Professional Documents

Culture Documents

CBO Analysis HR 3762

Uploaded by

iggybauCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBO Analysis HR 3762

Uploaded by

iggybauCopyright:

Available Formats

CONGRESSIONAL BUDGET OFFICE

U.S. Congress

Washington, DC 20515

Keith Hall, Director

December 11, 2015

Honorable Mike Enzi

Chairman

Committee on the Budget

United States Senate

Washington, DC 20510

Re: Budgetary Effects of H.R. 3762, the Restoring Americans Healthcare Freedom

Reconciliation Act, as Passed by the Senate on December 3, 2015

Dear Mr. Chairman:

At your request (and that of Chairman Tom Price, M.D.), CBO and the staff of the Joint

Committee on Taxation (JCT) have estimated the budgetary effects of H.R. 3762, the

Restoring Americans Healthcare Freedom Reconciliation Act, as passed by the Senate.

CBO and JCT estimate that enacting H.R. 3762 would decrease deficits by about

$474 billion over the 20162025 period.

That estimate includes two components: Excluding macroeconomic feedback effects, the

act would reduce deficits by about $282 billion. In addition, the changes in economic

output and other macroeconomic variables that would result from enacting the legislation

would reduce deficits by about $193 billion, CBO and JCT estimate. The budgetary effects

of the act would result from changes to both direct spending and revenues. (CBO has not

estimated any effects this act might have on discretionary spending.)

The largest budgetary effects of enacting the legislation would stem from:

Repealing subsidies for health insurance coverage obtained through exchanges

beginning in 2018 and, prior to that year, eliminating the limitation on the amount

people would have to repay if the premium tax credit they receive during the year

exceeds the allowed amount based on their actual income;

Repealing the optional expansion of eligibility for Medicaid that was established in

the Affordable Care Act (ACA), beginning in 2018;

Eliminating penalties associated with the requirements that most people obtain

health insurance coverage and that large employers offer their employees health

insurance coverage that meets specified standards, while keeping those

requirements in place, beginning in 2016;

Honorable Mike Enzi

Page 2

Repealing the federal excise tax imposed on some health insurance plans with high

premiums; and

Repealing many of the provisions of the ACA that are estimated to increase federal

revenues (apart from the effect of the provisions related to insurance coverage).

Those with the most significant budgetary effects include the Hospital Insurance

payroll tax rate for high-income taxpayers, a surtax on those taxpayers net

investment income, and annual fees on health insurers.

Other parts of the legislation that affect the budget would:

Repeal reductions to state allotments for Medicaid payments to hospitals that treat a

disproportionate share of uninsured or low income patients;

Eliminate the Prevention and Public Health Fund and rescind any unobligated

balances of the fund;

Terminate the enhanced federal matching rate for personal care attendant services

and supports provided under the Community First Choice Act beginning in calendar

year 2018;

Increase the amount of funding authorized and appropriated to the Community

Health Center Fund and for grants to states to address substance abuse;

Prohibit federal funds from being made available, for one year, to certain entities

that provide abortions; and

Repeal a portion of the Medicaid funding provided to U.S. territories.

As required by the Concurrent Resolution on the Budget for Fiscal Year 2016, CBO and

JCT have assessed the effect of H.R. 3762 on long-term deficits and direct spending. Both

including and excluding macroeconomic feedback, CBO and JCT estimate that enacting

the legislation would not increase net direct spending in any of the four consecutive

10-year periods beginning in 2026. Both including and excluding macroeconomic

feedback, the agencies estimate that enacting the legislation would increase on-budget

deficits by at least $5 billion in at least one of the four consecutive 10-year periods

beginning in 2026.

Honorable Mike Enzi

Page 3

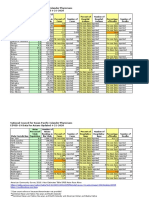

ESTIMATED COST TO THE FEDERAL GOVERNMENT

The estimated budgetary effects of H.R. 3762 are shown in Table 1. For this estimate, CBO

and JCT assume that the legislation will be enacted near the end of calendar year 2015.

TABLE 1. SUMMARY OF ESTIMATED EFFECTS ON DIRECT SPENDING AND REVENUES OF

H.R. 3762, THE RESTORING AMERICANS HEALTHCARE FREEDOM

RECONCILIATION ACT, AS PASSED BY THE SENATE ON DECEMBER 3, 2015

By Fiscal Year, in Billions of Dollars

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

20162020

20162025

ESTIMATED CHANGES WITHOUT MACROECONOMIC FEEDBACK

Effects on Outlays a

Effects on Revenues b

Net Increase or Decrease (-)

in the Deficit

-24.3

-56.2

31.9

-29.3 -113.4 -149.6 -156.4 -164.0 -172.5 -179.9 -187.4 -194.6 -473.0 -1,371.4

-53.5 -85.4 -102.0 -108.4 -116.4 -126.4 -136.8 -147.4 -158.0 -405.4 -1,089.8

24.2

-28.0

-47.6

-48.0

-47.7

-46.1

-43.2

-40.0

-36.6

-67.6

-281.6

5.1

32.5

-27.4

3.8

65.6

-61.7

25.7

218.4

-192.8

ESTIMATED BUDGETARY IMPACT OF MACROECONOMIC FEEDBACK

Effects on Outlays a

Effects on Revenues b

Net Decrease (-) in the Deficit

*

6.5

-6.5

0.6

8.8

-8.3

0.8

10.0

-9.2

0.8

16.7

-15.9

1.7

23.5

-21.9

3.1

27.2

-24.1

4.0

29.6

-25.6

4.6

31.3

-26.7

5.0

32.2

-27.2

TOTAL ESTIMATED CHANGES, INCLUDING MACROECONOMIC FEEDBACK

Effects on Outlays a

Effects on Revenues b

Net Increase or Decrease (-)

in the Deficit

-24.3

-49.7

25.5

-28.8 -112.6 -148.9 -154.7 -161.0 -168.4 -175.3 -182.4 -189.5 -469.2 -1,345.8

-44.7 -75.3 -85.3 -84.9 -89.2 -96.8 -105.4 -115.1 -125.5 -339.8 -871.4

15.9

-37.2

-63.5

-69.8

-71.8

-71.7

-69.8

-67.2

-64.0 -129.4

-474.4

Sources: Congressional Budget Office; staff of the Joint Committee on Taxation.

Notes:

Numbers may not add up to totals because of rounding; * = an increase or decrease between zero and $50 million.

a.

For outlays, a positive number indicates an increase (adding to the deficit) and a negative number indicates a decrease (reducing the deficit).

b.

For revenues, a positive number indicates an increase (reducing the deficit) and a negative number indicates a decrease (adding to the deficit).

Because the estimate of macroeconomic effects incorporates the impact of all of the acts

provisions taken together, the estimates of the acts effects by individual provision do not

reflect the macroeconomic feedback effects. Those estimates are shown in Table 2. CBO

and JCT are not able to produce separate estimates for each section where "included in

coverage estimate" is noted because the provisions interact with each other and their effects

are estimated simultaneously. As a result, the estimates for those sections are combined.

Honorable Mike Enzi

Page 4

TABLE 2. ESTIMATE OF DIRECT SPENDING AND REVENUE EFFECTS OF H.R. 3762, THE

RESTORING AMERICANS HEALTHCARE FREEDOM RECONCILIATION ACT, AS

PASSED BY THE SENATE ON DECEMBER 3, 2015

By Fiscal Year, in Billions of Dollars

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

20162020

20162025

ESTIMATED CHANGES WITHOUT MACROECONOMIC FEEDBACK

Changes in Direct Spending a

Coverage Provisions in Titles I and II

Estimated Budget Authority

-22.1

Estimated Outlays

-22.1

On-Budget

-22.1

Off-Budget

0

-26.2 -111.8 -148.8 -157.0 -165.3 -174.4 -182.5 -190.6 -197.7 -465.9 -1,376.4

-26.2 -111.8 -148.8 -157.0 -165.3 -174.4 -182.5 -190.6 -197.7 -465.9 -1,376.4

-26.2 -111.2 -147.9 -156.1 -164.3 -173.4 -181.5 -189.6 -196.5 -463.5 -1,368.8

0

-0.6

-0.9

-0.9

-1.0

-1.0

-1.0

-1.1

-1.1

-2.5

-7.7

Title IHealth, Education, Labor and Pensions

Sec. 101 Prevention and Public

Health Fund

Estimated Budget Authority

-1.0

-1.0

-1.3

Estimated Outlays

-0.2

-0.5

-0.9

-1.3

-1.1

-1.5

-1.3

-1.5

-1.4

-2.0

-1.6

-2.0

-1.8

-2.0

-1.9

-2.0

-2.0

-6.0

-4.1

-15.5

-12.7

Sec. 102 Community Health

Center Program

Estimated Budget Authority

Estimated Outlays

0.2

0.1

0.2

0.2

0

0.1

0

*

0

0

0

0

0

0

0

0

0

0

0

0

0.5

0.5

0.5

0.5

Sec. 103 - Territories

Estimated Budget Authority

Estimated Outlays

0

0

0

0

-0.1

-0.1

-0.1

-0.1

0

0

0

0

0

0

0

0

0

0

0

0

-0.2

-0.2

-0.2

-0.2

Sec. 104 Reinsurance, Risk

Corridor, and Risk Adjustment

Programs

Estimated Budget Authority

Estimated Outlays

Sec. 105 Support for State

Response to Substance Abuse

Public Health Crisis

Estimated Budget Authority

Estimated Outlays

Title IIFinance

Sec. 201 Recapture Excess

Advance Payments of Premium

Tax Credits

Estimated Budget Authority

Estimated Outlays

Sec. 202 Premium Tax Credit

and Cost Sharing Reductions

Estimated Budget Authority

Estimated Outlays

included in coverage estimate

included in coverage estimate

0.8

0.1

0.8

0.4

0

0.5

0

0.3

0

0.1

0

*

0

0

0

0

0

0

0

0

1.5

1.4

1.5

1.5

-1.8

-1.8

-3.3

-3.3

-1.1

-1.1

0

0

0

0

0

0

0

0

0

0

0

0

0

0

-6.1

-6.1

-6.1

-6.1

included in coverage estimate

included in coverage estimate

Continued

Honorable Mike Enzi

Page 5

TABLE 2, Continued.

By Fiscal Year, in Billions of Dollars

2016

2017

2018

2019

2020

2021

2022

2023

Sec. 203 Small Business Tax

Credit

Estimated Budget Authority

Estimated Outlays

included in coverage estimate

included in coverage estimate

Sec. 204 Individual Mandate

Estimated Budget Authority

Estimated Outlays

included in coverage estimate

included in coverage estimate

Sec. 205 Employer Mandate

Estimated Budget Authority

Estimated Outlays

included in coverage estimate

included in coverage estimate

Sec. 206 Federal Payment to

States

Estimated Budget Authority

Estimated Outlays

-0.2

-0.2

*

*

*

*

*

*

Sec. 207 Medicaid (Coverage)

Estimated Budget Authority

Estimated Outlays

*

*

*

*

*

*

*

*

2024

2025

20162020

20162025

*

*

0

0

-0.2

-0.2

-0.2

-0.2

included in coverage estimate

included in coverage estimate

Sec. 207 Medicaid

(Non-Coverage)

Estimated Budget Authority

Estimated Outlays

0

0

0

0

-1.6

-1.6

-2.3

-2.3

-1.6

-1.6

-1.7

-1.7

-1.8

-1.8

-1.9

-1.9

-2.0

-2.0

-2.1

-2.1

-5.5

-5.5

-15.0

-15.0

Sec. 208 Repeal of DSH

Allotment Reductions

Estimated Budget Authority

Estimated Outlays

0

0

0

0

1.5

1.5

2.4

2.4

3.4

3.4

4.3

4.3

5.3

5.3

6.2

6.2

7.2

7.2

7.2

7.2

7.2

7.2

37.5

37.5

0

0

0

0

0

0

0

0

Sec. 209 Repeal of the Tax on

Employee Health Insurance

Premiums and Health Plan

Benefits

Estimated Budget Authority

Estimated Outlays

Sec. 223 Budgetary Savings for

Extending Medicare Solvency

Estimated Budget Authority

Estimated Outlays

included in coverage estimate

included in coverage estimate

0

0

Total Changes in Direct Spending

Estimated Budget Authority

-24.2

Estimated Outlays

-24.3

On-Budget

-24.3

Off-Budget

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

-29.5 -114.4 -150.1 -156.7 -164.2 -172.9 -180.2 -187.4 -194.6 -474.9 -1,374.1

-29.3 -113.4 -149.6 -156.4 -164.0 -172.5 -179.9 -187.4 -194.6 -473.0 -1,371.4

-29.3 -112.8 -148.7 -155.5 -163.1 -171.5 -178.9 -186.3 -193.4 -470.6 -1,363.8

0

-0.6

-0.9

-0.9

-1.0

-1.0

-1.0

-1.1

-1.1

-2.5

-7.7

Continued

Honorable Mike Enzi

Page 6

TABLE 2, Continued.

By Fiscal Year, in Billions of Dollars

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

20162020

20162025

Coverage Provisions in Titles I and II

Estimated Revenues

-18.0

On-Budget

-19.2

Off-Budget

1.2

-14.4

-18.0

3.5

-29.5

-24.2

-5.3

-43.2

-34.0

-9.2

-46.3

-36.8

-9.4

-50.2

-39.6

-10.6

-56.2

-44.2

-11.9

-62.1

-49.0

-13.1

-68.4

-54.1

-14.3

-74.9 -151.3

-58.6 -132.2

-16.3 -19.1

-463.1

-377.8

-85.3

1.2

1.1

2.6

2.6

Changes in Revenues b

Title IIFinance

Sec. 201 - Recapture Excess

Advance Payments of Premium

Tax Credits

Sec. 202 - Premium Tax Credit

and Cost Sharing Reductions

Sec. 203 - Small Business Tax

Credit

Sec. 204 - Individual Mandate

Sec. 205 - Employer Mandate

Sec. 209 - Repeal of the Tax on

Employee Health Insurance

Premiums and Health Plan

Benefits

Sec. 210 - Repeal of Tax on

Over-the-Counter Medications

Sec. 211 - Repeal of Tax on

Health Savings Accounts

Sec. 212 - Repeal of Limitations

on Contributions to Flexible

Spending Accounts

Sec. 213 - Repeal of Tax on

Prescription Medications

Sec. 214 - Repeal of Medical

Device Excise Tax

Sec. 215 - Repeal of Health

Insurance Tax

Sec. 216 - Repeal of Elimination

of Deduction for Expenses

Allocable to Medicare Part D

Subsidy

Sec. 217 - Repeal of Chronic

Care Tax

Sec. 218 - Repeal of Medicare

Tax Increase

Sec. 219 - Repeal of Tanning Tax

Sec. 220 - Repeal of Net

Investment Tax

Sec. 221 - Remuneration

0.2

included in coverage estimate

included in coverage estimate

included in coverage estimate

included in coverage estimate

included in coverage estimate

-0.3

-0.5

-0.6

-0.6

-0.6

-0.7

-0.7

-0.8

-0.9

-0.9

-2.7

-6.7

-0.1

-1.4

-2.4

-2.7

-2.9

-3.1

-3.4

-3.6

-3.9

-4.4

-4.4

-12.6

-32.0

-2.9

-3.9

-4.0

-2.7

-2.7

-2.7

-2.7

-2.7

-2.7

-2.7

-16.1

-29.6

-1.4

-2.0

-2.1

-2.2

-2.3

-2.5

-2.6

-2.8

-2.9

-3.1

-10.0

-23.9

-9.9

-12.0

-12.5

-13.1

-13.8

-14.6

-15.5

-16.4

-17.0

-17.5

-61.2

-142.2

-0.1

-0.2

-0.2

-0.2

-0.2

-0.2

-0.2

-0.2

-0.2

-0.2

-0.8

-1.8

-0.6

-2.0

-3.4

-3.7

-4.1

-4.5

-4.9

-5.3

-5.7

-6.1

-13.7

-40.0

-6.4

-0.1

-8.9

-0.1

-10.1

-0.1

-10.9

-0.1

-11.7

-0.1

-12.7

-0.1

-13.8

-0.1

-14.9

-0.1

-16.1

-0.1

-17.6

-0.1

-48.0

-0.4

-123.0

-0.8

-15.1

*

-7.7

-0.1

-20.8

-0.1

-21.8

-0.1

-22.9

-0.1

-24.1

-0.1

-25.5

-0.1

-26.8

-0.1

-28.2

-0.1

-29.7

-0.1

-88.4

-0.3

-222.8

-0.6

Continued

Honorable Mike Enzi

Page 7

TABLE 2, Continued.

By Fiscal Year, in Billions of Dollars

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

20162020

20162025

Sec. 222 - Economic Substance

Doctrine

-0.3

-0.5

-0.5

-0.6

-0.6

-0.6

-0.6

-0.7

-0.7

-0.7

-2.5

-5.8

Total Changes in Revenues

On-Budget

Off-Budget

-56.2

-57.0

0.8

-53.5

-56.2

2.6

31.9

32.7

-0.8

24.2

26.8

-2.6

Net Increase or Decrease (-)

in the Deficit

On-Budget

Off-Budget

-85.4 -102.0 -108.4 -116.4 -126.4 -136.8 -147.4 -158.0 -405.4 -1,089.8

-79.0 -91.8 -97.8 -104.6 -113.2 -122.3 -131.6 -140.2 -381.5 -992.7

-6.4 -10.3 -10.6 -11.8 -13.2 -14.5 -15.8 -17.8 -23.9

-97.2

-28.0

-33.8

5.8

-47.6

-56.9

9.3

-48.0

-57.7

9.7

-47.7

-58.5

10.8

-46.1

-58.3

12.2

-43.2

-56.6

13.4

-40.0

-54.7

14.7

-36.6

-53.2

16.6

-67.6

-89.1

21.5

-281.6

-371.1

89.5

3.8

65.6

-61.7

25.7

218.4

-192.8

ESTIMATED BUDGETARY IMPACT OF MACROECONOMIC FEEDBACK c

Effects on Outlays a

Effects on Revenues b

Net Decrease (-) in the Deficit

*

6.5

-6.5

0.6

8.8

-8.3

0.8

10.0

-9.2

0.8

16.7

-15.9

1.7

23.5

-21.9

3.1

27.2

-24.1

4.0

29.6

-25.6

4.6

31.3

-26.7

5.0

32.2

-27.2

5.1

32.5

-27.4

TOTAL ESTIMATED CHANGES, INCLUDING MACROECONOMIC FEEDBACK c

Effects on Outlays a

Effects on Revenues b

Net Increase or Decrease (-)

in the Deficit

-24.3

-49.7

25.5

-28.8 -112.6 -148.9 -154.7 -161.0 -168.4 -175.3 -182.4 -189.5 -469.2 -1,345.8

-44.7 -75.3 -85.3 -84.9 -89.2 -96.8 -105.4 -115.1 -125.5 -339.8 -871.4

15.9

-37.2

-63.5

-69.8

-71.8

-71.7

-69.8

-67.2

-64.0 -129.4

-474.4

Sources: Congressional Budget Office; staff of the Joint Committee on Taxation.

Notes:

Numbers may not add up to totals because of rounding; DSH = Disproportionate Share Hospital;

* = an increase or decrease between zero and $50 million.

a. For outlays, a positive number indicates an increase (adding to the deficit) and a negative number indicates a decrease (reducing the deficit).

b. For revenues, a positive number indicates an increase (reducing the deficit) and a negative number indicates a decrease (adding to the deficit).

c. CBO and JCT have determined that it is not practicable at this time to provide the separate on-budget and off-budget estimates for the budgetary

impact of macroeconomic feedback.

ESTIMATE EXCLUDING MACROECONOMIC FEEDBACK

Excluding macroeconomic effects, CBO and JCT estimate that, on net, enacting the

legislation would reduce federal deficits by $281.6 billion over the 20162025 period; that

change would result from a $1.4 trillion reduction in outlays partially offset by a

$1.1 trillion decrease in revenues. (See Net Effects on Health Insurance Coverage for a

discussion of the effects of the legislation on health insurance coverage.)

Honorable Mike Enzi

Page 8

Budgetary Effects of Health Insurance Coverage Provisions

Provisions of H.R. 3762 that would affect health insurance coverage include eliminating

penalties associated with the individual and employer mandates, repealing the subsidies for

health insurance coverage obtained through exchanges beginning in 2018, repealing the

expansion of Medicaid eligibility beginning in 2018, eliminating certain changes to

payment rules and rates established by the ACA for Medicaid beginning in 2018, repealing

the small business tax credit beginning in 2018, and repealing the excise tax on certain

high-premium insurance plans. CBO and JCT estimate that those provisions would yield a

net decrease in federal deficits of $913 billion over the 20162025 period. That projected

decrease in federal deficits over the 10-year period consists of a $1.4 trillion decrease in

direct spending, partially offset by a $463 billion reduction in revenues.

The projected savings from the coverage provisions of this act are smaller than those that

CBO and JCT have estimated would stem from repealing all of the coverage provisions of

the ACA in 2016 for three main reasons. 1 First, the provisions related to coverage yielding

the largest budgetary effects would not be repealed until 2018. Second, the act would leave

in place certain rules established by the ACA that govern health insurance markets,

including guaranteed issue and renewability of coverage, the requirement that health

insurance cover certain health benefits, and rating rules that limit the extent to which

premiums can vary based on individual characteristics. Finally, H.R. 3762 would not

repeal changes made by the ACA related to coverage for young adults.

Budgetary Effects of Other Provisions

H.R. 3762 would also make changes to spending for other federal health care programs and

to federal revenues. CBO and JCT estimate that those provisions would result in a net

increase in federal deficits of $632 billion over the 20162026 period. That projected

increase over the 10-year period consists of a $627 billion decrease in revenues and a

$5 billion increase in direct spending.

The estimated $627 billion decrease in revenues results from provisions in the bill that

would repeal many of the revenue-related provisions of the ACA (apart from provisions

related to health insurance coverage discussed above). Those with the most significant

budgetary effects include the increase in the Hospital Insurance payroll tax rate for

high-income taxpayers, a surtax on those taxpayers net investment income, and annual

fees imposed on health insurers and medical devices.

The projected $5 billion increase in direct spending is primarily the net result of an

estimated $37.5 billion increase in payments to hospitals that treat a disproportionate share

of uninsured or low-income patients, partially offset by a $12.7 billion reduction in outlays

1.

Congressional Budget Office, Budgetary and Economic Effects of Repealing the Affordable Care Act (June

2015), www.cbo.gov/publication/50252.

Honorable Mike Enzi

Page 9

for the Prevention and Public Health Fund and a $15 billion reduction in spending for

Medicaid not related to insurance coverage.

Net Effects on Health Insurance Coverage

Without taking into account effects on coverage that would result from leaving in place the

ACAs insurance market reforms while repealing the subsidies and mandate penalties,

CBO and JCT estimate that enacting H.R. 3762 would increase the number of people

without health insurance coveragerelative to current-law projectionsby about

22 million people in most years after 2017. That increase in the uninsured population

would consist of roughly 14 million fewer individuals with coverage under Medicaid or the

Children's Health Insurance Program, about 10 million more individuals with

employment-based coverage, and 18 million fewer individuals with coverage obtained in

the nongroup market (including individual policies purchased through the exchanges or

directly from insurers in the nongroup market).

CBO and JCT have not estimated the changes in coverage from leaving in place the ACAs

insurance market reforms while repealing the subsidies and mandate penalties. However,

the agencies expect that, relative to the numbers provided above, leaving the market

reforms in place would lead to a further reduction in the number of people covered in the

nongroup market and an additional increase in the number of uninsured and people with

employment-based insurance.

CBO and JCT project that repealing the subsidies and mandate penalties established by the

ACA while leaving in place the insurance market reforms would result in a less healthy

population in the nongroup market and correspondingly higher average premiums. In

addition, the market for nongroup insurance, particularly in smaller states, could become

unstable, leading to very low to no participation by insurers and consumers.

ESTIMATE OF MACROECONOMIC FEEDBACK EFFECTS

CBO and JCT estimate that, compared with what would occur under CBOs baseline

projections, the legislation would boost the economys output by less than 0.2 percent in

each year over the 20162018 period, but by increasing amounts after that, resulting in an

increase in the level of gross domestic product (GDP) of about 0.8 percent, on average,

from 2021 to 2025. Those effects would stem mostly from repealing provisions of the ACA

that, under current law, are expected to reduce the supply of labor. 2 In addition, the act

would increase investment and the capital stock because, excluding macroeconomic

feedback, it would lower cumulative deficits over the next decade, and because certain

provisions would increase incentives to save and invest. The feedback of those economic

2.

For a description of CBOs methods used to estimate the effects of the Affordable Care Act on the labor market,

see How CBO Estimates the Effects of the Affordable Care Act on the Labor Market: Working Paper 2015-09

December 7, 2015, www.cbo.gov/publication/51065.

Honorable Mike Enzi

Page 10

effects to the budget would further lower federal deficits in the coming decade, CBO and

JCT estimate. The largest effect on the budget would be an increase in revenues arising

from the increased supply of labor and capital that in turn boosts employment and taxable

income.

In estimating those effects, CBO and JCT used an approach very similar to that employed

in Budgetary and Economic Effects of Repealing the Affordable Care Act (June 2015).

H.R. 3762 would eventually have much the same effects on incentives to work as repeal of

the ACA considered in that report. CBO adjusted its earlier analysis to account for

differences in the current legislation, including larger reductions in federal spending and

delays in the timing of certain provisions.

BUDGETARY EFFECTS BEYOND 2025

Both including and excluding macroeconomic feedback, CBO and JCT estimate that

enacting the legislation would not increase net direct spending in any of the four

consecutive 10-year periods beginning in 2026.

CBO and JCT estimate that the reductions in revenues under the bill would grow more

rapidly beyond 2025 than the reductions in outlays, both including and excluding

macroeconomic feedback. In particular, the agencies estimate that the revenue losses

stemming from repealing the excise tax on certain high-premium insurance plans would

grow more rapidly than other components of the estimate because an increasing portion of

employment-based plans are projected to be affected by the tax over time under current

law. On balance, the effect of the legislation on deficits becomes increasingly negative

over time, crowding out growing amounts of capital. Thus, the positive impact of

macroeconomic feedback fades over time. Overall, CBO and JCT estimate that enacting

H.R. 3762 would increase on-budget deficits by more than $5 billion in one or more of the

four consecutive 10-year periods beginning in 2026. Estimates over such a long horizon

are subject to even greater uncertainty than that surrounding projections for the next

decade. 3

3.

For further discussion of the sources of uncertainty underlying CBO and JCTs estimates, see Congressional

Budget Office, Budgetary and Economic Effects of Repealing the Affordable Care Act (June 2015), pp. 5-6,

www.cbo.gov/publication/50252.

Honorable Mike Enzi

Page 11

I hope this information is helpful to you. The CBO staff contacts are Chad Chirico and Ben

Page.

Sincerely,

Keith Hall

Director

cc:

Honorable Bernie Sanders

Ranking Member

Identical letter sent to the Honorable Tom Price, M.D.

You might also like

- Bostock v. Clayton County, Georgia DecisionDocument119 pagesBostock v. Clayton County, Georgia DecisionNational Content DeskNo ratings yet

- AAFP Letter To Domestic Policy Council 6-10-2020Document3 pagesAAFP Letter To Domestic Policy Council 6-10-2020iggybauNo ratings yet

- Boston Mayor Executive Order 6-12-2020Document3 pagesBoston Mayor Executive Order 6-12-2020iggybauNo ratings yet

- HR 6585 Equitable Data Collection COVID-19Document18 pagesHR 6585 Equitable Data Collection COVID-19iggybauNo ratings yet

- NCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020Document23 pagesNCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020iggybauNo ratings yet

- HR 4004 Social Determinants Accelerator ActDocument18 pagesHR 4004 Social Determinants Accelerator ActiggybauNo ratings yet

- S 3609 Coronavirus Immigrant Families Protection ActDocument17 pagesS 3609 Coronavirus Immigrant Families Protection ActiggybauNo ratings yet

- HR 6763 COVID-19 Racial and Ethnic Disparities Task ForceDocument11 pagesHR 6763 COVID-19 Racial and Ethnic Disparities Task ForceiggybauNo ratings yet

- HR 6437 Coronavirus Immigrant Families Protection AcfDocument16 pagesHR 6437 Coronavirus Immigrant Families Protection AcfiggybauNo ratings yet

- A Bill: in The House of RepresentativesDocument2 pagesA Bill: in The House of RepresentativesiggybauNo ratings yet

- S 3721 COVID-19 Racial and Ethnic Disparities Task ForceDocument11 pagesS 3721 COVID-19 Racial and Ethnic Disparities Task ForceiggybauNo ratings yet

- 7th Circuit Affirming Preliminary Injunction Cook County v. WolfDocument82 pages7th Circuit Affirming Preliminary Injunction Cook County v. WolfiggybauNo ratings yet

- COVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFDocument2 pagesCOVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFiggybauNo ratings yet

- Doe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctionDocument97 pagesDoe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctioniggybauNo ratings yet

- Milwaukee Board of Supervisors Ordinance 20-174Document9 pagesMilwaukee Board of Supervisors Ordinance 20-174iggybauNo ratings yet

- Physician Association Letter To HHS On Race Ethnicity Language Data and COVID-19Document2 pagesPhysician Association Letter To HHS On Race Ethnicity Language Data and COVID-19iggybauNo ratings yet

- Cook County v. Wolf Denial Motion To Dismiss Equal ProtectionDocument30 pagesCook County v. Wolf Denial Motion To Dismiss Equal ProtectioniggybauNo ratings yet

- COVID 19 FaceCovering 1080x1080 4 SPDocument1 pageCOVID 19 FaceCovering 1080x1080 4 SPiggybauNo ratings yet

- Tri-Caucus Letter To CDC and HHS On Racial and Ethnic DataDocument3 pagesTri-Caucus Letter To CDC and HHS On Racial and Ethnic DataiggybauNo ratings yet

- Doe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationDocument9 pagesDoe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationiggybauNo ratings yet

- Covid-19 Data For Asians Updated 4-21-2020Document2 pagesCovid-19 Data For Asians Updated 4-21-2020iggybauNo ratings yet

- SF StayHome MultiLang Poster 8.5x11 032620Document1 pageSF StayHome MultiLang Poster 8.5x11 032620iggybauNo ratings yet

- Doe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceDocument48 pagesDoe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceiggybauNo ratings yet

- CDC Covid-19 Report FormDocument2 pagesCDC Covid-19 Report FormiggybauNo ratings yet

- WA v. DHS Order On Motion To CompelDocument21 pagesWA v. DHS Order On Motion To CompeliggybauNo ratings yet

- MMMR Covid-19 4-8-2020Document7 pagesMMMR Covid-19 4-8-2020iggybauNo ratings yet

- ND California Order On Motion To CompelDocument31 pagesND California Order On Motion To CompeliggybauNo ratings yet

- Democratic Presidential Candidate Positions On ImmigrationDocument10 pagesDemocratic Presidential Candidate Positions On ImmigrationiggybauNo ratings yet

- Booker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseDocument4 pagesBooker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseStephen LoiaconiNo ratings yet

- Pete Buttigieg Douglass PlanDocument18 pagesPete Buttigieg Douglass PlaniggybauNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Conflict Resolution SkillsDocument51 pagesConflict Resolution SkillsZahirul HaqNo ratings yet

- Stores & Purchase SopDocument130 pagesStores & Purchase SopRoshni Nathan100% (4)

- Arvind Goyal Final ProjectDocument78 pagesArvind Goyal Final ProjectSingh GurpreetNo ratings yet

- Understanding Risk and Risk ManagementDocument30 pagesUnderstanding Risk and Risk ManagementSemargarengpetrukbagNo ratings yet

- Virgin Atlantic Strategic Management (The Branson Effect and Employee Positioning)Document23 pagesVirgin Atlantic Strategic Management (The Branson Effect and Employee Positioning)Enoch ObatundeNo ratings yet

- CBS NewsDocument21 pagesCBS Newstfrcuy76No ratings yet

- Tax Invoice / Receipt: Total Paid: USD10.00 Date Paid: 12 May 2019Document3 pagesTax Invoice / Receipt: Total Paid: USD10.00 Date Paid: 12 May 2019coNo ratings yet

- Valve SheetDocument23 pagesValve SheetAris KancilNo ratings yet

- Risk Management in Banking SectorDocument7 pagesRisk Management in Banking SectorrohitNo ratings yet

- Montaner Vs Sharia District Court - G.R. No. 174975. January 20, 2009Document6 pagesMontaner Vs Sharia District Court - G.R. No. 174975. January 20, 2009Ebbe DyNo ratings yet

- Ebook Imperva SecureSphere DAP Getting StartedDocument26 pagesEbook Imperva SecureSphere DAP Getting Startedjairo_lindeman100% (1)

- Judgment at Nuremberg - Robert ShnayersonDocument6 pagesJudgment at Nuremberg - Robert ShnayersonroalegianiNo ratings yet

- Cross Culture Management & Negotiation IBC201 Essay TestDocument2 pagesCross Culture Management & Negotiation IBC201 Essay TestVu Thi Thanh Tam (K16HL)No ratings yet

- FCP Business Plan Draft Dated April 16Document19 pagesFCP Business Plan Draft Dated April 16api-252010520No ratings yet

- United States Court of Appeals, Fourth CircuitDocument22 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Sources and Historiography of Kerala CoinageDocument68 pagesSources and Historiography of Kerala CoinageRenuNo ratings yet

- Social Media Audience Research (To Use The Template, Click The "File" Tab and Select "Make A Copy" From The Drop-Down Menu)Document7 pagesSocial Media Audience Research (To Use The Template, Click The "File" Tab and Select "Make A Copy" From The Drop-Down Menu)Jakob OkeyNo ratings yet

- The Art of Tendering - A Global Due Diligence Guide - 2021 EditionDocument2,597 pagesThe Art of Tendering - A Global Due Diligence Guide - 2021 EditionFrancisco ParedesNo ratings yet

- Volume 42, Issue 52 - December 30, 2011Document44 pagesVolume 42, Issue 52 - December 30, 2011BladeNo ratings yet

- 320-326 Interest GroupsDocument2 pages320-326 Interest GroupsAPGovtPeriod3No ratings yet

- 1.introduction To IESL B PaperDocument47 pages1.introduction To IESL B PaperGayan IndunilNo ratings yet

- Disadvantages of PrivatisationDocument2 pagesDisadvantages of PrivatisationumamagNo ratings yet

- Gaelic FootballDocument2 pagesGaelic FootballcanelaconlecheNo ratings yet

- FINPLAN Case Study: Safa Dhouha HAMMOU Mohamed Bassam BEN TICHADocument6 pagesFINPLAN Case Study: Safa Dhouha HAMMOU Mohamed Bassam BEN TICHAKhaled HAMMOUNo ratings yet

- Installation and repair of fibre optic cable SWMSDocument3 pagesInstallation and repair of fibre optic cable SWMSBento Box100% (1)

- Final PaperDocument5 pagesFinal PaperJordan Spoon100% (1)

- Anatomy of A Ransomware Operation 1663902494Document12 pagesAnatomy of A Ransomware Operation 1663902494Sai SubuNo ratings yet

- Intern Ship Final Report Henok MindaDocument43 pagesIntern Ship Final Report Henok Mindalemma tseggaNo ratings yet

- Guide to Sentence Inversion in EnglishDocument2 pagesGuide to Sentence Inversion in EnglishMarina MilosevicNo ratings yet

- Altar Server GuideDocument10 pagesAltar Server GuideRichard ArozaNo ratings yet