Professional Documents

Culture Documents

Learning Plan For ACCT 701 2 2017

Uploaded by

Anonymous I03Wesk92Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Learning Plan For ACCT 701 2 2017

Uploaded by

Anonymous I03Wesk92Copyright:

Available Formats

Learning plan for Accounting for Managerial Decision Making

Course code ACCT 701 w 2017

Week

Dates

Topics

Weekly Learning Outcomes

Jan. 9,13

Introduction to Management

Accounting How Management

Accounting Information

Supports Decision Making

1. Realize how financial accounting information provides an overall measure of

the organizations performance. 2 Understand how Management Accounting

Information supports decision making and how the organization's starategy

drives the need for different types of managerial accounting information. 3.

Explore the difference between management accounting and financial

accounting information. 4. Behavioural implications of Managerial Accounting.

Jan. 16,20

The Balance Scorecard and

Strategic Map.

Jan. 23,27

1. How Management Accounting supports internal decision making. 2. Explain

Using costs in decision making the difference between variable & fixed costs. 3. Explain Cost, Volume,profit

(CVP) Analysis to predict costs. 4. Explain other useful cost definitions.

Chapter 3 pages 62 - 120 Management Accounting by Atkinson et al.

Exercises & Cases Questions: 3-1 to 3-16. Exercises 325 to 3-30, 3-38 to 3-44, 3-54 to 3-56,3-60

Jan. 30, Feb. 3

Cost Management Systems. 2. Cost Flows in organizations manufacturing,retailing,services.3. Some important cost terms - cost object,

Accumulating and Assigning

consumable resources,direct and indirect costs.4. Handling Indirect costs in a

Costs to Products

manufacturing environment 5. Overhead allocation 6. Job Order & process

systems

Chapter 4 Pages 121-164. Management Accounting by Atkinson et al.

Exercises & Questions: 4-1 to 4-15.

Feb. 6,10

Feb. 13,17

Activity based cost systems

Feb. 24

Measuring and Managing

Customer Relationships

Mar. 6,10

Mar. 13,17

10

Mar. 20,24

11

Mar. 27,31

12

Apr. 3,7

13

Apr. 10

Apr. 17, 21

Chapter 1 pages 1 - 14 Managerial Accounting by Atkinson et al.

1. Understand why managers need a Balance Scorecard to measure and

manage intangible assets for value creation. 2. Creating a strategy Map. 3. Apply

Chapter 2 Pages 15 - 61 Management Accounting by Atkinson et al.

Balanced scorecard to nonprofit and Government. 4. Recognize common pitfalls

in implementing Balanced scorecard.

Instructional Strategies

Course Evaluations

Assignments

Lecture, discussion, in class group work. Questions 1-6,

1-8.Exercise 1-10.

In Class Assignment 1 Cases

1-18, 1-19 (1.5%)

Lecture, discussion, in class group work. Questions: 2Group case assignment due

2,2-3, 2-7, 2-8 to 2-16, Exercises 2-30 to 2-36,2-45 to 2Feb. 24 (15%) . Quiz 1 (1.5%)

47

ABC cost systems. Traditional Manufacturing Cost Systems. Limitations. Discuss

ABC: Capacity resource Capacity cost rates, Time useage per product, cost &

Chapter 5 Management Accounting by Atkinson et al.

profitability, Barriers to implementing ABC systems

1. Measuring customer profitability: Increasing customer profitability, managing

relationships, pricing waterfall.

In class Assignment 2

Exercise 3-28 (1.5%)

In Class Assignment 3 Cases

4-30, 4-36 (1.5%)

Term test 1 20%

Review and Term Test 1 20%

Feb. 27 - March 3

Reading Material

Chapter 6 pages 218 - 251 Management Accounting by Atkinson et al.

Questions 5-1 to 5-11, Problem 5-19

Exercises 6-20,6-21,6-22.

In class Assignment 4

Problems 5-22, 5-23 (1.5%)

Quiz 2 (1.5%)

Engagement week

Measuring and

Managing Process

Performance

1. Salesperson incentives. 2. Life cycle profitability 3. Measuring customer with

nonfinancial metrics 4. Process perspective and balanced scorecard 5.

Inventory costs and processing time 6. Cost of nonconformance 7. JIT 8. Kaizen

costing and benchmarking

Measuring and Managing Life 1. Discuss managing product over their life cycle 2. Explain target costing 3.

Cycle Costs

Explain breakeven 4.Discuss innovation measures on the balanced score card

Chapter 7 pages 252-300 Management Accounting by

Atkinson et al.

Chapter 8 Pages 301-339 Management Accounting by Atkinson et al.

Questions 7-1to 7-11

Questions 8-1 to 8-14

Term test 2 20%

Review and Term Test 2 20%

Behavioural and

Organizational Issues in

Management Accounting

1. Understand what are Management and Control Systems (MACS) 2.

Characteristics of a Well Designed MACS 3. Human Resource Management

Model of motivation 4. Explain and discuss the Organization's Ethical Code of

Conduct and MACS Design

Chapter 9 Pages 340 - 392 Management Accounting by Atkinson et al.

Questions 9-1 to 9-16. Exercises 9-36,9-37,9-38,9-42,944, 9-45

1. Explaining and determining levels of capacity-related and flexible resources 2.

Explaining and applying the budget process 3. Interpreting the Production Plan

Using Budgets and Planning

Chapter 10 Pages 393 to 462 Management Accounting by Atkinson et

4. Evaluate what if scenarios 5. Comparing Actual and Planned Results 6.

Questions 10 - 1 to 10-18

and Coordination

al.

Explaining the role of budgeting in the Service and Not for profit Organizations 7.

Discussing issues in Discretionary Expenditures and the budgetary process.

Financial Control

1, Explain the nature,scope and environment of financial control 2. Discuss the

motivation and why firms decentralize decision making 3. Understand why

organizations use responsibility centres and how to evaluate init performance 4. Chapter 11 Pages 462-509 Management Accounting by Atkinson et al.

Design and interpret performance measures to evaluate responsibility centres 5.

Understand the concept of transfer and various approaches

Questions 11-1 to 11-21

In class Assignment 6

Case 9-86 (1.5%)

In class Assignment 7

Exercises 10-38, 10-41

(1.5%)

In class Assignment 8

Problem 11-44,11-54

(1.5%)

Final (30%)

Review and Final 30%

14

Assessment

Weight

Quizes, In class assignments

15%

Group Assignment

15%

Test 1

20%

Test 2

In class Assignment 5

Exercise 7-30, 7-36

(1.5%)

20%

Final Exam

30%

Total

100%

You might also like

- Basic Project ManagementDocument17 pagesBasic Project ManagementFran JimenezNo ratings yet

- Vendor Evaluation in MM-PUR - ERP SCM - SCN WikiDocument12 pagesVendor Evaluation in MM-PUR - ERP SCM - SCN WikiSushil KanuNo ratings yet

- Senior Accountant Staff Accountant Assistant Controller in New Jersey Resume Magaly VanderbergDocument2 pagesSenior Accountant Staff Accountant Assistant Controller in New Jersey Resume Magaly VanderbergMagaly VanderbergNo ratings yet

- Tools and Techniques For Implementing Integrated Performance Management Systems PDFDocument36 pagesTools and Techniques For Implementing Integrated Performance Management Systems PDFDobu KolobingoNo ratings yet

- Management Control SystemDocument6 pagesManagement Control SystemN-aineel DesaiNo ratings yet

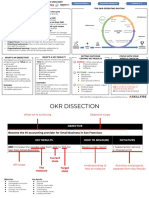

- Okr Cheat Sheet: Objective (Ideally 1) Key Results (Ideally 3-5) Initiatives ( 1)Document2 pagesOkr Cheat Sheet: Objective (Ideally 1) Key Results (Ideally 3-5) Initiatives ( 1)Tùng Hoàng50% (2)

- Contemporary Issues, Project 1Document7 pagesContemporary Issues, Project 1dipika upretyNo ratings yet

- Management AccountingDocument40 pagesManagement AccountingG Anwar100% (5)

- Quiz Questions - MCQ For CostingDocument27 pagesQuiz Questions - MCQ For Costingprakashvasantham75% (4)

- Fundamentals of Management AccountingDocument484 pagesFundamentals of Management AccountingMorick Gibson Mwasaga100% (9)

- Advanced Management AccountingDocument204 pagesAdvanced Management AccountingP TM100% (3)

- Module Study Pack (Stretigic Management Accounting)Document328 pagesModule Study Pack (Stretigic Management Accounting)Rimon BD100% (3)

- ITSM Assessment Artifacts-1Document1 pageITSM Assessment Artifacts-1Murali PvNo ratings yet

- OM Study Guide Lessons 1-12Document122 pagesOM Study Guide Lessons 1-12bingyang75% (4)

- Philippine University Syllabus for International Business CourseDocument11 pagesPhilippine University Syllabus for International Business CourseCharmaine ShaninaNo ratings yet

- Case Study A Profile of Toyota's Production SystemDocument1 pageCase Study A Profile of Toyota's Production SystemZhen WuNo ratings yet

- Auditing and Assurance Services 15e Chapter 26 SMDocument14 pagesAuditing and Assurance Services 15e Chapter 26 SMsellertbsm2014100% (3)

- Performance Management: Putting Research into ActionFrom EverandPerformance Management: Putting Research into ActionRating: 5 out of 5 stars5/5 (1)

- Questionnaire HRIS ImplementationDocument3 pagesQuestionnaire HRIS ImplementationNitin Bhat100% (1)

- ACT431 Management Accounting 1 Syllabus JDMDocument9 pagesACT431 Management Accounting 1 Syllabus JDMRalph Joshua JavierNo ratings yet

- Diary 1Document13 pagesDiary 1Brighton1990No ratings yet

- Course Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionDocument4 pagesCourse Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionSefiager MarkosNo ratings yet

- Accounting Information Systems Course OutlineDocument10 pagesAccounting Information Systems Course OutlineLouis Maps MapangaNo ratings yet

- The contingency theory of management accountingDocument26 pagesThe contingency theory of management accountingpersia_dec788363No ratings yet

- Assignment Brief MFPTDocument10 pagesAssignment Brief MFPTTabinda SeherNo ratings yet

- Managerial EconomicsDocument3 pagesManagerial EconomicsMar BelayNo ratings yet

- 1 5150099021255147675Document5 pages1 5150099021255147675Ketema AsfawNo ratings yet

- BAC3674 - Syllabus Sem1 2013-2014Document7 pagesBAC3674 - Syllabus Sem1 2013-2014secsmyNo ratings yet

- Syllabus Bkam 3033Document5 pagesSyllabus Bkam 3033Yadu Priya DeviNo ratings yet

- What Subjects Will I Be Studying in My Accountancy CourseDocument12 pagesWhat Subjects Will I Be Studying in My Accountancy CourseJerry CabaltierraNo ratings yet

- Quantitative Techniques at a GlanceDocument20 pagesQuantitative Techniques at a GlanceDivyangi WaliaNo ratings yet

- Key Words: Cost Accounting, Accounting Information, Decision Making, EfficiencyDocument19 pagesKey Words: Cost Accounting, Accounting Information, Decision Making, EfficiencyNejash Abdo IssaNo ratings yet

- Dokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Document748 pagesDokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Sie Humas Septia Ardianti100% (1)

- Management Accounting SyllabusDocument12 pagesManagement Accounting Syllabuswikka nindyaNo ratings yet

- Fiji National University course explores advanced management accountingDocument10 pagesFiji National University course explores advanced management accountingRavinesh PrasadNo ratings yet

- Cape Accounting A Literature ReviewDocument4 pagesCape Accounting A Literature Revieweldcahvkg100% (1)

- Download Cost And Management Accounting I Mohammed Hanif full chapterDocument67 pagesDownload Cost And Management Accounting I Mohammed Hanif full chapterrobert.hoppe659100% (2)

- BSC application in management accounting reviewedDocument4 pagesBSC application in management accounting reviewedexams_sbsNo ratings yet

- FBE Courses Descriptions 2017-18 Revise 25 Jul 2017Document37 pagesFBE Courses Descriptions 2017-18 Revise 25 Jul 2017Timothy CheungNo ratings yet

- AIS Course OutlineDocument6 pagesAIS Course OutlineRajivManochaNo ratings yet

- Adigrat University Colleg of Business and Economics Department of Accounting and FinanceDocument44 pagesAdigrat University Colleg of Business and Economics Department of Accounting and Financeyohannes johnNo ratings yet

- Ea 1Document20 pagesEa 1Ella LawanNo ratings yet

- Managerial Accounting PDFDocument20 pagesManagerial Accounting PDFMister GamerNo ratings yet

- Symbiosis International University (Siu) PHD Research Proposal For Faculty of ManagementDocument13 pagesSymbiosis International University (Siu) PHD Research Proposal For Faculty of Managementmahima_sodadasiNo ratings yet

- Aikas - Timo BSCDocument65 pagesAikas - Timo BSCOladipo OlanyiNo ratings yet

- Cost &MGMT Acc For ABVMDocument71 pagesCost &MGMT Acc For ABVMabdigedefa49No ratings yet

- Advanced Cost and Management Accounting SyllabusDocument8 pagesAdvanced Cost and Management Accounting Syllabusrief1010No ratings yet

- Evaluation Scheme & Syllabus For: Dr. A.P.J. Abdul Kalam Technical University LucknowDocument108 pagesEvaluation Scheme & Syllabus For: Dr. A.P.J. Abdul Kalam Technical University LucknowSumit KumarNo ratings yet

- Business Intelligence and Performance Management in Academic DisciplineDocument15 pagesBusiness Intelligence and Performance Management in Academic DisciplineRajan ChristianNo ratings yet

- Ch01-Managerial Accounting and TheDocument26 pagesCh01-Managerial Accounting and TheExequielCamisaCrusperoNo ratings yet

- MBA501A ABM v2.1Document5 pagesMBA501A ABM v2.1Ayush SatyamNo ratings yet

- Accounting For Managers Course PlanDocument3 pagesAccounting For Managers Course PlankelifaNo ratings yet

- What Are Sso Good Theis TopiDocument11 pagesWhat Are Sso Good Theis TopiAireeseNo ratings yet

- Download ebook Cost And Management Accounting I Pdf full chapter pdfDocument67 pagesDownload ebook Cost And Management Accounting I Pdf full chapter pdfedwina.perry203100% (23)

- Cost and Management Accounting GuideDocument79 pagesCost and Management Accounting GuideEalshady HoneyBee Work ForceNo ratings yet

- Chapter 1Document2 pagesChapter 1BS Accoutancy St. SimonNo ratings yet

- 294 Managerial Accounting - COURSE OUTLINEDocument5 pages294 Managerial Accounting - COURSE OUTLINEsilenteyes100% (1)

- Quiz Examples PDFDocument37 pagesQuiz Examples PDFumarrchNo ratings yet

- MMS 1st Year SyllabusDocument50 pagesMMS 1st Year SyllabusaryabhatmathsNo ratings yet

- MMS Syllabus University of MumbaiDocument60 pagesMMS Syllabus University of MumbaiDipen Ashokkumar KadamNo ratings yet

- Great Lakes MANAC Course Outline - 2013-15Document2 pagesGreat Lakes MANAC Course Outline - 2013-15Shiva Kumar DunaboinaNo ratings yet

- Problems and Perspectives of Balanced Scorecard Implementation in SerbiaDocument14 pagesProblems and Perspectives of Balanced Scorecard Implementation in SerbiaMohammad ShehataNo ratings yet

- An Appraisal of The Efficiency and Impact of Cost Control System On ProfitabilityDocument121 pagesAn Appraisal of The Efficiency and Impact of Cost Control System On ProfitabilityEmmanuel KingsNo ratings yet

- TB 1 Akuntansi Manajemen Stratejik - Faiz NarendraputraDocument11 pagesTB 1 Akuntansi Manajemen Stratejik - Faiz NarendraputraFaiz NarendraputraNo ratings yet

- A222 BKAM3033 Syllabus-Student VersionDocument6 pagesA222 BKAM3033 Syllabus-Student VersionNrsfqNo ratings yet

- Management Accounting - EditDocument8 pagesManagement Accounting - EdityudaNo ratings yet

- Semester - I & IIDocument12 pagesSemester - I & IIRehman QureshiNo ratings yet

- Value Creation in Management Accounting and Strategic Management: An Integrated ApproachFrom EverandValue Creation in Management Accounting and Strategic Management: An Integrated ApproachNo ratings yet

- Guide to Importing into Canada with Regulations, Duties, Customs RequirementsDocument3 pagesGuide to Importing into Canada with Regulations, Duties, Customs RequirementsAnonymous I03Wesk92No ratings yet

- Determining Your ProfitDocument1 pageDetermining Your ProfitAnonymous I03Wesk92No ratings yet

- Managing A Family-Owned BusinessDocument1 pageManaging A Family-Owned BusinessAnonymous I03Wesk92No ratings yet

- Marketing Plan OutlineDocument2 pagesMarketing Plan OutlineAnonymous I03Wesk92No ratings yet

- Business Guide For Newcomers To CanadaDocument4 pagesBusiness Guide For Newcomers To CanadaAnonymous I03Wesk92No ratings yet

- Exporting To World MarketsDocument7 pagesExporting To World MarketsAnonymous I03Wesk92No ratings yet

- Home-Based BusinessDocument1 pageHome-Based BusinessAnonymous I03Wesk92No ratings yet

- How To Start A BusinessDocument8 pagesHow To Start A BusinessAnonymous I03Wesk92No ratings yet

- Guide to Importing into Canada with Regulations, Duties, Customs RequirementsDocument3 pagesGuide to Importing into Canada with Regulations, Duties, Customs RequirementsAnonymous I03Wesk92No ratings yet

- Developing Your IdeasDocument2 pagesDeveloping Your IdeasAnonymous I03Wesk92No ratings yet

- How To Start A BusinessDocument8 pagesHow To Start A BusinessAnonymous I03Wesk92No ratings yet

- Business Plan GuideDocument3 pagesBusiness Plan GuideAnonymous I03Wesk92No ratings yet

- Financing A Business GuideDocument2 pagesFinancing A Business GuideAnonymous I03Wesk92No ratings yet

- Exporting To World MarketsDocument7 pagesExporting To World MarketsAnonymous I03Wesk92No ratings yet

- Financing A Business GuideDocument2 pagesFinancing A Business GuideAnonymous I03Wesk92No ratings yet

- Exporting To The United StatesDocument7 pagesExporting To The United StatesAnonymous I03Wesk92No ratings yet

- Case Interview Workshop Introduction 1Document1 pageCase Interview Workshop Introduction 1Anonymous I03Wesk92No ratings yet

- Employment Regulations - HiringDocument4 pagesEmployment Regulations - HiringAnonymous I03Wesk92No ratings yet

- Ana Paula Sanchez: ExperienceDocument2 pagesAna Paula Sanchez: ExperienceAnonymous I03Wesk92No ratings yet

- How To Make People Like You and TED Talks.Document1 pageHow To Make People Like You and TED Talks.Anonymous I03Wesk92No ratings yet

- Business Regulations GuideDocument8 pagesBusiness Regulations GuideAnonymous I03Wesk92No ratings yet

- Corporate Taxation GuideDocument2 pagesCorporate Taxation GuideAnonymous I03Wesk92No ratings yet

- Ecuaciones FinancierasDocument5 pagesEcuaciones FinancierasAnonymous I03Wesk92No ratings yet

- Eliana Duque: ContactDocument2 pagesEliana Duque: ContactAnonymous I03Wesk92No ratings yet

- Give & Go Assistant Product Manager OP 2020 PDFDocument6 pagesGive & Go Assistant Product Manager OP 2020 PDFAnonymous I03Wesk92No ratings yet

- Paula Pelaez: ExperienceDocument2 pagesPaula Pelaez: ExperienceAnonymous I03Wesk92No ratings yet

- Creating An Editorial CalendarDocument6 pagesCreating An Editorial CalendarAnonymous I03Wesk92No ratings yet

- 000-. Entrepreneurship Innovation and RRgional Development - Mitra Jay 4 Por Hoja Cap 10Document9 pages000-. Entrepreneurship Innovation and RRgional Development - Mitra Jay 4 Por Hoja Cap 10Anonymous I03Wesk92No ratings yet

- INTL711 Introduction Week 7 Entrepreneurship, Innovation, and Economic Development PDFDocument31 pagesINTL711 Introduction Week 7 Entrepreneurship, Innovation, and Economic Development PDFAnonymous I03Wesk92No ratings yet

- INTL 711 - CH 9 PDF 9 Por Pagina PDFDocument8 pagesINTL 711 - CH 9 PDF 9 Por Pagina PDFAnonymous I03Wesk92No ratings yet

- Economics QuestionsDocument5 pagesEconomics QuestionscommrceNo ratings yet

- KFUPM Maintenance Management SyllabusDocument10 pagesKFUPM Maintenance Management SyllabusNoman Ullah ChoudharyNo ratings yet

- Intro To SAS 70 AuditsDocument12 pagesIntro To SAS 70 AuditshvanhtuanNo ratings yet

- Chapter 3 Enterprise Management Systems IoenotesDocument38 pagesChapter 3 Enterprise Management Systems IoenotesKarki xavierNo ratings yet

- Summer Internship Project BriefDocument2 pagesSummer Internship Project BriefArushi SinghNo ratings yet

- Graham Management - Leadership Competency Frameworks 2021Document70 pagesGraham Management - Leadership Competency Frameworks 2021Angie ChuNo ratings yet

- Badrinathraju Vysyaraju: Professional SkillsDocument3 pagesBadrinathraju Vysyaraju: Professional SkillsVeera Manikanta GNo ratings yet

- Assignment M7Document4 pagesAssignment M7Khiết DoanhNo ratings yet

- 08 - Chapter 1 PDFDocument52 pages08 - Chapter 1 PDFDivyam NarnawareNo ratings yet

- How the Balanced Scorecard Framework Helps Organizations Link Strategy to PerformanceDocument19 pagesHow the Balanced Scorecard Framework Helps Organizations Link Strategy to PerformanceKailin DuNo ratings yet

- Managment Learning OutlineDocument38 pagesManagment Learning OutlineAamir RazaNo ratings yet

- Implementing Armenia's Protected Areas ProgrammeDocument13 pagesImplementing Armenia's Protected Areas ProgrammeNullus cumunisNo ratings yet

- Organise Meetings AssessmentDocument35 pagesOrganise Meetings AssessmentMarNo ratings yet

- Beer Game IntroDocument11 pagesBeer Game IntroAkhil DevNo ratings yet

- Indranil Pakrashi's Professional Profile and Experience SummaryDocument8 pagesIndranil Pakrashi's Professional Profile and Experience SummaryArjun GhoseNo ratings yet

- Supply Chain Security Risk and Mitigation TechniquesDocument11 pagesSupply Chain Security Risk and Mitigation TechniquesalnasserNo ratings yet

- BATADocument11 pagesBATARamya BalanNo ratings yet

- Working Capital Management at BEMLDocument20 pagesWorking Capital Management at BEMLadharav malikNo ratings yet

- Chapter 11 MisDocument5 pagesChapter 11 MisHeinz DoofenshmirtzNo ratings yet

- ErpmDocument19 pagesErpmakshay kushNo ratings yet