Professional Documents

Culture Documents

Asian Premium in Crude Oil Markets

Uploaded by

albyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asian Premium in Crude Oil Markets

Uploaded by

albyCopyright:

Available Formats

3/20/2016

ExploringtheAsianPremiuminCrudeOilMarkets

Skiptocontent

Skiptomainnavigation

Search

Skipto1stcolumn

Textsize

Skipto2ndcolumn

HOME

Home

EDITORIALBOARD

Archive

MILITARYENERGYEFFICIENCY

November2012Issue

IssueContent

EVENTS

SUBMISSIONGUIDELINES

SUBSCRIBE

ExploringtheAsianPremiuminCrudeOilMarkets

ExploringtheAsianPremiuminCrudeOil

Markets

WEDNESDAY,21NOVEMBER201200:00 ADIIMSIROVICANDDR.TILAKDOSHI

TheissueofchallengestoAsianenergysecurityisexemplifiedbythedebateovertheexistenceofwhatsome

refertoasanAsianPremium.AsiaisfarmoredependentonoilimportsfromtheMiddleEast(ME)thananyother

mayorimportingregionintheworld.In2011,over14millionbarrelsperday(mb/d)orsome57%ofoilimports

ARCHIVE

LIGHTHOUSE

Tweetsby@energysecurityj

J.ofEnergySecurity

@energysecurityj

Animation:Wealthvs.PopulationforUSA,China,

andIndia(19702030)

visualcapitalist.com/animationgdpvia

@Visualcap

Animation:Wealthvs.Populationfor

originatedintheME,comparedwith1.9mb/d(17%)fortheUSand2.5mb/d(21%)forEurope(EU).Becauseof

thisdependence,itiswidelybelievedthatAsiancustomershavebeenpayingapremiumforMiddleEastcrudeoil

relative to those in the US and EU. Indeed, a number of studies have consistently identified higher prices for

exportstoAsiarelativetoUSandEUpricesamountingtoabout$1.00to$1.50perbarrelduringthe1990sand

early 2000s.This has led to calls for intervention by some observers of theAsian crude oil market in order to

eliminatethissocalledAsianpremium.Morerecently,ithasbeenarguedthatthepremiumhasbeenreversed

because Asian has emerged as the dominant consuming region for oil from the ME forcing Middle East oil

producerstoreducetheircrudeoilpricesrelativetotheotheroilconsumingregions.

TheAsianPremiumdebate

Several papers by governmentfunded research institutions in the key Northeast Asian crude oil importing

countries such as Japan, South Korea, and China and by US academics have analyzed this issue and have

attemptedtocalculatethesizeandvariationsinthissocalledpremium.

The Institute for Energy Economics Japan (IEEJ) has suggested that crude oil prices forAsia have remained

higherthanthoseofEuropeanandUSmarketsby$1.00$1.50/barrel(bbl)throughoutthe1990s.Inanother

paper by the IEEJ, theAsia crude oil premium to Europe was estimated to have averaged $0.94/bbl over the

periodJanuary1991toJune2002.Morerecently,anarticleintheWallStreetJournal(WSJ)indicatedthatthe

Asiapremiumhasbeenonaverageabout$1.20abarrelsince1988.UtilizingdatafromPetroleumIntelligence

Weeklyfortheperiod19901997,AmericanresearchersfoundthatSaudiFOBpricesforcrudeoildestinedfor

Asianmarketshavebeenonaverage$0.83higherperbarrel(bbl)thanforWesternEuropeand$0.93higher

thanfortheUnitedStates.Inanotherpaper,theauthorscalculatedtheAsiaEuropedifferentialforSaudiArab

LightFOBsalestoaverage$0.90/bblover19882002,increasingto$1.48/bblover19972002.Inanother

careful study, covering the period January 1992 November 1996, theAsiadestined loadings for SaudiArab

Light(AL)realizedpriceswerefoundtobeonaverage$1.00$1.20/bblhigherthanforEuropeanloadings.All

these estimates from the cited sources are broadly consistent, with the Asian premium being in the range of

$1.00$1.50/bbloverthe1990sandtheearlypartofthe2000s.

WatchtheeconomiesoftheUnitedSt

visualcapitalist.com

05Mar

J.ofEnergySecurity

@energysecurityj

ISISLibyafootholdthreatensEU

ensec.org/index.php?opti

03Mar

J.ofEnergySecurity

@energysecurityj

ExportingtheChineseModelbyFrancis

Fukuyamavia@ProSyn#opedpo.st/vJkbSUvia

@po_st

ExportingtheChineseModel

As2016begins,anhistoriccontestis

Embed

ViewonTwitter

Videos

TheimplicationsofthesehigherpricesforAsiaareobvious.TheIEEJestimatesthattheAsiapremiumimposes

onJapananadditionalburdenof$48billionannually.Furthermore,itisclaimedthathighercrudeoilpricesalso

leadtohigherpricesforotherenergycommoditiessuchasLNGandcoal,whicharetypicallylinkedtooilprices.

Similarly,theKoreaEnergyEconomicsInstitute(KEEI)pointsoutthatthefinancialburdenofextracostsadversely

affectseconomicandindustrialactivityandleadstothedeteriorationofthecompetitivenessofAsianeconomies.

ItsestimateoftheburdenplacedbytheAsiapremiumontheKoreaneconomyis$800900milliondollarsayear.

Evolutionofoilpricingmechanisms

In1973theOrganizationofthePetroleumExportingCountries(OPEC)inheritedfromthemajoroilcompaniesa

pricingregimewhicheffectivelyadministeredthepriceofoilbyfiat.Inthepre1974period,theysimplyposteda

fixedpriceforcrudeoil.Thispricewasusedtocomputeroyaltiesandtheincometaxpaidtoproducingcountries.

WhenOPECcountriesnationalizedtheirupstreamhydrocarbonassets,theadministeredpriceeffectivelywasthe

priceatwhichoilwassoldandboughtinarmslengthtransactionsfromtheexportingcountries.

Theadministered,fixedpricesystemcollapsedin1985.Intheyearsleadingto1985,therewasdisarrayinthe

OPECranksoverpricingpolicyanditsfundamentallongtermpricingstrategy.Thiswasparticularlyobviousinthe

1980conferenceinAlgiers.OPECofficialpriceswerefallingoutoflinewithcompetingfreelytradedcrudesin

Atlantic Basin spot markets.The problem arose from the difficulty encountered by OPEC in defending a given

priceinthefaceofstrongcompetitionfromemerging,andrapidlygrowing,nonOPECsources.Increasingnon

OPECsupplies,atatimeofstagnantworlddemand,resultedintheemergenceofconsiderablesurpluscapacity

withintheOPECregion.ThisinducedintraOPECcompetitionwhichmeantpricediscountingbyseveralOPEC

membercountriestoprotecttheirexportvolumes.Byadheringtothesystemofofficialprices,whichmostofOPEC

wasabandoning,SaudiArabiawasforcedtoreduceoutputandtakeontheroleofswingproducer.TheKingdom

sufferedacontinuousdeclineinthevolumeoftheirexports,fromabout10millionbarrelsaday(m/bd)tojust

under 3 m/bd between 1980 and 1986. In the end, due to huge losses in export revenue, Saudi Arabia

abandoned the system. The OPEC administered price system, which had been in operation since 1974,

collapsed.

NEWBOOKS

POPULAR

http://ensec.org/index.php?option=com_content&view=article&id=393:exploringtheasianpremiumincrudeoilmarkets&catid=130:issuecontent&Itemid=405

1/6

3/20/2016

ExploringtheAsianPremiuminCrudeOilMarkets

Forarelativelyshortbutdramaticperiodin1986,netbackpricingreplacedadministeredprices.Undernetback

arrangements,thepriceofcrudeoilwasreferencedtothevalueofrefinedpetroleumproductsderivedfromthe

givencrude.Ineffect,netbacksguaranteedarefinerymarginwhich,inperiodsofexcessrefiningcapacitythat

prevailed at the time, resulted in falling product prices. This, in turn, led to a collapse of crude oil prices. The

effectswerecatastrophicforcrudeoilexporters.Atonepointoilprices,whichwerepreviouslyinthe$2426per

barrel(bbl)range,fellto$810/bbl.

The ensuing price recovery followed an OPEC meeting in November 1986. This meeting was significant as it

changed the overall strategy from charging official administered prices to managing OPEC supply through the

quotasysteminordertostabilizethepricearoundatargetlevelof$18/bbl.Giventhatneithertheadministered

OPEC prices nor netback prices were acceptable any longer, a system of marketrelated formulae prices was

gradually adopted. It involved setting official monthly discounts (or premiums) relative to the other marker or

referencegradessuchasBrentorWestTexasIntermediate(WTI).

SaudiAramcospricingmechanism

SaudiAramcospricingsystemislooselytrackedbymostexportersintheMiddleEast.Theotherlargeproducers

suchasKuwait,Iran,QatarandAbuDhabialsouseasimilarsystemandaregenerallyseenbythemarketas

followersintermsofdirectionandthemagnitudeofthechangesintheSaudidifferentials(sometimesreferredto

asoffsets).SaudiAramcossalestointernationalbuyersaremadeunderlongtermcontracts,usuallyevergreen

contractsrenewableannually.Thepricingformulagenerallyhasfourcomponents:pointofsale,amarketrelated

baseprice,anadjustmentfactorthatisreflectiveofcrudeoilqualityandthepointofsale,andatimingmechanism

thatstipulateswhenthevalueoftheformulaistobecalculated.Thebasepriceiscalculatedbytakingthedaily

average of market prices of a particular widelytraded reference crude oil. The FOB price for European

destinationsistiedtoBrentWeightedAverage(BWAVE)pricepublisheddailyforBrentcrudeoilfortheperiodof

10daysaroundthedeliveryofthecargo,about40daysafterloadingattheSaudiportofRasTanura.FortheUS,

theFOBpriceislinkedtoWestTexasIntermediate(WTI)crudeoilforthe10daysaroundthedeliveryofthecargo

about50daysafterloadingatthesameport.ForbuyersinAsia,crudeoilpricesarelinkedtotheaveragespot

pricesofOmanandDubaicrudeoilsasassessedbyPlattsduringthemonthinwhichthecrudeisloadedatRas

Tanura for delivery to theAsian market. The base price is then adjusted by adding or subtracting an offset or

adjustmentfactorasdeterminedbyAramco,onamonthlybasis,priortothemonthofloading.Thisadjustment

factortakesintoaccountthepointofsale(toadjustforthefreightcosts)andthequalitydifferentialbetweenthe

Saudicrudeandthereferencecrudeforeachparticularimportingregionseparately.Thequalitydifferentialis

essentiallythedifferencebetweenthegrossproductworth(GPW)oftheSaudicrudeandthereferencecrude.

GPW is calculated by multiplying the refined product yield of each barrel under a given refinery process

configurationwiththepriceoftheresultingrefinedproductsinthespotmarket.

Theofficialsellingprice(OSP)foranyparticularMiddleEastexportcrudeoilissimplythesumofthereference

crudepriceandtheannouncedmonthlyoffsetforgivenregionaldestinations,asexplainedabove.ForAtlantic

markets,thereferencecrudesWTI(AramcoswitchedovertotheArgusSourCrudeIndexorASCIforitscrudeoil

salesintheUSinJanuary2010)alongwithotherreferencecrudessuchasBWAVEaretradedinhighlyliquid

marketswithpricessetcompetitively,bothinphysicalbarreltradesaswellasintheorganizedfuturesmarketsof

New York and London. In contrast, Asia has no well established formal futures markets for crude oil. In the

absenceofanestablishedcrudeoilfuturesmarket,theDubaicrudeforwardmarketwassuccessfullydeveloped

in the 1980s. Dubai crude production went into decline in the early 1990s there was a corresponding fall in

liquidityinoutrightdealsthatprovidedabsolutepricesignals.Asaresult,theDubaimarketnolongerservedas

an indicator of absolute prices, and instead became a relative price market where its price was set relative to

Brent,andrelativetothetimestructureofDubaiprices.ThemarketsforBrentDubaispreadsandDubaiinter

monthspreadsarewellestablished,andPlattsassessedOmanDubaiUpperZakumpricesbecamethebasisfor

pricingMiddleEastcrudeexportsontermcontractstoAsia.

TherehasbeenextensivediscussionintheoilindustryregardingtheproblemswiththePlattsOmanDubaiprice

quotation.However,theworldslargestflowofcrudeoilthatis,theflowfromtheMiddleEasttoAsiaamounting

to some 15 mb/d remains largely priced on the basis of this agencys assessments. The price assessment,

based on the Platts partials assessment methodology and which allows delivery of Oman and Upper Zakum

crudeoilsinlieuofDubai,remainsthereferencequotationforMiddleEasttermcontracts.

"Remarkablecollectionspanninggeopolitics,

economyandtechnology.Thistimelyand

comprehensivevolumeisaonestopshopfor

anyoneinterestedinoneofthemostimportant

issuesininternationalrelations."

U.S.SenatorRichardG.Lugar

"Asmallmasterpiecerightonthemoneyboth

strategicallyandtechnically,witty,farsighted,and

barbequesanumberofsacredcows.Absolutelydo

notmissthis."

R.JamesWoolsey,FormerCIADirector

"ThebookisgoingtobecometheBiblefor

everyonewhoisseriousaboutenergyandnational

security."

RobertC.McFarlane,FormerU.S.NationalSecurity

Advisor

The Dubai Mercantile Exchange (DME) launched its Oman futures contract in June 2007, and since then the

exchangeachievedarecordtradedvolumeof141,129contracts.However,itsaveragedailyvolumesforamain

tradingmonthofdeliveryaretypicallybelow3,000lots(threemillionbarrels)paleincomparisontosome150,000

lots (one hundred and fifty million barrels) normally traded in the front month Brent contract for example. Its

emergenceasaviableinstrumentforestablishingareferencepriceforMiddleEastcrudeoilexportstoAsiaisstill

uncertain. To date, the Saudi, Kuwaiti, Iranian and other Middle East OSPs for Asiadestined crude oil sales

remainbasedonPlattsassessments.

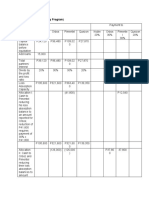

Regionalpricedifferentials20072009

ThefocusofthisanalysisisonthebiggestplayerintheMiddleEast,namelySaudiArabiaanditsnationaloil

companySaudiAramco.WeestimatethedifferentialsinArabLight(AL)officialsellingprices(OSPs)whichare

loaded on FOB terms at Ras Tanura port and destined for three major regions United States (US), Western

Europe(WE),andtheFarEast(FE)fortheperiodoverJanuary2007toDecember2009.Forallthreeregions,we

usedthedailypricedataforthe2007,2008,and2009(In2010,SaudiAramcochangedthemethodologyforthe

USandstartedusingArgusSourCrudeIndexorASCIsoweexcludeddatafromJanuary2010exceptwhenused

http://ensec.org/index.php?option=com_content&view=article&id=393:exploringtheasianpremiumincrudeoilmarkets&catid=130:issuecontent&Itemid=405

2/6

3/20/2016

ExploringtheAsianPremiuminCrudeOilMarkets

topricecrudeloadedattheendof2009).Wechosetwodifferentdatesfortheloadingorbilloflading(B/L)day.

Theloadingdaychosenfirstwasmiddleofeachmonth(15th).Thenweassumedthattheoiltobedeliveredtoall

threemarketswasloadedonthisverysamedate,clearlytocomparethepricesofthesamebarrelsforthethree

differentregionsonthesametemporalbasis.Onceweworkedoutthetimeseriesandobtainedresults,wechose

Books

another,arbitrarydate(5thdayofeachmonthofloading)andcalculatedanothersetofprices.Thiswasdoneto

Go

energysecurity

testforsensitivityofourresultstothechoiceofB/Ldate.

Itisworthexaminingthegeneraltrendsinthepriceofoilovertheperiodunderconsideration.

Figure1:OSPsbyMajorRegions

EnergyandSecurity:

StrategiesforaWorl

$35.00

(6)

TheQuest:Energy,

Security,andth

$15.75

(190)

MythsoftheOilBoom:

AmericanNational

$27.55

(8)

Viewall20100+results

onAmazon.com

Source:AuthorsbasedonPlattsdata

Three distinctive trends are immediately noticeable: One uptrend from January 2007 to July 2008 prior to the

financial crises reaching almost $140/bbl on a monthly average basis secondly, the collapse of prices from

$140/bbl to below $40/bbl following the financial crises which began in the third quarter of 2008 thirdly, a

recovery and uptrend from the end of 2008 and early 2009. The table below summarizes our results for

Asia/EuropedifferentialsfortwodifferentassumedB/LdatesandcomparesthemwiththePetroleumIntelligence

Weekly(PIW)estimates.

Table1:AsiaEuropeFOBPriceDifferentialsforArabLight

Year B/L(5th) B/L(15th) PIW

2007 2.24

3.57

2.00

2008 4.59

5.06

7.00

2009 0,04

0.91

0,50

Source:Authors'Calculations

The price differentials betweenAsia and Europe, as can be seen, are large and highly volatile. In 2007,Asia

experiencedalargediscountrelativetoEuroperangingfrom$2.00/bblto$3.57/bbl.In2008,Asiaexperienceda

verylargepremiumtoEurope,rangingfrom$4.59/bblto$7.00/bbl.In2009,thepremiumreversedagain,and

ArabLightsoldtoAsianbuyerswasatadiscounttoEuroperangingfrom$0.04/bblto$0.50/bbl.Overthethree

yearsstudied,Asiapaidasmallpremiumof$0.19relativetoEurope.

Figure2:AsiaUSALFOBPriceDifferential

http://ensec.org/index.php?option=com_content&view=article&id=393:exploringtheasianpremiumincrudeoilmarkets&catid=130:issuecontent&Itemid=405

3/6

3/20/2016

ExploringtheAsianPremiuminCrudeOilMarkets

Source:Authors'Calculations

ThefigureaboveshowsthattheOSPdifferentialbetweenAsiaandUSforArabLight(AL)rangesfromanegative

$20/bbltoover$30/bblover20072009.In2007,weestimatethatAsiapaidonaverage$2.00/bbllessforitsFOB

purchasesofALcrudewhileitpaidabout$4.70/bblmorein2008(whenthedifferentialspikesstartinginMarch

2008)and$1.90/bbllessin2009.

Figure3:AsiaEuropeALFOBDifferential

Source:Authors'Calculations

Similarly, this figure shows that the OSP differential for FOBAL betweenAsia and Europe also ranges from a

negative($15/bbl)toapositive($25/bbl)number.Onaverage,Asiapaid$2.24/bbllessin2007,$4.60/bblmorein

2008,and$0.04/bbllessin2009.ThereforeakintotheAsiaUSdifferential,annualaveragesforOSPdifferentials

betweenAsiaandEuropearealsovolatile.

WemeasuredtheFOBdifferentialsforALsoldinthethreemarketsutilizingadifferentarbitraryloadingdate.The

arbitraryloadingdatechosenforallthreemarketswasthe5thofeachmonth.Thisadvancedthepricingforcrude

destinedtobothEuropeandtheUSby10days(fromthe15thtothe5thoftheconsecutivemonth).Notethat

Asianpricingalwaysremainsthesamewithregardstotheloadingdate,forAsiansalesthepricingperiodisthe

averageofthemonthofloadingirrespectiveoftheactualB/Ldateinthemonth.

Figure4belowgivesaplotofthechangeinAsiaoffsetsalongwithaplotofthechangeintheAsiaOSP.During

20072009thechangeinAsianoffsetswasinsignificantcomparedtochangeAsiaOfficialSellingPrices(OSPs).

WecanseethatthemagnitudeofthechangeinAsianoffsetsisverysmallcomparedwiththemagnitudeofthe

changeinAsianOSPs.

http://ensec.org/index.php?option=com_content&view=article&id=393:exploringtheasianpremiumincrudeoilmarkets&catid=130:issuecontent&Itemid=405

4/6

3/20/2016

ExploringtheAsianPremiuminCrudeOilMarkets

Figure4:ChangeinthepriceoftheAsiaOSPsandtheAsiaoffsets($/bbl)

Source:Platts

Ascanbeseeninthefigureabove,AsianALOSPsgotoadiscountofbetween$10$20/bbltoEuropeanAL

OSPsinMarchMay2008asBWAVEtrendsupsharplyfrom$90/bblto$140/bbl.WhenBWAVEtrendsupward,

pricingona10dayaverageforwardwillbehigherthantheOman/Dubaiaveragemonthlypriceforthemonthof

loadingforAsiansales,i.e.inarisingmarketforBWAVEreferencecrude,oneexpectscrudeoilarrivinginEurope

some40daysafterloadingatRasTanuratobepricedhigherthanthatloadedfortheFarEastwhichispricedon

the average of the month of loading at Ras Tanura. When BWAVE falls off steeply from the $140/bbl peak to

around $40 beginning around June/July 2008, we see theAsian OSP quickly becoming a premium over the

EuropeanOSPofupto$20/bbl(aroundJulytoSeptember2008).AsimilarrelationshipofAsianOSPtoUSOSP

holdsasshowninFig5.Inshort,whetherAsiancustomerswerepayingapremiumorenjoyingdiscountsoverthe

past 3 years, relative to their counterparts in the Pacific Basin, seems to be determined by whether absolute

referencecrudepricesintheUSorEuropeanmarketswereonanupwardordowntrendtrend.

Figure5:AsiaUSALFOBDifferentialandWTI

Source:Platts

While SaudiAramco aspires to be a major and preferred long term supplier of crude oil to each of the major

consuming regions of North America, Europe and Far East, nevertheless its exports to Asia have grown

significantlyovertimeasaproportionoftotalcrudeexportsover19952008,fromlessthan50%toover60%

today.Thisisnotunexpected,givengrowinginvestmentsbytheexportingcountriesintheregionandbythefact

thatAsiasimplyconstitutesanaturalmarketforMiddleEastoilbothgeographicallyandlogistically.

TherehavebeenimportantdevelopmentsthathaveexpandedthecrudeoildietformanyAsiancustomerslike

introducing newer crude oil grades from nontraditional sources. With the advent of the financial crises in the

developedworldandrecentincreasesinthesupplyofoilintheUS,therehasbeenafurthershiftininternational

oilflows.WiththeendofthewarinLibyaandtheincreaseinoilproductionintheUS,sweet,NorthandWest

AfricancrudeoilwhichusedtoflowtotheEastCoastoftheUSandtheUSGulfisnowlookingforcustomersin

stillgrowingAsia.RussianexportsofEasternSiberiaPacificOcean(ESPO)crudeoiltoAsiaisabouttogeta

major boost with gradual increases in pipeline capacity and output. Even some Canadian crude oil has been

makingitswaytotheregion(Earlyin2012,theChineseNOCChinaOilboughtacargoofCanadianSynthetic

crudefortestprocessingintheirrecentlyacquiredSPCrefineryinSingapore).Allofthesechangesareexpected

influencethedynamicsofcrudeoilpricesinAsia.However,asoveralldemandcontinuestogrow,theMiddleEast

islikelytoremainthemostimportantsinglesourceofcrudeoilforAsia.

http://ensec.org/index.php?option=com_content&view=article&id=393:exploringtheasianpremiumincrudeoilmarkets&catid=130:issuecontent&Itemid=405

5/6

3/20/2016

ExploringtheAsianPremiuminCrudeOilMarkets

Conclusion

Since 1986, official Saudi prices are set only in relation to the freely traded reference or marker crude prices

(Brent,WTI,OmanandDubai).Themonthlyadjustmentsofthesedifferentialsareusuallyrelativelysmall.They

generallychangebylessthan2%oftheabsoluteprice,whiletheimpliedvolatilityintheabsolutepricelevelsis

usuallyabout30%.Hence,theyarefartoosmallinrelationtotheabsolutepricechangestobeusedasatoolfor

price discrimination between various consuming regions. What's more, our results have shown that the Asian

premiumduringtheperiodofourstudy(20072010)switchedfromanactualdiscountin2007,toaverylarge

premiumin2008,followedbyafallintoadiscountagain,during2009.Weshowthatthesechangescanlargely

beexplainedbythestructureofoilprices.Allthreecrudeoilmarkersshowaclearupwardtrendduring2007,

followed by a steep and persistent drop during the financial crises beginning in the summer of 2008 and the

recoveryattheendofthatyearandaslowuptrendthroughout2009.DuetodeferredpricingintheofficialSaudi

formula, the US and EU simply paid higher premiums in the rising market and received discounts in falling

markets,relativetoAsianmarkets.Therefore,duringthisperiod,wedonotfindanyevidenceofregionalprice

discriminationbyAramco(ThisassertionisquitedifferentfromtheargumentthatOPECasagroupsetsglobal

crudeoilpricesbyimposingproductionquotasonitsmembers.ThisOPECascartelargumentisnotthesubject

ofthispaper).

ThisconclusionfitswellwithwhatobserversknowabouttheoverallSaudiexportingstrategy.SaudiArabiaisa

producer with vast oil reserves, and its strategic interest is in maintaining a significant market share in all the

consumingregionsandindoingsoitmaybeperusingotherpoliticalandeconomicobjectives.However,further

workisnecessarytotestwhethertheoilpricestructurecanexplaintheAsianPremiumafter2010.

ContributorAdiImsiroviciswiththePetracoOilCo.LtdinSingapore.ThecontributionwascowrittenbyDr.Tilak

Doshi.

Copyright2016JournalofEnergySecurity.AllRightsReserved.IAGS.

http://ensec.org/index.php?option=com_content&view=article&id=393:exploringtheasianpremiumincrudeoilmarkets&catid=130:issuecontent&Itemid=405

6/6

You might also like

- WPM40 AnAnatomyoftheCrudeOilPricingSystem BassamFattouh 2011Document83 pagesWPM40 AnAnatomyoftheCrudeOilPricingSystem BassamFattouh 2011abasbatchooNo ratings yet

- Understanding Crude Oil and Product Markets Primer Low PDFDocument39 pagesUnderstanding Crude Oil and Product Markets Primer Low PDFrohanpujari100% (1)

- 05 TehraniDocument16 pages05 TehranialbyNo ratings yet

- Mouret EWODocument23 pagesMouret EWOalbyNo ratings yet

- OPTIMIZATION TECHNIQUES FOR OIL REFINERY BLENDING AND SCHEDULINGDocument41 pagesOPTIMIZATION TECHNIQUES FOR OIL REFINERY BLENDING AND SCHEDULINGalbyNo ratings yet

- 11 Blending OptimizationDocument31 pages11 Blending OptimizationferaldoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Gbs10e PPT ch10Document48 pagesGbs10e PPT ch10N ANo ratings yet

- Textiles 12th Edition Ebook PDFDocument41 pagesTextiles 12th Edition Ebook PDFpatricia.morrison594100% (34)

- Midlands State UniversityDocument6 pagesMidlands State UniversityHugh O'Brien GwazeNo ratings yet

- Introduction To Economics - ppt1Document13 pagesIntroduction To Economics - ppt1Akshay HemanthNo ratings yet

- Gaining valuable experience through internships abroadDocument1 pageGaining valuable experience through internships abroadTuyết HoaNo ratings yet

- Unit 2 Interval Estimation-1Document31 pagesUnit 2 Interval Estimation-1PetrinaNo ratings yet

- Bank Reconciliation Statements 5: This Chapter Covers..Document18 pagesBank Reconciliation Statements 5: This Chapter Covers..amal joy0% (1)

- Study PlanDocument2 pagesStudy PlanFAISHAH ISAHAKNo ratings yet

- Feasibility Study Guide: Sport and Recreation FacilitiesDocument36 pagesFeasibility Study Guide: Sport and Recreation Facilitiesdonny_dss_unsri100% (2)

- Checklist For Tiles FlooringDocument2 pagesChecklist For Tiles FlooringKishoreNo ratings yet

- Mean, Median, Mode and Range - Gaming Averages - AnswersDocument2 pagesMean, Median, Mode and Range - Gaming Averages - AnswersMarlita RantetandungNo ratings yet

- Po-1922003499-15 07 2022Document2 pagesPo-1922003499-15 07 2022kartikNo ratings yet

- 19 Articulo - Mine Size and The Structure of CostsDocument22 pages19 Articulo - Mine Size and The Structure of CostsCristian Santivañez MillaNo ratings yet

- Example HD MVP Experiment CanvasDocument1 pageExample HD MVP Experiment CanvasJohn GalindoNo ratings yet

- Apgvb Insurance Consent LetterDocument1 pageApgvb Insurance Consent LetterMahesh PasupuletiNo ratings yet

- Est Practical 3Document18 pagesEst Practical 3shahuNo ratings yet

- Assignment No. 3: Scenario/Case On BiddingDocument5 pagesAssignment No. 3: Scenario/Case On BiddingKristia Jolina Buendia AldeNo ratings yet

- Baf 0522 en EditDocument4 pagesBaf 0522 en EditHasibKaabiNo ratings yet

- r2 Cipl - BTR 044-3 QingdaoDocument4 pagesr2 Cipl - BTR 044-3 Qingdaoananda hanaNo ratings yet

- 12 Cal - Hrc2 - Pantalon - Fr03pt5020126 Ansi3Document12 pages12 Cal - Hrc2 - Pantalon - Fr03pt5020126 Ansi3Alexandra mariaca valdezNo ratings yet

- Catalogo Internacional 2018 SawcoDocument52 pagesCatalogo Internacional 2018 SawcoFrancisco GiudiciNo ratings yet

- Problem 7-1 (Cash Priority Program)Document7 pagesProblem 7-1 (Cash Priority Program)AmethystNo ratings yet

- H R N N TH T: Recording Transactions of Sample Data of Swayam Agencies Pvt. LTDDocument140 pagesH R N N TH T: Recording Transactions of Sample Data of Swayam Agencies Pvt. LTDDeepakNo ratings yet

- Eco PPT FinalDocument27 pagesEco PPT FinalPritam PatraNo ratings yet

- Hilega Milega ConseptsDocument8 pagesHilega Milega Consepts01ankuNo ratings yet

- 86Fb Football Trading: Everything You Need To Know About Your IncomeDocument5 pages86Fb Football Trading: Everything You Need To Know About Your IncomeMavixkeyz Onice IzoduwaNo ratings yet

- Federal Negarit Gazette: FJMF'FDocument39 pagesFederal Negarit Gazette: FJMF'FAdemNo ratings yet

- Price Action Breakout StrategiesDocument7 pagesPrice Action Breakout StrategiesRamon CastellanosNo ratings yet

- Accounting Vouchers in TallyDocument2 pagesAccounting Vouchers in TallyAbracadabraGoonerLincol'otu0% (2)

- Material Management ERP-SAPDocument50 pagesMaterial Management ERP-SAPNuman Rox100% (1)