldgs

Yanlord

Ho Bee Land

Shang Asia 2kHK$

0.3

0.3

0.4

0.4

0.5

0.5

0.5

0.5

0.6

0.6

Citic Envirotech

Sinarmas

IHH

China Everbright

Japfa

Delfi

Bumitama

BukitSem

JSH 500US$

CityDev

Hist.

9.3

9.0

7.4

7.2

7.1

7.0

7.0

7.0

6.8

6.7

Hist.

0.3

0.4

0.4

0.6

0.6

0.7

0.7

0.8

0.9

0.9

Highest 90 days Volatility (%) #

Ezra

Nam Cheong

EzionHldg

Sembcorp Marine

GoldenAgri

Pacific Radiance

IndoAgri

CoscoCorp

Sembcorp Ind

Genting SP

Highest Market Cap (S$m) *

70.6

49.9

49.4

43.0

38.6

37.7

37.5

36.2

32.9

31.3

Lowest 90 days Volatility (%) #

OUE Ltd

SIA Engineering

Starhill Gbl

AscottREIT

Kep REIT

CACHE

Frasers HTrust

DBS

Venture

SIA

SingTel

JMH 400US$

JSH 500US$

PRU 500 US$

DBS

OCBC Bk

UOB

THBEV

HKLand US$

Wilmar

66,643.8

57,020.9

45,882.2

45,133.3

39,010.1

36,066.1

29,476.2

25,988.8

20,358.4

19,786.5

Lowest Market Cap (S$m) *

12.0

13.1

13.6

13.6

14.2

14.8

15.2

15.6

16.1

16.5

Oxley

Far East HTrust

Bumitama

CWT

China Aviation

OUE HT

BukitSem

CapitaRChina

SIIC Environment

ARA

1,149.8

1,151.1

1,230.3

1,260.6

1,264.6

1,301.9

1,302.3

1,304.3

1,308.9

1,316.4

# Based on UOB Kay Hians universe

* Based on top 100 companies by market cap

Source: Bloomberg, UOB Kay Hian

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Performance At A Glance*

Company

---------- Price (S$) ---------29/7/16

30/6/16

--------------------- % Change --------------------mom

yoy

ytd

AVIATION

SIA

SIA Engg

SATS

ST Engrg

Sector

10.66

3.68

4.11

3.15

10.98

3.70

4.37

3.29

3.0

0.5

6.3

4.4

3.6

2.2

2.5

16.2

0.3

3.5

(2.0)

0.0

13.8

9.3

3.9

FINANCE

DBS

OCBC

S'pore Exchange @

UOB@

Sector

15.76

8.69

7.62

18.42

15.41

8.60

7.53

18.2

(2.2)

(1.0)

(1.2)

(1.2)

(1.5)

(23.6)

(16.4)

(5.5)

(18.0)

(18.8)

(7.7)

(2.3)

(2.2)

(7.2)

(5.5)

2.20

1.51

2.23

1.575

1.4

4.3

1.7

4.7

(1.4)

3.9

5.7

13.6

6.7

HEALTHCARE

IHH

Raffles Medical

Sector

LAND TRANSPORT

ComfortDelGro

SMRT

Sector

MEDIA

SPH

Sector

OIL SERVICES

Ezion

Ezra

Nam Cheong

Pacific Radiance

Triyards

Sector

2.75

1.505

2.82

1.63

2.5

8.3

4.2

(6.3)

17.7

(0.4)

(7.5)

8.3

(3.4)

3.95

3.78

(4.3)

(4.3)

(9.6)

(9.6)

(4.1)

(4.1)

0.47

0.073

0.077

0.25

0.385

0.30

0.05

0.067

0.21

0.34

(36.2)

(31.5)

(13.0)

(16.0)

(11.7)

(29.3)

(60.8)

(62.7)

(70.9)

(48.1)

(16.0)

(59.4)

(44.4)

(49.5)

(50.4)

(32.3)

(23.6)

(43.2)

Company

---------- Price (S$) ---------30/6/16

29/7/16

--------------------- % % Change --------------------mom

yoy

ytd

PLANTATION

Bumitama

FirstRes

GoldenAgri

IndoAgri

Wilmar

Sector

0.765

1.565

0.35

0.48

3.26

0.7

1.615

0.36

0.46

3.09

(8.5)

3.2

2.9

(4.2)

(5.2)

(3.2)

(24.3)

(15.0)

14.3

(21.4)

(3.4)

(2.7)

(0.7)

(15.9)

5.9

(6.1)

5.1

2.6

PROPERTY

CapitaLand

City Devt

GuocoLand

Ho Bee Land

OUE

Wing Tai

Sector

3.07

8.14

1.85

2.12

1.54

1.63

3.17

8.51

1.87

2.21

1.50

1.74

3.3

4.5

1.1

4.2

(2.6)

6.7

3.3

(1.6)

(8.8)

(18.3)

10.0

(22.5)

(7.7)

(6.2)

(5.4)

11.2

3.6

9.4

(16.2)

(0.9)

(0.3)

2.48

1.09

0.86

1.475

2.13

1.41

2.13

0.77

0.95

1.05

1.72

1.00

2.42

0.525

0.785

1.77

2.45

1.13

0.865

1.505

2.14

1.47

2.14

0.785

0.99

1.065

1.81

1.055

2.55

0.53

0.80

1.67

(1.2)

3.7

0.6

2.0

0.5

4.3

0.5

1.9

4.2

1.4

5.2

5.5

5.4

1.0

1.9

(5.6)

1.1

1.3

(9.6)

(19.9)

5.6

7.0

(5.8)

3.9

(4.3)

11.2

(0.9)

18.7

(5.0)

4.9

(35.8)

(8.0)

(2.1)

1.1

7.5

(4.6)

(4.9)

11.5

10.9

10.9

16.0

4.7

11.2

14.5

19.1

6.6

9.4

(25.9)

6.0

7.7

9.0

REITS

Ascendasreit

Ascott REIT

CACHE

CapitaCom Trust

CapitaMall Trust

CDL Htrust

FrasersCT

Frasers HTrust

Frasers Logistic Trust

Kep REIT

MapletreeInd

MapletreeLog

PLife REIT

Sabana REIT

Starhill Gbl

Suntec REIT

Sector

10

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Performance At A Glance*

Company

SHIPPING

NOL

Sector

----------Price (S$)---------29/7/16

30/6/16

--------------------- % Change --------------------mom

yoy

ytd

1.30

1.30

0.0

0.0

39.8

39.8

5.7

5.7

0.30

5.50

2.82

1.55

0.895

0.29

5.25

2.77

1.41

0.87

(3.3)

(4.5)

(1.8)

(9.0)

(2.8)

(4.3)

(25.6)

(30.0)

(22.4)

(46.0)

(32.6)

(31.5)

(37.0)

(19.4)

(9.2)

(19.4)

(20.9)

(18.2)

TECHNOLOGY

Venture Corp

Sector

8.28

8.90

7.5

7.5

13.4

13.4

8.5

8.5

TELECOMS

M1

SingTel

StarHub

Sector

2.73

4.13

3.79

2.62

4.18

3.92

(4.0)

1.2

3.4

1.2

(16.3)

2.2

2.3

1.5

(3.7)

13.9

5.9

12.5

SHIPYARD

COSCO Corp

Keppel Corp

Sembcorp Ind

Sembcorp Marine

Yangzijiang

Sector

Company

OTHERS

Genting HK US$

Genting SP

SingPost

SuperGroup

Sector

OVERALL

---------- Price (S$) ---------30/6/16

29/7/16

0.29

0.725

1.47

0.825

0.275

0.785

1.435

0.805

--------------------- % % Change --------------------mom

yoy

ytd

(5.2)

8.3

(2.4)

(2.4)

3.3

(19.1)

(10.8)

(26.6)

(19.9)

(16.1)

(14.1)

1.9

(12.5)

(4.2)

(4.1)

(0.0)

(9.2)

0.6

11

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Performance At A Glance*

Aviation

Finance

(31Dec15=100)

110

Healthcare

(31Dec15=100)

110

(31Dec15=100)

105

Aviation

105

100

100

95

FSSTI

95

85

85

80

Jan

Feb

Mar

Apr

May

Jun

Jul

90

85

Jan

Feb

Mar

Land Transport

Apr

May

Jun

Jul

105

FSSTI

Media

100

95

95

FSSTI

Land Transport

90

85

85

Jan

Feb

Mar

Apr

May

Feb

Mar

Jun

Jul

Jan

Feb

Mar

Apr

Apr

May

Jun

Jul

Oil Services

(31Dec15=100)

110

90

Jan

Media

(31Dec15=100)

105

100

FSSTI

95

Finance

90

90

Healthcare

105

FSSTI

100

May

Jun

Jul

(31Dec15=100)

105

100

95

90

85

80

75

70

65

60

55

Jan

Feb

FSSTI

Oil Services

Mar

Apr

May

Jun

Jul

12

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Performance At A Glance*

Plantation

Property

REITs

(31Dec15=100)

115

(31Dec15=100)

105

(31Dec15=100)

125

120

REITs

110

Plantation

115

100

105

110

105

95

100

Property

100

95

95

FSSTI

90

FSSTI

90

90

FSSTI

85

Jan

Feb

Mar

Apr

May

Jun

Jul

85

85

Jan

Feb

Mar

Shipyard

Apr

May

Jun

Jan

Jul

Feb

Mar

Technology

FSSTI

100

110

80

100

105

95

100

FSSTI

Shipyard

70

Feb

Mar

Apr

May

Jun

Jul

Jun

Jul

FSSTI

90

85

85

Jan

Telecoms

95

90

75

Jul

115

Technology

95

85

Jun

(31Dec15=100)

120

105

90

May

Telecoms

(31Dec15=100)

110

(31Dec15=100)

105

Apr

Jan

Feb

Mar

Apr

May

Jun

Jul

Jan

Feb

Mar

Apr

May

13

S i n g a p o r e

C o r p o r a t e

G u i d e

A ug u st 20 16

Performance At A Glance*

Others

(31Dec15=100)

105

FSSTI

100

95

90

Others

85

80

Jan

Feb

Mar

Apr

May

Jun

Jul

* Based on UOB Kay Hians universe

14

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Diary Of Events

Sunday

Monday

1

Tuesday

StarHub 2Q16*

11

DBS 2Q16*

SMRT 1Q17*

15

Jun 16 Retail Sales

16

17

Friday

5

4

CapitaLand 2q16*

Geinting Spore 2Q16*

SingPost 2Q16*

11

National Day

14

Thursday

2

SCI 2Q16*

Wednesday

City Devt 2Q16*

Ezion 2Q16*

Singapore O&G 2Q16*

Singtel 1Q17*

Super Group 2Q16*

Wilmar 2Q16*

18

Saturday

6

Cosco 2Q16*

Yangzijiang 2Q16*

Venture 2Q16

12

13

ComfortDelgro 2Q16*

GGR 2Q16*

Ho Bee Land 2Q16*

ST Engrg 2Q16*

Nam Cheong 2Q16

Bumitama 2Q16

First Resources 2Q16

Wing Tai 2Q16

19

20

Jul 16 NODX

15

S i n g a p o r e

C o r p o r a t e

A ug u st 20 16

G u i d e

Diary Of Events

Sunday

21

Monday

22

Tuesday

23

Wednesday

24

Jul 16 CPI

28

29

30

Thursday

25

Friday

26

Saturday

27

Jul 16 IPI

IHH 2Q16

Guocoland FY16

31

Jul 16 Money Supply

* Confirmed

16

S i n g a p o r e

C o r p o r a t e

G u i d e

A ug u st 20 16

Disclosures/Disclaimers

This report is prepared by UOB Kay Hian Private Limited (UOBKH), which is a holder of a capital markets services licence and an exempt financial adviser in Singapore.

This report is provided for information only and is not an offer or a solicitation to deal in securities or to enter into any legal relations, nor an advice or a recommendation with respect to such securities.

This report is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the particular needs of any recipient hereof. Advice should be sought

from a financial adviser regarding the suitability of the investment product, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the

recommendation, before the person makes a commitment to purchase the investment product.

This report is confidential. This report may not be published, circulated, reproduced or distributed in whole or in part by any recipient of this report to any other person without the prior written consent of

UOBKH. This report is not directed to or intended for distribution to or use by any person or any entity who is a citizen or resident of or located in any locality, state, country or any other jurisdiction as

UOBKH may determine in its absolute discretion, where the distribution, publication, availability or use of this report would be contrary to applicable law or would subject UOBKH and its connected persons

(as defined in the Financial Advisers Act, Chapter 110 of Singapore) to any registration, licensing or other requirements within such jurisdiction.

The information or views in the report (Information) has been obtained or derived from sources believed by UOBKH to be reliable. However, UOBKH makes no representation as to the accuracy or

completeness of such sources or the Information and UOBKH accepts no liability whatsoever for any loss or damage arising from the use of or reliance on the Information. UOBKH and its connected

persons may have issued other reports expressing views different from the Information and all views expressed in all reports of UOBKH and its connected persons are subject to change without notice.

UOBKH reserves the right to act upon or use the Information at any time, including before its publication herein.

Except as otherwise indicated below, (1) UOBKH, its connected persons and its officers, employees and representatives may, to the extent permitted by law, transact with, perform or provide broking,

underwriting, corporate finance-related or other services for or solicit business from, the subject corporation(s) referred to in this report; (2) UOBKH, its connected persons and its officers, employees and

representatives may also, to the extent permitted by law, transact with, perform or provide broking or other services for or solicit business from, other persons in respect of dealings in the securities

referred to in this report or other investments related thereto; (3) the officers, employees and representatives of UOBKH may also serve on the board of directors or in trustee positions with the subject

corporation(s) referred to in this report. (All of the foregoing is hereafter referred to as the Subject Business); and (4) UOBKH may otherwise have an interest (including a proprietary interest) in the

subject corporation(s) referred to in this report.

As of the date of this report, no analyst responsible for any of the content in this report has any proprietary position or material interest in the securities of the corporation(s) which are referred to in the

content they respectively author or are otherwise responsible for.

17

S i n g a p o r e

C o r p o r a t e

G u i d e

A ug u st 20 16

IMPORTANT DISCLOSURES FOR U.S. PERSONS

This research report was prepared by UOBKH, a company authorized, as noted above, to engage in securities activities in Singapore. UOBKH is not a registered broker-dealer in the United States and,

therefore, is not subject to U.S. rules regarding the preparation of research reports and the independence of research analysts. This research report is provided for distribution by UOBKH (whether directly

or through its US registered broker dealer affiliate named below) to major U.S. institutional investors in reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange

Act of 1934, as amended (the Exchange Act). All US persons that receive this document by way of distribution from or which they regard as being from UOBKH by their acceptance thereof represent

and agree that they are a major institutional investor and understand the risks involved in executing transactions in securities.

Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on the information provided in this research report should do so

only through UOB Kay Hian (U.S.) Inc (UOBKHUS), a registered broker-dealer in the United States. Under no circumstances should any recipient of this research report effect any transaction to buy or

sell securities or related financial instruments through UOBKH.

UOBKHUS accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is delivered to and intended to be received by a U.S. person other than a

major U.S. institutional investor.

The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry Regulatory Authority (FINRA) and may not be an associated person

of UOBKHUS and, therefore, may not be subject to applicable restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a research

analyst account.

Analyst Certification/Regulation AC

Each research analyst of UOBKH who produced this report hereby certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject corporation(s) and

securities in this report; (2) the report was produced independently by him/her; (3) he/she does not carry out, whether for himself/herself or on behalf of UOBKH or any other person, any of the Subject

Business involving any of the subject corporation(s) or securities referred to in this report; and (4) he/she has not received and will not receive any compensation that is directly or indirectly related or

linked to the recommendations or views expressed in this report or to any sales, trading, dealing or corporate finance advisory services or transaction in respect of the securities in this report. However, the

compensation received by each such research analyst is based upon various factors, including UOBKHs total revenues, a portion of which are generated from UOBKHs business of dealing in securities.

18

S i n g a p o r e

C o r p o r a t e

G u i d e

A ug u st 20 16

Reports are distributed in the respective countries by the respective entities and are subject to the additional restrictions listed in the following table.

General

This report is not intended for distribution, publication to or use by any person or entity who is a citizen or resident of or located in any country or jurisdiction where the distribution,

publication or use of this report would be contrary to applicable law or regulation.

Hong Kong

This report is distributed in Hong Kong by UOB Kay Hian (Hong Kong) Limited ("UOBKHHK"), which is regulated by the Securities and Futures Commission of Hong Kong.

Neither the analyst(s) preparing this report nor his associate, has trading and financial interest and relevant relationship specified under Para. 16.4 of Code of Conduct in the

listed corporation covered in this report. UOBKHHK does not have financial interests and business relationship specified under Para. 16.5 of Code of Conduct with the listed

corporation covered in this report. Where the report is distributed in Hong Kong and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKHHK (and not the relevant foreign research house) in Hong Kong in respect of any matters arising from, or in

connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Hong Kong who is not a professional investor, or institutional investor,

UOBKHHK accepts legal responsibility for the contents of the analyses or reports only to the extent required by law.

Indonesia

This report is distributed in Indonesia by PT UOB Kay Hian Securities, which is regulated by Financial Services Authority of Indonesia (OJK). Where the report is distributed in

Indonesia and contains research analyses or reports from a foreign research house, please note recipients of the analyses or reports are to contact PT UOBKH (and not the

relevant foreign research house) in Indonesia in respect of any matters arising from, or in connection with, the analysis or report.

Malaysia

Where the report is distributed in Malaysia and contains research analyses or reports from a foreign research house, the recipients of the analyses or reports are to contact

UOBKHM (and not the relevant foreign research house) in Malaysia, at +603-21471988, in respect of any matters arising from, or in connection with, the analysis or report as

UOBKHM is the registered person under CMSA to distribute any research analyses in Malaysia.

Singapore

This report is distributed in Singapore by UOB Kay Hian Private Limited ("UOBKH"), which is a holder of a capital markets services licence and an exempt financial adviser

regulated by the Monetary Authority of Singapore.Where the report is distributed in Singapore and contains research analyses or reports from a foreign research house, please

note:

(i) recipients of the analyses or reports are to contact UOBKH (and not the relevant foreign research house) in Singapore in respect of any matters arising from, or in connection

with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore who is not an accredited investor, expert investor or

institutional investor, UOBKH accepts legal responsibility for the contents of the analyses or reports only to the extent required by law.

Thailand

This report is distributed in Thailand by UOB Kay Hian Securities (Thailand) Public Company Limited, which is regulated by the Securities and Exchange Commission of Thailand.

United Kingdom

This report is being distributed in the UK by UOB Kay Hian (U.K.) Limited, which is an authorised person in the meaning of the Financial Services and Markets Act and is

regulated by The Financial Conduct Authority. Research distributed in the UK is intended only for institutional clients.

United States of

This report cannot be distributed into the U.S. or to any U.S. person or entity except in compliance with applicable U.S. laws and regulations. It is being distributed in the U.S. by

America (U.S.)

UOB Kay Hian (US) Inc, which accepts responsibility for its contents. Any U.S. person or entity receiving this report and wishing to effect transactions in any securities referred to

in the report should contact UOB Kay Hian (US) Inc. directly.

Copyright 2016, UOB Kay Hian Pte Ltd. All rights reserved.

http://research.uobkayhian.com

RCB Regn. No. 197000447W

19

You might also like

- 12011CaseWatch - UK Supreme Court - Expert Witnesses May Be Sued For NegligenceDocument5 pages12011CaseWatch - UK Supreme Court - Expert Witnesses May Be Sued For Negligencetth28288969No ratings yet

- 1exposure of The Bad ExpertDocument6 pages1exposure of The Bad Experttth28288969No ratings yet

- Expert Evidence-Overview - Lexis® Practical Guidance, Practical Guidan..Document1 pageExpert Evidence-Overview - Lexis® Practical Guidance, Practical Guidan..tth28288969No ratings yet

- VintageChart 1970-2015Document2 pagesVintageChart 1970-2015tth28288969No ratings yet

- SMart-material NCE JAN 17Document17 pagesSMart-material NCE JAN 17tth28288969No ratings yet

- Who Is An Expert Witness and How To Use... N Singapore - SingaporeLegalAdviceDocument4 pagesWho Is An Expert Witness and How To Use... N Singapore - SingaporeLegalAdvicetth28288969No ratings yet

- Staying Non-Partisan - The Duty of An Expert - The Singapore Law GazetteDocument6 pagesStaying Non-Partisan - The Duty of An Expert - The Singapore Law Gazettetth28288969No ratings yet

- Professionalism 1Document4 pagesProfessionalism 1tth28288969No ratings yet

- Rules of CourtDocument5 pagesRules of Courttth28288969No ratings yet

- Professionalism 2Document4 pagesProfessionalism 2tth28288969No ratings yet

- Has No Major Impact On Singapore'S Construction ProductivityDocument4 pagesHas No Major Impact On Singapore'S Construction Productivitytth28288969No ratings yet

- SG26 Fine-and-Rare-Wines 03112019 Web 1p PDFDocument118 pagesSG26 Fine-and-Rare-Wines 03112019 Web 1p PDFtth28288969No ratings yet

- Bren 14 00005Document26 pagesBren 14 00005tth28288969No ratings yet

- Jcien 15 00050Document7 pagesJcien 15 00050tth28288969No ratings yet

- Market Outlook & Strategy: Singapore Corporate GuideDocument19 pagesMarket Outlook & Strategy: Singapore Corporate Guidetth28288969No ratings yet

- Corporate Guide - Malaysia, August 2016Document40 pagesCorporate Guide - Malaysia, August 2016tth28288969No ratings yet

- A-Frame Rocker Bearing Replacement at Humber Bridge, UK: Volume 169 Issue CE3Document8 pagesA-Frame Rocker Bearing Replacement at Humber Bridge, UK: Volume 169 Issue CE3tth28288969No ratings yet

- Coma 15 00014Document13 pagesComa 15 00014tth28288969No ratings yet

- MGI Reinventing Construction Executive Summary PDFDocument20 pagesMGI Reinventing Construction Executive Summary PDFtth28288969No ratings yet

- Cien 14 00063Document9 pagesCien 14 00063tth28288969No ratings yet

- Bren 13 00032Document17 pagesBren 13 00032tth28288969No ratings yet

- A Review of Satellite Positioning Systems For Civil EngineeringDocument8 pagesA Review of Satellite Positioning Systems For Civil Engineeringtth28288969No ratings yet

- Bren 12 00017Document12 pagesBren 12 00017tth28288969No ratings yet

- Bridging Global Infrastructure Gaps Full Report June 2016 PDFDocument60 pagesBridging Global Infrastructure Gaps Full Report June 2016 PDFtth28288969No ratings yet

- Civil Engineering Issue Ce3Document52 pagesCivil Engineering Issue Ce3tth28288969100% (2)

- Durability Assessment of Building SystemsDocument10 pagesDurability Assessment of Building Systemstth28288969No ratings yet

- Corporate Guide - Malaysia, August 2016 PDFDocument40 pagesCorporate Guide - Malaysia, August 2016 PDFtth28288969No ratings yet

- Discover Happiness in BhutanDocument2 pagesDiscover Happiness in Bhutantth28288969No ratings yet

- Corporate Guide - Singapore, September 2015Document18 pagesCorporate Guide - Singapore, September 2015tth28288969No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)