Professional Documents

Culture Documents

PARTNERSHIP - First Outline - Page 1-3

Uploaded by

EsraRamosCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PARTNERSHIP - First Outline - Page 1-3

Uploaded by

EsraRamosCopyright:

Available Formats

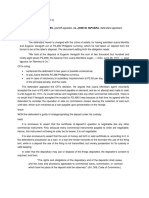

PARTNERSHIP

I.

INTRODUCTION

A. Sources of Philippine Law on Partnership

1. Code of commerce (arts. 116-238) commercial and mercantile

partnerships dealt with mercantile transactions

2. Old Spanish civil code (arts. 1665 1708) non-commercial or civil

partnership engaged in civil purposes; difference was in the

desired purpose not the manner of organization

3. New civil code (title IX, arts. 1767 1867) no more distinction

between commercial and civil partnership; governs all transactions

of all partnership, whether the object be civil or mercantile

a. Uniform partnership act (source of arts. 1769, 1774, 1785, 1805

to 1907, 1809, 1810 to 1814, 1819 to 1826)

b. Uniform limited partnership act

II.

NATURE AND CHARACTERISTICS

A. Concept art. 1767, 1 st par., CC established by a contract but the

law fixes the conditions under which it shall operate once so

established.

- Belo vs CA and Anay, 342 SCRA 20 (2000)

- Torres vs CA, 320 SCRA 428 (1999)

- Lim Tong Lim vs Phil. Fishing Gear Ind., Inc., 317 SCRA 728

(1999)

B. Partnership as a contract art 1769

1. Essential elements and characteristics (i) mutual contribution to

a common stock; (ii) joint interest in the profits; sec 22 (b); 27

(a), National Internal Revenue Code

- Jarantilla, Jr. vs Jarantilla, 636 SCRA 299 (2010)

- Heirs of Jose Lim vs. Juliet Villa Lim, 614 SCRA 141 (2010)

- Philex mining corp. vs. comm. Of internal revenue, 551 SCRA

183

- Santos vs spouses reyes, GR No. 135813, October 25, 2001

- Tocao vs CA, 365 SCRA 463 (2001) (MR)

- AFISCO insurance corp. vs. CA, 302 SCRA 1 (1999(

- Evangelista vs. Coll. Of internal revenue, 102 Phil. 140 (1957)

- Yulo vs yanh chiao seng, 106 Phil. 111 (1959)

a. Requires fulfillment of the essential requisites of contracts

art. 1318

i.

Consent and capacity of the contracting parties art

1327; 1329; 1782; 87; 73; art 234 family code; art 34

revise penal code; rules 93-94 rules of court

- A corporation Is without capacity or power to enter into a

contract of partnership because but may enter into a joint

venture

- Mendiola vs CA, 497 SCRA 346 (2006)

- J.M. tuason & co. vs bolanos, 95 Phil. 106 [1954]

- Aurbach vs sanitary wares, 180 SCRA 130 [1989]

ii.

Object certain or lawful subject matter arts. 1306;

1347 to 1349; 1409; 1770; - the pursuit of a particular

business for profit; except where the law requires a

specific form of business

organization, such as

banking or insurance which only corporations can

undertake.

Deluao vs. Casteel, 26 SCRA 475 [1968]

Arbes vs Polistico, 53 Phil. 489 [1929]

Fernandez vs de la Rosa, 1 Phil 671 [1906]

iii.

Cause of obligation art 1350 for each contracting

party, the prestation or promise of a thing or service

by the other; the undertaking of the other to

contribute money, property or industry.

1. Distinction from other business relations and

organizations

a. Joint venture

Realubit vs Jaso, 658 SCRA 146 [2011]

Primelink properties and devt. corp. vs. lazatin-magat, 493

SCRA 444 [2006]

Heirs of Tan Eng Kee vs Ca and Benguet Lumber Co., 341 SCRA

740 (2000);

Sevilla vs CA, 160 SCRA 171 (1988)

b. Joint accounts Bourns vs Carman, 7 Phil 117

(1906);

Dietrich vs freeman 18 Phil. 341 (1911) cuentas en

participacion art 239, code of commerce; no business name;

business transacted by only one partner; liquidation and

accounting is prerogative of manager

c. Agency Biglangawa vs Constantino, 109 Phil

172 (1960)

d. Corporation

i.

Manner of creation art 1787 vs sec 2,

corp. code

ii.

Number of incorporators art. 1767 vs

sec. 10, corp. code

iii.

Start of existence art 1784vs sec 19,

corp. code

iv.

Powers art 1306 vs sec 2, 36, corp. code

v.

Name art 1844 (1, a) vs. Sec. 18, Corp.

code

vi.

Term of existence art 1767 vs Sec.

11,Corp. code

vii.

Liability to 3rd parties art 1816, 1822

1824 vs Sec. 64, 37, Corp. Code

viii.

Transferability of interest art 1767,

1804, vs Sec. 63, Corp. code

ix.

Management art 1803 vs Sec. 23, Corp.

code

x.

Dissolution art. 1830 (1) (2) vs sec. 117122, Corp. Code

xi.

Governing law civil code vs. corporation

code

e. Art. 1769

Ona vs CIR, 45 SCRA 24 (1972);

Reyes vs CIR, 24 SCRA 198;

Obillos vs CIR, 139 SCRA 436;

Sardane vs CA, 167 SCRA 524;

C. Legal personality of Partnership art. 1768, 1771

1. In general Art. 1772 Effect of non-compliance partnership

still a juridical person; art. 1772 (1) is not a prerequisite for

acquiring juridical personality, but merely as a condition for the

issuance of licenses to engage in business;

- Litonjua Jr. vs. Litonjua Sr., 477 SCRA 576 (2005)

- Aguilar Jr. vs. CA, 319 SCRA 246 (1999)

- Sunga vs Chua, GR No. 143340, august 15, 2001

2. Consequence of legal personality art 51, 46;

- Campos rueda & Co., vs. pacific comm. Co., 44 Phil. 916 (1922)

3. When no juridical personality acquired art. 1773 and 1775

4. Securities and exchange commission (SEC) information relating

to partnership registration/ monitoring

III.

CLASSES AND KINDS OF PARTNERSHIP AND PARTNERS

A. As to object art 1776

1. Universal partnership art. 1777

- Present property art 1778; 1779

- Profits art. 1780, 1st par.

- Presumption when kind of universal partnership not specified

art. 1781; 1378

- Disqualified from universal partnership art. 1782; 133; 739

universal partnership is almost a donation; prohibits indirect act

of donation.

- Commissioner of internal revenue vs. Suter, 27 SCRA 152 (1969)

2. Particular partnership art. 1783 limited and well-defined, single,

temporary undertaking

B. As to liability of partners

1. General partnership art 1816 personally liable pro rata and

subsidiarily; arts. 1822 1824 solidarily

General professional partnership art 1767, par. 2; sec. 22 (B),

NIRC

- Tan vs. Del Rosario, Jr., 237 SCRA 324

2. Limited partnership art 1843 limited to capital contribution

C. As to duration

1. Partnership with a fixed term art 1785

2. Partnership for a particular undertaking

3. Partnership at will Ortega vs. CA, 245 SCRA 529

IV.

KINDS OF PARTNERS

A. Definitions

1. General and limited partners art 1843; 1844; 1816 based on

liability

2. Capitalist and industrial partners art 1767; 1789 - - based on

contribution

3. Ostensible, nominal, and dormant partners art 1834 (2); - partner

by estoppel based on degree of connection to partnership

4. Original and incoming partners based on time of joining

partnership

5. Managing partner art 1800 based on duties; art 1818, par. 3

6. Liquidating partner art 1836

You might also like

- No. 77 & 79Document2 pagesNo. 77 & 79EsraRamosNo ratings yet

- Wills 6th SetDocument11 pagesWills 6th SetEsraRamosNo ratings yet

- Assignment For Thursday - Wills - Last Set of CasesDocument20 pagesAssignment For Thursday - Wills - Last Set of CasesEsraRamosNo ratings yet

- Diaz Et Al vs. IACDocument1 pageDiaz Et Al vs. IACEsraRamosNo ratings yet

- 1st and 2nd SetDocument8 pages1st and 2nd SetEsraRamosNo ratings yet

- 3rd SetDocument21 pages3rd SetEsraRamosNo ratings yet

- Bicomong Vs AlmanzaDocument2 pagesBicomong Vs AlmanzaEsraRamosNo ratings yet

- Del Rosario Vs ConananDocument2 pagesDel Rosario Vs ConananEsraRamosNo ratings yet

- Ram Part - Page 12 & 13Document52 pagesRam Part - Page 12 & 13EsraRamosNo ratings yet

- Page 12 Agency CompleteDocument109 pagesPage 12 Agency CompleteEsraRamosNo ratings yet

- 81 Banawa Vs MiranoDocument2 pages81 Banawa Vs MiranoChezca MargretNo ratings yet

- Ram 1st 3 PagesDocument39 pagesRam 1st 3 PagesEsraRamosNo ratings yet

- Ram 1st 3 PagesDocument38 pagesRam 1st 3 PagesEsraRamosNo ratings yet

- 4th SetDocument10 pages4th SetEsraRamosNo ratings yet

- Trust - 1st HW - 5th PartDocument8 pagesTrust - 1st HW - 5th PartEsraRamosNo ratings yet

- PARTNERSHIP - Fifth Outline - Page 8-9Document1 pagePARTNERSHIP - Fifth Outline - Page 8-9EsraRamosNo ratings yet

- Trust - 2nd HW - 5th PartDocument7 pagesTrust - 2nd HW - 5th PartEsraRamosNo ratings yet

- Page 12 Agency CompleteDocument109 pagesPage 12 Agency CompleteEsraRamosNo ratings yet

- Consolidated Page 17-18 - TRUST - Without 6th PartDocument58 pagesConsolidated Page 17-18 - TRUST - Without 6th PartEsraRamosNo ratings yet

- Partnership 2nd Part of Consolidation (Luis)Document41 pagesPartnership 2nd Part of Consolidation (Luis)EsraRamosNo ratings yet

- PARTNERSHIP - Third Outline - Page 7Document1 pagePARTNERSHIP - Third Outline - Page 7EsraRamosNo ratings yet

- Consolidated Page 16 CompleteDocument97 pagesConsolidated Page 16 CompleteEsraRamosNo ratings yet

- Page 16 - 4th Part - TrustDocument16 pagesPage 16 - 4th Part - TrustEsraRamosNo ratings yet

- PARTNERSHIP - Fourth Outline - Page 8Document2 pagesPARTNERSHIP - Fourth Outline - Page 8EsraRamosNo ratings yet

- PARTNERSHIP - 2nd Outline - Page 4-6Document4 pagesPARTNERSHIP - 2nd Outline - Page 4-6EsraRamosNo ratings yet

- Consolidation of 1st 3 Pages of Pat Syllbaus (Without The 4th Part)Document186 pagesConsolidation of 1st 3 Pages of Pat Syllbaus (Without The 4th Part)EsraRamosNo ratings yet

- Consolidated Page 17-18 - Trust - CompleteDocument68 pagesConsolidated Page 17-18 - Trust - CompleteEsraRamosNo ratings yet

- Agency Part 1 ConsolidatedDocument67 pagesAgency Part 1 ConsolidatedEsraRamosNo ratings yet

- Docslide - Us Partnership Goquiolay V SycipDocument3 pagesDocslide - Us Partnership Goquiolay V SycipEsraRamosNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Legal Aspects of BusinessDocument297 pagesLegal Aspects of BusinessKARTHIKNo ratings yet

- Difference Between Codes & StandardsDocument2 pagesDifference Between Codes & StandardsAnil KulkarniNo ratings yet

- An Overview of Major Laws Affecting BusinessDocument5 pagesAn Overview of Major Laws Affecting BusinessSharwan SinghNo ratings yet

- Deduction of Income Tax from NRIs under Life Insurance PoliciesDocument15 pagesDeduction of Income Tax from NRIs under Life Insurance PoliciesBGMI NEW 3100% (1)

- Rules of Professional ConductDocument185 pagesRules of Professional ConductMichelle SchultzNo ratings yet

- View Completed FormsDocument8 pagesView Completed FormsDragos PopaNo ratings yet

- Cabales Vs CADocument8 pagesCabales Vs CAAr Yan SebNo ratings yet

- Combined Profit of Home Office and BranchDocument59 pagesCombined Profit of Home Office and BranchAllecks Juel LuchanaNo ratings yet

- Promoters of A CompanyDocument18 pagesPromoters of A CompanykritiNo ratings yet

- Tanada VS. Angara, 272 Scra 18 Declaration of Principles Not Self-ExecutingDocument5 pagesTanada VS. Angara, 272 Scra 18 Declaration of Principles Not Self-ExecutingMark TeaNo ratings yet

- Global Sales and Contract Law PDFDriveDocument2,114 pagesGlobal Sales and Contract Law PDFDriveAamir Sultan100% (1)

- Tony Elumelu Foundation Entrepreneurship ProgrammeDocument8 pagesTony Elumelu Foundation Entrepreneurship ProgrammeTumwine Kahweza ProsperNo ratings yet

- ALDOT Cooper BriefDocument51 pagesALDOT Cooper BriefErica ThomasNo ratings yet

- Pryda Catalogue September 2010Document34 pagesPryda Catalogue September 2010damianamesNo ratings yet

- Obli MidtermDocument5 pagesObli MidtermMyco MemoNo ratings yet

- 00 Digest - Evidence (121019)Document156 pages00 Digest - Evidence (121019)gieeNo ratings yet

- WorldNomads Travel Insurance GuideDocument28 pagesWorldNomads Travel Insurance Guide6778HUNNo ratings yet

- Guilty of Estafa for Misappropriating DepositDocument3 pagesGuilty of Estafa for Misappropriating DepositRalph Christian Lusanta FuentesNo ratings yet

- Complete With DocuSign Authority 2pdf ContDocument131 pagesComplete With DocuSign Authority 2pdf ContThomas LangfordNo ratings yet

- QS - Civil Engineering PDFDocument49 pagesQS - Civil Engineering PDFAsif RazaNo ratings yet

- Ups Technology AgreementDocument18 pagesUps Technology AgreementKrystle PendletonNo ratings yet

- Versus: Efore Anjiv HannaDocument6 pagesVersus: Efore Anjiv HannaSai VijitendraNo ratings yet

- Rights of the Holder in Due Course (Sec. 51-59Document6 pagesRights of the Holder in Due Course (Sec. 51-59Kris Zyl Faith LaiNo ratings yet

- Steel Authority of India Limited Bhilai Steel Plant: 7.0 MT Expansion of BSPDocument32 pagesSteel Authority of India Limited Bhilai Steel Plant: 7.0 MT Expansion of BSPmecon bhilaiNo ratings yet

- Difference Between Tort, Crime, Contracf and Breach of TrustDocument4 pagesDifference Between Tort, Crime, Contracf and Breach of TrustSona SharmaNo ratings yet

- Duguit Law in TH Modern State PDFDocument304 pagesDuguit Law in TH Modern State PDFCristobal FloresNo ratings yet

- CORRIGENDUM - 1 (Query & Reply) : Agency-1Document62 pagesCORRIGENDUM - 1 (Query & Reply) : Agency-1John Son GNo ratings yet

- 8 Villa Rey Transit Inc vs. FerrerDocument2 pages8 Villa Rey Transit Inc vs. FerrerRamon EldonoNo ratings yet

- Mergal k14 (2016) (Thailandia)Document4 pagesMergal k14 (2016) (Thailandia)Juan José Saavedra VargasNo ratings yet

- DCPS Chief Procurement Officer Position Description 7-22-09Document5 pagesDCPS Chief Procurement Officer Position Description 7-22-09api-15105945No ratings yet