Professional Documents

Culture Documents

Central Bank of Sri Lanka: - Annual Report 2015 Major Economic Policy Changes and Measures: 2015

Uploaded by

romeshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Bank of Sri Lanka: - Annual Report 2015 Major Economic Policy Changes and Measures: 2015

Uploaded by

romeshCopyright:

Available Formats

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

Major Economic Policy Changes and Measures: 20151

BOX 15

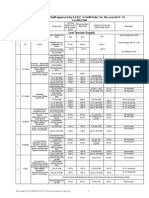

Real Sector2

- The retail prices of major petroleum products were reduced as follows:

- Petrol (92 Octane) by Rs. 33 to Rs. 117 per litre

- Petrol (95 Octane) by Rs. 30 to Rs. 128 per litre

- Auto Diesel by Rs. 16 to Rs. 95 per litre

- Super Diesel by Rs. 23 to Rs. 110 per litre

- Kerosene by Rs. 16 to Rs. 65 per litre

- Industrial Kerosene by Rs. 16 to Rs. 94 per litre

30 January 2015

- The retail price of kerosene was reduced by Rs. 6 to Rs. 59 per litre.

- The price of a 12.5 kg cylinder of LP gas was reduced by Rs. 300 to Rs. 1,596.

01 February 2015

- Passenger bus fares were reduced by 8.2 per cent on average.

20 February 2015

- The maximum retail price of certain items was set as follows:

- Ordinary Portland, Portland Limestone and Masonry cement at Rs. 840

per 50 kg bag

- White sugar (unpacketted) at Rs. 87 per kg

- Full cream milk powder at Rs. 325 per 400 g pack and Rs. 810 per

1 kg pack

- Sustagen at Rs. 1,500 per 400 g pack

- Wheat flour (unpacketted) at Rs. 87 per kg

- Green gram (Moong) at Rs. 265 per kg

- Dried sprats (imported) at Rs. 385 per kg

- Canned fish at Rs. 140 per net weight of 425 g or drained weight of 280 g and

Rs. 70 per net weight of 155 g or drained weight of 105 g

- Seeds of coriander, neither crushed nor ground, at Rs. 350 per kg

- Black gram at Rs. 300 per kg

- Maldives fish at Rs. 1,740 per kg

- Turmeric crushed or ground at Rs. 800 per kg

- Chillies crushed or ground at Rs. 400 per kg

Major Economic Policy Changes and Measures : 2015

22 January 2015

1 This includes major economic policy changes and measures implemented during 2015 as well as those that have been implemented during the first three months of 2016 and policy

measures envisaged to be taken in the near future.

2 Details of fiscal incentives granted for the development of the real sector are included in policy measures under the fiscal sector.

257

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

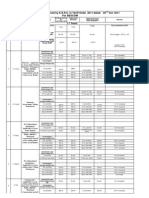

15 July 2015

- The price of a 12.5 kg cylinder of LP gas was reduced by Rs. 100 to Rs. 1,496.

15 September 2015 - A new electricity tariff, based on Time of Use (TOU) for domestic consumers connected

with 3-phase 30A or above, was introduced as an optional tariff in which the new

tariff structure is as follows:

Energy Charge

(Rs./kWh)

Fixed Charge

(Rs./month)

Off Peak (22:30 05:30 hrs)

13.00

540.00

Day (05:30 18:30 hrs)

25.00

540.00

Peak (18:30 22:30 hrs)

54.00

540.00

Major Economic Policy Changes and Measures : 2015

Time of Use (TOU)

258

21 November 2015

- The retail price of kerosene was reduced by Rs. 10 to Rs. 49 per litre.

- The price of a 12.5 kg cylinder of LP gas was reduced by Rs. 150 to Rs. 1,346.

01 February 2016

- The common floor rates for local voice calls and SMS/ MMS were determined as

follows:

Item

Floor Rate per Minute

(Rs.)

Local voice call (per minute basis billing)

1.50

Local voice call (per second basis billing)

1.80

SMS/ MMS

0.20 (per message)

External Sector

Trade and Tariff

01 January 2015

- Special Commodity Levy (SCL) on the importation of bonions was decreased

to Rs. 10 per kg from Rs. 50 per kg for a period of four months.

22 January 2015

- SCL on the importation of rice was increased to Rs. 20 per kg from Rs. 1 per

kg for a period of four months.

30 January 2015

- Excise (Special Provisions) duty on motor vehicles with less than 1,000 cc

was revised downwards and excise duty on hybrid motor vehicles was revised

upwards.

- The importation of Portland cement and semi-finished products of iron or non

alloy steel was exempted from Customs duty.

- Full Customs duty waiver of 15 per cent or Rs. 10 per kg was granted on the

importation of wheat grains.

- SCL on the importation of the following food items was reduced for a period

of six months:

- Maldives fish from Rs. 302 per kg to Rs. 102 per kg

- Sprats from Rs. 26 per kg to Rs. 11 per kg

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

- Green gram (Moong) from Rs. 40 per kg to Rs. 10 per kg

- Black gram from Rs.110 per kg to Rs. 60 per kg

- Chillies (crushed or ground) from Rs. 150 per kg to Rs. 125 per kg

- Coriander (seed) from Rs. 46 per kg to Rs. 26 per kg

- Coriander (crushed or ground) from Rs. 202 per kg to Rs. 52 per kg

- Turmeric (other) from Rs. 510 per kg to Rs. 360 per kg

- Black gram flour from Rs. 300 per kg to Rs. 200 per kg

- Canned fish from Rs. 102 per kg to Rs. 50 per kg

- Sugar from Rs. 28 per kg to Rs. 18 per kg

09 February 2015

- Full Customs duty waiver of 15 per cent or Rs. 10 per kg, granted on the

importation of wheat grains, was reduced to Rs. 4 per kg. Hence, the applicable

rate is Rs. 6 per kg.

15 February 2015

- SCL on the importation of potatoes was increased to Rs. 40 per kg from Rs.

10 per kg for a period of four months.

- SCL of Rs. 10 per kg on the importation of mackerel was extended for a period

of four months.

25 February 2015

- SCL on the importation of peas, chickpeas, cowpeas, Masoor dhal, yellow

lentils, kurakkan, millet and margarine was extended for a period of six months.

- SCL on the importation of maize and grain sorghum was rescinded.

27 February 2015

- Age limit on the importation of motor cars and other motor vehicles principally

designed for the transport of people was increased.

18 March 2015

- SCL on the importation of mackerel was reduced to Rs. 6 per kg from Rs. 10 per kg

for a period of six months.

26 March 2015

- SCL on the importation of rice was increased to Rs. 40 per kg from Rs. 20 per

kg for a period of four months.

02 April 2015

- SCL on the importation of fresh or chilled fish, dried fish, yoghurt, butter, dairy

spreads, red onions, garlic, fresh oranges, grapes, apples, cumin seeds, fennel

seeds, mathe seeds, kurakkan flour, ground nut, mustard seeds, vegetable oils

and salt was extended for a period of six months.

24 April 2015

- SCL on the importation of potatoes was increased to Rs. 55 per kg from Rs.

40 per kg for a period of four months.

- SCL on the importation of bonions was increased to Rs. 30 per kg from Rs.

10 per kg for a period of four months.

06 May 2015

- Customs duty of Rs. 35 per kg, Value Added Tax (VAT) of 11 per cent, Ports

and Airports Development Levy (PAL) of 5 per cent and Nation Building Tax

(NBT) of 2 per cent were imposed on the importation of rice in place of SCL

of Rs. 40 per kg.

Major Economic Policy Changes and Measures : 2015

- Turmeric (neither crushed nor ground) from Rs. 202 per kg to Rs. 102

per kg

259

Major Economic Policy Changes and Measures : 2015

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

06 June 2015

- SCL on the importation of potatoes was decreased to Rs. 30 per kg from Rs.

55 per kg for a period of three months.

- SCL on the importation of bonions was decreased to Rs. 10 per kg from Rs.

30 per kg for a period of three months.

17 June 2015

- SCL on the importation of Masoor dhal (red lentils-split and yellow lentils-split)

was decreased to Rs. 0.25 per kg from Rs. 5 per kg for a period of six months.

- SCL on the importation of crude oils of soya-bean, palm and sunflower was

increased to Rs. 105 per kg from Rs. 90 per kg for a period of six months.

- SCL on the importation of other vegetable oils was extended for a period of six

months.

29 June 2015

- SCL at a rate of 10 per cent was introduced on the importation of maize and

grain sorghum for a period of four months.

21 July 2015

- SCL on the importation of crude oils of soya-bean, palm and sunflower was

decreased to Rs. 90 per kg from Rs. 105 per kg for a period of six months.

- SCL on the importation of Maldives fish, dried sprats, green gram, black gram,

chillies, seeds of coriander, turmeric, black gram flour, vegetable oils except

crude oil, canned fish and sugar was extended for a period of six months.

23 July 2015

- Customs duty waiver granted on the importation of milk powder was reduced

to Rs. 45 per kg from Rs. 90 per kg. Hence, the applicable duty rate was Rs.

180 per kg.

06 August 2015

- Customs duty on the importation of milk powder was reduced to 20 per cent

or Rs. 225 per kg from 25 per cent or Rs. 225 per kg and Customs duty waiver

granted on the importation of milk powder was withdrawn.

08 September 2015

- SCL on the importation of potatoes was increased to Rs. 40 per kg from Rs.

30 per kg for a period of six months.

- SCL on the importation of sugar was increased to Rs. 30 per kg from Rs. 18

per kg for a period of six months.

- SCL on the importation of bonions, peas, chickpeas, cowpeas, Masoor dhal

(red and yellow lentilswhole), millet, kurakkan, margarine and sugar was

extended for a period of six months.

18 September 2015 - SCL of Rs. 6 per kg on the importation of mackerel was extended for a period

of six months.

22 September 2015

- A surcharge of Rs. 20 per kg was introduced on the importation of bonions

until 08 October 2015.

23 September 2015

- SCL on the importation of the following items was increased for a period of six months:

- Soya-bean oil, palm oil and sunflower oil and their fractions, whether or not

refined, but not chemically modified

- Coconut (copra), palm kernel or babassu oil and fractions whether or not

refined, but not chemically modified

260

02 October 2015

- SCL on the importation of fresh or chilled fish, dried fish, yoghurt, butter,

dairy spreads, red onions, garlic, fresh oranges, grapes, apples, seeds of cumin,

seeds of fennel, mathe seeds, kurakkan flour, ground nut, mustard seeds and

salt was extended for a period of six months.

09 October 2015

- SCL on the importation of bonions was increased to Rs. 30 per kg from Rs.

10 per kg for a period of four months.

19 October 2015

- The method of computation of the Customs value of motor vehicles for the

purpose of calculation of excise duty payable at the time of importation was

revised.

29 October 2015

- SCL of 10 per cent on the importation of maize and grain sorghum was

extended for a period of three months.

- SCL of Rs. 175 per kg was imposed on the importation of vegetable fats and

oils and their fractions for a period of three months.

21 November 2015

- SCL on the importation of fresh or chilled fish and frozen fish was increased

to 10 per cent or Rs. 50 per kg whichever is higher from 10 per cent or Rs.

10 per kg whichever is higher for a period of six months

- SCL on the importation of potatoes was decreased to Rs. 15 per kg from Rs.

40 per kg for a period of six months.

- SCL on the importation of bonions was decreased to Rs. 5 per kg from Rs.

30 per kg for a period of six months.

- SCL on the importation of red and yellow lentils (whole) was decreased to Rs.

0.25 per kg from Rs. 2 per kg for a period of six months.

- SCL of Rs. 0.25 per kg on the importation of red and yellow lentils (split) was

extended for a period of six months.

- SCL of Rs. 60 per kg was imposed on the importation of fresh and dried dates

for a period of six months.

- Instead of the four bands Customs duty tariff structure of zero, 7.5 per cent,

15 per cent and 25 per cent, a three bands tariff structure of zero, 15 per cent

and 30 per cent was introduced.

- Customs duty on the importation of alcoholic beverages, tyres of rim size above

20 inches and chocolate blocks was increased.

- Customs duty on the importation of garments, footwear, tiles, steel, musical

instruments and maize (corn) was reduced.

21 January 2016

- SCL on the importation of Maldives fish, dried sprats, green gram (Moong),

black gram, chillies, seeds of coriander, turmeric, black gram flour and canned

fish was extended for a period of six months.

29 January 2016

- SCL of 10 per cent on the importation of maize and grain sorghum was extended

until 29 February 2016.

- SCL of Rs. 175 per kg on the importation of vegetable fats and oils and their

fractions was extended up to 28 April 2016.

01 February 2016

- Customs duty on importation of rice was increased to Rs. 50 per kg from Rs.

35 per kg.

Major Economic Policy Changes and Measures : 2015

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

261

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

01 March 2016

- SCL on the importation of potatoes was increased to Rs. 35 per kg from

Rs. 15 per kg for a period of four months.

- SCL on the importation of bonions was increased to Rs. 25 per kg from Rs. 5

per kg for a period of four months.

08 March 2016

- SCL on the importation of mackerel, peas, chickpeas, cowpeas, kurakkan,

margarine, sugar and vegetable oil was extended for a period of six months.

Major Economic Policy Changes and Measures : 2015

Foreign Exchange Management

262

01 November 2015

- A 20 per cent Migrating Tax was imposed on all foreign exchange released to be taken

out of the country by migrants at the point of immigration.

29 December 2015

- Permission was granted to persons resident in Sri Lanka who hold Non Resident Foreign

Currency Accounts (NRFC), Resident Foreign Currency Accounts (RFC), Resident Non

Nationals Foreign Currency Accounts (RNNFC) and Foreign Exchange Earners

Accounts (FEEA) to acquire, hold and transfer securities issued outside Sri Lanka, to

acquire any other asset of capital nature and to make payments in respect of current

account (non-capital) transactions by utilising funds of such accounts.

- Exemption was granted for persons resident in Sri Lanka from the application of the

requirements to inform the Central Bank of Sri Lanka (CBSL) of the securities acquired,

held and transferred and any other asset of capital nature acquired as above.

20 January 2016

- Directions were issued to authorised dealers on NRFC, RFC, RNNFC and FEEA allowing

account holders to freely remit the funds of such accounts outside Sri Lanka for any

purpose in line with the above relaxations.

Forthcoming

- Implementing the new Foreign Exchange Management policy

- Introducing a new borrowing scheme allowing any company incorporated in Sri Lanka

other than companies limited by guarantee and overseas companies to borrow from

overseas sources

- Granting general permission for outward remittance of current income and

superannuation benefits of the emigrants

Revisiting inward investment procedures in line with the government policy through

broadening the limits and areas for investments in Sri Lanka by residents outside Sri

Lanka

Fiscal Sector

Government Revenue

01 January 2015

- VAT rate was reduced to 11 per cent from 12 per cent.

- The importation of machinery, equipment and spare parts by Sri Lanka Ports Authority

(SLPA) to be used exclusively within specified ports was exempted from VAT and NBT.

- The limit of the value of imported samples for the exemption from the VAT and NBT

of Rs. 25,000 was increased to Rs. 50,000.

The quarterly turnover of Rs. 250 million applicable for the imposition of VAT on

wholesale or retail trade was reduced to Rs. 100 million.

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

- The threshold of liable supplies for the registration for VAT purposes was increased to

Rs. 15 million per annum, from Rs. 12 million per annum.

- The threshold of liable turnover of NBT was increased to Rs. 3.75 million per quarter

from Rs. 3 million per quarter.

- Betting and Gaming levy, applicable on gross collection of total amount recovered

from the business of bookmaker or business of gaming was increased to 10 per cent

from 5 per cent.

- Casino entrance levy of US dollars 100 was imposed on every person who entered a

casino entertainment place.

01 April 2015

- Profits and income of the following persons/institutions were exempted from income tax:

- Company, partnership or body of persons outside Sri Lanka from any payment

made by way of royalty as a specific requirement of any IT/BPO company in

Sri Lanka for a period of 2 years from the commencement of such IT/BPO

company.

- Investment made on or after 01 January 2015 in any Corporate Debt Security,

issued by the Urban Development Authority (UDA).

- Concessionary income tax rates were introduced as follows:

- A deduction of 10 per cent of income tax payable by any local

manufacturer who has commenced the business of manufacturing during

1970s.

- 12 per cent on the local sugar industry.

- The annual turnover limit of small and medium undertakings qualifying for

the concessionary rate of 12 per cent was increased from Rs. 500 million to

Rs. 750 million.

-

One half of the profits and income from the production of films or dramas of

any individual who produces an award winning cinema or a drama at an

international film/drama festival was exempted for a period of 5 years from

the year in which such award is received.

- 16 per cent tax rate applicable for certain categories of employment income

was extended to cover other employment categories.

-

New undertakings, with an investment not less than US dollars 2 million and

engaged in manufacture of products for export market, were granted a frontloaded

depreciation allowance and the dividend distributed out of such profits will be

exempted for a period of five years.

The applicable tax rate on the profits and income of an existing enterprise outside

the Western province and carrying on a business of manufacture of products other

than liquor or tobacco was reduced by 50 per cent not exceeding Rs. 500 million

for a period of 5 years subject to certain conditions.

Any company, which registers with the Inland Revenue Department (IRD) for tax

purposes on or before 31 December 2015 with a committed investment in excess

of Rs. 500 million, to be made in any manufacturing business, was entitled for a

reduction of 50 per cent of the applicable tax rate for a period of 7 years.

Major Economic Policy Changes and Measures : 2015

- Unit Trust from investments made on or after 01 January 2015, in US dollar

deposits or US dollar denominated securities listed in any foreign stock

exchange.

263

Major Economic Policy Changes and Measures : 2015

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

264

- A single withholding tax rate of 2.5 per cent was introduced irrespective of the amount

of interest.

- Interest income of senior citizens was exempted from withholding tax.

- A triple deduction was granted to any person registered with the Tertiary and Vocational

Education Commission (TVEC) on expenditure incurred on standard skill development

training provided to trainees.

- The exempted amount from the employment income (annual) on Pay-As-You-Earn

(PAYE) tax was increased to Rs. 750,000 from Rs. 600,000 and the maximum rate of

PAYE was reduced to 16 per cent from 24 per cent.

- The annual liquor license fees on wholesale and retail outlets, hotels, hotel bars, rest

houses etc. were increased.

03 October 2015

- Excise (Special Provisions) duty rates on the importation of cigarettes were increased.

- Excise duty on any liquor made from any cereal molasses, palmyrah, coconut and

processed arrack, country made foreign sprits and malt liquor manufactured in Sri

Lanka was increased.

30 October 2015

A Bars and Taverns Levy of Rs. 250,000 was imposed as per tavern or liquor sales

outlet as a one off levy.

A Casino Industry Levy of Rs. 1,000 million was imposed on all casino operators as

a one off levy.

- A Mobile Telephone Operator Levy of Rs. 250 million was imposed on all licensed

mobile telephone operators in Sri Lanka as a one off levy.

- A Satellite Location Levy of Rs. 1,000 million was imposed on satellite owners who

utilise the Sri Lankan satellite locations as a one off levy.

- A Dedicated Sports Channel Levy of Rs. 1,000 million was imposed on dedicated

sports channels operating islandwide using more than 5 transmitting locations as a

one off levy.

- A Mansion Tax of Rs. 1 million was imposed on owners of all houses valued not less

than Rs. 150 million or on houses above 10,000 square feet and constructed on or

after 01 April 2000 on an annual basis.

- A Super Gain Tax at a rate of 25 per cent of the profit earned by any individual,

company or group of companies whose profits over Rs. 2,000 million for the year of

assessment 2013/2014 was implemented.

21 November 2015

- Excise duty on any liquor made from molasses, palmyrah, coconut and processed

arrack, country made foreign sprits and malt liquor of 5 per centum and above of

absolute strength manufactured in Sri Lanka was revised upwards.

- Excise duty rate on malt liquor of less than 5 per centum of absolute strength was

decreased to Rs. 160 per litre from Rs. 190 per litre.

- Excise duty on cigarettes exceeding 72 mm but not exceeding 84 mm in length and

cigarettes exceeding 84 mm in length was increased.

- Excise duty (Special Provisions) on motor vehicles was revised and a simple unit rate

of excise duty for the vehicles on the basis of cubic centimeters was introduced.

25 November 2015

- Cess of 10 per cent was imposed on imported jewellery.

05 December 2015

- Excise duty on malt liquor of less than 5 per centum of absolute strength was increased

to Rs. 190 per litre from Rs. 160 per litre.

10 December 2015

- Cess on exportation of spices was removed.

13 December 2015

- Cess applicable on the importation of Beedi leaves, refractory cements, prepared

binders for foundry moulds or cores, water based homopolymers and copolymers,

particle boards, oriented strand boards (OSB) and similar boards, tulles and other

net fabrics and cabinets for refrigerators was decreased.

- Cess applicable on the importation of lubricants, polymers of vinyl acetate, acrylic

polymers in primary forms, water proof footwear and other footwear was increased.

15 December 2015

- Annual licensing fee on liquor manufacturers and distilleries was increased.

31 December 2015

- The triennial authorisation fee on star class hotels, boutique hotels, boutique villas

and heritage hotels was increased.

01 January 2016

- An import license fee of Rs. 1.5 million per annum was imposed on all importers

engaged in the business of importing and selling motor vehicles.

- The duty on bottled toddy was increased to Rs. 30 per litre from Rs. 10 per litre.

- Stamp duty of 1.5 per cent levied on credit card usage was removed with regard to

local usage of credit cards.

- Stamp duty on usage of credit cards for foreign purchases was increased to 2.5 per

cent.

- Stamp duty on any share certificate issued consequent to the issue, transfer or

assignment of any number of shares of any company was removed.

- Embarkation Levy was increased as follows:

- To a person leaving Sri Lanka by aircraft from US dollars 25 to US dollars 30

- To a person leaving Sri Lanka by ship from US dollars 5 to US dollars 30

- Fees for passport and dual citizenship were increased.

- The rate of PAL was increased to 7.5 per cent from 5 per cent.

- Vehicle Entitlement Levy was introduced.

- Tax imposed on the leasing of land to foreigners was removed.

- Construction Industry Guarantee Fund Levy was removed.

- The rates on International Telecommunication Operators Levy (ITOL) were increased

from US dollars 9 cents to US dollars 12 cents.

- Concessionary PAL rate of 2.5 per cent was imposed on electronic and electric items.

- Machinery used for construction industry was exempted from PAL.

Major Economic Policy Changes and Measures : 2015

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

Government Expenditure

01 January 2015

- The maximum amount of Samurdhi allowance was increased to Rs. 3,000 per month

from Rs. 1,500 per month by Circular No. 2014/14 of the Department of Divineguma

Development, dated 29 December 2014.

265

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

01 February 2015

- Salaries of government employees were increased by Rs. 7,000 per month of which

Rs. 5,000 was given in February and the balance was given in June 2015.

01 April 2015

- The monthly interim allowance paid to pensioners was increased by Rs. 1,000 per

month to Rs. 3,500 per month.

30 April 2015

- The maximum amount of Samurdhi allowance to Rs. 3,500 per month from Rs. 3,000

per month was increased.

01 July 2015

- Pension of public servants who have retired before the implementation of Public

Administration Circular No. 06/2006 dated 25 April 2006, and 06/2006 (IV), dated

24 August 2007, which were issued revising the salaries of public service was revised

again based on the salary revisions by above Circulars.

- A special allowance was granted for the officers in Executive Service Category in the

public sector as follows :

Major Economic Policy Changes and Measures : 2015

Category

266

Monthly

Allowance (Rs.)

Active service period of less than 6 years

3,000

Active service period of 6 or more years, but less than 11 years

5,000

Active service period of 11 or more years, but less than 19 years

10,000

Officers of Grade I or above having an active service period

of 19 or more years

15,000

25 February 2016

- Public Administration Circular No. 03/2016 was issued to implement salary scales for

public service in five phases with effect from 01 January 2016 instead of the salary

scales implemented for the posts in public service under the provisions of Public

Administration Circular No. 06/2006, dated 25 April 2006, and the provisions of

the circular issued as the revisions to the said circular.

Forthcoming

- Granting a cash grant of Rs. 25,000 per hectare per year as the fertiliser subsidy for

paddy farmers

Debt Management

19 January 2015

- Issuance of Sri Lanka Development Bonds (SLDBs) up to a limit of US dollars 1,500

million for 2015 was authorised.

09 February 2015

- In addition to the issuance of SLDBs at floating rate, issuance of SLDBs at fixed rates

in different maturities was approved.

10 June 2015

- The authorised limit on the issuance of SLDBs was increased to US dollars 2,500

million for the year 2015.

05 October 2015

- Multi-currency functionality in LankaSettle system was enabled in order to facilitate

the scripless trading and recording of legal ownership of SLDBs denominated in US

dollars to promote the secondary market for SLDBs.

20 October 2015

- The authorised limit on the issuance of Treasury bills was increased to Rs. 1,250 billion

from Rs. 850 billion.

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

28 October 2015

The direction on minimum core capital requirement for Primary Dealers was revised,

increasing the minimum unimpaired core capital to be maintained by the Primary

Dealer companies from Rs. 300 million to Rs. 1,000 million.

The direction on Capital Adequacy Ratio for Primary Dealers was revised, increasing

the minimum Risk Weighted Capital Adequacy Ratio to be maintained by the Primary

Dealer companies from 8 per cent to 10 per cent.

04 December 2015

- The threshold of investments in Treasury bills and Treasury bonds by foreigners was

reduced from 12.5 per cent to 10 per cent of the total outstanding stock of Treasury

bills and Treasury bonds.

02 March 2015

- The 5.00 per cent special Standing Deposit Facility (SDF) rate was withdrawn.

15 April 2015

- The Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR)

were reduced by 50 basis points to 6.00 per cent and 7.50 per cent, respectively.

03 September 2015 -

The exchange rate was allowed to be determined based on demand and supply

conditions in the foreign exchange market.

30 December 2015 - The Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of Licensed

Commercial Banks (LCBs) was increased by 1.50 percentage points to 7.50 per cent

from 6.00 per cent to be effective from the reserve period commencing 16 January

2016.

19 February 2016

- The SDFR and SLFR were increased by 50 basis points to 6.50 per cent and 8.00 per

cent, respectively.

Financial Sector

Licensed Banks

01 January 2015

- Deposit insurance coverage per depositor per institution under the Sri Lanka Deposit

Insurance and Liquidity Support Scheme (SLDILSS) was increased to Rs. 300,000 from

Rs. 200,000.

01 February 2015

- A 50 per cent waiver was granted on the capital of the cultivation loans up to a

maximum amount of Rs. 100,000, granted by state banks to farmers and transferred

to non performing category on or before 31 January 2015.

13 March 2015

- An interest rate of 15 per cent per annum was granted for the savings of senior

citizens (above 60 years of age) who opened one year rupee fixed deposits up to Rs.

1.0 million with effect from 16 January 2015 and an interest rate of 12 per cent per

annum for the savings of senior citizens (above 60 years of age) who opened rupee

fixed deposits up to Rs. 2.5 million prior to 16 January 2015.

15 March 2015

- Interest payments in excess of 12 per cent on pawning advances were waived up to

a maximum amount of Rs. 200,000, granted by state banks and transferred to non

performing category on or before 31 January 2015, at the point of settlement of

pawned advances on or before 30 June 2015.

Major Economic Policy Changes and Measures : 2015

Monetary Sector

267

Major Economic Policy Changes and Measures : 2015

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

268

31 March 2015

- Directions were issued to licensed banks to implement the Liquidity Coverage Ratio

under Basel III Liquidity Standards from 01 April 2015.

15 April 2015

- A circular was issued to apprise licensed banks to expand access to banking as outlined

in the Interim Budget for 2015.

01 June 2015

- The charge of enhanced interest on accommodation granted to exporters was

re-imposed. The applicable enhanced interest rate was reduced from 1000 basis points

to 500 basis points. This enhanced interest is charged when export credit is not settled

out of export proceeds within 90 days or 120 days (whichever is applicable) from the

date of shipment of exports. Further, LCBs were allowed to use their discretion, subject

to conditions, to extend the period granted to settle export credit out of export proceeds

up to 180 days from the date of shipment in respect of tea exports.

28 July 2015

- Payment and Settlement Systems Circular No. 01 of 2015 on Maximum Limits on

Transaction Value and Fees of Common Electronic Fund Transfer Switch (CEFTS) was

issued to impose maximum per transaction value limit and maximum fees chargeable

on transactions effected through CEFTS.

06 August 2015

- Payment and Settlement Systems Circular No. 02 of 2015 on Maximum Limit on

Transaction Fees of Sri Lanka Interbank Payment System (SLIPS) was issued to impose

maximum transaction fee that can be charged from customers for fund transfers effected

through SLIPS.

07 August 2015

- Payment and Settlement Systems Circular No. 03 of 2015 on Operator Charges and

Maximum Limit on Transaction Fees of LankaSettle System was issued to impose maximum

transaction fee for fund transfers effected through Real Time Gross Settlement (RTGS) System

and to reduce transaction fee charged by CBSL as the operator of the RTGS System.

14 September 2015

- Directions were issued to licensed banks, Licensed Finance Companies (LFCs) and

Specialised Leasing Companies (SLCs) to maintain a maximum loan to value (LTV)

ratio of 70 per cent on loans and advances granted for the purpose of purchase or

utilisation of motor vehicles with effect from 15 September 2015.

29 October 2015

- Directions were issued to licensed banks, LFCs and SLCs informing that the applicability

of the maximum LTV ratio of 70 per cent shall come into force with effect from 01

December 2015.

30 October 2015

- A minimum cash margin requirement of 100 per cent on Letters of Credit (LCs) opened

with LCBs for the importation of motor vehicles was imposed until 01 December 2015.

30 November 2015

02 December 2015

- Licensed banks were informed to consider officers performing executive functions as

the key management personnel of licensed banks for the purpose of complying with

requirements of the Banking Act Directions on Corporate Governance.

Forthcoming

- Implementation of minimum capital requirement and leverage ratio for licensed banks

under Basel III

- Informing licensed banks to submit information on the occurrence of cyber security

events in banks

- Developing a crisis preparedness plan for licensed banks

Payment and Settlement Systems Circular No. 07 of 2015 on Timelines for Joining

Common Card and Payment Switch - LankaPay was issued to stipulate timelines for

joining Common Card and Payment Switch.

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

Other Financial Institutions

23 June 2015

- The annual licensing fee of LFCs was increased as follows:

Total assets as at end of the previous calendar year

Annual licence

fee (Rs.)

Rs. 5 billion or below

1,000,000

Above Rs. 5 billion up to Rs. 10 billion

1,500,000

Above Rs. 10 billion up to Rs. 20 billion

2,000,000

Over Rs. 20 billion

3,000,000

- The license fee payable in the year of licensing was increased from Rs. 1 million to

Rs. 2 million.

26 March 2015

- The Insurance Board of Sri Lanka (IBSL) issued a direction for all insurance companies

to settle their insurance claim amounts due within sixty days of the admission of liability

and upon establishment of the identity of the claimant.

30 March 2015

- IBSL imposed a condition on all insurance brokering companies to maintain at least a

minimum net capital of Rs. 1.125 million from 30 September 2015 and a minimum

net capital of Rs. 2.5 million from 30 September 2016.

24 April 2015

- The Colombo Stock Exchange (CSE) listing rules were amended pursuant to the Securities

Exchange Commission (SEC) Directive (SEC/LEG/14/12/41) on the mandatory disclosure

in respect of the basis of an offer price at an Initial Public Offer (IPO) of shares.

27 May 2015

- IBSL issued Rule No. 1916/10 requiring every insurer and broker to maintain a register

of all persons who are registered with them as insurance agents (other than individuals),

in a form specified by IBSL.

29 May 2015

- The rate of interest applicable for loans granted to borrowers by Participating Financial

Institutions (PFIs) under the Smallholder Plantation Entrepreneurship Development

Programme (SPEnDP) was reduced to 7 per cent per annum from 9 per cent per annum

and the rate of interest applicable for refinance facilities granted to PFIs by the CBSL

was reduced to 3 per cent per annum from 4 per cent per annum.

10 June 2015

- The methodology of computing closing prices of securities traded on the Automated

Trading rules (ATS rules) (except debt securities) was amended by CSE with effect from

17 June 2015.

01 July 2015

- The period of operation of Credit Guarantee Scheme for Pawning Advances was extended

for further period of six months, commencing from 01 July 2015 to 31 December 2015.

06 July 2015

- Operating Instructions of the New Comprehensive Rural Credit Scheme (NCRCS) were

amended to incorporate the implementation of warehouse receipts financing system

under the scheme to provide short term credit to small farmer producers.

10 July 2015

- The application fees for entities licensed/ registered by the SEC were revised pursuant

to the Circular No. SEC/Stamp duty/2015/03 issued by the IRD.

07 August 2015

- Operating Instructions to implement the Working Capital Loan Scheme for Tea

Factories (WCLSTF), introduced by the government were issued.

Major Economic Policy Changes and Measures : 2015

Other

269

Major Economic Policy Changes and Measures : 2015

CENTRAL BANK OF SRI LANKA | ANNUAL REPORT 2015

270

03 September 2015

- Operating Instructions of WCLSTF was amended to include that the rate of interest to

be fixed at 6 per cent per annum and government interest subsidy of 2 per cent per

annum, to be provided only for two years. The total interest will be recovered from

borrowers thereafter.

09 October 2015

- The Circular No. 36 on Overseas Health Insurance was issued by IBSL that no person

in Sri Lanka, shall without the prior written approval of the Board, directly or indirectly

place any insurance business with an insurer not registered under the Regulation of

Insurance Industry (RII) Act, except in relation to reinsurance business.

12 October 2015

- Operating Instructions of WCLSTF were amended permitting PFIs to determine the

rate of interest based on customer PFI relationship.

21 October 2015

- IBSL granted permission for an insurance agent to procure insurance business for

an insurance company carrying on long term insurance business and an insurance

company carrying on general insurance business, subject to strict compliance.

02 November 2015

- PFIs were allowed to charge floating interest rate for loans granted under WCLSTF

at a rate not exceeding the Weighted Average Prime Lending Rate plus 1.5 per cent

margin, including the 2 per cent government interest subsidy. The interest subsidy

provided to PFIs will be only for a period of 2 years and total interest will be recovered

from borrowers thereafter.

09 November 2015

- The rate of interest for sub loans granted by PFIs under the Poverty Alleviation

Microfinance Project II and Poverty Alleviation Microfinance Project II-RF was reduced

from 12 per cent per annum to 10 per cent per annum.

15 December 2015

- Operating Instructions of the Saubhagya Loan Scheme were amended to include following:

- To increase the eligible limit of a sub loan for which a project appraisal is needed

from Rs. 500,000 to Rs. 1 million

- To expand the grace period for loans granted under the scheme for the cultivation

of perennial crops up to a maximum of 12 months, depending on the nature of

the project

- To remove the requirement of the minimum number of 5 employees for a SME to

be eligible under the scheme. Accordingly, an enterprise with total asset value of

below Rs. 40 million, excluding land and buildings and those with employees less

than 100 persons are eligible to obtain loans under Saubhagya Loan Scheme

31 December 2015

- The operation of Credit Guarantee Scheme for Pawning Advances was concluded.

01 January 2016

- Share Transaction Levy was removed.

- IBSL issued Solvency Margin (Risk Based Capital) Rules to all insurance companies to

be compiled with effect from 01 January 2016.

- Guidelines were issued to open child savings accounts for children attending school

by depositing a minimum of Rs. 250 per child year.

04 January 2016

- IBSL issued a direction under section 96A of the RII Act to all insurers and brokers, to

obtain approval from IBSL on changes in ownership and control over 50 per cent of

shareholding.

27 January 2016

- Customer Due Diligence Rules No. 1 of 2016 were issued to financial institutions.

You might also like

- Farmers Association Constitution&Bylaws EnglishDocument10 pagesFarmers Association Constitution&Bylaws EnglishMaria Christina Sereno100% (3)

- K.E.R.C. approves revised retail supply tariff for BESCOMDocument5 pagesK.E.R.C. approves revised retail supply tariff for BESCOMSai Krishna MaddukuriNo ratings yet

- Annual Report 2015Document64 pagesAnnual Report 2015AdeelRafiqNo ratings yet

- Highlights of Union Budget 2010Document4 pagesHighlights of Union Budget 2010callvkNo ratings yet

- India Sugar 2010Document12 pagesIndia Sugar 2010jbabu123No ratings yet

- Economic Survey 2008-09 HighlightsDocument4 pagesEconomic Survey 2008-09 HighlightsPinaki SenguptaNo ratings yet

- Highlights of Union Budget 2013Document10 pagesHighlights of Union Budget 2013sapphire1988No ratings yet

- Nutrient Based Subsidy: Navneet DograDocument9 pagesNutrient Based Subsidy: Navneet DograNavneet DograNo ratings yet

- Food Civil SupplyDocument5 pagesFood Civil SupplyAzhar HaqueNo ratings yet

- K.E.R.C. approves BESCOM retail supply tariff for 2013-14Document4 pagesK.E.R.C. approves BESCOM retail supply tariff for 2013-14karthikvmandyaNo ratings yet

- Sugar Sector Analysis: Background and Measures Taken by Govt in Sugar Season 2017-18Document3 pagesSugar Sector Analysis: Background and Measures Taken by Govt in Sugar Season 2017-18Achal MeenaNo ratings yet

- Feb0511 7050211Document9 pagesFeb0511 7050211Kanav ThakurNo ratings yet

- 13th July (Monday), 2015 Daily Exclusive ORYZA E-Rice Newsletter by Riceplus MagazineDocument35 pages13th July (Monday), 2015 Daily Exclusive ORYZA E-Rice Newsletter by Riceplus MagazineMujahid AliNo ratings yet

- 23rd July (Thursday), 2015 Daily Exclusive ORYZA Rice E-Newsletter by Riceplus MagazineDocument15 pages23rd July (Thursday), 2015 Daily Exclusive ORYZA Rice E-Newsletter by Riceplus MagazineMujahid AliNo ratings yet

- The China Cob All The Biggest China Corn News From MarchDocument6 pagesThe China Cob All The Biggest China Corn News From MarchccmzfrNo ratings yet

- Biscuit Industry in India-Status Paper: Annual GrowthDocument19 pagesBiscuit Industry in India-Status Paper: Annual GrowthTeji AhlawatNo ratings yet

- New Govt PoliciesDocument2 pagesNew Govt PoliciesRakesh AroraNo ratings yet

- Final Report On Food BasketDocument29 pagesFinal Report On Food BasketFarhat Abbas DurraniNo ratings yet

- 4th March 2010 Finance + BudgetDocument41 pages4th March 2010 Finance + BudgetNeha GargNo ratings yet

- Impact of Increasing Sugar Prices On Sugar Demand in India.Document23 pagesImpact of Increasing Sugar Prices On Sugar Demand in India.Rishab Mehta0% (1)

- Date 28th February'11: The Following Pages ContainDocument31 pagesDate 28th February'11: The Following Pages ContainGagan Jeet SikhNo ratings yet

- Daily Agri Report, March 01Document8 pagesDaily Agri Report, March 01Angel BrokingNo ratings yet

- Retail Supply Tariff of BESCOM FY 12 With Proposed 2012Document4 pagesRetail Supply Tariff of BESCOM FY 12 With Proposed 2012nunna123nathNo ratings yet

- Urea Policy (Pricing and Administration) and Urea Pricing Policy SectionDocument5 pagesUrea Policy (Pricing and Administration) and Urea Pricing Policy SectionAnonymous w6TIxI0G8lNo ratings yet

- Union Budget 2010-2011Document5 pagesUnion Budget 2010-2011suvajit dasNo ratings yet

- UNION BUDGET 2013-14 KEY HIGHLIGHTSDocument34 pagesUNION BUDGET 2013-14 KEY HIGHLIGHTSSantosh SinghNo ratings yet

- Sugar Annual Report 2014Document64 pagesSugar Annual Report 2014FatimaIjazNo ratings yet

- India's Sugar Policy and Global Trade FAO Conference 2012Document24 pagesIndia's Sugar Policy and Global Trade FAO Conference 2012niksheth257No ratings yet

- Agri Weekly Market Review and OutlookDocument4 pagesAgri Weekly Market Review and OutlookNaveen DevarajNo ratings yet

- GDP,CPI,FDI,Infrastructure boost in Indian BudgetDocument4 pagesGDP,CPI,FDI,Infrastructure boost in Indian BudgetVishnuNo ratings yet

- India Ethanol Price 2022 CCEA-02.11.22Document2 pagesIndia Ethanol Price 2022 CCEA-02.11.22SRINIVASAN TNo ratings yet

- Wei 20150402 PDFDocument18 pagesWei 20150402 PDFRandora LkNo ratings yet

- Tribal Sub PlanDocument75 pagesTribal Sub PlanSantosh KundumNo ratings yet

- Agri News - WK 26Document3 pagesAgri News - WK 26shardulshindeNo ratings yet

- India Energy Conference 2008: Session 4 - Product Pricing & SubsidiesDocument14 pagesIndia Energy Conference 2008: Session 4 - Product Pricing & SubsidiesAbinash BiswalNo ratings yet

- KCPL - Kanpur Confectioneries Private Limited (A) - Case StudyDocument4 pagesKCPL - Kanpur Confectioneries Private Limited (A) - Case StudyAnanth KrishnanNo ratings yet

- Ministry of Consumer Affairs, Food & Public DistributionDocument4 pagesMinistry of Consumer Affairs, Food & Public DistributionHari KishanNo ratings yet

- New Price Chart : Aavin Milk: Tariff Structure (In RS)Document8 pagesNew Price Chart : Aavin Milk: Tariff Structure (In RS)Swethaa SureshkumarNo ratings yet

- Annexure 1 Biscuit Is Delicious Nutritious Common Man - S FoodDocument19 pagesAnnexure 1 Biscuit Is Delicious Nutritious Common Man - S FoodSachin PantnagarNo ratings yet

- Report Sugar & Gur Daily Fundamental ReportDocument5 pagesReport Sugar & Gur Daily Fundamental ReportAbuNo ratings yet

- Commodity Profile of Sugar For September 2015Document9 pagesCommodity Profile of Sugar For September 2015Donika MarkandeNo ratings yet

- Budget at A Glance 2011-12Document3 pagesBudget at A Glance 2011-12Ram Pratap SinghNo ratings yet

- Highlights of Union Budget 2016-17Document4 pagesHighlights of Union Budget 2016-17Suraj M ShettyNo ratings yet

- Budget AuroDocument38 pagesBudget AuroSrihari PatelNo ratings yet

- Sugar Industries of PakistanDocument19 pagesSugar Industries of Pakistanhelperforeu50% (2)

- Export Import Policy On Oils VMDocument20 pagesExport Import Policy On Oils VMAvineesh NigamNo ratings yet

- Sugarcane Pricing Issues in Uttar PradeshDocument24 pagesSugarcane Pricing Issues in Uttar PradeshsudhiNo ratings yet

- NABARD AFO 2020 ARD in News May 1 To 15 2021 Lyst9796Document17 pagesNABARD AFO 2020 ARD in News May 1 To 15 2021 Lyst9796Anumeya ChandraNo ratings yet

- Indian Sugar Industry: Production, Demand, Cycles and RegulationsDocument9 pagesIndian Sugar Industry: Production, Demand, Cycles and RegulationsBhavikNo ratings yet

- ReportDocument16 pagesReportasnashNo ratings yet

- Indian Sugar Sector Embracing Clean Energy FutureDocument26 pagesIndian Sugar Sector Embracing Clean Energy FutureEquity Nest100% (1)

- Report Sugar & Gur Daily Fundamental ReportDocument5 pagesReport Sugar & Gur Daily Fundamental ReportAbuNo ratings yet

- IBPS PO 2016 Capsule by AffairsCloudDocument109 pagesIBPS PO 2016 Capsule by AffairsCloudVicky VkyNo ratings yet

- Budget 2013-14 (Highlights, Provisions & Analysis) : By: Ankita Bharti Rajeev Kumar Manish RanjanDocument18 pagesBudget 2013-14 (Highlights, Provisions & Analysis) : By: Ankita Bharti Rajeev Kumar Manish RanjanpsNo ratings yet

- A) Explain Three Different Approaches To Calculate The GDP. Which Approach Should BeDocument2 pagesA) Explain Three Different Approaches To Calculate The GDP. Which Approach Should BeHaris KhanNo ratings yet

- Department of Animal Husbandry, Dairying & Fisheries Ministry of Agriculture, Govt. of India Dairy DevelopmentDocument4 pagesDepartment of Animal Husbandry, Dairying & Fisheries Ministry of Agriculture, Govt. of India Dairy Developmentshakti285No ratings yet

- CC-78 (New Rate List)Document5 pagesCC-78 (New Rate List)mota9820No ratings yet

- Double Digit Inflation Is Back... APRIL 2012Document22 pagesDouble Digit Inflation Is Back... APRIL 2012technoconsulting4smbsNo ratings yet

- CFCP e 22 2008Document2 pagesCFCP e 22 2008mlocal652No ratings yet

- India's Sugar Export Industry: Production, Trade & PolicyDocument11 pagesIndia's Sugar Export Industry: Production, Trade & Policyremoarun2uNo ratings yet

- Nepal Energy Sector Assessment, Strategy, and Road MapFrom EverandNepal Energy Sector Assessment, Strategy, and Road MapNo ratings yet

- Letter HeadDocument1 pageLetter HeadromeshNo ratings yet

- Titan Tech Engineering LogoDocument1 pageTitan Tech Engineering LogoromeshNo ratings yet

- CS Mid Model Paper 2017Document4 pagesCS Mid Model Paper 2017romeshNo ratings yet

- Humidity Sensors Improve Performance & SafetyDocument1 pageHumidity Sensors Improve Performance & SafetyromeshNo ratings yet

- UrlDocument2 pagesUrlromeshNo ratings yet

- Time TableDocument1 pageTime TableromeshNo ratings yet

- PLC LabDocument11 pagesPLC LabromeshNo ratings yet

- ThankingDocument1 pageThankingromeshNo ratings yet

- Technical Data: Relative Humidity SensorDocument4 pagesTechnical Data: Relative Humidity Sensorandresromero80No ratings yet

- Humirel Humidity SensorDocument2 pagesHumirel Humidity SensorRomeshNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentromeshNo ratings yet

- Return AddressDocument1 pageReturn AddressromeshNo ratings yet

- Question 2 4 Chapter Question 3 6 Chapter Ra-Of-Investment-BankingDocument1 pageQuestion 2 4 Chapter Question 3 6 Chapter Ra-Of-Investment-BankingromeshNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentromeshNo ratings yet

- Case of Financial Forecasting Champion Cattle Farm: Dr. Eduardo Añonuevo Dr. Janice Anñonuevo Dr. Jane TiongDocument30 pagesCase of Financial Forecasting Champion Cattle Farm: Dr. Eduardo Añonuevo Dr. Janice Anñonuevo Dr. Jane TiongEduardo AñonuevoNo ratings yet

- Rich Poor Foolish ExcerptDocument35 pagesRich Poor Foolish ExcerptRahul SharmaNo ratings yet

- Manager Loan Underwriting Mortgage Services in USA Resume Vicki AmaroDocument3 pagesManager Loan Underwriting Mortgage Services in USA Resume Vicki AmaroVickiAmaroNo ratings yet

- MBFS Mod 1Document119 pagesMBFS Mod 1kimsrNo ratings yet

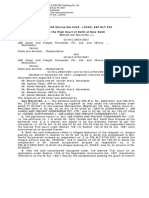

- Court Orders Confirmation of $1.8M Arbitration Award in Consumer Fraud CaseDocument137 pagesCourt Orders Confirmation of $1.8M Arbitration Award in Consumer Fraud CasecloudedtitlesNo ratings yet

- DBP vs Arcilla residential loan disputeDocument12 pagesDBP vs Arcilla residential loan disputePam ChuaNo ratings yet

- Chap 10 MCQDocument18 pagesChap 10 MCQMichelleLee100% (1)

- Tally - ERP 9: Billwise Details For Non-Trading Accounts in Tally - ERP 9Document5 pagesTally - ERP 9: Billwise Details For Non-Trading Accounts in Tally - ERP 9MANI KNo ratings yet

- Ba1 Module 1Document17 pagesBa1 Module 1Jenny PaculabaNo ratings yet

- Differential Equation For Loan Repayment: Bruce Emerson, PH213Document4 pagesDifferential Equation For Loan Repayment: Bruce Emerson, PH213Jhon Jasper ApanNo ratings yet

- Users of Financial StatementsDocument21 pagesUsers of Financial StatementsRomar SayoNo ratings yet

- Pershing Square's Q1 Letter To InvestorsDocument10 pagesPershing Square's Q1 Letter To InvestorsDealBook100% (22)

- Financial institutions and markets theory overviewDocument84 pagesFinancial institutions and markets theory overviewemre kutayNo ratings yet

- Tutoring Service Business PlanDocument45 pagesTutoring Service Business Plankevin gwenhureNo ratings yet

- Bangladesh Bank HistoryDocument5 pagesBangladesh Bank HistoryzonayetgaziNo ratings yet

- Richardson Steel Corporation v. Union Bank of The PhilippinesDocument2 pagesRichardson Steel Corporation v. Union Bank of The PhilippinesJay jogsNo ratings yet

- RWJ Chapter 16Document11 pagesRWJ Chapter 16Sohini Mo BanerjeeNo ratings yet

- Money and CreditDocument33 pagesMoney and CreditAnish TakshakNo ratings yet

- Meetings of Board and Powers of Board of DirectorsDocument2 pagesMeetings of Board and Powers of Board of Directorsअक्षय गोयलNo ratings yet

- Finance Business Cases ExamplesDocument4 pagesFinance Business Cases Examplestebobe7929No ratings yet

- Summer Training Report at HDFC BankDocument117 pagesSummer Training Report at HDFC BankAayush JainNo ratings yet

- Internship Report 17.10.14Document38 pagesInternship Report 17.10.14Umar SaeedNo ratings yet

- Financial Accounting and Reporting Ii: Examinable SupplementDocument30 pagesFinancial Accounting and Reporting Ii: Examinable SupplementShehrozSTNo ratings yet

- Ch03 Money MarketDocument8 pagesCh03 Money MarketPaw VerdilloNo ratings yet

- CHAPTER 2 - Presentation - For - TeachersDocument125 pagesCHAPTER 2 - Presentation - For - TeachersReffisa JiruNo ratings yet

- ORMILLA JOHN REY FERRERIA loan applicationDocument3 pagesORMILLA JOHN REY FERRERIA loan applicationRoc ValdezNo ratings yet

- JSB Cargo and Freight Forwarder (P) LTD v. State and Anr.Document28 pagesJSB Cargo and Freight Forwarder (P) LTD v. State and Anr.Rakshit GuptaNo ratings yet

- US Small Business Administration Disaster Loan Information For August StormDocument2 pagesUS Small Business Administration Disaster Loan Information For August StormKaren WallNo ratings yet

- Key Takeaways: CharacteristicsDocument10 pagesKey Takeaways: CharacteristicsARSALAN SATTARNo ratings yet